UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

FORM 20-F

(Mark One)

|

o

|

Registration statement pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934.

|

|

Or

|

|

|

x

|

Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

For the fiscal year ended May 31, 2012.

|

|

Or

|

|

|

o

|

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. For the transition period from ________ to ________ .

|

|

Or

|

|

|

o

|

Shell company report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Date of event requiring this shell company report _______________.

|

|

Commission file number 001-32001

|

LORUS THERAPEUTICS INC.

(Exact Name of Registrant as Specified in Its Charter)

Canada

(Jurisdiction of Incorporation or Organization)

2 Meridian Road

Toronto, Ontario

M9W 4Z7

Canada

(Address of Principal Executive Offices)

Elizabeth Williams

Director of Finance

2 Meridian Road

Toronto, Ontario M9W 4Z7

Canada

Telephone: (416) 798-1200

Facsimile: (416) 798-2200

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Each Exchange On Which Registered

|

| |

|

Securities registered or to be registered pursuant to Section 12(g) of the Act: Common Shares

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Common Shares, without par value, at May 31, 2012: 21,228,081

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

If this is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes o No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o Non-accelerated filer x

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing.

|

|

U.S. GAAP o International Financial Reporting Standards as issued by the International Accounting Standards Board x Other o

|

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 o Item 18 o

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

TABLE OF CONTENTS

Page

|

PART I

|

|

3

|

| |

|

|

| |

ITEM 1.

|

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

|

3

|

| |

ITEM 2.

|

OFFER STATISTICS AND EXPECTED TIMETABLE

|

3

|

| |

ITEM 3.

|

KEY INFORMATION

|

3

|

| |

ITEM 4.

|

INFORMATION ON THE COMPANY

|

16

|

| |

ITEM 4A.

|

UNRESOLVED STAFF COMMENTS

|

32

|

| |

ITEM 5.

|

OPERATING AND FINANCIAL REVIEW AND PROSPECTS

|

32

|

| |

ITEM 6.

|

DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES

|

45

|

| |

ITEM 7.

|

MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

|

59

|

| |

ITEM 8.

|

FINANCIAL INFORMATION

|

62

|

| |

ITEM 9.

|

THE OFFER AND LISTING

|

62

|

| |

ITEM 10.

|

ADDITIONAL INFORMATION

|

64

|

| |

ITEM 11.

|

QUALITATIVE AND QUANTITATIVE DISCLOSURES ABOUT MARKET RISK

|

76

|

| |

ITEM 12.

|

DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES

|

76

|

| |

|

|

|

PART II

|

|

77

|

| |

|

|

| |

ITEM 13.

|

DEFAULTS, DIVIDENDS, ARREARAGES AND DELINQUENCIES

|

77

|

| |

ITEM 14.

|

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS

|

77

|

| |

ITEM 15.

|

CONTROLS AND PROCEDURES

|

77

|

| |

ITEM 16.

|

[RESERVED]

|

78

|

| |

ITEM 16A.

|

AUDIT COMMITTEE FINANCIAL EXPERT

|

78

|

| |

ITEM 16B.

|

CODE OF ETHICS

|

78

|

| |

ITEM 16C.

|

PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

78

|

| |

ITEM 16D.

|

EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES

|

79

|

| |

ITEM 16E.

|

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS

|

79

|

| |

|

|

|

PART III

|

|

80

|

| |

|

|

| |

ITEM 17.

|

FINANCIAL STATEMENTS

|

80

|

| |

ITEM 18.

|

FINANCIAL STATEMENTS

|

80

|

| |

ITEM 19.

|

EXHIBITS

|

81

|

GENERAL

On July 10, 2007 (the ”Arrangement Date”), Lorus Therapeutics Inc. completed a plan of arrangement and corporate reorganization with, among others, 4325231 Canada Inc. (now Global Summit Real Estate Inc.), formerly Lorus Therapeutics Inc. (“Old Lorus”), 6707157 Canada Inc. and Pinnacle International Lands, Inc. (the “Arrangement”). As a result of the plan of arrangement and reorganization, among other things, each common share of Old Lorus was exchanged for one of our common shares and the assets (excluding certain future tax assets and related valuation allowance) and liabilities of Old Lorus (including all of the shares of its subsidiaries) were transferred, directly or indirectly, to our corporation and/or our subsidiaries. We continued the business of Old Lorus after the Arrangement Date with the same officers and employees and continued to be governed by the same directors as Old Lorus prior to the Arrangement Date. In this Annual Report on Form 20-F, all references to “Lorus”, the “Corporation”, the “Company”, “we”, “our”, “us” and similar expressions, unless otherwise stated, are references to Old Lorus prior to the Arrangement Date and Lorus after the Arrangement Date. References to this “Form 20-F” and this “Annual Report” mean references to this Annual Report on Form 20-F for the fiscal year ended May 31, 2012.

We use the Canadian dollar as our reporting currency. All references in this Annual Report to “dollars” or “$” are expressed in Canadian dollars, unless otherwise indicated. See also “Item 3. Key Information” for more detailed currency and conversion information. Our Consolidated Financial Statements, which form part of this Annual Report, are presented in Canadian dollars and are prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”), which differ in certain respects from accounting principles generally accepted in the United States (“U.S. GAAP”).

FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements within the meaning of securities laws. Such statements include, but are not limited to, statements relating to:

|

|

•

|

our ability to obtain the substantial capital required to fund research and operations;

|

|

|

•

|

our plans to secure strategic partnerships to assist in the further development of our product candidates;

|

|

|

•

|

our plans to conduct clinical trials and pre-clinical programs;

|

|

|

•

|

our expectations regarding the progress and the successful and timely completion of the various stages of our drug discovery, pre-clinical and clinical studies and the regulatory approval process;

|

|

|

•

|

our plans, objectives, expectations and intentions;

|

|

|

•

|

annual sales potential of our clinical stage drugs; and

|

|

|

•

|

other statements including words such as “anticipate”, “contemplate”, “continue”, “believe”, “plan”, “estimate”, “expect”, “intend”, “will”, “should”, “may”, and other similar expressions.

|

Such statements reflect our current views with respect to future events, are subject to risks and uncertainties, and are based upon a number of estimates and assumptions that, while considered reasonable by us, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors could cause our actual results, performance or achievements to be materially different from any future results, performance, or achievements that may be expressed or implied by such forward-looking statements, including, among others:

|

|

•

|

our lack of product revenues and history of operating losses;

|

|

|

•

|

our ability to obtain the substantial capital required to fund research and operations;

|

|

|

•

|

our early stage of development, particularly the inherent risks and uncertainties associated with (i) developing new drug candidates generally, (ii) demonstrating the safety and efficacy of these drug candidates in clinical studies in humans, and (iii) obtaining regulatory approval to commercialize these drug candidates;

|

|

|

•

|

our drug candidates require time-consuming and costly preclinical and clinical testing and regulatory approvals before commercialization;

|

|

|

•

|

clinical studies and regulatory approvals of our drug candidates are subject to delays, and may not be completed or granted on expected timetables, if at all, and such delays may increase our costs and could delay our ability to generate revenue;

|

|

|

•

|

the regulatory approval process;

|

|

|

•

|

our ability to recruit patients for clinical trials;

|

|

|

•

|

the progress of our clinical trials;

|

|

|

•

|

our liability associated with the indemnification of Old Lorus and its directors, officers and employees in respect of the arrangement;

|

|

|

•

|

our ability to find and enter into agreements with potential partners;

|

|

|

•

|

our ability to attract and retain key personnel;

|

|

|

•

|

our ability to obtain patent protection;

|

|

|

•

|

our ability to protect our intellectual property rights and not infringe on the intellectual property rights of others;

|

|

|

•

|

our ability to comply with applicable governmental regulations and standards;

|

|

|

•

|

development or commercialization of similar products by our competitors, many of which are more established and have or have access to greater financial resources than us;

|

|

|

•

|

commercialization limitations imposed by intellectual property rights owned or controlled by third parties;

|

|

|

•

|

our business is subject to potential product liability and other claims;

|

|

|

•

|

our ability to maintain adequate insurance at acceptable costs;

|

|

|

•

|

further equity financing may substantially dilute the interests of our shareholders;

|

|

|

•

|

changing market conditions; and

|

|

|

•

|

other risks detailed from time-to-time in our ongoing quarterly filings, annual information forms, annual reports and annual filings with Canadian securities regulators and the United States Securities and Exchange Commission (“SEC”), and those which are discussed under the heading “Risk Factors”.

|

Should one or more of these risks or uncertainties materialize, or should the assumptions set out in the section entitled “Risk Factors” underlying those forward-looking statements prove incorrect, actual results may vary materially from those described herein. These forward-looking statements are made as of the date of this Annual Report or, in the case of documents incorporated by reference herein, as of the date of such documents, and we do not intend, and do not assume any obligation, to update these forward-looking statements, except as required by law. We cannot assure you that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Investors are cautioned that forward-looking statements are not guarantees of future performance and accordingly investors are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty therein.

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

A. Selected Financial Data

The following tables present our selected consolidated financial data. You should read these tables in conjunction with our audited Consolidated Financial Statements and accompanying notes included in Item 18 of this Annual Report and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in Item 5 of this Annual Report.

The selected consolidated financial information set forth below for each of the two years ended May 31, 2012 and 2011, has been derived from the Company's audited consolidated financial statements as at and for the financial years ended May 31, 2012 and 2011 filed as part of this Form 20-F under Item 18. These consolidated financial statements have been prepared in accordance with IFRS issued by the International Accounting Standards Board, which differ in certain respects from the principles the Company would have followed had its consolidated financial statements been prepared in accordance with U.S. GAAP. The selected consolidated financial information should be read in conjunction with the discussion in Item 5 of this Form 20-F and the consolidated financial statements and related notes thereto.

The following table presents a summary of our consolidated statement of operations derived from our audited Consolidated Financial Statements for the fiscal years ended May 31, 2012 and 2011.

Consolidated statements of operations data(1) (2)

|

(In thousands, except per share data)

|

|

|

|

|

|

|

| |

|

May 31,

2012

|

|

|

May 31,

2011

|

|

|

In accordance with IFRS

|

|

|

|

|

|

|

|

Revenue

|

|

$ |

─ |

|

|

$ |

─ |

|

|

Research and development

|

|

$ |

2,170 |

|

|

$ |

2,518 |

|

|

General and administrative

|

|

$ |

2,430 |

|

|

$ |

2,420 |

|

|

Operating expenses

|

|

$ |

4,600 |

|

|

$ |

4,938 |

|

|

Finance expense

|

|

$ |

20 |

|

|

$ |

71 |

|

|

Finance income

|

|

$ |

(6 |

) |

|

|

(14 |

) |

|

Net loss

|

|

$ |

(4,614 |

) |

|

$ |

(4,995 |

) |

|

Basic and diluted loss per common share

|

|

$ |

(0.23 |

) |

|

$ |

(0.38 |

) |

|

Weighted average number of common shares outstanding

|

|

|

20,260 |

|

|

|

13,157 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

The selected consolidated financial information set forth in the first table below for each of the three years ended May 31, 2010, 2009 and 2008, has been derived from the Company's audited consolidated financial statements as at and for the financial years ended May 31, 2010, 2009 and 2008. These consolidated financial statements were prepared in accordance with generally accepted accounting principles in Canada ("Canadian GAAP"), which differ in certain respects from the principles the Company would have followed had its consolidated financial statements been prepared in accordance with United States GAAP.

The selected consolidated financial information in the IFRS chart above should not be compared to the information in the Canadian GAAP chart below as the information was prepared using different financial reporting standards:

|

(In thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

| |

|

May 31,

2010

|

|

|

May 31,

2009

|

|

|

May 31,

2008

|

|

|

In accordance with Canadian GAAP

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$ |

131 |

|

|

$ |

184 |

|

|

$ |

43 |

|

|

Research and development (a)

|

|

$ |

2,517 |

|

|

$ |

3,757 |

|

|

$ |

6,260 |

|

|

General and administrative (a)

|

|

$ |

2,964 |

|

|

$ |

2,958 |

|

|

$ |

3,715 |

|

|

Loss from operations

|

|

$ |

(5,725 |

) |

|

$ |

(9,310 |

) |

|

$ |

(12,633 |

) |

|

Net earnings (loss)

|

|

$ |

5,331 |

|

|

$ |

(8,860 |

) |

|

$ |

(6,334 |

) |

|

Basic and diluted earnings (loss) per common share

|

|

$ |

0.57 |

|

|

$ |

(1.08 |

) |

|

$ |

(0.87 |

) |

|

Weighted average number of common shares outstanding

|

|

|

9,364 |

|

|

|

8,236 |

|

|

|

7,169 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

In accordance with U.S. GAAP

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings (loss)

|

|

$ |

5,705 |

|

|

$ |

(7,735 |

) |

|

$ |

(5,526 |

) |

|

Basic and diluted earnings (loss) per share

|

|

$ |

0.61 |

|

|

$ |

(0.94 |

) |

|

$ |

(0.77 |

) |

|

|

(a)

|

Amounts in fiscal 2008 have been reclassified to conform to the financial statement presentation adopted in fiscal 2009.

|

The following table presents a summary of our consolidated balance sheet as at May 31, 2012 and 2011 in IFRS and May 31, 2010, 2009 and 2008 under Canadian GAAP.

Consolidated balance sheet data(1) (2)

|

(In thousands, except per share data)

|

|

As at May 31,

|

|

| |

|

2012

|

|

|

2011

|

|

|

In accordance with IFRS

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

320 |

|

|

$ |

911 |

|

|

Marketable securities and other investments

|

|

$─

|

|

|

$─

|

|

|

Total assets

|

|

$ |

668 |

|

|

$ |

1,398 |

|

|

Total debt

|

|

$ |

2,696 |

|

|

$ |

1,159 |

|

|

Total shareholders’ equity (deficit)

|

|

$ |

(2,028 |

) |

|

$ |

239 |

|

|

Number of common shares outstanding

|

|

|

21,228 |

|

|

|

15,685 |

|

|

Dividends paid on common shares

|

|

─

|

|

|

─

|

|

|

(In thousands, except per share data)

|

|

As at May 31,

|

|

| |

|

2010

|

|

|

2009

|

|

|

2008

|

|

|

In accordance with Canadian GAAP

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

667 |

|

|

$ |

5,374 |

|

|

$ |

2,652 |

|

|

Marketable securities and other investments

|

|

$ |

247 |

|

|

$ |

490 |

|

|

$ |

6,784 |

|

|

Total assets

|

|

$ |

2,303 |

|

|

$ |

7,527 |

|

|

$ |

11,607 |

|

|

Total debt

|

|

$ |

2,845 |

|

|

$ |

15,878 |

|

|

$ |

15,459 |

|

|

Total shareholders’ equity (deficit)

|

|

$ |

(542 |

) |

|

$ |

(8,351 |

) |

|

$ |

(3,852 |

) |

|

Number of common shares outstanding

|

|

|

9,933 |

|

|

|

8,560 |

|

|

|

7,255 |

|

|

Dividends paid on common shares

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

In accordance with U.S. GAAP

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$ |

2,303 |

|

|

$ |

7,592 |

|

|

$ |

11,911 |

|

|

Total debt

|

|

$ |

2,845 |

|

|

$ |

16,322 |

|

|

$ |

17,314 |

|

|

Total shareholders’ equity (deficit)

|

|

$ |

(542 |

) |

|

$ |

(8,729 |

) |

|

$ |

(5,403 |

) |

Footnotes to the prior tables:

|

|

(1)

|

On July 10, 2007, the Company completed a plan of arrangement and corporate reorganization with Old Lorus, 6707157 Canada Inc. and Pinnacle International Lands Inc. As a result of the plan of arrangement and reorganization, among other things, each common share of Old Lorus was exchanged for one common share of the Company and the assets (excluding certain future tax assets and related valuation allowance) and liabilities of Old Lorus were transferred to the Company and/or its subsidiaries. The Company continued the business of Old Lorus after the Arrangement Date with the same officers and employees and continued to be governed by the same board of directors as Old Lorus prior to the Arrangement Date. Therefore, the Company’s operations have been accounted for on a continuity of interest basis and accordingly, the consolidated financial statement information above reflects that of the Company as if it had always carried on the business formerly carried on by Old Lorus.

|

|

|

(2)

|

At our annual and special meeting of shareholders held on November 30, 2009, our shareholders approved a special resolution permitting our board of directors, in its sole discretion, to file an amendment to our articles of incorporation to consolidate our issued and outstanding common shares. On May 12, 2010, our board approved the share consolidation on the basis of one post-consolidation common share for every 30 pre-consolidation common shares. The record date and effective date for the share consolidation was May 25, 2010. Our common shares began trading on the Toronto Stock Exchange (the “TSX”) on a post-consolidation basis on May 31, 2010. The share consolidation resulted in an adjustment to the exercise price and number of common shares issuable upon exercise of outstanding stock options and warrants. In this Annual Report, all references to number of shares, stock options and warrants in the current and past periods have been adjusted to reflect the impact of the consolidation unless noted otherwise.

|

Changes in accounting policies:

As result of the Accounting Standards Board of Canada’s decision to require the adoption of IFRS for publicly accountable entities for financial reporting periods beginning on or after January 1, 2011, the Company adopted IFRS for its first quarterly filing for the quarter ended August 31, 2011 and consequently for its audited financial statements for the year ended May 31, 2012. These are the first audited annual financial statements of the Company under IFRS. The Company previously applied the available standards under Canadian GAAP that were issued by the Accounting Standards Board of Canada. The effects of the conversion from Canadian GAAP to IFRS are identified in Note 16 "Transition To IFRS" of our consolidated financial statements for year ended May 31, 2012, included in as Item 18.

The significant differences between the line items under Canadian GAAP and those as determined under U.S. GAAP arise primarily from:

Fiscal 2008 to 2010

The following table reconciles the earnings (loss) per IFRS to the earnings (loss) per U.S. GAAP for the fiscal years ended May 31, 2010, 2009 and 2008:

|

(In thousands, except per share data)

|

|

Years Ended May 31,

|

|

| |

|

2010

|

|

|

2009

|

|

|

2008

|

|

| |

|

|

|

|

|

|

|

|

|

|

Net earnings (loss) per Canadian GAAP

|

|

$ |

5,331 |

|

|

$ |

(8,860 |

) |

|

$ |

(6,334 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on repurchase of convertible debentures and transfer of assets (i)

|

|

|

328 |

|

|

|

- |

|

|

|

- |

|

|

Accretion of convertible debentures (i)

|

|

|

54 |

|

|

|

1,222 |

|

|

|

903 |

|

|

Amortization and write off of debt issue costs (i)

|

|

|

(4 |

) |

|

|

(48 |

) |

|

|

(40 |

) |

|

Stock compensation expense (gain) (ii)

|

|

|

4 |

|

|

|

(39 |

) |

|

|

(47 |

) |

|

Short-term investments (iii)

|

|

|

(8 |

) |

|

|

(10 |

) |

|

|

(7 |

) |

|

Earnings (loss) per U.S. GAAP

|

|

|

5,705 |

|

|

|

(7,735 |

) |

|

|

(5,526 |

) |

|

Other comprehensive gain (loss) (iii)

|

|

|

8 |

|

|

|

10 |

|

|

|

(20 |

) |

|

Earnings (loss) and comprehensive gain (loss) per U.S. GAAP

|

|

|

5,713 |

|

|

|

(7,725 |

) |

|

|

(5,546 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted earnings (loss) per common share per U.S. GAAP

|

|

$ |

0.61 |

|

|

$ |

(0.94 |

) |

|

$ |

(0.77 |

) |

Under U.S. GAAP, the number of weighted average common shares outstanding for basic and diluted loss per share is the same as under Canadian GAAP.

(i) Convertible debentures

On October 6, 2004 the Company entered into a Subscription Agreement with The Erin Mills Investment Corporation (“TEMIC”) to issue an aggregate of $15 million of secured convertible debentures issuable in three tranches of $5.0 million each, in each of, October 2004, January 2005 and April 2005. The convertible debentures were due on October 6, 2009.

On June 22, 2009, the Company reached a settlement with TEMIC with respect to the purchase and settlement of the convertible debentures. Under the agreement, Lorus purchased all of the convertible debentures from TEMIC for consideration that included a cash payment of $3.3 million, the assignment of the rights under the license agreement with ZOR Pharmaceuticals, LLC (“ZOR”), certain intellectual property associated with Virulizin® and all of Lorus' shares in its wholly owned subsidiary, Pharma Immune Inc., which held an equity interest in ZOR. As a result of the transaction, the Company recognized a gain on the repurchase of the debentures of $11.0 million reflecting the difference between the fair value of the debentures at the repurchase date, net of transaction costs of approximately $221 thousand, and the cash payment amount of $3.3 million. The gain on repurchase of the debentures did not result in income taxes payable as the Company has sufficient capital loss and non-capital loss carryforwards to shelter these gains. As the carrying value of the convertible debentures was different under U.S. GAAP, as explained below, the Company recognized an additional gain of $328 thousand on the repurchase of the convertible debentures and transfer of assets including the write-down of the deferred financing charges compared to under Canadian GAAP in the year ended May 31, 2010.

Under Canadian GAAP, the conversion option embedded in the convertible debentures is presented separately as a component of shareholders’ equity. Under U.S. GAAP, the embedded conversion option is not subject to bifurcation and is thus presented as a liability along with the balance of the convertible debentures. Measurement differences from the accretion of the value attributed to the conversion option on the convertible debentures and amortization of debt issue costs are further explained in the Supplementary Information entitled “Reconciliation of Canadian and United States Generally Accepted Accounting Principles” included in Item 18 of this Annual Report.

(ii) Stock options

Effective June 1, 2006, the Company adopted the fair value-based method of accounting for stock options granted to employees and directors as required by FASB Statement of Financial Accounting Standards No. 123R, Share-Based Payment (“SFAS 123R”), in accordance with the modified prospective method. Accordingly the Company has applied the fair value-based method to all employee stock options granted after June 1, 2006. Additionally, compensation costs for awards granted in prior periods for which the requisite service period has not been rendered as of June 1, 2006 will be recognized in the consolidated statement of operations and deficit as the requisite service is rendered.

During fiscal 2007, the Company recorded stock compensation expense of $503 thousand in accordance with Canadian GAAP in the consolidated statement of operations, representing the amortization applicable to the current year at the estimated fair value of options granted since June 1, 2002, and an offsetting adjustment to stock options of $503 thousand in the consolidated balance sheets. Under U.S. GAAP, the Company recognized $697 thousand in expense during the same period as a result of adopting SFAS 123R.

The primary reason for the difference between U.S. GAAP and Canadian GAAP relating to fiscal years 2008, 2009 and 2010 is due to estimation of forfeitures in the determination of the stock-based compensation expense under U.S. GAAP and accounting for forfeitures as they occur under Canadian GAAP.

(iii) Financial instruments

Effective June 1, 2007, the Company adopted the recommendations of The Canadian Institute of Chartered Accountants’ Handbook Section 3855, Financial Instruments - Recognition and Measurement, retroactively without restatement of prior periods. This section provides standards for recognition and measurement, of financial assets, financial liabilities and non-financial derivatives.

As part of the adoption of the new standards on June 1, 2007, the Company designated certain short-term investments consisting of corporate instruments as “held-for-trading”. This change in accounting policy for Canadian GAAP resulted in a decrease in the carrying amount of these investments of $27 thousand and an increase in the fiscal 2008 opening deficit accumulated during the development stage of $27 thousand. Further, the Company recognized a net unrealized gain in the consolidated statements of operations for the fiscal year ended May 31, 2010 of $8 thousand (2009 - $10 thousand, 2008 - $7 thousand).

Under U.S. GAAP, the Company previously accounted for these investments as “held-to-maturity” in accordance with SFAS 115, now Accounting Standards (ASC) 320, Investments in Debt and Equity Securities. Because the Company did not have the ability or intent to hold these investments until their stated maturity date, the Company made a reassessment of the appropriateness of the previous classification and reallocated these investments as “available-for-sale” as of May 31, 2008, in accordance with ASC 320. Consequently, an unrealized holding gain in the amount of $8 thousand for the year ended May 31, 2010 (2009 - $10 thousand gain, 2008 - loss of $20 thousand) was recorded in other comprehensive income.

We publish our Consolidated Financial Statements in Canadian (“CDN”) dollars. In this Annual Report, except where otherwise indicated, all amounts are stated in CDN dollars.

The following table sets out the exchange rates of CDN$ for U.S$1.00 for the following periods as taken from the Bank of Canada’s website:

|

Period

|

|

Average Close

|

|

|

High

|

|

|

Low

|

|

|

August , 2012

|

|

|

1.0073 |

|

|

$ |

1.0160 |

|

|

$ |

0.9916 |

|

|

July, 2012

|

|

|

0.9866 |

|

|

$ |

0.9992 |

|

|

$ |

0.9755 |

|

|

June, 2012

|

|

|

0.9732 |

|

|

$ |

0.9837 |

|

|

$ |

0.9576 |

|

|

May, 2012

|

|

|

0.9898 |

|

|

$ |

1.0173 |

|

|

$ |

0.9647 |

|

|

April, 2012

|

|

|

1.0074 |

|

|

$ |

1.0204 |

|

|

$ |

0.9950 |

|

|

March, 2012

|

|

|

1.0065 |

|

|

$ |

1.0161 |

|

|

$ |

0.9965 |

|

|

Fiscal Year Ended May 31, 2012

|

|

|

1.0005 |

|

|

$ |

1.0204 |

|

|

$ |

0.9576 |

|

|

Fiscal Year Ended May 31, 2011

|

|

|

1.0066 |

|

|

|

1.0660 |

|

|

|

0.9486 |

|

|

Fiscal Year Ended May 31, 2010

|

|

|

1.0635 |

|

|

|

1.1676 |

|

|

|

0.9988 |

|

|

Fiscal Year Ended May 31, 2009

|

|

|

1.1567 |

|

|

|

1.2991 |

|

|

|

1.0012 |

|

|

Fiscal Year Ended May 31, 2008

|

|

|

1.0140 |

|

|

|

1.0750 |

|

|

|

0.9170 |

|

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Investing in our securities involves a high degree of risk. Before making an investment decision with respect to our common shares, you should carefully consider the following risk factors, in addition to the other information included or incorporated by reference in this Annual Report. Additional risks not currently known by us or that we consider immaterial at the present time may also impair our business, financial condition, prospects or results of operations. If any of the following risks occur, our business, financial condition, prospects or results of operations would likely be affected. In that case, the trading price of our common shares could decline and you may lose all or part of the money you paid to buy our common shares. The risks set out below are not the only we currently face; other risks may arise in the future.

RISKS RELATED TO OUR BUSINESS

We might not be able to continue as a going concern.

We have forecasted that our level of cash and cash equivalents and short-term investments including the proceeds from the Private Placement completed in June 2012 will be sufficient to execute our current planned expenditures for the next 9-12 months without further investment. We intend to continue to pursue additional funding and partnership opportunities to execute our planned expenditures in the future, but there can be no assurance that sufficient capital will be available to enable us to meet these continuing expenditures, or if the capital is available, that it will be available on terms acceptable to us. If we are unable to obtain sufficient financing on acceptable terms in order to meet our future operational needs, there is substantial doubt as to whether we will be able to continue as a going concern and realize our assets and pay our liabilities as they fall due, in which case investors may lose their investment.

We are an early stage development company.

We are at an early stage of development. Since our incorporation, none of our products has obtained regulatory approval for commercial use and sale in any country, except for Virulizin in very limited circumstances in Mexico. As such, significant revenues have not resulted from product sales. Significant additional investment will be necessary to complete the development of any of our product candidates. Pre-clinical and clinical trial work must be completed before our products could be ready for use within the markets that we have identified. We may fail to develop any products, obtain regulatory approvals, enter clinical trials or commercialize any products. We do not know whether any of our potential product development efforts will prove to be effective, meet applicable regulatory standards, obtain the requisite regulatory approvals, be capable of being manufactured at a reasonable cost or be accepted in the marketplace. We also do not know whether sales, license fees or related royalties will allow us to recoup any investment we make in the commercialization of our products.

The product candidates we are currently developing are not expected to be commercially viable for several years and we may encounter unforeseen difficulties or delays in commercializing our product candidates. In addition, our products may cause undesirable side effects.

Our product candidates require significant funding to reach regulatory approval assuming positive clinical results. For example, our lead product candidate LOR-253 is currently in a Phase I clinical trial. Should this trial be successful significant additional funding or a partnership would be necessary to complete the necessary Phase II and Phase III clinical trials. Such funding will be very difficult, or impossible to raise in the public markets or through partnerships. If such funding or partnerships are not attainable, the development of these product candidates maybe significantly delayed or stopped altogether. The announcement of such delay or discontinuation of development may have a negative impact on our share price.

We need to raise additional capital.

We have an ongoing need to raise additional capital. To obtain the necessary capital, we must rely on some or all of the following: additional share issues, debt issuances (including promissory notes), collaboration agreements or corporate partnerships and grants and tax credits to provide full or partial funding for our activities. We cannot assure you that additional funding will be available on terms that are acceptable to us or in amounts that will enable us to carry out our business plan.

Our need for capital may require us to:

|

|

•

|

engage in equity financings that could result in significant dilution to existing investors;

|

|

|

•

|

delay or reduce the scope of or eliminate one or more of our development programs;

|

|

|

•

|

obtain funds through arrangements with collaborators or others that may require us to relinquish rights to technologies, product candidates or products that we would otherwise seek to develop or commercialize ourselves; or license rights to technologies, product candidates or products on terms that are less favourable to us than might otherwise be available;

|

|

|

•

|

considerably reduce operations; or

|

We have a history of operating losses. We expect to incur net losses and we may never achieve or maintain profitability.

We have not been profitable since our inception in 1986. Under International Financial Reporting Standards, we reported net losses of $4.6 million, and $5.0 million for the years ended May 31, 2012 and 2011, respectively, and as of May 31, 2012, we had an accumulated deficit of $194 million.

We have not generated any significant revenue from product sales to date and it is possible that we will never have sufficient product sales revenue to achieve profitability. We expect to continue to incur losses for at least the next several years as we or our collaborators and licensees pursue clinical trials and research and development efforts. To become profitable, we, either alone or with our collaborators and licensees, must successfully develop, manufacture and market our current product candidates LOR-253 and IL17E as well as continue to identify, develop, manufacture and market new product candidates. It is possible that we will never have significant product sales revenue or receive significant royalties on our licensed product candidates. If funding is insufficient at any time in the future, we may not be able to develop or commercialize our products, take advantage of business opportunities or respond to competitive pressures.

We may be unable to obtain partnerships for one or more of our product candidates, which could curtail future development and negatively affect our share price. In addition, our partners might not satisfy their contractual responsibilities or devote sufficient resources to our partnership.

Our strategy for the research, development and commercialization of our products requires entering into various arrangements with corporate collaborators, licensers, licensees and others, and our commercial success is dependent upon these outside parties performing their respective contractual responsibilities. The amount and timing of resources that such third parties will devote to these activities may not be within our control. We cannot assure you that such parties will perform their obligations as expected. We also cannot assure you that our collaborators will devote adequate resources to our programs. In addition, we could become involved in disputes with our collaborators, which could result in a delay or termination of the related development programs or result in litigation. We intend to seek additional collaborative arrangements to develop and commercialize some of our products. We may not be able to negotiate collaborative arrangements on favourable terms, or at all, in the future, or assure you that our current or future collaborative arrangements will be successful.

If we cannot negotiate collaboration, licence or partnering agreements, we may never achieve profitability.

Clinical trials are long, expensive and uncertain processes and Health Canada or the FDA may ultimately not approve any of our product candidates. We may never develop any commercial drugs or other products that generate revenues.

None of our product candidates has received regulatory approval for commercial use and sale in North America. We cannot market a pharmaceutical product in any jurisdiction until it has completed thorough preclinical testing and clinical trials in addition to that jurisdiction’s extensive regulatory approval process. Approval in one country does not assure approval in another country. In general, significant research and development and clinical studies are required to demonstrate the safety and effectiveness of our product candidates before we can submit any regulatory applications.

Clinical trials are long, expensive and uncertain processes. Clinical trials may not be commenced or completed on schedule, and Health Canada or the FDA or any other regulatory body may not ultimately approve our product candidates for commercial sale.

The clinical trials of any of our drug candidates could be unsuccessful, which would prevent us from advancing, commercializing or partnering the drug.

Even if the results of our preclinical studies or clinical trials are initially positive, it is possible that we will obtain different results in the later stages of drug development or that results seen in clinical trials will not continue with longer term treatment. Positive results in early Phase I or Phase II clinical trials may not be repeated in larger Phase II or Phase III clinical trials. We cannot assure you that our preclinical studies and clinical trials will generate positive results that will allow us to move towards the commercial use and sale of our product candidates. Furthermore, negative preclinical or clinical trial results may cause our business, financial condition, or results of operations to be materially adversely affected.

For example, as our lead product candidates LOR-253 is in the Phase I stage of development and our product candidate IL-17E is in the pre-clinical stage of development and there is still a long development path ahead which will take many years to complete and like all of our potential drug candidates is prone to the risks of failure inherent in drug development.

Preparing, submitting and advancing applications for regulatory approval is complex, expensive and time intensive and entails significant uncertainty. A commitment of substantial resources to conduct time-consuming research, preclinical studies and clinical trials will be required if we are to complete development of our products.

Clinical trials of our products require that we identify and enrol a large number of patients with the illness under investigation. We may not be able to enrol a sufficient number of appropriate patients to complete our clinical trials in a timely manner particularly in smaller indications and indications where this is significant competition for patients. If we experience difficulty in enrolling a sufficient number of patients to conduct our clinical trials, we may need to delay or terminate ongoing clinical trials and will not accomplish objectives material to our success that could affect the price of our Common Shares. Delays in planned patient enrolment or lower than anticipated event rates in our current clinical trials or future clinical trials may result in increased costs, program delays, or both.

In addition, unacceptable toxicities or adverse side effects may occur at any time in the course of preclinical studies or human clinical trials or, if any product candidates are successfully developed and approved for marketing, during commercial use of any approved products. The appearance of any such unacceptable toxicities or adverse side effects could interrupt, limit, delay or abort the development of any of our product candidates or, if previously approved, necessitate their withdrawal from the market. Furthermore, disease resistance or other unforeseen factors may limit the effectiveness of our potential products.

Our failure to develop safe, commercially viable drugs would substantially impair our ability to generate revenues and sustain our operations and would materially harm our business and adversely affect our share price. We may never achieve profitability.

We have indemnified our predecessor, Old Lorus, and its directors, officers and employees.

In connection with the reorganization that we undertook in fiscal 2008, we have agreed to indemnify our predecessor, Old Lorus, and its directors, officers and employees from and against all damages, losses, expenses (including fines and penalties), other third party costs and legal expenses, to which any of them may be subject arising out of any matter occurring:

|

|

•

|

prior to, at or after the effective time of the arrangement transaction, and directly or indirectly relating to any of the assets of Old Lorus transferred to us pursuant to the arrangement transaction (including losses for income, sales, excise and other taxes arising in connection with the transfer of any such asset) or conduct of the business prior to the effective time of the arrangement;

|

|

|

•

|

prior to, at or after the effective time as a result of any and all interests, rights, liabilities and other matters relating to the assets transferred by Old Lorus to us under the arrangement; and

|

|

|

•

|

prior to or at the effective time and directly or indirectly relating to, with certain exceptions, any of the activities of Old Lorus or the arrangement.

|

This indemnification could result in significant liability to us. To date no amount has been claimed on this indemnification. Should a claim arise under this indemnification it could result in significant liability to the Company which could have a negative impact on our liquidity, financial position, and ability to obtain future funding among other things.

We may not achieve our projected development goals in the time frames we announce and expect.

We set goals for, and make public statements regarding the expected timing of the accomplishment of objectives material to our success, such as the commencement and completion of clinical trials, the partnership of our product candidates and our ability to secure the financing necessary to continue the development of our product candidates. The actual timing of these events can vary dramatically due to factors within and beyond our control such as delays or failures in our clinical trials, the uncertainties inherent in the regulatory approval process, market conditions and interest by partners in our product candidates among other things. We cannot assure you that our clinical trials will be completed, that we will make regulatory submissions or receive regulatory approvals as planned, or that we will secure partnerships for any of our product candidates. Any failure to achieve one or more of these milestones as planned would have a material adverse effect on our business, financial condition and results of operations.

As a result of intense competition and technological change in the pharmaceutical industry, the marketplace may not accept our products or product candidates, and we may not be able to compete successfully against other companies in our industry and achieve profitability.

Many of our competitors have:

|

|

•

|

drug products that have already been approved or are in development, and operate large, well-funded research and development programs in these fields;

|

|

|

•

|

substantially greater financial and management resources, stronger intellectual property positions and greater manufacturing, marketing and sales capabilities, areas in which we have limited or no experience; and

|

|

|

•

|

significantly greater experience than we do in undertaking preclinical testing and clinical trials of new or improved pharmaceutical products and obtaining required regulatory approvals.

|

Consequently, our competitors may obtain Health Canada, FDA and other regulatory approvals for product candidates sooner and may be more successful in manufacturing and marketing their products than we or our collaborators are.

Our competitor’s existing and future products, therapies and technological approaches will compete directly with the products we seek to develop. Current and prospective competing products may be more effective than our existing and future products insofar as they may provide greater therapeutic benefits for a specific problem or may offer easier delivery or comparable performance at a lower cost.

Any product candidate that we develop and that obtains regulatory approval must then compete for market acceptance and market share. Our product candidates may not gain market acceptance among physicians, patients, healthcare payers, insurers, the medical community and other stakeholders. Further, any products we develop may become obsolete before we recover any expenses we incurred in connection with the development of these products. As a result, we may never achieve profitability.

If we fail to attract and retain key employees, the development and commercialization of our products may be adversely affected.

We depend on the principal members of our scientific and management staff. If we lose any of these persons, our ability to develop products and become profitable could suffer. The risk of being unable to retain key personnel may be increased by the fact that we have not executed long-term employment contracts with our employees, except for our senior executives. Our future success will also depend in large part on our ability to attract and retain other highly qualified scientific and management personnel. We face competition for personnel from other companies, academic institutions, government entities and other organizations.

We may be unable to obtain patents to protect our technologies from other companies with competitive products, and patents of other companies could prevent us from manufacturing, developing or marketing our products.

Patent protection:

The patent positions of pharmaceutical and biotechnology companies are uncertain and involve complex

legal and factual questions. The United States Patent and Trademark Office and many other patent offices in the world have not established a consistent policy regarding the breadth of claims that they will allow in biotechnology patents.

Allowable patentable subject matter and the scope of patent protection obtainable may differ between jurisdictions. If a patent office allows broad claims, the number and cost of patent interference proceedings in the United States, or analogous proceedings in other jurisdictions and the risk of infringement litigation may increase. If it allows narrow claims, the risk of infringement may decrease, but the value of our rights under our patents, licenses and patent applications may also decrease.

The scope of the claims in a patent application can be significantly modified during prosecution before the patent is issued. Consequently, we cannot know whether our pending applications will result in the issuance of patents or, if any patents are issued, whether they will provide us with significant proprietary protection or will be circumvented, invalidated or found to be unenforceable.

Publication of discoveries in scientific or patent literature often lags behind actual discoveries. Patent applications filed in the United States generally will be published 18 months after the filing date unless the applicant certifies that the invention will not be the subject of a foreign patent application. In many other jurisdictions, such as Canada, patent applications are published 18 months from the priority date. We cannot assure you that, even if published, we will be aware of all such literature. Accordingly, we cannot be certain that the named inventors of our products and processes were the first to invent that product or process or that we were the first to pursue patent coverage for our inventions.

Enforcement of intellectual property rights:

Protection of the rights revealed in published patent applications can be complex, costly and uncertain. Our commercial success depends in part on our ability to maintain and enforce our proprietary rights. If third parties engage in activities that infringe our proprietary rights, our management’s focus will be diverted and we may incur significant costs in asserting our rights. We may not be successful in asserting our proprietary rights, which could result in our patents being held invalid or a court holding that the third party is not infringing, either of which would harm our competitive position.

Others may design around our patented technology. We may have to participate in interference proceedings declared by the United States Patent and Trademark Office, European opposition proceedings, or other analogous proceedings in other parts of the world to determine priority of invention and the validity of patent rights granted or applied for, which could result in substantial cost and delay, even if the eventual outcome is favourable to us. We cannot assure you that our pending patent applications, if issued, would be held valid or enforceable.

Trade secrets:

We also rely on trade secrets, know-how and confidentiality provisions in our agreements with our collaborators, employees and consultants to protect our intellectual property. However, these and other parties may not comply with the terms of their agreements with us, and we might be unable to adequately enforce our rights against these people or obtain adequate compensation for the damages caused by their unauthorized disclosure or use of our trade secrets or know how. Our trade secrets or those of our collaborators may become known or may be independently discovered by others.

Our products and product candidates may infringe the intellectual property rights of others, or others many infringe on our intellectual property rights which could increase our costs.

Our success also depends on avoiding infringement of the proprietary technologies of others. In particular, there may be certain issued patents and patent applications claiming subject matter which we or our collaborators may be required to license in order to research, develop or commercialize at least some of our product candidates, including LOR-253 and IL17E. In addition, third parties may assert infringement or other intellectual property claims against us based on our patents or other intellectual property rights. An adverse outcome in these proceedings could subject us to significant liabilities to third-parties, require disputed rights to be licensed from third-parties or require us to cease or modify our use of the technology. If we are required to license such technology, we cannot assure you that a license under such patents and patent applications will be available on acceptable terms or at all. Further, we may incur substantial costs defending ourselves in lawsuits against charges of patent infringement or other unlawful use of another’s proprietary technology. We may also need to bring claims against others who we believe are infringing our rights in order to become or remain competitive and successful.

If product liability claims are brought against us or we are unable to obtain or maintain product liability insurance, we may incur substantial liabilities that could reduce our financial resources.

The clinical testing and commercial use of pharmaceutical products involves significant exposure to product liability claims. We have obtained limited product liability insurance coverage for our clinical trials on humans; however, our insurance coverage may be insufficient to protect us against all product liability damages. Regardless of merit or eventual outcome, liability claims may result in decreased demand for a future product, injury to reputation, withdrawal of clinical trial volunteers, loss of revenue, costs of litigation, distraction of management and substantial monetary awards to plaintiffs. Additionally, if we are required to pay a product liability claim, we may not have sufficient financial resources to complete development or commercialization of any of our product candidates and our business and results of operations will be adversely affected. In general, insurance will not protect us against some of our own actions such as negligence.

We are subject to privacy laws. Violations of these laws may result in significant liability and the incurring of substantial costs to achieve compliance.

Our business is focused on the development of biopharmaceutical products. As a result, we are subject to some privacy laws in Canada and several other jurisdictions which control the use, disclosure, transmission and retention of confidential personal information. Our insurance coverage and/or diligence may not protect us from all liability and regulatory action arising from non-compliance with these laws, particularly if our non-compliance is the result of our own negligent actions or misconduct. If we have to respond to regulatory action, pay damages, or incur expenses defending any claims, we may be materially and adversely affected.

We have no manufacturing capabilities. We depend on third-parties, including a number of sole suppliers, for manufacturing and storage of our product candidates used in our clinical trials. Product introductions may be delayed or suspended if the manufacture of our products is interrupted or discontinued.

Other than limited quantities for research purposes, we do not have manufacturing facilities to produce supplies of LOR-253, IL17E or any of our other product candidates to support clinical trials or commercial launch of these products, if they are approved. We are dependent on third parties for manufacturing and storage of our product candidates. If we are unable to contract for a sufficient supply of our product candidates on acceptable terms, or if we encounter delays or difficulties in the manufacturing process or our relationships with our manufacturers, we may not have sufficient product to conduct or complete our clinical trials or support preparations for the commercial launch of our product candidates, if approved.

Our business depends on licensing agreements, which may require us to meet obligations that are not favourable for our business.

Our business depends on arrangements with third parties such as licensors and licensees. Our license agreements may require us to diligently bring our products to market, make milestone payments and royalties that may be significant, and incur expenses associated with filing and prosecuting patent applications. We cannot assure you that we will be able to establish and maintain license agreements that are favourable for our business, if at all.

Our operations involve hazardous materials and we must comply with environmental laws and regulations, which can be expensive and restrict how we do business.

Our research and development activities involve the controlled use of hazardous materials, radioactive compounds and other potentially dangerous chemicals and biological agents. Although we believe our safety procedures for these materials comply with governmental standards, we cannot entirely eliminate the risk of accidental contamination or injury from these materials. We currently have insurance, in amounts and on terms typical for companies in businesses that are similarly situated that could cover all or a portion of a damage claim arising from our use of hazardous and other materials. However, if an accident or environmental discharge occurs, and we are held liable for any resulting damages, the associated liability could exceed our insurance coverage and our financial resources.

RISKS RELATED TO OUR COMMON SHARES

Our share price has been and may continue to be volatile and an investment in our Common Shares could suffer a decline in value.

You should consider an investment in our Common Shares as risky and invest only if you can withstand a significant loss and wide fluctuations in the market value of your investment. We receive only limited attention by securities analysts and frequently experience an imbalance between supply and demand for our Common Shares. The market price of our Common Shares has been highly volatile and is likely to continue to be volatile. This leads to a heightened risk of securities litigation pertaining to such volatility. Factors affecting our Common Share price include but are not limited to:

|

|

•

|

our financial position and doubt as to whether we will be able to continue as a going concern;

|

|

|

•

|

our ability to raise additional capital;

|

|

|

•

|

the progress of our clinical trials:

|

|

|

•

|

our ability to obtain partners and collaborators to assist with the future development of our products;

|

|

|

•

|

general market conditions;

|

|

|

•

|

announcements of technological innovations or new product candidates by us, our collaborators or our competitors;

|

|

|

•

|

published reports by securities analysts;

|

|

|

•

|

developments in patent or other intellectual property rights;

|

|

|

•

|

the cash and short term investments held us and our ability to secure future financing;

|

|

|

•

|

public concern as to the safety and efficacy of drugs that we and our competitors develop; and

|

|

|

•

|

shareholder interest in our Common Shares.

|

Future sales of our Common Shares by us or by our existing shareholders could cause our share price to fall.

The issuance of Common Shares by us could result in significant dilution in the equity interest of existing shareholders and adversely affect the market price of our Common Shares. Sales by existing shareholders of a large number of our Common Shares in the public market and the issuance of shares issued in connection with strategic alliances, or the perception that such additional sales could occur, could cause the market price of our Common Shares to decline and have an undesirable impact on our ability to raise capital.

Our outstanding common shares could be subject to dilution.

The exercise of stock options and warrants already issued by us, and the issuance of other additional securities in the future, could result in dilution in the value of our common shares and the voting power represented by the common shares. Furthermore, to the extent holders of our stock options or other securities exercise their securities and then sell the common shares they receive, our share price may decrease due to the additional amount of our common shares available in the market.

We are susceptible to stress in the global economy and therefore, our business may be affected by the current and future global financial condition.

If the increased level of volatility and market turmoil that have marked recent years continue, our operations, business, financial condition and the trading price of our Common Shares could be materially adversely affected. Furthermore, general economic conditions may have a great impact on us, including our ability to raise capital, our commercialization opportunities and our ability to establish and maintain arrangements with others for research, manufacturing, product development and sales.

There is no assurance that an active trading market in our common shares will be sustained.

Our common shares are listed for trading on the Toronto Stock Exchange. However, there can be no assurance that an active trading market in our common shares on the stock exchange will be sustained or that we will be able to maintain our listing.

There is a limited market for our common shares in the United States.

There is currently a limited market for our common shares in the United States. If a shareholder in the United States is unable to sell their common shares in the United States, they will be forced to sell their common shares over the TSX, which may expose the selling shareholder to currency exchange risk. In addition, because we are not listed on any United States stock exchange, resales of our common shares to United States residents under state securities or “blue sky” laws are likely to be limited to unsolicited transactions.

It may be difficult for non-Canadian investors to obtain and enforce judgments against us because of our Canadian incorporation and presence.

We are a corporation existing under the laws of Canada. Most of our directors and officers, and all of the experts named in this prospectus and the documents incorporated by reference into this prospectus, are residents of Canada, and all or a substantial portion of their assets, and a substantial portion of our assets, are located outside the United States. Consequently, although we have appointed an agent for service of process in the United States, it may be difficult for holders of these securities who reside in the United States to effect service within the United States upon those directors and officers, and the experts who are not residents of the United States. It may also be difficult for holders of these securities who reside in the United States to realize in the United States upon judgments of courts of the United States predicated upon our civil liability and the civil liability of our directors, officers and experts under the United States federal securities laws. Investors should not assume that Canadian courts (i) would enforce judgments of United States courts obtained in actions against us or such directors, officers or experts predicated upon the civil liability provisions of the United States federal securities laws or the securities or “blue sky” laws of any state within the United States or (ii) would enforce, in original actions, liabilities against us or such directors, officers or experts predicated upon the United States federal securities laws or any such state securities or “blue sky” laws. In addition, we have been advised by our Canadian counsel that in normal circumstances, only civil judgments and not other rights arising from United States securities legislation are enforceable in Canada and that the protections afforded by Canadian securities laws may not be available to investors in the United States.

We are likely a “passive foreign investment company” which may likely have adverse U.S. federal income tax consequences for U.S. shareholders.

U.S. investors in our common shares should be aware that the Company believes it was classified as a passive foreign investment company (“PFIC”) during the tax year ended May 31, 2012, and based on current business plans and financial expectations, the Company believes that it will be a PFIC for the current tax year. If the Company is a PFIC for any year during a U.S. shareholder’s holding period, then such U.S. shareholder generally will be required to treat any gain realized upon a disposition of common shares, or any so-called “excess distribution” received on its common shares, as ordinary income, and to pay an interest charge on a portion of such gain or distributions, unless the shareholder makes a timely and effective “qualified electing fund” election (“QEF Election”) or a “mark-to-market” election with respect to the common shares. A U.S. shareholder who makes a QEF Election generally must report on a current basis its share of the Company’s net capital gain and ordinary earnings for any year in which the Company is a PFIC, whether or not the Company distributes any amounts to its shareholders. However, U.S. shareholders should be aware that there can be no assurance that we will satisfy record keeping requirements that apply to a qualified electing fund, or that we will supply U.S. shareholders with information that such U.S. shareholders require to report under the QEF Election rules, in the event that we are a PFIC and a U.S. shareholder wishes to make a QEF Election. Thus, U.S. shareholders may not be able to make a QEF Election with respect to their common shares. A U.S. shareholder who makes the mark-to-market election generally must include as ordinary income each year the excess of the fair market value of the common shares over the taxpayer’s basis therein. This paragraph is qualified in its entirety by the discussion below under the heading “Certain United States Federal Income Tax Considerations.” Each U.S. shareholder should consult its own tax advisor regarding the U.S. federal, U.S. local, and foreign tax consequences of the PFIC rules and the acquisition, ownership, and disposition of our common shares.

Item 4. Information on the Company

A. History and Development of the Company

Old Lorus was incorporated under the Business Corporations Act (Ontario) on September 5, 1986 under the name RML Medical Laboratories Inc. On October 28, 1991, RML Medical Laboratories Inc. amalgamated with Mint Gold Resources Ltd., resulting in Old Lorus becoming a reporting issuer (as defined under applicable securities law) in Ontario, on such date. On August 25, 1992, Old Lorus changed its name to IMUTEC Corporation. On November 27, 1996, Old Lorus changed its name to Imutec Pharma Inc., and on November 19, 1998, Old Lorus changed its name to Lorus Therapeutics Inc. On October 1, 2005, Old Lorus continued under the Canada Business Corporations Act.

On the Arrangement Date, Old Lorus completed a plan of arrangement and corporate reorganization with, among others, 6650309 Canada Inc., a corporation incorporated under the Canada Business Corporations Act (“New Lorus”), 6707157 Canada Inc. and Pinnacle International Lands, Inc. As a result of the plan of arrangement and reorganization each common share of Old Lorus was exchanged for one common share of New Lorus. New Lorus continued the business of Old Lorus after the Arrangement Date with the same officers and employees and continued to be governed by the same board of directors as Old Lorus prior to the Arrangement Date.

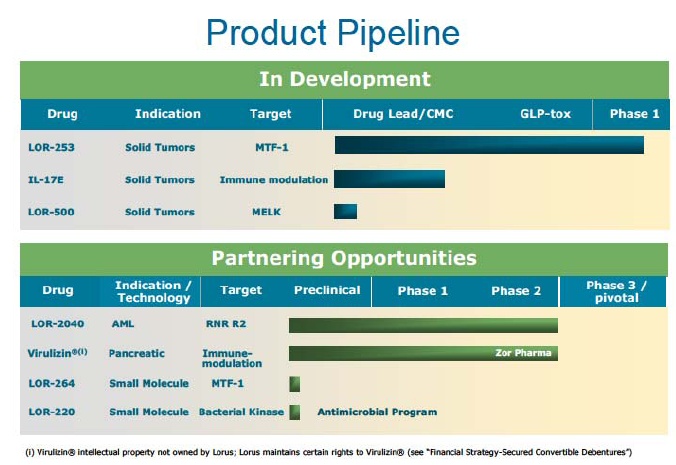

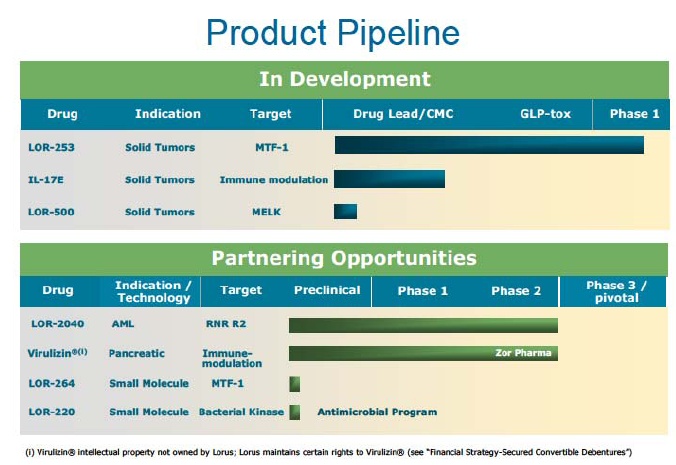

Lorus is a biopharmaceutical company focused on the discovery, research and development of novel anticancer therapies with a high safety profile. Lorus has worked to establish a diverse, marketable anticancer product pipeline, with products in various stages of development ranging from discovery and pre-clinical to a product available to start a Phase III clinical trial. A growing intellectual property portfolio supports our diverse product pipeline.