|

TO: |

Lorus Therapeutics Inc. (the “Corporation”) |

|

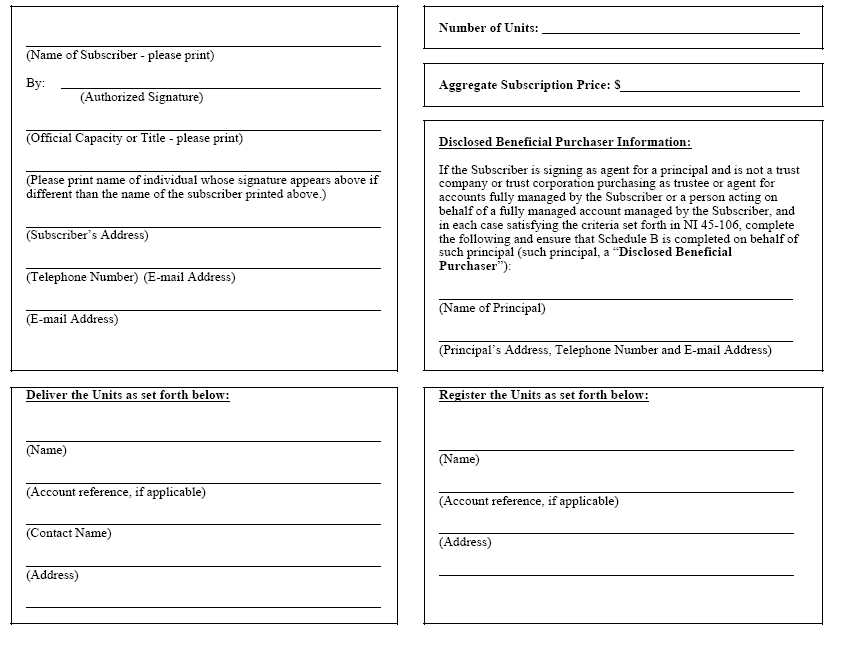

Number of common shares currently held directly or indirectly by the Subscriber and, if applicable, the Disclosed Beneficial Purchaser or over which such person exercises direction or control (excluding Offered Shares or Warrant Shares subscribed for hereunder):

______________________________________________________________________________________________________________________________________________________________________________________________________________

Number of securities convertible into common shares currently held directly or indirectly by the Subscriber and, if applicable, the Disclosed Beneficial Purchaser or over which such person exercises direction or control:

______________________________________________________________________________________________________________________________________________________________________________________________________________ |

|

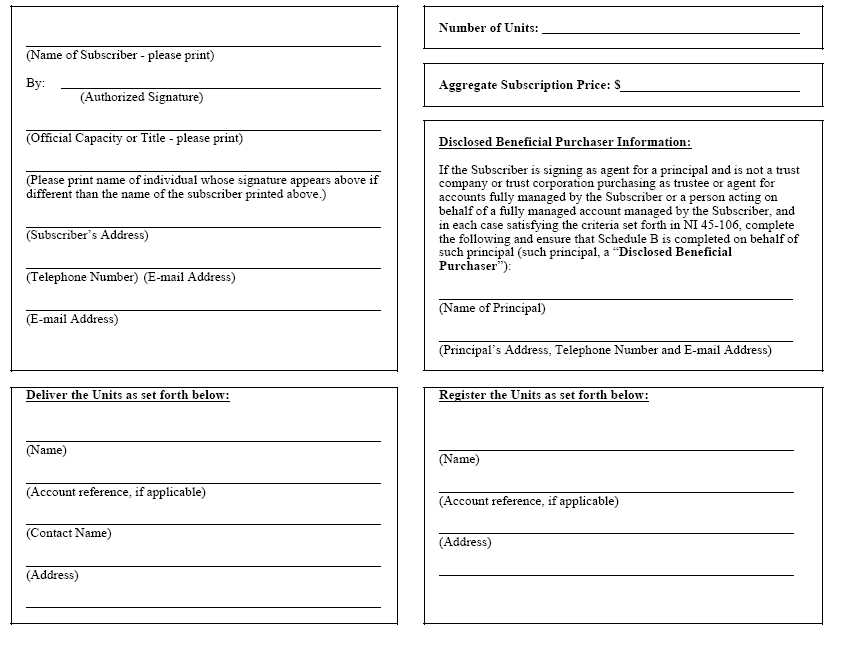

LORUS THERAPEUTICS INC.

By: __________________________________________________________

Authorized Signatory |

|

|

(1) |

The Subscriber acknowledges (on its own behalf and, if applicable, on behalf of the Disclosed Beneficial Purchaser) that this subscription is subject to rejection, acceptance or allotment by the Corporation at its discretion in whole or in part. |

|

|

(2) |

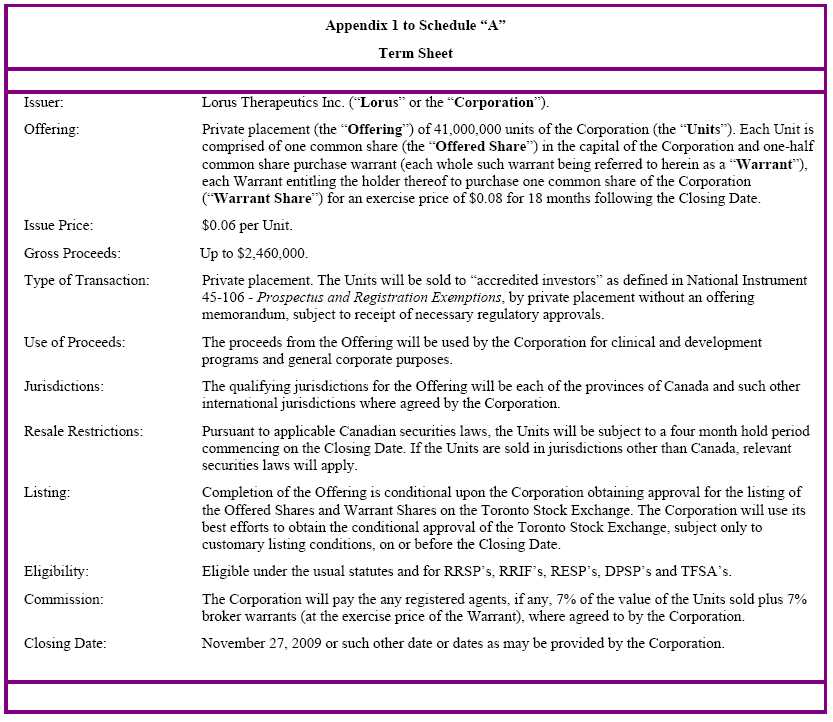

The Subscriber acknowledges (on its own behalf and, if applicable, on behalf of the Disclosed Beneficial Purchaser) that the Units subscribed for by it hereunder form part of a larger issuance and sale by the Corporation of up to 41,000,000 Units at a subscription price of $0.06, for aggregate gross proceeds of up to approximately $2,460,000 (the “Offering”). |

|

|

(a) |

The Corporation has been incorporated and organized and is a valid and subsisting corporation under the laws of Canada and has all requisite corporate power and authority to carry on its business as now conducted or proposed to be conducted and to own or lease and operate the property and assets thereof and the Corporation has all requisite corporate power and authority to enter into, execute and deliver this Subscription

Agreement and the certificate representing the Warrants and to carry out the obligations thereof hereunder and thereunder. |

|

|

(b) |

The Corporation is authorized to issue an unlimited number of common shares. |

|

|

(c) |

the Corporation will reserve or set aside sufficient shares in its treasury to issue the Warrant Shares on exercise of the Warrants; |

|

|

(d) |

the execution of this Subscription Agreement, the issue and sale of the Offered Securities by the Corporation does not and will not conflict with, and does not and will not result in a breach of, any of the terms of the Corporation’s incorporating documents or any agreement or instrument to which the Corporation is a party; |

|

|

(e) |

this Subscription Agreement has been or will be by the Closing, duly authorized by all necessary corporate action on the part of the Corporation, duly executed and delivered by the Corporation, it constitutes a legal, valid and binding agreement of the Corporation enforceable against the Corporation except as enforcement may be limited by bankruptcy, insolvency, moratorium, reorganization or other laws affecting

the rights of creditors generally and by general equitable principles, and the Corporation has full corporate power and authority to undertake the Offering; |

|

|

(f) |

the Corporation is a “reporting issuer” within the meaning of applicable Canadian securities legislation, and is not in material default of any of the requirements of applicable Canadian securities legislation or any of the administrative policies or notices of the regulatory authorities; |

|

|

(g) |

there are no judgments against the Corporation or any of its subsidiaries, if any, which are unsatisfied, nor are there any consent decrees or injunctions to which the Corporation or any of its subsidiaries is subject; |

|

|

(h) |

the common shares in the capital of the Corporation are listed for trading on the Toronto Stock Exchange under the symbol “LOR” and the Corporation is in compliance with the rules and regulations of such body; |

|

|

(i) |

no order ceasing or suspending trading in securities of the Corporation nor prohibiting the sale of such securities has been issued to and is outstanding against the Corporation or its directors, officers or promoters or against any other companies that have common directors, officers or promoters and, to the best of the Corporation’s knowledge, no investigations or proceedings for such purposes are pending

or threatened; and |

|

|

(j) |

the Corporation will within the required time, file with the Toronto Stock Exchange or any other applicable securities agency, any documents, reports and information, in the required form, required to be filed by applicable securities laws in connection with this Offering, together with any applicable filing fees and other materials; |

|

|

(3) |

The Subscriber (on its own behalf and, if applicable, on behalf of the Disclosed Beneficial Purchaser) represents, warrants and covenants to the Corporation to such representations, warranties and covenants, (and the Subscriber acknowledges that the Corporation, and its legal counsel are relying thereon) that: |

|

|

a. |

each of the Subscriber and, if applicable, the Disclosed Beneficial Purchaser is an accredited investor (“Accredited Investor”) as such term is defined in both National Instrument 45-106 - Prospectus and

Registration Exemptions (“NI 45-106”), and has indicated each category of Accredited Investor that it satisfies by completing (i) the certification attached as Appendix I to Schedule B hereto and (ii) the representation letter attached as Schedule B hereto; |

|

|

b. |

unless the Subscriber is purchasing the Units under subparagraph (3)c, the Subscriber is purchasing the Units as principal for its own account, and not for the benefit of any other person, and for investment purposes only, and not with a view to the resale or distribution of all or any of such Units, and is resident in or otherwise subject to the applicable securities legislation of the jurisdiction set

out as the “Subscriber’s Address” on the face page hereof; provided that, for the avoidance of doubt, nothing contained in this Subscription Agreement will prejudice the Subscriber’s right at any time or from time to time to sell or otherwise dispose of all or some of the Units in compliance with applicable securities laws and nothing contained in this Subscription Agreement shall be deemed a representation or warranty by the Subscriber to hold the Units for any period of time; |

|

|

c. |

if the Subscriber is not purchasing as a principal, (i) the Subscriber is duly authorized to enter into this Subscription Agreement and to execute and deliver all documentation in connection with the purchase of Units on behalf of the Disclosed Beneficial Purchaser, (ii) the Subscriber and the Disclosed Beneficial Purchaser acknowledge that the Corporation is required by law to disclose to certain regulatory authorities

the identity of the Disclosed Beneficial Purchaser for whom it may be acting, (iii) the Subscriber is resident in the jurisdiction set out as the “Subscriber’s Address” on the face page hereof and the Disclosed Beneficial Purchaser is resident in the jurisdiction set out under the heading “Disclosed Beneficial Purchaser Information” on the face page hereof; |

|

|

d. |

neither the Subscriber nor, if applicable, the Disclosed Beneficial Purchaser was formed for the purpose of purchasing the Units; |

|

|

e. |

if the Subscriber is an individual, the Subscriber has the legal capacity and competence to enter into and execute this Subscription Agreement and to take all actions required pursuant hereto; |

|

|

f. |

the Subscriber (and, if applicable, the Disclosed Beneficial Purchaser) is aware of and has received independent legal advice with respect to applicable securities legislation that may impose restrictions upon the resale of the Offered Shares, Warrants, and Warrant Shares, is aware of the fact that he, she or it may not be able to resell the Offered Shares, Warrants or Warrant Shares except in accordance with the

terms of this Subscription Agreement, applicable securities legislation and regulatory policies and acknowledges and agrees that he, she or it is solely responsible (and the Corporation is not in any way responsible) for compliance with applicable resale restrictions and will comply with such restrictions; |

|

|

g. |

the Subscriber (and, if applicable, the Disclosed Beneficial Purchaser) has such prior investment experience, knowledge, sophistication and experience in business and financial matters that he, she or it is capable of evaluating the merits and risks of an investment in the Units, is able to bear the economic risk of losing its entire investment and recognizes the highly speculative nature of its investment; |

|

|

h. |

the Subscriber (and, if applicable, the Disclosed Beneficial Purchaser) has been given the opportunity to ask questions concerning the business, business plans, finances, management and ownership of the Corporation and has received answers to such questions to his, her or its full satisfaction; |

|

|

i. |

in making the decision to invest in the Units, the Subscriber (and, if applicable, the Disclosed Beneficial Purchaser) has relied solely upon the information provided in this Subscription Agreement, the attached Term Sheet, the Corporation’s publicly disclosed documents as filed at www.sedar.com and his, her or its own investigation of the Corporation, which information and investigation has provided the Subscriber

(and, if applicable, the Disclosed Beneficial Purchaser) with all the information he, she or it has deemed necessary for purposes of his, her or its investment decision, and has not relied upon any statements made or information provided by the Corporation or any of its officers, employees, agents or representatives other than the statements and information that is set forth in this Subscription Agreement; |

|

|

j. |

the Subscriber (and, if applicable, the Disclosed Beneficial Purchaser) acknowledges and understands that no person has made any written or oral representation (i) that any person will resell or repurchase any or all of the Offered Shares, Warrants and Warrant Shares, (ii) that any person will refund the purchase price of the Units or (iii) as to future price or value of the Offered Shares, Warrants and Warrant Shares; |

|

|

k. |

no Units were offered to the Subscriber (or, if applicable, the Disclosed Beneficial Purchaser) by means of general solicitation or advertisement and, in connection therewith, the Subscriber (and, if applicable, the Disclosed Beneficial Purchaser) has not received or been provided with or requested, and does not have any need to receive, any offering memorandum, prospectus, sales or advertising literature or other

document describing the business and affairs of the Corporation which has been prepared for delivery to, and review by, prospective purchasers in order to assist them in making an investment decision with respect to the Units and the Subscriber (and, if applicable, the Disclosed Beneficial Purchaser) has not become aware of any advertisement in printed media of general and regular paid circulation (or other printed public media), radio, television or telecommunications or other form of advertisement with respect

to the distribution of the Units; |

|

|

l. |

none of the funds being used to purchase the Units are, to the knowledge of the Subscriber, proceeds obtained or derived directly or indirectly as a result of illegal activities; |

|

|

m. |

the Subscriber (and, if applicable, the Disclosed Beneficial Purchaser) acknowledges and consents to the placement of any required legend under Canadian securities laws on any certificate evidencing the Offered Shares, Warrants, and Warrant Shares issued to the Subscriber. The legend to be placed on each certificate shall be in form substantially similar to the following: |

|

|

n. |

the Subscriber (and, if applicable, the Disclosed Beneficial Purchaser) represents and warrants that on and from the date that he, she or it first became aware of the Offering until the date hereof he, she or it has not engaged in, and covenants that for the period commencing on the date hereof and ending on the public announcement of the Offering he, she or it will not engage in, any hedging, short sale or other

similar transaction with respect to the Offered Shares, Warrants and Warrant Shares or any security (other than a broad-based market basket or index) that relates to or derives a significant part of its value from the Offered Shares, Warrants and Warrant Shares; |

|

|

o. |

the Subscriber has full power and authority (corporate, statutory and otherwise) to execute and deliver this Subscription Agreement and to purchase the Units on its own behalf or, if applicable, on behalf of the Disclosed Beneficial Purchaser and this Subscription Agreement has been duly and validly executed and delivered by the Subscriber and constitutes the legal, valid and binding obligation of the Subscriber,

enforceable against the Subscriber in accordance with its terms; |

|

|

p. |

neither the Subscriber nor, if applicable, the Disclosed Beneficial Purchaser is a “control person” of the Company, as that term is defined in the applicable securities legislation and will not become a “control person” of the Company by virtue of the purchase of Units under this Agreement and does not act or intend to act in concert with any other person to form a control group in respect

of the Company; |

|

|

q. |

the entering into of this Subscription Agreement and the completion of the transactions contemplated hereby will not result in a violation of any of the terms or provisions of any law applicable to the Subscriber (or, if applicable, the Disclosed Beneficial Purchaser) or, if Subscriber (or, if applicable, the Disclosed Beneficial Purchaser) is not a natural person, the constating documents of the Subscriber (or,

if applicable, the Disclosed Beneficial Purchaser) or of any agreement, instrument, undertaking or covenant to which the Subscriber (or, if applicable, the Disclosed Beneficial Purchaser) is a party or by which he, she or it is bound; |

|

|

r. |

the Subscriber (and, if applicable, the Disclosed Beneficial Purchaser) has no knowledge of a “material fact” or “material change” (as those terms are defined in the applicable securities legislation) in the affairs of the Corporation that has not been generally disclosed to the public, save knowledge of this particular transaction; |

|

|

s. |

the Subscriber (and, if applicable, the Disclosed Beneficial Purchaser) acknowledges that purchasing, holding, exercising and disposing of the Offered Shares, Warrants and Warrant Shares may have tax consequences under the laws of Canada, that prospective purchasers are solely responsible for determining the tax consequences applicable to their particular circumstances and that he, she or it has been advised by the

Corporation to consult its tax advisors concerning an investment in the Units; |

|

|

t. |

the Subscriber (and, if applicable, the Disclosed Beneficial Purchaser) understands that no governmental or regulatory authority, including any securities regulatory authority, has made any recommendations or endorsements with respect to the Units or an investment therein and there is no government or other insurance covering the Units or an investment therein; |

|

|

u. |

the Subscriber (and, if applicable, the Disclosed Beneficial Purchaser) understands, acknowledges and agrees that this Subscription Agreement shall be binding upon and inure to the benefit of the parties and their heirs, executors, administrators, successors, legal representatives and permitted assigns; |

|

|

v. |

the Subscriber (and, if applicable, the Disclosed Beneficial Purchaser) acknowledges and understands that the Corporation is relying on an exemption under applicable securities legislation from the requirements to provide the Subscriber (or, if applicable, the Disclosed Beneficial Purchaser) with a prospectus and to sell securities through a person or company registered to sell securities under applicable securities

legislation, and: |

|

|

i. |

in issuing securities pursuant to this exemption, the Corporation is relying upon the representations and warranties of the Subscriber (and, if applicable, the Disclosed Beneficial Purchaser); and |

|

|

ii. |

as a consequence of acquiring securities pursuant to this exemption, certain protections, rights and remedies provided by such securities legislation, including statutory rights of rescission or damages, will not be available to the Subscriber (or, if applicable, the Disclosed Beneficial Purchaser); |

|

|

w. |

the Subscriber (and, if applicable, the Disclosed Beneficial Purchaser) represents and warrants that the Units have not been offered to the Subscriber (or any Disclosed Beneficial Purchaser) in the United States, and the person making the order to purchase the Units and executing and delivering this Subscription Agreement was not in the United States when such order was placed and this Subscription Agreement was

executed and delivered; and |

|

|

x. |

the Subscriber (and, if applicable, the Disclosed Beneficial Purchaser) represents and warrants that it is not a U.S. Person (as defined in Regulation S under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), which definition includes, but is not limited to, an individual resident

in the United States, an estate or trust of which any executor or administrator or trustee, respectively, is a U.S. Person, and any partnership or corporation organized or incorporated under the laws of the United States) and is not purchasing the Units on behalf of, or for the account or benefit of, a person in the United States or a U.S. Person; and |

|

|

y. |

the Subscriber (and, if applicable, the Disclosed Beneficial Purchaser) understands and acknowledges that none of the Units, the Offered Shares and Warrants comprising the Units, or the Warrant Shares have been or will be registered under the U.S. Securities Act, and that the Warrants may be exercised only pursuant to an exemption or exclusion from the registration requirements of the U.S. Securities Act and any

applicable state securities laws. |

|

|

(4) |

On or before 5:00 p.m. (Toronto time) on November 25, 2009 or such other time as is established by the Corporation, the Subscriber will deliver to the Corporation at 2 Meridian Road, Toronto ON, M9W 4Z7, Attention: Saied Babaei (416-798-1200), fax number: (416) 798-2200, Attention: Saeid Babaei (i) this duly and completed Subscription Agreement (including Schedule B attached hereto) and

(ii) unless other payment arrangements acceptable to the Corporation has been made, a certified cheque or bank draft payable to “Lorus Therapeutics Inc.” in an amount equal to the Aggregate Subscription Price. |

|

|

(5) |

The sale of Units pursuant to this Subscription Agreement will be completed at the offices of McCarthy Tétrault LLP, counsel to the Corporation, at 8:30 a.m. (Toronto time) or such other time as is established by the Corporation (the “Closing

Time”) on November 27, 2009 or such other date as is established by the Corporation (the “Closing Date”). If this Subscription Agreement is rejected in whole or in part, the Subscriber acknowledges (on its own behalf and, if applicable, on behalf of the Disclosed Beneficial Purchaser) that the unused portion of the subscription amount will be promptly returned to it without

interest. |

|

|

(6) |

The Corporation shall be entitled to rely on delivery of a facsimile copy or an electronic transmission of this executed Subscription Agreement, and acceptance by the Corporation of such facsimile subscriptions shall be legally effective to create a valid and binding agreement between the Subscriber and the Corporation in accordance with the terms hereof. In addition, this Subscription Agreement may be

executed in counterparts, each of which shall be deemed to be an original and all of which shall constitute one and the same document. |

|

|

(7) |

The Subscriber agrees (on its own behalf and, if applicable, on behalf of the Disclosed Beneficial Purchaser) that the representations, warranties and covenants of the Subscriber herein will be true and correct both as of the execution of this Subscription Agreement and as of the Closing Time and will survive the completion of the issuance of the Offered Shares, Warrants and Warrant Shares issued pursuant hereto. The

representations, warranties and covenants of the Subscriber herein are made with the intent that they be relied upon by the Corporation and its legal counsel in determining the eligibility of a purchaser of Offered Shares, Warrants and Warrant Shares under the Offering and the Subscriber (and, if applicable, the Disclosed Beneficial Purchaser) agrees to indemnify and save harmless the Corporation and its affiliates, shareholders, directors, officers, employees, counsel and agents against all losses,

claims, costs, expenses and damages or liabilities which any of them may suffer or incur which are caused or arise from a breach thereof. The Subscriber undertakes to immediately notify the Corporation at Lorus Therapeutics, 2 Meridian Road, Toronto ON, M9W 4Z7, Attention: Saied Babaei (416-798-1200), fax number: (416) 798-2200 of any change in any statement or other information relating to the Subscriber (or, if applicable, the Disclosed Beneficial Purchaser) set forth herein which takes

place prior to the Closing Time. |

|

|

(8) |

The Subscriber (on its own behalf and, if applicable, on behalf of the Disclosed Beneficial Purchaser) acknowledges that the Units are being offered on a private placement basis. |

|

|

(9) |

The Subscriber (on its own behalf and, if applicable, on behalf of the Disclosed Beneficial Purchaser) hereby irrevocably authorizes the Corporation, in its sole discretion to complete or correct any errors or omissions in any form or document provided by the Subscriber, including this Subscription Agreement; and to receive on its behalf certificates representing the Units purchased under this Subscription Agreement. |

|

(10) |

The obligations of the parties hereunder are subject to acceptance of the terms of the Offering by the Toronto Stock Exchange and all other required regulatory approvals. |

|

(11) |

The Subscriber (on its own behalf and, if applicable, on behalf of the Disclosed Beneficial Purchaser) acknowledges and agrees that all costs incurred by the Subscriber (or, if applicable, the Disclosed Beneficial Purchaser), including any fees and disbursements of any special counsel retained by the Subscriber (or, if applicable, the Disclosed Beneficial Purchaser) relating to the sale of the Units issued hereunder

shall be borne by the Subscriber (or, if applicable, the Disclosed Beneficial Purchaser). |

|

(12) |

This Subscription Agreement and all documents relating thereto shall be governed by and construed in accordance with the laws of the Province of Ontario and the federal laws of Canada applicable therein. The parties irrevocably attorn to the exclusive jurisdiction of the courts of the Province of Ontario. Time shall be of the essence hereof. |

|

(13) |

The invalidity, illegality or unenforceability of any provision of this Subscription Agreement shall not affect the validity, legality or enforceability of any other provision hereof. |

|

(14) |

The headings used in this Subscription Agreement have been inserted for convenience of reference only and shall not affect the meaning or interpretation of this Subscription Agreement or any provision hereof. |

|

(15) |

This Subscription Agreement represents the entire agreement of the parties hereto relating to the subject matter hereof and there are no representations, covenants or other agreements relating to the subject matter hereof except as stated or referred to herein. |

|

(16) |

Neither this Subscription Agreement nor any provision hereof shall be modified, changed, discharged or terminated except by an instrument in writing signed by the party against whom any waiver, change, discharge or termination is sought. |

|

(17) |

The Subscriber (on its own behalf and, if applicable, on behalf of the Disclosed Beneficial Purchaser) acknowledges that this Subscription Agreement and the exhibits and schedules hereto require the Subscriber to provide certain personal information relating to the Subscriber (and, if applicable, the Disclosed Beneficial Purchaser) to the Corporation. Such information is being collected by the Corporation

for the purposes of completing the Offering, which includes, without limitation, determining the Subscriber’s eligibility to purchase the Units under applicable securities legislation, preparing and registering certificates representing Units to be issued to the Subscriber and completing filings required by any stock exchange or securities regulatory authority. Such personal information may be disclosed by the Corporation to (a) stock exchanges or securities regulatory authorities (including

the Ontario Securities Commission, (b) the Corporation’s registrar and transfer agent, (c) any government agency, board or other entity and (d) any of the other parties involved in this private placement, including the Corporation, and its legal counsel, and may be included in record books in connection with this Offering. By executing this Subscription Agreement, the Subscriber (on its own behalf and, if applicable, on behalf of the Disclosed Beneficial Purchaser) is deemed to be consenting

to the foregoing collection, use and disclosure of such personal information. The Subscriber (on its own behalf and, if applicable, on behalf of the Disclosed Beneficial Purchaser) also consents to the filing of copies or originals of any of the schedules to this Subscription Agreement as may be required to be filed with any stock exchange or securities regulatory authority in connection with the transactions contemplated hereby. |

|

(18) |

The Subscriber (on its own behalf and, if applicable, on behalf of the Disclosed Beneficial Purchaser) represents and warrants that the Aggregate Subscription Price which will be advanced by the Subscriber to the Corporation hereunder will not represent proceeds of crime for the purposes of the Proceeds of Crime (Money

Laundering) and Terrorist Financing Act (Canada) (the “PCMLA”) and the Subscriber acknowledges (on its own behalf and, if applicable, on behalf of the Disclosed Beneficial Purchaser) that the Corporation may in the future be required by law to disclose his, her or its name and other information

relating to this Subscription Agreement and his, her or its subscription hereunder, on a confidential basis, pursuant to the PCMLA or other applicable legislation. To the best of his, her or its knowledge, none of the subscription funds to be provided pursuant to this Agreement (a) have been or will be derived from or related to any activity that is deemed criminal under the law of Canada or any other jurisdiction or (b) are being tendered on behalf of a person or entity who has not been identified

to the Subscriber. The Subscriber shall promptly notify the Corporation if the Subscriber discovers that any of such representations ceases to be true, and to provide the Corporation with appropriate information in connection therewith. |

|

(19) |

The parties hereto acknowledge and confirm that they have requested that this Subscription Agreement as well as all notices and other documents contemplated hereby be drawn up on the English language. Les parties aux présentes reconnaissent et conferment qu'elles ont convenu que la présente convention de souscription ainsi que tous les avis et documents qui s'y rattachent soient rédigés dans la

langue anglaise. |

|

Signature of individual or Authorized Signatory |

|

|

|

Name (please print) |

|

|

|

Name of authorized signatory (please print) |

|

|

|

Address (residence if an individual) |

|

|

|

Telephone Number |

|

IMPORTANT: PLEASE INITIAL THE APPLICABLE PROVISION ON APPENDIX 1 TO THIS SCHEDULE “B” |

|

|

(a) |

a Canadian financial institution, or a Schedule III bank; |

|

|

(b) |

the Business Development Bank of Canada incorporated under the Business Development Bank of Canada Act (Canada); |

|

|

(c) |

a subsidiary of any person referred to in paragraphs (a) or (b), if the person owns all of the voting securities of the subsidiary, except the voting securities required by law to be owned by directors of that subsidiary; |

|

|

(d) |

a person registered under the securities legislation of a jurisdiction of Canada as an adviser or dealer, other than a person registered solely as a limited market dealer under one or both of the Securities Act (Ontario) or the Securities

Act (Newfoundland and Labrador); |

|

|

(e) |

an individual registered or formerly registered under the securities legislation of a jurisdiction of Canada as a representative of a person referred to in paragraph (d); |

|

|

(f) |

the Government of Canada or a jurisdiction of Canada, or any crown corporation, agency or wholly owned entity of the Government of Canada or a jurisdiction of Canada; |

|

|

(g) |

a municipality, public board or commission in Canada and a metropolitan community, school board, the Comité de gestion de la taxe scolaire de l’île de Montréal or an intermunicipal management board in Québec; |

|

|

(h) |

any national, federal, state, provincial, territorial or municipal government of or in any foreign jurisdiction, or any agency of that government; |

|

|

(i) |

a pension fund that is regulated by either the Office of the Superintendent of Financial Institutions (Canada) or a pension commission or similar regulatory authority of a jurisdiction of Canada; |

|

|

(j) |

an individual who, either alone or with a spouse, beneficially owns, directly or indirectly, financial assets having an aggregate realizable value that before taxes, but net of any related liabilities, exceeds CDN$1,000,000; |

|

|

(k) |

an individual whose net income before taxes exceeded CDN$200,000 in each of the two most recent calendar years or whose net income before taxes combined with that of a spouse exceeded CDN$300,000 in each of the two most recent calendar years and who, in either case, reasonably expects to exceed that net income level in the current calendar year; |

|

|

(l) |

an individual who, either alone or with a spouse, has net assets of at least CDN$5,000,000; |

|

|

(m) |

a person, other than an individual or investment fund, that has net assets of at least $5,000,000 as shown on its most recently prepared financial statements, provided that such person has not been created or used solely to purchase or hold securities as an accredited investor; |

|

|

(n) |

an investment fund that distributes or has distributed its securities only to |

|

|

(A) |

a person that is or was an accredited investor at the time of the distribution, |

|

|

(B) |

a person that acquires or acquired securities in the circumstances referred to in sections 2.10 [Minimum amount investment], and 2.19 [Additional investment in investment funds] of NI 45-106, or |

|

|

(C) |

a person described in paragraph (A) or (B) that acquires or acquired securities under section 2.18 [Investment fund reinvestment] of NI 45-106; |

|

|

(o) |

an investment fund that distributes or has distributed securities under a prospectus in a jurisdiction of Canada for which the regulator or, in Québec, the securities regulatory authority, has issued a receipt; |

|

|

(p) |

a trust company or trust corporation registered or authorized to carry on business under the Trust and Loan Companies Act (Canada) or under comparable legislation in a jurisdiction of Canada or a foreign jurisdiction, acting on behalf of a fully managed account managed by the trust company or trust corporation, as

the case may be; |

|

|

(q) |

a person acting on behalf of a fully managed account managed by that person, if that person |

|

|

(A) |

is registered or authorized to carry on business as an adviser or the equivalent under the securities legislation of a jurisdiction of Canada or a foreign jurisdiction, and |

|

|

(B) |

in Ontario, is purchasing a security that is not a security of an investment fund; |

|

|

(r) |

a registered charity under the Income Tax Act (Canada) that, in regard to the trade, has obtained advice from an eligibility adviser or an adviser registered under the securities legislation of the jurisdiction of the registered charity to give advice on the securities being traded; |

|

|

(s) |

an entity organized in a foreign jurisdiction that is analogous to any of the entities referred to in paragraphs (a) to (d) or paragraph (i) in form and function; |

|

|

(t) |

a person in respect of which all of the owners of interests, direct, indirect or beneficial, except the voting securities required by law to be owned by directors, are persons that are accredited investors (as defined in NI 45-106); |

|

|

(u) |

an investment fund that is advised by a person registered as an adviser or a person that is exempt from registration as an adviser; or |

|

|

(v) |

a person that is recognized or designated by the securities regulatory authority or, except in Ontario and Québec, the regulator as |

|

|

(B) |

an exempt purchaser in Alberta or British Columbia, and confirmation of such status is being provided to the Corporation. |

|

|

(a) |

for the purposes of British Columbia, Manitoba, and Ontario securities law, when such securities are beneficially owned by |

|

|

(a) |

an association governed by the Cooperative Credit Associations Act (Canada) or a central cooperative credit society for which an order has been made under section 473(1) of that Act, or |

|

|

(b) |

a bank, loan corporation, trust company, trust corporation, insurance company, treasury branch, credit union, caisse populaire, financial services cooperative, or league that, in each case, is authorized by an enactment of Canada or a jurisdiction of Canada to carry on business in Canada or a jurisdiction in Canada; |

|

|

(a) |

is engaged to provide services to the issuer or a related entity of the issuer, other than services provided in relation to a distribution, |

|

|

(c) |

spends or will spend a significant amount of time and attention on the affairs and business of the issuer or a related entity of the issuer |

|

|

(a) |

the first person, directly or indirectly, beneficially owns or exercises control or direction over securities of the second person carrying votes which, if exercised, would entitle the first person to elect a majority of directors of the second person, unless that first person holds the voting securities only to secure an obligation; |

|

|

(b) |

the second person is a partnership, other than a limited partnership, and the first person holds more than 50% of the interests of the partnership; or |

|

|

(c) |

the second person is a limited partnership and the general partner of the limited partnership is the first person; |

|

|

(a) |

for the purposes of Alberta securities law, any person or company that holds or is one of a combination of persons or companies that holds |

|

|

(i) |

a sufficient number of any of the securities of an issuer so as to affect materially the control of the issuer, or |

|

|

(ii) |

more than 20% of the outstanding voting securities of an issuer except where there is evidence showing that the holding of those securities does not affect materially the control of the issuer; |

|

|

(i) |

a person who holds a sufficient number of the voting rights attached to all outstanding voting securities of an issuer to affect materially the control of the issuer, or |

|

|

(ii) |

each person in a combination of persons, acting in concert by virtue of an agreement, arrangement, commitment or understanding, which holds in total a sufficient number of the voting rights attached to all outstanding voting securities of an issuer to affect materially the control of the issuer, |

|

|

(c) |

and, for the purposes of Manitoba, Ontario and Québec securities law, any person or company that holds or is one of a combination of persons that holds: |

|

|

(i) a sufficient number of any securities of an issuer so as to affect materially the control of the issuer, or |

|

|

(ii) |

more than 20% of the outstanding voting securities of an issuer except where there is evidence showing |

|

|

that the holding of those securities does not affect materially the control of that issuer; |

|

|

(a) |

a member of the board of directors of a company or an individual who performs similar functions for a company, and |

|

|

(b) |

with respect to a person that is not a company, an individual who performs functions similar to those of a director of a company; |

|

|

“eligibility adviser” means |

|

(a) |

a person that is registered as an investment dealer or in an equivalent category of registration under the securities legislation of the jurisdiction of a purchaser and authorized to give advice with respect to the type of security being distributed; and |

|

|

(b) |

in Manitoba, also means a lawyer who is a practicing member in good standing with a law society of a jurisdiction of Canada or a public accountant who is a member in good standing of an institute or association of chartered accountants, certified general accountants or certified management accountants in a jurisdiction of Canada provided that the lawyer or public accountant must not |

|

|

(i) |

have a professional, business or personal relationship with the issuer, or any of its directors, executive officers, founders, or control persons, and |

|

|

(ii) |

have acted for or been retained personally or otherwise as an employee, executive officer, director, associate or partner of a person that has acted for or been retained by the issuer or any of its directors, executive officers, founders or control persons within the previous 12 months; |

|

|

(b) |

a vice-president in charge of a principal business unit, division or function including sales, finance or production, |

|

|

(c) |

an officer of the issuer or any of its subsidiaries and who performs a policy-making function in respect of the issuer, or |

|

|

(d) |

performing a policy-making function in respect of the issuer; |

|

|

(c) |

a contract of insurance, a deposit or an evidence of a deposit that is not a security for the purposes of securities legislation; |

|

|

(a) |

acting alone, in conjunction, or in concert with one or more other persons, directly or indirectly, takes the initiative in founding, organizing or substantially reorganizing the business of the issuer, and |

|

|

(a) |

a partnership, unincorporated association, unincorporated syndicate, unincorporated organization or a trust, or |

|

|

(b) |

a natural person in the person’s capacity as trustee, executor, administrator or other legal representative; |

|

(a) |

for the purposes of Alberta, Manitoba, Ontario and Québec securities law, an issuer of securities that entitles the holder to receive on demand, or within a specified period after demand, an amount computed by reference to the value of a proportionate interest in the whole or in part of the net assets, including a separate fund or trust account, of the issuer; |

|

(b) |

and, for the purposes of British Columbia securities law, also includes |

|

|

(i) |

an issuer described in an order that the British Columbia Securities Commission may make pursuant to section 3.2 of the Securities Act (British Columbia); and |

|

|

(ii) |

an issuer that is in a class of prescribed issuers, |

|

|

(A) |

for the purpose of exercising or seeking to exercise control of an issuer, other than an issuer that is a mutual fund or a non-redeemable investment fund, or |

|

|

(B) |

for the purpose of being actively involved in the management of any issuer in which it invests, other than an issuer that is a mutual fund or a non-redeemable investment fund, and |

|

|

(c) |

a partnership, trust, fund and an association, syndicate, organization or other organized group of persons, whether incorporated or not, and |

|

|

(d) |

an individual or other person in that person’s capacity as a trustee, executor, administrator or personal or other legal representative; |

|

|

(a) |

liabilities incurred or assumed for the purpose of financing the acquisition or ownership of financial assets; or |

|

|

(a) |

for Alberta, the Securities Act (Alberta) and the regulations and rules under such Act and the blanket rulings and orders issued by the Alberta Securities Commission; |

|

|

(b) |

for British Columbia, the Securities Act (British Columbia) and the regulations, rules and forms under such Act and the blanket rulings and orders issued by the British Columbia Securities Commission; |

|

|

(c) |

for Manitoba, the Securities Act (Manitoba) and the regulations and rules under such Act and the blanket rulings and orders issued by the Manitoba Securities Commission; |

|

|

(d) |

for Ontario, the Securities Act (Ontario) and the regulations and rules under such Act; and |

|

|

(e) |

for Québec, the Securities Act (Québec) and the regulations and rules under such Act, policy statements and blanket rulings and orders and decisions issued by the Authorité des marchés financiers; |

|

|

(a) |

is married to another individual and is not living separate and apart within the meaning of the Divorce Act (Canada), from the other individual, |

|

|

(b) |

is living with another individual in a marriage-like relationship, including a marriage-like relationship between individuals of the same gender, or |

|

|

(c) |

in Alberta, is an individual referred to in paragraph (a) or (b), or is an adult interdependent partner within the meaning of the Adult Interdependent Relationships Act (Alberta); |