|

o

|

REGISTRATION

STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES

EXCHANGE

ACT OF 1934.

|

|

OR

|

|

|

x

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE

ACT OF

1934.FOR THE FISCAL YEAR ENDED MAY 31, 2007.

|

|

|

OR

|

|

o

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE

ACT OF

1934. FOR THE TRANSITION PERIOD FROM_________TO___________

. . |

|

COMMISSION

FILE NUMBER 001-32001

|

|

|

|

OR

|

|

o

|

SHELL

COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES

EXCHANGE

ACT OF 1934.

DATE

OF EVENT REQUIRING THIS SHELL COMPANY REPORT

__________________.

|

|

Title

of Each Class

|

Name

of Each Exchange On Which Registered

|

|

|

Common

Shares

|

American

Stock Exchange

|

|

Page

|

|||||

|

PART

I

|

|||||

|

ITEM

1.

|

IDENTITY

OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

|

2

|

|||

|

ITEM

2.

|

OFFER

STATISTICS AND EXPECTED TIMETABLE

|

2

|

|||

|

ITEM

3.

|

KEY

INFORMATION

|

2

|

|||

|

ITEM

4.

|

INFORMATION

ON THE COMPANY

|

13

|

|||

|

ITEM

4A.

|

UNRESOLVED

STAFF COMMENTS

|

32

|

|||

|

ITEM

5.

|

OPERATING

AND FINANCIAL REVIEW AND PROSPECTS

|

32

|

|||

|

ITEM

6.

|

DIRECTORS,

SENIOR MANAGEMENT AND EMPLOYEES

|

46

|

|||

|

ITEM

7.

|

MAJOR

SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

|

58

|

|||

|

ITEM

8.

|

FINANCIAL

INFORMATION

|

58

|

|||

|

ITEM

9.

|

THE

OFFER AND LISTING

|

58

|

|||

|

ITEM

10.

|

ADDITIONAL

INFORMATION

|

60

|

|||

|

ITEM

11.

|

QUALITATIVE

AND QUANTITATIVE DISCLOSURES ABOUT MARKET RISK

|

71

|

|||

|

ITEM

12.

|

DESCRIPTION

OF SECURITIES OTHER THAN EQUITY SECURITIES

|

72

|

|||

|

PART

II

|

|||||

|

ITEM

13.

|

DEFAULTS,

DIVIDENDS, ARREARAGES AND DELINQUENCIES

|

72

|

|||

|

ITEM

14.

|

MATERIAL

MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF

PROCEEDS

|

72

|

|||

|

ITEM

15.

|

CONTROLS

AND PROCEDURES

|

72

|

|||

|

ITEM

16.

|

[RESERVED]

|

73

|

|||

|

ITEM

16A.

|

AUDIT

COMMITTEE FINANCIAL EXPERT

|

73

|

|||

|

ITEM

16B.

|

CODE

OF ETHICS

|

73

|

|||

|

ITEM

16C.

|

PRINCIPAL

ACCOUNTANT FEES AND SERVICES

|

74

|

|||

|

ITEM

16D.

|

EXEMPTIONS

FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES

|

74

|

|||

|

ITEM

16E.

|

PURCHASES

OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED

PURCHASERS

|

74

|

|||

|

PART

III

|

|||||

|

ITEM

17.

|

FINANCIAL

STATEMENTS

|

74

|

|||

|

ITEM

18.

|

FINANCIAL

STATEMENTS

|

75

|

|||

|

ITEM

19.

|

EXHIBITS

|

75

|

|||

|

|

•

|

our

expectations regarding future

financings;

|

|

|

•

|

our

plans to conduct clinical

trials;

|

|

|

•

|

our

expectations regarding the progress and the successful and timely

completion of the various stages of our drug discovery, preclinical

and

clinical studies and the regulatory approval

process;

|

|

|

•

|

our

plans to obtain partners to assist in the further development of

our

product candidates; and

|

|

|

•

|

our

expectations with respect to existing and future corporate alliances

and

licensing transactions with third parties, and the receipt and timing

of

any payments to be made by us or to us in respect of such arrangements,

and

|

|

|

•

|

our

ability to obtain the substantial capital required to fund research

and

operations;

|

|

|

•

|

our

lack of product revenues and history of operating

losses;

|

|

|

•

|

our

early stage of development, particularly the inherent risks and

uncertainties associated with (i) developing new drug candidates

generally, (ii) demonstrating the safety and efficacy of these drug

candidates in clinical studies in humans, and (iii) obtaining regulatory

approval to commercialize these drug

candidates;

|

|

|

•

|

our

drug candidates require time-consuming and costly preclinical and

clinical

testing and regulatory approvals before

commercialization;

|

|

|

•

|

clinical

studies and regulatory approvals of our drug candidates are subject

to

delays, and may not be completed or granted on expected timetables,

if at

all, and such delays may increase our costs and could delay our ability

to

generate revenue;

|

|

|

•

|

the

regulatory approval process;

|

|

|

•

|

the

progress of our clinical

trials;

|

|

|

•

|

our

ability to find and enter into agreements with potential

partners;

|

|

|

•

|

our

ability to attract and retain key

personnel;

|

|

|

•

|

our

ability to obtain patent protection and protect our intellectual

property

rights;

|

|

|

•

|

our

ability to protect our intellectual property rights and to not infringe

on

the intellectual property rights of

others;

|

|

|

•

|

our

ability to comply with applicable governmental regulations and

standards;

|

|

|

•

|

development

or commercialization of similar products by our competitors, many

of which

are more established and have greater financial resources than we

do;

|

|

|

•

|

commercialization

limitations imposed by intellectual property rights owned or controlled

by

third parties;

|

|

|

•

|

our

business is subject to potential product liability and other

claims;

|

|

|

•

|

our

ability to maintain adequate insurance at acceptable

costs;

|

|

|

•

|

further

equity financing may substantially dilute the interests of our

shareholders;

|

|

|

•

|

changing

market conditions; and

|

|

|

•

|

other

risks detailed from time-to-time in our ongoing quarterly filings,

annual

information forms, annual reports and annual filings with Canadian

securities regulators and the United States Securities and Exchange

Commission, and those which are discussed under Item 3.D. “Risk

Factors”.

|

|

Years

Ended May 31,

|

||||||||||||||||||||||||

| 2007 | 1 | 2006 | 1 | 2005 | 1 | 2004 | 1 | 2003 | 1 |

Period

From Inception2

|

||||||||||||||

|

In

accordance with Canadian

GAAP

|

||||||||||||||||||||||||

|

Revenue

|

$ |

107

|

$ |

26

|

$ |

6

|

$ |

608

|

$ |

66

|

$ |

813

|

||||||||||||

|

Research

and development

|

$ |

3,384

|

$ |

10,237

|

$ |

14,394

|

$ |

26,785

|

$ |

12,550

|

$ |

113,859

|

||||||||||||

|

General

and administrative

|

$ |

3,848

|

$ |

4,334

|

$ |

5,348

|

$ |

4,915

|

$ |

4,290

|

$ |

51,323

|

||||||||||||

|

Net

loss

|

$ |

9,638

|

$ |

17,909

|

$ |

22,062

|

$ |

30,301

|

$ |

16,634

|

$ |

174,190

|

||||||||||||

|

Basic

and diluted loss per share

|

$ |

0.05

|

$ |

0.10

|

$ |

0.13

|

$ |

0.18

|

$ |

0.12

|

||||||||||||||

|

Weighted

average number of common shares outstanding

|

204,860

|

173,523

|

172,112

|

171,628

|

144,590

|

|||||||||||||||||||

|

In

accordance with U.S. GAAP

|

||||||||||||||||||||||||

|

Net

loss3

|

$ |

9,150

|

$ |

16,388

|

$ |

20,298

|

$ |

30,301

|

$ |

16,634

|

$ |

167,648

|

||||||||||||

|

Basic

and diluted loss per share

|

$ |

0.05

|

$ |

0.09

|

$ |

0.12

|

$ |

0.18

|

$ |

0.12

|

||||||||||||||

|

|

As

at May 31,

|

|||||||||||||||||||

| 2007 | 1 | 2006 | 1 | 2005 | 1 | 2004 | 1 | 2003 | 1 | |||||||||||

|

In

accordance with Canadian GAAP

|

||||||||||||||||||||

|

Cash

and cash equivalents

|

$ |

1,405

|

$ |

2,692

|

$ |

2,776

|

$ |

1,071

|

$ |

905

|

||||||||||

|

Marketable

securities and other investments

|

$ |

10,993

|

$ |

5,627

|

$ |

18,683

|

$ |

25,657

|

$ |

24,219

|

||||||||||

|

Total

assets

|

$ |

15,475

|

$ |

11,461

|

$ |

27,566

|

$ |

34,424

|

$ |

34,255

|

||||||||||

|

Total

debt

|

$ |

14,714

|

$ |

14,017

|

$ |

14,300

|

$ |

5,825

|

$ |

5,360

|

||||||||||

|

Total

shareholders’ deficit

|

761

|

$ | (2,556 | ) | $ |

13,266

|

$ |

28,599

|

$ |

28,895

|

||||||||||

|

Number

of common shares outstanding

|

211,923

|

174,694

|

172,541

|

171,794

|

171,517

|

|||||||||||||||

|

Dividends

paid on common shares

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||||

|

In

accordance with U.S. GAAP3

|

||||||||||||||||||||

|

Total

assets

|

$ |

15,579

|

$ |

11,625

|

$ |

27,838

|

$ |

34,424

|

$ |

34,255

|

||||||||||

|

Total

debt

|

$ |

17,232

|

$ |

17,277

|

$ |

18,040

|

$ |

5,825

|

$ |

5,360

|

||||||||||

|

Total

shareholders’ deficit

|

$ | (1,653 | ) | $ | (5,652 | ) | $ |

9,798

|

$ |

28,599

|

$ |

28,895

|

||||||||

|

Years

ended May 31,

|

||||||||||||

|

|

2007

|

2006

|

2005

|

|||||||||

|

Loss

per Canadian GAAP

|

$ | (9,638 | ) | $ | (17,909 | ) | $ | (22,062 | ) | |||

|

Accretion

of convertible debentures (i)

|

741

|

480

|

329

|

|||||||||

|

Amortization

of debt issue costs (i)

|

(59 | ) | (108 | ) | (40 | ) | ||||||

|

Stock

compensation expense (ii)

|

(194 | ) |

1,149

|

1,475

|

||||||||

|

Loss

and comprehensive loss per U.S. GAAP

|

(9,150 | ) | (16,388 | ) | (20,298 | ) | ||||||

|

Basic

and diluted loss per share per U.S. GAAP

|

$ | (0.05 | ) | $ | (0.09 | ) | $ | (0.12 | ) | |||

|

Period

|

Average

Close

|

High

|

Low

|

|||||||||

|

October,

2007

|

0.9747

|

0.9984

|

0.9447

|

|||||||||

|

September,

2007

|

1.0246

|

1.0562

|

0.9914

|

|||||||||

|

August,

2007

|

1.0589

|

1.0778

|

1.0487

|

|||||||||

|

July,

2007

|

1.0517

|

1.0684

|

1.0378

|

|||||||||

|

June,

2007

|

1.0656

|

1.0747

|

1.0580

|

|||||||||

|

May,

2007

|

1.0953

|

1.1122

|

1.0696

|

|||||||||

|

|

||||||||||||

|

Fiscal

Year Ended May 31, 2007

|

1.1366

|

1.1855

|

1.0696

|

|||||||||

|

Fiscal

Year Ended May 31, 2006

|

1.1701

|

1.246

|

1.0948

|

|||||||||

|

Fiscal

Year Ended May 31, 2005

|

1.2551

|

1.378

|

1.1746

|

|||||||||

|

Fiscal

Year Ended May 31, 2004

|

1.3423

|

1.418

|

1.2683

|

|||||||||

|

Fiscal

Year Ended May 31, 2003

|

1.5245

|

1.601

|

1.3438

|

|||||||||

|

|

•

|

engage

in equity financings that would be dilutive to current

shareholders;

|

|

|

•

|

delay,

reduce the scope of or eliminate one or more of our development programs;

or

|

|

|

•

|

obtain

funds through arrangements with collaborators or others that may

require

us to relinquish rights to technologies, product candidates or products

that we would otherwise seek to develop or commercialize ourselves;

or

license rights to technologies, product candidates or products on

terms

that are less favourable to us than might otherwise be

available.

|

|

|

•

|

there

may be delays in scale-up to quantities needed for clinical trials

and

commercial launch or failure to manufacture such quantities to our

specifications, or to deliver such quantities on the dates we

require;

|

|

|

•

|

our

current and future manufacturers are subject to ongoing, periodic,

unannounced inspection by the FDA and corresponding Canadian and

international regulatory authorities for compliance with strictly

enforced

cGMP regulations and similar standards, and we do not have control

over

our contract manufacturers’ compliance with these regulations and

standards;

|

|

|

•

|

our

current and future manufacturers may not be able to comply with applicable

regulatory requirements, which would prohibit them from manufacturing

products for us;

|

|

|

•

|

if

we need to change to other commercial manufacturing contractors,

the FDA

and comparable foreign regulators must approve these contractors

prior to

our use, which would require new testing and compliance inspections,

and

the new manufacturers would have to be educated in, or themselves

develop

substantially equivalent processes necessary for the production or

our

products; and

|

|

|

•

|

our

manufacturers might not be able to fulfill our commercial needs,

which

would require us to seek new manufacturing arrangements and may result

in

substantial delays in meeting market

demand.

|

|

|

•

|

the

progress of our and our collaborators’ clinical trials, including our and

our collaborators’ ability to produce clinical supplies of our product

candidates on a timely basis and in sufficient quantities to meet

our

clinical trial requirements;

|

|

|

•

|

announcements

of technological innovations or new product candidates by us, our

collaborators or our competitors;

|

|

|

•

|

fluctuations

in our operating results;

|

|

|

•

|

published

reports by securities analysts;

|

|

|

•

|

developments

in patent or other intellectual property

rights;

|

|

|

•

|

publicity

concerning discovery and development activities by our

licensees;

|

|

|

•

|

the

cash and short term investments held us and our ability to secure

future

financing;

|

|

|

•

|

public

concern as to the safety and efficacy of drugs that we and our competitors

develop;

|

|

|

•

|

governmental

regulation and changes in medical and pharmaceutical product reimbursement

policies; and

|

|

|

•

|

general

market conditions.

|

|

|

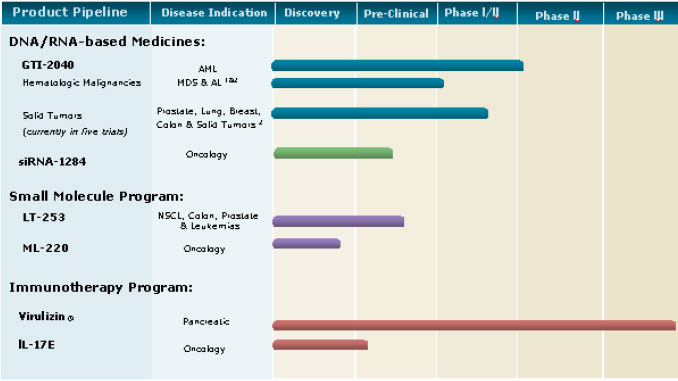

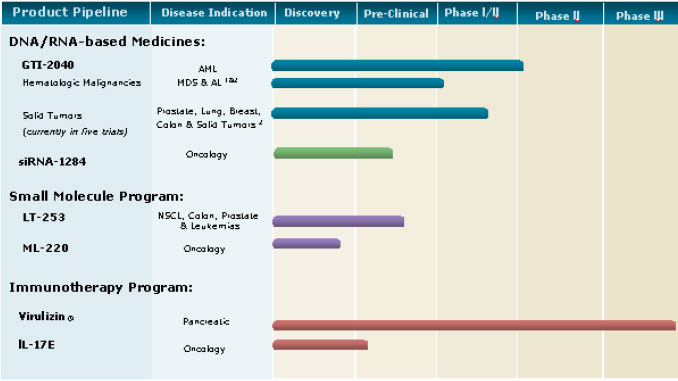

(i)

|

GTI-2040

|

|

|

(ii)

|

siRNA

|

|

|

(iii)

|

GTI-2501

|

|

|

(iv)

|

Other

|

|

|

(v)

|

Virulizin®

|

|

|

(vi)

|

IL-17E

|

|

|

•

|

LT-253

second generation derivatives for oral

administration:

|

|

|

•

|

Further

structural modifications of LT-253 produced derivatives optimized

for oral

absorption. Animal efficacy studies are in

progress.

|

|

|

•

|

ML-220

platform

|

|

|

(i)

|

Bio

Vectra dcl

|

|

|

(b)

|

Licence Agreements

|

|

|

(i)

|

Ion

Pharmaceuticals and

Cyclacel

|

|

|

(ii)

|

University

of Manitoba

|

|

|

(c)

|

Collaboration Agreements

|

|

|

(i)

|

National

Cancer Institute

|

|

|

(ii)

|

Sumitomo

and Koken

|

|

|

(d)

|

Other

|

|

|

(i)

|

Secured

Convertible Debentures

|

|

|

(ii)

|

Share

Issuances

|

|

|

(iii)

|

Plan

of Arrangement and Corporate

Reorganization

|

|

|

Years

Ended May 31

|

|||||||||||

|

2007

|

2006

|

2005

|

||||||||||

|

REVENUE

|

$ |

107

|

$ |

26

|

$ |

6

|

||||||

|

EXPENSES

|

||||||||||||

|

Cost

of sales

|

16

|

3

|

1

|

|||||||||

|

Research

and development

|

3,384

|

10,237

|

14,394

|

|||||||||

|

General

and administrative

|

3,848

|

4,334

|

5,348

|

|||||||||

|

Stock-based

compensation

|

503

|

1,205

|

1,475

|

|||||||||

|

Depreciation

and amortization

|

402

|

771

|

564

|

|||||||||

|

Operating

expenses

|

8,153

|

16,550

|

21,782

|

|||||||||

|

Interest

expense on convertible debentures

|

1,050

|

882

|

300

|

|||||||||

|

Accretion

in carrying value of secured convertible debentures

|

935

|

790

|

426

|

|||||||||

|

Amortization

of deferred financing charges

|

110

|

87

|

84

|

|||||||||

|

Interest

income

|

(503 | ) | (374 | ) | (524 | ) | ||||||

|

Loss

for the period

|

9,638

|

17,909

|

22,062

|

|||||||||

|

Basic

and diluted loss per common share

|

$ |

0.05

|

$ |

0.10

|

$ |

0.13

|

||||||

|

Weighted

average number of common shares outstanding

used inthecalculationof basic

and diluted loss per share

|

204,860

|

173,523

|

172,112

|

|||||||||

|

Total

Assets

|

$ |

15,475

|

$ |

11,461

|

$ |

27,566

|

||||||

|

Total

Long-term liabilities

|

$ |

11,937

|

$ |

11,002

|

$ |

10,212

|

||||||

|

Fiscal

2007

Quarter

Ended

|

Fiscal

2006

Quarter

Ended

|

|||||||||||||||||||||||||||||||

|

(Amounts

in 000’s except for per common share data)

|

May

31,

2007

|

Feb.

28,

2007

|

Nov.

30,

2006

|

Aug.

31,

2006

|

May

31,

2006

|

Feb.

28,

2006

|

Nov.

30,

2005

|

Aug.

31,

2005

|

||||||||||||||||||||||||

|

Revenue

|

$ |

40

|

$ |

37

|

$ |

23

|

$ |

7

|

$ |

14

|

$ |

5

|

$ |

6

|

$ |

1

|

||||||||||||||||

|

Research

and development

|

259

|

672

|

1,122

|

1,331

|

1,353

|

2,296

|

2,631

|

3,957

|

||||||||||||||||||||||||

|

General

and administrative

|

820

|

833

|

1,407

|

788

|

730

|

909

|

1,619

|

1,076

|

||||||||||||||||||||||||

|

Net

loss

|

(1,689 | ) | (2,062 | ) | (3,117 | ) | (2,770 | ) | (2,970 | ) | (4,095 | ) | (5,102 | ) | (5,742 | ) | ||||||||||||||||

|

Basic

and diluted net

loss per share

|

$ | (0.01 | ) | $ | (0.01 | ) | $ | (0.01 | ) | $ | (0.01 | ) | $ | (0.02 | ) | $ | (0.02 | ) | $ | (0.03 | ) | $ | (0.03 | ) | ||||||||

|

Cash

used in operating activities

|

$ | (89 | ) | $ | (1,805 | ) | $ | (2,585 | ) | $ | (1,814 | ) | $ | (1,940 | ) | $ | (3,956 | ) | $ | (2,360 | ) | $ | (4,809 | ) | ||||||||

|

(Amounts

in 000s)

|

||||||||||||||||||||

|

Less

than 1 year

|

1-3

years

|

4-5

years

|

5+

years

|

Total

|

||||||||||||||||

|

Operating

leases

|

118

|

8

|

-

|

-

|

126

|

|||||||||||||||

|

Convertible

Debentures1

|

-

|

15,000

|

-

|

-

|

15,000

|

|||||||||||||||

|

Total

|

118

|

15,008

|

-

|

-

|

15,126

|

|||||||||||||||

|

Name

and Province/State and Country of Residence

|

Position

|

Director

or Officer Since

|

|

J.

Kevin Buchi(1)

Pennsylvania,

United States

|

Director

|

December

2002

|

|

Donald

W. Paterson(1)(3)(5)

Ontario,

Canada

|

Director

|

July

1991

|

|

Alan

Steigrod(2)

Florida,

United States

|

Director

|

May

2001

|

|

Georg

Ludwig(2)

Eschen,

Liechtenstein

|

Director

|

September

2006

|

|

Name

and Province/State and Country of Residence

|

Position

|

Director

or Officer Since

|

|

Michael

Moore(2)(5)

Surrey,

United Kingdom

|

Director

|

September

2006

|

|

Graham

Strachan(1))(3)(4)(5)

Ontario,

Canada

|

Chairman,

Director

|

May

2001

|

|

Dr.

Jim Wright

Ontario,

Canada

|

Director,

Former President and Chief Executive Officer, Director

|

October

1999

|

|

Dr.

Aiping Young(4)

Ontario,

Canada

|

President

and Chief Executive Officer, former Chief Operating

Officer

|

October

1999

|

|

Elizabeth

Williams

Ontario,

Canada

|

Director

of Finance and Acting Chief Financial Officer

|

November

2005

|

|

Directors

elected subsequent to the year-end:

|

||

|

HERBERT

ABRAMSON

Ontario,

Canada

|

Director

|

July

2007

|

|

DR.

DENIS BURGER

Oregon,

United States

|

Chairman,

Director

|

September

2007

|

|

SUSAN

KOPPY

California,

United States

|

Director

|

September

2007

|

|

Dr.

Mark vincent

Ontario,

Canada

|

Director

|

September

2007

|

|

Director

or Nominee Director

|

Reporting

Issuer

|

|

Herbert

Abramson(2)

|

St

Andrew Goldfields Ltd.

|

|

J.

Kevin Buchi

|

Encysive

Pharmaceuticals

|

|

Dr.

Denis Burger(2)

|

Trinity

Biotech plc

|

|

Susan

Koppy(2)

|

-

|

|

Georg

Ludwig

|

-

|

|

Michael

Moore(1)

|

-

|

|

Donald

W. Paterson(1)

|

ANGOSS

Software Corporation

NewGrowth

Inc.

Homeserve

Technologies Inc.

Utility

Corporation

|

|

Alan

Steigrod

|

Sepracor

Inc.

|

|

Graham

Strachan(1)

|

Amorfix

BiotechnologiesInc.

Ibex

Technologies Inc.

|

|

Dr.

Mark Vincent(2)

|

-

|

|

Dr.

Jim A. Wright

|

-

|

|

Dr.

Aiping Young

|

-

|

|

|

(1)

|

Did

not stand for re-election at the Company’s annual and special meeting of

shareholders.

|

|

|

(2)

|

Elected

at the Company’s annual and special meeting of shareholders subsequent to

the year-end.

|

|

Annual

Compensation

|

Long-Term

Compensation

Awards

|

|||||

|

Name

and Principal Position

|

Fiscal

Year

|

Salary

($)

|

Bonus

($)

|

Other

Annual

Compensation

($)

|

Securities

Under

Options/SARs

Granted

(#)(1)

|

All

Other

Compensation

($)

|

|

Dr.

Aiping Young

President

and Chief Executive Officer,

former

Chief Operating Officer

|

2007

2006

2005

|

286,269

259,692

222,697

|

41,250

32,000

46,125

|

Nil

Nil

Nil

|

2,312,496

1,194,144

250,000

|

Nil

Nil

Nil

|

|

Ms.

Elizabeth Williams

Director

of Finance,

Acting

Chief Financial Officer

|

2007

2006

2005

|

87,152

88,631

84,163

|

7,565

7,000

7,990

|

Nil

Nil

Nil

|

139,739

228,035

52,388

|

Nil

Nil

Nil

|

|

Dr.

Jim A. Wright

Former

President and

Chief

Executive Officer

|

2007

2006

2005

|

108,814

345,442

313,586

|

131,070

53,000

95,760

|

Nil

Nil

Nil

Nil

|

(265,000)

947,500

228,000

|

584,630

Nil

Nil

|

|

Mr.

Paul Van Damme(3)

Former

Chief Financial Officer

|

2007

2006

2005

|

Nil

152,654

Nil

|

Nil

35,030

Nil

|

Nil

Nil

Nil

|

Nil

Nil

202,500

|

Nil

74,633

37,000

|

|

|

(1)

|

Options

granted are net of forfeitures.

|

|

|

(2)

|

Dr. Wright

resigned from his position on September 21, 2006. The amount

of "All Other Compensation" relates

to a lump sum amount paid pursuant to our separation

agreement with Dr. Wright.

|

|

|

(3)

|

Mr. Van

Damme resigned from his position on November 9, 2005. The amount of

"All Other Compensation" relates to a lump sum amount paid pursuant

to our

separation agreement with Mr. Van

Damme.

|

|

Number of

common shares to be issued upon exercise of outstanding

options

(a)

|

Number of

common shares remaining available for future issuance under the equity

compensation plans (Excluding Securities reflected

in Column (a))

(c)

|

Total

Stock Options outstanding and available for Grant

(a)

+ (c)

|

|||||

|

Plan

Category

|

Number

|

% of

common shares outstanding

|

Weighted-

average

exercise

price of outstanding options

(b)

|

Number

|

% of

common shares outstanding

|

Number

|

% of

Common

shares

outstanding

|

|

Equity

compensation plans approved

by

Shareholders

|

12,987,431

|

6.1

|

$0.59

|

18,800,951

|

8.9

|

31,788,382

|

15%

|

|

Equity

compensation plans approved

by Shareholders

(November 15, 2007)

|

15,051,338

|

7.0

|

$0.52

|

16,842,843

|

8.0

|

31,894,181

|

15%

|

|

Name

and Principal Position

|

Securities

Under Options/SARs Granted

(#)(1)

|

% of Total

Options/SARs Granted to Employees in

Financial

Year

(%)

|

Exercise or

Base Price

($/Security)

|

Market Value

of Securities Underlying Options/SARs on the Date of Grant

($/Security)

|

Expiration

Date

|

|

Dr.

Aiping Young

President

and Chief Executive Officer, Former Chief Operating

Officer

|

75,000(1)

1,000,000(2)

500,000(3)

1,000,000(4)

|

1.40

18.80

9.40

18.80

|

0.33

0.27

0.27

0.27

|

0.33

0.27

0.27

0.27

|

July

28, 2016

October

5, 2016

October

5, 2016

October

5, 2106

|

|

Ms.

Elizabeth Williams

Director

of Finance, Acting Chief Financial Officer

|

159,848(1)

|

3.00

|

0.33

|

0.33

|

July

28, 2016

|

|

Dr.

Jim A. Wright

Former

President and Chief Executive Officer

|

50,000(5)

|

0.90

|

0.30

|

0.30

|

Sept.

20, 2016

|

|

(1)

|

These

options were granted on July 29, 2006 in respect of corporate and

personal performance during the year ended May 31, 2006. The options

vest on the basis of 50% on the first anniversary and 25% on the

second

and third anniversaries of the date of

granting.

|

|

(2)

|

Options

granted upon entering into Employment Agreement. The options vested

upon

granting.

|

|

(3)

|

These

options to purchase common shares are incentive options. The options

vest

upon the attainment of specific undertakings based on certain corporate

performance objectives; failing to achieve the undertakings will

result in

forfeiture on the specified

deadline.

|

|

(4)

|

These

options to purchase common shares are incentive options. The options

vest

upon attainment of certain share price performance objectives; failing

to

achieve the undertakings will result in forfeiture on the specified

deadline.

|

|

(5)

|

These

options were granted by virtue of Dr. Wright's role as director. No

options were granted in reference to his role as

a President

and Chief Executive officer.

|

|

Name

|

Securities

Acquired on

Exercise

(#)

|

Aggregate

Value

Realized

($)Nil

|

Unexercised

Options/SARs

at

May

31, 2007

(#)

Exercisable/

Unexercisable

|

Value

of Unexercised

in-the-Money

Options/SARs

at

May

31, 2007 ($)

Exercisable/

Unexercisable

|

|

Dr.

Aiping Young

President

and Chief Executive Officer Former Chief Operating Officer

|

Nil

|

Nil

|

2,890,255/1,617,187

|

0/0

|

|

Ms.

Elizabeth Williams

Director

of Finance, Acting Chief Financial Officer

|

Nil

|

Nil

|

299,802/120,360

|

0/0

|

|

Dr.

Jim A. Wright

Former

President and Chief Executive Officer

|

Nil

|

Nil

|

2,447,500/25,000

|

0/0

|

|

Audit

Committee:

|

J.

Kevin Buchi, Donald W. Paterson and Graham Strachan

|

|

Compensation

Committee:

|

Alan

Steigrod, Georg Ludwig and Michael Moore

|

|

Nominating

and Corporate Governance Committee:

|

Donald

W. Paterson, Graham Strachan and J. Kevin Buchi

|

|

Environment,

Health and Safety Committee:

|

Graham

Strachan and Dr. Aiping Young

|

|

Audit

Committee:

|

J.

Kevin Buchi, Dr. Denis Burger and Alan Steigrod

|

|

Compensation

Committee:

|

Alan

Steigrod, Dr Denis Burger and Susan Koppy

|

|

Nominating

and Corporate Governance Committee:

|

Herbert

Abramson, J. Kevin Buchi, and Susan Koppy

|

|

Environment,

Health and Safety Committee:

|

Dr.

Mark Vincent, Dr. Jim Wright and Dr. Aiping

Young

|

|

|

(a)

|

serves

as an independent and objective party to monitor the integrity of

our

financial reporting process and systems of internal controls regarding

finance, accounting, and legal compliance, including the review of

our

financial statements, MD&A and annual and interim

results;

|

|

|

(b)

|

identifies

and monitors the management of the principal risks that could impact

our

financial reporting;

|

|

|

(c)

|

monitors

the independence and performance of our independent auditors, including

the pre-approval of all audit fees and all permitted non-audit

services;

|

|

|

(d)

|

provides

an avenue of communication among the independent auditors, management,

and

our board of directors; and

|

|

|

(e)

|

encourages

continuous improvement of, and foster adherence to, our policies,

procedures and practices at all

levels.

|

|

Number

of Shares

Beneficially

Owned

|

Percentage

of Shares Outstanding

|

|||||||

|

Dr.

Jim A. Wright

|

4,439,541

|

2.07 | % | |||||

|

Dr.

Aiping H. Young

|

37,803

|

0.00 | % | |||||

|

Elizabeth

Williams

|

6,852

|

0.00 | % | |||||

|

Michael

Moore(1)

|

Nil

|

0.00 | % | |||||

|

Georg

Ludwig(3)

|

29,090,000

|

13.57 | % | |||||

|

Donald

Paterson(1)

|

125,260

|

0.06 | % | |||||

|

Graham

Strachan(1)

|

10,000

|

0.00 | % | |||||

|

Alan

Steigrod

|

10,000

|

0.00 | % | |||||

|

J.

Kevin Buchi

|

50,000

|

0.02 | % | |||||

|

Herbert

Abramson(2)(4)

|

25,946,625

|

12.10 | % | |||||

|

Dr.

Denis Burger(2)

|

59,620

|

0.02 | % | |||||

|

Susan

Koppy(2)

|

Nil

|

0.00 | % | |||||

|

Dr.

Mark Vincent(2)

|

Nil

|

0.00 | % | |||||

|

All

directors and executive officers as a group

|

59,995,701

|

27.89 | % | |||||

|

(1)

|

Director

did not stand for re-election at the annual general meeting in September

2007

|

|

(2)

|

Elected

subsequent to

the year-end

|

|

(3)

|

Mr.

Ludwig is deemed to control the shares held by High Tech in his capacity

as managing director of High Tech.

|

|

(4)

|

In

addition to shares held personally, Mr. Abramson is deemed to control

the

shares held by Technifund Inc. in his capacity as sole owner of

Technifund.

|

|

American

Stock Exchange/Amex

(US$)

|

Toronto

Stock Exchange/TSX

(CDN$)

|

|||||||||||||||

|

Five

most recent full fiscal years:

|

High

|

Low

|

High

|

Low

|

||||||||||||

|

Year

ended May 31, 2007

|

0.34

|

0.14

|

0.39

|

0.22

|

||||||||||||

|

Year

ended May 31, 2006

|

0.79

|

0.19

|

0.92

|

0.22

|

||||||||||||

|

Year

ended May 31, 2005

|

0.70

|

0.45

|

0.94

|

0.57

|

||||||||||||

|

Year

ended May 31, 2004

|

1.09

|

0.60

|

1.47

|

0.83

|

||||||||||||

|

Year

ended May 31, 2003

|

1.40

|

0.18

|

2.04

|

0.31

|

||||||||||||

|

Year

ended May 31, 2007

|

0.34

|

0.14

|

0.39

|

0.22

|

||||||||||||

|

Quarter

ended May 31, 2007

|

0.27

|

0.22

|

0.33

|

0.25

|

||||||||||||

|

Quarter

ended February 28, 2007

|

0.34

|

0.14

|

0.39

|

0.22

|

||||||||||||

|

Quarter

ended November 30, 2006

|

0.31

|

0.19

|

0.34

|

0.22

|

||||||||||||

|

Quarter

ended August 31, 2006

|

0.34

|

0.25

|

0.39

|

0.28

|

||||||||||||

|

Year

ended May 31, 2006

|

0.79

|

0.19

|

0.92

|

0.22

|

||||||||||||

|

Quarter

ended May 31, 2006

|

0.36

|

0.30

|

0.42

|

0.34

|

||||||||||||

|

Quarter

ended February 28, 2006

|

0.42

|

0.19

|

0.49

|

0.22

|

||||||||||||

|

Quarter

ended November 30, 2005

|

0.79

|

0.22

|

0.92

|

0.25

|

||||||||||||

|

Quarter

ended August 31, 2005

|

0.68

|

0.55

|

0.84

|

0.60

|

||||||||||||

|

Year

ended May 31, 2005

|

0.70

|

0.45

|

0.94

|

0.57

|

||||||||||||

|

Quarter

ended May 31, 2005

|

0.68

|

0.55

|

0.94

|

0.58

|

||||||||||||

|

Quarter

ended February 28, 2005

|

0.70

|

0.46

|

0.88

|

0.66

|

||||||||||||

|

Quarter

ended November 30, 2004

|

0.69

|

0.55

|

0.86

|

0.57

|

||||||||||||

|

Quarter

ended August 31, 2004

|

0.69

|

0.45

|

0.82

|

0.67

|

||||||||||||

|

October

2007

|

0.27

|

0.16

|

0.24

|

0.17

|

||||||||||||

|

September

2007

|

0.23

|

0.18

|

0.24

|

0.19

|

||||||||||||

|

August

2007

|

0.23

|

0.15

|

0.25

|

0.16

|

||||||||||||

|

July

2007

|

0.24

|

0.20

|

0.24

|

0.21

|

||||||||||||

|

June

2007

|

0.26

|

0.21

|

0.26

|

0.23

|

||||||||||||

|

May

2007

|

0.27

|

0.22

|

0.29

|

0.25

|

||||||||||||

|

|

•

|

limitations

on share ownership;

|

|

|

•

|

provisions

of the Articles or by-laws that would have the effect of delaying,

deferring or preventing a change of control of our

company;

|

|

|

•

|

by-law

provisions that govern the ownership threshold above which stockholder

ownership must be disclosed; and

|

|

|

•

|

conditions

imposed by the Articles or by-laws governing changes in capital,

but

Canadian Corporate law requires any changes to the terms of share

capital

be approved by 66b%

of the shares represented by proxy or in person at a stockholders’ meeting

convened for that purpose at which a quorum

exists.

|

|

1.

|

Subscription

Agreement dated July 13, 2006 between the Company and HighTech. See

“Business of the Company - Financial Strategy - Share

Issuances”.

|

|

2.

|

Subscription

Agreement dated July 24, 2006 between the Company and Technifund.

See

“Business of the Company - Financial Strategy - Share

Issuances”.

|

|

3.

|

Registration

Rights Agreement dated August 30, 2006 between the Company and High

Tech

under which certain rights were granted to High Tech, including the

right

to require the Company to file a Canadian prospectus or a United

States

Registration Statement and the right to require the Company to include

in

any public offering such number of securities of the Company held

by High

Tech as High Tech may request.

|

|

4.

|

Arrangement

Agreement dated May 1, 2007, as amended, between the Company, Old

Lorus,

6707157 Canada Inc., NuChem Pharmaceuticals Inc. (“NuChem”), GeneSense

Technologies Inc. (“GeneSense”) and Pinnacle International Lands Inc., as

amended May 14, 2007 and July 4, 2007. See “Business of the Company -

Financial Strategy - Plan of Arrangement and Corporate

Reorganization”.

|

|

5.

|

Warrant

Repurchase Agreement dated May 1, 2007 between the Company and TEMIC.

See

“Business of the Company - Financial Strategy - Secured Convertible

Debentures”.

|

|

6.

|

Assignment,

Novation and Amendment Agreement and Consent dated May 1, 2007 among

the

Company, Old Lorus, GeneSense and TEMIC as amended June 28, 2007

under

which the Company assumed Old Lorus’ obligation to pay TEMIC the $15

million aggregate principal amount of the Debentures plus accrued

unpaid

interest thereon in consideration for Old Lorus issuing a non-interest

bearing promissory note.

|

|

7.

|

Tangible

Business Assets Transfer Agreement dated July 10, 2007 between Old

Lorus

and GeneSense under which Old Lorus transferred certain depreciable

property to GeneSense, as contemplated in the plan of

arrangement.

|

|

8.

|

Antisense

Patent Transfer Agreement dated July 10, 2007 between the Company

and

GeneSense under which GeneSense transferred certain Antisense patent

assets to the Company in exchange for a demand non-interest bearing

promissory note issued by the

Company.

|

|

9.

|

Virulizin

and Small Molecule Patent Assets Transfer Agreement dated July 10,

2007

between Old Lorus and GeneSense under which Old Lorus transferred

Virulizin and Small Molecule Patent Assets to GeneSense in consideration

for the issuance by GeneSense of one common share of

GeneSense.

|

|

10.

|

Prepaid

Expenses and Receivables Transfer Agreement dated July 10, 2007 between

Old Lorus and GeneSense under which Old Lorus transferred certain

prepaid

expenses and receivables to GeneSense in exchange for the issuance

by

GeneSense of one common share of

GeneSense.

|

|

11.

|

Share

Purchase Agreement dated July 10, 2007 under which Old Lorus transferred

all of the common shares of NuChem held by it to the Company at a

price

equal to their fair market value in consideration for the issuance

of a

demand non-interest bearing promissory

note.

|

|

12.

|

Share

Purchase Agreement dated July 10, 2007 under which Old Lorus transferred

all of the common shares of GeneSense held by it to the Company at

a price

equal to their fair market value in exchange for the assumption by

the

Company of Old Lorus’ remaining liabilities and the issuance of a demand

non-interest bearing promissory

note.

|

|

13.

|

Share

purchase agreement dated July 10, 2007 under which the Company transferred

certain shares of Old Lorus held by it to 6707157 Canada Inc. in

consideration of a cash payment as specified in the plan of arrangement,

subject to payment and adjustment in accordance with such agreement

and a

holdback to an escrow agreement.

|

|

14.

|

Indemnification

Agreement dated July 10, 2007 between Old Lorus and the Company.

See

“Business of the Company - Financial Strategy - Plan of Arrangement

and

Corporate Reorganization”.

|

|

15.

|

Escrow

Agreement between 6707157 Canada Inc, the Company and Equity Transfer

& Trust Company dated July 10, 2007 providing for an escrow amount

related to the plan of arrangement. See “Business of the Company -

Financial Strategy - Plan of Arrangement and Corporate

Reorganization”.

|

|

16.

|

Amended

and Restated Guarantee and Indemnity between GeneSense and TEMIC

dated

July 10, 2007 reaffirming TEMIC’s guaranties and indemnities in respect of

TEMIC’s Debentures.

|

|

17.

|

Amended

and Restated Share Pledge Agreement between the Company and TEMIC

dated

July 10, 2007 reaffirming the Company’s pledge of shares in its

subsidiaries in respect of TEMIC’s

Debentures.

|

|

|

•

|

at

any time within the 60-month period immediately preceding the disposition

or deemed disposition, the Holder, persons not dealing at arm’s length

with the Holder, or the Holder together with such non-arm’s length

persons, owned 25% or more of the issued shares of any class or series

of

the Company’s capital stock;

|

|

|

•

|

the

Holder was formerly resident in Canada and, upon ceasing to be a

Canadian

resident, elected under the ITA to have the Common Shares deemed

to be

“taxable Canadian property”; or

|

|

|

•

|

the

Holder’s Common Shares were acquired in a tax deferred exchange in

consideration for property that was itself “taxable Canadian

property.”

|

|

2007

|

2006

|

|||||||

|

Audit

Fees

|

$ |

330,000

|

$ |

198,500

|

||||

|

Tax

Fees

|

$ |

8,500

|

$ |

13,100

|

||||

|

Total

|

$ |

338,500

|

$ |

211,600

|

||||

|

Page

|

|

|

Managements

Responsibility for Financial Reporting

|

F-1

|

|

Report

of Independent Registered Public Accounting Firm

|

F-2

|

|

Consolidated

Balance Sheets as of May 31, 2006 and 2005

|

F-4

|

|

Consolidated

Statements of Loss and Deficit for the years ended May 31, 2006,

2005 and

2004

|

F-5

|

|

Consolidated

Statements of Cash Flows for the years ended May 31, 2006, 2005 and

2004

|

F-6

|

|

Notes

to Consolidated Financial Statements

|

F-7

|

|

Supplementary

Information: Reconciliation of Canadian and United States Generally

Accepted Accounting Principals

|

F-40

|

|

Number

|

Exhibit

|

|

1.1

*

|

Articles

of Arrangement

|

|

1.2

*

|

By-law

#2 of the Registrant

|

|

2.1**

|

Share

Purchase Agreement dated as of July 13, 2006 between Lorus and High

Tech

Beteiligungen GmbH & Co. KG (“High Tech”)

|

|

2.2**

|

Registration

Rights Agreement dated as of August 30, 2006 between Lorus and High

Tech

|

|

2.3**

|

Share

Purchase Agreement dated as of July 24, 2006 between Lorus and Technifund

Inc.

|

|

2.4

***

|

Subscription

Agreement entered into with The Erin Mills Investment Corporation

dated

October 6, 2004

|

|

2.5**

|

Convertible

Secured Debentures issued to The Erin Mills Investment Corporation

on

April 15, 2005, January 14, 2005 and October 6, 2004

|

|

2.6****

|

Arrangement

Agreement dated May 1, 2007, as amended, between the Company, Old

Lorus,

6707157 Canada Inc., NuChem Pharmaceuticals Inc. (“NuChem”), GeneSense

Technologies Inc. (“GeneSense”) and Pinnacle International Lands Inc., as

amended May 14, 2007 and July 4, 2007.

|

|

2.7*****

|

Warrant

Repurchase Agreement dated May 1, 2007 between the Company and

TEMIC

|

|

2.8*****

|

Assignment,

Novation and Amendment Agreement and Consent dated May 1, 2007 among

the

Company, Old Lorus, GeneSense and TEMIC as amended June 28,

2007

|

|

2.9+

|

Tangible

Business Assets Transfer Agreement dated July 10, 2007 between Old

Lorus

and GeneSense

|

|

2.10+

|

Antisense

Patent Transfer Agreement dated July 10, 2007 between the Company

and

GeneSense

|

|

2.11+

|

Virulizin

and Small Molecule Patent Assets Transfer Agreement dated July 10,

2007

between Old Lorus and GeneSense

|

|

2.12+

|

Prepaid

Expenses and Receivables Transfer Agreement dated July 10, 2007 between

Old Lorus and GeneSense

|

|

2.13+

|

Nuchem

Share Purchase Agreement dated July 10, 2007 between Old Lorus and

GeneSense

|

|

2.14+

|

GeneSense

Share Purchase Agreement dated July 10, 2007 between Old Lorus and

New

Lorus

|

|

2.15*****

|

Pinnacle

Share purchase agreement dated July 10, 2007 between Old Lorus and

6707157

Canada Inc.

|

|

2.16+

|

Indemnification

Agreement dated July 10, 2007 between Old Lorus and the

Company

|

|

2.17+

|

Escrow

Agreement between 6707157 Canada Inc, the Company and Equity Transfer

& Trust Company dated July 10, 2007

|

|

2.18+

|

Amended

and Restated Guarantee and Indemnity between GeneSense and TEMIC

dated

July 10,

|

|

2.19+

|

Amended

and Restated Share Pledge Agreement between the Company and TEMIC

dated

July 10, 2007

|

|

4.1

|

Stock

Option Plans

|

|

4.2**

|

Form

of Officer and Director Indemnity Agreement

|

|

4.3

++

|

Amalgamation

Agreement dated August 23, 1991, among the Company, Mint Gold

Resources Ltd., Harry J. Hodge and Wayne Beach.

|

|

8.1**

|

List

of Subsidiaries

|

|

11.1**

|

Code

of Business Conduct and Ethics

|

|

12.1

|

Certification

of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley

Act

|

|

12.2

|

Certification

of Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley

Act

|

|

13.1

|

Certification

of Chief Executive Officer pursuant to Section 906 of the Sarbanes-Oxley

Act

|

|

13.2

|

Certification

of Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley

Act

|

|

*

|

Incorporated

by reference to File 0-32001, Form 6-K dated November 19,

2007.

|

|

**

|

Incorporated

by reference to File 1-32001-Form 20 F, Annual Report, dated November

21,

2006.

|

|

***

|

Incorporated

by reference to File 1-32001, Form 6-K dated February 10,

2005.

|

|

****

|

Incorporated

by reference to File 1-32001, Form 6-K dated May 30,

2007.

|

|

*****

|

Incorporated

by reference to File 1-32001, Form 6-K dated November 20,

2007.

|

|

+

|

Incorporated

by reference to File 1-32001, Form 6-K dated September 4,

2007.

|

|

++

|

Incorporated

by reference to File 0-19763, Registration Statement on Form 20-FR,

dated March 4, 1992.

|

|

LORUS

THERAPEUTICS INC.

|

||

|

|

By:

|

/s/

Aiping H. Young

|

|

Name: Aiping

H. Young

Title: President

and Chief Executive Officer

Date: November

29, 2007

|

||

|

|

By:

|

/s/

Elizabeth Williams

|

|

Name: Elizabeth

Williams

Title: Director

of Finance and Acting ChiefFinancial Officer

Date: November

29, 2007

|

| /s/ Aiping H. Young | /s/ Elizabeth Williams |

|

Aiping

H. Young

President and Chief

Executive

|

Elizabeth

Williams

OfficerDirector of Finance (Acting Chief Financial

Officer)

|

|

|

|

|

2007

|

2006

|

|||||||

|

Assets

|

||||||||

|

Current

assets:

|

||||||||

|

Cash

and cash

equivalents (note 11)

|

$ |

1,405

|

$ |

2,692

|

||||

|

Marketable

securities and other investments (note 4)

|

7,265

|

5,627

|

||||||

|

Prepaid

expenses and other assets

|

335

|

515

|

||||||

|

9,005

|

8,834

|

|||||||

|

Marketable

securities and other

investments (note 4)

|

3,728

|

-

|

||||||

|

Fixed

assets (note

5)

|

503

|

885

|

||||||

|

Deferred

financing

charges

|

371

|

481

|

||||||

|

Deferred

arrangement costs (note

16)

|

1,262

|

-

|

||||||

|

Goodwill

|

606

|

606

|

||||||

|

Acquired

patents and licenses

(note 6)

|

-

|

655

|

||||||

| $ |

15,475

|

$ |

11,461

|

|||||

|

Liabilities

and Shareholders'

Equity (Deficiency)

|

||||||||

|

Current

liabilities:

|

||||||||

|

Accounts

payable

|

$ |

1,104

|

$ |

555

|

||||

|

Liability

to

repurchase warrants (note 7)

|

252

|

-

|

||||||

|

Accrued

liabilities

|

1,421

|

2,460

|

||||||

|

2,777

|

3,015

|

|||||||

|

Secured

convertible debentures

(note 12)

|

11,937

|

11,002

|

||||||

|

Shareholders'

equity

(deficiency):

|

||||||||

|

Share

capital

(note 7):

|

||||||||

|

Common

shares

|

157,714

|

145,001

|

||||||

|

Equity

portion

of secured convertible debentures

|

3,814

|

3,814

|

||||||

|

Stock

options

|

4,898

|

4,525

|

||||||

|

Contributed

surplus

|

8,525

|

7,665

|

||||||

|

Warrants

|

-

|

991

|

||||||

|

Deficit

accumulated during development stage

|

(174,190 | ) | (164,552 | ) | ||||

|

761

|

(2,556 | ) | ||||||

|

Basis

of presentation (note

1)

|

||||||||

|

Subsequent

events (note

16)

|

||||||||

| $ |

15,475

|

$ |

11,461

|

|||||

| Director |

|

Period

|

||||||||||||||||

|

from

inception

|

||||||||||||||||

|

September

5,

|

||||||||||||||||

|

1986

to

|

||||||||||||||||

|

Years

ended May

31,

|

May

31,

|

|||||||||||||||

|

2007

|

2006

|

2005

|

2007

|

|||||||||||||

|

Revenue

|

$ |

107

|

$ |

26

|

$ |

6

|

$ |

813

|

||||||||

|

Expenses:

|

||||||||||||||||

|

Cost

of

sales

|

16

|

3

|

1

|

103

|

||||||||||||

|

Research

and

development (note 10)

|

3,384

|

10,237

|

14,394

|

113,859

|

||||||||||||

|

General

and

administrative

|

3,848

|

4,334

|

5,348

|

51,323

|

||||||||||||

|

Stock-based

compensation (note 8)

|

503

|

1,205

|

1,475

|

7,253

|

||||||||||||

|

Depreciation

and amortization of fixed assets

|

402

|

771

|

564

|

9,225

|

||||||||||||

|

8,153

|

16,550

|

21,782

|

181,763

|

|||||||||||||

| (8,046 | ) | (16,524 | ) | (21,776 | ) | (180,950 | ) | |||||||||

|

Other

expenses

(income):

|

||||||||||||||||

|

Interest

on

convertible debentures

|

1,050

|

882

|

300

|

2,232

|

||||||||||||

|

Accretion

in

carrying value of convertible debentures (note 12)

|

935

|

790

|

426

|

2,151

|

||||||||||||

|

Amortization

of

deferred financing charges

|

110

|

87

|

84

|

281

|

||||||||||||

|

Interest

|

(503 | ) | (374 | ) | (524 | ) | (11,424 | ) | ||||||||

|

1,592

|

1,385

|

286

|

(6,760 | ) | ||||||||||||

|

Loss

for the

period

|

(9,638 | ) | (17,909 | ) | (22,062 | ) | (174,190 | ) | ||||||||

|

Deficit,

beginning of

period

|

(164,552 | ) | (146,643 | ) | (124,581 | ) |

-

|

|||||||||

|

Deficit,

end of

period

|

$ | (174,190 | ) | $ | (164,552 | ) | $ | (146,643 | ) | $ | (174,190 | ) | ||||

|

Basic

and diluted loss per common

share

|

$ | (0.05 | ) | $ | (0.10 | ) | $ | (0.13 | ) | |||||||

|

Weighted

average number of common

shares outstanding used in the calculation of basic and diluted

loss per

share

(in thousands) |

204,860

|

173,523

|

172,112

|

|||||||||||||

|

Period

|

||||||||||||||||

|

from

inception

|

||||||||||||||||

|

September

5,

|

||||||||||||||||

|

1986

to

|

||||||||||||||||

|

Years

ended May

31,

|

May

31,

|

|||||||||||||||

|

2007

|

2006

|

2005

|

2007

|

|||||||||||||

|

Cash

flows from operating

activities:

|

||||||||||||||||

|

Loss

for the

period

|

$ | (9,638 | ) | $ | (17,909 | ) | $ | (22,062 | ) | $ | (174,190 | ) | ||||

|

Items

not

involving cash:

|

||||||||||||||||

|

Stock-based

compensation

|

503

|

1,205

|

1,475

|

7,253

|

||||||||||||

|

Interest

on

convertible debentures

|

1,050

|

882

|

300

|

2,232

|

||||||||||||

|

Accretion

in

carrying value of convertible debentures

|

935

|

790

|

426

|

2,151

|

||||||||||||

|

Amortization

of

deferred financing charges

|

110

|

87

|

84

|

281

|

||||||||||||

|

Depreciation,

amortization and write-down of fixed assets and acquired patents

and

licenses

|

1,057

|

2,342

|

2,260

|

21,786

|

||||||||||||

|

Other

|

-

|

-

|

(38 | ) |

707

|

|||||||||||

|

Change

in

non-cash operating working capital (note 11)

|

(310 | ) | (462 | ) | (1,166 | ) |

1,282

|

|||||||||

|

Cash

flows used

in operating activities

|

(6,293 | ) | (13,065 | ) | (18,721 | ) | (138,498 | ) | ||||||||

|

Cash

flows from financing

activities:

|

||||||||||||||||

|

Issuance

of

debentures, net of issuance costs

|

-

|

-

|

12,948

|

12,948

|

||||||||||||

|

Issuance

of

warrants

|

-

|

-

|

991

|

37,405

|

||||||||||||

|

Issuance

of

common shares, net of issuance costs (note 7)

|

11,654

|

-

|

112

|

109,025

|

||||||||||||

|

Additions

to

deferred financing/ arrangement charges

|

(1,262 | ) |

-

|

-

|

(1,507 | ) | ||||||||||

|

Cash

flows

provided by financing activities

|

10,392

|

-

|

14,051

|

157,871

|

||||||||||||

|

Cash

flows from investing

activities:

|

||||||||||||||||

|

Maturity

(purchase) of marketable securities and other investments,

net

|

(5,366 | ) |

13,056

|

6,974

|

(10,993 | ) | ||||||||||

|

Business

acquisition, net of cash received

|

-

|

-

|

-

|

(539 | ) | |||||||||||

|

Acquired

patents and licenses

|

-

|

-

|

-

|

(715 | ) | |||||||||||

|

Additions

to

fixed assets

|

(20 | ) | (75 | ) | (599 | ) | (6,069 | ) | ||||||||

|

Proceeds

on

sale of fixed assets

|

-

|

-

|

-

|

348

|

||||||||||||

|

Cash

flows

provided by (used in) investing activities

|

(5,386 | ) |

12,981

|

6,375

|

(17,968 | ) | ||||||||||

|

Increase

(decrease) in cash and

cash equivalents

|

(1,287 | ) | (84 | ) |

1,705

|

1,405

|

||||||||||

|

Cash

and cash equivalents,

beginning of period

|

2,692

|

2,776

|

1,071

|

-

|

||||||||||||

|

Cash

and cash equivalents, end of

period

|

$ |

1,405

|

$ |

2,692

|

$ |

2,776

|

$ |

1,405

|

||||||||

|

1.

|

Basis

of presentation:

|

|

1.

|

Basis

of presentation

(continued):

|

|

2.

|

Significant

accounting policies:

|

|

(a)

|

Principles

of consolidation:

|

|

2.

|

Significant

accounting policies

(continued):

|

|

(b)

|

Revenue

recognition:

|

|

(c)

|

Cash

and cash equivalents:

|

|

2.

|

Significant

accounting policies

(continued):

|

|

(d)

|

Marketable

securities and other investments:

|

|

(e)

|

Fixed

assets:

|

|

Furniture

and

equipment

|

Over

3 to 5

years

|

|

Leasehold

improvements

|

Over

the lease

term

|

|

|

(f)

|

Research

and development:

|

|

2.

|

Significant

accounting policies

(continued):

|

|

(g)

|

Goodwill

and acquired patents and licenses:

|

|

(h)

|

Impairment

of long-lived assets:

|

|

2.

|

Significant

accounting policies

(continued):

|

|

|

(i)

|

Stock-based

compensation:

|

|

|

(j)

|

Investment

tax credits:

|

|

2.

|

Significant

accounting policies

(continued):

|

|

(k)

|

Income

taxes:

|

|

|

(l)

|

Loss

per share:

|

|

(m)

|

Deferred

financing charges:

|

|

2.

|

Significant

accounting policies

(continued):

|

|

(n)

|

Segmented

information:

|

|

(o)

|

Foreign

currency translation:

|

|

(p)

|

Use

of estimates:

|

|

(q)

|

Recent

Canadian accounting pronouncements not yet

adopted:

|

|

|

(i)

|

Comprehensive

income and equity:

|

|

2.

|

Significant

accounting policies

(continued):

|

|

|

(ii)

|

Financial

instruments - recognition and

measurement:

|

|

|

(iii)

|

Hedges:

|

|

|

(iv)

|

Financial

instruments - disclosure and

presentation:

|

|

3.

|

Changes

in accounting policies:

|

|

(a)

|

Variable

interest entities:

|

|

(b)

|

Financial

instruments - disclosure and

presentation:

|

|

3.

|

Changes

in accounting policies

(continued):

|

|

(c)

|

Non-monetary

transactions:

|

|

4.

|

Marketable

securities and other

investments:

|

|

Less

than

|

Greater

than

|

|||||||||||||||

|

one

year

|

one

year

|

Yield

to

|

||||||||||||||

|

2007

|

maturities

|

maturities

|

Total

|

maturity

|

||||||||||||

|

Fixed

income government

investments

|

$ |

1,549

|

$ |

-

|

$ |

1,549

|

3.91 | % | ||||||||

|

Corporate

instruments

|

5,716

|

3,728

|

9,444

|