Exhibit 15.1

Management Discussion and Analysis

December 31, 2015

MANAGEMENT’S DISCUSSION AND ANALYSIS

March 15, 2016

This management’s discussion and analysis of Aptose Biosciences Inc. (“Aptose”, the “Company”, “we”, “our”, “us” and similar expressions) should be read in conjunction with the Company’s annual audited financial statements for the year ended December 31, 2015 and the annual report on form 20-F of the Company for the year ended December 31, 2015 which can be found on SEDAR at www.sedar.com and EDGAR at www.sec.gov/edgar.shtml.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This management’s discussion and analysis may contain forward-looking statements within the meaning of securities laws. Such statements include, but are not limited to, statements relating to:

| · | our business strategy; |

| · | our clinical development plans; |

| · | our ability to obtain the substantial capital we require to fund research and operations; |

| · | our plans to secure strategic partnerships to assist in the further development of our product candidates and to build our pipeline; |

| · | our plans to conduct clinical trials and preclinical programs; |

| · | our expectations regarding the progress and the successful and timely completion of the various stages of our drug discovery, preclinical and clinical studies and the regulatory approval process; |

| · | our plans, objectives, expectations and intentions; and |

| · | other statements including words such as “anticipate”, “contemplate”, “continue”, “believe”, “plan”, “estimate”, “expect”, “intend”, “will”, “should”, “may”, and other similar expressions. |

The forward-looking statements reflect our current views with respect to future events, are subject to significant risks and uncertainties, and are based upon a number of estimates and assumptions that, while considered reasonable by us, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors could cause our actual results, performance or achievements to be materially different from any future results, performance, or achievements that may be expressed or implied by such forward-looking statements, including, among others:

| · | our ability to obtain the substantial capital we require to fund research and operations; |

| · | our lack of product revenues and history of operating losses; |

| · | our early stage of development, particularly the inherent risks and uncertainties associated with (i) developing new drug candidates generally, (ii) demonstrating the safety and efficacy of these drug candidates in clinical studies in humans, and (iii) obtaining regulatory approval to commercialize these drug candidates; |

| · | our drug candidates require time-consuming and costly preclinical and clinical testing and regulatory approvals before commercialization; |

| · | clinical studies and regulatory approvals of our drug candidates are subject to delays, and may not be completed or granted on expected timetables, if at all, and such delays may increase our costs and could delay our ability to generate revenue; |

| · | the regulatory approval process; |

| · | our ability to recruit patients for clinical trials; |

| · | the progress of our clinical trials; |

| · | our ability to find and enter into agreements with potential partners; |

| · | our ability to attract and retain key personnel; |

| · | our ability to obtain and maintain patent protection; |

| · | our ability to protect our intellectual property rights and not infringe on the intellectual property rights of others; |

| · | our ability to comply with applicable governmental regulations and standards; |

| · | development or commercialization of similar products by our competitors, many of which are more established and have or have access to greater financial resources than us; |

| · | commercialization limitations imposed by intellectual property rights owned or controlled by third parties; |

| · | potential product liability and other claims; |

| · | our ability to maintain adequate insurance at acceptable costs; |

| · | further equity financing, which may substantially dilute the interests of our existing shareholders; |

| · | changing market conditions; and |

| · | other risks detailed from time-to-time in our on-going quarterly filings, annual information forms, annual reports and annual filings with Canadian securities regulators and the United States Securities and Exchange Commission, and those which are discussed under the heading “Risk Factors” in this document. |

Should one or more of these risks or uncertainties materialize, or should the assumptions set out in the section entitled “Risk Factors” underlying those forward-looking statements prove incorrect, actual results may vary materially from those described herein. These forward-looking statements are made as of the date of this management’s discussion and analysis or, in the case of documents incorporated by reference herein, as of the date of such documents, and we do not intend, and do not assume any obligation, to update these forward-looking statements, except as required by law. We cannot assure you that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Investors are cautioned that forward-looking statements are not guarantees of future performance and accordingly investors are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty therein.

2

corporate update

The following items highlight our corporate activities during the year ended December 31, 2015 and any subsequent development up until the date hereof.

Orphan Drug Designation

On June 2, 2015, we announced that the U.S. Food and Drug Administration (“FDA”) had granted Aptose orphan drug designation for APTO-253 for the treatment of acute myeloid leukemia (“AML”). APTO-253, a first-in-class inducer of the Krüppel-like factor 4 (“KLF4”) gene, is the Company’s lead product candidate in a Phase Ib clinical trial in patients with AML, high-risk myelodysplastic syndrome (“MDS”) and other hematologic malignancies in which KLF4 silencing is reported as operative.

Orphan drug designation is granted by the FDA to encourage companies to develop therapies for the treatment of diseases that affect fewer than 200,000 individuals in the United States. Orphan drug status provides research and development tax credits, an opportunity to obtain grant funding, exemption from FDA application fees and other benefits. If APTO-253 is approved to treat AML, the orphan drug designation provides Aptose with seven years of marketing exclusivity.

At-The-Market-Facility

In early April 2015, Aptose entered into an at-the-market (“ATM”) facility for up to US $20,000,000 of common shares. The ATM will, along with the effective shelf prospectus that was filed in December 2014, provide us with the added flexibility to quickly access the market and raise capital at market price. During the year ended December 31, 2015, we issued 1,504 common shares under the ATM at a price of US$5.20 per share for gross proceeds of approximately Cdn $10 thousand.

LALS and Moffitt

On November 10, 2015, we announced collaborations with Moffitt Cancer Center, a prominent research institute that provides us with exclusive rights to multi-targeting epigenetic inhibitors and with Laxai-Avanti Life Sciences, a medicinal chemistry institution that will focus on the discovery and optimization of novel epigenetic-based therapies.

program updates

APTO-253

APTO-253 is a novel small molecule that can induce expression of the genes that codes for the Krüppel-like factor 4 (KLF4) master transcription factor and the p21 cell cycle inhibitor protein, and can inhibit expression of the c-Myc oncogene, leading to cell cycle arrest and programmed cell death (apoptosis) in human-derived solid tumor and hematologic cancer cells. Likewise, in nonclinical pharmacology studies APTO-253 demonstrates in vivo anti-tumor activity against xenograft models of solid tumors and hematologic cancers, with acute myeloid leukemia (AML) cells exhibiting a particular sensitivity to APTO-253. A Phase 1 study with APTO-253 in patients with advanced solid tumors was completed in mid-2013. That trial, which employed a suboptimal dosing schedule, demonstrated modest clinical activity in the all-comer solid tumor patient population.

The vast majority of patients with AML are reported to exhibit inappropriate activation of the CDX2 gene and resultant epigenetic down-regulation (silencing) of KLF4 expression, as well as inappropriate upregulation of c-Myc as key leukemogenic events. Aptose scientists performed RT-qPCR expression analysis of KLF4 and CDX2 levels in normal PBMC and AML cell lines and confirmed the silencing of KLF4 expression and elevated expression of CDX2 in AML cells, and multiple publications have reported the elevation of c-Myc oncogene expression in AML cells. In addition to AML, similar roles for KLF4 silencing and c-Myc upregulation have been reported in subpopulations of adult T-cell leukemia, lymphoma, multiple myeloma and high-risk MDS. Induction of KLF4 expression and suppression of c-Myc by APTO-253 may therefore be an effective therapeutic approach in these patient populations. Because of the robust scientific evidence linking KLF4 silencing and c-Myc upregulation to cellular transformation in hematologic malignancies, Aptose undertook an ongoing Phase 1b clinical study with escalating doses of APTO-253 followed by two planned disease-specific expansions in adults with hematologic malignancies. This Phase 1b trial is currently on clinical hold (see discussion below).

3

Preclinical In Vitro Evaluation of APTO-253

APTO-253 demonstrated potent and selective in vitro antiproliferative activity against a variety of leukemia cell lines, including AML, ALL and chronic myeloid leukemia (CML), as well as non-Hodgkin’s lymphoma (NHL) cell lines, with IC50 values ranging from ~0.007 – 0.3 µM. These hematologic cell lines appeared to be far more sensitive to APTO-253 than the solid tumor cell lines, including colon cancer, non-small cell lung cancer (NSCLC), prostate cancer and melanoma, which exhibited IC50 values of ~0.04– 2.6 µM, which had previously served to support the completed Phase 1 solid tumor study. However, new insights from academic publications into the significance of KLF4 suppression in patients with hematologic malignancies appear to be broadly corroborated by these data.

APTO-253 Induces Expression of the KLF4 Gene

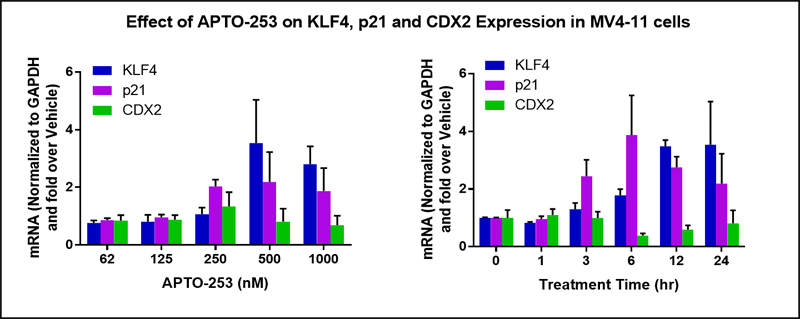

Inappropriate expression of CDX2 in AML cells results in epigenetic silencing of the KLF4 gene and subsequent downstream silencing of the pro-apoptotic p21 gene. To characterize the effect of APTO-253 treatment of AML cells, the levels of CDX2, KLF4 and p21 gene expression were measured as a function of the concentration of APTO-253 and as a function treatment time. As shown in Figure 3, KLF4 and p21 gene expression increased in cells treated with APTO-253, while there was no change in the levels of CDX2 expression.

APTO-253 Induces Expression of KLF4 and p21. The MV4-11 AML cell line was treated with the indicated concentrations of APTO-253 or Vehicle for 24 hours (left panel) or with 500 nM APTO-253 or Vehicle for the indicated period of time (right panel) and the expression of KLF4, p21 and CDX2 mRNA levels were determined by qRT-PCR.

Because AML cells are known to exhibit extreme epigenetic plasticity and to have inappropriate expression of the c-Myc oncogene, we queried if APTO-253 might also inhibit the expression of c-Myc. Indeed, APTO-253 induced a dose-dependent inhibition of c-Myc mRNA expression in three different AML cell lines, and caused reductions in the c-Myc protein. In a time course assay, APTO-253 induces the simultaneous induction of the KLF4 gene and the suppression of the c-Myc gene in AML cells. Moreover, in studies conducted to evaluate apoptotic events, AML cells treated with APTO-253 displayed changes in apoptotic markers, including high level induction of caspase-3 activity. APTO-253-treated AML cells demonstrated a high percentage of apoptotic (Annexin V-positive) cells that correlated with drug concentration. Together, these preclinical studies demonstrate that APTO-253 can affect critical oncogenic process (expression of KLF4, c-Myc and p21 genes) which should lead to programmed cell death in AML cells.

Phase Ib Trial

APTO-253 is being evaluated by Aptose in a Phase 1b relapsed / refractory hematologic malignancy study. For the study, a modified dose schedule was selected, such that APTO-253 is being administered on the first two days of each 7-day dosing period of a 28-day cycle (i.e., days 1, 2, 8, 9, 15, 16, 22, 23). This results in lower per-administration dose levels to provide the same overall exposure per cycle achieved in the prior Phase 1 solid tumor study, and to more consistently achieve the minimum exposure levels at the end of each dosing period that may be important for efficacy.

4

Approximately 15 patients will be enrolled in each of two arms of the dose escalation phase of the study: arm (A) will include patients with acute leukemias (including AML) and high-risk myelodysplastic syndromes, or MDS; arm (B) will include patients with lymphomas (Hodgkin’s and non-Hodgkin’s Lymphoma) and multiple myeloma, followed by enrollment of an additional 15 patients in each of two separate disease-specific expansion cohorts, for a total estimated enrollment of 60 patients.

For future development, upon selection of a lead hematologic indication from this Phase 1b study, combination of APTO-253 with a standard therapy will be considered.

Indications for APTO-253

Clinical Studies

APTO-253 is being administered to patients who have any of the following hematologic malignancies

that have failed standard therapies.

Upon completion of the dose-escalation stage of the study and determination of the recommended Phase 2 dose (RP2D), two hematologic cancer indications will be selected from those indications studied in the dose-escalation phase, for enrollment in two disease-specific single-agent expansion cohorts.

Clinical Hold and Current Status

We announced in November 2015 that the Food and Drug Administration (FDA), following a voluntary suspension of dosing by us and discussions with us, placed our Phase Ib clinical trial of APTO-253 in patients with hematologic cancers on clinical hold. This hold was intended to ensure patient safety within the trial and to ensure manufacturing and dosing procedures are consistent with the appropriate documented quality standards.

The voluntary suspension of dosing by Aptose was initiated as a result of a preliminary review, which was accelerated to evaluate manufacturing processes and procedures upon the report of an operational difficulty with an IV infusion pump at a clinical site. The pump experienced back pressure during IV patient dosing at the point of the filter. Further review discovered preliminary concerns regarding the documentation records of the manufacturing procedures of the drug product associated with APTO-253. A complete safety review of all patient files had been completed prior to initial discovery of the manufacturing documentation irregularities, and there have been no drug-related serious adverse events (SAEs) reported. The observed pharmacokinetic levels in the patients treated were within the expected range. Thus, the clinical hold is based on a manufacturing issue and is not related to safety, efficacy or pharmacokinetics.

Currently, Aptose is guiding a qualified CMO to introduce new procedures to formulate APTO-253 into a drug product that is safe and stable, and which should not result in filter clogging events in the future. The CMO now has manufactured new GMP batches of the Active Pharmaceutical Ingredient (“API”) to provide material for formulation studies and to supply the clinical trials into the future. Aptose also qualified a separate CMO with expertise in liquid formulations to perform formulation development studies and to manufacture the final form of the drug product for return to the clinic. The CMO has performed numerous formulation studies using a variety of methodologies and is now evaluating their solubility and stability over time to select the best methodology to manufacture the new batch of drug product to take to the FDA. In order to have the clinical hold lifted and to return APTO-253 to the clinical trial, Aptose must articulate the root cause of the filter clogging incident to the FDA and demonstrate to the FDA that a newly manufactured batch of GMP-grade APTO-253 drug substance has been formulated and is unlikely to cause such incidents in the future. The ultimate decisions regarding the lift of the clinical hold, the appropriateness of the new drug product, and the starting dose for the trial will reside with the FDA.

Biomarker Strategy for APTO-253

in a Clinical Setting

Previous basic research studies have utilized RT-qPCR analyses of CDX2, KLF4 and p21 transcripts

in AML cell lines and the primary blood cells of AML patients (Scholl et al., 2007; Faber et al., 2013). Aptose has now optimized

the RT-qPCR reagents and procedures for measurement of the CDX2, KLF4 and p21 mRNA expression levels in human AML cells. Consequently,

analytically validated RT-qPCR assays for the relative quantification of CDX2, KLF4 and p21 transcripts may be used to select patients

expected to be most sensitive for response to APTO-253 therapy. In addition, these assays may be used to monitor on-treatment

responses.

Biopsies are collected from lymphoma patients that are enrolled in the clinical trial. Blood and bone marrow are collected from AML patients and bone marrow aspirates are collected from MDS patients. FFPE core needle biopsy tissue and CD34+ cell pellets derived from blood and bone marrow will be used for gene expression profiling. A RT-qPCR method is being developed, optimized and validated for the analysis of CDX2, KLF4 and p21 target transcripts and appropriate reference gene transcripts in the samples collected from patients enrolled in the clinical trial.

5

BEAT AML Preclinical Studies of APTO-253 Against Patient Isolates

On September 29, 2014, we announced, along with the Knight Cancer Institute at Oregon Health & Science University (OHSU) and The Leukemia & Lymphoma Society (LLS) that we entered into a formal collaboration with the Beat AML initiative. Beat AML is a groundbreaking research initiative that includes industry and academic collaborators led by top scientists within the Knight Cancer Institute in collaboration with The Leukemia & Lymphoma Society. Its goal is to accelerate development of potential therapies for AML.

During the 2015 American Society of Hematology (ASH) Conference, Aptose’s collaborators at OHSU’s Knight Cancer Institute presented preclinical data on APTO-253 that are derived from our participation in the Beat AML Initiative with Dr. Brian Druker. The poster presentation was entitled “Broad Activity of APTO-253 in AML and Other Hematologic Malignancies Correlates with KLF4 Expression Level”. The Beat AML initiative, a groundbreaking initiative that was formed in collaboration with The Leukemia & Lymphoma Society and the Knight Cancer Institute, has allowed Aptose to evaluate the effect of APTO-253, alone or in combination with other anti-cancer agents, in fresh bone marrow isolates from patients with AML, myelodysplastic syndrome (MDS), chronic myeloid leukemia (CML) and chronic lymphocytic leukemia (CLL).

In the 2015 OHSU ASH presentation, researchers used a range of doses, from low nanomolar to ten micromolar, and found that APTO-253 killed AML cells at an IC50 of less than 1uM in a significant number of AML patient samples, with a trend toward correlation with baseline KLF4 expression level. Moreover, APTO-253 demonstrated enhanced killing of AML patient samples when combined with two other therapeutic strategies, the BET bromodomain inhibitor JQ1 and the FLT3 inhibitor quizartinib. Such data support the development of APTO-253 for the treatment of AML, support the role of KLF4 in the mechanism of action of APTO-253, and support the ultimate use of APTO-253 in combination with other high profile drugs under development for the treatment of AML. OHSU continues to evaluate APTO-253 in additional samples across AML and other hematologic malignancies, along with other novel therapeutic combinations.

Multi-Targeting Bromodomain Program

In November, 2015, Aptose entered into a definitive agreement with Moffitt Cancer Center for exclusive global rights to potent, multi-targeting, single-agent inhibitors for the treatment of hematologic and solid tumor cancers. These small molecule agents are highly differentiated inhibitors of the Bromodomain and Extra-Terminal motif (BET) protein family members, which simultaneously target specific kinase enzymes. The molecules developed by Moffitt exhibit single-digit nanomolar potency against the BET family members and specific oncogenic kinases which, when inhibited, are synergistic with BET inhibition. Under the agreement, Aptose will gain access to the drug candidates developed by Moffitt and the underlying intellectual property covering the chemical modifications enabling potent bromodomain (BRD) inhibition on the chemical backbone of a kinase inhibitor. Aptose expects lead clinical candidates to emerge from the collaboration by late 2016.

In December, 2015, collaborators from Moffitt Cancer Center presented preclinical data for one of the candidates in the collaboration, MA2-014, at the 57th Annual American Society of Hematology (ASH) Meeting. The MA2-014 program was developed to inhibit both the bromodomain 4 (BRD4) protein and the Janus kinase 2 (JAK2) for the potential treatment of various hematologic and solid tumor cancers. Moffitt researchers presented data for MA2-014 that exhibited similar anti-JAK2 activity as a known JAK2 inhibitor, TG101209, with an approximate ten-fold improvement in anti-BRD activity. Moffitt researchers also demonstrated a ten-fold improvement in the ability of MA2-014 to inhibit JAK2-V617F signaling over TG101209, and comparable to ruxolitinib. Ruxolitinib is the only FDA approved JAK inhibitor for MPNs. However, MA2-014 retained its potency against ruxolitinib-resistant cells. Moffitt researchers also determined in long-term culture assays that JAK2-V617F driven MPN Uke1 cells do not experience resistance to MA2-014 as readily as they do to TG101209 or ruxolitinib.

Multi-Targeting Epigenetic Program

In November 2015, Aptose also announced an exclusive drug discovery partnership with Laxai Avanti Life Sciences (LALS) for their expertise in next generation epigenetic-based therapies. Under the agreement, LALS will be responsible for developing multiple clinical candidates, including optimizing candidates derived from Aptose's relationship with the Moffitt Cancer Center. Aptose will own global rights to all newly discovered candidates characterized and optimized under the collaboration, including all generated intellectual property.

6

financing activities

equity financings

At-The-Market (“ATM”) Facility

On April 2, 2015, we entered into an ATM equity facility with Cowen and Company, LLC, acting as sole agent. Under the terms of this facility, we may, from time to time, sell shares of our common stock having an aggregate offering value of up to US$20 million through Cowen and Company, LLC on the Nasdaq Capital Market. We determine, at our sole discretion, the timing and number of shares to be sold under this ATM facility. During the twelve months ended December 31, 2015 the Company issued 1,504 common shares under the ATM at a price of US$5.20 per share for gross proceeds of approximately Cdn $10 thousand.

April 2014

In April 2014, we completed a public offering of common shares. Aptose issued 4,708,334 (56,500,000 pre-consolidation) common shares at a purchase price of $6.00 ($0.50 pre-consolidation) per common share, including 541,667 (6,500,000 pre-consolidation) common shares pursuant to the partial exercise of an over-allotment option, for aggregate gross proceeds of $28.3 million. The total costs associated with the transaction were approximately $2.7 million which includes a cash commission of $2.0 million based on 7% of the gross proceeds received as part of the offering.

December 2013

In December 2013, Aptose completed a public offering of common shares. Aptose issued 1,060,833 (pre-consolidation 12,730,000) common shares at a price of $6.60 (pre-consolidation $0.55) per common share and an additional 159,125 (pre-consolidation 1,909,500) common shares upon the exercise of the overallotment option for aggregate gross proceeds of $8.1 million.

The total costs associated with the transaction were approximately $1.1 million which include a cash commission of $483 thousand based on 6% of the gross proceeds received as part of the offering, and the issuance of 73,198 (pre-consolidation 878,370) broker warrants with an estimated fair value of $350 thousand. The fair value of these warrants was determined using the Black Scholes model with a 24 month time to maturity, an assumed volatility of 130% and a risk free interest rate of 1.5%. Each broker warrant was exercisable into one common share of the Company at a price of $6.60 (pre-consolidation $0.55) for a period of twenty four months following closing of the offering.

warrant exercises

| Warrants exercised during the twelve months ended December 31, 2015: | ||||||||

| (in thousands) | Number | Proceeds | ||||||

| August 2011 warrants (i) | 16 | $ | 86 | |||||

| June 2013 private placement warrants (ii) | 47 | 141 | ||||||

| December 2013 broker warrants (iii) | 18 | 121 | ||||||

| Total | 81 | $ | 348 | |||||

In addition to the cash proceeds received, the original fair value related to these warrants of $155 thousand was transferred from warrants to share capital. This resulted in a total amount of $503 thousand credited to share capital.

| Warrants exercised during the seven months ended December 31, 2014: | ||||||||

| (in thousands) | Number | Proceeds | ||||||

| August 2011 warrants (i) | 8 | $ | 48 | |||||

| June 2012 private placement warrants (iv) | 1,223 | 6,600 | ||||||

| Total | 1,231 | $ | 6,648 |

In addition to the cash proceeds received, as a result of the exercise of the warrants, the original fair value related to these warrants of $1.2 million was transferred from the warrants to the share capital of the Company. This resulted in a total amount of $7.8 million credited to share capital following the exercise of the warrants.

7

| Warrants exercised during the year ended May 31, 2014: | ||||||||

| (in thousands) | Number | Proceeds | ||||||

| August 2011 warrants (i) | 327 | $ | 1,764 | |||||

| June 2012 private placement warrants (iv) | 409 | 2,210 | ||||||

| June 2012 finder warrants | 103 | 396 | ||||||

| June 2013 private placement warrants (iii) | 29 | 88 | ||||||

| Total | 868 | $ | 4,458 |

In addition to the cash proceeds received, as a result of the exercise of the warrants, the original fair value related to these warrants of $964 thousand was transferred from the warrants to the share capital of the Company. This resulted in a total amount of $5.4 million credited to share capital following the exercise of the warrants.

| Summary of outstanding warrants: | ||||||||

| (in thousands) | December 31, 2015 | December 31, 2014 | ||||||

| August 2011 warrants (i) | 73 | 89 | ||||||

| June 2013 private placement warrants (ii) | - | 47 | ||||||

| December 2013 broker warrants (iii) | - | 73 | ||||||

| Number of warrants outstanding, end of year | 73 | 209 |

| (i) | August 2011 warrants are exercisable into common shares of Aptose at a price per share of $5.40 and expire in August 2016. |

| (ii) | June 2013 private placement warrants were exercisable into common shares of Aptose at a price per share of $3.00 and expired in June 2015. |

| (iii) | December 2013 broker warrants were exercisable into common shares of Aptose at a price per share of $6.60 and expired in December 2015. |

| (iv) | June 2012 private placement warrants were exercisable into common shares of Aptose at a price per share of $5.40 ($0.45 pre-consolidation) and expired on June 8, 2014 |

promissory notes and warrants

In June 2013, we completed a private placement of units (“Units” in this section) at a price of $1 thousand per unit, for aggregate gross proceeds of $918 thousand.

Each Unit consisted of (i) a $1 thousand principal amount of unsecured promissory note and (ii) 83 (pre-consolidation 1,000) common share purchase warrants. The promissory notes bore interest at a rate of 10% per annum, payable monthly and were due June 19, 2014. Each warrant entitled the holder thereof to acquire one common share of Aptose a price per common share equal to $3.00 (pre-consolidation $0.25) at any time until June 19, 2015.

The Units contained a liability component and an equity component represented by the warrants to purchase common shares. The fair value of the liability component of $843 thousand was estimated by discounting the future cash flows associated with the debt at a discounted rate of approximately 19% which represents the estimated borrowing cost to Aptose for similar promissory notes with no warrants. The residual value of $75 thousand was allocated to the warrants. We incurred costs associated with the financing of $23 thousand. These costs were amortized using the effective interest rate method over the 12 month life of the notes.

These notes and any interest accrued thereon were repaid in full in April 2014.

Convertible promissory notes

In September 2013, we completed a private placement of convertible promissory notes for aggregate gross proceeds of $600 thousand. Each convertible promissory note consisted of a $1 thousand principal amount of unsecured promissory note convertible into common shares of Aptose at a price per share of $3.60. The promissory notes bore interest at a rate of 10% per annum, payable quarterly and were due September 26, 2015.

The promissory notes were a compound financial instrument containing a liability component and an equity component represented by the conversion feature. The fair value of the liability component upon issuance was estimated by discounting the future cash flows associated with the debt at a discounted rate of approximately 19% which represented the estimated borrowing cost to us for similar promissory notes with no conversion feature. The residual value of $88 thousand was allocated to the conversion feature.

8

Subsequent to initial recognition, the promissory notes were accounted for at amortized cost using the effective interest rate method. We incurred costs associated with the financing of $17 thousand. These costs along with the adjustment for the conversion feature were being accreted using the effective interest rate method over the 24 month life of the notes.

During the year ended December 31, 2015, all of the outstanding promissory notes were converted into common shares of Aptose.

Loans payable

In September 2013, we entered into loan agreements for proceeds of $150 thousand. The loans were unsecured, bore interest at a rate of 10% per annum payable quarterly and were due September 30, 2015. We repaid the loans and all accrued and unpaid interest thereon on April 25, 2014.

LIQUIDITY AND CAPITAL RESOURCES

Since its inception, Aptose has financed its operations and technology acquisitions primarily from equity and debt financing, proceeds from the exercise of warrants and stock options, and interest income on funds held for future investment. We plan to continue our development programs from internal resources as they are available.

We currently do not earn any revenues from our drug candidates and are therefore considered to be in the development stage. The continuation of our research and development activities and the commercialization of the targeted therapeutic products are dependent upon our ability to successfully finance and complete our research and development programs through a combination of equity financing and payments from strategic partners. We have no current sources of significant payments from strategic partners.

Cash Position

At December 31, 2015, we had cash and cash equivalents and investments of $19.7 million compared to $30.5 million at December 31, 2014. We generally invest our cash in excess of current operations requirements in highly rated and liquid instruments. Investment decisions are made in accordance with an established investment policy administered by senior management and overseen by the Board. As at December 31, 2015, our cash was invested in cash of $761 thousand (December 31, 2014 - $293 thousand) and funds deposited into high interest savings accounts totaling $10.742 million (December 31, 2014 - $14.072 million). Working capital (representing primarily cash, cash equivalents and investments other current assets less current liabilities) at December 31, 2015 was $18.5 million (December 31, 2014 - $29.1 million).

We do not expect to generate positive cash flow from operations for the foreseeable future due to additional research and development costs, including costs related to drug discovery, preclinical testing, clinical trials, manufacturing costs and operating expenses associated with supporting these activities. It is expected that negative cash flow from operations will continue until such time, if ever, that we receive regulatory approval to commercialize any of our products under development and/or royalty or milestone revenue from any such products exceeds expenses.

RESULTS OF OPERATIONS

Our net loss and comprehensive loss for the year ended December 31, 2015 was $14.6 million ($1.23 per share) compared with a loss of $7.8 million ($0.67 per share) in the seven months ended December 31, 2014 and with a loss of $10.6 million ($2.02 per share post-consolidation) in the year ended May 31, 2014.

The increase in net loss and comprehensive loss in the year ended December 31, 2015 compared with the seven months ended December 31, 2014 is due to a twelve month period compared with a seven month period as well as increased research and development costs associated with the APTO-253 Phase Ib clinical trial described above for which the first patient was enrolled in January 2015. The increased research and development costs were offset by a higher finance income related to foreign currency gains on our USD cash and cash equivalents balances due to the devaluation of the Canadian dollar.

9

The increase in annualized net loss and comprehensive loss in the seven months ended December 31, 2014 compared with the twelve months ended May 31, 2014 is due to increased research and development costs associated with the initiation of the APTO-253 Phase Ib clinical trial described above as well as increased general and administrative costs associated with corporate activities during the seven month period including our name change and rebranding initiates, the NASDAQ listing and associated costs as well as increased patent costs and anticipated relocation costs associated with our former facilities in Toronto.

We utilized cash of $12.7 million in our operating activities in the year ended December 31, 2015 compared with $6.7 million in the seven months ended December 31, 2014 and $8.5 million in the year ended May 31, 2014. The increase in cash utilized in the current year is due to increased research and development activities offset by an increased in finance income.

At December 31, 2015, we had cash and cash equivalents and investments of $19.7 million compared to $30.5 million at December 31, 2014.

SELECTED ANNUAL FINANCIAL DATA

The following selected consolidated financial data have been derived from, and should be read in conjunction with, the accompanying audited consolidated financial statements for the year ended December 31, 2015 (the “Financial Statements”) which are prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board.

Consolidated Statements of Loss and Comprehensive Loss | Year ended December 31, |

7 months ended |

Year ended | |||||||||

| (amounts in Canadian thousands except for per common share data) | 2015 | 2014 | 2014 | |||||||||

| REVENUE | $ | — | $ | — | $ | — | ||||||

| EXPENSES | ||||||||||||

| Research and development | 6,254 | 2,404 | 3,015 | |||||||||

| General and administrative | 9,845 | 5,542 | 7,317 | |||||||||

| Operating expenses | 16,099 | 7,946 | 10,332 | |||||||||

| Finance expense | 43 | 104 | 297 | |||||||||

| Finance income | (1,516 | ) | (279 | ) | (76 | ) | ||||||

| Net finance expense (income) | (1,473 | ) | (175 | ) | 221 | |||||||

| Net loss and total comprehensive loss for the period | 14,626 | 7,771 | 10,553 | |||||||||

| Basic and diluted loss per common share | $ | 1.23 | $ | 0.67 | $ | 2.02 | ||||||

| Weighted average number of common shares | ||||||||||||

| outstanding used in the calculation of: | ||||||||||||

| Basic and diluted loss per share | 11,906 | 11,605 | 5,216 | |||||||||

| Total Assets | $ | 21,249 | $ | 31,600 | $ | 30,899 | ||||||

| Total Long-term liabilities | $ | — | $ | - | $ | 528 |

10

Research and Development

Research and development expenses totaled $6.3 million in the year ended December 31, 2015 compared with $2.4 million in the seven months ended December 31, 2014 and $3.0 million in the twelve months ended May 31, 2014. Research and development expenses consist of the following:

| Year ended | 7 months ended | Year ended | ||||||||||

December 31, | December 31, | May 31, | ||||||||||

| (in thousands) | 2015 | 2014 | 2014 | |||||||||

| Research and development costs | $ | 6,015 | $ | 2,371 | $ | 2,287 | ||||||

| Severance cost for former officer | - | - | 326 | |||||||||

| Deferred share unit (“DSU”) costs | - | - | 90 | |||||||||

| Stock-based compensation | 210 | 29 | 296 | |||||||||

| Depreciation of equipment | 29 | 4 | 16 | |||||||||

| $ | 6,254 | $ | 2,404 | $ | 3,015 |

Expenditures for the year ended December 31, 2015 increased significantly over the seven months ended December 31, 2014 (on an annualized basis) due to the following:

| · | Costs associated with the Phase 1b clinical trial of APTO-253 in patients with relapsed or refractory hematologic malignancies including clinical site costs, patient costs, contract research organization and consulting charges. The first patient in the trial was enrolled in January 2015; |

| · | Development costs related to the Moffit/LALS programs which were initiated in the fourth quarter of 2015; |

| · | Formulation, manufacturing and compliance costs related to the development of APTO-253 including costs related to the clinical hold described above; |

| · | Additional payroll related costs in the clinical department due to restructuring to support ongoing activities; and |

| · | The increased cost of US dollar denominated expenditures due to the devaluation of the CDN dollar in 2015. |

Expenditures for the seven month period ended December 31, 2014 increased on an annualized basis in comparison to the twelve months ended May 31, 2014. The increase in expenditures in the seven months ended December 31, 2014 related primarily to our Phase Ib clinical study of APTO-253 in patients with relapsed or refractory hematologic malignancies, which was initiated in late 2014, whereas no clinical development activity was ongoing in the twelve months ended May 31, 2014. In addition to the clinical costs associated with APTO-253, activity related to supporting the advancement of APTO-253 as a drug candidate through research and development activities increased significantly in the seven months ended December 31, 2014 compared with the prior year. These costs include research collaborations, animal studies and drug formulation work.

In the twelve months ended May 31, 2014 we incurred one time severance costs associated with a former officer of the Company which were paid in full in April 2014. The total severance amount of $1.1 million was allocated between general and administrative ($762 thousand) and research and development ($326 thousand). There are no ongoing obligations related to the severance payment. The allocation was based upon the time spent by the former officer on research and development versus general and administrative activities.

There were no DSUs outstanding in the year ended December 31, 2015 or the seven months ended December 31, 2014. In the twelve months ended May 31, 2014 DSU costs increased due to an increase in the share price of Aptose and the associated fair value of the units. In April 2014, 65,000 (780,000 pre-consolidation) common shares of Aptose were issued in payment of the outstanding DSU liability with a fair value of $444 thousand. There were no outstanding DSUs as of May 31, 2014.

Stock-based compensation expense increased in the year ended December 31, 2015 compared with the seven months ended December 31, 2014 primarily due to option grants to new employees and advisors during the year.

Stock-based compensation expense was lower in the seven months ended December 31, 2014 compared with the twelve months ended May 31, 2014 due primarily to the timing of option grants as well as options granted in the twelve months ended May 31, 2014 which vested immediately resulting in increased expenses for that year.

11

General and Administrative

General and administrative expenses totaled $9.8 million for the year ended December 31, 2015 compared with $5.5 million in the seven months ended December 31, 2014 and $7.3 million in the twelve months ended May 31, 2014. General and administrative expenses consisted of the following:

| (in thousands) | 12 months ended | 7 months ended | 12 months ended | |||||||||

December 31, | December 31, | May, 31 | ||||||||||

| 2015 | 2014 | 2014 | ||||||||||

| General and administrative excluding salaries | $ | 4,327 | $ | 2,421 | $ | 2,620 | ||||||

| Salaries | 2,849 | 1,505 | 2,217 | |||||||||

| Severance cost of former officer | - | - | 762 | |||||||||

| DSU costs | - | - | 183 | |||||||||

| Stock-based compensation | 2,602 | 1,598 | 1,530 | |||||||||

| Depreciation and amortisation | 67 | 18 | 5 | |||||||||

| $ | 9,845 | $ | 5,542 | $ | 7,317 |

On an annualized basis, general and administrative costs excluding salaries have increased slightly in the year ended December 31, 2015 compared with the seven months ended December 31, 2014. The increase is attributable to increased costs associated with our NASDAQ listing (initiated late 2014) including listing fees and insurance charges, internal control documentation work completed during the year as well as the devaluation of the Canadian dollar which has increased the cost of our US dollar denominated expenditures including, board fees, legal and other corporate costs. These increases have been offset by the charges related to the termination of the Toronto lease in December 2014 as well as costs incurred in 2014 related to our rebranding for which no comparable costs were incurred in the current year.

Salary costs on an annualized basis have increased slightly in the year ended December 31, 2015 compared with the seven months ended December 31, 2014. While the majority of our salary costs are incurred in US dollars and therefore have increased during the year, this increase has been offset by a reduction in bonus payments made to executives in the year ended December 31, 2015.

Stock-based compensation on an annualized basis in the year ended December 31, 2015 is consistent compared with the seven months ended December 31, 2014.

General and administrative expenses excluding salaries increased on an annualized basis in the seven months ended December 31, 2014 compared with the twelve months ended May 31, 2014. The increased costs were the result of the following corporate activities:

| · | Our name change (described above) and related rebranding initiatives; |

| · | Our listing on NASDAQ and the subsequent increase in Directors and Officers insurance costs; |

| · | The change in year end from May 31, to December 31; |

| · | Increased patent filing and maintenance costs; |

| · | Costs associated with additional corporate offices and the estimated increased cost of restoring the current Toronto office location; and |

| · | Increased travel costs. |

Salary costs increased on an annualized basis in the seven months ended December 31, 2014 compared with the twelve months ended May 31, 2014 as the new executives hired in October and November 2013 were employed for the entire operating period in the seven month period rather than a partial year in the prior period. These increased costs were offset by the termination of a former officer of the Company in the twelve months ended May 31, 2014 and therefore no further costs in the current seven month period.

Stock-based compensation expense on an annualized basis was significantly higher in the seven months ended December 31, 2014 compared with the year ended May 31, 2014 due to option grants in June and July 2014 which vested 50% in the first year with no comparative grants in the year ended May 31, 2014.

12

The severance costs related to the former officer of the Company were paid in full in April 2014 and the details are described under ‘Research and Development’ above.

DSU costs are described under “Research and Development” above.

Finance Expense

Finance expense totaled $43 thousand for the year ended December 31, 2015 compared with $104 thousand in the seven months ended December 31, 2014 and $297 thousand in the year ended May 31, 2014. The components of finance expense are as follows:

Year ended | 7 months ended | Year ended | ||||||||||

| December 31, | December 31, | May 31, | ||||||||||

| 2015 | 2014 | 2014 | ||||||||||

| Interest expense | $ | 25 | $ | 30 | $ | 129 | ||||||

| Accretion expense | 18 | 28 | 130 | |||||||||

| Foreign exchange loss on cash and cash equivalents | - | 46 | 38 | |||||||||

| $ | 43 | $ | 104 | $ | 297 |

Interest and accretion expense incurred in the year ended December 31, 2015 and the seven months ended December 31, 2014 relates to the 10% convertible promissory notes described above. Interest and accretion expense incurred in the year ended May 31, 2014 relates to the 10% promissory notes issued in June 2013 and repaid in April 2014 as well as the 10% convertible promissory notes and non-convertible promissory notes issued in September 2013 described above. There were no interest-bearing liabilities outstanding at December 31, 2015.

Finance Income

Finance income totaled $1.5 million in the year ended December 31, 2015 compared with $279 thousand in the seven months ended December 31, 2014 and $76 thousand in the year ended May 31, 2014. The components of finance income are as follows:

Year ended | 7 months ended | Year ended | ||||||||||

| December 31, | December 31, | May 31, | ||||||||||

| 2015 | 2014 | 2014 | ||||||||||

| Interest income | $ | 286 | $ | 279 | $ | 76 | ||||||

| Foreign exchange gain on cash and cash equivalents | 1,230 | - | - | |||||||||

| $ | 1,516 | $ | 279 | $ | 76 |

Interest income represents interest earned on our cash and cash equivalent and investment balances. The increase in interest income during the seven months ended December 31, 2014 compared with the prior year is the result of a higher average cash and cash equivalents balance throughout the period following the April 2014 public offering described above.

The foreign exchange gain realized in the year ended December 31, 2015 is due to the depreciation of the Canadian dollar and the subsequent increase in value of our US dollar currency balances.

Net loss and total comprehensive loss for the year

Our net loss and total comprehensive loss for the year ended December 31, 2015 was $14.6 million ($1.23 per share) compared with $7.8 million ($0.67 per share) in the seven months ended December 31, 2014 and with $10.6 million ($2.02 per share) in year ended May 31, 2014.

The increase in net loss and comprehensive loss in the year ended December 31, 2015 compared with the seven months ended December 31, 2014 is due to a twelve month period compared with a seven month period as well as increased research and development costs associated with the APTO-253 Phase Ib clinical trial described above for which the first patient was enrolled in January 2015. The increased research and development costs were offset by a higher finance income related to foreign currency gains on our USD cash and cash equivalents balances due to the devaluation of the Canadian dollar.

13

The increase in annualized net loss and comprehensive loss in the seven months ended December 31, 2014 compared with the twelve months ended May 31, 2014 is due to increased research and development costs associated with the initiation of the APTO-253 Phase Ib clinical trial described above as well as increased general and administrative costs associated with corporate activities during the seven month period including our name change and rebranding initiates, the NASDAQ listing and associated costs as well as increased patent costs and anticipated relocation costs associated with our former facilities in Toronto.

QUARTERLY FINANCIAL INFORMATION (UNAUDITED)

The selected financial information provided below is derived from the Company’s unaudited quarterly financial statements for each of the last eight quarters prepared in accordance with IFRS.

Q4 |

Q3 |

Q2 |

Q1 | Four months ended |

Q4 | Q3 | ||||||||||||||||||||||||||

| (Amounts in 000’s except for per common share data) | Dec 31, 2015 | Sept 30, 2015 | June 30, 2015 | Mar 31, 2015 | Dec 31, 2014 | Sept 30, 2014 | May 31, 2014 | Feb 28, 2014 | ||||||||||||||||||||||||

| Revenue | $ | ― | $ | ― | $ | ― | $ | ― | $ | ― | $ | ― | $ | ― | $ | ― | ||||||||||||||||

| Research and development expense | 2,340 | 1,722 | 1,308 | 884 | 1,093 | 1,311 | 1,012 | 597 | ||||||||||||||||||||||||

| General and administrative expense | 2,364 | 2,248 | 2,504 | 2,729 | 2,554 | 2,988 | 3,192 | 1,751 | ||||||||||||||||||||||||

| Net loss | (4,431 | ) | (3,261 | ) | (3,365 | ) | (3,569 | ) | (3,584 | ) | (4,187 | ) | (4,221 | ) | (2,433 | ) | ||||||||||||||||

| Basic and diluted net loss per share | $ | (0.38 | ) | $ | (0.27 | ) | $ | (0.28 | ) | $ | (0.30 | ) | $ | (0.31 | ) | $ | (0.36 | ) | $ | (0.49 | ) | $ | (0.48 | ) | ||||||||

| Cash (used in) operating activities | $ | (3,619 | ) | $ | (2,567 | ) | $ | (4,296 | ) | $ | (2,182 | ) | $ | (2,745 | ) | $ | (3,926 | ) | $ | (3,926 | ) | $ | (2,171 | ) |

Research and development expenditures were lower in the quarter ended February 28, 2014 as the Company focused its efforts on a strategic review and securing adequate financing for future development. In the quarter ended May 31, 2014, expenditures increased due to the allocation of severance costs related to a former Officer of the Company to research and development of $326 thousand. In the four months ended September 30, 2014 and in following quarters, research and development activities have increased as we prepared and subsequently launched the APTO-253 Phase Ib clinical trial. In the third and fourth quarters of 2015 research and development expenditures increased further due to costs associated with the clinical trial as well as the quality, manufacturing and formulation work including the Clinical Hold described above.

The increase in general and administrative expense in the three months ended May 31, 2014 is due to severance costs associated with a former officer of the Company of $762 thousand, bonus costs, and increased Board, consulting and legal fees associated with activities during the quarter. In the four months ended September 30, 2014, the general and administrative expense is higher due to a four-month versus three-month period in relation to the change in the financial year of the Company discussed above as well as option grants during the quarter which increased option-related expenses. During the three months ended December 31, 2014, we incurred additional expenses related to our listing on NASDAQ and recognized an increase in expected costs to terminate our current Toronto lease which led to higher general and administrative expenses in the quarter. General and administrative costs in the three months ended March 31, 2015 again were higher due to the relocation of the Toronto office and related clean-up costs as well as costs related to our NASDAQ listing.

Cash used in operating activities fluctuates significantly due primarily to timing of payments and increases and decreases in the accounts payables and accrued liabilities balances.

14

Three months ended december 31, 2015 and 2014 (unaudited)

| (Amounts in 000’s except for per common share data) | Dec 31, 2015 | Dec 31, 2014 | ||||||

| Revenue | $ | ― | $ | ― | ||||

| Research and development expense | 2,340 | 1,093 | ||||||

| General and administrative expense | 2,364 | 2,554 | ||||||

| Operating expenses | 4,704 | 3,647 | ||||||

| Finance expense | - | 55 | ||||||

| Finance income | (273 | ) | (118 | ) | ||||

| Net financing income | (273 | ) | (63 | ) | ||||

| Net loss | (4,431 | ) | (3,584 | ) | ||||

| Basic and diluted net loss per share | $ | (0.38 | ) | $ | (0.31 | ) |

Our net loss and comprehensive loss for the three months ended December 31, 2015 increased to $4.4 million compared with $3.6 million in the three months ended December 31, 2014. The increase in net loss is primarily the result of increased research and development activities of $1.2 million offset by reduced general and administrative costs of $190 thousand in the three months ended December 31, 2015 compared with the three months ended December 31, 2014 as well as an increase in net financing income of $210 thousand in the three months ended December 31, 2015 which reduced the net loss in comparison to the prior year period.

The increased research and development expense in the three months ended December 31, 2015 compared with the three months ended December 31, 2014 results from the APTO-253 Phase Ib clinical trial for which the first patient was enrolled in January 2015 and related personnel and consulting costs.

General and administrative expenses decreased to $2.4 million in the three months ended December 31, 2015 compared with $2.6 million in the three months ended December 31, 2014. The decrease despite the increased cost of our US dollar expenditures due to the devaluation of the Canadian dollar is related to a reduction in bonus expense for Executives as well as costs related to the termination of our Toronto lease recognized in the final quarter of 2014, for which no comparable costs exist in the current year.

use of proceeds

The following table provides an update on the anticipated use of proceeds raised in the December 2013 and April 2014 equity offerings along with amounts actually expended.

As of December 31, 2015 the following expenditures have been incurred:

| (in thousands) | Previously

disclosed | Additional

Costs | Spent to Date | Remaining

to be spent | ||||||||||||

| Phase Ib clinical trial | $ | 3,350 | $ | ** | $ | 2,052 | $ | ** | ||||||||

| Depending on the Phase Ib clinical trial of APTO-253 results, fund single agent expansion and drug combination focused Phase 2 Trials in both AML and MDS patients | 7,800 | - | nil | 7,800 | ||||||||||||

| APTO-253 manufacturing program | 2,250 | ** | 1,608 | ** | ||||||||||||

| Research and development programs(1) | 2,000 | - | 2,000 | - | ||||||||||||

| General and corporate purposes | 15,869 | - | 14,593 | 1,276 | ||||||||||||

| $ | 31,269 | $ | ** | $ | 20,253 | $ | ** |

| (1) | We have utilized all of the funds allocated from the December 2013 and April 2014 equity offerings to Research and Development programs and continue to fund expenses through proceeds related to warrant and stock option exercises for which no allocations were stipulated. | |

| ** | In November 2015, the ongoing Phase 1b clinical trial was placed on clinical hold (as described above). We are diligently working on reinitiating the clinical trial, however the ultimate decisions, and the related costs, regarding the lift of the clinical hold, the appropriateness of the new drug product, and the starting dose for the trial will depend on the outcome of our discussions with the FDA and may vary significantly. As such, we are not currently in a position to reasonably estimate the total costs to be incurred to complete the Phase 1b clinical trial and associated manufacturing program and do not anticipate to be in such a position until we receive additional feedback from the FDA. |

15

We do not anticipate initiating the Phase 2 trials until the results of the Phase Ib are available and only then if the results warrant further clinical investigation. It is currently anticipated that the remaining balance of the general and corporate costs will be allocated in accordance with the previously disclosed use of proceeds and additional costs will be funded through proceeds related to warrant and stock option exercises.

CRITICAL ACCOUNTING POLICIES

Critical Accounting Policies and Estimates

We periodically review our financial reporting and disclosure practices and accounting policies to ensure that they provide accurate and transparent information relative to the current economic and business environment. As part of this process, Aptose has reviewed its selection, application and communication of critical accounting policies and financial disclosures. Management has discussed the development and selection of the critical accounting policies with the Audit Committee of the Board of Directors and the Audit Committee has reviewed the disclosure relating to critical accounting policies in this MD&A. Other important accounting policies are described in note 3 of the audited financial statements.

(a) Valuation of stock-based compensation and share purchase warrants:

Management measures the costs for stock-based payments and share purchase warrants using market-based option valuation techniques. Assumptions are made and judgment is used in applying valuation techniques. These assumptions and judgments include estimating the future volatility of the share price, expected dividend yield, future employee turnover rates and future share option and share purchase warrant behaviors and corporate performance. Such judgments and assumptions are inherently uncertain. The increase or decrease of one of these assumptions could materially increase or decrease the fair value of share-based compensation and share purchase warrants issued and the associated expense.

(b) Valuation of tax accounts:

Uncertainties exist with respect to the interpretation of complex tax regulations and the amount and timing of future taxable income. Currently, we have deductible temporary differences which would create a deferred tax asset. Deferred tax assets are recognized for all deductible temporary differences to the extent that it is probable that future taxable profit will be available against which the deductible temporary differences can be utilized. Management judgment is required to determine the amount of deferred tax assets that can be recognized, based upon the likely timing and the level of future taxable profits together with future tax planning strategies. To date, we have determined that none of our deferred tax assets should be recognized. Our deferred tax assets are mainly comprised of our net operating losses from prior years and prior year research and development expenses. These tax pools relate to entities that have a history of losses, have varying expiry dates, and may not be used to offset taxable income. As well, there are no taxable temporary differences or any tax planning opportunities available that could partly support the recognition of these losses as deferred tax assets. The generation of future taxable income could result in the recognition of some portion or all of the remaining benefits, which could result in an improvement in our results of operations through the recovery of future income taxes.

(c) Valuation of contingent liabilities:

We utilize considerable judgment in the measurement and recognition of provisions and Aptose’s exposure to contingent liabilities. Judgment is required to assess and determine the likelihood that any potential or pending litigation or any and all potential claims against us may be successful. We must estimate if an obligation is probable as well as quantify the possible economic cost of any claim or contingent liability. Such judgments and assumptions are inherently uncertain. The increase or decrease of one of these assumptions could materially increase or decrease the fair value of the liability and the associated expense.

16

Accounting pronouncements adopted during the year

There were no new accounting policies adopted during the year ended December 31, 2015.

Recent Accounting pronouncements not yet adopted

IFRS 9, Financial Instruments ("IFRS 9"):

IFRS 9 (2014) introduces new requirements for the classification and measurement of financial assets. Under IFRS 9 (2014), financial assets are classified and measured based on the business model in which they are held and the characteristics of their contractual cash flows. The standard introduces additional changes relating to financial liabilities and also amends the impairment model by introducing a new ‘expected credit loss’ model for calculating impairment. IFRS 9 (2014) also includes a new general hedge accounting standard which aligns hedge accounting more closely with risk management. The Company intends to adopt IFRS 9 (2014) in its consolidated financial statements for the annual period beginning on January 1, 2018. The extent of the impact of adoption of the standard has not yet been determined.

Amendments to IAS 1

On December 18, 2014, the IASB issued amendments to IAS 1 Presentation of Financial Statements as part of its major initiative to improve presentation and disclosure in financial reports. The amendments are effective for annual periods beginning on or after 1 January 2016. Early adoption is permitted. The Company intends to adopt these amendments in its consolidated Financial Statements for the annual period beginning on January 1, 2016. The impact of adoption of the amendments is not expected to have a material impact on the financial statements.

IFRS 16, Leases (“IFRS 16”)

On January 13, 2016, the IASB issued IFRS 16 Leases. The new standard is effective for annual periods beginning on or after January 1, 2019. Earlier application is permitted for entities that apply IFRS 15 Revenue from Contracts with Customers at or before the date of initial adoption of IFRS 16. IFRS 16 will replace IAS 17 Leases. This standard introduces a single lessee accounting model and requires a lessee to recognize assets and liabilities for all leases with a term of more than 12 months, unless the underlying asset is of low value. The extent of the impact of adoption of the standard has not yet been determined.

Related Party Transactions

In March 2015, the Company entered into an agreement with the Moores Cancer Center at the University of California San Diego (UCSD) to provide pharmacology lab services to the Company. Dr. Stephen Howell is the Acting Chief Medical Officer of Aptose and is also a Professor of Medicine at UCSD and will be overseeing the laboratory work. The research services will be provided from April 1, 2015 to March 31, 2016 for an annual fee of US$154,456 to be paid to UCSD in monthly installments. This research services agreement was approved by the Aptose Board of Directors on February 23, 2016 for an additional 12 month period beginning April 1, 2016 and for an annual fee of up to US$200,000.

This transaction is in the normal course of business and will be measured at the amount of consideration established and agreed to by the related parties.

See note 14 to the audited financial statements for disclosures of key management personnel compensation and directors’ compensation.

Contractual Obligations and Off-Balance Sheet Financing

At December 31, 2015, we had contractual obligations requiring annual payments as follows:

| Less than 1 year | 1 - 3 years | 3 - 5 years | Total | |||||||||||||

| Operating leases | $ | 587 | $ | 907 | $ | 319 | $ | 1,813 | ||||||||

The Company has entered into various contracts with service providers with respect to the clinical development of APTO-253. These contracts will result in future payment commitments of up to approximately $4 million over the related service period. Of this amount, $544 thousand has been paid and $574 thousand has been accrued at December 31, 2015. The payments are based on services performed and amounts may be higher or lower based on actual services performed.

17

The Company enters into research, development and license agreements in the ordinary course of business where the Company receives research services and rights to proprietary technologies. Milestone and royalty payments that may become due under various agreements are dependent on, among other factors, clinical trials, regulatory approvals and ultimately the successful development of a new drug, the outcome and timing of which is uncertain. Under the license agreement with the Moffitt Cancer Centre, the Company has future contingent milestones payable totalling US$9 million relating to the first patient dosed in a phase I, II and III clinical trial and regulatory and commercial milestones totalling US$16 million. The Company does not anticipate making any payments under this license agreement in 2016. Under the Laxai-Avanti Life Science agreement the Company has total future contingent milestones payable of US$5.3 million related to certain research achievements as well as upon the first patient dosed in a phase I, II and III clinical trial and regulatory milestones totalling US$5 million. The Company expects to make payments totalling US$300 thousand under this agreement in 2016.

As at December 31, 2015, we have not entered into any off-balance sheet arrangements.

Financial instruments

(a) Financial instruments

We have classified our financial instruments as follows:

As at December 31,

| (in thousands) | 2015 | 2014 | ||||||

| Financial assets: | ||||||||

| Cash and cash equivalents, consisting | ||||||||

| of high interest savings accounts, | ||||||||

| measured at amortized cost | $ | 11,503 | $ | 14,365 | ||||

| Investments, consisting of | ||||||||

| guaranteed investment certificates, | ||||||||

| measured at amortized cost. | 8,245 | 16,180 | ||||||

| Financial liabilities: | ||||||||

| Accounts payable, measured at amortized cost | 522 | 256 | ||||||

| Accrued liabilities, measured at amortized cost | 1,834 | 1,662 | ||||||

| Convertible promissory notes, | ||||||||

| measured at amortized cost | - | 410 |

At December 31, 2015, there are no significant differences between the carrying values of these amounts and their estimated market values due to their short-term nature.

(b) Financial risk management

We have exposure to credit risk, liquidity risk and market risk. Our Board of Directors has the overall responsibility for the oversight of these risks and reviews our policies on an ongoing basis to ensure that these risks are appropriately managed.

(i) Credit risk

Credit risk is the risk of financial loss to us if a customer, partner or counterparty to a financial instrument fails to meet its contractual obligations, and arises principally from our cash and cash equivalents. The carrying amount of the financial assets represents the maximum credit exposure.

18

We manage credit risk for our cash and cash equivalents by maintaining minimum standards of R1-low or A-low investments and we invest only in highly rated Canadian corporations with debt securities that are traded on active markets and are capable of prompt liquidation.

(ii) Liquidity risk

Liquidity risk is the risk that we will not be able to meet our financial obligations as they come due. To the extent that we do not believe we have sufficient liquidity to meet our current obligations, the Board considers securing additional funds through equity, debt or partnering transactions. We manage our liquidity risk by continuously monitoring forecasts and actual cash flows. All of our financial liabilities are due within the current operating period.

(iii) Market risk

Market risk is the risk that changes in market prices, such as interest rates, foreign exchange rates and equity prices will affect our income or the value of our financial instruments.

We are subject to interest rate risk on our cash and cash equivalents and investment balances. We do not believe that the results of operations or cash flows would be affected to any significant degree by a sudden change in market interest rates relative to interest rates on the investments, owing to the relative short-term nature of the investments. We do not have any interest bearing liabilities subject to interest rate fluctuations.

Currency risk is the risk that future cash flows of a financial instrument will fluctuate because of changes in foreign exchange rates. We are exposed to currency risk from employee costs as well as the purchase of goods and services primarily in the United States and on cash balances held in foreign currencies. Fluctuations in the US dollar exchange rate could have a significant impact on our results. Assuming all other variables remain constant, a 10% depreciation or appreciation of the Canadian dollar against the US dollar would result in an increase or decrease in loss for the year and comprehensive loss of $576 thousand (December 31, 2014- $50 thousand, May 31, 2014 - $18 thousand). Balances in foreign currencies are as follows:

US$ Balances | ||||||||||||

December 31, | December 31, | May 31, | ||||||||||

| (in thousands) | 2015 | 2014 | 2014 | |||||||||

| Cash and cash equivalents | $ | 5,000 | $ | 66 | 594 | |||||||

| Accounts payable and accrued liabilities | (838 | ) | (565 | ) | (769 | ) | ||||||

| Balance, end of period | $ | 4,162 | $ | (499 | ) | $ | (175 | ) | ||||

We do not have any forward exchange contracts to hedge this risk.

We do not invest in equity instruments of other corporations.

(c) Capital management

Our primary objective when managing capital is to ensure that we have sufficient cash resources to fund our development and commercialization activities and to maintain our ongoing operations. To secure the additional capital necessary to pursue these plans, we may attempt to raise additional funds through the issuance of equity or by securing strategic partners.

We include cash and cash equivalents and short-term deposits in the definition of capital.

We are not subject to externally imposed capital requirements and there has been no change with respect to the overall capital management strategy during the year ended December 31, 2015.

Outlook

Until one of our drug candidates receives regulatory approval and is successfully commercialized, Aptose will continue to incur operating losses. The magnitude of these operating losses will be largely affected by the timing and scope of future research and development, clinical trials and the Company’s ability to raise additional and ongoing working capital and/or establish effective partnerships to share the costs of development and clinical trials.

19

RISK FACTORS

Investing in our securities involves a high degree of risk. Before making an investment decision with respect to our common shares, you should carefully consider the following risk factors, in addition to the other information included or incorporated by reference into the most recently filed annual information form, as well as our historical consolidated financial statements and related notes. Management has reviewed the operations of the Company in conjunction with the Board of Directors and identified the following risk factors which are monitored on a bi-annual basis and reviewed with the Board of Directors. The risks set out below are not the only risks we face. If any of the following risks occur, our business, financial condition, prospects or results of operations and cash flows would likely suffer. In that case, the trading price of our common shares could decline and you may lose all or part of the money you paid to buy our common shares.

We are an early stage development company.

We are at an early stage of development. In the past five years, none of our potential products has obtained regulatory approval for commercial use and sale in any country and as such, no significant revenues have resulted from product sales. Significant additional investment will be necessary to complete the development of any of our product candidates. Preclinical and clinical trial work must be completed before our potential products could be ready for use within the markets that we have identified. We may fail to develop any products, obtain regulatory approvals, enter clinical trials or commercialize any products. We do not know whether any of our potential product development efforts will prove to be effective, meet applicable regulatory standards, obtain the requisite regulatory approvals, be capable of being manufactured at a reasonable cost or be accepted in the marketplace. We also do not know whether sales, license fees or related royalties will allow us to recoup any investment we make in the commercialization of our products.

The product candidates we are currently developing are not expected to be commercially viable for at least the next several years and we may encounter unforeseen difficulties or delays in commercializing our product candidates. In addition, our potential products may not be effective or may cause undesirable side effects.

Our product candidates require significant funding to reach regulatory approval assuming positive clinical results. For example, our lead product candidate APTO-253 began enrolment in a Phase I clinical trial in patients with relapsed or refractory hematologic malignancies and was placed on clinical hold by the United States Food and Drug Administration (“FDA”) following a voluntary suspension of dosing by us. We are currently working with the FDA to have such hold lifted but significant additional funding or a partnership will be necessary to complete, if required, Phase II or Phase III clinical trials. Such funding may be very difficult, or impossible to raise in the public or private markets or through partnerships. If funding or partnerships are not attainable, the development of these product candidates may be significantly delayed or stopped altogether. The announcement of a delay or discontinuation of development would likely have a negative impact on our share price.

We need to raise additional capital.

We have an ongoing need to raise additional capital. To obtain the necessary capital, we must rely on some or all of the following: additional share issues, debt issuances (including promissory notes), collaboration agreements or corporate partnerships and grants and tax credits to provide full or partial funding for our activities. Additional funding may not be available on terms that are acceptable to us or in amounts that will enable us to carry out our business plan.

Our need for capital may require us to:

| · | engage in equity financings that could result in significant dilution to existing investors; |

| · | delay or reduce the scope of or eliminate one or more of our development programs; |

| · | obtain funds through arrangements with collaborators or others that may require us to relinquish rights to technologies, product candidates or products that we would otherwise seek to develop or commercialize ourselves; or |

| · | license rights to technologies, product candidates or products on terms that are less favourable to us than might otherwise be available; |

| · | considerably reduce operations; or |

| · | cease our operations. |

20

We have a history of operating losses. We expect to incur net losses and we may never achieve or maintain profitability.

We have not been profitable since our inception in 1986. We reported net losses of $14.6 million in the fiscal year ended December 31, 2015, $7.8 million in the 7 months ended December 31, 2014 and $10.6 million in the fiscal years ended May 31, 2014, and as of December 31, 2015, we had an accumulated deficit of $232.9 million.

We have not generated any significant revenue to date and it is possible that we will never have sufficient product sales revenue (if any) to achieve profitability. We expect to continue to incur losses for at least the next several years as we or our collaborators and licensees pursue clinical trials and research and development efforts. To become profitable, we, either alone or with our collaborators and licensees, must successfully develop, manufacture and market our current product candidate APTO-253 as well as continue to identify, develop, manufacture and market new product candidates. It is possible that we will never have significant product sales revenue or receive royalties on our licensed product candidates. If funding is insufficient at any time in the future, we may not be able to develop or commercialize our products, take advantage of business opportunities or respond to competitive pressures.