UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | Registration statement pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934. |

| Or | |

| x | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.For the fiscal year ended May 31, 2013. |

| Or | |

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. For the transition period from ________ to ________ . |

| Or | |

| ¨ | Shell company report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Date of event requiring this shell company report _______________. |

Commission file number 001-32001 | |

LORUS THERAPEUTICS INC.

(Exact Name of Registrant as Specified in Its Charter)

Canada

(Jurisdiction of Incorporation or Organization)

2 Meridian Road

Toronto, Ontario

M9W 4Z7

Canada

(Address of Principal Executive Offices)

Gregory Chow

Chief Financial Officer

2 Meridian Road

Toronto, Ontario M9W 4Z7

Canada

Telephone: (416) 798-1200

Facsimile: (416) 798-2200

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act: None

Title of Each Class |

Name of Each Exchange On Which Registered |

Securities registered or to be registered pursuant to Section 12(g) of the Act: Common Shares

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Common Shares, without par value, at May 31, 2013: 42,251,081

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

If this is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨ No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing.

U.S. GAAP ¨ International Financial Reporting Standards as issued by the International Accounting Standards Board x Other ¨

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

TABLE OF CONTENTS

GENERAL

On July 10, 2007 (the ”Arrangement Date”), Lorus Therapeutics Inc. completed a plan of arrangement and corporate reorganization with, among others, 4325231 Canada Inc. (now Global Summit Real Estate Inc.), formerly Lorus Therapeutics Inc. (“Old Lorus”), 6707157 Canada Inc. and Pinnacle International Lands, Inc. (the “Arrangement”). As a result of the plan of arrangement and reorganization, among other things, each common share of Old Lorus was exchanged for one Lorus Common Share and the assets (excluding certain deferred tax assets) and liabilities of Old Lorus (including all of the shares of its subsidiaries) were transferred, directly or indirectly, to Lorus and/or our subsidiaries. We continued the business of Old Lorus after the Arrangement Date with the same officers and employees and continued to be governed by the same directors as Old Lorus prior to the Arrangement Date. In this Annual Report on Form 20-F, all references to “Lorus”, the “Corporation”, the “Company”, “we”, “our”, “us” and similar expressions, unless otherwise stated, are references to Old Lorus prior to the Arrangement Date and Lorus Therapeutics Inc. (and where the context requires, Lorus Therapeutics Inc. and its subsidiary) after the Arrangement Date. References to this “Form 20-F” and this “Annual Report” mean references to this Annual Report on Form 20-F for the fiscal year ended May 31, 2013.

We use the Canadian dollar as our reporting currency. All references in this Annual Report to “dollars” or “$” are expressed in Canadian dollars, unless otherwise indicated. See also “Item 3. Key Information” for more detailed currency and conversion information. Our Consolidated Financial Statements, which form part of this Annual Report, are presented in Canadian dollars and are prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”), which differ in certain respects from accounting principles generally accepted in the United States (“U.S. GAAP”).

FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements within the meaning of U.S. securities laws. Such statements include, but are not limited to, statements relating to:

| · | our business strategy; |

| · | our ability to obtain the substantial capital we require to fund research and operations; |

| · | our plans to secure strategic partnerships to assist in the further development of our product candidates; |

| · | our plans to conduct clinical trials and pre-clinical programs; |

| · | our expectations regarding the progress and the successful and timely completion of the various stages of our drug discovery, pre-clinical and clinical studies and the regulatory approval process; |

| · | our plans, objectives, expectations and intentions; and |

| · | other statements including words such as “anticipate”, “contemplate”, “continue”, “believe”, “plan”, “estimate”, “expect”, “intend”, “will”, “should”, “may”, and other similar expressions. |

Such statements reflect our current views with respect to future events, are subject to risks and uncertainties, and are based upon a number of estimates and assumptions that, while considered reasonable by us, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors could cause our actual results, performance or achievements to be materially different from any future results, performance, or achievements that may be expressed or implied by such forward-looking statements, including, among others:

| · | our ability to obtain the substantial capital we require to fund research and operations; |

| · | our lack of product revenues and history of operating losses; |

| · | our early stage of development, particularly the inherent risks and uncertainties associated with (i) developing new drug candidates generally, (ii) demonstrating the safety and efficacy of these drug candidates in clinical studies in humans, and (iii) obtaining regulatory approval to commercialize these drug candidates; |

| 1 |

| · | our drug candidates require time-consuming and costly preclinical and clinical testing and regulatory approvals before commercialization; |

| · | clinical studies and regulatory approvals of our drug candidates are subject to delays, and may not be completed or granted on expected timetables, if at all, and such delays may increase our costs and could delay our ability to generate revenue; |

| · | the regulatory approval process; |

| · | our ability to recruit patients for clinical trials; |

| · | the progress of our clinical trials; |

| · | our liability associated with the indemnification of Old Lorus and its directors, officers and employees in respect of a reorganization of the Company that occurred in 2007; |

| · | our ability to negotiate and enter into agreements with potential partners; |

| · | our ability to attract and retain key personnel; |

| · | our ability to obtain and maintain patent protection; |

| · | our ability to protect our intellectual property rights and not infringe on the intellectual property rights of others; |

| · | our ability to comply with applicable governmental regulations and standards; |

| · | development or commercialization of similar products by our competitors, many of which are more established and have or have access to greater financial resources than us; |

| · | commercialization limitations imposed by intellectual property rights owned or controlled by third parties; |

| · | our business is subject to potential product liability and other claims; |

| · | our ability to maintain adequate insurance at acceptable costs; |

| · | further equity financing may substantially dilute the interests of our shareholders; |

| · | changing market conditions; and |

| · | other risks detailed from time-to-time in our ongoing quarterly filings, annual information forms, annual reports and annual filings with Canadian securities regulators and the United States Securities and Exchange Commission (“SEC”), and those which are discussed under the heading “Risk Factors”. |

Should one or more of these risks or uncertainties materialize, or should the assumptions set out in the section entitled “Risk Factors” underlying those forward-looking statements prove incorrect, actual results may vary materially from those described herein. These forward-looking statements are made as of the date of this Annual Report or, in the case of documents incorporated by reference herein, as of the date of such documents, and we do not intend, and do not assume any obligation, to update these forward-looking statements, except as required by law. Such statements may not prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Investors are cautioned that forward-looking statements are not guarantees of future performance and accordingly investors are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty therein. New factors emerge from time to time, and it is not possible for management of the Corporation to predict all of these factors or to assess in advance the impact of each such factor on the Corporation’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

| 1 |

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

A. Selected financial data.

The following tables present our selected consolidated financial data. You should read these tables in conjunction with our audited Consolidated Financial Statements and accompanying notes included in Item 18 of this Annual Report and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in Item 5 of this Annual Report.

The selected consolidated financial information set forth below for each of the two years ended May 31, 2013 and 2012, has been derived from the Company's audited consolidated financial statements as at and for the financial years ended May 31, 2013 and 2012 filed as part of this Form 20-F under Item 18. These consolidated financial statements have been prepared in accordance with IFRS, which differ in certain respects from the principles the Company would have followed had its consolidated financial statements been prepared in accordance with U.S. GAAP. The selected consolidated financial information should be read in conjunction with the discussion in Item 5 of this Form 20-F and the consolidated financial statements and related notes thereto.

Selected IFRS financial data for the years ended May 31, 2010 and 2009 have not been included in this Annual Report on Form 20-F because IFRS financial statements for such periods have not previously been prepared and could not be prepared without unreasonable effort and expense. We changed our basis of accounting to IFRS beginning with the quarter ended August 31, 2011. Prior to the adoption of IFRS, we prepared financial statements in accordance with accounting principles generally accepted in the United States for purposes of our SEC reporting.

The following table presents a summary of our consolidated statement of operations derived from our audited Consolidated Financial Statements for the fiscal years ended May 31, 2013, 2012 and 2011.

Consolidated statements of operations data

| (In thousands, except per share data) | ||||||||||||

| May

31, 2013 | May

31, 2012 | May

31, 2011 | ||||||||||

| In accordance with IFRS | ||||||||||||

| Revenue | $ | — | $ | — | $ | — | ||||||

| Research and development | $ | 3,317 | $ | 2,170 | $ | 2,518 | ||||||

| General and administrative | $ | 2,272 | $ | 2,430 | $ | 2,420 | ||||||

| Operating expenses | $ | 5,589 | $ | 4,600 | $ | 4,938 | ||||||

| Finance expense | $ | 6 | $ | 20 | $ | 71 | ||||||

| Finance income | $ | (30 | ) | $ | (6 | ) | $ | (14 | ) | |||

| Net loss | $ | (5,565 | ) | $ | (4,614 | ) | $ | (4,995 | ) | |||

| Basic and diluted loss per Common Share | $ | (0.13 | ) | $ | (0.23 | ) | $ | (0.38 | ) | |||

| Weighted average number of Common Shares outstanding | 42,251 | 20,260 | 13,157 | |||||||||

| 2 |

The following table presents a summary of our consolidated balance sheet as at May 31, 2013, 2012 and 2011. We publish our consolidated financial statements in Canadian (“CDN”) dollars. In this Annual Report, except where otherwise indicated, all amounts are stated in CDN dollars.

Consolidated balance sheet data

| (In thousands, except per share data) | As at May 31, | |||||||||||

| 2013 | 2012 | 2011 | ||||||||||

| In accordance with IFRS | ||||||||||||

| Cash and cash equivalents | $ | 653 | $ | 320 | $ | 911 | ||||||

| Total assets | $ | 1,035 | $ | 668 | $ | 1,398 | ||||||

| Total debt | $ | 1,816 | $ | 2,696 | $ | 1,159 | ||||||

| Total shareholders’ equity (deficit) | $ | (781 | ) | $ | (2,028 | ) | $ | 239 | ||||

| Number of Common Shares outstanding | 42,251 | 21,228 | 15,685 | |||||||||

| Dividends paid on Common Shares | — | — | — | |||||||||

The following table sets out the exchange rates of CDN$ for US$1.00 for the following periods as taken from the Bank of Canada’s website:

| Period | Average Close | |||

| Month Ended April 30, 2014 | 1.0990 | |||

| Fiscal Year Ended May 31, 2013 | 1.0042 | |||

| Fiscal Year Ended May 31, 2012 | 1.0005 | |||

| Fiscal Year Ended May 31, 2011 | 1.0066 | |||

| Fiscal Year Ended May 31, 2010 | 1.0635 | |||

| Fiscal Year Ended May 31, 2009 | 1.1567 | |||

The following table sets forth the high and low exchange rates for each month during the previous six months.

| Period | High | Low | ||||||

| April 2014 | $ | 1.0857 | $ | 1.1054 | ||||

| March 2014 | $ | 1.0955 | $ | 1.1279 | ||||

| February 2014 | $ | 1.0939 | $ | 1.1195 | ||||

| January 2014 | $ | 1.0974 | $ | 1.0909 | ||||

| December 2013 | $ | 1.0669 | $ | 1.0616 | ||||

| November 2013 | $ | 1.0509 | $ | 1.0469 | ||||

B. Capitalization and indebtedness.

Not applicable.

C. Reasons for the offer and use of proceeds.

Not applicable.

D. Risk factors.

| 3 |

Investing in our securities involves a high degree of risk. Before making an investment decision with respect to our Common Shares, you should carefully consider the following risk factors, in addition to the other information included or incorporated by reference in this Annual Report. Additional risks not currently known by us or that we consider immaterial at the present time may also impair our business, financial condition, prospects or results of operations. If any of the following risks occur, our business, financial condition, prospects or results of operations would likely be materially adversely affected. In that case, the trading price of our Common Shares could decline and you may lose all or part of the money you paid to buy our Common Shares. The risks set out below are not the only risks and uncertainties we currently face; other risks may arise in the future.

RISKS RELATED TO OUR BUSINESS

We are an early stage development company.

We are at an early stage of development. Since our incorporation, none of our potential products has obtained regulatory approval for commercial use and sale in any country, except for Virulizin, for which we have no control over commercialization efforts. We currently do not receive any revenue from sales of Virulizin. As such, no significant revenues have resulted from product sales. Significant additional investment will be necessary to complete the development of any of our product candidates. Preclinical and clinical trial work must be completed before our potential products could be ready for use within the markets that we have identified. We may fail to develop any products, obtain regulatory approvals, enter clinical trials or commercialize any products. We do not know whether any of our potential product development efforts will prove to be effective, meet applicable regulatory standards, obtain the requisite regulatory approvals, be capable of being manufactured at a reasonable cost or be accepted in the marketplace. We also do not know whether sales, license fees or related royalties will allow us to recoup any investment we make in the commercialization of our products.

The product candidates we are currently developing are not expected to be commercially viable for at least the next several years and we may encounter unforeseen difficulties or delays in commercializing our product candidates. In addition, our potential products may not be effective or may cause undesirable side effects.

Our product candidates require significant funding to reach regulatory approval assuming positive clinical results. For example, our lead product candidate LOR-253, has recently completed a Phase I clinical trial in patients with solid tumors, and we have reported initial results. Additional funding or a partnership will be necessary to complete, if required, a Phase II or Phase III clinical trial. Such funding may be very difficult, or impossible to raise in the public or private markets or through partnerships. If funding or partnerships are not attainable, the development of these product candidates may be significantly delayed or stopped altogether. The announcement of a delay or discontinuation of development would likely have a negative impact on our share price.

We need to raise additional capital.

We have an ongoing need to raise additional capital. To obtain the necessary capital, we must rely on some or all of the following: additional share issues, debt issuances (including promissory notes), collaboration agreements or corporate partnerships and grants and tax credits to provide full or partial funding for our activities. Additional funding may not be available on terms that are acceptable to us or in amounts that will enable us to carry out our business plan.

Our need for capital may require us to:

| · | engage in equity financings that could result in significant dilution to existing investors; |

| · | delay or reduce the scope of or eliminate one or more of our development programs; |

| · | obtain funds through arrangements with collaborators or others that may require us to relinquish rights to technologies, product candidates or products that we would otherwise seek to develop or commercialize ourselves; or license rights to technologies, product candidates or products on terms that are less favourable to us than might otherwise be available; |

| · | considerably reduce operations; or |

| · | cease our operations. |

| 4 |

We have a history of operating losses. We expect to incur net losses and we may never achieve or maintain profitability.

We have not been profitable since our inception in 1986. Under IFRS, we reported net losses of $5.6 million and $4.6 million for the fiscal years ended May 31, 2013 and 2012, respectively, and as of May 31, 2013, we had an accumulated deficit of $200 million.

We have not generated any significant revenue to date and it is possible that we will never have sufficient product sales revenue to achieve profitability. We expect to continue to incur losses for at least the next several years as we or our collaborators and licensees pursue clinical trials and research and development efforts. To become profitable, we, either alone or with our collaborators and licensees, must successfully develop, manufacture and market our current product candidate LOR-253 as well as continue to identify, develop, manufacture and market new product candidates. It is possible that we will never have significant product sales revenue or receive royalties on our licensed product candidates. If funding is insufficient at any time in the future, we may not be able to develop or commercialize our products, take advantage of business opportunities or respond to competitive pressures.

We may be unable to obtain partnerships for our product candidates, which could curtail future development and negatively affect our share price. In addition, our partners might not satisfy their contractual responsibilities or devote sufficient resources to our partnership.

Our strategy for the research, development and commercialization of our products requires entering into various arrangements with corporate collaborators, licensors, licensees and others, and our commercial success is dependent upon these outside parties performing their respective contractual responsibilities. The amount and timing of resources that such third parties will devote to these activities may not be within our control. These third parties may not perform their obligations as expected and our collaborators may not devote adequate resources to our programs. In addition, we could become involved in disputes with our collaborators, which could result in a delay or termination of the related development programs or result in litigation. We intend to seek additional collaborative arrangements to develop and commercialize some of our products. We may not be able to negotiate collaborative arrangements on favourable terms, or at all, in the future, and our current or future collaborative arrangements may not be successful.

If we cannot negotiate collaboration, licence or partnering agreements, we may never achieve profitability and we may not be able to continue to develop our product candidates. Phase II and Phase III clinical trials for LOR-253 would require significant amounts of funding and such funding may not be available to us.

Clinical trials are long, expensive and uncertain processes and Health Canada or the United States Food and Drug Administration (“FDA”) may ultimately not approve any of our product candidates. We may never develop any commercial drugs or other products that generate revenues.

None of our product candidates has received regulatory approval for commercial use and sale in North America, other than Virulizin. We cannot market a pharmaceutical product in any jurisdiction until it has completed thorough preclinical testing and clinical trials in addition to that jurisdiction’s extensive regulatory approval process. Approval in one country does not assure approval in another country. In general, significant research and development and clinical studies are required to demonstrate the safety and effectiveness of our product candidates before we can submit any regulatory applications.

Clinical trials are long, expensive and uncertain processes. Clinical trials may not be commenced or completed on schedule and Health Canada or the FDA or any other regulatory body may not ultimately approve our product candidates for commercial sale. The clinical trials of any of our drug candidates could be unsuccessful, which would prevent us from advancing, commercializing or partnering the drug.

Even if the results of our preclinical studies or clinical trials are initially positive, it is possible that we will obtain different results in the later stages of drug development or that results seen in clinical trials will not continue with longer term treatment. Positive results in Phase I clinical trials may not be repeated in larger Phase II or Phase III clinical trials.

| 5 |

Our preclinical studies and clinical trials may not generate positive results that will allow us to move towards the commercial use and sale of our product candidates. Furthermore, negative preclinical or clinical trial results may cause our business, financial condition, or results of operations to be materially adversely affected. For example, as our lead product candidate LOR-253 has completed the Phase I testing in patients with solid tumors, for which we previously reported initial data, there is still a long development path ahead which will take many years to complete and like all of our potential drug candidates is prone to the risks of failure inherent in drug development.

Preparing, submitting and advancing applications for regulatory approval is complex, expensive and time intensive and entails significant uncertainty. A commitment of substantial resources to conduct time-consuming research, preclinical studies and clinical trials is required if we are to complete development of our products.

Later stage clinical trials of our products require that we identify and enroll a large number of patients with the illness under investigation. We may not be able to enroll a sufficient number of appropriate patients to complete our clinical trials in a timely manner, particularly in smaller indications and indications where this is significant competition for patients. If we experience difficulty in enrolling a sufficient number of patients to conduct our clinical trials, we may need to delay or terminate ongoing clinical trials and will not accomplish objectives material to our success. Delays in planned patient enrolment or lower than anticipated event rates in our current clinical trials or future clinical trials also may result in increased costs, program delays, or both.

In addition, unacceptable toxicities or adverse side effects may occur at any time in the course of preclinical studies or human clinical trials or, if any product candidates are successfully developed and approved for marketing, during commercial use of any approved products. The appearance of any unacceptable toxicities or adverse side effects could interrupt, limit, delay or abort the development of any of our product candidates or, if previously approved, necessitate their withdrawal from the market. Furthermore, disease resistance or other unforeseen factors may limit the effectiveness of our potential products.

Our failure to develop safe, commercially viable drugs would substantially impair our ability to generate revenues and sustain our operations and would materially harm our business and adversely affect our share price.

We have agreed to indemnify our predecessor, Old Lorus, and its directors, officers and employees.

In connection with the reorganization that we undertook in fiscal year 2008, we have agreed to indemnify our predecessor, Old Lorus, and its directors, officers and employees from and against all damages, losses, expenses (including fines and penalties), other third party costs and legal expenses, to which any of them may be subject arising out of any matter occurring:

| · | prior to, at or after the effective time of the arrangement transaction, and directly or indirectly relating to any of the assets of Old Lorus transferred to us pursuant to the arrangement transaction (including losses for income, sales, excise and other taxes arising in connection with the transfer of any such asset) or conduct of the business prior to the effective time of the arrangement; |

| · | prior to, at or after the effective time as a result of any and all interests, rights, liabilities and other matters relating to the assets transferred by Old Lorus to us under the arrangement; and |

| · | prior to or at the effective time and directly or indirectly relating to, with certain exceptions, any of the activities of Old Lorus or the arrangement. |

This indemnification obligation could result in significant liability to us. To date no amount has been claimed on this indemnification obligation. Should a claim arise under this indemnification obligation it could result in significant liability to the Company which could have a negative impact on our liquidity, financial position, and ability to obtain future funding among other things.

| 6 |

We may not achieve our projected development goals in the time frames we announce and expect.

We set goals for, and make public statements regarding, the expected timing of the accomplishment of objectives material to our success, such as the commencement and completion of clinical trials, the partnership of our product candidates and our ability to secure the financing necessary to continue the development of our product candidates. The actual timing of these events can vary dramatically due to factors within and beyond our control, such as delays or failures in our clinical trials, the uncertainties inherent in the regulatory approval process, market conditions and interest by partners in our product candidates among other things. Our clinical trials may not be completed, and we may not make regulatory submissions or receive regulatory approvals as planned, or that we will secure partnerships for any of our product candidates. Any failure to achieve one or more of these milestones as planned would have a material adverse effect on our business, financial condition and results of operations.

As a result of intense competition and technological change in the pharmaceutical industry, the marketplace may not accept our products or product candidates, and we may not be able to compete successfully against other companies in our industry and achieve profitability.

Many of our competitors have:

| · | drug products that have already been approved or are in development, and operate large, well-funded research and development programs in these fields; |

| · | substantially greater financial and management resources, stronger intellectual property positions and greater manufacturing, marketing and sales capabilities, areas in which we have limited or no experience; and |

| · | significantly greater experience than we do in undertaking preclinical testing and clinical trials of new or improved pharmaceutical products and obtaining required regulatory approvals. |

Consequently, our competitors may obtain Health Canada FDA and other regulatory approvals for product candidates sooner and may be more successful in manufacturing and marketing their products than we or our collaborators are.

Our competitor’s existing and future products, therapies and technological approaches will compete directly with the products we seek to develop. Current and prospective competing products may be more effective than our existing and future products insofar as they may provide greater therapeutic benefits for a specific problem or may offer easier delivery or comparable performance at a lower cost.

Any product candidate that we develop and that obtains regulatory approval must then compete for market acceptance and market share. Our product candidates may not gain market acceptance among physicians, patients, healthcare payers, insurers, the medical community and other stakeholders. Further, any products we develop may become obsolete before we recover any expenses we incurred in connection with the development of these products. As a result, we may never achieve profitability.

If we fail to attract and retain key employees, the development and commercialization of our products may be adversely affected.

We depend on the principal members of our scientific and management staff. If we lose any of these persons, our ability to develop products and become profitable could suffer. The risk of being unable to retain key personnel may be increased by the fact that we have not executed long-term employment contracts with our employees, except for our senior executives. Our future success will also depend in large part on our ability to attract and retain other highly qualified scientific and management personnel. We face competition for personnel from other companies, academic institutions, government entities and other organizations.

We may be unable to obtain patents to protect our technologies from other companies with competitive products, and patents of other companies could prevent us from manufacturing, developing or marketing our products.

| 7 |

Patent protection

The patent positions of pharmaceutical and biotechnology companies are uncertain and involve complex legal and factual questions. The United States Patent and Trademark Office and many other patent offices in the world have not established a consistent policy regarding the breadth of claims that they will allow in biotechnology patents.

Allowable patentable subject matter and the scope of patent protection obtainable may differ between jurisdictions. If a patent office allows broad claims, the number and cost of patent interference proceedings in the United States, or analogous proceedings in other jurisdictions and the risk of infringement litigation may increase. If it allows narrow claims, the risk of infringement may decrease, but the value of our rights under our patents, licenses and patent applications may also decrease.

The scope of the claims in a patent application can be significantly modified during prosecution before the patent is issued. Consequently, we cannot know whether our pending applications will result in the issuance of patents or, if any patents are issued, whether they will provide us with significant proprietary protection or will be circumvented, invalidated or found to be unenforceable.

Publication of discoveries in scientific or patent literature often lags behind actual discoveries. Patent applications filed in the United States generally will be published 18 months after the filing date unless the applicant certifies that the invention will not be the subject of a foreign patent application. In many other jurisdictions, such as Canada, patent applications are published 18 months from the priority date. We may not be aware of such literature. Accordingly, we cannot be certain that the named inventors of our products and processes were the first to invent that product or process or that we were the first to pursue patent coverage for our inventions.

Enforcement of intellectual property rights

Protection of the rights revealed in published patent applications can be complex, costly and uncertain. Our commercial success depends in part on our ability to maintain and enforce our proprietary rights. If third parties engage in activities that infringe our proprietary rights, our management’s focus will be diverted and we may incur significant costs in asserting our rights. We may not be successful in asserting our proprietary rights, which could result in our patents being held invalid or a court holding that the third party is not infringing, either of which would harm our competitive position.

Others may design around our patented technology. We may have to participate in interference proceedings declared by the United States Patent and Trademark Office, European opposition proceedings, or other analogous proceedings in other parts of the world to determine priority of invention and the validity of patent rights granted or applied for, which could result in substantial cost and delay, even if the eventual outcome is favourable to us. Our pending patent applications, even if issued, may not be held valid or enforceable.

Trade secrets

We also rely on trade secrets, know-how and confidentiality provisions in our agreements with our collaborators, employees and consultants to protect our intellectual property. However, these and other parties may not comply with the terms of their agreements with us, and we might be unable to adequately enforce our rights or obtain adequate compensation for the damages caused by unauthorized disclosure or use of our trade secrets or know how. Our trade secrets or those of our collaborators also may be independently discovered by others.

Our products and product candidates may infringe the intellectual property rights of others, or others may infringe on our intellectual property rights which could increase our costs.

Our success also depends on avoiding infringement of the proprietary technologies of others. In particular, there may be certain issued patents and patent applications claiming subject matter which we or our collaborators may be required to license in order to research, develop or commercialize LOR-253, our lead product candidate. In addition, third parties may assert infringement or other intellectual property claims against us. An adverse outcome in these proceedings could subject us to significant liabilities to third-parties, require disputed rights to be licensed from third-parties or require us to cease or modify our use of the technology. If we are required to license third-party technology, a license under such patents and patent applications may not be available on acceptable terms or at all. Further, we may incur substantial costs defending ourselves in lawsuits against charges of patent infringement or other unlawful use of another’s proprietary technology. We may also need to bring claims against others who we believe are infringing our rights in order to become or remain competitive and successful. Any such claims can be time consuming and expensive to pursue.

| 8 |

If product liability, clinical trial liability or environmental liability claims are brought against us or we are unable to obtain or maintain product liability, clinical trial or environmental liability insurance, we may incur substantial liabilities that could reduce our financial resources.

The clinical testing and commercial use of pharmaceutical products involves significant exposure to product liability, clinical trial liability, environmental liability and other risks that are inherent in the testing, manufacturing and marketing of our products. These liabilities, if realized, could have a material adverse effect on the Corporation’s business, results of operations and financial condition.

We have obtained limited product liability insurance coverage for our clinical trials on humans; however, our insurance coverage may be insufficient to protect us against all product liability damages. Regardless of merit or eventual outcome, liability claims may result in decreased demand for a future product, injury to reputation, withdrawal of clinical trial volunteers, loss of revenue, costs of litigation, distraction of management and substantial monetary awards to plaintiffs. Additionally, if we are required to pay a product liability claim, we may not have sufficient financial resources to complete development or commercialization of any of our product candidates and our business and results of operations will be adversely affected. In general, insurance will not protect us against some of our own actions, such as negligence.

As the Corporation’s development activities progress towards the commercialization of product candidates, our liability coverage may not be adequate, and the Corporation may not be able to obtain adequate product liability insurance coverage at a reasonable cost, if at all. Even if the Corporation obtains product liability insurance, its financial position may be materially adversely affected by a product liability claim. A product liability claim could also significantly harm the Corporation’s reputation and delay market acceptance of its product candidates. Additionally, product recalls may be issued at the direction of the FDA, other government agencies or other companies having regulatory control for pharmaceutical sales. If a product recall occurs in the future, such a recall could adversely affect our business, financial condition or reputation.

We have no manufacturing capabilities and face supply risks. We depend on third-parties, including a number of sole suppliers, for manufacturing and storage of our product candidates used in our clinical trials. Product introductions may be delayed or suspended if the manufacture of our products is interrupted or discontinued.

Other than limited quantities for research purposes, we do not have manufacturing facilities to produce supplies of LOR-253 or any of our other product candidates to support clinical trials or commercial launch of these products, if they are approved. We are dependent on third parties for manufacturing and storage of our product candidates. If the supply of necessary components is interrupted, components from alternative suppliers may not be available in sufficient volumes or at acceptable quality levels within required timeframes, if at all, to meet the needs of the Corporation. An inability to contract for a sufficient supply of our product candidates on acceptable terms, or delays or difficulties in the manufacturing process or our relationships with our manufacturers, may lead to us not having sufficient product to conduct or complete our clinical trials or support preparations for the commercial launch of our product candidates, if approved. This may lead to substantial lost revenue opportunity and contract liability to third parties.

Reliance on Licensor(s) to Maintain Patent Rights

The Corporation's commercial success depends, in part, on maintaining and defending patent rights related to products that the Corporation may market in the future. Since the Corporation may not fully control the patent prosecution of any licensed patent applications it is possible that the licensors will not devote the same resources or attention to the prosecution of the licensed patent applications as the Corporation would if it controlled the prosecution of the applications. The licensors may also not pursue and successfully prosecute, enforce or defend any potential patent infringement or invalidity claim, may fail to maintain their issued patents or prosecute or maintain their patent applications, or may pursue any litigation less aggressively than the Corporation would. Consequently, the resulting patent protection, if any, may not be as strong or comprehensive, which could have a material adverse effect on the Corporation.

| 9 |

Extensive Government Regulation

Government regulation is a significant factor in the development, production and marketing of the Corporation’s products. Research and development, testing, manufacture, marketing and sales of pharmaceutical products or related products are subject to extensive regulatory oversight, often in multiple jurisdictions, which may cause significant additional costs and/or delays in bringing products to market, and in turn, may cause significant losses to investors. The regulations applicable to the Corporation's product candidates may change. Even if granted, regulatory approvals may include significant limitations on the uses for which products can be marketed or may be conditioned on the conduct of post-marketing surveillance studies. Failure to comply with applicable regulatory requirements can, among other things, result in warning letters, the imposition of civil penalties or other monetary payments, delay in approving or refusal to approve a product candidate, suspension or withdrawal of regulatory approval, product recall or seizure, operating restrictions, interruptions of clinical trials or manufacturing, injunctions or criminal prosecution. In addition, regulatory agencies many not approve the labeling claims that are necessary or desirable for the successful commercialization of the Corporation’s product candidates.

Requirements for regulatory approval vary widely from country to country. Whether or not approved in Canada or the United States, regulatory authorities in other countries must approve a product prior to the commencement of marketing the product in those countries. The time required to obtain any such approval may be longer or shorter than in Canada or the United States. Approved drugs, as well as their manufacturers, are subject to continuing and ongoing review, and discovery of problems with these products or the failure to adhere to manufacturing or quality control requirements may result in regulatory restrictions being imposed

Risks Related To Our Common Shares

Our share price has been and will continue to be volatile and an investment in our Common Shares could suffer a decline in value.

You should consider an investment in our Common Shares as risky and invest only if you can withstand a significant loss and wide fluctuations in the market value of your investment. We receive only limited attention by securities analysts and frequently experience an imbalance between supply and demand for our Common Shares. The market price of our Common Shares has been highly volatile and is likely to continue to be volatile. This leads to a heightened risk of securities litigation pertaining to such volatility. Factors affecting our Common Share price include but are not limited to:

| · | our ability to raise additional capital; |

| · | the progress of our clinical trials: |

| · | our ability to obtain partners and collaborators to assist with the future development of our products; |

| · | general market conditions; |

| · | announcements of technological innovations or new product candidates by us, our collaborators or our competitors; |

| · | published reports by securities analysts; |

| · | developments in patent or other intellectual property rights; |

| · | the cash and short term investments held us and our ability to secure future financing; |

| · | public concern as to the safety and efficacy of drugs that we and our competitors develop; and |

| · | shareholder interest in our Common Shares. |

| 10 |

Future sales of our Common Shares by us or by our existing shareholders could cause our share price to fall.

The issuance of Common Shares by us could result in significant dilution in the equity interest of existing shareholders and adversely affect the market price of our Common Shares. Sales by existing shareholders of a large number of our Common Shares in the public market and the issuance of Common Shares issued in connection with strategic alliances, or the perception that such additional sales could occur, could cause the market price of our Common Shares to decline and have an undesirable impact on our ability to raise capital.

We are susceptible to stress in the global economy and therefore, our business may be affected by the current and future global financial condition.

If the increased level of volatility and market turmoil that have marked recent years continue, our operations, business, financial condition and the trading price of our Common Shares could be materially adversely affected. Furthermore, general economic conditions may have a great impact on us, including our ability to raise capital, our commercialization opportunities and our ability to establish and maintain arrangements with others for research, manufacturing, product development and sales.

An active trading market in our Common Shares may not be sustained.

Our Common Shares are listed for trading on the Toronto Stock Exchange. However, an active trading market in our Common Shares on the stock exchange may not be sustained and we may not be able to maintain our listing.

There is a limited market for our Common Shares in the United States.

There currently is a limited market for our Common Shares in the United States. If shareholders in the United States are unable to sell their Common Shares in the United States, they may have to sell their Common Shares over the Toronto Stock Exchange (the “TSX”), which may expose the selling shareholders to currency exchange risk. In addition, because we are not listed on any United States stock exchange, resales of our Common Shares to United States residents under state securities or “blue sky” laws are likely to be limited to unsolicited transactions.

It may be difficult for non-Canadian investors to obtain and enforce judgments against us because of our Canadian incorporation and presence.

We are a corporation existing under the laws of Canada. Many of our directors and officers, and all of the experts named in this Annual Report and the documents incorporated by reference into this Annual Report, are residents of Canada, and all or a substantial portion of their assets, and a substantial portion of our assets, are located outside the United States. Consequently, although we have appointed an agent for service of process in the United States, it may be difficult for holders of our shares who reside in the United States to effect service within the United States upon our directors and officers and experts who are not residents of the United States. It may also be difficult for holders of our shares who reside in the United States to realize in the United States upon judgments of courts of the United States predicated upon our civil liability and the civil liability of our directors, officers and experts under the United States federal securities laws. Investors should not assume that Canadian courts (i) would enforce judgments of United States courts obtained in actions against us or our directors, officers or experts predicated upon the civil liability provisions of the United States federal securities laws or the securities or “blue sky” laws of any state within the United States or (ii) would enforce, in original actions, liabilities against us or our directors, officers or experts predicated upon the United States federal securities laws or any such state securities or “blue sky” laws. In addition, we have been advised by our Canadian counsel that in normal circumstances, only civil judgments and not other rights arising from United States securities legislation are enforceable in Canada and that the protections afforded by Canadian securities laws may not be available to investors in the United States.

| 11 |

We are likely a “passive foreign investment company” which may have adverse U.S. federal income tax consequences for U.S. shareholders.

U.S. investors in our Common Shares should be aware that the Company believes it was classified as a passive foreign investment company (“PFIC”) during the tax year ended May 31, 2013, and based on current business plans and financial expectations, the Company believes that it will be a PFIC for the current tax year. If the Company is a PFIC for any year during a U.S. shareholder’s holding period, then such U.S. shareholder generally will be required to treat any gain realized upon a disposition of Common Shares, or any so-called “excess distribution” received on its Common Shares, as ordinary income, and to pay an interest charge on a portion of such gain or distributions, unless the shareholder makes a timely and effective “qualified electing fund” election (“QEF Election”) or a “mark-to-market” election with respect to the Common Shares. A U.S. shareholder who makes a QEF Election generally must report on a current basis its share of the Company’s net capital gain and ordinary earnings for any year in which the Company is a PFIC, whether or not the Company distributes any amounts to its shareholders. However, U.S. shareholders should be aware that we may not satisfy record keeping requirements that apply to a qualified electing fund, and we may not supply U.S. shareholders with information that such U.S. shareholders require to report under the QEF Election rules, in the event that we are a PFIC and a U.S. shareholder wishes to make a QEF Election. Thus, U.S. shareholders may not be able to make a QEF Election with respect to their Common Shares. A U.S. shareholder who makes the mark-to-market election generally must include as ordinary income each year the excess of the fair market value of the Common Shares over the taxpayer’s basis therein. This paragraph is qualified in its entirety by the discussion below under the heading “Certain United States Federal Income Tax Considerations.” Each U.S. shareholder should consult its own tax advisor regarding the U.S. federal, U.S. local, and foreign tax consequences of the PFIC rules and the acquisition, ownership, and disposition of our Common Shares.

Item 4. Information on the Company

| A. | History and development of the company. |

Old Lorus was incorporated under the Business Corporations Act (Ontario) on September 5, 1986 under the name RML Medical Laboratories Inc. On October 28, 1991, RML Medical Laboratories Inc. amalgamated with Mint Gold Resources Ltd., resulting in Old Lorus becoming a reporting issuer (as defined under applicable securities law) in Ontario, on such date. On August 25, 1992, Old Lorus changed its name to IMUTEC Corporation. On November 27, 1996, Old Lorus changed its name to Imutec Pharma Inc., and on November 19, 1998, Old Lorus changed its name to Lorus Therapeutics Inc. On October 1, 2005, Old Lorus continued under the Canada Business Corporations Act.

On the Arrangement Date, Old Lorus completed a plan of arrangement and corporate reorganization with, among others, 6650309 Canada Inc. (“New Lorus”), 6707157 Canada Inc. and Pinnacle International Lands, Inc. As a result of the plan of arrangement and reorganization, each Common Share of Old Lorus was exchanged for one Common Share of New Lorus. New Lorus continued the business of Old Lorus after the Arrangement Date with the same officers and employees and continued to be governed by the same board of directors as Old Lorus prior to the Arrangement Date.

The address of the Company’s head and registered office is 2 Meridian Road, Toronto, Ontario, Canada, M9W 4Z7 and our phone number is (416) 798-1200. Our corporate website is www.lorusthera.com. The contents of the website and items accessible through the website are specifically not incorporated in this Annual Report by reference.

Lorus’ subsidiary is NuChem Pharmaceuticals Inc. (“NuChem”), a corporation incorporated under the laws of Ontario, of which Lorus owns 80% of the issued and outstanding voting share capital and 100% of the issued and outstanding non-voting preference share capital.

Our Common Shares are listed on the TSX under the symbol “LOR”.

| 12 |

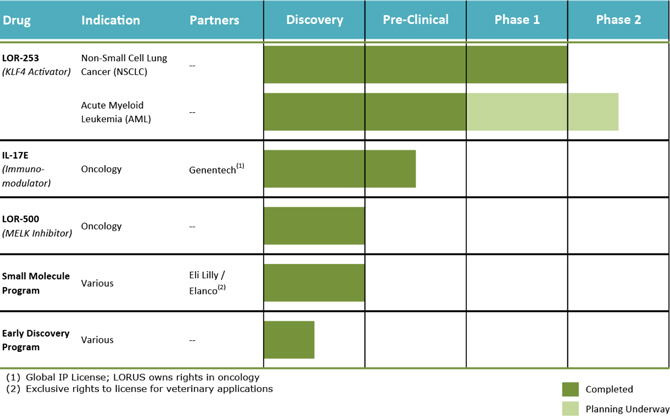

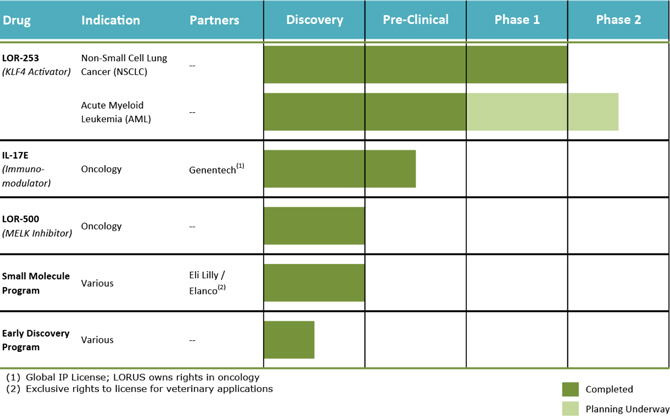

Lorus is a clinical stage biotechnology company with a commitment to discovering and developing targeted therapies addressing unmet medical needs in oncology. We aim to develop therapeutics focused on novel cellular targets on the leading edge of cancer research coupled to companion diagnostics to identify the optimal patient population for our products. Our pipeline of cancer drug candidates includes small molecule products and immunotherapies providing additive or synergistic efficacy without leading to overlapping toxicities with existing anti-cancer regimens, facilitating the adoption of doublet or possibly triplet therapies.

Our success is dependent upon several factors, including recruitment and retention of skilled personnel, maintaining sufficient levels of funding through public and/or private financing, establishing the efficacy and safety of our drug candidates in clinical trials, securing strategic partnerships and obtaining the necessary regulatory approvals to market our products.

We believe the future of cancer treatment and management lies in selecting for treatment patients having cancers that are predisposed to response based on a drug’s unique mechanism of action. Our opinion is that many drugs currently approved for the treatment and management of cancer are not selective for the specific genetic alterations (targets) that cause the patient’s tumor and hence lead to significant toxicities due to off-target effects. Lorus’ strategy is to continue the development of our product pipeline across several therapeutic indications in oncology with therapeutics addressing novel targets that drive particular types of cancers. We also strive to optimize our therapeutics for synergy with currently available, commercialized therapeutics for a drug combination regimen with enhanced efficacy. We evaluate the merits of each drug candidate throughout the clinical trial process and will consider partnering a program when appropriate.

Capital Expenditures and Divestitures

Not applicable.

| 13 |

| B. | Business overview. |

Lorus is a clinical stage biotechnology company with a commitment to discovering and developing targeted therapies addressing unmet medical needs in oncology. We aim to develop therapeutics focused on novel cellular targets on the leading edge of cancer research coupled to companion diagnostics to identify the optimal patient population for our products. Our pipeline of cancer drug candidates includes small molecule products and immunotherapies providing additive or synergistic efficacy without leading to overlapping toxicities with existing anti-cancer regimens, facilitating the adoption of doublet or possibly triplet therapies.

We believe the future of cancer treatment and management lies in the prospective selection and treatment of patients predisposed to response based on a drug’s unique mechanism of action. We are of the view that many drugs currently approved for the treatment and management of cancer are not selective for the specific genetic alterations (targets) that cause the patient’s tumor and hence lead to significant toxicities due to off-target effects. Lorus’ strategy is to continue the development of our programs that address a common underlying pathway within a patient population, and we intend to apply this strategy across several therapeutic indications in oncology, including hematologic malignancies and solid tumor indications. Our lead program, LOR-253, is a first-in-class inducer of the Krüppel-like factor 4 gene (the “Klf4 Gene”) for patients with advanced hematologic malignancies, including acute myeloid leukemia (“AML”) and myelodysplastic syndromes (“MDS”).

Krüppel-Like Factor 4 & CDX2

Krüppel-like factors constitute a diverse family of genes (the “Klf Genes”) that act by modifying the expression levels of other genes that control essential cellular processes such as proliferation, migration, differentiation, cell death and metastasis. Approximately 17 Klf Genes are known, with an array of roles that include serving as innate tumor suppressors. The Klf Genes give rise to the production of proteins (the “KLF Proteins”). Structurally, KLF Proteins include DNA binding domains that allow for the identification and regulation of other genes. Of particular importance, the Krüppel-like factor 4 protein (the “KLF4 Protein”) is also reported to be impacted by the embryonic gene, Cdx2 (the “Cdx2 Gene”).

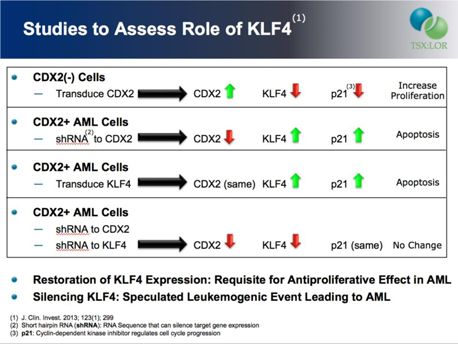

The Cdx2 Gene, while not activated in the bone marrow and blood cells of normal adults, was observed to be activated in the malignant cells in a majority of patients with AML. It has subsequently been noted that the gene product of the Cdx2 Gene, the protein CDX2 (the “CDX2 Protein”), had the most profound intracellular impact on KLF4 Protein levels by binding, and epigenetically silencing the Klf4 Gene (Faber et. al., J Clin Invest. 2013;123(1):299–314). In other words, while the sequence of the bases in the DNA in the gene remain intact, those bases are modified chemically to reduce the expression of the gene. In subsequent studies from Faber et. al., it was demonstrated that induction of the Cdx2 Gene, in cells lacking CDX2 Protein, subsequently decreased KLF4 Protein levels and promoted proliferation (Figure 1, First Bullet), while silencing the Cdx2 Gene in cells possessing CDX2 Protein alleviated the suppression of the Klf4 Gene and restored innate function (Figure 1, Second Bullet) to drive cellular apoptosis (programmed cell death) in AML cells. Further, in cells possessing an active Cdx2 Gene, Faber et. al. inserted an active Klf4 Gene to overcome innate KLF4 Protein suppression, and revealed that increased KLF4 Protein promoted apoptosis (Figure 1, Third Bullet).

| 14 |

Figure 1: Studies Assessing the Role of KLF4 in AML Cells

It has been suggested by Faber et. al. that a multitude of genetic abnormalities culminate in the aberrant expression of the Cdx2 Gene and ultimately converge on decreased Klf4 Gene transcription to yield diminished KLF4 Protein levels. This CDX2 Protein-KLF4 Protein signature was speculated by Faber et. al. to be a potential trigger for AML based on the aforementioned pro-proliferative outcomes of diminished KLF4 levels and the absence of this protein signature in healthy patient samples. Notably, it was observed by Scholl et. al. in 2007 (J. Clin. Invest. 117:1037–1048 (2007) that approximately 40% of patients with higher risk MDS possessed increased CDX2 Protein levels, and may represent the portion of the MDS population progressing to AML. Other opportunities in oncology in which the Klf4 Gene has been implicated to play a role include colorectal, gastric, cervical, prostate and lung cancers, among others.

LOR-253: Lead Clinical Program

Our lead program is LOR-253, a small molecule found to induce the transcription of the Klf4 Gene in vitro studies. LOR-253 was discovered and identified by Lorus scientists based upon the magnitude of its antiproliferative and anti-metastatic activity across a multitude of cell lines. In vitro studies conducted at Lorus have demonstrated significant potency (nanomolar IC50 concentrations) of LOR-253 in AML cell lines, and ten to 1000 times greater potency than in solid tumor cell lines. In vitro analyses with relevant AML cell lines, including THP1, HL-60 and Kasumi-1, have demonstrated that LOR-253 led to significant elevation of KLF4 Protein levels, with the anticipated increase in cyclin-dependent kinase inhibitor 1 (p21, a protein that halts the cell cycle and prevents cells from proliferating), caspase-3 (an enzyme activated during programmed cell death to chop up other proteins), and Annexin-V (a protein used as a marker for the initiation of programmed cell death), leading to G1 cell cycle arrest and apoptosis (programmed cell death). LOR-253 is administered as an intravenous infusion in patients. We have reported initial results from a Phase I clinical study of LOR-253 in patients with various solid tumors which indicated that LOR- 253 was safe and well tolerated with indications of anti-tumor activity as a single agent. Our plans are to advance LOR-253 to a Phase Ib clinical study in relapsed / refractory hematologic malignancies, including patients with AML, MDS and various lymphomas, based upon the common underlying, leukemia-causing profile of Klf4 Gene suppression. The development of LOR-253 currently represents the main focus of Lorus.

Lorus is currently pursuing the clinical development of LOR-253 in AML, based on in vitro data demonstrating significant sensitivity to AML cell lines and recent academic research implicating up-regulation of the CDX2 Protein, and suppression of the KLF4 Protein, as a possible leukemogenic trigger in AML. This CDX2 Protein-KLF4 Protein signature has been observed to be absent in the normal hematopoietic stem and progenitor cells of healthy individuals. The CDX2 Protein is reported by Faber et. al. to epigenetically silence the Klf4 Gene tumor suppressor as a critical oncogenic event (transforming normal cells to cancer cells) in AML, and LOR-253 has demonstrated the ability in preclinical investigations to up-regulate the Klf4 Gene and induce tumor-killing effect. We believe these findings warrant investigation of the potential clinical utility of LOR-253 in the treatment of patients with suppressed Klf4 Gene in AML, MDS, and, potentially, other hematologic malignancies.

| 15 |

Lorus is currently developing and validating a companion diagnostic for LOR-253. The diagnostic will assess the extent of genetic expression of Cdx2 and Klf4 in patients as a potential predictor of response to therapy with LOR-253, as well as assess post-treatment expression levels as biomarkers of efficacy.

Acute Myeloid Leukemia

AML is a rapidly progressing cancer of the blood and bone marrow characterized by the uncontrolled proliferation of dysfunctional myeloblasts that do not mature into healthy blood cells. It is the most common form of acute leukemia in adults. The American Cancer Society estimates there were approximately 14,590 new cases of AML and approximately 10,370 deaths from AML in the U.S. in 2013 and that there will be approximately 18,860 new cases of AML and approximately 10,460 deaths from AML in the U.S. in 2014. Standard induction therapy with chemotherapy is successful in many AML patients, but the majority of these patients will relapse with treatment refractory disease. Typical relapse rates in patients less than, and greater than, 60 years of age are approximately 48%and 71%respectively, as reported by Datamonitor Healthcare

Myelodysplastic Syndromes

MDS are a group of blood and bone marrow disorders. In MDS, stem cells do not mature normally, and the number of blasts (immature cells) and dysplastic (abnormally developed) cells increases. Also, the number of healthy mature cells decreases, meaning there are fewer normal red blood cells, white blood cells, and platelets. The numbers of blood cells are often called blood cell counts. Because of the decrease in healthy cells, people with MDS often have anemia (a lowered blood cell count), and may have neutropenia (a low white blood cell count) and thrombocytopenia (a low platelet count). Also, the chromosomes (long strands of genes) in the bone marrow cells may be abnormal. According to the American Cancer Society, there are approximately 13,000 new cases of MDS annually in the US. Additionally, Datamonitor Healthcare reports median survival in higher risk MDS patients may range between five months and two years. There are several subtypes of MDS, and some subtypes of MDS may eventually turn into AML.

Solid Tumors

Phase 1 data with LOR-253 in patients with solid tumors and extensive preclinical data in solid tumor cells, including non-small cell lung cancer (“NSCLC”), have identified an opportunity for LOR-253 in patients possessing cancers with reduced Klf4 Gene expression. Our prior Phase 1 study with LOR-253 also exhibited a favorable safety profile for LOR-253 without an identified maximally tolerated dose over a 28-day cycle. Various solid tumors have exhibited suppressed levels of Klf4 Gene in scientific publications, including colorectal, gastric, pancreatic and cervical cancers, as well as NSCLC. NSCLC is an indication that we consider to have a large market potential and important unmet need worldwide, in which the Klf4 Gene is a tumor suppressor that is present in case-matched normal cells but depressed in NSCLC tumor cells. Lorus may evaluate the clinical utility of LOR-253 in additional studies in a subset of NSCLC patients that may be predisposed to a response with a therapeutic activating the Klf4 Gene.

Undisclosed Program

In April 2013, Lorus entered into a research and license option agreement with Elanco, the animal health division of Eli Lilly and Company (“Elanco”), to investigate a new proprietary series of Lorus’ compounds for veterinary medicine. Pursuant to the agreement, Elanco will fund the research program and was granted an exclusive option to license the worldwide rights for selected compounds for veterinary use; the terms of which will be negotiated if the option is exercised by Elanco. Lorus retains the rights to develop and commercialize these compounds for human use and intends to use the animal data from the collaboration as a basis for a partnership with a third party that will seek to develop the technology for the treatment of patients with cancer. Lead optimization is underway and the next goal is to identify a clinical drug candidate which can be developed for both human and animal use.

| 16 |

Subsequent Events

June 2013 Private Placement

In June 2013, Lorus completed a private placement of units consisting of (i) $ 1,000 principal amount of unsecured promissory notes; and (ii) 1,000 Common Share purchase warrants at a price of $ 1,000 per unit, for aggregate gross proceeds of $893,000.

Strategic Review Process

On September 12, 2013, the Corporation formed a special committee, the Special Committee, composed of independent directors to review strategic alternatives available to the Corporation, designed to secure the long-term financial and operational sustainability of the Corporation with a view to enhance shareholder value. On October 28, 2013, the Special Committee, after having considered and reviewed a number of options, concluded its review. The Special Committee recommended that the board of directors of Lorus (the “Board”) approve the appointments of William G. Rice, Ph.D. as Chief Executive Officer and Chairman of the Board and of Daniel D. Von Hoff, M.D., to serve as a special advisor to fulfill the functions of the Corporation’s Senior Vice President of Medical Affairs.

September 2013 Private Placement

On September 26, 2013, the Corporation completed a private placement of convertible promissory notes for aggregate gross proceeds of $600,000 to maintain the research and development activities of the Corporation while the Special Committee was continuing to review strategic alternatives available to the Corporation. An additional $150,000 was raised subsequently under unsecured non-convertible loans.

Changes in Management

On October 28, 2013, William G. Rice, Ph.D., was appointed as Chief Executive Officer of the Corporation and Chairman of the Board, while former Chief Executive Officer of the Corporation, Dr. Aiping Young, continued as President and Chief Operating Officer until she departed the Corporation on March 18, 2014. On October 28, 2013, Lorus also appointed Daniel D. Von Hoff, M.D., to serve as a special advisor to fulfill the functions of the Corporation’s Senior Vice President of Medical Affairs. Dr. Von Hoff is an independent contractor and advisor, but is not an employee of Lorus. The Board, after receiving the recommendation of the Special Committee, unanimously approved the appointments. In doing so, the Board determined that such appointments were in the best interest of Lorus, as they were considered to enhance the management team and advisory team with the addition of two seasoned and experienced biotechnology executives bringing extensive clinical development and capital raising experience and improving the awareness and presence of the Corporation in the United States. William G. Rice, Ph.D., as the new Chief Executive Officer of the Corporation and Chairman of the Board, was authorized and mandated by the Board to explore all available options to maximize shareholder value. On April 10, 2014, Dr. Rice was additionally appointed as President of the Corporation.

On October 29, 2013, Brian Druker, M.D., was appointed as the Chair of the Corporation’s Scientific Advisory Board. Like Dr. Von Hoff, Dr. Druker is an independent contractor and advisor, but not any employee of Lorus.

On December 2, 2013, Avanish Vellanki was appointed as Chief Business Officer of the Corporation to manage global business development, licensing and corporate strategy, and Gregory K. Chow was appointed as Chief Financial Officer of the Corporation and assumed global responsibility for corporate finance and accounting functions for the Corporation. On April 10, 2014, Mssrs. Vellanki and Chow were additionally appointed as Senior Vice Presidents of the Corporation.

| 17 |

December 2013 Public Offering and Over Allotment

On December 10, 2013, the Company completed a public offering of Common Shares. The Company issued a total of 12,730,000 Common Shares at a purchase price of $0.55 per Common Share, for aggregate gross proceeds of $7,001,500.

In January 2014, the underwriters exercised in full their over-allotment option to purchase an additional 1,909,500 Common Shares of the Company at a purchase price of $0.55 per Common Share, in connection with the December 10, 2013 public offering. As a result of the exercise of this over-allotment option, Lorus received additional gross proceeds of $1,050,225 and raised total gross proceeds of $8,051,725 from this public offering.

April 2014 Public Offering

In April 2014, the Company completed a public offering of Common Shares. The Company issued a total of 56,500,000 Common Shares at a purchase price of $0.50 per Common Share, including 6,500,000 Common Shares sold pursuant to the partial exercise of an over-allotment option, for aggregate gross proceeds of $28,250,000.

LOR-253 Development

On October 29, 2013, the Corporation announced that it will pursue the clinical development of LOR-253, its small molecule inducer of the tumor suppressor KLF4, in AML and other hematologic malignancies.

Agreements

Manufacturing Agreements

We currently rely upon subcontractors for the manufacture of our drug candidates. The subcontractors manufacture clinical material according to current Good Manufacturing Practices, or GMPs, at contract manufacturing organizations that have been approved by our quality assurance department staff, after having conducted audits to ensure such manufacturers meet the requirements of the relative regulatory authorities.

Manufactured product for clinical purposes is tested for conformance with product specifications prior to release by our quality assurance staff. GMP batches of our drug candidates are subjected to prospectively designed stability test protocols.

License Agreements

Genentech Inc.

The Company holds a non-exclusive license from Genentech Inc. (“Genentech”) to certain patent rights to develop and sub-license a specified polypeptide. In consideration of the license, the Company paid an upfront amount and could be required to pay to Genentech additional milestones and royalties on sales. The initial amount paid upfront was a one-time non-creditable, non-refundable fee which was immaterial to the Company. The aggregate milestone amounts payable under the agreement total $2,325,000. Additionally, the Company is obligated to make royalty payments after the first commercial sale of the polypeptide within a range of 1% to 5% on a country by country basis on an aggregate worldwide scale of net sales. No milestone or royalty payments under this agreement have become due and the Company does not expect to make any milestone or royalty payments under this agreement during the fiscal year ending May 31, 2014. The Company cannot reasonably predict when such royalties will become payable, if at all. The agreement will terminate upon the expiration of the last patent, which is expected to be in 2020. The agreement may be terminated (i) by the Company for any reason upon 60 days prior written notice to Genentech or (ii) by Genentech for any material breach of the agreement by the Company, provided that the Company has the option to cure such breach within 30 days following written notice by Genentech.

| 18 |

Collaboration Agreements

Elanco

In April 2013, Lorus entered into a research and license option agreement with Elanco, the animal health division of Eli Lilly and Company, to investigate a new proprietary series of Lorus’ compounds for veterinary medicine. Pursuant to the agreement, Elanco agreed to fund the research program and was granted an exclusive option to license from Lorus our worldwide rights for selected compounds for veterinary use; the terms of which will be negotiated if the option is exercised by Elanco. Lorus retains the rights to develop and commercialize these compounds for human use and intends to use the animal data from the collaboration as a basis for a partnership with a third party to develop the technology for the treatment of patients with cancer. Lead optimization is underway and the next goal is to identify a clinical drug candidate that can be developed for both human and animal use.

Cancer Research UK

In November 2012, Lorus entered into a clinical trial and option agreement with Cancer Research UK to develop IL-17E through to a Phase I clinical trial. IL-17E (also known as IL-25) is a cytokine that plays an important role in inflammation. Lorus scientists were the first to discover the anticancer properties of IL-17E against a range of solid tumors, including human melanoma, pancreatic, colon, lung, ovarian and breast tumor models, with very low toxicity. Cancer Research UK, through its Clinical Development Partnerships program, had agreed to fund and complete the preclinical studies, non-clinical toxicology studies and a Phase I clinical study in solid tumors. This agreement was terminated by Cancer Research UK in early 2014.

Other

From time to time, we enter into other research and technology agreements with third parties under which research is conducted and monies expended. These agreements outline the responsibilities of each participant and the appropriate arrangements in the event the research produces a product candidate.

Business Strategy