Exhibit 99.1

Notice and Management Proxy Circular

For the

Annual and Special Meeting of Shareholders

to be held on March 27, 2014

February 24, 2014

Lorus Therapeutics Inc.

Notice of 2013 Annual and Special Meeting of Shareholders

NOTICE IS HEREBY GIVEN that the annual and special meeting (the “Meeting”) of shareholders of Lorus Therapeutics Inc. (the “Corporation”) will be held at the offices of McCarthy Tétrault LLP, Toronto Dominion Bank Tower, 66 Wellington Street West, Suite 5300, Toronto, Ontario on Thursday, March 27, 2014 at 1:00 p.m. (Toronto time).

What the Meeting is About

The following items of business will be covered at the Meeting:

| 1. | receiving the financial statements of the Corporation for the financial year ended May 31, 2013, including the auditor’s report thereon; |

| 2. | appointing KPMG LLP as auditor of the Corporation for the ensuing year and to authorize the directors to fix its remuneration; |

| 3. | electing directors; |

| 4. | to consider, and if deemed advisable, pass a resolution in the form included in the management proxy circular accompanying this notice of meeting approving amendments to the share option plan, the deferred share unit plan and the alternate compensation plan of the Corporation; and |

| 5. | to transact such other business as may be properly brought before the Meeting. |

The Meeting may also consider other business that properly comes before the Meeting or any adjournment of the Meeting. The management proxy circular accompanying this notice of meeting provides additional information relating to the matters to be dealt with at the Meeting and forms part of this notice.

You have the right to vote

You are entitled to receive notice of and vote at the Meeting, or any adjournment, if you are a holder of common shares of the Corporation at the close of business on February 21, 2014.

You have the right to vote your shares on items 2, 3, 4 and 5 listed above and any other items that may properly come before the Meeting or any adjournment.

Your vote is important

If you are not able to be present at the Meeting, please exercise your right to vote by signing and returning the enclosed form of proxy to Computershare Investor Services Inc., 100 University Avenue, 8th Floor, Toronto, Canada M5J 2Y1, so as to arrive not later than 1:00 p.m. on Tuesday, March 25, 2014 or, if the Meeting is adjourned, 48 hours (excluding Saturdays, Sundays and holidays) before any adjournment of the Meeting.

BY ORDER OF THE BOARD OF DIRECTORS

William

G. Rice, Ph. D.

Chairman of the Board of Directors and

Chief Executive Officer

Toronto, Canada

February 24, 2014

MANAGEMENT PROXY CIRCULAR

FEBRUARY 24, 2014

PROXY INFORMATION

Solicitation of Proxies

The information contained in this management proxy circular (the “Circular”) is furnished in connection with the solicitation of proxies to be used at the annual and special meeting (the “Meeting”) of holders (the “Shareholders”) of common shares (the “Shares”) of Lorus Therapeutics Inc. (the “Corporation”, “Lorus”, “we” or “our”) to be held on Thursday, March 27, 2014 at 1:00 p.m. (Toronto time) at the offices of McCarthy Tétrault LLP, Toronto Dominion Bank Tower, 66 Wellington Street West, Suite 5300, Toronto, Ontario and at all adjournments thereof, for the purposes set forth in the accompanying notice of meeting (the “Notice of Meeting”). It is expected that the solicitation will be made primarily by mail but proxies may also be solicited personally by directors, officers, employees or agents of the Corporation. The solicitation of proxies by this Circular is being made by or on behalf of the management of the Corporation. The total cost of the solicitation will be borne by Lorus. The information contained in this Circular is given as at February 24, 2014 except where otherwise noted.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This Circular contains forward-looking statements within the meaning of securities laws. Such statements include, but are not limited to the Corporation’s plans, objectives, expectations and intentions and other statements including words such as “anticipate”, “contemplate”, “continue”, “believe”, “plan”, “estimate”, “expect”, “intend”, “will”, “should”, “may”, and other similar expressions.

Such statements reflect our current views with respect to future events and are subject to risks and uncertainties and are necessarily based upon a number of estimates and assumptions that, while considered reasonable by us are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors could cause our actual results, performance or achievements to be materially different from any future results, performance, or achievements that may be expressed or implied by such forward-looking statement. See our Annual Information Form dated July 11, 2013 for the fiscal year ended May 31, 2013 for additional information. A copy of this document can be found on SEDAR at www.sedar.com, however we will promptly provide a copy of this document to any securityholder of the Corporation free of charge upon request.

ABOUT VOTING YOUR SHARES

Appointment of Proxies

This is the easiest way to vote. Voting by proxy means that you are giving the person or people named on your proxy form (the “proxyholder”) the authority to vote your Shares for you at the Meeting or any adjournment. A proxy form is included with this Circular.

| -4- |

The persons named on the proxy form will vote your Shares for you, unless you appoint someone else to be your proxyholder. You have the right to appoint a person to represent you at the Meeting other than the persons named on the proxy form. If you appoint someone else, he or she must be present at the Meeting to vote your Shares. If you want to appoint someone else, you can insert that person’s name in the blank space provided in the form of proxy. That other person does not need to be a Shareholder of the Corporation.

If you are voting your Shares by proxy, our transfer agent, Computershare Investor Services Inc. (“Computershare”), must receive your completed proxy form by 1:00 p.m. (Toronto time) on Tuesday, March 25, 2014 or, if the Meeting is adjourned, 48 hours (excluding Saturdays, Sundays and holidays) before any adjournment of the Meeting.

Registered Shareholders

You are a registered Shareholder if your name appears on your Share certificate. Your proxy form tells you whether you are a registered Shareholder.

Non-Registered (or Beneficial) Shareholders

You are a non-registered (or beneficial) Shareholder if your bank, trust company, securities broker or other financial institution holds your Shares for you (your nominee). For most of you, your voting instruction form or proxy tells you whether you are a non-registered (or beneficial) Shareholder.

In accordance with Canadian securities law, we have distributed copies of the Notice of Meeting, this Circular and the form of proxy (collectively, the “meeting materials”) to CDS Clearing and Depository Services Inc. and intermediaries (such as securities brokers or financial institutions) for onward distribution to those non-registered or beneficial Shareholders to whom we have not sent the meeting materials directly. We previously mailed to those who requested them, the audited financial statements of the Corporation for the fiscal year ended May 31, 2013 and the auditor’s report thereon as well as management’s discussion and analysis.

The intermediaries are required to forward meeting materials to non-registered or beneficial Shareholders unless a non-registered or beneficial Shareholder has waived the right to receive them. Very often, intermediaries will use a service company such as Broadridge Investor Communication Solutions to forward the meeting materials to non-registered or beneficial Shareholders.

Non-registered or beneficial Shareholders who have not waived the right to receive meeting materials will receive either a voting instruction form or, less frequently, a form of proxy. The purpose of these forms is to permit non-registered or beneficial Shareholders to direct the voting of the Shares they beneficially own. Non-registered or beneficial Shareholders should follow the procedures set out below, depending on what type of form they receive.

| A. | Voting Instruction Form. In most cases, a non-registered Shareholder will receive, as part of the meeting materials, a voting instruction form. If the non-registered Shareholder does not wish to attend and vote at the Meeting in person (or have another person attend and vote on the non-registered Shareholder’s behalf), the voting instruction form must be completed, signed and returned in accordance with the directions on the form. If a non-registered Shareholder wishes to attend and vote at the Meeting in person (or have another person attend and vote on the non-registered Shareholder’s behalf), the non-registered Shareholder must complete, sign and return the voting instruction form in accordance with the directions provided and a form of proxy giving the right to attend and vote will be forwarded to the non-registered Shareholder. |

| -5- |

or

| B. | Form of Proxy. Less frequently, a non-registered Shareholder will receive, as part of the meeting materials, a form of proxy that has already been signed by the intermediary (typically by a facsimile or stamped signature), which is restricted as to the number of Shares beneficially owned by the non-registered Shareholder but which is otherwise uncompleted. If the non-registered Shareholder does not wish to attend and vote at the Meeting in person (or have another person attend and vote on the non-registered Shareholder’s behalf), the non-registered Shareholder must complete the form of proxy and deposit it with Computershare, 100 University Avenue, 8th Floor Toronto, Canada, M5J 2Y1 as described above. If a non-registered Shareholder wishes to attend and vote at the Meeting in person (or have another person attend and vote on the non-registered Shareholder’s behalf), the non-registered Shareholder must strike out the names of the persons named in the proxy and insert the non-registered Shareholder’s (or such other person’s) name in the blank space provided. |

Non-registered Shareholders should follow the instructions on the forms they receive and contact their intermediaries promptly if they need assistance.

Meeting Materials

The meeting materials are being sent to both registered and non-registered owners of Shares. The Corporation is sending this Circular and other meeting materials indirectly to non-objecting beneficial owners (as defined in National Instrument 54-101 - Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”)). The Corporation intends to pay for intermediaries to forward to objecting beneficial owners (as defined in NI 54-101) this Circular and other meeting materials.

Changing Your Vote

A registered Shareholder who has given a proxy may revoke that proxy by:

| (a) | completing and signing a proxy bearing a later date and depositing it with Computershare as described above; |

| (b) | depositing an instrument in writing executed by the Shareholder or by the Shareholder’s attorney authorized in writing: |

| (i) | at our registered office at any time before 1:00 p.m. on Tuesday, March 25, 2014, or 48 hours (not including Saturdays, Sundays and holidays) before any adjournment of the Meeting at which the proxy is to be used, or |

| (ii) | with the chair of the Meeting prior to the commencement of the Meeting on the day of the Meeting or any adjournment of the Meeting; or |

| (c) | in any other manner permitted by law. |

A non-registered or beneficial Shareholder may revoke a voting instruction form or a waiver of the right to receive meeting materials and to vote given to an intermediary or to the Corporation, as the case may be, at any time by written notice to the intermediary or the Corporation, except that neither an intermediary nor the Corporation is required to act on a revocation of a voting instruction form or of a waiver of the right to receive materials and to vote that is not received by such intermediary or the Corporation, at least seven (7) days prior to the Meeting.

| -6- |

VOTING OF PROXIES

You can choose to vote “For”, “Against” or “Withhold”, depending on the items listed on the proxy form. The Shares represented by the proxy form will be voted or withheld from voting in accordance with the instructions of the Shareholder on any ballot that may be called for and, if the Shareholder specifies a choice with respect to any matter to be acted upon, the Shares will be voted accordingly.

If you return your proxy form and do not tell us how you want to vote your Shares, your Shares will be voted by the management representatives named in the proxy form as follows:

| • | FOR the election of the directors nominated for election as listed in this Circular; |

| • | FOR the appointment of KPMG LLP as auditor of the Corporation; and |

| • | FOR the approval of the amendments to the share option plan, the deferred share unit plan and the alternate compensation plan of the Corporation. |

The enclosed form of proxy confers discretionary authority upon the management representatives designated in the form of proxy with respect to amendments to or variations of matters identified in the Notice of Meeting and with respect to other matters that may properly come before the Meeting. At the date of this Circular, the management of the Corporation knows of no such amendments, variations or other matters.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

As of the date hereof, 62,006,452 Shares are issued and outstanding. Each holder of Shares of record at the close of business on February 21, 2014, the record date established for notice of the Meeting, will be entitled to one vote for each Share held on all matters proposed to come before the Meeting, except to the extent that the Shareholder has transferred any Shares after the record date and the transferee of such Shares establishes ownership of them and makes a written demand, not later than 10 days prior to the Meeting, to be included in the list of Shareholders entitled to vote at the Meeting, in which case the transferee will be entitled to vote such Shares.

To the knowledge of Lorus’ directors and executive officers, no single person or entity beneficially owns, directly or indirectly, or exercises control or direction over more than 10% of the votes attached to all the outstanding Shares, other than Mr. Herbert Abramson and his affiliated company Technifund Inc. who, according to publicly available information, hold 8,993,041 Shares or approximately 14.50% of the issued and outstanding Shares and Mr. Sheldon Inwentash who, according to publicly available information, hold, both personally and through Pinetree Capital Ltd., hold 7,670,000 Shares or approximately 12.37% of the issued and outstanding Shares.

PARTICULARS OF MATTERS TO BE ACTED UPON

1. Financial Statements

At the Meeting, Shareholders will receive and consider the financial statements of the Corporation for the financial year ended May 31, 2013 and the auditor’s report thereon, but no vote by the Shareholders with respect thereto is required or proposed to be taken.

| -7- |

2. Appointment and Remuneration of the Auditor

The Board of Directors of the Corporation (the “Board”), on the Audit Committee’s advice, recommends the appointment of KPMG LLP, as auditor of the Corporation. The auditor will be in office until the next annual Shareholders’ meeting or until a successor is named.

Unless you have specified in the enclosed form of proxy that the votes attaching to the Shares represented by the proxy are to be withheld with respect to the appointment of the auditor, on any ballot that may be called for in the appointment of the auditor, the management representatives designated in the enclosed form of proxy intend to vote the Shares in respect of which they are appointed proxy FOR the appointment of KPMG LLP, Chartered Accountants, as auditor of the Corporation to hold office until the next annual meeting of Shareholders, and authorizing the directors to fix the remuneration of the auditor.

3. Election of Directors

Unless they resign, all directors elected at the Meeting will hold office until our next annual meeting of Shareholders or until their successors are elected or appointed.

Unless you have specified in the enclosed form of proxy that the votes attaching to the Shares represented by the proxy are to be withheld with respect to the election of directors, on any ballot that may be called for in the election of directors, the management representatives designated in the enclosed form of proxy intend to vote the Shares in respect of which they are appointed proxy FOR the election as directors of the proposed nominees whose names are set forth below.

Management does not contemplate that any of the proposed nominees will be unable to serve as a director but, if that should occur for any reason prior to the Meeting, the management representatives designated in the enclosed form of proxy may vote for another nominee at their discretion.

Pursuant to the articles of the Corporation, the number of directors of the Corporation is set at a minimum of three and a maximum of eleven and the directors are authorized to determine the actual number of directors to be elected from time to time. The Corporation currently has eight directors, and is proposing seven directors for nomination at the Meeting.

On February 24, 2014, the Board adopted a majority voting policy (the “Majority Voting Policy”). The Majority Voting Policy applies to this election of directors. Under such policy, a director nominee who is elected in an uncontested election with a greater number of votes “withheld” than votes “for” will be considered by the Board not to have received the support of the shareholders, even though duly elected as a matter of corporate law. Such a nominee will be expected to provide forthwith his or her resignation to the Board, effective on acceptance by the Board. Unless special circumstances apply, the Board will accept the resignation. Within ninety (90) days following the applicable meeting of the shareholders, the Board will determine whether to accept or reject the resignation offer that has been submitted. Following the Board’s decision on the resignation, the Board will promptly disclose, via press release, its decision (including the reasons for rejecting the resignation offer, if applicable).

The following table sets out for all persons proposed to be nominated by management for election as director, the name and place of residence, all major positions and offices with the Corporation now held by them, the period during which they have served as directors of the Corporation, their present principal occupation and principal occupation for the preceding five years, and the number of Shares beneficially owned, directly or indirectly, by each of them, or over which they exercise control or direction as at the date hereof.

| -8- |

The Corporation has an Audit Committee, a Corporate Governance and Nominating Committee and a Compensation Committee. The members of these committees are indicated in the table below.

| Name of Director, Province/State and Country of Residence | Director Since | Present and Past Principal Occupation or Employment | No. of Securities Beneficially Owned, Controlled or Directed |

| DR. DENIS BURGER(1) (2) Oregon, United States | September 2007 | Executive Chairman, BioCurex, Inc. (2009 to present) (biotechnology company) President, Yamhill Valley Vineyards, Inc. (1983 to present) (vineyards) Served on several Boards of Directors (2007 to 2009) |

101,987 Shares |

| DR.

WILLIAM G. RICE California, United States |

October 2013 | Chairman and Chief Executive Officer of the Corporation (2013 to present) Chairman, President and Chief Executive Officer, Cylene Pharmaceuticals Inc. (2003 to 2013) (biotechnology company) |

Nil |

| DR.

BRADLEY THOMPSON Alberta, Canada |

June 2013 | President and Chief Executive Officer, Oncolytics Biotech Inc. (1999 to present) (biotechnology company) | Nil |

| DR.

BRIAN UNDERDOWN(1) Ontario, Canada |

December 2013 | Managing

Director, Lumira Capital (1997 to present) (life science venture capital investment manager) |

Nil(4) |

| DR. MARK D. VINCENT(3) Ontario, Canada | September 2007 | Physician; medical oncologist, London Regional Cancer Program Cancer Care Ontario (1990 to present) (cancer care facility) Chief Executive Officer, Sarissa Inc. (2000 to present) (biotechnology company) |

Nil |

WARREN WHITEHEAD(1) Ontario, Canada |

April 2011 | Chief Financial

Officer, Amorfix Life Sciences

Director of Plantform (2009 to present) (biotechnology company) |

Nil |

DR. JIM A. WRIGHT (2) (6) Ontario, Canada

|

October 1999 | Adjunct Professor, Department of Biochemistry and Biomedical sciences, McMaster University (2010 to present) Chief Executive Officer of NuQuest Bio Inc. (2006 to present) (biotechnology company) |

214,400 Shares(5) |

(1) Member of the Audit Committee.

(2) Member of the Compensation Committee.

(3) Member of the Corporate Governance and Nominating Committee.

(4) Lumira Capital, of which Dr. Underdown is the managing director, holds 2,727,500 Shares.

(5) Of the Shares owned by Dr. Wright, 56,141 are registered in the name of Calliope Investments Limited.

(6) Lead Director.

| -9- |

The information as to principal occupation, business or employment and Shares beneficially owned or controlled is not within the knowledge of management of the Corporation and has been furnished by the respective nominees.

No proposed director is, as at the date of the Circular, or has been, within ten (10) years before the date of this Circular, a director, chief executive officer or chief financial officer of any company (including Lorus) that: (i) was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemption under Canadian securities legislation that was in effect for a period of more than 30 consecutive days, (ii) was subject to cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemption under Canadian securities legislation that was in effect for a period of more than 30 consecutive days that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer, (iii) while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets, or (iv) become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromised with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director.

Moreover, no proposed director of the Corporation has been subject to (i) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority, or (ii) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed director.

4. Amendments to the Share Option Plan, the DSU Plan and the ACP Plan

The Board approved, subject to the Toronto Stock Exchange (“TSX”) and Shareholder approval, certain amendments to the share option plan (the “Share Option Plan”), the deferred share unit plan (the “DSU Plan”) and the alternate compensation plan of the Corporation (the “ACP Plan” and, collectively with the Share Option Plan and the DSU Plan, the “Plans”) to: (i) remove the insider participation limits that currently provides that the number of Shares issuable to insiders of the Corporation, at any time, under all security based compensation arrangements of the Corporation cannot exceed 10% of the issued and outstanding Shares of the Corporation, that the number of Shares issued to insiders, within any one year period, under any security based compensation arrangement of the Corporation cannot exceed 10% of the issued and outstanding Shares of the Corporation and that any one insider may not, within a 12 month period, be issued a number of Shares under any security based compensation arrangement of the Corporation exceeding 10% of the number of issued and outstanding Shares of the Corporation; and (ii) remove the individual limit that provides that the number of Shares reserved for issuance under the security based compensation arrangements may not exceed 5% of the number of issued and outstanding Shares of the Corporation. Consequently, the Board also approved, subject to TSX and Shareholder approval, the removal of the requirement under the Share Option Plan to obtain the approval of the Shareholders for any amendment related to the increase in the limits on the grants of options to insiders of the Corporation. Our original stock option plan, the 1993 stock option plan, which was established in 1993 and replaced by the Share Option Plan in 2003, has been terminated by the Board as no option was outstanding thereunder.

| -10- |

As the Corporation is an early stage development company and has not begun earning significant revenue from its operations, it is expected to continue to have limited cash resources and must preserve its cash. Therefore, equity-based incentive compensation is a critical component of the compensation offered to directors, officers and consultants of the Corporation. With the current limits on insider and individual participation, that are proposed to be removed from the Share Option Plan, the Corporation considers that the pool of options and other equity-based awards available is insufficient to provide insiders with appropriate incentives to realize the Corporation’s business plans and to ultimately deliver value to the Shareholders. Furthermore, as the Corporation’s development continue, the Corporation may have to recruit and hire additional senior personnel, some of whom are likely to qualify as insiders for the purpose of the Share Option Plan, DSU Plan and ACP Plan. The limits would further reduce the Corporation’s flexibility and ability to recruit and retain highly qualified personnel. Subject to shareholder approval, the proposed amendments to the Plans have been conditionally approved by the TSX. See “Equity Compensation Plan Information” for a summary of the material provisions of the Plans.

As of the date hereof, the total number of Shares outstanding and available for issuance by the Corporation under the Plans is 9,300,967. The maximum number of Shares reserved for issuance collectively under the Plans may not exceed 15% of the Corporation’s issued and outstanding Shares at any given time. Any exercise of options pursuant to the Share Option Plan will make new option grants available under the Share Option Plan, provided that the maximum number of Shares reserved for issuance collectively under the Plans may not exceed 15% of the Corporation’s issued and outstanding Shares at any given time. As of the date hereof: (i) there are outstanding options to purchase 6,633,595 Shares issued under the Share Option Plan, representing 10.70% of the issued and outstanding Shares of the Corporation; (ii) there are no outstanding Shares issued under the ACP Plan; (iii) and there are outstanding deferred share units to acquire 780,000 Shares issued under the DSU Plan, representing 1.2% of the issued and outstanding Shares of the Corporation. Therefore, 1,887,372 Shares are remaining available for future issuance under the Corporation’s security based compensation arrangements, representing 3.1% of the issued and outstanding Shares of the Corporation.

Pursuant to the requirements of the TSX, the proposed amendments to the Plans require the approval of a majority of the votes cast by the Shareholders at the Meeting, but excluding the votes attached to 537,971 Shares held directly or indirectly by insiders of the Corporation that hold options under the Share Option Plan or deferred share units under the DSU Plan or that are otherwise eligible to participate in the Plans. In addition, if the proposed amendments are approved, because of the removal of insider participation limits, TSX rules provide that, for any further proposed amendment to the Plans submitted for approval to the Shareholders of the Corporation, the votes attached to any Shares held directly or indirectly by insiders of the Corporation that hold options under the Share Option Plan or deferred share units under the DSU Plan or that are otherwise eligible to participate in the Plans will be excluded from the vote pursuant to the requirements of the TSX. The directors of the Corporation recommend that the Shareholders vote in favour of the proposed amendments to the Plans.

The text of the resolution approving the proposed amendments to the Plans to be submitted to Shareholders at the Meeting is set forth below:

| -11- |

BE IT RESOLVED THAT:

| 1. | The Corporation is hereby authorized to amend its share option plan (the “Share Option Plan”), deferred share unit plan (the “DSU Plan”) and alternate compensation plan (the “ACP Plan” and, collectively with the Share Option Plan and the DSU Plan, the “Plans”) to: (i) remove the insider participation limits that currently provides that the number of common shares of the Corporation (the “Shares”) issuable to insiders of the Corporation, at any time, under all security based compensation arrangements of the Corporation cannot exceed 10% of the issued and outstanding Shares of the Corporation, that the number of Shares issued to insiders, within any one year period, under the any security based compensation arrangement of the Corporation cannot exceed 10% of the issued and outstanding Shares of the Corporation and that any one insider may not, within a 12 month period, be issued a number of Shares under any security based compensation arrangement of the Corporation exceeding 10% of the number of issued and outstanding Shares of the Corporation; and (ii) remove the individual limit that provides that the number of Shares reserved for issuance under the security based compensation arrangements may not exceed 5% of the number of issued and outstanding Shares of the Corporation; and |

| 2. | Any director or officer of the Corporation is authorized and directed to execute and deliver for and in the name of and on behalf of the Corporation, under its corporate seal or otherwise, all such certificates, instruments, agreements, notices and other documents and to do such other acts and things as, in the opinion of such persons, may be necessary or desirable in connection with the proposed amendments to the Plans, with the performance of the Corporation of its obligations in connection therewith, and to give effect to the foregoing and facilitate the implementation of the foregoing resolutions. |

Unless otherwise instructed by a Shareholder, the persons named in the accompanying form of proxy will vote “FOR” the resolution approving the amendments to the Plans.

STATEMENT OF EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

Composition of the Compensation Committee

The Board, upon the advice of the Compensation Committee, determines executive compensation. From June 1, 2010 to present, the Compensation Committee has been comprised of independent Board members Dr. Burger and Dr. Wright. Dr. Burger is chair of the Compensation Committee. The Compensation Committee met four times during the period lasting from June 1, 2012 until May 31, 2013. For more information on the Compensation Committee, please see the section entitled “Compensation” of the Corporation’s Corporate Governance Practices attached hereto as Appendix A.

Members of the Compensation Committee each have direct experience relevant to compensation matters resulting from their respective current and past activities. The members of the Compensation Committee have experience dealing with compensation matters in comparable organizations, including public companies, as well as companies with a strong emphasis on governance in their current and former roles as principal executives.

| -12- |

Compensation Objectives and Philosophy

The Compensation Committee’s mandate is to review and advise the Board on the recruitment, appointment, performance, compensation, benefits and termination of executive officers. The Compensation Committee also administers and reviews procedures and policies with respect to the Plans, employee benefit programs, pay equity and employment equity and reviews executive compensation disclosure where it is publicly disclosed.

Lorus’ executive compensation program is designed to:

| • | attract and retain qualified, motivated and achievement-oriented individuals by offering compensation that is competitive in the industry and marketplace; |

| • | align executive interests with the interests of Shareholders; and |

| • | ensure that individuals continue to be compensated in accordance with their personal performance and responsibilities and their contribution to the overall objectives of the Corporation. |

These objectives are achieved by offering executives and employees a compensation package that is competitive and rewards the achievement of both short-term and long-term objectives of the Corporation. As such, our compensation package consists of three key elements:

| • | base salary and initial share options; |

| • | short-term compensation incentives to reward corporate and personal performance through potential annual cash bonuses; and |

| • | long-term compensation incentives related to long-term increase in Share value through participation in the Share Option Plan. |

The Compensation Committee reviews each of these items on a stand-alone basis and also reviews compensation as a total package. Adjustments to compensation are made as appropriate following a review of the compensation package as a whole.

Base Salary - Initial Share Options

In establishing base salaries, the objective of the Compensation Committee is to establish levels that will enable Lorus to attract and retain executive officers that can effectively contribute to the long-term success of the Corporation. Base salary for each executive officer is determined by the individual’s skills, abilities, experience, past performance and anticipated future contribution to the success of Lorus. The members of the Compensation Committee use their knowledge of the industry and of industry trends to assist with the determination of an appropriate compensation package for each executive officer. In certain cases, the Compensation Committee may recommend inclusion of automobile allowances, fitness allowances and the payment of certain professional dues as a component of an overall remuneration package for executives.

In certain cases, executive officers may be granted share options on the commencement of employment with Lorus in accordance with the responsibility delegated to each executive officer for achieving corporate objectives and enhancing Shareholder value in accordance with those objectives.

| -13- |

Short-Term Compensation Incentives

The role of short-term compensation incentives at Lorus is to reward corporate and personal performance. Each year, the Board approves the annual corporate objectives encompassing scientific, clinical, regulatory, business and corporate development and financial criteria. The annual cash bonus for the executive officers is based, at least in part, on the level of achievement of these annual objectives. One hundred percent of the President and Chief Operating Officer’s and seventy-five percent of the other executive officers’ cash bonus is based on the level of achievement of corporate objectives. The balance of the other executive officers’ bonus is based on achievement of individual/departmental objectives.

All corporate and executive officer objectives are reviewed by the Compensation Committee and approved by the Board. The Compensation Committee recommends to the Board the awarding of bonuses, payable in cash, stock or share options, to reward extraordinary individual performance.

For each executive officer, during the fiscal year ended May 31, 2013, the annual cash bonuses ranged from 15% to 40% of base salary when all corporate and individual executive officer objectives were achieved.

Cash bonuses are determined as soon as practicable after the end of the fiscal year and, for the Named Executive Officers (as defined hereinafter), are included in the Summary Compensation Table in the year in respect of which they are earned.

Long-Term Incentive Plan

The role of long-term compensation incentives at Lorus is to reward an executive’s contribution to the attainment of Lorus’ long-term objectives, align an executive’s performance with the long-term performance of Lorus and to provide an additional incentive for an executive to enhance Shareholder value. Long-term incentive compensation for directors, officers, employees and consultants is reviewed annually and is accomplished through the grant of share options under our Share Option Plan.

The number of options granted for certain executives of Lorus for the fiscal year ended May 31, 2013 was based on achievement of both corporate and executive officer objectives. The Compensation Committee approves the allocation of options and options are priced using the closing market price of the Shares on the TSX on the last trading day prior to the date of grant. Options to purchase Shares expire ten years from the date of grant and vest over a term determined by the Compensation Committee. The Compensation Committee takes into account previous grants of options when considering new grant of options.

The granting of options to purchase Shares for Named Executive Officers is included in the Summary Compensation Table in the year that they are earned.

The Compensation Committee takes into account previous grants of options when considering new grant of options.

Performance Metrics

The performance of the Named Executive Officers for the 2013 financial year was measured in the following areas:

| -14- |

| 1. | Maximizing the value of LOR-253; |

| 2. | Maximizing the value of IL-17E; |

| 3. | Maximizing the value of LOR-500; |

| 4. | Establishing at least one corporate partnership; and |

| 5. | Equity financing to establish at least one year of cash. |

Each of the above is weighted at 20%, 25%, 5%, 30% and 20% respectively in relation to assessment of satisfaction of overall corporate objective and determination of any general corporate bonuses. Based on these criteria the Board assigned an achievement of 87%. Incentive compensation related to the attainment of these objectives will be paid in fiscal 2014. Similar performance metrics were established for the year ending May 31, 2014 based on the approved business plan for the current year.

Hedge or Offset Instruments

Named Executive Officers or directors are not permitted to purchase financial instruments that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by Named Executive Officers or directors, including, for greater certainty, prepaid variable forward contracts, equity swaps, collars, or units of exchange funds.

Risk Assessment of Compensation

The implications of the risks associated with the Corporation’s compensation practices were not considered by the Board or a committee of the Board.

PERFORMANCE GRAPH

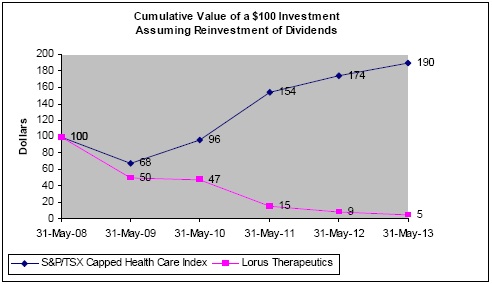

The following graph illustrates our cumulative total Shareholder return (assuming a $100 investment) for the Shares on the TSX as compared with the S&P/TSX Capped Health Care Index during the period from May 31, 2008 to May 31, 2013.

| -15- |

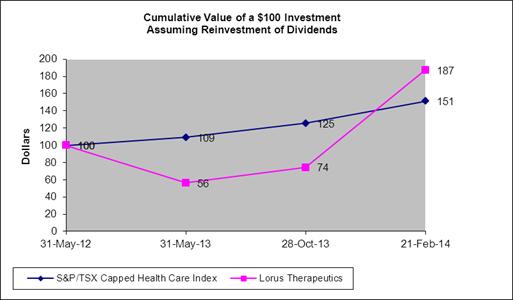

Subsequent to May 31, 2013 the Corporation completed a strategic review which resulted in the appointment of Dr. William Rice as Chief Executive Officer and Chairman of the Board of the Corporation on October 28, 2013. Following the appointment of Dr. Rice the Corporation has focused the future development of LOR-253 on acute myeloid leukemia (AML), myelodysplastic syndromes (MDS) and other hematologic malignancies, appointed Mr. Gregory Chow as Chief Financial Officer and Mr. Avanish Vellanki as Chief Business Officer and attracted several other key advisors. The Corporation believes these changes have created significant shareholder value as depicted in the graph below, which illustrates our cumulative total Shareholder return (assuming a $100 investment) for the Shares on the TSX as compared with the S&P/TSX Capped Health Care Index during the period from May 31, 2012 until February 21, 2014.

Compensation levels for the Named Executive Officers have not fluctuated to the same degree as Shareholder returns. Compensation does not solely reflect consideration of Corporation performance. Instead, compensation is determined in light of an overall compensation package that is considered appropriate in the circumstances.

| -16- |

Summary Compensation Table

The following table details the compensation information for the three most recent fiscal years of the Corporation, for the President and Chief Executive Officer, the Director of Finance and Acting Chief Financial Officer and the Vice President of Research (each, a “NEO” and, collectively the “Named Executive Officers”):

| Non-equity incentive plan compensation | ||||||||||||||

| Name and Principal Position | Fiscal Year ended May 31 |

Salary ($) |

Share-based awards(4) ($) | Option-based awards(1) ($) |

Annual incentive plans ($) |

Long-term incentive plans ($) |

Pension value ($) |

All other compensation ($) |

Total compensation

($) |

|||||

Dr. Aiping Young (2)(3) President and Chief Executive Officer |

2013 2012 2011 |

352,937 349,334 342,819 |

N/A 304,200 N/A |

443,100 49,500 644,711 |

128,416 Nil 127,845 |

Nil Nil Nil |

N/A N/A N/A |

Nil Nil Nil |

924,453 703,034 1,115,375 |

|||||

Ms. Elizabeth Williams(5) Director of Finance, Acting Chief Financial Officer |

2013 2012 2011 |

69,659 68,923 66,322 |

N/A N/A N/A |

42,200 27,238 54,385 |

9,535 Nil 808 |

Nil Nil Nil |

N/A N/A N/A |

Nil Nil Nil |

121,194 96,161 120,707 |

|||||

Dr. Yoon Lee Vice President Research |

2013 2012 2011 |

139,546 138,071 135,405 |

N/A N/A N/A |

63,300 27,983 61,183 |

26,484 Nil 25,599 |

Nil Nil Nil |

N/A N/A N/A |

Nil Nil Nil |

229,330 166,054 222,187 |

|||||

| (1) | In determining the fair value of these option-based awards, the Black-Scholes valuation methodology was used with the following assumptions: (i) expected life of five years; (ii) volatility of 135%; (iii) risk free interest rate of 3%; and (iv) no dividend yield. The Corporation has decided to use the Black-Scholes valuation methodology because it is equivalent to the option value reported in the Corporation’s consolidated financial statements. |

| (2) | Dr. Aiping Young was named Chief Operating Officer on October 28, 2013. On this date, she was replaced as Chief Executive Officer by William G. Rice, Ph. D. |

| (3) | Dr. Young did not receive any compensation for her role as a director of the Corporation. |

| (4) | During the year ended May 31, 2012, 780,000 deferred share units were issued to Dr. Aiping Young. The fair value of these deferred share units is marked to market and during the fiscal year ended May 31, 2013 the fair value had decreased from $304,200 at May 31, 2012 to $171,600 resulting in a reduction in value of $132,600. |

| (5) | Ms. Williams is employed on a part-time basis. |

| -17- |

INCENTIVE PLAN AWARDS

Outstanding Share-Based Awards and Option-Based Awards

The following tables show all awards outstanding to each NEO as at May 31, 2013:

| Option-based Awards | Share-based Awards | ||||||

| Name and Principal Position | Number of securities underlying unexercised options (#) |

Option exercise price ($) |

Option expiration date | Value of unexercised in-the-money options ($) (1) |

Number of shares or units of shares that have not vested (#) |

Market or payout value of share-based awards that have not vested ($) |

Market or payout value of vested share-based awards not paid out or distributed ($) |

Dr. Aiping Young President and Chief Executive Officer |

275,000 1,050,000

|

0.215 0.475 |

Nov 28, 2021 Aug 1, 2022

|

1,375 Nil

|

780,000

|

171,600

|

Nil

|

Ms. Elizabeth Williams Director of Finance, Acting Chief Financial Officer |

85,000 62,000 100,000 |

0.215 0.18 0.475 |

Nov 28, 2021 March 8, 2022 Aug 1, 2022 |

425 2,480 Nil |

- | - | - |

Dr. Yoon Lee Vice President, Research |

100,000 67,000 150,000 |

0.215 0.18 0.475 |

Nov 28, 2021 March 8, 2022 Aug 1, 2022 |

500 2,680 Nil |

- | - | - |

| (1) | These amounts are calculated based on the difference between the market value of the securities underlying the options on May 31, 2013 at the end of the fiscal year ($0.22), and the exercise price of the options. |

The 250,000 option grants to Ms. Elizabeth Williams and Dr. Yoon Lee during the fiscal year ended May 31, 2013 vest contingently upon the achievement of corporate objectives that the Compensation Committee has deemed to be the drivers of Shareholder value. These shares options vest 50% upon the achievement of the stated objectives, 25% on the next anniversary and 25% on the second anniversary. The options granted to Dr. Aiping Young vest 50% upon the first anniversary, 25% on the second anniversary and 25% on the third anniversary.

| -18- |

Value Vested or Earned During the Year

The following table sets forth for each Named Executive Officer the value vested or earned on all option-based awards, share-based awards, and non-equity incentive plan compensation during the fiscal year ended May 31, 2013:

| Name and Principal Position | Option-based awards - Value vested during the year ($) |

Share-based awards - Value vested during the year ($) |

Non-equity incentive plan compensation - Value earned during the year ($) |

Dr. Aiping Young President and Chief Executive Officer |

10,656 | Nil | Nil |

Ms. Elizabeth Williams Director of Finance, Acting Chief Financial Officer |

2,896 | Nil | Nil |

Dr. Yoon Lee Vice President Research |

3,131 | Nil | Nil |

PENSION PLAN BENEFITS

The Corporation does not provide pension plan benefits to its Named Executive Officers or employees of the Corporation.

TERMINATION AND CHANGE OF CONTROL BENEFITS

If the employment agreements of the Named Executive Officers are terminated by the Corporation other than for cause, Dr. Young shall be entitled to 18 months plus one additional month for each year of employment under the agreement in lieu of notice (approximately 25 months or $710,000 as at May 31, 2013), Dr. Lee shall be entitled to a notice period equal to 4 months plus one additional month for each year of employment, to a maximum of 12 months (approximately 12 months or $140,000 as at May 31, 2013) and Ms. Williams shall be entitled to the greater of one month and the applicable notice entitlement under employment legislation in the event of termination (approximately 9 months or $63,000 as at May 31, 2013). If the employment agreements are terminated by the Corporation other than for cause, then all unexercised share options then held by each are governed by the terms of the Share Option Plan. Further, if there is a change of control of the Corporation and Dr. Young’s employment within 36 months of a change of control of Lorus is terminated without cause or if she terminates the agreement with good reason as defined in the agreement, then she is entitled to receive the equivalent of two years’ of her basic salary plus one month salary for each year under the agreement (approximately $852,000 as at May 31, 2013), plus an annual bonus prorated over the severance period (based on the bonus paid in respect of the last completed fiscal year). The employment agreements of Dr. Lee and Ms. Williams do not include change of control provisions. All Named Executive Officers will also be entitled to benefits coverage for the severance period or a cash payment in lieu thereof.

| -19- |

COMPENSATION OF DIRECTORS

The following table details the compensation received by each director for the year ended May 31, 2013:

| Name | Fees earned

($) |

Share-based awards ($) |

Option-based awards ($)(1) |

Non-equity incentive plan compensation ($) | Pension value ($) |

All other Compensation ($) |

Total

($) |

| Mr. Herbert Abramson (2) | 34,500 | Nil | 6,330 | Nil | N/A | Nil | 40,830 |

| Dr. Denis Burger | 34,500 | Nil | 6,330 | Nil | N/A | Nil | 40,830 |

| Dr. Mark Vincent | 25,500 | Nil | 6,330 | Nil | N/A | Nil | 31,830 |

| Mr. Warren Whitehead | 31,500 | Nil | 6,330 | Nil | N/A | Nil | 37,830 |

| Dr. Jim Wright | 55,500 | Nil | 42,200 | Nil | N/A | Nil | 97,700 |

| (1) | In determining the fair value of these option awards, the Black-Scholes valuation methodology was used with the following assumptions: (i) expected life of five years; (ii) volatility of 135%; (iii) risk free interest rate of 3%; and (iv) no dividend yield. The Corporation has decided to use the Black-Scholes valuation methodology because it is equivalent to the option value reported in the Corporation’s consolidated financial statements. |

| (2) | Mr. Abramson resigned from the Board effective December 10, 2013. |

During the fiscal year ended May 31, 2013, each director who was not an officer of the Corporation was entitled to receive 15,000 share options (the Chair received 100,000) and, at his election, common shares, deferred share units and/or cash compensation for attendance at the Board committee meetings. Compensation consisted of an annual fee of $15,000 (the Chair received $35,000) and $1,500 per Board meeting attended ($4,500 to the Chair of a Board meeting). Members of the Audit Committee received an annual fee of $8,000 (the Chair received $10,000). Each member of the Compensation Committee and Corporate Governance and Nominating Committee received an annual fee of $5,000 per committee. Board members (including the Chair) receive $500 for meetings held via conference call. There have not been any changes to the fees from the prior year. Non-executive directors are reimbursed for any out-of pocket travel expenses incurred in order to attend meetings. Executive directors are not entitled to directors’ compensation or reimbursement of travel expenses.

Directors are entitled to participate in the DSU Plan. None of our directors except for Dr. Aiping Young participated in this plan in the fiscal years ended May 31, 2013 or 2012.

| -20- |

Incentive Plan Awards

Outstanding Share-Based Awards and Option Based Awards

The following table sets forth for each director, other than Named Executive Officers who are directors, all option-based and share-based awards outstanding at May 31, 2013:

| Option-based Awards | Share-based Awards | ||||||

| Name | Number of securities underlying unexercised options (#) |

Option exercise price

($) |

Option expiration date | Value of unexercised in-the-money options ($) (1) |

Number of shares or units of shares that have not vested (#) |

Market or payout value of share-based awards that have not vested ($) |

Market or payout value of vested share-based awards not paid out or distributed ($) |

| Mr. Herbert Abramson(2) | 15,000 25,000 15,000 |

$0.215 $0.18 $0.475 |

Nov 28, 2021 March 8, 2022 Aug 1, 2022 |

75 1,000 Nil |

Nil | Nil | Nil |

| Dr. Denis Burger | 15,000 50,000 50,000 15,000 |

$0.215 $0.215 $0.18 $0.475 |

Nov 28, 2021 Nov 28, 2021 March 8, 2022 Aug 1, 2022 |

75 250 2,000 Nil |

Nil | Nil | Nil |

| Dr. Mark Vincent | 15,000 25,000 15,000 |

$0.215 $0.18 $0.475 |

Nov 28, 2021 March 8, 2022 Aug 1, 2022 |

75 1,000 Nil |

Nil | Nil | Nil |

| Mr. Warren Whitehead | 15,000 6,000 15,000 |

$0.215 $0.18 $0.475 |

Nov 28, 2021 March 8, 2022 Aug 1, 2022 |

75 240 Nil |

Nil | Nil | Nil |

Dr. Jim Wright

|

30,000 500,000 25,000 100,000 |

$0.215 $0.215 $0.18 $0.475 |

Nov 28, 2021 Nov 28, 2021 March 8, 2022 Aug 1, 2022 |

150 2,500 1,000 Nil |

Nil | Nil | Nil |

| (1) | These amounts are calculated based on the difference between the market value of the securities underlying the options on May 31, 2013 at the end of the fiscal year ($0.22), and the exercise price of the options. |

| (2) | Mr. Abramson resigned from the Board effective December 10, 2013. |

| -21- |

Value Vested or Earned During the Year

The following table sets forth for each director the value vested or earned on all option-based awards, share-based awards, and non-equity incentive plan compensation during the financial year ending May 31, 2013.

| Name | Option-based awards - Value vested during the year ($) (1) |

Share-based awards - Value vested during the year ($) |

Non-equity incentive plan compensation - Value earned during the year ($) |

| Mr. Herbert Abramson (2) | 2,288 | Nil | Nil |

| Dr. Denis Burger | 3,413 | Nil | Nil |

| Dr. Mark Vincent | 2,288 | Nil | Nil |

| Mr. Warren Whitehead | 1,433 | Nil | Nil |

| Dr. Jim Wright | 3,450 | Nil | Nil |

| (1) | All options which vested during the year vested at the date of issue and the market value of the securities underlying the options was the same as the exercise price. |

| (2) | Mr. Abramson resigned from the Board effective December 10, 2013. |

INDEBTEDNESS

As of the date hereof, there is no indebtedness owing to the Corporation by any employees, officers or directors of the Corporation. The Corporation did not provide financial assistance to any employees, officers or directors for the purchase of securities during the fiscal year ended May 31, 2013 or from June 1, 2013 to the date hereof.

AUDIT COMMITTEE INFORMATION

Reference is made to the Annual Information Form of the Corporation dated July 11, 2013 for the fiscal year ended May 31, 2013, under the heading “Audit Committee Information” for a disclosure of information related to the Audit Committee required under Form 52-110F1 to National Instrument 52-110 - Audit Committees (“NI 52-110”). A copy of this document can be found on SEDAR at www.sedar.com, however we will promptly provide a copy of this document to any securityholder of the Corporation free of charge upon request.

DIRECTORS AND OFFICERS’ LIABILITY

We purchase and maintain liability insurance for the benefit of directors and officers to cover any liability incurred by such person in such capacities. The policy provides for coverage in the amount of $10,000,000 with a deductible amount of $150,000 (with certain exceptions). For the period June 1, 2012 to May 31, 2013, the premium cost of this insurance was $86,000.

| -22- |

MANAGEMENT CONTRACTS

The management functions of the Corporation are not, in any way, performed in a substantial degree by a person or persons other than the directors or the executive officers of the Corporation.

EQUITY COMPENSATION PLAN INFORMATION

Share Option Plan

The Share Option Plan was established to advance the interests of Lorus by:

| • | providing Eligible Persons (as defined below) with additional incentives; |

| • | encouraging stock ownership by Eligible Persons; |

| • | increasing the interest of Eligible Persons in the success of Lorus; |

| • | encouraging Eligible Persons to remain loyal to Lorus; and |

| • | attracting new Eligible Persons to Lorus. |

The Compensation Committee as authorized by the Board administers the Share Option Plan. The maximum total number of Shares available for issuance from treasury under the Share Option Plan, together with the DSU Plan, the ACP and any other security based compensation arrangement is 15% of the Corporation’s issued and outstanding Shares at any given time. Any exercise of options pursuant to the Share Option Plan will make new option grants available under the Share Option Plan, provided that the maximum number of Shares reserved for issuance collectively under the Plans may not exceed 15% of the Corporation’s issued and outstanding Shares at any given time.

Under the Share Option Plan, options may be granted to any executive officer, employee, subsidiary of an executive officer or employee, or consultant or consultant entity (“Eligible Persons”). Currently, the maximum number of Shares reserved for issuance to insiders, at any time, under the Share Option Plan and any other compensation arrangement of the Corporation is 10% of the issued and outstanding Shares of the Corporation. The maximum number of Shares that may be issued to insiders, at any time, under the Share Option Plan and any other compensation arrangement of the Corporation within a 12 month period is 10% of the issued and outstanding Shares of the Corporation. The maximum number of Shares reserved for issuance to any one person is 5% of the issued and outstanding Shares of the Corporation representing 3,097,572 Shares as of the date hereof. Such provisions are proposed to be removed from the Share Option Plan by the Corporation and such matter will be submitted for approval by the Shareholders at the Meeting.

The exercise price of options granted under the Share Option Plan is established by the Board and will be equal to the closing market price of the Shares on the TSX on the last trading day preceding the date of grant. If there is no trading on that date, the exercise price will be the average of the bid and ask on the TSX on the last trading date preceding the date of grant. If not otherwise determined by the Board, an option granted under the Share Option Plan will vest as to 50% on the first anniversary of the date of grant of the option and an additional 25% on the second and third anniversaries after the date of grant. The Board fixes the term of each option when granted, but such term may not be greater than 10 years from the date of grant. If the date on which an option expires pursuant to an option agreement occurs during, or within 10 days after the last day of, a black out period or other restriction period imposed on the trading of Shares by the Corporation, the expiry date for the option will be the last day of the 10-day period. Options are personal to the participant and a participant may not transfer an option except in accordance with the Share Option Plan.

| -23- |

The Board may, its sole discretion, amend, suspend or terminate the Share Option Plan or any portion of it at any time in accordance with applicable legislation, without obtaining the approval of Shareholders. Any amendment to any provision of the Share Option Plan is subject to any required regulatory or Shareholder approval. The Corporation is, however, required to obtain the approval of the Shareholders for any amendment related to (i) the maximum number of Shares reserved for issuance under the Share Option Plan, and under any other security based compensation arrangements of the Corporation; (ii) a reduction in the exercise price for options held by insiders of the Corporation; and (iii) an extension to the term of options held by insiders of the Corporation. In addition, the Corporation is required to obtain the approval of the shareholders for any amendment related to the increase in the limits on the grants of options to insiders of the Corporation and any shareholder approval required in respect of an amendment to increase such limits shall exclude the votes attaching to Shares, if any, held by Eligible Persons who are insiders of the Corporation. This provision is proposed to be removed from the Share Option Plan by the Corporation in accordance with the proposed amendment to insider participation limits and such matter will be submitted for approval by the Shareholders at the Meeting.

If an option holder is terminated without cause, resigns or retires, each option that has vested will cease to be exercisable three months after the option holder’s termination date. Any portion of an option that has not vested on or prior to the termination date will expire immediately. If an option holder is terminated for cause, each option that has vested will cease to be exercisable immediately upon the Corporation’s notice of termination. Any portion of an option that has not vested on or prior to the termination date will expire immediately.

During the period from June 1, 2012 to May 31, 2013, options to purchase 1,780,000 Shares were granted under the Share Option Plan at an exercise price of $0.475 per Share. During the year ended May 31, 2013, we granted options to employees, other than executive officers of the Corporation, to purchase 320,000 Shares, being 18% of the total incentive stock options granted during the year to employees, executive officers and directors. Since May 31, 2013, there have been 3,358,004 options to purchase Shares granted under the Share Option Plan at exercise prices ranging from $0.29 to $0.78. During this period we granted options to employees and consultants other than executive officers of the Corporation to purchase 388,004 Shares, being 12% of the total stock options granted during the period to employees, executive officers, consultants and directors.

Alternate Compensation Plan

The Corporation has an ACP Plan which enables Lorus to meet its obligations to pay directors’ fees, salary and performance bonuses to certain employees in the form of Shares. The ACP Plan permits the Corporation to, in circumstances considered appropriate by the Board, encourage the ownership of equity of the Corporation by its directors and senior employees (“ACP Participants”), enhance the Corporation’s ability to retain key personnel and reward significant performance achievements while preserving the cash resources of the Corporation.

Under the ACP Plan, ACP Participants have the option of receiving director’s fees, salary, bonuses or other remuneration, as applicable (“Remuneration”) by the allotment and issuance from treasury of such number of Shares as will be equivalent to the cash value of the Remuneration determined by dividing the Remuneration by the weighted average closing Share price for the five (5) trading days prior to payment date (the “5-day VWAP”). The issue price of Shares issued under the ACP is the 5-day VWAP. Upon ceasing to be an ACP Participant, such ACP Participant will no longer be eligible to receive Shares under the ACP Plan and any amounts owing to such ACP Participant shall be paid without reference to the ACP Participant.

| -24- |

Currently, the maximum number of Shares that may be reserved for issuance to insiders, at any time, under the ACP Plan and any other compensation arrangement of the Corporation is 10% of the issued and outstanding Shares of the Corporation. The maximum number of Shares that may be issued to insiders, at any time, under the ACP Plan and any other compensation arrangement of the Corporation within a 12 month period is 10% of the issued and outstanding Shares of the Corporation. The maximum number of Shares reserved for issuance under the ACP Plan to any one ACP Participant is 5% of the issued and outstanding Shares of the Corporation on a non-diluted basis. Such provisions are proposed to be removed from the ACP Plan by the Corporation and such matters will be submitted for approval by the Shareholders at the Meeting.

The maximum number of Shares reserved for issuance under the ACP Plan, when combined with the Share Option Plan and the DSU Plan, if the proposed amendments to the ACP Plan are approved at the Meeting, will not exceed 15% of the Corporation’s issued and outstanding Shares at any given time.

There have been no Shares issued under the ACP Plan during the year ending May 31, 2013. Since May 31, 2013, there have been no Shares issued under the ACP Plan.

The Board may, at any time and from time to time, amend, suspend or terminate the ACP Plan without Shareholder approval, provided that no such amendment, suspension or termination may be made without obtaining any required approval of any regulatory authority or stock exchange. Notwithstanding the foregoing, the Board may not, without the approval of the Shareholders, make amendments to the ACP Plan to increase the maximum number of Shares issuable under the ACP Plan, or to amend the provisions regarding Shareholder approval.

Deferred Share Units Plan

The Corporation adopted the DSU Plan on April 17, 2000 which provides that participating directors and senior officers (“DSU Participants”) may elect to receive either a portion or all of the remuneration to be received from the Corporation in deferred share units. Such remuneration includes all amounts payable in cash or Shares (subject to election otherwise under the DSU Plan) to a DSU Participant by the Corporation or a subsidiary of the Corporation in respect of the services provided to the Corporation or subsidiary by the DSU Participant in any calendar year, including (a): in the case of a director, without limitation, (i) annual Board or committee of the Board or advisory retainer fees, (ii) fees for attending meetings of the Board or a committee of the Board and (iii) fees for serving as chairman or chairwoman of any committee of the Board, but, for greater certainty, excluding amounts payable to a DSU Participant as a reimbursement for expenses incurred in attending meetings; and (b): in the case of a senior officer, without limitation, those services for which a salary or cash bonus would normally be paid, provided that the relevant performance criteria which serve as a basis for the granting of such bonuses have been met.

Under the DSU Plan, the deferred share units that DSU Participants elect to receive for remuneration earned are credited to each DSU Participant’s account in an amount of units equal to the gross amount of remuneration to be deferred divided by the fair market value of the Shares, being the closing price of the Shares on the TSX on the day immediately preceding the recommendation by the Compensation Committee or such other amount as determined by the Board and permitted by the applicable regulatory authorities. Rights respecting deferred share units are not transferable or assignable other than by will or by the laws of descent and distribution.

| -25- |

A DSU Participant who has retired, resigned or has been terminated without cause from all positions with the Corporation and any subsidiary of the Corporation may redeem the deferred share units credited to the DSU Participant’s account. Subject to the approval of the Compensation Committee, the DSU Participant may indicate what portion of the payment is to be paid in cash and what portion is to be paid in Shares. A DSU Participant who has been terminated with cause may not redeem the deferred share units held by that DSU Participant and those deferred share units so held will be deemed cancelled as of the date of termination of the DSU Participant.

Currently, the maximum number of Shares that may be reserved for issuance to insiders, at any time, pursuant to deferred share units granted under the DSU Plan and any other compensation arrangement of the Corporation is 10% of the issued and outstanding Shares of the Corporation. The maximum number of Shares that may be issued to insiders, at any time, pursuant to deferred share units granted under the DSU Plan and any other compensation arrangement of the Corporation within a 12 month period is 10% of the issued and outstanding Shares of the Corporation. The maximum number of Shares reserved for issuance pursuant to deferred share units granted under the DSU Plan to any one DSU Participant is 5% of the issued and outstanding Shares of the Corporation on a non-diluted basis. Such provisions are proposed to be removed from the DSU Plan by the Corporation and such matters will be submitted for approval by the Shareholders at the Meeting.

The maximum number of Shares reserved for issuance under the DSU Plan, when combined with the Share Option Plan and the ACP Plan, if the proposed amendments to the DSU Plan are approved at the Meeting, will not exceed 15% of the Corporation’s issued and outstanding Shares at any given time.

During the period from June 1, 2012 to May 31, 2013, nil deferred share units were issued to DSU Participants under the DSU Plan. Since May 31, 2013, there have been no deferred share units issued under the DSU Plan.

The Board may amend the DSU Plan as it deems necessary or appropriate without Shareholder approval, subject to applicable corporate, securities and tax law requirements, but no amendment will, without the consent of the DSU Participant or unless required by law, adversely affect the rights of a DSU Participant with respect to deferred share units that have been credited to the account of the DSU Participant at the time of such amendment to the DSU Plan. Notwithstanding the foregoing, the Board must obtain Shareholder approval to increase to the maximum number of securities reserved for issuance under the DSU Plan or any other security based compensation arrangement, or to amend the provisions regarding Shareholder approval.

Employee Share Purchase Plan

We have an Employee Share Purchase Plan (“ESPP”) with the purpose of the ESPP to assist the Corporation to retain the services of its employees, to secure and retain the services of new employees and to provide incentives for such persons to exert maximum efforts for the success of the Corporation. The ESPP provides a means by which employees of the Corporation and its affiliates may purchase Shares on the stock market at a 15% discount through accumulated payroll deductions. Eligible participants in the ESPP include all employees, including executive officers, who work at least 20 hours per week and are customarily employed by the Corporation or an affiliate of the Corporation for at least six months per calendar year. Generally, each offering is of three months’ duration with purchases occurring every quarter. Participants may authorize payroll deductions of up to 15% of their base compensation for the purchase of Shares under the ESPP.

| -26- |

During the year ended May 31, 2013, under the ESPP, Named Executive Officers, as a group, and employees did not purchase any Shares pursuant to the ESPP. Since May 31, 2013, there have been no Shares purchased pursuant to the ESPP.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table sets forth certain details as at the end of the fiscal year of Lorus, ended May 31, 2013 with respect to compensation plans pursuant to which equity securities of the Corporation are authorized for issuance.

Number of Shares to be issued upon exercise of outstanding options, warrants and rights (a) |

Weighted- average exercise price of outstanding options, warrants and rights (b) |

Number of Shares remaining available for future issuance under the equity compensation plans (Excluding Shares reflected in Column (a)) (c) |

Total options, warrants and rights outstanding and available for grant

(a) + (c) | ||||

| Plan Category | Number | % of Shares outstanding | Number | % of Shares outstanding | Number | % of Shares outstanding | |

| Equity compensation plans approved by Shareholders |

4,138,116 |

10% |

$0.46 |

2,199,546 |

5% |

6,337,662 |

15% |

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

None of the directors or executive officers of the Corporation, none of the persons who have been directors or executive officers of the Corporation at any time since June 1, 2012, none of the proposed nominees for election as a director of the Corporation and none of the associates or affiliates of any of the foregoing has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter scheduled to be acted upon at the Meeting other than the election of directors and as disclosed under the heading “PARTICULARS OF MATTERS TO BE ACTED UPON - Amendments to the Share Option Plan, the DSU Plan and the ACP Plan” of this Circular.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Since the commencement of the Corporation’s most recently completed financial year, no director, proposed director, officer, or associate of a director, proposed director or officer nor, to the knowledge of our directors or officers, after having made reasonable inquiry, any person or company who beneficially owns, directly or indirectly, Shares carrying more than 10% of the voting rights attached to all Shares outstanding at the date hereof, or any associate or affiliate thereof, had any material interest, direct or indirect, in any material transaction of the Corporation, nor do any such persons have a material interest, direct or indirect, in any proposed transaction of the Corporation.

| -27- |

STATEMENT OF CORPORATE GOVERNANCE PRACTICES

Corporate governance relates to the activities of the Board, the members of which are elected by and are accountable to the Shareholders, and takes into account the role of the individual members of management who are appointed by the Board and who are charged with the day-to-day management of Lorus. The Board believes that sound corporate governance practices are essential to contributing to the effective and efficient decision-making of management and the Board and to the enhancement of Shareholder value. The Board and management believe that Lorus has a sound governance structure in place for both management and the Board. Of particular note Lorus has:

| • | established a written mandate of the Board; |

| • | established a written charter for the Audit Committee; |

| • | established a written charter for the Compensation Committee; |

| • | established a written charter for the Corporate Governance and Nominating Committee; |

| • | established a written Disclosure and Insider Trading Policy; and |

| • | established a written Code of Ethics. |

National Instrument 58-101 - Disclosure of Corporate Governance Practices (“NI 58-101”) and National Policy 58-201 - Corporate Governance Guidelines (“NP 58-201”) requires issuers, including Lorus, to disclose the corporate governance practices that they have adopted. NP 58-201 provides guidance on governance practices. The Corporation is also subject to NI 52-110, which has been adopted in various Canadian provinces and territories and which prescribes certain requirements in relation to audit committees. The required disclosure under NI 58-101 is attached hereto as Appendix A.

2014 SHAREHOLDER PROPOSALS

For the next annual meeting of Shareholders of Lorus, Shareholders must submit any proposal that they wish to raise at that meeting on or before August 1, 2014.

ADDITIONAL INFORMATION

Additional information relating to us, including our most current annual information form (together with documents incorporated therein by reference), our financial statements for the fiscal year ended May 31, 2013, the report of the auditor thereon, management’s discussion and analysis of our financial condition and results of operations for fiscal 2013 and our interim financial statements for periods subsequent to the end of our last financial year, can be found on the System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com. Copies of those documents are available upon written request to the Director of Finance of Lorus, upon payment of a reasonable charge where applicable. Our financial information is provided in our consolidated financial statements for the year ended May 31, 2013 and management’s discussion and analysis of our financial condition and results of operations for year ended May 31, 2013.

| -28- |

DIRECTORS’ APPROVAL

The contents and sending of this Circular have been approved by our directors.

(signed)

William G. Rice, Ph. D.

Chairman of the Board of Directors and

Chief Executive Officer

APPENDIX A

Corporate Governance Practices

Lorus Therapeutics Inc. (the “Corporation”) is committed to sound and comprehensive corporate governance policies and practices and is of the view that its corporate governance policies and practices, outlined below, are comprehensive and consistent with National Policy 58-201 - Corporate Governance Guidelines (“NP 58-201”), and National Instrument 52-110 - Audit Committees (“NI 52-110”).

Board of Directors

The board of directors of the Corporation (the “Board”) encourages sound and comprehensive corporate governance policies and practices designed to promote the ongoing development of the Corporation.

Composition of the Board