|

Notice and Management Proxy Circular

For the

Annual and Special Meeting of Shareholders

to be held on November 29, 2012

October 15, 2012

Lorus Therapeutics Inc.

Notice of 2012 Annual and Special Meeting of Shareholders

NOTICE IS HEREBY GIVEN that the annual and special meeting (the “Meeting”) of shareholders of Lorus Therapeutics Inc. (the “Corporation”) will be held at the offices of McCarthy Tétrault LLP, Toronto Dominion Bank Tower, 66 Wellington Street West, Suite 5300, Toronto, Ontario on Thursday, November 29, 2012 at 10:00 a.m. (Toronto time).

What the Meeting is About

We will be covering five items of business at the Meeting:

|

1.

|

receiving the financial statements of the Corporation for the financial year ended May 31, 2012, including the auditors' report;

|

|

2.

|

electing directors;

|

|

3.

|

appointing KPMG LLP as auditors of the Corporation for the ensuing year and to authorize the directors to fix the remuneration to be paid to the auditors;

|

|

4.

|

to consider, and if deemed advisable, pass a resolution in the form included in the Circular accompanying this Notice of Meeting approving amendments to the deferred share unit plan of the Corporation; and

|

|

5.

|

to transact such other business as may be properly brought before the Meeting.

|

The Meeting may also consider other business that properly comes before the Meeting or any adjournment of the Meeting. The Circular accompanying this notice of Meeting provides additional information relating to the matters to be dealt with at the Meeting and forms part of this notice.

You have the right to vote

You are entitled to receive notice of and vote at the Meeting, or any adjournment, if you are a holder of Shares of the Corporation on October 15, 2012.

You have the right to vote your Shares on items 2, 3 and 4 listed above and any other items that may properly come before the Meeting or any adjournment.

Your vote is important

If you are not able to be present at the Meeting, please exercise your right to vote by signing and returning the enclosed form of proxy to Computershare Investor Services Inc., 100 University Avenue, 8th Floor, Toronto, Canada M5J 2Y1, so as to arrive not later than 10:00 a.m. on Tuesday, November 27, 2012 or, if the Meeting is adjourned, 48 hours (excluding Saturdays, Sundays and holidays) before any adjournment of the Meeting.

BY ORDER OF THE BOARD OF DIRECTORS

“Aiping Young”

Aiping Young

President and Chief Executive Officer

Toronto, Canada

October 15, 2012

2

MANAGEMENT PROXY CIRCULAR

OCTOBER 15, 2012

PROXY INFORMATION

Solicitation of Proxies

The information contained in this management proxy circular (the “Circular”) is furnished in connection with the solicitation of proxies to be used at the annual and special meeting (the “Meeting”) of holders (the “Shareholders”) of common shares (the “Shares”) of Lorus Therapeutics Inc. (the “Corporation”, “Lorus”, “we” or “our”) to be held on Thursday, November 29, 2012 at 10:00 a.m. (Toronto time) at the offices of McCarthy Tétrault LLP, Toronto Dominion Bank Tower, 66 Wellington Street West, Suite 5300, Toronto, Ontario and at all adjournments thereof, for the purposes set forth in the accompanying notice of Meeting. It is expected that the solicitation will be made primarily by mail but proxies may also be solicited personally by directors, officers, employees or agents of the Corporation. The solicitation of proxies by this Circular is being made by or on behalf of the management of the Corporation. The total cost of the solicitation will be borne by Lorus. The information contained in this Circular is given as at October 15, 2012 except where otherwise noted.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This Circular contains forward-looking statements within the meaning of securities laws, including without limitation, amount of payments required to Named Executive Officers (as such term is defined hereinafter) in the event of termination or a change in control. Such statements include, but are not limited to the Corporation’s plans, objectives, expectations and intentions and other statements including words such as “anticipate”, “contemplate”, “continue”, “believe”, “plan”, “estimate”, “expect”, “intend”, “will”, “should”, “may”, and other similar expressions.

Such statements reflect our current views with respect to future events and are subject to risks and uncertainties and are necessarily based upon a number of estimates and assumptions that, while considered reasonable by us are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors could cause our actual results, performance or achievements to be materially different from any future results, performance, or achievements that may be expressed or implied by such forward-looking statement. See our Annual Information Form dated August 3, 2012 for the fiscal year ended May 31, 2012 for additional information. A copy of this document can be found on SEDAR at www.sedar.com, however we will promptly provide a copy of this document to any securityholder of the Corporation free of charge upon request.

ABOUT VOTING YOUR SHARES

Appointment of Proxies

This is the easiest way to vote. Voting by proxy means that you are giving the person or people named on your proxy form (the “proxyholder”) the authority to vote your Shares for you at the Meeting or any adjournment. A proxy form is included with this Circular.

3

The persons named on the proxy form will vote your Shares for you, unless you appoint someone else to be your proxyholder. You have the right to appoint a person or company to represent you at the Meeting other than the persons named on the proxy form. If you appoint someone else, he or she must be present at the Meeting to vote your Shares. If you want to appoint someone else, you can insert that person's name in the blank space provided in the form of proxy. That other person does not need to be a Shareholder of the Corporation.

If you are voting your Shares by proxy, our transfer agent, Computershare Investor Services Inc. (“Computershare”), must receive your completed proxy form by 10:00 a.m. (Toronto time) on Tuesday, November 27, 2012 or, if the Meeting is adjourned, 48 hours (excluding Saturdays, Sundays and holidays) before any adjournment of the Meeting.

Registered Shareholders

You are a registered Shareholder if your name appears on your Share certificate. Your proxy form tells you whether you are a registered Shareholder.

Non-Registered (or Beneficial) Shareholders

You are a non-registered (or beneficial) Shareholder if your bank, trust company, securities broker or other financial institution holds your Shares for you (your nominee). For most of you, your voting instruction form or proxy tells you whether you are a non-registered (or beneficial) Shareholder.

In accordance with Canadian securities law, we have distributed copies of the notice of Meeting, this Circular and the form of proxy (collectively, the “meeting materials”) to CDS Clearing and Depository Services Inc. and intermediaries (such as securities brokers or financial institutions) for onward distribution to those non-registered or beneficial Shareholders to whom we have not sent the meeting materials directly. We previously mailed to those who requested them, the audited financial statements of the Corporation for the fiscal year ended May 31, 2012 and the auditors' report thereon as well as management's discussion and analysis.

The intermediaries are required to forward meeting materials to non-registered or beneficial Shareholders unless a non-registered or beneficial Shareholder has waived the right to receive them. Very often, intermediaries will use a service company such as Broadridge Investor Communication Solutions to forward the meeting materials to non-registered or beneficial Shareholders.

Non-registered or beneficial Shareholders who have not waived the right to receive meeting materials will receive either a voting instruction form or, less frequently, a form of proxy. The purpose of these forms is to permit non-registered or beneficial Shareholders to direct the voting of the Shares they beneficially own. Non-registered or beneficial Shareholders should follow the procedures set out below, depending on what type of form they receive.

|

A.

|

Voting Instruction Form. In most cases, a non-registered Shareholder will receive, as part of the meeting materials, a voting instruction form. If the non-registered Shareholder does not wish to attend and vote at the Meeting in person (or have another person attend and vote on the non-registered Shareholder's behalf), the voting instruction form must be completed, signed and returned in accordance with the directions on the form. If a non-registered Shareholder wishes to attend and vote at the Meeting in person (or have another person attend and vote on the non-registered Shareholder's behalf), the non-registered Shareholder must complete, sign and return the voting instruction form in accordance with the directions provided and a form of proxy giving the right to attend and vote will be forwarded to the non-registered Shareholder.

|

4

|

or

|

|

|

B.

|

Form of Proxy. Less frequently, a non-registered Shareholder will receive, as part of the meeting materials, a form of proxy that has already been signed by the intermediary (typically by a facsimile or stamped signature), which is restricted as to the number of Shares beneficially owned by the non-registered Shareholder but which is otherwise uncompleted. If the non-registered Shareholder does not wish to attend and vote at the Meeting in person (or have another person attend and vote on the non-registered Shareholder's behalf), the non-registered Shareholder must complete the form of proxy and deposit it with Computershare, 100 University Avenue, 8th Floor Toronto, Canada, M5J 2Y1 as described above. If a non-registered Shareholder wishes to attend and vote at the Meeting in person (or have another person attend and vote on the non-registered Shareholder's behalf), the non-registered Shareholder must strike out the names of the persons named in the proxy and insert the non-registered Shareholder's (or such other person's) name in the blank space provided.

|

Non-registered Shareholders should follow the instructions on the forms they receive and contact their intermediaries promptly if they need assistance.

Meeting Materials

The meeting materials are being sent to both registered and non-registered owners of Shares. If you are a non-registered owner, and the Corporation or its agent has sent the meeting materials directly to you, your name and address and information about your holdings of securities, have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding on your behalf.

By choosing to send the meeting materials to you directly, the Corporation (and not the intermediary holding on your behalf) has assumed responsibility for (i) delivering the meeting materials to you, and (ii) executing your proper voting instructions. Please return your voting instructions as specified in the request for voting securities.

Changing Your Vote

A registered Shareholder who has given a proxy may revoke that proxy by:

|

|

(a)

|

completing and signing a proxy bearing a later date and depositing it with Computershare as described above;

|

|

|

(b)

|

depositing an instrument in writing executed by the Shareholder or by the Shareholder's attorney authorized in writing:

|

|

|

(i)

|

at our registered office at any time before 10:00 a.m. on Tuesday, November 27, 2012, or 48 hours (not including Saturdays, Sundays and holidays) before any adjournment of the Meeting at which the proxy is to be used, or

|

|

|

(ii)

|

with the chair of the Meeting prior to the commencement of the Meeting on the day of the Meeting or any adjournment of the Meeting; or

|

|

|

(c)

|

in any other manner permitted by law.

|

5

A non-registered or beneficial Shareholder may revoke a voting instruction form or a waiver of the right to receive meeting materials and to vote given to an intermediary or to the Corporation, as the case may be, at any time by written notice to the intermediary or the Corporation, except that neither an intermediary nor the Corporation is required to act on a revocation of a voting instruction form or of a waiver of the right to receive materials and to vote that is not received by such intermediary or the Corporation, at least seven (7) days prior to the Meeting.

VOTING OF PROXIES

You can choose to vote “For”, “Against” or “Withhold”, depending on the items listed on the proxy form.

When you sign the proxy form, you authorize the management representatives named in the proxy form to vote your Shares for you at the Meeting according to your instructions.

If you return your proxy form and do not tell us how you want to vote your Shares, your Shares will be voted by the management representatives named in the proxy form as follows:

• FOR the election of the directors nominated for election as listed in this Circular;

• FOR the appointment of KPMG LLP as auditors of the Corporation; and

|

|

•

|

FOR the approval of the amendments to the deferred share unit plan of the Corporation (the “DSU Plan”).

|

The enclosed form of proxy confers discretionary authority upon the management representatives designated in the form of proxy with respect to amendments to or variations of matters identified in the notice of Meeting and with respect to other matters that may properly come before the Meeting. At the date of this Circular, the management of the Corporation knows of no such amendments, variations or other matters.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

On October 15, 2012, 42,251,081 Shares are issued and outstanding. Each holder of Shares of record at the close of business on October 15, 2012, the record date established for notice of the Meeting, will be entitled to one vote for each Share held on all matters proposed to come before the Meeting, except to the extent that the Shareholder has transferred any Shares after the record date and the transferee of such Shares establishes ownership of them and makes a written demand, not later than 10 days prior to the Meeting, to be included in the list of Shareholders entitled to vote at the Meeting, in which case the transferee will be entitled to vote such Shares.

To the knowledge of Lorus' directors and executive officers, no single person or entity beneficially owns, directly or indirectly, or exercises control or direction over more than 10% of the votes attached to all the outstanding Shares, other than Mr. Herbert Abramson and his affiliated company Technifund Inc. who, according to information furnished to the Corporation, hold 8,938,041 Shares or approximately 21.15% of the Shares issued and outstanding, Pinetree Capital Ltd. who together with its joint actors, according to publicly filed records hold 5,000,000 Shares or approximately 11.8% of the Shares issued and outstanding and Sprott Asset Management LP who according to publicly filed records hold 4,550,000 Shares or approximately 10.8% of the Shares issued and outstanding .

6

PARTICULARS OF MATTERS TO BE ACTED UPON

1. Appointment and Remuneration of Auditors

Unless you have specified in the enclosed form of proxy that the votes attaching to the Shares represented by the proxy are to be withheld with respect to the appointment of auditors, on any ballot that may be called for in the appointment of auditors, the management representatives designated in the enclosed form of proxy intend to vote the Shares in respect of which they are appointed proxy FOR the appointment of KPMG LLP, Chartered Accountants, as auditors of the Corporation to hold office until the next annual meeting of Shareholders, and authorizing the directors to fix the remuneration of the auditors.

2. Election of Directors

Unless they resign, all directors elected at the Meeting will hold office until our next annual meeting of Shareholders or until their successors are elected or appointed.

Unless you have specified in the enclosed form of proxy that the votes attaching to the Shares represented by the proxy are to be withheld with respect to the election of directors, on any ballot that may be called for in the election of directors, the management representatives designated in the enclosed form of proxy intend to vote the Shares in respect of which they are appointed proxy FOR the election as directors of the proposed nominees whose names are set forth below.

Management does not contemplate that any of the proposed nominees will be unable to serve as a director but, if that should occur for any reason prior to the Meeting, the management representatives designated in the enclosed form of proxy may vote for another nominee at their discretion.

Pursuant to the articles of the Corporation, the number of directors of the Corporation is set at a minimum of three and a maximum of eleven and the directors are authorized to determine the actual number of directors to be elected from time to time.

The Corporation currently has six directors, and is proposing six directors for nomination.

The following table sets out for all persons proposed to be nominated by management for election as director, the name and place of residence, all major positions and offices with the Corporation now held by them, the period during which they have served as directors of the Corporation, their present principal occupation and principal occupation for the preceding five years, and the number of Shares beneficially owned, directly or indirectly, by each of them, or over which they exercise control or direction as at October 15, 2012.

The Corporation has an Audit Committee, a Corporate Governance and Nominating Committee and a Compensation Committee. The members of these committees are indicated in the table below.

7

|

Name Of Director, Province/State and Country of Residence

|

Director Since

|

Present and Past Principal Occupation or Employment

|

No. of Securities Beneficially Owned, Controlled or Directed

|

|

HERBERT ABRAMSON(1) (3)

Ontario, Canada

|

July 2007

|

Chairman and Portfolio Manager, Trapeze Capital Corp. (1998 to present) (investment dealer)

Chairman and Portfolio Manager, Trapeze Asset Management Inc. (1999 to present) (portfolio manager)

|

8,938,041 Shares and 2,444,500 warrants to purchase Shares(4)

|

|

DR. DENIS BURGER(1) (2)

Oregon, United States

|

September 2007

|

Executive Chairman, BioCurex, Inc. (2009 to present)

President, Yamhill Valley Vineyards, Inc.

Retired, served on several Boards of Directors (2007 to 2009)

|

51,987 Shares

|

|

DR. MARK D. VINCENT (3)

Ontario, Canada

|

September 2007

|

Physician; medical oncologist (1990 to present)

London Regional Cancer Program Cancer Care Ontario

Chief Executive Officer, Sarissa Inc. (2000 to present) (biotechnology company focused on development of targeted products for the therapeutic manipulation of gene expression)

|

Nil

|

|

WARREN WHITEHEAD(1)

Ontario, Canada

|

April 2011

|

Director of Plantform (2009 to present)

(A private biotechnology company)

Chief Financial Officer of Arius Research Inc. (2006 to 2008)

(A biotechnology company focused on the development of antibody drug candidates acquired by Roche in 2008)

|

Nil

|

|

DR. JIM A. WRIGHT (2)

Ontario, Canada

|

October 1999

|

Adjunct Professor, Department of Biochemistry and Biomedical sciences, McMaster University (2010 to present)

Chief Executive Officer of NuQuest Bio Inc. (2006 to present) (start-up biotechnology company with the intention of developing novel therapies for treatment of life threatening diseases)

Senior Investigator, Manitoba Institute of Cell Biology (1982 to 1998, on Leave from 1998)

|

214,400 Shares(5)

|

|

DR. AIPING YOUNG

Ontario, Canada

|

September 2006

|

President and Chief Executive Officer of the Corporation (2006 to present)

|

221,584 and 125,000 warrants to purchase Shares(6)

|

|

(1)

|

Member of the Audit Committee.

|

|

(2)

|

Member of the Compensation Committee.

|

|

(3)

|

Member of the Corporate Governance and Nominating Committee.

|

|

(4)

|

Warrants to purchase Shares were acquired under the August 2011 unit offering and are exercisable into a Share at a price of $0.45 expiring in August 2016.

|

|

(5)

|

Of the Shares owned by Dr. Wright, 56,141 are registered in the name of Calliope Investments Limited.

|

|

(6)

|

Warrants to purchase Shares were acquired under the August 2011 unit offering and are exercisable into a Share at a price of $0.45 expiring in August 2016.

|

The information as to principal occupation, business or employment and Shares beneficially owned or controlled is not within the knowledge of management of the Corporation and has been furnished by the respective nominees.

8

No proposed director is or has been, during the ten (10) years preceding the date of this Circular, a director or executive officer, including a chief executive officer or chief financial officer of a company that: (i) while exercising this function, was subject to a cease trade or similar order or an order to deny the relevant company the right to invoke any exemption under Canadian securities legislation for more than 30 consecutive days, (ii) has been the subject to a cease trade or similar order or an order to deny the relevant company the right to invoke any exemption under Canadian securities legislation for more than 30 consecutive days issued after the director or executive officer ceased to be a director or executive officer because of an event that occurred while the person was exercising such function, (iii), while that person was a director or executive officer or within a year of that person ceasing to act in that capacity, gone bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, was pursued by its creditors, concluded an arrangement or compromise with them, prosecute them, arranged or taken steps to conclude an arrangement or compromise with them, or a receiver, receiver-manager or trustee in bankruptcy was appointed to hold its assets or (iv) went bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, was pursued by its creditors, concluded an arrangement or compromise with them, prosecute them or a receiver, receiver-manager or trustee in bankruptcy has been appointed to hold its assets.

Moreover, except as stated below, no proposed director of the Corporation has been imposed a fine or sanctions by a court under the securities laws of Canada or a Canadian securities regulator nor has entered into a settlement agreement with a regulatory authority, nor any other fine or sanctions by a court or regulatory body that might be considered as important by a reasonable investor when making investment decisions.

Trapeze Asset Management Inc. and OSC

On April 27, 2012, the Ontario Securities Commission (the “OSC”) issued an order approving a settlement agreement between OSC staff and Trapeze Asset Management Inc. (“TAMI”), Randall Abramson and Herbert Abramson (collectively, the “Respondents”). The Respondents cooperated with the OSC in this matter. The Respondents admitted in the settlement agreement that as a result of their emphasis on issuer-related risks and longer term investment periods, they did not give sufficient weight to concentration risk or to price volatility risk and liquidity risk. They acknowledged that underweighting of these risks led them to understate in marketing material the risks of investments and to treat as medium risk securities that were higher than medium risk, and that in some cases in connection with managed accounts this resulted in know-your-client and suitability deficiencies, contraventions of sections 13.2 and 13.3 of National Instrument 31-103 Registration requirements, exemptions and ongoing registrant obligations (and section 1.5 of OSC Rule 31-505 - Registration Streamlining System prior to September 28, 2009) and conduct that was contrary to the public interest. Herbert Abramson, as a director, officer or authorizing person, also admitted to contravention of s. 129.2 of the Securities Act (Ontario). The Respondents were reprimanded and together required to pay to the OSC an administrative penalty of $1,000,000 and costs of $250,000. TAMI was also required to submit to a review of its practices and procedures by an independent consultant in accordance with terms of reference attached to the order, conduct account reviews with its clients in accordance with the terms of reference, and send a letter to clients outlining its intention to conduct such account reviews.

9

Trapeze Capital Corp. and IIROC

On April 27, 2012, an Investment Industry Regulatory Organization of Canada (“IIROC”) hearing panel accepted a settlement agreement between IIROC staff, Trapeze Capital Corp. (“TCC”), Randall Abramson and Herbert Abramson (collectively, the “IIROC Respondents”). The IIROC Respondents cooperated with IIROC in this matter. The IIROC Respondents admitted in the settlement agreement that as a result of their emphasis on issuer-related risks and longer term investment periods, they did not give sufficient weight to concentration risk or to price volatility risk and liquidity risk. They acknowledged that underweighting of these risks led them to understate in marketing material the risks of investments and to treat as medium risk securities that were higher than medium risk, and that in some cases in connection with managed accounts this resulted in know-your-client and suitability deficiencies, contraventions of IIROC Dealer Member Rules 1300.1(a), (p) and (q) and 29.1 in that some of the conduct was detrimental to the public interest. The IIROC Respondents are together required to pay to IIROC a fine of $500,000 and costs of $200,000. TCC was also required to submit to a review of its practices and procedures by an independent consultant in accordance with terms of reference to the agreement, conduct account reviews with its clients in accordance with the terms of reference, and send a letter to clients outlining its intention to conduct such account reviews.

3. Amendments to the DSU Plan

The Corporation adopted the DSU Plan on April 17, 2000 which provides that participating directors and senior officers (“Participants”) may elect to receive either a portion or all of the remuneration to be received from the Corporation in deferred share units. Such remuneration includes all amounts payable in cash or Shares (subject to election otherwise under the DSU Plan) to a Participant by the Corporation or a Subsidiary of the Corporation in respect of the services provided to the Corporation or Subsidiary by the Participant in any calendar year, including (a): in the case of a director, without limitation, (i) annual Board or committee of the Board or advisory retainer fees, (ii) fees for attending meetings of the Board or a committee of the Board and (iii) fees for serving as chairman or chairwoman of any committee of the Board, but, for greater certainty, excluding amounts payable to a Participant as a reimbursement for expenses incurred in attending meetings; and (b): in the case of a senior officer, without limitation, those services for which a salary or cash bonus would normally be paid, provided that the relevant performance criteria which serve as a basis for the granting of such bonuses have been met.

Under the DSU Plan, the deferred share units that Participants elect to receive for remuneration earned are credited to each Participant’s account in an amount of units equal to the gross amount of remuneration to be deferred divided by the fair market value of the Shares, being the closing price of the Shares on the Toronto Stock Exchange (the “TSX”) on the day immediately preceding the recommendation by the Compensation Committee or such other amount as determined by the Board and permitted by the applicable regulatory authorities. Rights respecting deferred share units are not transferable or assignable other than by will or by the laws of descent and distribution.

Administration and Limits on Issuable Shares

The Compensation Committee may, in its sole and absolute discretion, but subject to applicable corporate, securities and tax law requirements: (i) interpret and administer the DSU Plan, (ii) establish, amend and rescind any rules and regulations relating to the DSU Plan, and (iii) make any other determinations that the Compensation Committee deems necessary or desirable for the administration of the DSU Plan. The Compensation Committee may correct any defect or supply any omission or reconcile any inconsistency in the DSU Plan in the manner and to the extent the Compensation Committee deems, in its sole and absolute discretion, necessary or desirable. Any decision of the Compensation Committee in the interpretation and administration of the DSU Plan will be final, conclusive and binding on all parties concerned. All expenses of administration of the DSU Plan will be borne by the Corporation including any reasonable brokerage fees relating to the purchase of Shares under the DSU Plan.

10

The maximum total number of Shares available for issuance from treasury under the DSU Plan, the Option Plans, the ACP and any other security based compensation arrangements, if the proposed amendments are approved at the Meeting, is 15% of the Corporation’s issued and outstanding Shares at any given time.

The DSU Plan is considered an “evergreen” plan, since the Shares covered by the deferred share units which have been redeemed shall be available for subsequent grants under the DSU Plan and the number of deferred share units available for election increases as the number of issued and outstanding Shares of the Corporation increases.

The maximum number of Shares that may be reserved for issuance to any one Participant pursuant to deferred share units granted under the DSU Plan is 5% of the number of Shares outstanding at the time of reservation. The maximum number of Shares that may be:

(a) reserved for issuance to insiders pursuant to deferred share units granted under the DSU Plan and any other security based compensation arrangements of the Corporation is 10% of the number of Shares outstanding at the time of reservation;

(b) issued to insiders pursuant to deferred share units granted under the DSU Plan and any other security based compensation arrangements of the Corporation within a one-year period is 10% of the number of Shares outstanding at the time of issuance; and

(c) issued to any one insider pursuant to deferred share units granted under the DSU Plan and any other security based compensation arrangements of the Corporation within a one-year period is 5% of the number of Shares outstanding at the time of issuance.

Termination of Service and Redemption of Deferred Share Units

When a Participant retires, resigns or has been terminated without cause from all positions with the Corporation, or as a result of disability ceases to hold any and all positions with the Corporation (“Termination of Service”), the Participant receives either (a) a lump sum cash payment equal to the number of deferred share units held multiplied by the then fair market value of the Shares on the date of termination, or (b) the number of Shares that can be acquired in the open market with the amount described in (a), either case being subject to withholding for income tax.

A Participant who has Terminated Service may redeem the deferred share units credited to its account by filing with the secretary of the Corporation a notice of redemption of the deferred share units in the prescribed form on or before March 15 of the first calendar year commencing after the date the Participant Terminated Service. If the Participant fails to file a notice of redemption of the deferred share units on or before that date, the Participant will be deemed to have filed with the secretary of the Corporation a notice of redemption on that date. The date on which a notice of redemption is filed or deemed to be filed with the secretary of the Corporation is the “Filing Date”.

The notice of redemption filed by the Participant will specify that the Participant wishes to receive either: (i) a lump sum cash payment (net of any applicable withholdings) equal to the number of deferred share units credited to the Participant’s account as of the Filing Date multiplied by the fair market value per Share on the Filing Date (the “Final Payment”); or (ii) that number of Shares that is equal to the number of deferred share units credited to the Participant’s account as of the Filing Date. The Participant may request on the notice of redemption that the Participant receive a percentage of the Final Payment in cash and the remaining percentage of the Final Payment in Shares, in either case in accordance with the preceding sentence as appropriately amended. If a notice of redemption is deemed to be filed or the notice of redemption filed does not request receipt of cash or Shares, the Participant will be deemed to have requested to receive the entire Final Payment in cash.

11

The requests of a Participant referred to above are subject to the approval of the Compensation Committee, and the Compensation Committee will determine, in its sole discretion, of what portion of the Final Payment is to be paid to the Participant in cash and what portion is to be paid in Shares. The Compensation Committee will further determine whether payment in Shares will be made by the issuance of Shares from treasury, if the proposed amendments are approved at the Meeting, or through the Corporation contributing all or a Portion of the Final Payment to a trustee to be used by the trustee to purchase Shares on the TSX.

Within seven days following the Filing Date, the Corporation will, if the Participant is to receive all or a portion of the Final Payment in cash, make that payment to the Participant in cash. Within ten (10) business days following the Filing Date, if the Participant is to receive Shares, the Corporation may, at its discretion, elect to issue Shares from treasury equal to the number of deferred share units credited to the Participant’s account as of the relevant redemption date, if the proposed amendments are approved at the Meeting, or contribute all or the appropriate portion of the Final Payment to the Trustee and require the Trustee to use that amount as soon as practicable thereafter to purchase Shares on the TSX and deliver those Shares to the Participant. An amount that would otherwise give rise to fractional Shares will be paid in cash. If a Participant who would otherwise receive Shares is a citizen or resident of a country other than Canada, the Corporation has the right, in its sole discretion, to pay entirely in cash the Final Payment, should the Corporation determine that the regulatory or other requirements of the applicable foreign jurisdiction associated with the purchase of Shares are too onerous to it or the Participant.

In the event of the death of a Participant, the Corporation will make Final Payment, if the proposed amendments to the DSU Plan are approved at the Meeting, within ninety days after the Participant’s death, through either: (i) a lump sum cash payment; (ii) an issuance of Shares from treasury or (iii) a combination of a lump sum cash payment and issuance of Shares, to or for the benefit of the legal representative of the Participant. The Committee will determine, in its sole discretion, what portion of the Final Payment is to be paid to the Participant in cash and what portion is to be paid in Shares. The lump sum cash payment will equal the number of deferred share units credited to the Participant’s account on the date of payment multiplied by the fair market value per Share determined as of the date that is five days before the date of payment. The Shares issued from treasury will equal the number of deferred share units credited to the Participant’s account as of the date of payment. If a Participant dies after the Participant has Terminated Service but before filing a notice of redemption with the secretary of the Corporation, these same rules will apply provided that in no event will payment or the issuance of Shares be made later than December 31 of the first calendar year commencing after the Participant has Terminated Service.

A Participant who has been terminated with cause may not redeem the deferred share units held that it holds and those deferred share units will be deemed cancelled as of the date of termination of the Participant. The Board may terminate the DSU Plan any time before or after any allotment or accrediting of deferred share units thereunder.

Proposed Amendments

Subject to the rules about specific amendments set out below, the Board may amend the DSU Plan as it deems necessary or appropriate without shareholder approval, subject to applicable corporate, securities and tax law requirements, but no amendment will, without the consent of the Participant or unless required by law, adversely affect the rights of a Participant with respect to deferred share units that have been credited to the account of the Participant at the time of such amendment to the DSU Plan.

12

Notwithstanding the above, the Board must obtain shareholder approval for the following amendments to the DSU Plan:

i) the removal or an increase in the insider participation limits;

ii) an increase to the maximum number of securities reserved for issuance under the DSU Plan or any other security based compensation arrangement; and

iii) amendments to the amendment provisions of the DSU Plan.

As of October 15, 2012, the following are active security based compensation arrangements of the Corporation: the 2003 Share Option Plan (the “2003 Plan”), the Alternate Compensation Plan (the “ACP”) and the DSU Plan. As of October 15, 2012, the total number of Shares outstanding and available for issuance by the Corporation under its security based compensation arrangements is 6,337,662. As of October 15, 2012: there are outstanding options to purchase 3,358,116 Shares issued under the 2003 Plan, representing 7.9% of the Shares outstanding and available for issuance by the Corporation; there are zero (0) outstanding Shares issued under the ACP, representing 0% of the total Shares outstanding and available for issuance by the Corporation; and there are outstanding deferred share units to acquire 780,000 Shares issued under the DSU Plan, representing 1.9% of the total Shares outstanding and available for issuance by the Corporation. There are therefore 2,199,546 Shares remaining available for future issuance under the Corporation’s security based compensation arrangements, representing 5.2% of the total Shares outstanding and available for issuance by the Corporation, if the proposed amendments to the DSU Plan are approved at the Meeting. The outstanding deferred share units to acquire 780,000 Shares representing approximately 1.9% of the issued and outstanding Shares and which are worth $253,500 as of October 15, 2012, have been credited to Dr. Aiping Young, President and Chief Executive Officer of the Corporation.

The Corporation wishes to amend the DSU Plan in order to permit the issuance from treasury of Shares that are issuable under DSU Plan. In addition, the Corporation wants to be authorized to issue shares from treasury in payment of any amount due under the DSU Plan, including for deferred share units credited before the approval of the proposed amendments.

The DSU Plan is administered by the Board (in consultation with the Compensation Committee) and subject to regulatory requirements, may be amended by the Board without shareholder approval. Pursuant to the requirements of the TSX, the proposed amendments to the DSU Plan require the approval of a majority of the votes cast by the shareholders of the Corporation at the Meeting. The Corporation has applied to the TSX for its approval of the proposed amendments.

The directors of the Corporation have determined that the proposed amendments to the DSU Plan are in the best interests of the Corporation and the shareholders as it will provide the Corporation with additional flexibility as well as preserve cash available to the Company as under the current DSU Plan the settlement of DSU’s issued will result in a cash outflow. The directors of the Corporation recommend that the shareholders vote in favour of the proposed amendments to the DSU Plan. To be approved, the resolution approving the amendments to the DSU Plan must be approved by not less than a majority of the votes cast by shareholders, present in person or represented by proxy, at the Meeting.

13

The text of the resolution approving the amendments to the DSU Plan to be submitted to shareholders at the Meeting is set forth below:

BE IT RESOLVED THAT:

|

|

1.

|

The Corporation is hereby authorized to amend its deferred share unit plan (the “DSU Plan”) to (i) permit the issuance from treasury of common shares of the Corporation (the “Shares”) that are issuable under the DSU Plan; and (ii) set the maximum total number of Shares available for issuance from treasury under all security based compensation arrangement of the Corporation at 15% of the Corporation’s issued and outstanding Shares at any given time, the whole as set out in Appendix A to the management proxy circular of the Corporation dated October 15, 2012;

|

|

|

2.

|

The Corporation is hereby authorized to issue shares from treasury in payment of any amount due under the DSU Plan, including for the deferred share units to acquire 780,000 Shares credited to Dr. Aiping Young, President and Chief Executive Officer of the Corporation, before the date hereof; and

|

|

|

3.

|

Any director or officer of the Corporation is authorized and directed to execute and deliver for and in the name of and on behalf of the Corporation, under its corporate seal or otherwise, all such certificates, instruments, agreements, notices and other documents and to do such other acts and things as, in the opinion of such persons, may be necessary or desirable in connection with the amendments to the DSU Plan, with the performance of the Corporation of its obligations in connection therewith, and to give effect to the foregoing and facilitate the implementation of the foregoing resolutions.

|

Unless otherwise instructed by a Shareholder, the persons named in the accompanying form of proxy will vote “FOR” the resolution approving the amendments to the DSU Plan.

STATEMENT OF EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

Composition of the Compensation Committee

The Board, upon the advice of the Compensation Committee, determines executive compensation. From June 1, 2010 to present, the Compensation committee has been comprised of independent board members Dr. Burger and Dr. Wright. Dr. Burger is chair of the Compensation Committee. The Compensation Committee met four times during the period lasting from June 1, 2011 to present. For more information on the Compensation Committee, please see the section entitled “Compensation” of the Corporation’s Corporate Governance Practices attached hereto as Appendix B.

Compensation Objectives and Philosophy

The Compensation Committee's mandate is to review and advise the Board on the recruitment, appointment, performance, compensation, benefits and termination of executive officers. The Compensation Committee also administers and reviews procedures and policies with respect to our 1993 Plan and 2003 Plan, employee benefit programs, pay equity and employment equity and reviews executive compensation disclosure where it is publicly disclosed.

14

The market for biotechnology companies in the development phase, particularly small capital issuers, has been extremely challenging for the past few years and throughout fiscal 2012. It has been very difficult to raise the capital required to continue our operations and meet our developmental milestones. The Compensation Committee has taken these factors into consideration when recommending the compensation for Named Executive Officers (as defined hereinafter) and focuses the assessment on achievement of the corporate objectives described below as being the key value drivers of the Corporation.

Lorus’ executive compensation program is designed to:

|

|

•

|

attract and retain qualified, motivated and achievement-oriented individuals by offering compensation that is competitive in the industry and marketplace;

|

|

|

•

|

align executive interests with the interests of Shareholders; and

|

|

|

•

|

ensure that individuals continue to be compensated in accordance with their personal performance and responsibilities and their contribution to the overall objectives of the Corporation.

|

These objectives are achieved by offering executives and employees a compensation package that is competitive and rewards the achievement of both short-term and long-term objectives of the Corporation. As such, our compensation package consists of three key elements:

|

|

•

|

base salary and initial stock options;

|

|

|

•

|

short-term compensation incentives to reward corporate and personal performance through potential annual cash bonuses; and

|

|

|

•

|

long-term compensation incentives related to long-term increase in Share value through participation in the 2003 Plan.

|

Base Salary - Initial Stock Options

In establishing base salaries, the objective of the Compensation Committee is to establish levels that will enable Lorus to attract and retain executive officers that can effectively contribute to the long-term success of the Corporation. Base salary for each executive officer is a function of the individual's skills, abilities, experience, past performance and anticipated future contribution to the success of Lorus. The members of the Compensation Committee use their knowledge of the industry and of industry trends to assist with the determination of an appropriate compensation package for each executive officer. In certain cases, the Compensation Committee may recommend inclusion of automobile allowances, fitness allowances and the payment of certain professional dues as a component of an overall remuneration package for executives.

In certain cases, executive officers may be granted stock options on the commencement of employment with Lorus in accordance with the responsibility delegated to each executive officer for achieving corporate objectives and enhancing Shareholder value in accordance with those objectives.

Short-Term Compensation Incentives

The role of short-term compensation incentives at Lorus is to reward corporate and personal performance. Each year, the Board approves the annual corporate objectives encompassing scientific, clinical, regulatory, business and corporate development and financial criteria. The annual cash bonus for the President and Chief Executive Officer and the other executive officers is based, at least in part, on the level of achievement of these annual objectives. One hundred percent of the President and Chief Executive Officer's and seventy-five percent of the other executive officers’ cash bonus is based on the level of achievement of corporate objectives. The balance of the other executive officers’ bonus is based on achievement of individual/departmental objectives.

15

All corporate and executive officer objectives are reviewed by the Compensation Committee and approved by the Board. The Compensation Committee recommends to the Board the awarding of bonuses, payable in cash, stock or stock options, to reward extraordinary individual performance.

For each executive officer, during the fiscal year ended May 31, 2012, the annual cash bonuses ranged from 15% to 40% of base salary when all corporate and individual executive officer objectives were achieved.

Cash bonuses are determined as soon as practicable after the end of the fiscal year and, for the Named Executive Officers, are included in the Summary Compensation Table in the year in respect of which they are earned.

Long-Term Incentive Plan

The role of long-term compensation incentives at Lorus is to reward an executive’s contribution to the attainment of Lorus’ long-term objectives, align an executive’s performance with the long-term performance of Lorus and to provide an additional incentive for an executive to enhance Shareholder value. Long-term incentive compensation for directors, officers, employees and consultants is reviewed annually and is accomplished through the grant of stock options under our 2003 Plan.

The number of options granted to the CEO was not based on achievement of objectives and vested over a two year period. The number of options granted for certain executives of Lorus for the fiscal year ended May 31, 2012 was based on achievement of both corporate and executive officer objectives. The Compensation Committee approves the allocation of options and options are priced using the closing market price of the Shares on the TSX on the last trading day prior to the date of grant. Options to purchase Shares expire ten years from the date of grant and vest over a term determined by the Compensation Committee. The granting of options to purchase Shares for Named Executive Officers is included in the Summary Compensation Table in the year that they are earned.

Performance Metrics

The performance of the President and Chief Executive Officer and other Named Executive Officers for the 2012 financial year was measured in the following areas:

|

|

1.

|

Maximizing the value of LOR-253;

|

|

|

2.

|

Maximizing the value of LOR-500;

|

|

|

3.

|

Establishing at least one corporate partnership; and

|

|

|

4.

|

Equity financing to establish at least one year of cash.

|

Each of the above is weighted at 30%, 15%, 30% and 25% respectively in relation to assessment of satisfaction of overall corporate objective and determination of any general corporate bonuses. Based on these criteria the Board assigned an achievement of 97%. Incentive compensation related to the attainment of these objectives will be paid in fiscal 2013. Similar performance metrics were established for the year ending May 31, 2013 based on the approved business plan for the current year.

16

Hedge or Offset Instruments

Named Executive Officers or directors are not permitted to purchase financial instruments that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by Named Executive Officers or directors, including, for greater certainty, prepaid variable forward contracts, equity swaps, collars, or units of exchange funds.

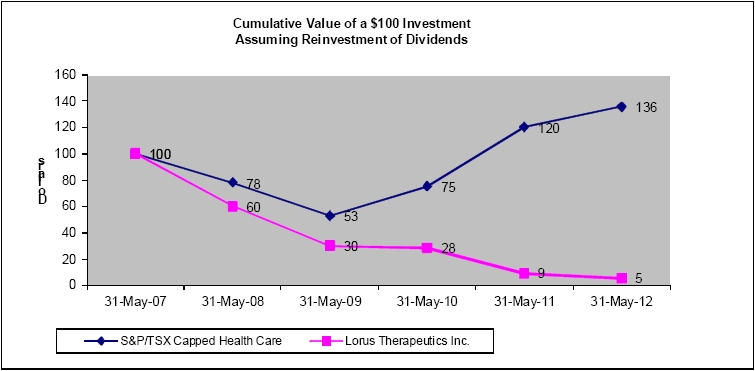

PERFORMANCE GRAPH

The following graph illustrates our cumulative total Shareholder return (assuming a $100 investment) for the Shares on the TSX as compared with the S&P/TSX Capped Health Care Index during the period May 31, 2007 to May 31, 2012.

Compensation levels for the Named Executive Officers have not fluctuated to the same degree as Shareholder returns. Compensation does not solely reflect consideration of Corporation performance. Instead, compensation is determined in light of an overall compensation package that is considered appropriate in the circumstances.

SUMMARY COMPENSATION TABLE

The following table details the compensation information for the most recent fiscal years of the Corporation, for the President and Chief Executive Officer, the Director of Finance and Acting Chief Financial Officer, the Vice President of Business Development and the Vice President of Research (“NEO” or collectively “Named Executive Officers”):

17

| Non-equity incentive plan compensation | |||||||||

|

Name and Principal Position

|

Fiscal

Year ended May 31

|

Salary

($)

|

Share-based awards(3) ($)

|

Option-based awards(1)

($)

|

Annual incentive plans

($)

|

Long-term incentive plans

($)

|

Pension value

($)

|

All other compensation

($)

|

Total

compensation

($)

|

|

Dr. Aiping Young

President and Chief Executive Officer

|

2012

2011

2010

|

337,334

342,819

336,480

|

304,200

N/A

N/A

|

49,500

644,711

70,500

|

Nil

127,845

129,792

|

Nil

Nil

Nil

|

N/A

N/A

N/A

|

Nil

Nil

Nil

|

691,034

1,115,375

536,772

|

|

Ms. Elizabeth Williams

Director of Finance, Acting Chief Financial Officer(2)

|

2012

2011

2010

|

68,923

66,322

16,319

|

N/A

N/A

N/A

|

27,238

54,385

7,050

|

Nil

808

11,933

|

Nil

Nil

Nil

|

N/A

N/A

N/A

|

Nil

Nil

Nil

|

96,161

120,707

35,299

|

|

Dr. Yoon Lee

Vice President Research

|

2012

2011

2010

|

138,071

135,405

132,810

|

N/A

N/A

N/A

|

27,983

61,183

21,150

|

Nil

25,599

25,632

|

Nil

Nil

Nil

|

N/A

N/A

N/A

|

Nil

Nil

Nil

|

166,054

222,187

179,592

|

|

|

(1)

|

In determining the fair value of these option awards, the Black-Scholes valuation methodology was used with the following assumptions: (i) expected life of five years; (ii) volatility of 123-125%; (iii) risk free interest rate of 1.5%; and (iv) no dividend yield.

|

|

|

(2)

|

Ms. Williams was on maternity leave from July 2009 to June 2010.

|

|

|

(3)

|

During the year ended May 31, 2012, 780,000 deferred share units were issued to Dr. Aiping Young. The fair value of these deferred share units was $304,200 at May 31, 2012

|

Dr. Young did not receive any compensation for her role as a director of the Corporation.

INCENTIVE PLAN AWARDS

|

|

Outstanding Share-Based Awards and Option-Based Awards

|

The following table shows all awards outstanding to each NEO as at May 31, 2012:

|

Option-based Awards

|

||||

|

Name and Principal Position

|

Number of securities underlying unexercised options

(#)

|

Option exercise price

($)

|

Option expiration date

|

Value of unexercised in-the-money options

($) (1)

|

|

Dr. Aiping Young

President and Chief Executive Officer

|

275,000

|

0.215

|

Nov 28, 2021

|

48,125

|

|

Ms. Elizabeth Williams

Director of Finance, Acting Chief Financial Officer

|

100,000

62,000

|

0.215

0.18

|

Nov 28, 2021

March 8, 2022

|

17,500

13,020

|

|

Dr. Yoon Lee

Vice President, Research

|

100,000

67,000

|

0.215

0.18

|

Nov 28, 2021

March 8, 2022

|

17,500

14,070

|

|

|

(1)

|

These amounts are calculated based on the difference between the market value of the securities underlying the options on May 31, 2012 at the end of the fiscal year ($0.39), and the exercise price of the options.

|

18

|

Share-based Awards

|

|||

|

Name and Principal Position

|

Number of shares

or units that

have not vested

(#)

|

Market or payout value of share-based awards that have not vested

($)

|

Market or payout value of vested share-based awards not paid out or distributed

($)

|

|

Dr. Aiping Young

President and Chief Executive Officer

|

780,000

|

304,000

|

nil

|

The 100,000 option grants to Ms. Elizabeth Williams and Dr. Yoon Lee during the fiscal year ended May 31, 2012 vest contingently upon the achievement of corporate objectives that the Compensation Committee has deemed to be the drivers of Shareholder value. These stock options vest 50% upon the achievement of the stated objectives, 25% on the next anniversary and 25% on the second anniversary. The options granted in March 2012 to Ms. Williams and Dr. Lee vest 50% after one year and 25% on each of the second and third anniversaries. The options granted to Dr. Aiping Young vested 50% upon grant and 25% on the first anniversary and 25% on the second anniversary.

Value Vested or Earned During the Year

The following table sets forth for each Named Executive Officer the value vested or earned on all option-based awards, share-based awards, and non-equity incentive plan compensation during the fiscal year ended May 31, 2012:

|

Name and Principal Position

|

Option-based awards - Value vested during the year

($)

|

Share-based awards - Value vested during the year

($)

|

Non-equity incentive plan compensation - Value earned during the year

($)

|

|

Dr. Aiping Young

President and Chief Executive Officer

|

Nil

|

304,200

|

Nil

|

|

Ms. Elizabeth Williams

Director of Finance, Acting Chief Financial Officer

|

8,750

|

Nil

|

Nil

|

|

Dr. Yoon Lee

Vice President Research

|

8,750

|

Nil

|

Nil

|

PENSION PLAN BENEFITS

The Corporation does not provide pension plan benefits to its Named Executive Officers or employees of the Corporation.

19

TERMINATION AND CHANGE OF CONTROL BENEFITS

If the employment agreements of the Named Executive Officers are terminated by the Corporation other than for cause, Dr. Young shall be entitled to 18 months plus one additional month for each year of employment under the agreement in lieu of notice (approximately 24 months or $661,500 as at May 31, 2012), Dr. Lee shall be entitled to a notice period equal to 4 months plus one additional month for each year of employment, to a maximum of 12 months (approximately 12 months or $135,000 as at May 31, 2012) and Ms. Williams shall be entitled to the greater of one month and the applicable notice entitlement under employment legislation in the event of termination (approximately 8 months or $44,500 as at May 31, 2012). If the employment agreements are terminated by the Corporation other than for cause, then all unexercised stock options then held by each are governed by the terms of the 2003 Plan. Further, if there is a change of control of the Corporation and Dr. Young’s employment within 36 months of a change of control of Lorus is terminated without cause or if she terminates the agreement with good reason as defined in the agreement, then she is entitled to receive the equivalent of two years' of her basic salary plus one month salary for each year under the agreement (approximately $827,000 as at May 31, 2012), plus an annual bonus prorated over the severance period (based on the bonus paid in respect of the last completed fiscal year). All Named Executive Officers will also be entitled to benefits coverage for the severance period or a cash payment in lieu thereof.

COMPENSATION OF DIRECTORS

The following table details the compensation received by each director for the year ended May 31, 2012:

|

Name

|

Fees earned

($)

|

Share-based awards

($)

|

Option-based awards

($)(1)

|

Non-equity incentive plan compensation ($)

|

Pension value

($)

|

All Other Compensation

($)

|

Total

($)

|

|

Mr. Herbert Abramson

|

34,500

|

Nil

|

6,425

|

Nil

|

N/A

|

Nil

|

40,925

|

|

Dr. Denis Burger

|

38,500

|

Nil

|

19,150

|

Nil

|

N/A

|

Nil

|

57,650

|

|

Dr. Mark Vincent

|

27,500

|

Nil

|

6,425

|

Nil

|

N/A

|

Nil

|

33,925

|

|

Mr. Warren Whitehead

|

32,500

|

Nil

|

3,594

|

Nil

|

N/A

|

Nil

|

36,094

|

|

Dr. Jim Wright

|

53,500

|

Nil

|

99,125

|

Nil

|

N/A

|

Nil

|

152,625

|

During the fiscal year ended May 31, 2012, each director who was not an officer of the Corporation was entitled to receive 15,000 stock options (the Chair received 30,000) and, at his election, common shares, deferred share units and/or cash compensation for attendance at the board of directors of the Corporation committee meetings. During the year ended May 31, 2012 the Chair was granted an additional 525,000 options and the directors, in aggregate, an additional 156,000 options. These grants were one time option grants. Compensation consisted of an annual fee of $15,000 (the Chair received $35,000) and $1,500 per Board meeting attended ($4,500 to the Chair of a Board meeting). Members of the Audit Committee received an annual fee of $8,000 (the Chair received $10,000). Each member of the Compensation Committee and Corporate Governance and Nominating Committee received an annual fee of $5,000 per committee. Board members (including the Chair) receive $500 for meetings held via conference call. There have not been any changes to the fees from the prior year. Non-executive directors are reimbursed for any out-of pocket travel expenses incurred in order to attend meetings. Executive directors are not entitled to directors’ compensation or reimbursement of travel expenses.

20

Directors are entitled to participate in the DSU Plan. None of our directors participated in this plan in the fiscal years ended May 31, 2012 or 2011.

Incentive Plan Awards

Outstanding Share-Based Awards and Option Based Awards

The following table sets forth for each director, other than Named Executive Officers who are directors, all option-based and share-based awards outstanding at May 31, 2012:

|

Option-based Awards

|

||||

|

Name and Principal Position

|

Number of securities underlying unexercised options

(#)

|

Option exercise price

($)

|

Option expiration date

|

Value of unexercised in-the-money options

($) (1)

|

|

Mr. Herbert Abramson

|

15,000

25,000

|

$0.215

$0.18

|

Nov 28, 2021

March 8, 2022

|

2,625

5,250

|

|

Dr. Denis Burger

|

15,000

50,000

50,000

|

$0.215

$0.215

$0.18

|

Nov 28, 2021

Nov 28, 2021

March 8, 2022

|

2,625

8,750

10,500

|

|

Dr. Mark Vincent

|

15,000

25,000

|

$0.215

$0.18

|

Nov 28, 2021

March 8, 2022

|

2,625

5,250

|

|

Mr. Warren Whitehead

|

15,000

6,000

|

$0.215

$0.18

|

Nov 28, 2021

March 8, 2022

|

2,625

1,260

|

|

Dr. Jim Wright

|

30,000

500,000

25,000

|

$0.215

$0.215

$0.18

|

Nov 28, 2021

Nov 28, 2021

March 8, 2022

|

5,250

87,500

5,250

|

|

|

(1)

|

These amounts are calculated based on the difference between the market value of the securities underlying the options on May 31, 2012, at the end of the fiscal year ($0.39), and the exercise price of the options.

|

Value Vested or Earned During the Year

The following table sets forth for each director the value vested or earned on all option-based awards, share-based awards, and non-equity incentive plan compensation during the financial year ending May 31, 2012.

|

Name

|

Option-based awards - Value vested during the year

($) (1)

|

|

Mr. Herbert Abramson

|

Nil

|

|

Dr. Denis Burger

|

Nil

|

|

Dr. Mark Vincent

|

Nil

|

|

Mr. Warren Whitehead

|

Nil

|

|

Dr. Jim Wright

|

Nil

|

|

|

(1)

|

All options which vested during the year vested at the date of issue and the market value of the securities underlying the options was the same as the exercise price.

|

21

INDEBTEDNESS

As of the date hereof, there is no indebtedness owing to the Corporation by any employees, officers or directors of the Corporation. The Corporation did not provide financial assistance to any employees, officers or directors for the purchase of securities during the fiscal year ended May 31, 2012 from June 1, 2012 to the date hereof.

AUDIT COMMITTEE INFORMATION

Reference is made to the Annual Information Form of the Corporation dated August 3, 2012 for the fiscal year ended May 31, 2012, under the heading “Audit Committee Information” for a disclosure of information related to the Audit Committee required under Form 52-110F1 to National Instrument 52-110 - Audit Committees (“NI 52-110”). A copy of this document can be found on SEDAR at www.sedar.com, however we will promptly provide a copy of this document to any securityholder of the Corporation free of charge upon request.

DIRECTORS AND OFFICERS' LIABILITY

We purchase and maintain liability insurance for the benefit of directors and officers to cover any liability incurred by such person in such capacities. The policy provides for coverage in the amount of $10,000,000 with a deductible amount of $150,000 (with certain exceptions). For the period June 1, 2011 to May 31, 2012, the premium cost of this insurance was $96,000.

EQUITY COMPENSATION PLAN INFORMATION

|

|

Stock Option Plans

|

The stock option plans were established to advance the interests of Lorus by:

|

|

•

|

providing Eligible Persons (as defined below) with additional incentives;

|

|

|

•

|

encouraging stock ownership by Eligible Persons;

|

|

|

•

|

increasing the interest of Eligible Persons in the success of Lorus;

|

|

|

•

|

encouraging Eligible Persons to remain loyal to Lorus; and

|

|

|

•

|

attracting new Eligible Persons to Lorus.

|

Our original stock option plan, the 1993 Plan, was established in 1993; however, due to significant developments in the laws relating to share option plans and our then future objectives, in November 2003 we created the 2003 Plan, ratified by our Shareholders, pursuant to which all future grants of stock options would be made.

The Compensation Committee as authorized by the Board administers the 1993 Plan and the 2003 Plan (collectively the “Stock Option Plans”).

The DSU Plan, which is proposed to be amended at the Meeting, is described in the “PARTICULARS OF MATTERS TO BE ACTED UPON - 3. Amendments to the DSU Plan” section of this Circular.

22

The 1993 Plan

Under the 1993 Plan, options were granted to directors, officers, consultants and employees of the Corporation or its subsidiaries (“Eligible Persons”). The total number of options issued under the 1993 Plan is 1,530. This represents 0.0% of the Corporation's issued and outstanding capital as at October 15, 2012. There were no further option grants made under the 1993 Plan after November 2003. Therefore, no further options are issuable under the 1993 Plan. The total number of Shares issuable under actual grants pursuant to the 1993 Plan is 1,530 being 0.0% of the Corporation's issued and outstanding capital as at October 15, 2012.

The number of Shares issuable to insiders, at any time, under the 1993 Plan and any other compensation arrangement of the Corporation cannot exceed 10% of the issued and outstanding Shares of the Corporation. The number of Shares issued to insiders, within any one year period, under the 1993 Plan and any other compensation arrangement of the Corporation cannot exceed 10% of the issued and outstanding Shares of the Corporation. The maximum percentage of Shares reserved for issuance to any one person is 5% of the issued and outstanding Shares of the Corporation. The exercise price of options granted under the 1993 Plan was established by the Board on the basis of the closing market price of Shares of the Corporation on the TSX on the last trading day preceding the date of grant. If such a price was not available, the exercise price was to be determined on the basis of the average of the bid and ask for the Shares on the TSX on the date preceding the date of grant. The Board determined the vesting period of options at the time of granting the option. The term of options granted under the 1993 Plan and outstanding as of October 15, 2012 is 10 years from the date of grant.

If an option holder ceases to be an officer, director, continuing consultant or employee of the Corporation or a subsidiary, each unexpired, vested option may be exercised within three months of the date of cessation. In the event of the death of an optionee, each unexpired, vested option may be exercised within nine months of the option holder's date of death.

Options granted under the 1993 Plan are not transferable. Currently, the 1993 Plan may be amended by the Board subject to regulatory approval in certain circumstances.

The 2003 Plan

Under the 2003 Plan, options may be granted to Eligible Persons. At October 15, 2012, the total number of options outstanding under the 2003 Plan is 3,358,116 representing 7.9% of the Corporation's issued and outstanding capital. Options to purchase up to an additional 2,979,546 Shares, being 7.1% of Shares issued and outstanding, are available for grant under the 2003 Plan. The total number of Shares issuable under the 2003 Plan is 15.0% of the Corporation's issued and outstanding capital as at October 15, 2012 which represents 6,337,662 Shares. The total number of options issued under the 2003 Plan combined with those issued under the 1993 Plan and Shares issued under the ACP and DSU Plan, if the proposed amendments to the DSU Plan are approved at the Meeting, will not exceed 15% of the Shares issued and outstanding at any time.

23

The maximum number of Shares reserved for issuance to insiders, at any time, under the 2003 Plan and any other compensation arrangement of the Corporation is 10% of the issued and outstanding Shares of the Corporation. The maximum number of Shares that may be issued to insiders, at any time, under the 2003 Plan and any other compensation arrangement of the Corporation within a 12 month period is 10% of the issued and outstanding Shares of the Corporation. The maximum number of Shares reserved for issuance to any one person is 5% of the issued and outstanding Shares of the Corporation. The exercise price of options granted under the 2003 Plan is established by the Board and will be equal to the closing market price of the Shares on the TSX on the last trading day preceding the date of grant. If there is no trading on that date, the exercise price will be the average of the bid and ask on the TSX on the last trading date preceding the date of grant. If not otherwise determined by the Board, an option granted under the 2003 Plan will vest as to 50% on the first anniversary of the date of grant of the option and an additional 25% on the second and third anniversaries after the date of grant. The Board fixes the term of each option when granted, but such term may not be greater than 10 years from the date of grant.

If an option holder is terminated without cause, resigns or retires, each option that has vested will cease to be exercisable three months after the option holder's termination date. Any portion of an option that has not vested on or prior to the termination date will expire immediately. If an option holder is terminated for cause, each option that has vested will cease to be exercisable immediately upon the Corporation's notice of termination. Any portion of an option that has not vested on or prior to the termination date will expire immediately.

Options granted under the 2003 Plan are not assignable.

Currently, the Board may amend the 2003 Plan subject to regulatory approval, provided that the Board may not make the following amendments without the approval of Shareholders:

|

|

•

|

an amendment to the maximum number of Shares reserved for issuance under the 2003 Plan and under any other security based compensation arrangement of the Corporation;

|

|

|

•

|

a reduction in the exercise price for options held by insiders;

|

|

|

•

|

an extension to the term of options held by insiders; and

|

|

|

•

|

an increase in the 10% limits on grants to insiders.

|

During the period June 1, 2011 to May 31, 2012, options to purchase 1,538,000 Shares were granted under the 2003 Plan at exercise prices between $0.18 and $0.215 per Share. During the year ended May 31, 2012, we granted options to employees, other than executive officers of the Corporation, to purchase 163,000 Shares, being 10.6% of the total incentive stock options granted during the year to employees, executive officers and directors.

Alternative Compensation Plan

The Corporation has an ACP which enables Lorus to meet its obligations to pay directors’ fees, salary and performance bonuses to certain employees in the form of Shares. The ACP permits the Corporation to, in circumstances considered appropriate by the Board, encourage the ownership of equity of the Corporation by its directors and senior employees (“Participants”), enhance the Corporation’s ability to retain key personnel and reward significant performance achievements while preserving the cash resources of the Corporation.

Under the ACP, Participants have the option of receiving director’s fees, salary, bonuses or other remuneration, as applicable (“Remuneration”) by the allotment and issuance from treasury of such number of Shares as will be equivalent to the cash value of the Remuneration determined by dividing the Remuneration by the weighted average closing Share price for the five (5) trading days prior to payment date (the “5-day VWAP”). The issue price of Shares issued under the ACP is the 5-day VWAP.

The maximum number of Shares reserved for issuance under the ACP, when combined with the Stock Option Plans and the DSU Plan, if the proposed amendments to the DSU Plan are approved at the Meeting, will not exceed 15% of the Corporation’s issued and outstanding Shares at any given time.

24

There have been no Shares issued under the ACP.

Employee Share Purchase Plan

We have an Employee Share Purchase Plan (“ESPP”) with the purpose of the ESPP to assist the Corporation to retain the services of its employees, to secure and retain the services of new employees and to provide incentives for such persons to exert maximum efforts for the success of the Corporation. The ESPP provides a means by which employees of the Corporation and its affiliates may purchase Shares at a 15% discount through accumulated payroll deductions. Eligible participants in the ESPP include all employees, including executive officers, who work at least 20 hours per week and are customarily employed by the Corporation or an affiliate of the Corporation for at least six months per calendar year. Generally, each offering is of three months' duration with purchases occurring every quarter. Participants may authorize payroll deductions of up to 15% of their base compensation for the purchase of Shares under the ESPP.

For the year fiscal ended May 31, 2012, a total of 14,120 common shares had been purchased by employees under the ESPP at prices per share between $0.26 and $0.15 per common share and a weighted average purchase price of $0.20. During the year ended May 31, 2012, under the ESPP, Named Executive Officers, as a group, did not purchase any shares pursuant to the ESPP.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS