ANNUAL INFORMATION FORM

Fiscal year ended May 31, 2012

August 3, 2012

2

Meridian Road, Toronto, Ontario M9W 4Z7

Telephone: (416) 798-1200

Fax: (416) 798-2200

| i |

TABLE OF CONTENTS

| CAUTION REGARDING FORWARD-LOOKING STATEMENTS | 1 |

| THE COMPANY | 2 |

| Business Strategy | 5 |

| Financial Strategy | 5 |

| REGULATORY APPROVAL PROCESS | 8 |

| BUSINESS OF THE COMPANY | 9 |

| RISK FACTORS | 14 |

| DIVIDENDS | 21 |

| SHARE CAPITAL AND MARKET FOR SECURITIES | 21 |

| DIRECTORS AND OFFICERS | 22 |

| AUDIT COMMITTEE INFORMATION | 24 |

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 25 |

| INTERESTS OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 25 |

| TRANSACTIONS WITH RELATED PARTIES | 25 |

| TRANSFER AGENT AND REGISTRAR | 25 |

| MATERIAL CONTRACTS | 25 |

| INTERESTS OF EXPERTS | 26 |

| ADDITIONAL INFORMATION | 26 |

| GLOSSARY | 27 |

| SCHEDULE A | 28 |

| ii |

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This annual information form may contain forward-looking statements within the meaning of securities laws. Such statements include, but are not limited to, statements relating to:

| · | our business strategy; |

| · | our ability to obtain the substantial capital we require to fund research and operations; |

| · | our plans to secure strategic partnerships to assist in the further development of our product candidates; |

| · | our plans to conduct clinical trials and pre-clinical programs; |

| · | our expectations regarding the progress and the successful and timely completion of the various stages of our drug discovery, pre-clinical and clinical studies and the regulatory approval process; |

| · | our plans, objectives, expectations and intentions; |

| · | sales potential of our clinical stage drugs; and |

| · | other statements including words such as “anticipate”, “contemplate”, “continue”, “believe”, “plan”, “estimate”, “expect”, “intend”, “will”, “should”, “may”, and other similar expressions. |

The forward-looking statements reflect our current views with respect to future events, are subject to risks and uncertainties, and are based upon a number of estimates and assumptions that, while considered reasonable by us, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors could cause our actual results, performance or achievements to be materially different from any future results, performance, or achievements that may be expressed or implied by such forward-looking statements, including, among others:

| · | our ability to obtain the substantial capital we require to fund research and operations; |

| · | our lack of product revenues and history of operating losses; |

| · | our early stage of development, particularly the inherent risks and uncertainties associated with (i) developing new drug candidates generally, (ii) demonstrating the safety and efficacy of these drug candidates in clinical studies in humans, and (iii) obtaining regulatory approval to commercialize these drug candidates; |

| · | our drug candidates require time-consuming and costly preclinical and clinical testing and regulatory approvals before commercialization; |

| · | clinical studies and regulatory approvals of our drug candidates are subject to delays, and may not be completed or granted on expected timetables, if at all, and such delays may increase our costs and could delay our ability to generate revenue; |

| · | the regulatory approval process; |

| · | our ability to recruit patients for clinical trials; |

| · | the progress of our clinical trials; |

| · | our liability associated with the indemnification of Old Lorus and its directors, officers and employees in respect of the arrangement described in “The Corporation – Corporate History”; |

| · | our ability to find and enter into agreements with potential partners; |

| · | our ability to attract and retain key personnel; |

| · | our ability to obtain patent protection; |

| · | our ability to protect our intellectual property rights and not infringe on the intellectual property rights of others; |

| · | our ability to comply with applicable governmental regulations and standards; |

| · | development or commercialization of similar products by our competitors, many of which are more established and have or have access to greater financial resources than us; |

| · | commercialization limitations imposed by intellectual property rights owned or controlled by third parties; |

| · | our business is subject to potential product liability and other claims; |

| · | our ability to maintain adequate insurance at acceptable costs; |

| · | further equity financing may substantially dilute the interests of our shareholders; |

| · | changing market conditions; and |

| · | other risks detailed from time-to-time in our on-going quarterly filings, annual information forms, annual reports and annual filings with Canadian securities regulators and the SEC, and those which are discussed under the heading “Risk Factors” in our annual information form for the fiscal year ended May 31, 2012 |

Should one or more of these risks or uncertainties materialize, or should the assumptions set out in the section entitled “Risk Factors” underlying those forward-looking statements prove incorrect, actual results may vary materially from those described herein. These forward-looking statements are made as of the date of this annual information form or, in the case of documents incorporated by reference herein, as of the date of such documents, and we do not intend, and do not assume any obligation, to update these forward-looking statements, except as required by law. We cannot assure you that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Investors are cautioned that forward-looking statements are not guarantees of future performance and accordingly investors are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty therein.

Unless otherwise indicated, or the context requires otherwise, the information appearing in this annual information form is stated as at May 31, 2012 and references in this annual information form to “$” or “dollars” are to Canadian dollars.

In this Annual Information Form, the terms “Company” and “Lorus” refer to Lorus Therapeutics Inc.

For ease of reference, a glossary of terms used in this annual information form can be found beginning on page 26.

THE COMPANY

Lorus Therapeutics Inc. (“Old Lorus”) was incorporated under the Business Corporations Act (Ontario) on September 5, 1986 under the name RML Medical Laboratories Inc. On October 28, 1991, RML Medical Laboratories Inc. amalgamated with Mint Gold Resources Ltd., resulting in Old Lorus becoming a reporting issuer (as defined under applicable securities law) in Ontario, on such date. On August 25, 1992, Old Lorus changed its name to IMUTEC Corporation. On November 27, 1996, Old Lorus changed its name to Imutec Pharma Inc., and on November 19, 1998, Old Lorus changed its name to Lorus Therapeutics Inc. On October 1, 2005, Old Lorus continued under the Canada Business Corporations Act.

On July 10, 2007 (the “Arrangement Date”), Old Lorus completed a plan of arrangement and corporate reorganization with, among others, 6650309 Canada Inc. (“New Lorus”), 6707157 Canada Inc. and Pinnacle International Lands, Inc. As a result of the plan of arrangement and reorganization each common share of Old Lorus was exchanged for one common share of New Lorus. New Lorus continued the business of Old Lorus after the Arrangement Date with the same officers and employees and continued to be governed by the same board of directors as Old Lorus prior to the Arrangement Date. References in this annual information form to the Company, Lorus, “we”, “our”, “us” and similar expressions, unless otherwise stated, are references to Old Lorus prior to the Arrangement Date and New Lorus after the Arrangement Date.

At our annual and special meeting of shareholders held on November 30, 2009, our shareholders approved a special resolution permitting our board of directors, in its sole discretion, to file an amendment to our articles of incorporation to consolidate our issued and outstanding common shares.

On May 12, 2010, our board approved the share consolidation on the basis of one post-consolidation common share for every 30 pre-consolidation common shares. The record date and effective date for the share consolidation was May 25, 2010. Our common shares began trading on the TSX on a post-consolidation basis on May 31, 2010. The share consolidation resulted in an adjustment to the exercise price and number of common shares issuable upon exercise of outstanding stock options and warrants.

In this annual information form, all references to number of shares, stock options and warrants in the current and past periods have been adjusted to reflect the impact of the consolidation unless noted otherwise.

The address of the Company’s head and registered office is 2 Meridian Road, Toronto, Ontario, Canada, M9W 4Z7. Our corporate website is www.lorusthera.com. The contents of the website are specifically not included in this annual information form by reference.

Lorus’ subsidiary is NuChem Pharmaceuticals Inc. (“NuChem”), a corporation incorporated under the laws of Ontario, of which Lorus owns 80% of the issued and outstanding voting share capital and 100% of the issued and outstanding non-voting preference share capital. On May 31, 2009, GeneSense Technologies Inc. (“GeneSense”), of which Lorus owned 100% of the issued and outstanding share capital was wound up into Lorus and subsequently dissolved. Until June 22, 2009 Lorus owned 100% of the issued and outstanding share capital of Pharma Immune Inc. (“Pharma Immune”), a corporation incorporated under the laws of Delaware, at which time it disposed of these shares (See “Financial Strategy – Secured Convertible Debentures”).

Our common shares are listed on the Toronto Stock Exchange (“TSX”) under the symbol “LOR”.

| 2 |

GENERAL DEVELOPMENT OF THE BUSINESS

Lorus Therapeutics Inc. is a biopharmaceutical company focused on the discovery, research and development of novel anticancer therapies with a high safety profile. Lorus has worked to establish a diverse, marketable anticancer product pipeline, with products in various stages of development ranging from discovery and pre-clinical to a product available to start a Phase III clinical trial. A growing intellectual property portfolio supports our diverse product pipeline.

Our success is dependent upon several factors, including maintaining sufficient levels of funding through public and/or private financing, establishing the efficacy and safety of our product candidates in clinical trials, securing strategic partnerships and obtaining the necessary regulatory approvals to market our products.

We believe that the future of cancer treatment and management lies in drugs that are effective, have minimal side effects, and therefore improve a patient's quality of life. Many of the cancer drugs currently approved for the treatment and management of cancer are toxic with severe side effects, and we believe that a product development plan based on effective and safe drugs could have broad applications in cancer treatment. Lorus' strategy is to continue the development of our product pipeline using several therapeutic approaches. Each therapeutic approach is dependent on different technologies, which we believe mitigates the development risks associated with a single technology platform. We evaluate the merits of each product candidate throughout the clinical trial process and consider partnership when appropriate.

Over the past three years, we have focused on advancing our product candidates through pre-clinical and clinical testing. It costs millions of dollars and takes many years before a product candidate may be approved for therapeutic use in humans and the risk exists that a product candidate may not meet the end points of any Phase I, Phase II or Phase III clinical trial. See “Regulatory Approval Process” and “Risk Factors”.

Our business model is to take our product candidates through pre-clinical testing and into Phase I and Phase II clinical trials. It is our intention to then partner or co-develop these drug candidates after successful completion of Phase I or II clinical trials. Lorus will give careful consideration in the selection of partners that can best advance its drug candidates into a pivotal Phase III clinical trial and, upon successful results, commercialization. Our objective is to receive upfront and milestone payments as well as royalties from such partnerships, which will support continued development of our other product candidates.

Small Molecules

We have small molecule drug discovery capability and preclinical scientific expertise, which we are using to create a drug candidate pipeline. Our proprietary group of small molecule compounds include the lead compound LOR-253. LOR-253 is currently in a Phase I clinical trial and has unique structures and modes of action that represents a promising targeted anticancer agent with, we believe, a high safety profile. LOR-264 represents a second generation structural derivative of LOR-253 that has been optimized for oral absorption. Structural diversification and lead optimization of LOR-264 is currently underway.

Another small molecule program in active development is LOR-500, currently in the lead optimization stage of development. See “— “Business of the Company — Small Molecule Therapies”.

Immunotherapy

IL-17E is a novel immunotherapy based on stimulating anticancer properties of the immune system and by direct tumor cell killing. It has an excellent therapeutic index and is currently in preclinical development. Lorus owns the patents for the anti-cancer use of IL-17E. See “Business of the Company – Immunotherapy.”

| 3 |

Other Technologies

In addition to its active pipeline programs (LOR-253, LOR-500, IL-17E), Lorus has rights to two late-stage compounds, LOR-2040 and Virulizin. The intellectual property rights to Virulizin were sold in 2009 (see “Financial Strategy – Secured Convertible Debentures”) however Lorus retains certain rights to Virulizin which is partnered with Zor Pharma. Lorus is seeking potential partners for LOR-2040. In addition Lorus has discovered LOR-220, a novel small molecule with antimicrobial properties in the preclinical stage. We are not currently developing these product candidates in house and are seeking partnership for further development. See “Business of the Company —Other Technologies”.

Clinical Development

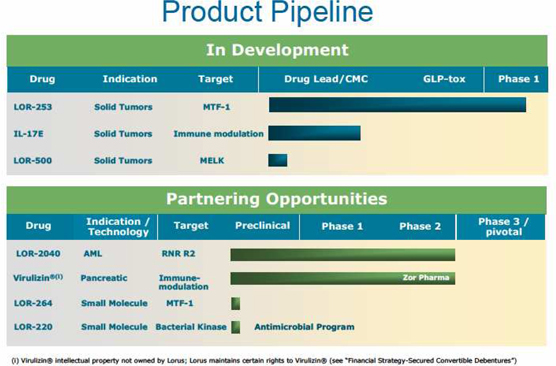

The chart below illustrates our current view of the clinical and preclinical development stage of each of our products. This chart reflects the current regulatory approval process for biopharmaceuticals in Canada and the United States. See “Regulatory Requirements” for a description of the regulatory approval process in Canada and the United States. These qualitative estimates of the progress of our products are intended solely for illustrative purposes and this information is qualified in its entirety by the information appearing elsewhere or incorporated by reference in this annual information form.

| 4 |

Business Strategy

Our business strategy is based on the identification and development of novel therapies that are effective but with fewer side effects. In order to minimize single technology-related risks, we have adopted the following technology approaches:

| · | Development of small molecules that recognize specific targets in cancer cells; |

| · | Immunotherapy using safe and efficacious products to stimulate the natural anticancer properties of the immune system. |

In our efforts to obtain the greatest return on our investment in each drug candidate, we separately evaluate the merits of each drug candidate throughout the pre-clinical and clinical development process and consider commercialization opportunities when appropriate.

Our business model is to take our product candidates through pre-clinical testing and into Phase I and Phase II clinical trials. It is our intention to then partner or co-develop these drug candidates after successful completion of Phase I or II clinical trials. Lorus will give careful consideration in the selection of partners that can best advance its drug candidates into a pivotal Phase III clinical trial and, upon successful results, commercialization. Our objective is to receive upfront and milestone payments as well as royalties from such partnerships, which will support continued development of our other product candidates.

In the next fiscal year, we intend to pursue partnerships and collaborations for our compounds and further the development of our promising pipeline. More specifically, our main objectives are (i) to complete the Phase I clinical trial of our lead small molecule drug, LOR-253, and prepare for initiation of a Phase II clinical trial; (ii) to advance our pre-clinical product candidates IL-17E and LOR-500 derivative; and (iii) to secure partnership and financing alternatives in order to successfully continue our operations.

Financial Strategy

To meet our future financing requirements, we intend to finance our operations through some or all of the following methods: public or private equity financings, and collaborative and licensing agreements. We intend to pursue financing opportunities as they arise. See “Risk Factors”.

June 2012 Private Placement

Subsequent to our fiscal year end of May 31, 2012, in June 2012, Lorus completed a private placement (the “Private Placement”) of 20,625,000 units at a subscription price of $0.32 per unit, each unit (in this section a “Unit”) consisting of one common share and one common share purchase warrant for gross proceeds to Lorus of $6,600,000.

Each warrant is exercisable for a period of 24 months from the date of issuance at an exercise price of $0.45 (in this section, the “Warrants”). If after one year (in this section the “Accelerated Exercise Date”) the closing price of the common shares on the Toronto Stock Exchange equals or exceeds $0.90 for twenty consecutive days, then upon the Company sending the holders of Warrants written notice of such Accelerated Exercise Date and issuing a news release announcing such Accelerated Exercise Date, the Warrants shall only be exercisable for a period of 30 days following the date on which such written notice is sent to holders of Warrants.

PowerOne Capital Markets Limited acted as a finder in the financing and were paid a cash finder’s fee equal to 6% of the gross proceeds of the Private Placement and were issued 1,237,500 finder’s warrants at an exercise price of $0.32 each. Each finder’s warrant is exercisable into Units consisting of 1,237,500 common shares and 1,237,500 Warrants.

| 5 |

August 2011 Unit Offering

On July 22, 2011, the Company filed a final short-form prospectus in connection with a best efforts offering (the "Offering") of a minimum of 5,000,000 units of the Company (in this section the "Units") at a price of $0.40 per Unit for gross proceeds of $2,000,000 and a maximum of 10,000,000 Units for gross proceeds of $4,000,000. Each Unit consisted of one common share of Lorus (a "Common Share") and one common share purchase warrant of Lorus (in this section a "Warrant"). Each Warrant entitles the holder to purchase one Common Share for five years after the closing of the Offering at an exercise price of $0.45 per Common Share (in this section the "Exercise Price"). If on any date (in this section the "Accelerated Exercise Date") the 10-day volume weighted average trading price of the Common Shares on the Toronto Stock Exchange equals or exceeds 200% of the Exercise Price, then upon the Company sending the holders of Warrants written notice of such Accelerated Exercise Date and issuing a news release announcing such Accelerated Exercise Date, the Warrants shall only be exercisable for a period of 30 days following the date on which such written notice is sent to holders of Warrants.

In connection with the Offering, Herbert Abramson, a director of the Company, entered into an irrevocable commitment letter on June 20, 2011, and amended July 11, 2011, to purchase, directly or indirectly, common shares and common share purchase warrants (or as may otherwise be agreed) in the capital of Lorus (collectively the "Securities") having an aggregate subscription price equal to the difference (the "Commitment Amount"), if any, between (a) the sum of (i) the gross proceeds realized by Lorus in the Offering and (ii) the gross proceeds received by Lorus in respect of all financings completed by Lorus from the date of the final short-form prospectus to November 30, 2011 and (b) $4.0 million.

The Offering closed on August 15, 2011 for total gross proceeds of $2.2 million. In connection with the Offering, Lorus has issued 5.484 million Common Shares and 5.678 million Warrants including the broker warrants. Mr. Abramson purchased 2.4 million Units as part of the Offering.

The total costs associated with the transaction were approximately $395 thousand which included the $25 thousand which represented the fair value of the brokers' services provided as part of the Offering. Each such broker warrant is exercisable for one Unit at a price of $0.40 per Unit for a period of 24 months following the closing of the Offering. The Company has allocated the net proceeds of the Offering to the common shares and the common share purchase warrants based on their estimated relative fair values. Based on relative fair values, $1.2 million of the net proceeds were allocated to the common shares and $609 thousand to the common share purchase warrants.

December 2010 Private Placement

On December 1, 2010, pursuant to a private placement, the Company issued 1.6 million common shares in exchange for cash consideration of $1.66 million. The total costs associated with the transaction were approximately $20 thousand. The Company has allocated the net proceeds of the private placement to common shares. Mr. Herbert Abramson, a director of the Corporation, subscribed for 1,410,000 common shares, representing approximately 89% of the total number of common shares issued through the private placement. No commission was paid in connection with the private placement.

November 2010 Rights Offering

On August 27, 2010 the Company announced a proposed rights offering as described below including a $4 million standby purchase agreement from a director of the Company Mr. Herbert Abramson. Mr. Abramson also provided the Company with interim financing by way of three $500 thousand monthly loans, advanced on August 11, 2010, September 13, 2010 and October 5, 2010. The loans were unsecured, had a six-month term (or the earlier of the closing of the rights issue) and bore interest at the annual rate of 10%. All three notes were repaid upon the close of the rights offering described below.

| 6 |

On September 27, 2010, Lorus filed a final short form prospectus in connection with a distribution to its shareholders of rights exercisable for units of the Company (the “Rights Offering”). Under the Rights Offering, holders of common shares received one right for each common share held as of the record date. Each two rights entitled the holder thereof to purchase a unit of the Company at a price of $1.11 per unit. Each unit consisted of one common share of the Company and one warrant to purchase an additional common share of the Company at a price of $1.33 until May 2012.

A total of 4.2 million units of the Company at a price of $1.11 per unit were issued in connection with the rights offering. As a result of the rights offering Lorus issued 4.2 million common shares and 4.2 million common share purchase warrants.

In connection with the rights offering, the Company secured a standby purchase arrangement of $4 million by Herbert Abramson, one of Lorus’ directors. Mr. Abramson agreed to make an investment such that the minimum gross proceeds of the proposed rights offering would be $4 million. No fee was payable to Mr. Abramson for this commitment. In accordance with the terms of the stand-by purchase agreement, Mr. Abramson subscribed for 3.6 million of the 4.2 million units of the offering for $4.0 million.

The total costs associated with the transaction were approximately $370 thousand. The Company has allocated the net proceeds of the rights offering to the common shares and the common share purchase warrants based on their relative fair values. Based on relative fair values, $3.2 million of the net proceeds were allocated to the common shares and $1.0 million to the common share purchase warrants.

Share Consolidation

At our annual and special meeting of shareholders held on November 30, 2009, our shareholders approved a special resolution permitting our board of directors, in its sole discretion, to file an amendment to our articles of incorporation to consolidate our issued and outstanding common shares.

On May 12, 2010, our board approved the share consolidation on the basis of one post-consolidation common share for every 30 pre-consolidation common shares. The record date and effective date for the share consolidation was May 25, 2010. Our common shares began trading on the TSX on a post-consolidation basis on May 31, 2010. The share consolidation resulted in an adjustment to the exercise price and number of common shares issuable upon exercise of outstanding stock options and warrants.

In this annual information form, all references to number of shares, stock options and warrants in the current and past periods have been adjusted to reflect the impact of the consolidation unless noted otherwise.

Promissory Notes

In April 2010, the Company entered into a loan agreement with a company related to a member of its Board of Directors to borrow $1 million. The loan amount, which was received on April 14, 2010, was unsecured, evidenced by a promissory note and bore interest at the annual rate of 10%. The principal and interest amount are due in on October 14, 2010. The funds were used for general working capital purposes. This loan was repaid in November 2010.

In October 2009, the Company entered into a loan agreement with the same member of our Board of Directors to borrow $1 million. The loan amount, which was received on October 6, 2009, was unsecured, evidenced by a promissory note and bears interest at the annual rate of 10%. The principal and interest was due in six months. The principal amount of $1.0 million was applied to subscribe for units as part of the November 27, 2009 private placement described below.

November 2009 Private Placement

On November 27, 2009, pursuant to a private placement, the Company issued 41.0 million (pre-consolidation) common shares and 20.5 million (pre-consolidation) common share purchase warrants in exchange for cash consideration of $2.5 million. This amount includes the principal amount of $1.0 million originally received by way of a loan from a director on October 6, 2009 which was applied to subscribe for units as part of the private placement. In addition, the Company issued 2.2 million (pre-consolidation) brokers’ warrants to purchase an equivalent number of common shares at $0.08 (pre-consolidation) until May 27, 2011.

| 7 |

Secured Convertible Debentures

On October 6, 2004, the Company entered into a Subscription Agreement with The Erin Mills Investment Corporation (“TEMIC”) to issue an aggregate of $15.0 million of secured convertible debentures (the “Debentures”) issuable in three tranches of $5.0 million each, in each of, October 2004, January 2005 and April 2005. The Debentures were due on October 6, 2009.

On June 22, 2009, the Company reached a settlement with TEMIC with respect to the purchase and settlement of the $15.0 million Debentures.

Under the settlement agreement, Lorus purchased all of the Debentures from TEMIC for a cash payment of $3.3 million, the assignment of the rights under the license agreement with ZOR Pharmaceuticals, LLC (“ZOR”), the sale of intellectual property associated with Virulizin and the sale to TEMIC of Lorus’ shares in its wholly owned subsidiary Pharma Immune Inc. which holds an equity interest in ZOR (the “Consideration”). Under the settlement agreement, Lorus is entitled to 50% of any royalties received under the ZOR license agreement and 50% of the deal value of any transaction completed in territories not covered by the ZOR license agreement. TEMIC is fully responsible for all clinical and regulatory costs associated with commercialization of Virulizin in territories not covered by the ZOR license agreement. Lorus assists TEMIC with certain agreed upon services.

For receipt of the Consideration TEMIC released all security interest in the assets of Lorus.

REGULATORY APPROVAL PROCESS

The research, development, manufacture and marketing of pharmaceutical products are governed by various governmental authorities throughout the world to ensure efficacy and safety. In Canada, these activities are governed by the provisions of the Food and Drugs Act (Canada) and its regulations, the enforcement of which is ensured by the Therapeutic Products Directorate of the Health Products and Food Branch of Health Canada. In the United States, it is the Food and Drug Administration (“FDA”) that has jurisdiction. Similar processes are conducted in other countries by similar regulatory bodies. Regulations in each jurisdiction require that licenses be obtained from regulatory agencies for drug manufacturing facilities and also mandate strict research and product testing standards in order to ensure quality in respect of the manufacturing of therapeutic products. Companies must establish that the production of their products comply with Good Manufacturing Practices (GMPs) and the clinical development be conducted in accordance with Good Clinical Practices in order to demonstrate the safety and effectiveness of the therapeutic drug candidate. While Lorus will pursue the approval of any product that it develops, success in acquiring regulatory approval for any such product is not assured. See “Risk Factors”.

In order to market its pharmaceutical products in Canada and the United States, the product candidate must successfully satisfy the requirements of each of the following stages of the regulatory approval process and drug development:

Pre–Clinical Studies: Pre–clinical studies involve extensive testing in laboratory animals to determine if a potential therapeutic product has utility in an in vivo disease model and has any adverse toxicological effects in animals. The conduct and results of these studies are reported to regulatory agencies in an Investigational New Drug (“IND”) application in the United States and a Clinical Trial Application (“CTA”) in Canada, to gain approval to commence clinical trials of the product in human subjects or patients, depending on the indication for use.

Phase I Clinical Trials: Phase I clinical trials are designed to determine the pharmacokinetics, metabolism and pharmacologic actions of the drug in humans, the side effects associated with increasing doses and the maximum tolerated dose. These drug candidate studies, often short in duration, enroll only a small number of patients at each dose level.

| 8 |

Phase II Clinical Trials: Phase II studies are conducted to evaluate the safety of the drug in the intended patient population with the disease or condition under study and to determine the common short-term side effects and risks associated with the drug. Phase II studies are typically well controlled, closely monitored and conducted in a relatively small number of patients. These studies are usually designed to gain early evidence of the effectiveness of the drug candidate, along with its safety.

Phase III Clinical Trials: Phase III studies are expanded studies performed after preliminary evidence suggesting effectiveness of the drug is obtained. Phase III studies gather additional information about effectiveness and safety that is required to evaluate the overall benefit-risk profile of the drug candidate and to provide adequate basis for physician labeling. Phase III trials usually involve several hundred to several thousand patients.

Once these trials are completed, a company files a registration file named New Drug Submission in Canada and a New Drug Application (“NDA”) in the United States. If such a registration file shows that the product was developed in accordance with the regulatory authorities’ rules, regulations and guidelines and demonstrates a favourable risk/benefit analysis, then the regulatory authorities issue a notice of compliance (Canada) or an approval letter (US), which allows a company to market the product.

If and when marketing approval is granted by Health Canada or the FDA, the product is then approved for commercial sale in the respective jurisdiction. In addition to the approval of the drug itself, Health Canada and the FDA each require that the manufacturer of a therapeutic drug be in full compliance with the current GMPs in effect in Canada or the United States, respectively. A similar process for therapeutic drug approval is followed in most other countries with sophisticated regulatory bodies that have appropriate regulations and oversight.

BUSINESS OF THE COMPANY

Lorus is a discovery, research and clinical development stage company with a focus on novel cancer drugs. We have a diversified active portfolio including small molecules (LOR-253/LOR-500) and an immunotherapy (IL-17E), all of which represent first in class compounds with unique validated targets and distinct mechanisms of action. Our mandate is to discover and develop drugs up to and including the Phase II clinical stage, and then out-license to pharmaceutical partners to fund the large and expensive registration clinical trials and if the clinical trials are successful, subsequent commercialization.

Small Molecule Therapies

Most anticancer chemotherapeutic treatments are DNA damaging, cytotoxic agents, designed to act on rapidly dividing cells. Treatment with these drugs is typically associated with unpleasant or even serious side effects due to the inability of these drugs to differentiate between normal and cancer cells and/or due to a lack of high specificity for the targeted protein. In addition, these drugs often lead to the development of tumor-acquired drug resistance. As a result of these limitations, a need exists for more effective anticancer drugs. One approach is to develop small molecules that have greater target specificity and are more selective against cancer cells. Chemical compounds weighing less than 1000 daltons (a unit of molecular weight) are designated as small or low molecular weight molecules. These molecules can be designed to target specific proteins or receptors that are known to be involved with disease.

LOR-253: is a proprietary, first-in-class, small molecule that stimulates Krüppel-like factor 4 (KLF4) to suppress tumor growth. This compound, which is unique to Lorus, exhibits potent anti-proliferative and anti-metastatic properties and is currently in a Phase I trial for solid tumors. The Phase I dose-escalation study is in patients with advanced or metastatic solid tumors who are unresponsive to conventional therapy or for which no effective therapy is available. The study, which is currently enrolling patients, is being conducted at Memorial Sloan-Kettering Cancer Center in New York and MD Anderson Cancer Center in Houston. Objectives of the study include determination or characterization of the safety profile, maximum tolerated dose, and antitumor activity of LOR-253, as well as pharmacokinetics and recommended Phase II dose for subsequent clinical trials.

In September, 2011, Lorus announced the allowance of an Australian patent for LOR-253, which covers LOR-253 composition of matter and methods of treating cancer with LOR-253.

| 9 |

In November, 2011, Lorus announced the presentation of positive nonclinical toxicity data for LOR-253 at the Annual Meeting of the American College of Toxicology (ACT). The presentation details the results of nonclinical toxicity and toxicokinetics studies conducted with LOR-253. The studies were part of the formal safety evaluation of LOR-253 to support first-in-man clinical trials in cancer, and to determine the starting dose of LOR-253 in patients. The studies, which took place over one year, examined a wide range of toxicity parameters in rat and dog species, as well as safety pharmacology and blood toxicity. Overall, LOR-253 had a favorable nonclinical toxicology profile in both animal species and was well tolerated at doses higher than efficacious dose levels established in animal models of human cancers. Of significance, the data show that the effective dose could be increased by a factor of eight to fifteen before seeing levels of toxicity in the animal studies. Additional data in the poster include the results of preclinical anticancer studies on LOR-253 in mouse models of human non-small cell lung cancer (NSCLC). The data show that LOR-253 has significant anticancer activity against NSCLC, particularly in tumors with low expression levels of the tumor suppressor KLF4. Lorus is currently examining the role of KLF4 as a potential biomarker for LOR-253 anticancer activity.

In March, 2012, Lorus announced that the Canadian Patent Office has issued a patent for LOR-253. The patent provides Lorus with exclusive rights to LOR-253 in Canada until it expires in 2026. The Canadian patent covers LOR-253 composition of matter and its use in the treatment of a wide range of cancers.

In April, 2012, Lorus announced the presentation of new preclinical data for LOR-253, at the AACR annual meeting. The data supports the treatment of lung and colon cancers with LOR-253 in combination with a variety of chemotherapy agents. The studies examined the anticancer activities of LOR-253, given in combination with approved anticancer agents, at different doses and schedules. The preclinical data showed that initial treatment of non-small cell lung cancer (NSCLC) cells with chemotherapy drugs docetaxel, paclitaxel, or cisplatin, followed by treatment with LOR-253, had significant and synergistic anticancer activity compared to either drug given alone. In animal studies, LOR-253 plus docetaxel showed significant efficacy against human NSCLC tumors when both drugs were administered at efficacious doses sequentially, compared to treatment with either agent alone at the same dose levels. Similar anticancer synergy was also seen in colon cancer cells when LOR-253 was combined with the chemotherapeutics oxaliplatin, CPT-11, or fluorouracil. Each of these drugs are currently used for the treatment of colon cancer. In animal studies, LOR-253 plus oxaliplatin showed significant efficacy against human colon tumors when both drugs were administered sequentially, compared to either agent alone at the same dose levels.

In April, 2012, Lorus announced that the United States Patent and Trademark Office has allowed Lorus’ patent for LOR-253. The patent, which was originally set to expire in May 2026, was granted a patent term adjustment that extends the patent expiry date to February 2028.

In June, 2012 Lorus announced the addition of MD Anderson Cancer Center as a second site in the ongoing LOR 253 Phase I clinical trial, under the direction of Dr. Jennifer Wheler as the principal investigator. In addition, Lorus announced that the study had successfully completed the accelerated drug dose escalation stage (Stage 1), with further escalation under way in the non-accelerated dose escalation stage (Stage 2) for the purpose of determining the maximal tolerated dose level and recommended Phase II dose. The addition of a second site expands patient availability for enrollment as the study is now in Stage 2. Upon completion of the final dose of this stage, the study will be further expanded to include biopsy-suitable patients for evaluating direct drug effects in the tumors.

LOR-500 program: potent and first-in-class small molecule anticancer agents with a novel target, MELK. Lorus’ research suggests that the MELK target is highly expressed in multiple cancers.

Immunotherapy

Immunotherapy is a form of treatment that stimulates the body’s immune system to fight diseases including cancer. Lorus’ research suggests that immunotherapy may help the immune system to fight cancer by improving recognition of differences between healthy cells and cancer cells. Alternatively, it may stimulate the production of specific cancer fighting cells.

| 10 |

IL-17E: a novel immunotherapy based on stimulating anticancer properties of the immune system and by direct tumor cell killing. It has an excellent therapeutic index and is currently in preclinical development. Lorus owns the patents for the anti-cancer use of IL-17E.

In February 2010, we announced the publication of an article entitled “IL-17E, a proinflammatory cytokine, has antitumor efficacy against several tumor types in vivo”, in the peer-reviewed journal Cancer Immunology Immunotherapy. In this article, we demonstrated the antitumor effects of IL-17E alone and in combination with a number of approved anticancer agents in preclinical models. The studies showed that IL-17E alone had potent antitumor activity in a number of solid tumors, including melanoma, breast, colon, pancreatic, and non-small cell lung cancers. In combination studies, IL-17E was compatible with a wide variety of approved anticancer drugs, including Avastin, Tarceva, Taxol, Cisplatin, Dacarbazine, Irinotecan, and Gemzar. Furthermore, the combination of IL-17E with each of these anticancer agents showed greater anticancer efficacy than either agent alone without additional toxicity. The article also provided data on the mechanism of anticancer activity for IL-17E, showing that IL-17E activated the immune system, specifically acting on eosinophils and B cells.

In May, 2012, Lorus announced that it had entered into a global license with Genentech, a member of the Roche Group, in respect of the in-licensing of certain patents owned by Genentech for IL-17E. Lorus believes that the Genentech license will enable Lorus to develop this program as a novel and exciting treatment for a large number of cancers. See “License Agreement – Genentech”.

Other Technologies

In addition to its active pipeline programs, Lorus has two late-stage compounds, LOR-2040 and Virulizin. The intellectual property rights to Virulizin were sold in 2009 (see “Financial Strategy – Secured Convertible Debentures”) however Lorus retains certain rights to Virulizin which is partnered with Zor Pharma. Lorus is seeking a potential partner for the further development of LOR-2040.

Lorus also has LOR-220, a novel small molecule with antimicrobial properties in the preclinical stage. LOR-220 has demonstrated antimicrobial activity with growth inhibition of Gram-positive bacteria including strains of methicillin-resistant S. aureus (MRSA), vancomycin-resistant E. faecalis (VRE), and Streptococcus pneumoniae, with minimal inhibitory concentration (MIC) values comparable to the newly introduced oxazolidinone & Linezolid, and potent in vitro and in vivo bactericidal activity.

Lorus does not plan to develop any of these other technologies using its own resources and as such these programs will only advance in the event Lorus is able to secure a partnership.

Agreements

Manufacturing Agreements

We currently rely upon subcontractors for the manufacture of our drug candidates. The subcontractors manufacture clinical material according to current GMP at contract manufacturing organizations that have been approved by our quality assurance department staff, after having conducted audits to ensure such manufacturers meet the requirements of the relative regulatory authorities.

Manufactured product for clinical purposes is tested for conformance with product specifications prior to release by our quality assurance staff. GMP batches of our drug candidates are subjected to prospectively designed stability test protocols.

| 11 |

Licence Agreements

Genentech

The Company holds a non-exclusive license from Genentech to certain patent rights to develop and sub-license a certain polypeptide. In consideration of the license the Company paid an upfront amount and could be required to pay additional milestones and royalties on sales. The Company does not expect to make any milestone or royalty payments under this agreement in fiscal years ended May 31, 2013 or 2014, and cannot reasonably predict when such royalties will become payable, if at all.

University of Manitoba

The Company holds an exclusive worldwide license to certain patent rights relates specifically to antisense and related technologies described in patent applications that were pending at the time of the agreement with The University of Manitoba. Subsequent patent amendments or advancements to these patents remain as the property of Lorus, without license rights accruing back to the University of Manitoba. In consideration for the exclusive license the University of Manitoba is entitled to an aggregate of 1.67% of the net sales received by Lorus from the sale of products or processes derived from the patent rights and 1.67% of all monies received by Lorus from sub-licenses of the patent rights. We do not expect to make any royalty payments under this agreement in fiscal years ended May 31, 2013 or 2014 if at all.

Collaboration Agreements

Zoticon Bioventures Inc.

In April 2008,Lorus signed an exclusive multinational license agreement with ZOR, a subsidiary of Zoticon Bioventures Inc. (“Zoticon”), a research-driven biopharmaceutical group, to further develop and commercialize Virulizin® for human therapeutic applications. In June 2009, Lorus assigned these rights to TEMIC in settlement of an outstanding convertible debenture. Lorus retained rights to 50% of royalties received by TEMIC as well as a right to 50% of consideration received in territories not covered by the Zor license agreement.

Other

From time to time, we enter into other research and technology agreements with third parties under which research is conducted and monies expended. These agreements outline the responsibilities of each participant and the appropriate arrangements in the event the research produces a product candidate.

Intellectual Property and Protection of Confidential Information and Technology

We believe that our issued patents and pending applications are important in establishing and maintaining a competitive position with respect to our products and technology.

Small Molecule

We have been issued 10 patents and have 14 pending patents worldwide for our in-house small molecules. These patents cover composition of matter and method claims.

Immunotherapy

We have one issued patent and two pending patents for our IL-17E immunotherapy program.

Other Therapies

We have 19 issued patents and three pending patents worldwide for our DNA-based therapeutics. These patents include composition of matter and method claims.

See “Risk Factors”

| 12 |

Regulatory Strategy

Our overall regulatory strategy is to work with the appropriate government departments which regulate the use and sale of therapeutic drug products. This includes Health Canada in Canada, the Food and Drug Administration in the United States, the European Medicines Agency in Europe, and any other local regulatory agencies with oversight of preclinical studies, clinical trials and marketing of therapeutic products. Where possible, we intend to take advantage of opportunities for accelerated development of drugs designed to treat rare and serious or life-threatening diseases. We also intend to pursue priority evaluation of any application for marketing approval filed in Canada, the United States or the European Union and to file additional drug applications in other markets where commercial opportunities exist. We cannot assure you that we will be able to pursue these opportunities successfully. See “Regulatory Approval Process” and “Risk Factors”.

Competition

The biotechnology and pharmaceutical industries are characterized by rapidly evolving technology and intense competition. There are numerous players in both of these industries that are focusing their efforts on activities similar to ours. Some of these are companies with established positions in the pharmaceutical industry and may have substantially more financial and technical resources, more extensive research and development capabilities, and greater marketing, distribution, production and human resources than us. In addition, we may face competition from other companies for opportunities to enter into partnerships with biotechnology and pharmaceutical companies and academic institutions. Many of these other companies however are not solely focused on cancer, as is the mission of our drug development strategy to specialize in the development of drugs for the treatment and management of cancer.

Competition with our products may include chemotherapeutic agents, monoclonal antibodies, antisense therapies, small molecules, vaccines and other biologics, and immunotherapies with novel mechanisms of action. These drugs may kill cancer cells indiscriminately, or through a targeted approach, and some have the potential to be used in non-cancer indications. We also expect that we may experience competition from established and emerging pharmaceutical and biotechnology companies that have other forms of treatment for the cancers that we target, including drugs currently in development for the treatment of cancer that employ a number of novel approaches for attacking these cancer targets. Cancer is a complex disease with more than 100 indications requiring drugs for treatment. The drugs in competition with our drugs have specific targets for attacking the disease; targets which are not necessarily the same as ours. These competitive drugs therefore could potentially also be used together in combination therapies with our drugs to manage the disease. Other factors that could render our products less competitive may include the stage of development, where competitors’ products may achieve earlier commercialization, as well as superior patent protection, better safety profile, or a preferred cost-benefit profile.

Human Resources

As at May 31, 2012, we employed 12 full-time persons and four part-time people in research and drug development and administration activities. Of our employees, four hold Ph.D.s. To encourage a focus on achieving long-term performance, employees and members of the board of directors have the ability to acquire an ownership interest in the Company through Lorus’ stock option and alternative compensation plans.

Our ability to develop commercial products and to establish and maintain our competitive position in light of technological developments will depend, in part, on our ability to attract and retain qualified personnel. There is a significant level of competition in the marketplace for such personnel. We believe that to date we have been successful in attracting and retaining the highly skilled personnel critical to our business. We have also chosen to outsource activities where skills are in short supply or where it is economically prudent to do so.

None of our employees are unionized, and we consider our relations with our employees to be good.

| 13 |

See “Risk Factors”

Properties

Our head office, which occupies 20,500 square feet, is located at 2 Meridian Road, Toronto, Ontario. The leased premises include approximately 8,000 square feet of laboratory and research space. We believe that our existing facilities are adequate to meet our requirements for the near term. Our current lease expires on March 31, 2013.

RISK FACTORS

Investing in our securities involves a high degree of risk. Before making an investment decision with respect to our common shares, you should carefully consider the following risk factors, in addition to the other information included or incorporated by reference into this annual information form, as well as our historical consolidated financial statements and related notes. Management has reviewed the operations of the Company in conjunction with the Board of Directors and identified the following risk factors which are monitored on a bi-annual basis and reviewed with the Board of Directors. The risks set out below are not the only risks we face. If any of the following risks occur, our business, financial condition, prospects or results of operations and cash flows would likely suffer. In that case, the trading price of our common shares could decline and you may lose all or part of the money you paid to buy our common shares.

We are an early stage development company.

We are at an early stage of development. Since our incorporation, none of our products has obtained regulatory approval for commercial use and sale in any country, except for Virulizin in very limited circumstances in Mexico. As such, significant revenues have not resulted from product sales. Significant additional investment will be necessary to complete the development of any of our product candidates. Pre-clinical and clinical trial work must be completed before our products could be ready for use within the markets that we have identified. We may fail to develop any products, obtain regulatory approvals, enter clinical trials or commercialize any products. We do not know whether any of our potential product development efforts will prove to be effective, meet applicable regulatory standards, obtain the requisite regulatory approvals, be capable of being manufactured at a reasonable cost or be accepted in the marketplace. We also do not know whether sales, license fees or related royalties will allow us to recoup any investment we make in the commercialization of our products.

The product candidates we are currently developing are not expected to be commercially viable for several years and we may encounter unforeseen difficulties or delays in commercializing our product candidates. In addition, our products may cause undesirable side effects.

Our product candidates require significant funding to reach regulatory approval assuming positive clinical results. For example, our lead product candidate LOR-253 is currently in a Phase I clinical trial. Should this trial be successful significant additional funding or a partnership would be necessary to complete the necessary Phase II and Phase III clinical trials. Such funding will be very difficult, or impossible to raise in the public markets or through partnerships. If such funding or partnerships are not attainable, the development of these product candidates maybe significantly delayed or stopped altogether. The announcement of such delay or discontinuation of development may have a negative impact on our share price.

We need to raise additional capital.

We have an ongoing need to raise additional capital. To obtain the necessary capital, we must rely on some or all of the following: additional share issues, debt issuances (including promissory notes), collaboration agreements or corporate partnerships and grants and tax credits to provide full or partial funding for our activities. We cannot assure you that additional funding will be available on terms that are acceptable to us or in amounts that will enable us to carry out our business plan.

| 14 |

Our need for capital may require us to:

| · | engage in equity financings that could result in significant dilution to existing investors; |

| · | delay or reduce the scope of or eliminate one or more of our development programs; |

| · | obtain funds through arrangements with collaborators or others that may require us to |

| · | relinquish rights to technologies, product candidates or products that we would otherwise seek to develop or commercialize ourselves; or license rights to technologies, product candidates or products on terms that are less favourable to us than might otherwise be available; |

| · | considerably reduce operations; or |

| · | cease our operations. |

We have a history of operating losses. We expect to incur net losses and we may never achieve or maintain profitability.

We have not been profitable since our inception in 1986. Under International Financial Reporting Standards, we reported net losses of $4.6 million, and $5.0 million and for the years ended May 31, 2012 and 2011, respectively, and as of May 31, 2012, we had an accumulated deficit of $194 million.

We have not generated any significant revenue from product sales to date and it is possible that we will never have sufficient product sales revenue to achieve profitability. We expect to continue to incur losses for at least the next several years as we or our collaborators and licensees pursue clinical trials and research and development efforts. To become profitable, we, either alone or with our collaborators and licensees, must successfully develop, manufacture and market our current product candidates LOR-253 and IL17E as well as continue to identify, develop, manufacture and market new product candidates. It is possible that we will never have significant product sales revenue or receive significant royalties on our licensed product candidates. If funding is insufficient at any time in the future, we may not be able to develop or commercialize our products, take advantage of business opportunities or respond to competitive pressures.

We may be unable to obtain partnerships for one or more of our product candidates, which could curtail future development and negatively affect our share price. In addition, our partners might not satisfy their contractual responsibilities or devote sufficient resources to our partnership.

Our strategy for the research, development and commercialization of our products requires entering into various arrangements with corporate collaborators, licensers, licensees and others, and our commercial success is dependent upon these outside parties performing their respective contractual responsibilities. The amount and timing of resources that such third parties will devote to these activities may not be within our control. We cannot assure you that such parties will perform their obligations as expected. We also cannot assure you that our collaborators will devote adequate resources to our programs. In addition, we could become involved in disputes with our collaborators, which could result in a delay or termination of the related development programs or result in litigation. We intend to seek additional collaborative arrangements to develop and commercialize some of our products. We may not be able to negotiate collaborative arrangements on favourable terms, or at all, in the future, or assure you that our current or future collaborative arrangements will be successful.

If we cannot negotiate collaboration, licence or partnering agreements, we may never achieve profitability.

| 15 |

Clinical trials are long, expensive and uncertain processes and Health Canada or the FDA may ultimately not approve any of our product candidates. We may never develop any commercial drugs or other products that generate revenues.

None of our product candidates has received regulatory approval for commercial use and sale in North America. We cannot market a pharmaceutical product in any jurisdiction until it has completed thorough preclinical testing and clinical trials in addition to that jurisdiction’s extensive regulatory approval process. Approval in one country does not assure approval in another country. In general, significant research and development and clinical studies are required to demonstrate the safety and effectiveness of our product candidates before we can submit any regulatory applications.

Clinical trials are long, expensive and uncertain processes. Clinical trials may not be commenced or completed on schedule, and Health Canada or the FDA or any other regulatory body may not ultimately approve our product candidates for commercial sale.

The clinical trials of any of our drug candidates could be unsuccessful, which would prevent us from advancing, commercializing or partnering the drug.

Even if the results of our preclinical studies or clinical trials are initially positive, it is possible that we will obtain different results in the later stages of drug development or that results seen in clinical trials will not continue with longer term treatment. Positive results in early Phase I or Phase II clinical trials may not be repeated in larger Phase II or Phase III clinical trials. We cannot assure you that our preclinical studies and clinical trials will generate positive results that will allow us to move towards the commercial use and sale of our product candidates. Furthermore, negative preclinical or clinical trial results may cause our business, financial condition, or results of operations to be materially adversely affected.

For example, as our lead product candidates LOR-253 is in the Phase I stage of development and our product candidate IL-17E is in the pre-clinical stage of development and there is still a long development path ahead which will take many years to complete and like all of our potential drug candidates is prone to the risks of failure inherent in drug development.

Preparing, submitting and advancing applications for regulatory approval is complex, expensive and time intensive and entails significant uncertainty. A commitment of substantial resources to conduct time-consuming research, preclinical studies and clinical trials will be required if we are to complete development of our products.

Clinical trials of our products require that we identify and enrol a large number of patients with the illness under investigation. We may not be able to enrol a sufficient number of appropriate patients to complete our clinical trials in a timely manner particularly in smaller indications and indications where this is significant competition for patients. If we experience difficulty in enrolling a sufficient number of patients to conduct our clinical trials, we may need to delay or terminate ongoing clinical trials and will not accomplish objectives material to our success that could affect the price of our Common Shares. Delays in planned patient enrolment or lower than anticipated event rates in our current clinical trials or future clinical trials may result in increased costs, program delays, or both.

In addition, unacceptable toxicities or adverse side effects may occur at any time in the course of preclinical studies or human clinical trials or, if any product candidates are successfully developed and approved for marketing, during commercial use of any approved products. The appearance of any such unacceptable toxicities or adverse side effects could interrupt, limit, delay or abort the development of any of our product candidates or, if previously approved, necessitate their withdrawal from the market. Furthermore, disease resistance or other unforeseen factors may limit the effectiveness of our potential products.

Our failure to develop safe, commercially viable drugs would substantially impair our ability to generate revenues and sustain our operations and would materially harm our business and adversely affect our share price. We may never achieve profitability.

We have indemnified our predecessor, Old Lorus, and its directors, officers and employees.

In connection with the reorganization that we undertook in fiscal 2008, we have agreed to indemnify our predecessor, Old Lorus, and its directors, officers and employees from and against all damages, losses, expenses (including fines and penalties), other third party costs and legal expenses, to which any of them may be subject arising out of any matter occurring:

| 16 |

| · | prior to, at or after the effective time of the arrangement transaction, and directly or indirectly relating to any of the assets of Old Lorus transferred to us pursuant to the arrangement transaction (including losses for income, sales, excise and other taxes arising in connection with the transfer of any such asset) or conduct of the business prior to the effective time of the arrangement; |

| · | prior to, at or after the effective time as a result of any and all interests, rights, liabilities and other matters relating to the assets transferred by Old Lorus to us under the arrangement; and |

| · | prior to or at the effective time and directly or indirectly relating to, with certain exceptions, any of the activities of Old Lorus or the arrangement. |

This indemnification could result in significant liability to us. To date no amount has been claimed on this indemnification. Should a claim arise under this indemnification it could result in significant liability to the Company which could have a negative impact on our liquidity, financial position, and ability to obtain future funding among other things.

We may not achieve our projected development goals in the time frames we announce and expect.

We set goals for, and make public statements regarding the expected timing of the accomplishment of objectives material to our success, such as the commencement and completion of clinical trials, the partnership of our product candidates and our ability to secure the financing necessary to continue the development of our product candidates. The actual timing of these events can vary dramatically due to factors within and beyond our control such as delays or failures in our clinical trials, the uncertainties inherent in the regulatory approval process, market conditions and interest by partners in our product candidates among other things. We cannot assure you that our clinical trials will be completed, that we will make regulatory submissions or receive regulatory approvals as planned, or that we will secure partnerships for any of our product candidates. Any failure to achieve one or more of these milestones as planned would have a material adverse effect on our business, financial condition and results of operations.

As a result of intense competition and technological change in the pharmaceutical industry, the marketplace may not accept our products or product candidates, and we may not be able to compete successfully against other companies in our industry and achieve profitability.

Many of our competitors have:

| · | drug products that have already been approved or are in development, and operate large, well-funded research and development programs in these fields; |

| · | substantially greater financial and management resources, stronger intellectual property positions and greater manufacturing, marketing and sales capabilities, areas in which we have limited or no experience; and |

| · | significantly greater experience than we do in undertaking preclinical testing and clinical trials of new or improved pharmaceutical products and obtaining required regulatory approvals. |

Consequently, our competitors may obtain Health Canada, FDA and other regulatory approvals for product candidates sooner and may be more successful in manufacturing and marketing their products than we or our collaborators are.

| 17 |

Our competitor’s existing and future products, therapies and technological approaches will compete directly with the products we seek to develop. Current and prospective competing products may be more effective than our existing and future products insofar as they may provide greater therapeutic benefits for a specific problem or may offer easier delivery or comparable performance at a lower cost.

Any product candidate that we develop and that obtains regulatory approval must then compete for market acceptance and market share. Our product candidates may not gain market acceptance among physicians, patients, healthcare payers, insurers, the medical community and other stakeholders. Further, any products we develop may become obsolete before we recover any expenses we incurred in connection with the development of these products. As a result, we may never achieve profitability.

If we fail to attract and retain key employees, the development and commercialization of our products may be adversely affected.

We depend on the principal members of our scientific and management staff. If we lose any of these persons, our ability to develop products and become profitable could suffer. The risk of being unable to retain key personnel may be increased by the fact that we have not executed long-term employment contracts with our employees, except for our senior executives. Our future success will also depend in large part on our ability to attract and retain other highly qualified scientific and management personnel. We face competition for personnel from other companies, academic institutions, government entities and other organizations.

We may be unable to obtain patents to protect our technologies from other companies with competitive products, and patents of other companies could prevent us from manufacturing, developing or marketing our products.

Patent protection:

The patent positions of pharmaceutical and biotechnology companies are uncertain and involve complex legal and factual questions. The United States Patent and Trademark Office and many other patent offices in the world have not established a consistent policy regarding the breadth of claims that they will allow in biotechnology patents.

Allowable patentable subject matter and the scope of patent protection obtainable may differ between jurisdictions. If a patent office allows broad claims, the number and cost of patent interference proceedings in the United States, or analogous proceedings in other jurisdictions and the risk of infringement litigation may increase. If it allows narrow claims, the risk of infringement may decrease, but the value of our rights under our patents, licenses and patent applications may also decrease.

The scope of the claims in a patent application can be significantly modified during prosecution before the patent is issued. Consequently, we cannot know whether our pending applications will result in the issuance of patents or, if any patents are issued, whether they will provide us with significant proprietary protection or will be circumvented, invalidated or found to be unenforceable.

Publication of discoveries in scientific or patent literature often lags behind actual discoveries. Patent applications filed in the United States generally will be published 18 months after the filing date unless the applicant certifies that the invention will not be the subject of a foreign patent application. In many other jurisdictions, such as Canada, patent applications are published 18 months from the priority date. We cannot assure you that, even if published, we will be aware of all such literature. Accordingly, we cannot be certain that the named inventors of our products and processes were the first to invent that product or process or that we were the first to pursue patent coverage for our inventions.

Enforcement of intellectual property rights:

Protection of the rights revealed in published patent applications can be complex, costly and uncertain. Our commercial success depends in part on our ability to maintain and enforce our proprietary rights. If third parties engage in activities that infringe our proprietary rights, our management’s focus will be diverted and we may incur significant costs in asserting our rights. We may not be successful in asserting our proprietary rights, which could result in our patents being held invalid or a court holding that the third party is not infringing, either of which would harm our competitive position.

| 18 |

Others may design around our patented technology. We may have to participate in interference proceedings declared by the United States Patent and Trademark Office, European opposition proceedings, or other analogous proceedings in other parts of the world to determine priority of invention and the validity of patent rights granted or applied for, which could result in substantial cost and delay, even if the eventual outcome is favourable to us. We cannot assure you that our pending patent applications, if issued, would be held valid or enforceable.

Trade secrets:

We also rely on trade secrets, know-how and confidentiality provisions in our agreements with our collaborators, employees and consultants to protect our intellectual property. However, these and other parties may not comply with the terms of their agreements with us, and we might be unable to adequately enforce our rights against these people or obtain adequate compensation for the damages caused by their unauthorized disclosure or use of our trade secrets or know how. Our trade secrets or those of our collaborators may become known or may be independently discovered by others.

Our products and product candidates may infringe the intellectual property rights of others, or others many infringe on our intellectual property rights which could increase our costs.

Our success also depends on avoiding infringement of the proprietary technologies of others. In particular, there may be certain issued patents and patent applications claiming subject matter which we or our collaborators may be required to license in order to research, develop or commercialize at least some of our product candidates, including LOR-253 and IL17E. In addition, third parties may assert infringement or other intellectual property claims against us based on our patents or other intellectual property rights. An adverse outcome in these proceedings could subject us to significant liabilities to third-parties, require disputed rights to be licensed from third-parties or require us to cease or modify our use of the technology. If we are required to license such technology, we cannot assure you that a license under such patents and patent applications will be available on acceptable terms or at all. Further, we may incur substantial costs defending ourselves in lawsuits against charges of patent infringement or other unlawful use of another’s proprietary technology. We may also need to bring claims against others who we believe are infringing our rights in order to become or remain competitive and successful.

If product liability claims are brought against us or we are unable to obtain or maintain product liability insurance, we may incur substantial liabilities that could reduce our financial resources.

The clinical testing and commercial use of pharmaceutical products involves significant exposure to product liability claims. We have obtained limited product liability insurance coverage for our clinical trials on humans; however, our insurance coverage may be insufficient to protect us against all product liability damages. Regardless of merit or eventual outcome, liability claims may result in decreased demand for a future product, injury to reputation, withdrawal of clinical trial volunteers, loss of revenue, costs of litigation, distraction of management and substantial monetary awards to plaintiffs. Additionally, if we are required to pay a product liability claim, we may not have sufficient financial resources to complete development or commercialization of any of our product candidates and our business and results of operations will be adversely affected. In general, insurance will not protect us against some of our own actions such as negligence.

We are subject to privacy laws. Violations of these laws may result in significant liability and the incurring of substantial costs to achieve compliance.

Our business is focused on the development of biopharmaceutical products. As a result, we are subject to some privacy laws in Canada and several other jurisdictions which control the use, disclosure, transmission and retention of confidential personal information. Our insurance coverage and/or diligence may not protect us from all liability and regulatory action arising from non-compliance with these laws, particularly if our non-compliance is the result of our own negligent actions or misconduct. If we have to respond to regulatory action, pay damages, or incur expenses defending any claims, we may be materially and adversely affected.

| 19 |

We have no manufacturing capabilities. We depend on third-parties, including a number of sole suppliers, for manufacturing and storage of our product candidates used in our clinical trials. Product introductions may be delayed or suspended if the manufacture of our products is interrupted or discontinued.

Other than limited quantities for research purposes, we do not have manufacturing facilities to produce supplies of LOR-253, IL17E or any of our other product candidates to support clinical trials or commercial launch of these products, if they are approved. We are dependent on third parties for manufacturing and storage of our product candidates. If we are unable to contract for a sufficient supply of our product candidates on acceptable terms, or if we encounter delays or difficulties in the manufacturing process or our relationships with our manufacturers, we may not have sufficient product to conduct or complete our clinical trials or support preparations for the commercial launch of our product candidates, if approved.

Our business depends on licensing agreements, which may require us to meet obligations that are not favourable for our business.

Our business depends on arrangements with third parties such as licensors and licensees. Our license agreements may require us to diligently bring our products to market, make milestone payments and royalties that may be significant, and incur expenses associated with filing and prosecuting patent applications. We cannot assure you that we will be able to establish and maintain license agreements that are favourable for our business, if at all.

Our operations involve hazardous materials and we must comply with environmental laws and regulations, which can be expensive and restrict how we do business.