Registered Shareholders

You are a registered Shareholder if your name appears on your Share certificate. Your proxy form tells you whether you are a registered Shareholder.

Non-Registered (or Beneficial) Shareholders

You are a non-registered (or beneficial) Shareholder if your bank, trust company, securities broker or other financial institution holds your shares for you (your nominee). For most of you, your voting instruction form or proxy tells you whether you are a non-registered (or beneficial) Shareholder.

In accordance with Canadian securities law, we have distributed copies of the notice of Meeting, this Circular and the form of proxy (collectively, the “meeting materials”) to CDS Clearing and Depository Services Inc. and intermediaries (such as securities brokers or financial institutions) for onward distribution to those non-registered or beneficial Shareholders to whom we have not sent the meeting materials directly. We previously mailed to those who requested them, the audited financial statements of the Corporation for the year ended May 31, 2010 and the auditors' report thereon as well as management's discussion and analysis.

The intermediaries are required to forward meeting materials to non-registered or beneficial Shareholders unless a non-registered or beneficial Shareholder has waived the right to receive them. Very often, intermediaries will use a service company such as Broadridge Investor Communication Solutions to forward the meeting materials to non-registered or beneficial Shareholders.

Non-registered or beneficial Shareholders who have not waived the right to receive meeting materials will receive either a voting instruction form or, less frequently, a form of proxy. The purpose of these forms is to permit non-registered or beneficial Shareholders to direct the voting of the Shares they beneficially own. Non-registered or beneficial Shareholders should follow the procedures set out below, depending on what type of form they receive.

|

A.

|

Voting Instruction Form. In most cases, a non-registered Shareholder will receive, as part of the meeting materials, a voting instruction form. If the non-registered Shareholder does not wish to attend and vote at the Meeting in person (or have another person attend and vote on the non-registered Shareholder's behalf), the voting instruction form must be completed, signed and returned in accordance with the directions on the form. If a non-registered Shareholder wishes to attend and vote at the Meeting in person (or have another person attend and vote on the non-registered Shareholder's behalf), the non-registered Shareholder must complete, sign and return the voting instruction form in accordance with the directions provided and a form of proxy giving the right to attend and vote will be forwarded to the non-registered Shareholder.

|

or

|

B.

|

Form of Proxy. Less frequently, a non-registered Shareholder will receive, as part of the meeting materials, a form of proxy that has already been signed by the intermediary (typically by a facsimile or stamped signature), which is restricted as to the number of Shares beneficially owned by the non-registered Shareholder but which is otherwise uncompleted. If the non-registered Shareholder does not wish to attend and vote at the Meeting in person (or have another person attend and vote on the non-registered Shareholder's behalf), the non-registered Shareholder must complete the form of proxy and deposit it with Computershare, 100 University Avenue, 8th Floor Toronto, Canada, M5J 2Y1 as described above. If a non-registered Shareholder wishes to attend and vote at the Meeting in person (or have another person attend and vote on the non-registered Shareholder's behalf), the non-registered Shareholder must strike out the names of the persons named in the proxy and insert the non-registered Shareholder's (or such other person's) name in the blank space provided.

|

Non-registered Shareholders should follow the instructions on the forms they receive and contact their intermediaries promptly if they need assistance.

Changing Your Vote

A registered Shareholder who has given a proxy may revoke that proxy by:

|

|

(a)

|

completing and signing a proxy bearing a later date and depositing it with Computershare as described above;

|

|

|

(b)

|

depositing an instrument in writing executed by the Shareholder or by the Shareholder's attorney authorized in writing:

|

|

|

(i)

|

at our registered office at any time before 10:00 a.m. on Friday, November 26, 2010, or 48 hours (not including Saturdays, Sundays and holidays) before any adjournment of the Meeting at which the proxy is to be used, or

|

|

|

(ii)

|

with the chair of the Meeting prior to the commencement of the Meeting on the day of the Meeting or any adjournment of the Meeting; or

|

|

|

(c)

|

in any other manner permitted by law.

|

A non-registered or beneficial Shareholder may revoke a voting instruction form or a waiver of the right to receive meeting materials and to vote given to an intermediary or to the Corporation, as the case may be, at any time by written notice to the intermediary or the Corporation, except that neither an intermediary nor the Corporation is required to act on a revocation of a voting instruction form or of a waiver of the right to receive materials and to vote that is not received by such intermediary or the Corporation, at least seven (7) days prior to the Meeting.

VOTING OF PROXIES

You can choose to vote “For”, “Against” or “Withhold”, depending on the items listed on the proxy form.

When you sign the proxy form, you authorize the management representatives named in the proxy form to vote your Shares for you at the Meeting according to your instructions.

If you return your proxy form and do not tell us how you want to vote your Shares, your Shares will be voted by the management representatives named in the proxy form as follows:

• FOR the election of the directors nominated for election as listed in this Circular;

• FOR the appointment of KPMG LLP as auditors of the Corporation;

The enclosed form of proxy confers discretionary authority upon the management representatives designated in the form of proxy with respect to amendments to or variations of matters identified in the notice of Meeting and with respect to other matters that may properly come before the Meeting. At the date of this Circular, the management of the Corporation knows of no such amendments, variations or other matters.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

On October 29, 2010, we had outstanding 9,933,481 Shares. Each holder of Shares of record at the close of business on October 29, 2010, the record date established for notice of the Meeting, will be entitled to one vote for each Share held on all matters proposed to come before the Meeting, except to the extent that the Shareholder has transferred any Shares after the record date and the transferee of such Shares establishes ownership of them and makes a written demand, not later than 10 days prior to the Meeting, to be included in the list of Shareholders entitled to vote at the Meeting, in which case the transferee will be entitled to vote such Shares.

To the knowledge of Lorus' directors and executive officers, no single person or entity beneficially owns, directly or indirectly, or exercises control or direction over more than 10% of the votes attached to all the outstanding Shares, other than High Tech Beteiligungen GmbH & Co. KG (“High Tech”) that, according to information furnished to the Corporation, holds 1,212,083 Shares or approximately 12% of the Shares outstanding and Mr. Herbert Abramson and his affiliated company Technifund Inc. that, according to information furnished to the Corporation, holds 1,427,552 Shares or approximately 14% of the Shares outstanding.

PARTICULARS OF MATTERS TO BE ACTED UPON

1. Appointment and Remuneration of Auditors

Unless you have specified in the enclosed form of proxy that the votes attaching to the Shares represented by the proxy are to be withheld with respect to the appointment of auditors, on any ballot that may be called for in the appointment of auditors, the management representatives designated in the enclosed form of proxy intend to vote the Shares in respect of which they are appointed proxy FOR the appointment of KPMG LLP, Chartered Accountants, as auditors of the Corporation to hold office until the next annual meeting of Shareholders, and authorizing the directors to fix the remuneration of the auditors.

2. Election of Directors

Unless they resign, all directors elected at the Meeting will hold office until our next annual meeting of Shareholders or until their successors are elected or appointed.

Unless you have specified in the enclosed form of proxy that the votes attaching to the Shares represented by the proxy are to be withheld with respect to the election of directors, on any ballot that may be called for in the election of directors, the management representatives designated in the enclosed form of proxy intend to vote the Shares in respect of which they are appointed proxy FOR the election as directors of the proposed nominees whose names are set forth below.

Management does not contemplate that any of the proposed nominees will be unable to serve as a director but, if that should occur for any reason prior to the Meeting, the management representatives designated in the enclosed form of proxy may vote for another nominee at their discretion.

Pursuant to the articles of the Corporation, the number of directors of the Corporation is set at a minimum of three and a maximum of eleven and the directors are authorized to determine the actual number of directors to be elected from time to time.

The Corporation currently has five directors, and is proposing five directors for nomination.

The following table sets out for all persons proposed to be nominated by management for election as director, the name and place of residence, all major positions and offices with the Corporation now held by them, the period during which they have served as directors of the Corporation, their present principal occupation and principal occupation for the preceding five years, and the number of Shares beneficially owned, directly or indirectly, by each of them, or over which they exercise control or direction as at October 29, 2010.

The Corporation has an Audit Committee, a Corporate Governance and Nominating Committee and a Compensation Committee. The members of these committees are indicated in the table below.

|

Name Of Director,

Province/State and Country

of Residence

|

Director

Since

|

Present Principal Occupation or Employment

|

No. of Shares

Beneficially Owned,

Controlled

or Directed

|

| |

|

|

|

|

HERBERT ABRAMSON(1) (3)

Ontario, Canada

|

Director

July 2007

|

Chairman and Portfolio Manager, Trapeze Capital Corp. (1998 to present) (investment dealer/portfolio manager)

Chairman and Portfolio Manager, Trapeze Asset Management Inc. (1999 to present) (investment counselor)

|

1,427,552 and

283,333 warrants(4) to purchase Shares

|

|

DR. DENIS BURGER(1) (2)

Oregon, United States

|

Director

September

2007

|

Executive Chairman, BioCurex, Inc. (2009 to present)

President, Yamhill Valley Vineyards, Inc.

Retired, serving on several Boards of Directors (2007 to 2009)

Chairman and CEO of AVI BioPharma, Inc. (1992-2007) (biopharmaceutical using gene-targeted therapeutics to interfere with ribosomal translation)

|

1,987

|

|

DR. MARK D. VINCENT (3)

Ontario, Canada

|

Director

September

2007

|

Chief Executive Officer, Sarissa Inc. (2000 to present) (biotechnology company focused on development of targeted products for the therapeutic manipulation of gene expression)

Physician; medical oncologist (1990 to present)

London Regional Cancer Program Cancer Care Ontario

|

Nil

|

|

DR. JIM A. WRIGHT (2)

Ontario, Canada

|

Director,

October

1999

|

President and Chief Executive Officer, Lorus (1999 to 2006)

Chief Executive Officer of NuQuest Bio Inc. (2006 to present) (start-up biotechnology company with the intention of developing novel therapies for treatment of life threatening diseases)

Adjunct Professor, Department of Biochemistry and Biomedical sciences, McMaster University (2010 to present)

Senior Investigator, Manitoba Institute of Cell Biology (1982 to 1998, on Leave from 1998)

|

154,659

|

|

DR. AIPING YOUNG

Ontario, Canada

|

Director,

President and

Chief

Executive

Officer

|

President and Chief Executive Officer of the Corporation (2006 to present)

Chief Operating Officer, Lorus (2003 to 2006)

|

22,575

|

| |

|

|

|

|

(1)

|

Member of the Audit Committee.

|

|

(2)

|

Member of the Compensation Committee.

|

|

(3)

|

Member of the Corporate Governance and Nominating Committee.

|

|

(4)

|

Warrants to purchase Shares were acquired pursuant to a private placement completed on November 27, 2009. Each warrant represents the right to acquire a Share at an exercise price of $2.40. These warrants will expire on May 27, 2011.

|

The information as to principal occupation, business or employment and Shares beneficially owned or controlled is not within the knowledge of management of the Corporation and has been furnished by the respective nominees.

STATEMENT OF EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

Composition of the Compensation Committee

The board of directors (“Board”), upon the advice of the Compensation Committee, determines executive compensation. From June 1, 2009 to present, the Compensation committee is comprised of Dr. Burger and Dr. Wright. Dr. Burger is chair of the Compensation Committee. The Compensation Committee met four times during the above noted period.

Compensation Objectives and Philosophy

The Compensation Committee's mandate is to review and advise the Board on the recruitment, appointment, performance, compensation, benefits and termination of executive officers. The Compensation Committee also administers and reviews procedures and policies with respect to our 1993 and 2003 Stock Option Plans, employee benefit programs, pay equity and employment equity and reviews executive compensation disclosure where it is publicly disclosed.

The market for biotechnology companies in the development phase has been extremely challenging throughout fiscal 2010 and it has been negatively impacted further by the deterioration of the capital markets late in calendar 2008 and continuing in 2009 and 2010. The Compensation Committee has taken these factors into consideration when recommending the compensation for Named Executive Officers (as defined below) and focuses the assessment on achievement of the corporate objectives described below as being the key value drivers of the Corporation.

Lorus’ executive compensation program is designed to:

|

|

•

|

attract and retain qualified, motivated and achievement-oriented individuals by offering compensation that is competitive in the industry and marketplace;

|

|

|

•

|

align executive interests with the interests of Shareholders; and

|

|

|

•

|

ensure that individuals continue to be compensated in accordance with their personal performance and responsibilities and their contribution to the overall objectives of the Corporation.

|

These objectives are achieved by offering executives and employees a compensation package that is competitive and rewards the achievement of both short-term and long-term objectives of the Corporation. As such, our compensation package consists of three key elements:

|

|

•

|

base salary and initial stock options;

|

|

|

•

|

short-term compensation incentives to reward corporate and personal performance through potential annual cash bonuses; and

|

|

|

•

|

long-term compensation incentives related to long-term increase in Share value through participation in the 2003 Stock Option Plan.

|

Base Salary - Initial Stock Options

In establishing base salaries, the objective of the Compensation Committee is to establish levels that will enable Lorus to attract and retain executive officers that can effectively contribute to the long-term success of Lorus. Base salary for each executive officer is a function of the individual's skills, abilities, experience, past performance and anticipated future contribution to the success of Lorus. The Compensation Committee uses their knowledge of the industry and of industry trends to assist with the determination of an appropriate compensation package for each executive officer. In certain cases, the Compensation Committee may recommend inclusion of automobile allowances, fitness allowances and the payment of certain professional dues as a component of an overall remuneration package for executives.

In certain cases, executive officers may be granted stock options on the commencement of employment with Lorus in accordance with the responsibility delegated to each executive officer for achieving corporate objectives and enhancing Shareholder value in accordance with those objectives.

Short-Term Compensation Incentives

The role of short-term compensation incentives at Lorus is to reward corporate and personal performance. Each year, the Board approves the annual corporate objectives encompassing scientific, clinical, regulatory, business and corporate development and financial criteria. The annual cash bonus for the President and Chief Executive Officer and the other executive offices is based, at least in part, on the level of achievement of these annual objectives. One hundred percent of the President and Chief Executive Officer's and seventy-five percent of the other executive officers’ cash bonus is based on the level of achievement of corporate objectives. The balance of the other executive officers’ bonus is based on achievement of individual/departmental objectives.

All corporate and executive officer objectives are reviewed by the Compensation Committee and approved by the Board. The Compensation Committee recommends to the Board the awarding of bonuses, payable in cash, stock or stock options, to reward extraordinary individual performance.

For each executive officer, during the year ended May 31, 2010, the potential annual cash bonuses ranged from 15% to 40% of base salary when all corporate and individual executive officer objectives were achieved.

Cash bonuses are determined as soon as practicable after the end of the fiscal year and, for the Named Executive Officers, are included in the Summary Compensation Table in the year in respect of which they are earned.

Long-Term Incentive Plan

The role of long-term compensation incentives at Lorus is to reward an executive’s contribution to the attainment of Lorus’ long-term objectives, align an executive’s performance with the long-term performance of Lorus and to provide an additional incentive for an executive to enhance Shareholder value. Long-term incentive compensation for directors, officers, employees and consultants is reviewed annually and is accomplished through the grant of stock options under our 2003 Stock Option Plan.

The number of options granted for executives of Lorus for the year ended May 31, 2010 was based on achievement of both corporate and executive officer objectives. The Compensation Committee approves the allocation of options and options are priced using the closing market price of the Shares on the Toronto Stock Exchange (“TSX”) on the last trading day prior to the date of grant. Options to purchase Shares expire ten years from the date of grant and vest over a term determined by the Compensation Committee. The granting of options to purchase Shares for Named Executive Officers is included in the Summary Compensation Table in the year that they are earned.

Performance Metrics

The performance of the President and Chief Executive Officer and other Named Executive Officers for the 2010 financial year was measured in the following areas:

|

|

1.

|

Maximizing the value of LOR-2040;

|

|

|

2.

|

Maximizing the value of LOR-253;

|

|

|

3.

|

Advancing another lead drug candidate in preparation for GLP-toxicology studies

|

|

|

4.

|

Establishing at least one corporate partnership;

|

|

|

5.

|

Formulating a detailed strategic plan; and

|

|

|

6.

|

Equity financing of at least $10 million subject to the Board approval.

|

Each of the above is weighted 20%, 20%, 10%, 20%, 5% and 25% in relation to assessment of satisfaction of overall corporate objective and determination of any general corporate bonuses. Based on these criteria the Board assigned an achievement of 80.5%. In its evaluation, the Board also considered the impact of negotiating the repurchase of the convertible debt on management’s attainment of the objectives during the year and in recognition of the significance of this achievement determined that management receive an overall rating of 100%. Incentive compensation related to the attainment of these objectives will be paid in fiscal 2011. Similar performance metrics were established for the year-ended May 31, 2011 based on the approved business plan for the current year.

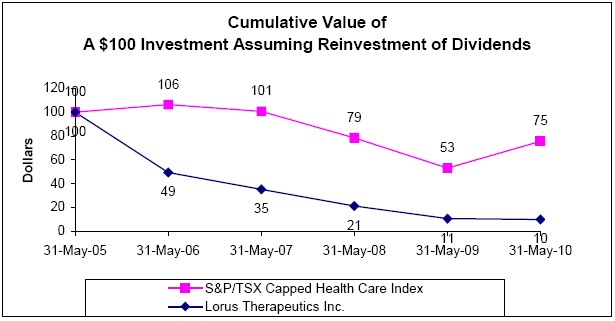

The following graph illustrates our cumulative total Shareholder return (assuming a $100 investment) for the Shares on the TSX as compared with the S&P/TSX Capped Health Care Index during the period May 31, 2005 to May 31, 2010. From February 23, 2004 to October 31, 2008 the Shares were also traded on the American Stock Exchange (now the NYSE Alternext) under the symbol “LRP”. The Corporation voluntarily delisted its Shares from the American Stock Exchange effective October 31, 2008. On June 2, 2010 the Corporations shares began trading on the OTCBB under the symbol “LRUFS”.

Compensation levels for the Named Executive Officers have not fluctuated to the same degree as shareholder returns. Compensation does not solely reflect consideration of Corporation performance. Instead, compensation is determined in light of an overall compensation package that is considered appropriate in the circumstances.

|

|

SUMMARY COMPENSATION TABLE

|

The following table details the compensation information for the most recent fiscal year of the Corporation, for the President and Chief Executive Officer, the Director of Finance and Acting Chief Financial Officer, the Vice President of Business Development and the Vice President of Research (“NEO” or collectively “Named Executive Officers”):

| |

|

|

|

|

Non-equity incentive plan

compensation

|

|

|

Name and Principal Position

|

Fiscal

Year

|

Salary

($)

|

Share-based

awards ($)

|

Option-based awards(1)

($)

|

Annual

incentive

plans

($)

|

Long-term

incentive

plans

($)

|

Total

Compensation

($)

|

| |

|

|

|

|

|

|

|

|

Dr. Aiping Young

President and Chief Executive Officer

|

2010

2009

|

336,480

335,236

|

N/A

N/A

|

70,500

115,000

|

129,792

112,320

|

Nil

Nil

|

536,772

562,566

|

|

Ms. Elizabeth Williams

Director of Finance, Acting Chief Financial Officer(2)

|

2010

2009

|

16,319

79,376

|

N/A

N/A

|

7,050

34,600

|

11,933

4,935

|

Nil

Nil

|

35,299

118,911

|

|

Dr. Saeid Babaei

Vice President Business Development

|

2010

2009

|

155,951

157,269

|

N/A

N/A

|

21,150

34,600

|

29,630

23,670

|

Nil

Nil

|

206,731

215,539

|

|

Dr. Yoon Lee

Vice President Research

|

2010

2009

|

132,810

133,587

|

N/A

N/A

|

21,150

34,600

|

25,632

19,080

|

Nil

Nil

|

179,592

187,267

|

| |

|

|

|

|

|

|

|

|

(1)

|

In determining the fair value of these option awards, the Black-Scholes valuation methodology was used with the following assumptions: (i) expected life of five years; (ii) volatility of 83%; (iii) risk free interest rate of 2.51%; and (iv) no dividend yield.

|

|

(2)

|

Ms. Williams was on maternity leave from July 2009 to June 2010.

|

|

Dr. Young did not receive any compensation for her role as a director of the Corporation.

|

|

Outstanding Share-Based Awards and Option-Based Awards

|

The following table shows all awards outstanding to each NEO as at the financial year ended May 31, 2010:

| |

Option-based Awards

|

|

|

|

Name

|

Number of securities

underlying unexercised

options

(#)

|

Option exercise

price

($)

|

Option

expiration date

|

Value of unexercised

in-the-money options

($) (1)

|

|

Dr. Aiping Young

|

1,666

833

3,776

1,888

2,500

2,500

1,250

1,250

2,500

1,250

2,500

1,250

2,500

1,250

5,000

2,500

2,500

5,833

1,250

2,916

2,500

6,944

1,250

3,472

1,666

1,666

2,500

33,333

16,333

15,000

30,000

50,000

40,000

|

75.00

9.00

48.30

9.00

28.50

28.50

9.00

9.00

28.50

9.00

9.90

9.00

36.60

9.00

35.10

9.00

23.40

23.40

9.00

9.00

23.40

23.40

9.00

9.00

7.80

9.00

9.90

8.10

8.10

6.60

6.15

3.60

2.10

|

Oct 10, 2010

Oct 10, 2010

Dec 17, 2010

Dec 17, 2010

Sept 17, 2011

Sept 17, 2011

Sept 17, 2011

Sept 17, 2011

July 6, 2012

July 6, 2012

Sep 24, 2012

Sep 24, 2012

July 15, 2013

July 15, 2013

Sep 7, 2013

Sep 7, 2013

July 20, 2014

July 20, 2014

July 20, 2014

July 20, 2014

July 19, 2015

July 19, 2015

July 19, 2015

July 19, 2015

Nov 30, 2015

Jan 5, 2016

July 27, 2016

Oct 5, 2016

Oct 5, 2016

July 21, 2017

Jan 14, 2018

Aug 10, 2018

July 15, 2019

|

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

800

|

|

Ms. Elizabeth Williams

|

79

39

1,666

833

1,816

908

1,666

1,666

4,494

833

5,000

1,666

15,000

5,000

|

23.40

9.00

21.60

9.00

23.40

9.00

7.80

9.00

9.90

9.90

6.60

6.60

3.60

2.10

|

Jul 20, 2014

Jul 20, 2014

Nov 17, 2014

Nov 17, 2014

July 19, 2015

July 19, 2015

Nov 30, 2015

Jan 5, 2016

July 27, 2016

July 27, 2016

July 21, 2017

July 21, 2017

Aug 10, 2018

July 15, 2019

|

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

100

|

|

Dr. Saeid Babaei

|

5,000

5,000

15,000

7,500

|

6.60

5.70

3.60

2.10

|

July 21, 2017

Feb 4, 2018

Aug 10, 2018

July 15, 2019

|

Nil

Nil

Nil

150

|

|

Dr. Yoon Lee

|

184

386

575

166

461

908

919

1,666

1,666

4,694

5,000

5,000

15,000

13,500

|

9.00

9.00

9.00

9.00

9.00

9.00

9.00

7.80

9.00

9.00

6.60

5.70

3.60

2.10

|

Oct 10, 2010

Sep 17, 2011

July 6, 2012

July 15, 2013

July 15, 2013

July 20, 2014

July 19, 2015

Nov 30, 2015

Jan 5, 2016

July 27, 2016

July 21, 2017

Feb 4, 2018

Aug 10, 2018

July 15, 2019

|

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

270

|

|

(1)

|

These amounts are calculated based on the difference between the market value of the securities underlying the options at the end of the fiscal year ($2.12), and the exercise price of the options.

|

The options granted to the Named Executive Officers during the year ended May 31, 2010 vest contingently upon the achievement of corporate objectives that the Compensation Committee has deemed to be the drivers of Shareholder value. These stock options vest 50% upon the achievement of the stated objectives, 25% on the next anniversary and 25% on the second anniversary.

Value Vested or Earned During the Year

The following table sets forth for each Named Executive Officer the value vested or earned on all option-based awards, share-based awards, and non-equity incentive plan compensation during the financial year ending May 31, 2010:

|

Name and Principal Position

|

Option-based awards

- Value vested

during the year

($)

|

Share-based awards -

Value vested during the

year

($)

|

Non-equity incentive plan

compensation - Value

earned during the year

($)

|

|

Dr. Aiping Young

President and Chief Executive Officer

|

400

|

Nil

|

129,792

|

|

Ms. Elizabeth Williams

Director of Finance, Acting Chief Financial Officer

|

50

|

Nil

|

11,933

|

|

Dr. Saeid Babaei

Vice President Business Development

|

75

|

Nil

|

29,630

|

|

Dr. Yoon Lee

Vice President Research

|

135

|

Nil

|

25,632

|

PENSION PLAN BENEFITS

The Corporation does not provide pension plan benefits to its Named Executive Officers or employees of the Corporation.

TERMINATION AND CHANGE OF CONTROL BENEFITS

If the employment agreements of the Named Executive Officers are terminated by the Corporation other than for cause, Dr. Young shall be entitled to 18 months plus one additional month for each year of employment under the agreement in lieu of notice (currently approximately 22 months or $596,000), Dr. Babaei and Dr. Lee shall be entitled to a notice period equal to 4 months plus one additional month for each year of employment, to a maximum of 12 months (currently approximately 7 months or $91,000 for Dr. Babaei and 12 months or $132,000 for Dr. Lee) and Ms. Williams shall be entitled to the greater of one month and the applicable notice entitlement under employment legislation in the event of termination (currently approximately 6 months or $33,000). If the employment agreements are terminated by the Corporation other than for cause, then all unexercised stock options then held by each are governed by the terms of the 2003 Stock Option Plan. Further, if there is a change of control of the Corporation and Dr. Young’s employment within 18 months of a change of control of Lorus is terminated without cause or if she terminates the agreement with good reason as defined in the agreement, then she is entitled to receive the equivalent of two years' of her basic salary plus one month salary for each year under the agreement (currently approximately $750,000), plus an annual bonus prorated over the severance period (based on the bonus paid in respect of the last completed fiscal year). All Named Executive Officers will also be entitled to benefits coverage for the severance period or a cash payment in lieu thereof.

COMPENSATION OF DIRECTORS

The following table details the compensation received by each Director for the year ended May 31, 2010:

|

Name

|

Fees earned

($)

|

Share-based

awards

($)

|

Option-based

awards

($)(3)

|

All Other

Compensation

($)

|

Total

Compensation

($)

|

| |

|

|

|

|

|

|

Mr. Herbert Abramson

|

37,500

|

Nil

|

9,750

|

Nil

|

47,250

|

|

Dr. Denis Burger(2)

|

74,040

|

Nil

|

19,500

|

Nil

|

93,540

|

|

Mr. Georg Ludwig(2)(1)

|

20,603

|

Nil

|

9,750

|

Nil

|

30,353

|

|

Dr. Mark Vincent

|

29,000

|

Nil

|

9,750

|

Nil

|

38,750

|

|

Dr. Jim Wright

|

29,500

|

Nil

|

9,750

|

Nil

|

39,250

|

|

(1)

|

Mr. Ludwig resigned from the Board of Directors on March 4, 2010

|

|

(2)

|

Non-Canadian directors were paid in US dollars. The amounts disclosed above are in Canadian dollars converted from US dollars at rates prevailing at the time of payment (December 1, 2009 - 1US$ = CDN$1.0432, January 7, 2010 - 1US$ = CDN$1.0525, April 14, 2010 - 1US$ = CDN$1.0435)

|

|

(3)

|

In determining the fair value of these option awards, the Black-Scholes valuation methodology was used with the following assumptions: (i) expected life of five years; (ii) volatility of 114%; (iii) risk free interest rate of 2.44%; and (iv) no dividend yield.

|

During the fiscal year ended May 31, 2010, each director who was not an officer of the Corporation was entitled to receive 150,000 stock options (the Chair received 300,000) and, at their election, Shares, deferred share units and/or cash compensation for attendance at the board of directors of the Corporation committee meetings. Compensation consisted of an annual fee of $15,000 (the Chair received $35,000) and $1,500 per Board meeting attended ($4,500 to the Chair of a Board meeting). Members of the Audit Committee received an annual fee of $8,000 (the Chair received $10,000). Each member of the Compensation Committee and Corporate Governance and Nominating Committee received an annual fee of $5,000 per committee. Board members (including the Chair) receive $500 for meetings held via conference call. There have not been any changes to the fees from the prior year. Non-executive directors are reimbursed for any out-of pocket travel expenses incurred in order to attend meetings.

On December 3, 2009, stock options to purchase 30,000 Shares at a price of $2.40 per share expiring December 2, 2019 were granted, in aggregate, to our directors. These options vested 50% upon issuance and the remaining 50% will vest after one year.

Directors are entitled to participate in our Deferred Share Unit Plan. See “Equity Compensation Plans - Directors' and Officers' Deferred Share Unit Plan”. None of our directors participated in this plan in the years ended May 31, 2010 or 2009.

Incentive Plan Awards

Outstanding Share-Based Awards and Option Based Awards

The following table sets forth for each Director, other than Named Executive Officers who are Directors, all option-based and share-based awards outstanding at May 31, 2010:

| |

Option-based Awards

|

|

|

|

Name and Principal Position

|

Number of securities

underlying unexercised

options

(#)

|

Option exercise

price

($)

|

Option

expiration date

|

Value of

unexercised

in-the-money options

($) (2)

|

|

Mr. Herbert Abramson

|

1,666

3,333

5,000

5,000

|

$6.60

$6.15

$2.40

$2.40

|

Sept 18, 2017

Jan 14, 2018

Oct 1, 2018

Dec 2, 2019

|

Nil

Nil

Nil

Nil

|

|

Dr. Denis Burger

|

3,333

6,666

10,000

10,000

|

$6.60

$6.15

$2.40

$2.40

|

Sep 18, 2017

Jan 14, 2018

Oct 1, 2018

Dec 2, 2019

|

Nil

Nil

Nil

Nil

|

|

Mr. Georg Ludwig(1)

|

1,666

1,666

3,333

5,000

2,500

|

$9.00

$6.60

$6.15

$2.40

$2.40

|

Sep 20, 2016

Sep 18, 2017

Jan 14, 2018

Oct 1, 2018

Dec 2, 2019

|

Nil

Nil

Nil

Nil

Nil

|

|

Dr. Mark Vincent

|

1,666

3,333

5,000

5,000

|

$6.60

$6.15

$2.40

$2.40

|

Sept 18, 2017

Jan 14, 2018

Oct 1, 2018

Dec 2, 2019

|

Nil

Nil

Nil

Nil

|

|

Dr. Jim Wright

|

1,666

1,666

3,333

5,000

5,000

|

$9.00

$6.60

$6.15

$2.40

$2.40

|

Sep 20, 2016

Sep 18, 2017

Jan 14, 2018

Oct 1, 2018

Dec 2, 2019

|

Nil

Nil

Nil

Nil

Nil

|

|

(1)

|

Mr. Ludwig resigned from the Board on March 3, 2010. All unvested options expired upon resignation and all vested options expired three months after resignation or June 3, 2010.

|

|

(2)

|

These amounts are calculated based on the difference between the market value of the securities underlying the options at the end of the fiscal year ($2.12), and the exercise price of the options.

|

Value Vested or Earned During the Year

The following table sets forth for each director the value vested or earned on all option-based awards, share-based awards, and non-equity incentive plan compensation during the financial year ending May 31, 2010.

|

Name

|

Option-based awards - Value vested

during the year

($) (2)

|

|

Mr. Herbert Abramson

|

750

|

|

Dr. Denis Burger

|

1,500

|

|

Mr. Georg Ludwig(1)

|

750

|

|

Dr. Mark Vincent

|

750

|

|

Dr. Jim Wright

|

750

|

|

(1)

|

Mr. Ludwig resigned from the Board on March 3, 2010.

|

|

(2)

|

For those directors granted options on October 2, 2008 at an exercise price of $2.40, options vested 50% upon grant and 50% on October 2, 2009. The value upon vesting arose as the closing share price on October 2, 2009 was $2.70 therefore the options were $0.30 in the money on the day of vesting. Each of the directors had 2,500 options vest on October 2, 2009 and the Chair had 5,000 options vest on October 2, 2009.

|

INDEBTEDNESS

In October 2009, the Company entered into a loan agreement with a member of its Board of Directors, Mr. Herbert Abramson, to borrow $1 million. The loan amount, which was received on October 6, 2009, was unsecured, evidenced by a promissory note and bore interest at the annual rate of 10%. The principal and interest were due on April 6, 2010. The principal amount of $1.0 million was applied to subscribe for Units as part of the November 27, 2009 private placement.

In April 2010, the Company entered into a loan agreement with a company related to Mr. Abramson to borrow $1 million. The loan amount, which was received on April 14, 2010, is unsecured, evidenced by a promissory note and bears interest at the annual rate of 10%. The principal and interest amount were due on October 14, 2010. In August 2010 the note was extended for an additional three months and is due on January 14, 2011.

On August 27, 2010, the Company announced a proposed shareholders' rights issue with a financing commitment for a future investment of $4 million by Mr. Abramson by way of standby purchase arrangements such that the minimum gross proceeds of the rights offering are $4 million. Mr. Abramson is also providing the Company with interim financing by way of three $500,000 monthly loans, the first of which was advanced on August 11, 2010 and the second and third on September 13, 2010 and October 5, 2010, respectively, subsequent to the quarter end. The loans are unsecured, have a six-month term (or the earlier of the closing of the rights issue) and bear interest at the annual rate of 10%. These loans will be repaid from the proceeds of the rights offering.

Other than described above, as of, and at all times throughout the fiscal year ended May 31, 2010, there was no indebtedness owing to the Corporation by any employees, officers or directors of the Corporation. The Corporation did not provide financial assistance to any employees, officers or directors for the purchase of securities in during the year ended May 31, 2010.

AUDIT COMMITTEE INFORMATION

Reference is made to the Annual Information Form of the Corporation for the financial year ended May 31, 2010 for a disclosure of information related to the Audit Committee required under Form 52-110F1 to Multilateral Instrument 52-110 - Audit Committees. A copy of this document can be found on SEDAR at www.sedar.com.

DIRECTORS AND OFFICERS' LIABILITY

We purchase and maintain liability insurance for the benefit of directors and officers to cover any liability incurred by such person in such capacities. The policy provides for coverage in the amount of $10,000,000 with a deductible amount of $150,000 (with certain exceptions). For the period June 1, 2009 to May 31, 2010, the premium cost of this insurance was $135,000.

EQUITY COMPENSATION PLAN INFORMATION

The stock option plans were established to advance the interests of Lorus by:

|

|

•

|

Providing Eligible Persons (as defined below) with additional incentives;

|

|

|

•

|

Encouraging stock ownership by Eligible Persons;

|

|

|

•

|

Increasing the interest of Eligible Persons in the success of Lorus;

|

|

|

•

|

Encouraging Eligible Persons to remain loyal to Lorus; and

|

|

|

•

|

Attracting new Eligible Persons to Lorus.

|

Our original stock option plan was established in 1993 pursuant to our 1993 Stock Option Plan (the “1993 Plan”); however, due to significant developments in the laws relating to share option plans and our then future objectives, in November 2003 we created the 2003 Stock Option Plan (the “2003 Plan”), ratified by our Shareholders, pursuant to which all future grants of stock options would be made.

The Compensation Committee as authorized by the Board administers our stock option plans (collectively the “Stock Option Plans”).

The 1993 Plan

Under the 1993 Plan, options were granted to directors, officers, consultants and employees of the Corporation or its subsidiaries (“Eligible Persons”). The total number of options issued under the 1993 Plan is 29,540. This represents 0.3% of the Corporation's issued and outstanding capital as at October 29, 2010. There were no further option grants made under the 1993 Plan after November 2003. Therefore, no further options are issuable under the 1993 Plan. The total number of Shares issuable under actual grants pursuant to the 1993 Plan is 29,540 being 0.3% of the Corporation's issued and outstanding capital as at October 29, 2010.

The number of Shares issuable to insiders, at any time, under the 1993 Plan and any other compensation arrangement of the Corporation cannot exceed 10% of the issued and outstanding Shares of the Corporation. The number of shares issued to insiders, within any one year period, under the 1993 Plan and any other compensation arrangement of the Corporation cannot exceed 10% of the issued and outstanding Shares of the Corporation. The maximum percentage of Shares reserved for issuance to any one person is 5% of the issued and outstanding Shares of the Corporation. The exercise price of options granted under the 1993 Plan was established by the Board on the basis of the closing market price of Shares of the Corporation on the TSX on the last trading day preceding the date of grant. If such a price was not available, the exercise price was to be determined on the basis of the average of the bid and ask for the Shares on the TSX on the date preceding the date of grant. The Board determined the vesting period of options at the time of granting the option. The term of options granted under the 1993 Plan and outstanding as of October 7, 2004 is 10 years from the date of grant.

If an option holder ceases to be an officer, director, continuing consultant or employee of the Corporation or a subsidiary, each unexpired, vested option may be exercised within three months of the date of cessation. In the event of the death of an optionee, each unexpired, vested option may be exercised within nine months of the option holder's date of death.

Options granted under the 1993 Plan are not transferable. Currently, the 1993 Plan may be amended by the Board subject to regulatory approval in certain circumstances.

The 2003 Plan

Under the 2003 Plan, options may be granted to Eligible Persons. At October 29, 2010, the total number of options outstanding under the 2003 Plan is 643,361 representing 6.5% of the Corporation's issued and outstanding capital. Options to purchase up to an additional 817,269 Shares, being 8.2% of Shares issued and outstanding, remain available for grant under the 2003 Plan. The total number of Shares issuable under the 2003 Plan is 1,460,630. This represents 14.7% of the Corporation's issued and outstanding capital as at October 29, 2010. The total number of options issued under the 2003 Plan combined with those issued under the 1993 Plan and shares issued under the Alternative Compensation Plan will not exceed 15% of the Shares issued and outstanding at any time.

The maximum number of Shares reserved for issuance to insiders, at any time, under the 2003 Plan and any other compensation arrangement of the Corporation is 10% of the issued and outstanding Shares of the Corporation. The maximum number of Shares that may be issued to insiders, at any time, under the 2003 Plan and any other compensation arrangement of the Corporation within a 12 month period is 10% of the issued and outstanding Shares of the Corporation. The maximum number of Shares reserved for issuance to any one person is 5% of the issued and outstanding Shares of the Corporation. The exercise price of options granted under the 2003 Plan is established by the Board and will be equal to the closing market price of the Shares on the TSX on the last trading day preceding the date of grant. If there is no trading on that date, the exercise price will be the average of the bid and ask on the TSX on the last trading date preceding the date of grant. If not otherwise determined by the Board, an option granted under the 2003 Plan will vest as to 50% on the first anniversary of the date of grant of the option and an additional 25% on the second and third anniversaries after the date of grant. The Board fixes the term of each option when granted, but such term may not be greater than 10 years from the date of grant.

If an option holder is terminated without cause, resigns or retires, each option that has vested will cease to be exercisable thee months after the option holder's termination date. Any portion of an option that has not vested on or prior to the termination date will expire immediately. If an option holder is terminated for cause, each option that has vested will cease to be exercisable immediately upon the Corporation's notice of termination. Any portion of an option that has not vested on or prior to the termination date will expire immediately.

Options granted under the 2003 Plan are not assignable.

Currently, the Board may amend the 2003 Plan subject to regulatory approval, provided that the Board may not make the following amendments without the approval of Shareholders:

|

|

•

|

an amendment to the maximum number of Shares reserved for issuance under the 2003 Plan and under any other security based compensation arrangement of the Corporation;

|

|

|

•

|

a reduction in the exercise price for options held by insiders;

|

|

|

•

|

an extension to the term of options held by insiders; and

|

|

|

•

|

an increase in the 10% limits on grants to insiders.

|

During the period June 1, 2009 to May 31, 2010, options to purchase 189,406 Shares were granted under the 2003 Plan at exercise prices between $2.10 and $3.60 per Share. During the year ended May 31, 2010, we granted options to employees, other than executive officers of the Corporation, to purchase 41,073 Shares, being 22% of the total incentive stock options granted during the year to employees, executive officers and directors.

Alternative Compensation Plan

On November 30, 2009, after receiving shareholder approval, the Company adopted an alternate compensation plan (the “ACP”) which enables Lorus to meet its obligations to pay directors’ fees, salary and performance bonuses to certain employees in the form of Shares. The ACP permits the Corporation to, in circumstances considered appropriate by the Board of Directors (the “Board”), encourage the ownership of equity of the Corporation by its directors and senior employees (“Participants”), enhance the Corporation’s ability to retain key personnel and reward significant performance achievements while preserving the cash resources of the Corporation.

Under the ACP, Participants have the option of receiving director’s fees, salary, bonuses or other remuneration, as applicable (“Remuneration”) by the allotment and issuance from treasury of such number of Shares as will be equivalent to the cash value of the Remuneration determined by dividing the Remuneration by the weighted average closing Share price for the five (5) trading days prior to payment date (the “5-day VWAP”). The issue price of Shares issued under the ACP is the 5-day VWAP.

The maximum number of Shares reserved for issuance under the ACP, when combined with the Stock Option Plans described under “Equity Compensation Plan Information” section, will not exceed 15% of the Corporation’s issued and outstanding Shares at any given time.

There have been no shares issued under the ACP.

Employee Share Purchase Plan

We have an Employee Share Purchase Plan (“ESPP”) with the purpose of the ESPP to assist the Corporation to retain the services of its employees, to secure and retain the services of new employees and to provide incentives for such persons to exert maximum efforts for the success of the Corporation. The ESPP provides a means by which employees of the Corporation and its affiliates may purchase Shares at a 15% discount through accumulated payroll deductions. Eligible participants in the ESPP include all employees, including executive officers, who work at least 20 hours per week and are customarily employed by the Corporation or an affiliate of the Corporation for at least six months per calendar year. Generally, each offering is of three months' duration with purchases occurring every quarter. Participants may authorize payroll deductions of up to 15% of their base compensation for the purchase of Shares under the ESPP.

For the year ended May 31, 2010, a total of 3,159 Shares had been purchased by employees under the ESPP at prices per share between $2.12 and $2.85 per Share and a weighted average purchase price of $2.42. During the year ended May 31, 2010, under the ESPP, Named Executive Officers, as a group did not purchase any shares.

Directors' and Officers' Deferred Share Unit Plan

We have a deferred share unit plan for directors and officers (the “Deferred Share Unit Plan”). Under the Deferred Share Unit Plan, participating directors (“Participating Directors”) may elect to receive either a portion or all of their annual fees for acting as a director (“Annual Fees”) from us in deferred share units. Under the Deferred Share Unit Plan, the Compensation Committee may at any time during the period between the annual meetings of our Shareholders, in its discretion recommend the Corporation credit to each participating director who has elected under the terms of the Deferred Share Unit Plan, the number of units equal to the gross amount of the Annual Fees to be deferred divided by the fair market value of the Shares. The fair market value of the Shares is determined as the closing price of the Shares on the TSX on the day immediately preceding such recommendation by the Compensation Committee or such other amount as determined by the Board and permitted by the stock exchanges or other market(s) upon which the Shares are from time to time listed for trading and by any other applicable regulatory authority (collectively, the “Regulatory Authorities”).

In addition, the Participating Directors may elect under the Deferred Share Unit Plan to receive deferred share units in satisfaction for meeting fees earned by the Participating Directors as a result of attendance at meetings of the Board held between the annual meetings of our Shareholders by the credit to each Participating Director of the number of units equal to the gross amount of the meeting fees to be deferred divided by the fair market value of the Shares, being the closing price of the Shares on the TSX on the day immediately preceding the recommendation by the Compensation Committee or such other amount as determined by the Board and permitted by the Regulatory Authorities.

The Deferred Share Unit Plan is administered by the Board (in consultation with the Compensation Committee) and, subject to regulatory requirements, may be amended by the Board without Shareholder approval. When a Participating Director ceases to hold the position of director and is no longer otherwise employed by us, the Participating Director receives either (a) a lump sum cash payment equal to the number of deferred share units held multiplied by the then fair market value of the Shares on the date of termination, or (b) the number of Shares that can be acquired in the open market with the amount described in (a), either case being subject to withholding for income tax. The Board may terminate the Deferred Share Unit Plan any time before or after any allotment or accrediting of deferred share units thereunder.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table sets forth certain details as at the end of the fiscal year of Lorus, ended May 31, 2010 with respect to compensation plans pursuant to which equity securities of the Corporation are authorized for issuance.

| |

Number of Shares to be issued

upon exercise of outstanding

options

(a)

|

|

Number of Shares remaining

available for future issuance

under the equity compensation

plans (Excluding Securities

reflected in Column (a))

(c)

|

Total Stock Options

outstanding and available

for Grant

(a) + (c)

|

|

Plan Category

|

Number

|

% of Shares outstanding

|

Weighted-

average

exercise price of

outstanding options

(b)

|

Number

|

% of Shares outstanding

|

Number

|

% of

Common

shares

outstanding

|

| |

|

|

|

|

|

|

|

|

Equity compensation

plans approved by

Shareholders

|

672,901

|

6.8%

|

$6.60

|

817,269

|

8.2%

|

1,490,170

|

15.0%

|

| |

|

|

|

|

|

|

|

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

None of the directors or executive officers of the Corporation, no proposed nominee for election as a director of the Corporation, none of the persons who have been directors or executive officers of the Corporation at any time since June 1, 2009 no proposed nominee for election as a director and no associate or affiliate of any of the foregoing has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter scheduled to be acted upon at the Meeting other than the election of directors.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Other than as set forth above under the headings “Statement of Executive Compensation”, “Voting Securities and Principal Holders of Voting Securities” and “Indebtedness”, during the financial year of the Corporation ended May 31, 2010, no director, proposed director, officer, or associate of a director, proposed director or officer nor, to the knowledge of our directors or officers, after having made reasonable inquiry, any person or company who beneficially owns, directly or indirectly, Shares carrying more than 10% of the voting rights attached to all Shares outstanding at the date hereof, or any associate or affiliate thereof, had any material interest, direct or indirect, in any material transaction of the Corporation, nor do any such persons have a material interest, direct or indirect, in any proposed transaction of the Corporation.

STATEMENT OF CORPORATE GOVERNANCE PRACTICES

Corporate governance relates to the activities of the Board, the members of which are elected by and are accountable to the Shareholders, and takes into account the role of the individual members of management who are appointed by the Board and who are charged with the day-to-day management of Lorus. The Board believes that sound corporate governance practices are essential to contributing to the effective and efficient decision-making of management and the Board and to the enhancement of Shareholder value. The Board and management believe that Lorus has a sound governance structure in place for both management and the Board. Of particular note Lorus has:

|

|

•

|

Established a written mandate of the Board;

|

|

|

•

|

Established a written charter for the Audit Committee;

|

|

|

•

|

Established a written charter for the Compensation Committee;

|

|

|

•

|

Established a written charter for the Corporate Governance Committee;

|

|

|

•

|

Established a written Disclosure and Insider Trading Policy; and

|

| |

|

|

|

|

•

|

Established a written Code of Ethics.

|

National Instrument 58-101 - Disclosure of Corporate Governance Practices (“NI 58-101”) and National Policy 58-201 - Corporate Governance Guidelines (“NP 58-201”) requires issuers, including Lorus, to disclose the corporate governance practices that they have adopted. NP 58-201 provides guidance on governance practices. The Corporation is also subject to National Instrument 52-110 - Audit Committees (“NI 52-110”), which has been adopted in various Canadian provinces and territories and which prescribes certain requirements in relation to audit committees. The required disclosure under NI 58-101 is attached hereto as Appendix “A”.

2011 SHAREHOLDER PROPOSALS

For the next annual meeting of Shareholders of Lorus, Shareholders must submit any proposal that they wish to raise at that meeting on or before July 29, 2011.

ADDITIONAL INFORMATION

Additional information relating to us, including our most current annual information form (together with documents incorporated therein by reference), our financial statements for the financial year ended May 31, 2010, the report of the auditors thereon, management's discussion and analysis of our financial condition and results of operations for fiscal 2010 and our interim financial statements for periods subsequent to the end of our last financial year, can be found on the System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com. For any documents relating to us filed on SEDAR prior to the July 10, 2007 (the date of reorganization of the Corporation), please refer to the public documents for Global Summit Real Estate. Copies of those documents are available upon written request to the Director of Finance of Lorus, upon payment of a reasonable charge where applicable. Our financial information is provided in our consolidated financial statements for the year ended May 31, 2010 and management's discussion and analysis of our financial condition and results of operations for year ended May 31, 2010.

DIRECTORS' APPROVAL

The contents and sending of this Circular have been approved our directors.

(signed) AIPING YOUNG

President and CEO

APPENDIX A

Corporate Governance Practices

Lorus Therapeutics Inc. (the “Corporation”) is committed to sound and comprehensive corporate governance policies and practices and is of the view that its corporate governance policies and practices, outlined below, are comprehensive and consistent with National Policy 58-201 - Corporate Governance Guidelines (“NP 58-201”), and National Instrument 52-110 - Audit Committees (“NI 52-110”).

Board of Directors

The board of directors of the Corporation (the “Board”) encourages sound and comprehensive corporate governance policies and practices designed to promote the ongoing development of the Corporation.

Composition of the Board

The Corporation's Board is currently composed of five directors, and the proposed Board will be composed of five directors, a majority of whom are independent directors. An “independent” board member, as further defined in NI 52-110, means that such member has no “material relationship” with the issuer. A “material relationship” is a relationship that could, in the view of the Board, be reasonably expected to interfere with the exercise of a member's judgment. Each year the board reviews the composition of the board and assesses whether a board member is “independent”.

|

Director

|

Independent

|

| |

|

|

Herbert Abramson

|

Yes

|

|

Denis Burger

|

Yes

|

|

Mark Vincent

|

Yes

|

|

Jim A. Wright

|

Yes

|

|

Aiping Young

|

No

|

Aiping Young, the President and Chief Executive Officer (“CEO”) of the Corporation, is not an independent director by virtue of her role on the Corporation's management team.

The following table outlines other reporting issuers that Board members are directors of:

|

Director

|

Reporting Issuer

|

| |

|

|

Herbert Abramson

|

St Andrew Goldfields Ltd.

|

|

Denis Burger

|

Trinity Biotech plc

BioCurex, Inc.

|

|

Mark Vincent

|

-

|

|

Jim A. Wright

|

-

|

|

Aiping Young

|

-

|

The independent directors hold meetings as a matter of routine after each Board meeting, without the presence of non-independent directors and members of management. There were four meetings of the independent directors in the financial year ended May 31, 2010.

Denis Burger, the chair of the Board (the “Chair”) is an independent director.

The Chair provides leadership to the Board in discharging its mandate and also assists the Board in discharging its stewardship function, which includes (i) working to ensure a strong, effective, well-balanced and representative membership of the Board and its committees, (ii) ensuring that committees are working effectively, (iii) ensuring the integrity of management, (iv) evaluating, together with the Compensation Committee and Nominating and Corporate Governance Committee, the President and CEO and corporate performance, and (v) ensuring the Board receives timely and accurate information before, during and after Board meetings.

The following table illustrates the attendance record of each director for all board meetings held for the fiscal year ended May 31, 2010.

|

Director

|

Meetings Attended

|

|

Herbert Abramson

|

11 of 11

|

|

Denis Burger

|

11 of 11

|

|

Georg Ludwig(1)

|

5 of 7

|

|

Mark Vincent

|

10 of 11

|

|

Jim A. Wright

|

11 of 11

|

|

Aiping Young

|

11 of 11

|

(1) Mr. Ludwig resigned from the Board March 3, 2010.

Board Mandate

The Board has adopted a mandate in which it explicitly assumes responsibility for stewardship of the Corporation. The Board is mandated to represent the shareholders to ensure appropriate succession planning is in place, select the appropriate CEO, assess and approve the strategic direction of the Corporation, ensure that appropriate processes for risk assessment, management and internal control are in place, monitor management performance against agreed benchmarks, and assure the integrity of financial reports. A copy of the Board Mandate is attached hereto as Appendix B.

Position Descriptions

The Board has developed written position descriptions, which are reviewed annually, for the Chair and the chairs of each of the audit committee, the compensation committee and the corporate governance and nominating committee. The CEO also has a written position description that has been approved by the Board and is reviewed annually.

Orientation and Continuing Education

It is the mandate of the Corporate Governance and Nominating Committee to ensure that a process is established for the orientation and education of new directors that addresses the nature and operation of the Corporation's business and their responsibilities and duties as directors (including the contribution individual directors are expected to make and the commitment of time and resources that the Corporation expects from its directors).

With respect to the continuing education of directors, the Corporate Governance and Nominating Committee ensures that directors receive adequate information and continuing education opportunities on an ongoing basis to enable directors to maintain their skills and abilities as directors and to ensure their knowledge and understanding of the Corporation's business remains current.

Ethical Business Conduct

The Corporation has adopted a Code of Business Conduct and Ethics (the “Code”) that applies to the directors, officers and employees of the Corporation its subsidiary. Additionally, consultants and agents for the Corporation are expected to abide by the Code.

The Corporate Governance and Nominating Committee regularly monitors compliance with the Code and ensures that management of the Corporation encourages and promotes a culture of ethical business conduct. A copy of the Code may be found at www.SEDAR.com under the Corporation’s public profile.

The Corporation has developed a Disclosure and Insider Trading Policy that covers “whistle blowing” and provides an anonymous means for employees and officers to report violations of the Code or any other corporate policies.

The Board has not granted any waiver of the Code in favour of a director or officer of the Corporation.

Conflicts of Interest

The Corporate Governance and Nominating Committee monitors the disclosure of conflicts of interest by directors and ensures that no director will vote or participate in a discussion on a matter in respect of which such director has a material interest.

Nomination of Directors

It is the mandate of the Corporate Governance and Nominating Committee to identify and recommend qualified candidates for the Board. In assessing whether identified candidates are suitable for the Board, the Corporate Governance and Nominating Committee considers: (i) the competencies and skills considered necessary for the Board as a whole; (ii) the competencies and skills that the existing directors possess and the competencies and skills nominees will bring to the Board; and (iii) whether nominees can devote sufficient time and resources to his or her duties as a member of the Board. In addition, the Corporate Governance and Nominating Committee assesses the participation, contribution and effectiveness of the individual members of the Board on an annual basis. All members of the Corporate Governance and Nominating Committee are independent in accordance with the mandate of the Corporate Governance and Nominating Committee.

Compensation

The Compensation Committee is responsible for reviewing and recommending to the Board the compensation of: (i) the directors, (ii) the Chair of the Board, (iii) the chairs of the Corporation's committees, and (iv) the senior officers. In addition, the Compensation Committee reviews and makes recommendations to the Board regarding the corporate goals and objectives, performance and compensation of the CEO on an annual basis and is responsible for reviewing the recommendations of the CEO regarding compensation of the senior officers.

In addition, the Compensation Committee reviews and recommends changes to the compensation of the members of the Board based on a comparison of peer companies and issues relevant to the Corporation. The Compensation Committee also reviews and makes recommendations regarding annual bonus policies for employees, the incentive-compensation plans and equity-based plans for the Corporation and reviews executive compensation disclosure before the Corporation publicly discloses this information.

Further information pertaining the compensation of directors and officers can be found in this Circular under the heading “Statement of Executive Compensation”.

Assessments

It is the Board's mandate, in conjunction with the Corporate Governance and Nominating Committee, to assess the participation, contributions and effectiveness of the Chair and the individual members of the Board on an annual basis. The Board also monitors the effectiveness of the Board and its committees and the actions of the Board as viewed by the individual directors and senior management.

APPENDIX B

LORUS THERAPEUTICS INC.

BOARD MANDATE

Purpose

The board of directors (the “Board”) of Lorus Therapeutics Inc. (the “Corporation”) is responsible for the proper stewardship of the Corporation. The Board is mandated to represent the shareholders to select the appropriate Chief Executive Officer (“CEO”), assess and approve the strategic direction of the Corporation, ensure that appropriate processes for risk assessment, management and internal control are in place, monitor management performance against agreed bench marks, and assure the integrity of financial reports.

Membership and Reporting

|

1.

|

A majority of the directors of the Board will be independent as defined by National Instrument 58-101 - Disclosure of Corporate Governance Practices (“NI 58-101”), U.S. securities laws and applicable stock exchange rules. The Board will have no more than the maximum set out in the Corporation’s articles and by-laws, which maximum number the Board will reassess from time to time having consideration for the particular needs of the Corporation.

|

|

2.

|

Appointments to the Board will be reviewed on an annual basis. The Corporate Governance and Nominating Committee, in consultation with the CEO, is responsible for identifying and recommending new nominees with appropriate skills to the Board.

|

|

3.

|

The chair of the Board (the “Chair”) will be an independent director and will be appointed by a vote of the Board on an annual basis.

|

|

4.

|

The Board will report to the shareholders of the Corporation.

|

Terms of Reference

Meetings

|

1.

|

The Board will meet as required, but at least once quarterly.

|

|

2.

|

The independent directors will meet as required, without the non-independent directors and members of management, but at least once quarterly.

|

Meeting Preparation and Attendance

|

3.

|

In connection with each meeting of the Board and each meeting of a committee of the Board of which a director is a member, each director will:

|

|

|

(a)

|

review thoroughly the materials provided to the directors in connection with the meeting and be adequately prepared for the meeting; and

|

|

|

(b)

|

attend each meeting in person, by phone or by video-conference depending on the format of the meeting, to the extent practicable.

|

Corporate Planning and Performance

|

|

(a)

|

adopt a strategic planning process and approve a strategic plan each year; and

|

|

|

(b)

|

approve and monitor the operational plans and budgets of the Corporation submitted by management at the beginning of each fiscal year.

|

|

In establishing corporate performance objectives, the Board will:

|

|

|

(a)

|

ensure that it has adequate opportunity and information available to it to gain knowledge of the business and the industry sufficient to make fully informed decisions and to adopt meaningful and realistic long-term and short-term strategic objectives for the Corporation. This may include the opportunity for the Board to meet from time to time with industry, medical and scientific experts in related fields of interest;

|

|

|

(b)

|

ensure that effective policies and processes are in place relating to the proper conduct of the business, the effective management of risk and the values to be adopted by the Corporation; and

|

|

|

(c)

|

ensure that appropriate and effective environmental and occupational health and safety policies are in place, are operational and are supported by adequate resources.

|

|

|

(a)

|

ensure the integrity of the Corporation's financial reporting and internal control and disclosure policies and processes;

|

|

|

(b)

|

review the Corporation's quarterly and year-end audited financial statements;

|

|

|

(c)

|

review annual audit plans and findings and monitor the implementation of audit recommendations;

|

|

|

(d)

|

ensure that the Board has available to it any independent external advice that may be required from time to time; and

|

|

|

(e)

|

implement, or delegate the implementation of measures for receiving feedback from stakeholders.

|

Risk Management and Ethics

|

|

(a)

|

ensure that the business of the Corporation is conducted in compliance with applicable laws and regulations and according to the highest ethical standards;

|

|

|

(b)

|

identify and document the financial risks and other risks that the Corporation faces in the course of its business and ensure that such risks are appropriately managed; and

|

|

|

(c)

|

adopt a disclosure policy.

|

Shareholder Communication

|

7.

|

The Board will ensure that effective communication and disclosure policies are in place between the Board and the Corporation's shareholders, other stakeholders and the public. The Board will determine, from time to time, the appropriate criteria against which to evaluate performance against shareholder expectations and will set corporate strategic goals and objectives within this context. The Board will regularly review its criteria for the evaluation of shareholder expectations to ensure that they remain relevant to changing circumstances.

|