|

|

1.

|

receiving

the financial statements of the Corporation for the financial year ended

May 31, 2008, including the auditors'

report;

|

|

|

2.

|

electing

directors;

|

|

|

3.

|

appointing

KPMG LLP as auditors of the Corporation for the ensuing year and to

authorize the directors to fix the remuneration to be paid to the

auditors; and

|

|

|

4.

|

to

consider, and if deemed advisable, approve the unallocated options under

the stock option plan.

|

|

A.

|

Voting

Instruction Form. In most cases, a non-registered holder will receive, as

part of the meeting materials, a voting instruction form. If the

non-registered holder does not wish to attend and vote at the Meeting in

person (or have another person attend and vote on the non-registered

holder's behalf), the voting instruction form must be completed, signed

and returned in accordance with the directions on the form. If a

non-registered holder wishes to attend and vote at the Meeting in person

(or have another person attend and vote on the non-registered holder's

behalf), the non-registered holder must complete, sign and return the

voting instruction form in accordance with the directions provided and a

form of proxy giving the right to attend and vote will be forwarded to the

non-registered holder.

|

|

B.

|

Form

of Proxy. Less frequently, a non-registered holder will receive, as part

of the meeting materials, a form of proxy that has already been signed by

the intermediary (typically by a facsimile or stamped signature), which is

restricted as to the number of common shares beneficially owned by the

non-registered holder but which is otherwise uncompleted. If the

non-registered holder does not wish to attend and vote at the Meeting in

person (or have another person attend and vote on the non-registered

holder's behalf), the non-registered holder must complete the form of

proxy and deposit it with Computershare, 100 University Avenue, 8th Floor

Toronto, Canada, M5J 2Y1 as described above. If a non-registered

holder wishes to attend and vote at the Meeting in person (or have another

person attend and vote on the non-registered holder's behalf), the

non-registered holder must strike out the names of the persons named in

the proxy and insert the non-registered holder's (or such other person's)

name in the blank space provided.

|

|

|

Non-registered

holders should follow the instructions on the forms they receive and

contact their intermediaries promptly if they need

assistance.

|

|

|

(a)

|

completing

and signing a proxy bearing a later date and depositing it with

Computershare as described above;

or

|

|

|

(b)

|

depositing

an instrument in writing executed by the shareholder or by the

shareholder's attorney authorized in

writing:

|

|

|

(i)

|

at

our registered office at any time before 10:00 a.m. on Wednesday,

October 1, 2008, or 48 hours (not including Saturdays, Sundays and

holidays) before any adjournment of the Meeting at which the proxy is to

be used, or

|

|

|

(ii)

|

with

the chair of the Meeting prior to the commencement of the Meeting on the

day of the Meeting or any adjournment of the Meeting;

or

|

|

|

(c)

|

in

any other manner permitted by law.

|

|

|

•

|

FOR the election of the

directors nominated for election as listed in this

Circular

|

|

|

•

|

FOR the appointment of KPMG LLP

as auditors of the

Corporation

|

|

|

•

|

FOR the approval of the

unallocated options under the stock option plan of the

Corporation

|

|

|

•

|

Mr.

Buchi has served as chair of the Audit Committee and member of the

Corporate Governance, and Nomination

Committee;

|

|

|

•

|

Mr. Steigrod

has served as a member of the Audit Committee and Chair of the

Compensation Committee, and

|

|

|

•

|

Ms.

Koppy has served as a member of the Compensation and Corporate Governance,

and Nomination Committees.

|

|

Name Of

Director, Province/State

and Country

of Residence

|

Position with the

Corporation and when

Individual became a Director

|

Present Principal Occupation or

Employment

|

No. of common shares

Beneficially Owned,

Controlled

or Directed

|

|

HERBERT

ABRAMSON(3)

Ontario,

Canada

|

Director

July 2007

|

Chairman,

CEO and Portfolio Manager, Trapeze Capital Corp.

(investment

dealer/portfolio manager)

Chairman

and Portfolio Manager, Trapeze Asset Management Inc.

(investment

counselor)

|

47,101,515

|

|

DR. DENIS BURGER(1) (2)

Oregon,

United States

|

Director

September 2007

|

Retired,

currently lead independent director of Trinity Biotech plc.

(developer,

manufacturer of clinical diagnostic products)

Chairman

and CEO of AVI BioPharma, Inc. (1992-2007)

(biopharmaceutical

using gene-targeted therapeutics to interfere with ribosomal

translation)

|

59,620

|

|

GEORG

LUDWIG (4)

Eschen,

Liechtenstein

|

Director

September 2006

|

Managing

Director, ConPharm Anstalt (2005 to present)

(consulting

and managing company for life science funds)

Managing

Director, High Tech Private Equity

(general

partner of High Tech)

(2000

to 2004)

|

36,362,500

|

|

DR.

MARK D. VINCENT

Ontario,

Canada

|

Director

September 2007

|

Chief

Executive Officer, Sarissa Inc.

(biotechnology

company focused on development of targeted products for the therapeutic

manipulation of gene expression)

|

Nil

|

|

DR.

JIM A. WRIGHT

Ontario,

Canada

|

Director,

October 1999

|

Chief

Executive Officer of NuQuest Bio Inc. (2006 to present)

(start-up

biotechnology company with the intention of developing novel therapies for

treatment of life threatening diseases)

President

and Chief Executive Officer, Lorus (1999 to 2006)

|

4,639,791

|

|

DR.

AIPING YOUNG

Ontario,

Canada

|

Director,

President and Chief Executive Officer, October 2006

|

President

and Chief Executive Officer of the Corporation

(2006

to present)

Chief

Operating Officer, Lorus (2003 to 2006)

|

334,153

|

|

(1)

|

Member

of the Audit Committee.

|

|

(2)

|

Member

of the Compensation Committee.

|

|

(3)

|

Member

of the Corporate Governance and Nominating

Committee.

|

|

(4)

|

Pursuant

to a subscription agreement with High Tech dated July 13, 2006, as

amended, for as long as High Tech owns shares of the Corporation, it is

entitled to put forward a board nominee. Georg Ludwig is the nominee of

High Tech.

|

|

|

1.

|

the

unallocated options under the stock option plans are approved and

affirmed;

|

|

|

2.

|

the

Corporation seed further shareholder approval of unallocated options under

the stock option plans no later than October 1, 2011;

and

|

|

|

3.

|

any

director or officer of the Corporation is hereby authorized and directed

for and in the name of and on behalf of the Corporation to execute, or

cause to be executed, whether under corporate seal of the Corporation or

otherwise, and to deliver or cause to be delivered such certificates,

instruments, agreements, notices and other documents, and to do or cause

to be done all such other acts and things as such director or officer

determines to be necessary or desirable in connection with the foregoing,

such determination to be conclusively evidenced by the execution of such

document, agreement or instrument or the doing of any such act or

filing.

|

|

Annual Compensation

|

Long-Term

Compensation

Awards

|

|||||

|

Name and Principal Position

|

Fiscal

Year

|

Salary

($)

|

Bonus

($)

|

Other

Annual

Compensation

($)

|

Securities

Under

Options

/SARs Granted

(#)(1)

|

All

Other

Compensation

($)

|

|

Dr.

Aiping Young

President

and Chief Executive Officer, former Chief Operating

|

2008

2007

2006

|

323,846

286,269

259,692

|

117,600

41,250

32,000

|

Nil

Nil

Nil

|

1,350,000

2,312,496

1,194,144

|

Nil

Nil

Nil

|

|

Ms.

Elizabeth Williams(2)

Director

of Finance, Acting Chief Financial Officer

|

2008

2007

2006

|

27,412

87,152

88,631

|

15,996

7,565

7,000

|

Nil

Nil

Nil

|

200,000

139,739

228,035

|

Nil

Nil

Nil

|

|

Dr.

Saeid Babaei(3)

Vice

President Business Development

|

2008

2007

2006

|

126,606

64,731

Nil

|

10,072

Nil

Nil

|

Nil

Nil

Nil

|

300,000

Nil

Nil

|

Nil

Nil

Nil

|

|

Dr.

Yoon Lee(4)

Vice

President Research

|

2008

2007

2006

|

116,581

109,752

92,314

|

16,647

7,901

8,413

|

Nil

Nil

Nil

|

300,000

240,833

27,585

|

Nil

Nil

Nil

|

|

Dr.

Jim A. Wright(5)

Former

President and Chief Executive Officer

|

2008

2007

2006

|

Nil

108,814

345,442

|

Nil

131,070

53,000

|

Nil

Nil

Nil

|

Nil

(265,000)

947,500

|

Nil

584,630

Nil

|

|

Mr.

Peter Korth(6)

Former

Chief Financial Officer

|

2008

2007

2006

|

48,462

Nil

Nil

|

Nil

Nil

Nil

|

Nil

Nil

Nil

|

250,000

Nil

Nil

|

29,423

Nil

Nil

|

|

Mr.

Paul Van Damme(7)

Former

Chief Financial Officer

|

2008

2007

2006

|

Nil

Nil

152,654

|

Nil

Nil

35,030

|

Nil

Nil

Nil

|

Nil

Nil

Nil

|

Nil

Nil

74,633

|

|

(1)

|

Options

granted are net of forfeitures.

|

|

(2)

|

Ms.

Williams was on maternity leave from February 2007 to January

2008. Ms. Williams returned to work on a part time

basis.

|

|

(3)

|

Dr.

Babaei started with Lorus on September 7, 2006; hence, there are no

amounts relating to Dr. Babaei’s compensation for 2006. Dr.

Babaei was promoted to Vice President of Business Development on May 5,

2008.

|

|

(4)

|

Dr.

Lee was promoted to Vice President of Research on May 5,

2008.

|

|

(5)

|

Dr. Wright

resigned from his position on September 21, 2006. The amount of "All

Other Compensation" relates to a lump sum amount paid pursuant to our

separation agreement with

Dr. Wright.

|

|

(6)

|

Mr.

Korth resigned from his position on April 14, 2008. The amount

of “All Other Compensation” relates to salary continuance paid pursuant to

our separation agreement with Mr.

Korth.

|

|

(7)

|

Mr. Van

Damme resigned from his position on November 9, 2005. The amount of

"All Other Compensation" relates to a lump sum amount paid pursuant to our

separation agreement with Mr. Van

Damme.

|

|

Name and Principal Position

|

Securities

Under Options/SARs Granted

(#)

|

% of Total

Options/SARs Granted to Employees in FinancialYear

(%)

|

Exercise or

Base Price

($/Security)

|

Market Value of Securities Underlying

Options/SARs on the Date of Grant

($/Security)

|

Expiration

Date

|

|

Dr.

Aiping Young

President

and Chief Executive Officer, Former Chief Operating Officer

|

900,000(2)

450,000(2)

|

16.53

8.27

|

0.205

0.220

|

0.205

0.220

|

January

14, 2018

July

21, 2017

|

|

Ms.

Elizabeth Williams

Director

of Finance, Acting Chief Financial Officer

|

200,000(1)

|

3.31

|

0.220

|

0.220

|

July

21, 2017

|

|

Dr.

Saeid Babaei

Vice

President Business Development

|

150,000(1)

150,000(2)

|

2.48

2.48

|

0.220

0.190

|

0.220

0.190

|

July

21, 2017

February

4, 2018

|

|

Dr.

Yoon Lee

Vice

President Research

|

150,000(1)

150,000(2)

|

2.48

2.48

|

0.220

0.190

|

0.220

0.190

|

July

21, 2017

February

4, 2018

|

|

Mr.

Peter Korth

Former

Chief Financial Officer

|

250,000(3)

|

4.13

|

0.19

|

0.19

|

January

20, 2018

|

|

(1)

|

These

options were granted on July 21, 2007 in respect of corporate and

personal performance during the year ended May 31, 2007. The options

vest on the basis of 50% on the first anniversary and 25% on the second

and third anniversaries of the date of

granting.

|

|

(2)

|

These

options to purchase common shares are incentive options. The options vest

upon the attainment of specific undertakings based on certain corporate

performance objectives; failing to achieve the undertakings will result in

forfeiture on the specified

deadline.

|

|

(3)

|

Options

granted upon entering into Employment Agreement. The options vested upon

granting.

|

|

|

Aggregated

Option/SAR Exercises During the Most Recently

Completed

|

|

Name and Principal Position

|

Securities

Acquired on

Exercise

(#)

|

Aggregate

Value

Realized

($)

|

Unexercised

1)Options/SARs

at

May

31, 2008

(#)

Exercisable/

Unexercisable

|

Value

of Unexercised

in-the-Money

Options/SARs

at

May

31, 2008 ($)

Exercisable/

Unexercisable

|

|

Dr.

Aiping Young

President

and Chief Executive Officer,

Former

Chief Operating Officer

|

Nil

|

Nil

|

4,747,442/1,100,000

|

0/0

|

|

Ms.

Elizabeth Williams

Director

of Finance, Acting Chief Financial Officer

|

Nil

|

Nil

|

288,257/331,906

|

0/0

|

|

Dr.

Saeid Babaei

Vice

President Business Development

|

Nil

|

Nil

|

150,000/150,000

|

0/0

|

|

Dr.

Yoon Lee

Vice

President Research

|

Nil

|

Nil

|

396,579/252,313

|

0/0

|

|

Mr.

Peter Korth

Former

Chief Financial Officer

|

Nil

|

Nil

|

250,000/0

|

0/0

|

|

Number of

common shares to be issued upon exercise of outstanding

options

(a)

|

Number of

common shares remaining available for future issuance under the equity

compensation plans (Excluding Securities reflected

in Column (a))

(c)

|

Total

Stock Options outstanding and available for Grant

(a) + (c)

|

|||||

|

Plan Category

|

Number

|

% of common shares

outstanding

|

Weighted-average

exercise

price of

outstanding

options

(b)

|

Number

|

% of common shares

outstanding

|

Number

|

% of

Common

shares

outstanding

|

|

Equity

compensation plans approved by Shareholders

|

16,438,000

|

7.6

|

$0.45

|

16,209,000

|

7.4

|

32,647,000

|

15%

|

|

Equity

compensation plans approved by Shareholders

(August 26, 2008)

|

20,475,000

|

8.3

|

$0.38

|

16,628,193(1)

|

6.7

|

37,103,193

|

15%

|

|

(1)

|

The

Corporation had applied to the TSX to list 5,592,097 of the common shares

available for future issuance under the Corporation's equity compensation

plans.

|

|

|

EQUITY

COMPENSATION PLANS

|

|

|

2003

Plan

|

|

|

•

|

an

amendment to the maximum number of common shares reserved for issuance

under the 2003 Plan and under any other security based compensation

arrangement of the Corporation;

|

|

|

•

|

a

reduction in the exercise price for options held by

insiders;

|

|

|

•

|

an

extension to the term of options held by insiders;

and

|

|

|

•

|

an

increase in the 10% limits on grants to

insiders.

|

|

|

Base

Salary - Initial Stock

Options

|

|

|

Potential

Annual Cash Bonuses and Annual Participation in the 2003 Stock Option

Plan

|

|

|

President

and Chief Executive Officer

Compensation

|

|

|

•

|

maximize

the value of LOR-2040 in Acute Myeloid Leukemia through the timely

enrollment of patients in the ongoing Phase II clinical trial and

preparation of a Phase III study

proposal;

|

|

|

•

|

maximize

the value of LOR-2040 in MDS through the preparation of a development plan

and submission of a orphan drug application to certain regulatory

bodies;

|

|

|

•

|

maximize

the value of LOR-253 through the completion of certain pre-clinical

objectives and drafting of a Phase I protocol for advisory

review;

|

|

|

•

|

establishing

at least two partnerships (one academic and one

corporate);

|

|

|

•

|

evaluate

and assess potential merger and/or acquisition candidates;

and

|

|

|

•

|

certain

other objectives.

|

|

|

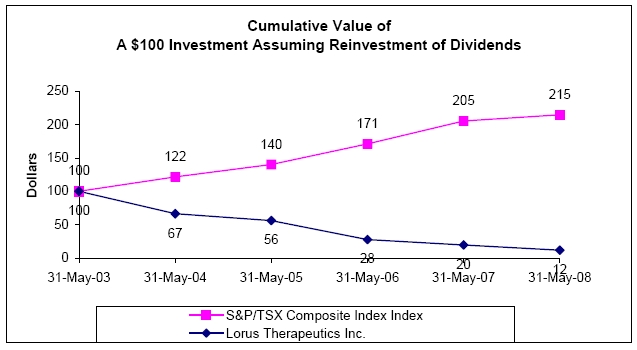

PERFORMANCE

GRAPH

|

|

Year End

|

2003

|

2004

|

2005

|

2006

|

2007

|

2008

|

||||||||||||||||||

|

LOR

|

$ | 100 | $ | 67 | $ | 56 | $ | 28 | $ | 20 | $ | 12 | ||||||||||||

|

S&P/TSX

Composite Index

|

$ | 100 | $ | 122 | $ | 140 | $ | 171 | $ | 205 | $ | 215 | ||||||||||||

|

Year End

|

31-May-03

|

31-May-04

|

31-May-05

|

31-May-06

|

31-May-07

|

31-May-08

|

|||||||||||||||

|

LOR

|

100=$1.26

|

$ | 0.84 | $ | 0.71 | $ | 0.35 | $ | 0.25 | $ | 0.15 | ||||||||||

|

S&P/TSX

Composite Index

|

100=6,860

|

8,347 | 9,619 | 11,744 | 14,082 | 14,715 | |||||||||||||||

|

Director

|

Independent

|

|

Herbert

Abramson

|

Yes

|

|

J.

Kevin Buchi(1)

|

Yes

|

|

Denis

Burger

|

Yes

|

|

Susan

Koppy(1)

|

Yes

|

|

Georg

Ludwig

|

Yes

|

|

Alan

Steigrod(1)

|

Yes

|

|

Mark

Vincent

|

Yes

|

|

Jim

A. Wright

|

No

|

|

Aiping

Young

|

No

|

|

(1)

|

Not

standing for re-election at the current shareholder

meeting

|

|

Director

|

Reporting Issuer

|

||

|

Herbert

Abramson

|

St

Andrew Goldfields Ltd.

|

||

|

J.

Kevin Buchi(1)

|

-

|

||

|

Denis

Burger

|

Trinity

Biotech plc

Paulson

Capital

|

||

|

Susan

Koppy(1)

|

-

|

||

|

Georg

Ludwig

|

-

|

||

|

Alan

Steigrod(1)

|

Sepracor

Inc.

|

||

|

Mark

Vincent

|

-

|

||

|

Jim

A. Wright

|

-

|

||

|

Aiping

Young

|

-

|

|

(1)

|

Not

standing for re-election at the current shareholder

meeting

|

|

Director

|

Meetings Attended

|

|

Herbert

Abramson(2)

|

8

of 8

|

|

J.

Kevin Buchi(1)

|

8

of 9

|

|

Denis

Burger(3)

|

5

of 6

|

|

Susan

Koppy(3)

(1)

|

6

of 6

|

|

Georg

Ludwig

|

8

of 9

|

|

Alan

Steigrod(1)

|

8

of 9

|

|

Mark

Vincent(3)

|

6

of 6

|

|

Jim

A. Wright

|

8

of 9

|

|

Aiping

Young

|

9

of 9

|

|

(1)

|

Not

standing for re-election at the current shareholder

meeting

|

|

(2)

|

Appointed

to the Board July 23, 2007

|

|

(3)

|

Elected

to the Board September 19, 2007

|

|

1.

|

A

majority of the directors of the Board will be independent as defined by

NI 58-101, U.S. securities laws and applicable stock exchange rules. The

Board will have no more than the maximum set out in the Corporation’s

articles and by-laws, which maximum number the Board will reassess from

time to time having consideration for the particular needs of the

Corporation.

|

|

2.

|

Appointments

to the Board will be reviewed on an annual basis. The Corporate Governance

and Nominating Committee, in consultation with the CEO, is responsible for

identifying and recommending new nominees with appropriate skills to the

Board.

|

|

3.

|

The

chair of the Board (the "Chair") will be an

independent director and will be appointed by a vote of the Board on an

annual basis.

|

|

4.

|

The

Board will report to the shareholders of the

Corporation.

|

|

1.

|

The

Board will meet as required, but at least once

quarterly.

|

|

2.

|

The

independent directors will meet as required, without the non-independent

directors and members of management, but at least once

quarterly.

|

|

3.

|

In

connection with each meeting of the Board and each meeting of a committee

of the Board of which a director is a member, each director

will:

|

|

|

(a)

|

review

thoroughly the materials provided to the directors in connection with the

meeting and be adequately prepared for the meeting;

and

|

|

|

(b)

|

attend

each meeting in person, by phone or by video-conference depending on the

format of the meeting, to the extent

practicable.

|

|

4.

|

The

Board will:

|

|

|

(a)

|

adopt

a strategic planning process and approve a strategic plan each year;

and

|

|

|

(b)

|

approve

and monitor the operational plans and budgets of the Corporation submitted

by management at the beginning of each fiscal

year.

|

|

|

In

establishing corporate performance objectives, the Board

will:

|

|

|

(a)

|

ensure

that it has adequate opportunity and information available to it to gain

knowledge of the business and the industry sufficient to make fully

informed decisions and to adopt meaningful and realistic long-term and

short-term strategic objectives for the Corporation. This may include the

opportunity for the Board to meet from time to time with industry, medical

and scientific experts in related fields of

interest;

|

|

|

(b)

|

ensure

that effective policies and processes are in place relating to the proper

conduct of the business, the effective management of risk and the values

to be adopted by the Corporation;

and

|

|

|

(c)

|

ensure

that appropriate and effective environmental and occupational health and

safety policies are in place, are operational and are supported by

adequate resources.

|

|

5.

|

The

Board will:

|

|

|

(a)

|

ensure

the integrity of the Corporation's financial reporting and internal

control and disclosure policies and

processes;

|

|

|

(b)

|

review

the Corporation's quarterly and year-end audited financial

statements;

|

|

|

(c)

|

review

annual audit plans and findings and monitor the implementation of audit

recommendations; and

|

|

|

(d)

|

ensure

that the Board has available to it any independent external advice that

may be required from time to time.

|

|

|

(e)

|

(e)

implement, or delegate the implementation of measures for receiving

feedback from stakeholders.

|

|

6.

|

The

Board will:

|

|

|

(a)

|

ensure

that the business of the Corporation is conducted in compliance with

applicable laws and regulations and according to the highest ethical

standards;

|

|

|

(b)

|

identify

and document the financial risks and other risks that the Corporation

faces in the course of its business and ensure that such risks are

appropriately managed; and

|

|

|

(c)

|

adopt

a disclosure policy.

|

|

7.

|

The

Board will ensure that effective communication and disclosure policies are

in place between the Board and the Corporation's shareholders, other

stakeholders and the public. The Board will determine, from time to time,

the appropriate criteria against which to evaluate performance against

shareholder expectations and will set corporate strategic goals and

objectives within this context. The Board will regularly review its

criteria for the evaluation of shareholder expectations to ensure that

they remain relevant to changing

circumstances.

|

|

8.

|

The

Board will:

|

|

|

(a)

|

to

the extent feasible, satisfy itself as to the integrity of the CEO and

other executive officers and that all such officers are creating a culture

of integrity throughout the

Corporation;

|

|

|

(b)

|

ensure

that the CEO is appropriately managing the business of the

Corporation;

|

|

|

(c)

|

ensure

appropriate succession planning is in place (including appointing,

training and monitoring senior management), in particular with respect to

the CEO position;

|

|

|

(d)

|

establish

corporate objectives for the CEO annually and evaluate the performance of

the CEO against these corporate

objectives;

|

|

|

(e)

|

consider

and approve major business initiatives and corporate transactions proposed

by management; and

|

|

|

(f)

|

ensure

the Corporation has internal control and management information systems in

place.

|

|

9.

|

The

Board will:

|

|

|

(a)

|

ensure

that an appropriate governance structure is in place, including a proper

delineation of roles and clear authority and accountability among the

Board, Board committees, the CEO, the Chief Financial Officer (or its

functional equivalent) and the Chief Operating

Officer;

|

|

|

(b)

|

develop

a process for the orientation and education of new members of the

Board;

|

|

|

(c)

|

support

continuing education opportunities for all members of the

Board;

|

|

|

(d)

|

in

conjunction with the Corporate Governance and Nominating Committee, assess

the participation, contributions and effectiveness of the Chair, and

individual Board members on an annual

basis;

|

|

|

(e)

|

monitor

the effectiveness of the Board and its committees and the actions of the

Board as viewed by the individual directors and senior

management;

|

|

|

(f)

|

ensure

that Board meetings operate effectively, agendas are focused on the

governance role of the Board, and that the Board is able to function

independently of management when

required;

|

|

|

(g)

|

ensure

that effective governance policies are in place regarding the conduct of

individual directors and employees, including but not limited to, policies

relating to insider trading and confidentiality and conflict of

interest;

|

|

|

(h)

|

establish

the committees of the Board it deems necessary or as required by

applicable law to assist it in the fulfillment of its mandate;

and

|

|

|

(i)

|

disclose

on an annual basis the mandate, composition of the Board and its

committees.

|