ANNUAL

INFORMATION FORM

Fiscal

year ended May 31, 2007

August

29, 2007

2

Meridian Road, Toronto, Ontario M9W 4Z7

Telephone: (416)

798-1200

Fax:

(416) 798-2200

TABLE

OF CONTENTS

|

CAUTION

REGARDING FORWARD-LOOKING STATEMENTS

|

1

|

|||

|

THE

COMPANY

|

4

|

|||

|

GENERAL

DEVELOPMENT OF THE BUSINESS

|

4

|

|||

|

REGULATORY

REQUIREMENTS

|

7

|

|||

|

BUSINESS

OF THE COMPANY

|

10

|

|||

|

Overview

|

10

|

|||

|

Antisense-DNA/RNA-based

Therapeutics

|

10

|

|||

|

Small

Molecule Therapies

|

15

|

|||

|

Immunotherapy

|

16

|

|||

|

Other

Technologies

|

18

|

|||

|

Agreements

|

19

|

|||

|

Business

Strategy

|

21

|

|||

|

Financial

Strategy

|

22

|

|||

|

Intellectual

Property and Protection of Confidential Information and

Technology

|

24

|

|||

|

Regulatory

Strategy

|

25

|

|||

|

Competition

|

25

|

|||

|

Human

Resources

|

26

|

|||

|

Properties

|

26

|

|||

|

Control

of the Registrant

|

26

|

|||

|

RISK

FACTORS

|

26

|

|||

|

RISKS

RELATED TO OUR COMMON SHARES AND CONVERTIBLE DEBENTURES

|

26

|

|||

|

DIVIDENDS

|

34

|

|||

|

SHARE

CAPITAL AND MARKET FOR SECURITIES

|

35

|

|||

|

Share

Capital

|

35

|

|||

|

Market

for Securities

|

35

|

|||

|

Principal

Shareholders

|

35

|

|||

|

DIRECTORS

AND OFFICERS

|

36

|

|||

|

COMMITTEE

INFORMATION

|

37

|

|||

|

Audit

Committee

|

37

|

|||

|

Independent

Auditors

|

37

|

|||

|

LEGAL

PROCEEDINGS

|

38

|

i

|

TRANSFER

AGENT AND REGISTRAR

|

38

|

|||

|

MATERIAL

CONTRACTS

|

39

|

|||

|

INTERESTS

OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS

|

40

|

|||

|

INTEREST

OF EXPERTS

|

40

|

|||

|

ADDITIONAL

INFORMATION

|

40

|

|||

|

GLOSSARY

|

42

|

|||

|

CHARTER

OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS OF LORUS THERAPEUTICS

INC. (THE “COMPANY”)

|

46

|

ii

CAUTION

REGARDING FORWARD-LOOKING STATEMENTS

This

annual information form may contain forward-looking statements within the

meaning of Canadian and U.S. securities laws. Such statements

include, but are not limited to, statements relating to:

|

|

•

|

our

expectations regarding future

financings;

|

|

|

•

|

our

plans to conduct clinical

trials;

|

|

|

•

|

our

expectations regarding the progress and the successful and timely

completion of the various stages of our drug discovery, preclinical

and

clinical studies and the regulatory approval

process;

|

|

|

•

|

our

plans to obtain partners to assist in the further development of

our

product candidates; and

|

|

|

•

|

our

expectations with respect to existing and future corporate alliances

and

licensing transactions with third parties, and the receipt and

timing of

any payments to be made by us or to us in respect of such arrangements,

and

|

the

Company’s plans, objectives, expectations and intentions and other statements

including words such as “anticipate”, “contemplate”, “continue”, “believe”,

“plan”, “estimate”, “expect”, “intend”, “will”, “should”, “may”, and other

similar expressions.

Such

statements reflect our current views with respect to future events and are

subject to risks and uncertainties and are necessarily based upon a number

of

estimates and assumptions that, while considered reasonable by us are inherently

subject to significant business, economic, competitive, political and social

uncertainties and contingencies. Many factors could cause our actual results,

performance or achievements to be materially different from any future results,

performance, or achievements that may be expressed or implied by such

forward-looking statements, including, among others:

|

|

•

|

our

ability to obtain the substantial capital required to fund research

and

operations;

|

|

|

•

|

our

lack of product revenues and history of operating

losses;

|

|

|

•

|

our

early stage of development, particularly the inherent risks and

uncertainties associated with (i) developing new drug candidates

generally, (ii) demonstrating the safety and efficacy of these

drug

candidates in clinical studies in humans, and (iii) obtaining regulatory

approval to commercialize these drug

candidates;

|

|

|

•

|

our

drug candidates require time-consuming and costly preclinical and

clinical

testing and regulatory approvals before

commercialization;

|

|

|

•

|

clinical

studies and regulatory approvals of our drug candidates are subject

to

delays, and may not be completed or granted on expected timetables,

if at

all, and such delays may increase our costs and could delay our

ability to

generate revenue;

|

|

|

•

|

the

regulatory approval process;

|

|

|

•

|

the

progress of our clinical

trials;

|

|

|

•

|

our

ability to find and enter into agreements with potential

partners;

|

|

|

•

|

our

ability to attract and retain key

personnel;

|

|

|

•

|

our

ability to obtain patent protection and protect our intellectual

property

rights;

|

|

|

•

|

our

ability to protect our intellectual property rights and to not

infringe on

the intellectual property rights of

others;

|

|

|

•

|

our

ability to comply with applicable governmental regulations and

standards;

|

|

|

•

|

development

or commercialization of similar products by our competitors, many

of which

are more established and have greater financial resources than

we

do;

|

|

|

•

|

commercialization

limitations imposed by intellectual property rights owned or controlled

by

third parties;

|

|

|

•

|

our

business is subject to potential product liability and other

claims;

|

|

|

•

|

our

ability to maintain adequate insurance at acceptable

costs;

|

|

|

•

|

further

equity financing may substantially dilute the interests of our

shareholders;

|

|

|

•

|

changing

market conditions; and

|

|

|

•

|

other

risks detailed from time-to-time in our ongoing quarterly filings,

annual

information forms, annual reports and annual filings with Canadian

securities regulators and the United States Securities and Exchange

Commission, and those which are discussed under the heading “Risk

Factors”.

|

Should

one or more of these risks or uncertainties materialize, or should the

assumptions set out in the section entitled “Risk Factors” underlying those

forward-looking statements prove incorrect, actual results may vary materially

from those described herein. These forward-looking statements are made as

of the

date of this annual information form or, in the case of documents incorporated

by reference herein, as of the date of such documents, and we do not intend,

and

do not assume any obligation, to update these forward-looking statements,

except

as required by law. We cannot assure you that such statements will prove

to be

accurate as actual results and future events could differ materially from

those

anticipated in such statements. Investors are cautioned that forward-looking

statements are not guarantees of future performance and accordingly investors

are cautioned not to put undue reliance on forward-looking statements due

to the

inherent uncertainty therein.

Unless

otherwise indicated, or the context requires otherwise, the information

appearing in this annual information form is stated as at May 31, 2007 and

references in this annual information form to “$” or “dollars” are to Canadian

dollars.

On

July 10, 2007 (the “Arrangement Date”), the Old Lorus completed a plan of

arrangement and corporate reorganization with, among others, 6650309 Canada

Inc.

(“New Lorus”), 6707157 Canada Inc. and Pinnacle International Lands,

Inc. As a result of the plan of arrangement and reorganization, among

other things, each common share of Old Lorus was exchanged for one common

share

of New Lorus and the assets (excluding certain future tax attributes and

related

valuation allowance) and liabilities of Old Lorus (including all of

the

-

2

-

shares

of its subsidiaries held by it) were transferred, directly or indirectly,

to the

Company and/or its subsidiaries. New Lorus continued the business of

Old Lorus after the Arrangement Date with the same officers and employees

and

continued to be governed by the same board of directors as Old Lorus prior

to

the Arrangement Date. References in this annual information form to the Company,

Lorus, “we”, “our”, “us” and similar expressions, unless otherwise stated, are

references to Old Lorus prior to the Arrangement Date and New Lorus after

the

Arrangement Date.

For

ease of reference, a glossary of terms used in this annual information form

can

be found beginning on page 42.

-

3

-

THE

COMPANY

Lorus

Therapeutics Inc. (“Old Lorus”) was incorporated under the Business

Corporations Act (Ontario) on September 5, 1986 under the name RML Medical

Laboratories Inc. On October 28, 1991, RML Medical Laboratories Inc.

amalgamated with Mint Gold Resources Ltd., resulting in Old Lorus becoming

a

reporting issuer (as defined under applicable securities law) in Ontario,

on

such date. On August 25, 1992, Old Lorus changed its name to IMUTEC

Corporation. On November 27, 1996, Old Lorus changed its name to

Imutec Pharma Inc., and on November 19, 1998, Old Lorus changed its name

to

Lorus Therapeutics Inc. On October 1, 2005, Old Lorus continued under

the Canada Business Corporations Act.

On

July 10, 2007 (the “Arrangement Date”), Old Lorus completed a plan of

arrangement and corporate reorganization with, among others, 6650309 Canada

Inc.

(“New Lorus”), 6707157 Canada Inc. and Pinnacle International Lands,

Inc. As a result of the plan of arrangement and reorganization, among

other things, each common share of Old Lorus was exchanged for one common

share

of New Lorus and the assets (excluding certain future tax attributes and

related

valuation allowance) and liabilities of Old Lorus (including all of the shares

of its subsidiaries held by it) were transferred, directly or indirectly,

to the

Company and/or its subsidiaries. New Lorus continued the business of

Old Lorus after the Arrangement Date with the same officers and employees

and

continued to be governed by the same board of directors as Old Lorus prior

to

the Arrangement Date. References in this annual information form to the Company,

Lorus, “we”, “our”, “us” and similar expressions, unless otherwise stated, are

references to Old Lorus prior to the Arrangement Date and New Lorus after

the

Arrangement Date.

The

address of the Company’s head and registered office is 2 Meridian Road, Toronto,

Ontario, Canada, M9W 4Z7. Our corporate website is

www.lorusthera.com. The contents of the website are specifically not

included in this annual information form by reference.

Our

common shares are listed on the Toronto Stock Exchange under the symbol “LOR”

and are listed on the American Stock Exchange under the symbol

“LRP”.

Lorus’

subsidiaries are GeneSense Technologies Inc. (“GeneSense”), a corporation

incorporated under the laws of Canada, of which Lorus owns 100% of the issued

and outstanding share capital, and NuChem Pharmaceuticals Inc. (“NuChem”), a

corporation incorporated under the laws of Ontario, of which Lorus owns 80%

of

the issued and outstanding voting share capital and 100% of the issued and

outstanding non-voting preference share capital.

GENERAL

DEVELOPMENT OF THE BUSINESS

Lorus

Therapeutics Inc. is a life sciences company focused on the discovery, research

and development of effective anticancer therapies with a high safety profile.

Lorus has worked to establish a diverse, marketable anticancer product pipeline,

with products in various stages of development ranging from preclinical to

multiple Phase II clinical trials. A growing intellectual property portfolio

supports our diverse product pipeline.

Our

success is dependent upon several factors, including establishing the efficacy

and safety of our products in clinical trials, securing strategic partnerships,

obtaining the necessary regulatory approvals to market our products and

maintaining sufficient levels of funding through public and/or private

financing.

We

believe that the future of cancer treatment and management lies in drugs

that

are effective, safe and have minimal side effects, and therefore improve

a

patient's quality of life. Many of the cancer drugs currently approved for

the

treatment and management of cancer are toxic with severe side effects, and

we

therefore believe that a product development plan based on effective and

safe

drugs could have broad

-

4

-

applications

in cancer treatment. Lorus' strategy is to continue the development

of our product pipeline using several therapeutic approaches. Each therapeutic

approach is dependent on different technologies, which we believe mitigates

the

development risks associated with a single technology platform. We evaluate

the

merits of each product throughout the clinical trial process and consider

commercialization as appropriate. The most advanced anticancer drugs in our

pipeline, each of which flow from different platform technologies, are

antisense-DNA/RNA-based therapeutics, small molecules and

immunotherapeutics.

Over

the past three years, we have focused on advancing our product candidates

through pre-clinical and clinical testing. You should be aware that it can

cost

millions of dollars and take many years before a product candidate may be

approved for therapeutic use in humans. In addition, a product candidate

may not

meet the end points of any Phase I, Phase II or Phase III clinical trial.

See

“Risk Factors”.

Antisense-DNA/RNA-based

Therapeutics

Our

lead antisense product in clinical development is GTI-2040. In addition we

have

a number of other antisense molecules in development. See “-- Clinical

Development” and “Business of the Company - Antisense-DNA/RNA-based

Therapeutics” for more details.

GTI-2040

Seven

of the nine clinical studies for GTI-2040 have been conducted in conjunction

with the United States National Cancer Institute (“NCI”) with the remaining

studies conducted or initiated by Lorus. We have initiated, are

conducting or conducted Phase I/II clinical trials of GTI-2040 in patients

with

refractory or relapsed acute myeloid leukemia (“AML”), metastatic breast cancer,

non-small cell lung cancer, solid tumors, advanced unresectable colon cancer,

hormone refractory prostate cancer, high grade myelodysplastic syndrome (“MDS”)

and acute leukemia (“AL”). Our collaboration with the NCI is active

and ongoing. In addition, the Company is pursuing a Phase II clinical trial

with

GTI-2040 and high dose Ara-C in refractory and relapsed AML and completed

a

Phase I/II study of advanced, end-stage renal cell cancer.

siRNA

As

a complement to our antisense therapy, we are exploiting RNA intereference

technology using a novel class of small interefering RNA (“siRNA”)

molecules. SiRNA has the potential to decrease the

cellular target RNA expression though a process known as RNA

interference.

GTI-2501

Our

other antisense therapy, GTI-2501, is currently in a Phase II clinical trial

for

the treatment of hormone refractory prostate cancer at the Toronto Sunnybrook

Regional Cancer Centre, following the successful conclusion of a Phase I

clinical trial in the United States.

Other

We

have also entered into a collaboration agreement in respect of our antisense

therapy, GTI-2601 and have other antisense molecules in pre-clinical

development.

Small

Molecule

We

believe we have small molecule drug screening technologies and preclinical

scientific expertise, which we are using to create a drug candidate pipeline.

Our proprietary group of novel small molecule compounds,

-

5

-

which

include lead compounds LT-253 and ML-220, have unique structures and modes

of

action, and are promising candidates for the development of novel anticancer

agents with high safety profiles. See “-- Clinical Development” and

“Business of the Company - Small Molecule Therapies”.

Immunotherapy

Lorus’

immunotherapy product candidates are Virulizin® and IL-17E. See “--

Clinical Development” and “Business of the Company - Immunotherapy” for more

details.

Virulizin®

In

2002, we initiated a phase III clinical trial of Virulizin® for patients with

locally advanced or metastatic pancreatic cancer who had not previously received

systemic chemotherapy. In July of 2005, we announced the completion

of the study and in October 2005, we announced that the results of the trial

indicated that the overall survival rate of patients who were treated with

Virulizin® plus gemcitabine (a standard chemotherapy drug) was not statistically

significant when compared to those patients in the study who were given

gemcitabine plus a placebo. Subsequent sub-group analyses support the potential

for further study in select patient populations. We are currently seeking

partners to continue the clinical development of Virulizin®.

IL-17E

We

have discovered a new lead drug candidate, IL-17E, which belongs to a larger

family of cytokines. In experiments with mice, IL-17E has demonstrated

significant antitumor activity against a variety of human tumors, including

melanoma, pancreatic, colon, lung and ovarian tumors grown in mice. We believe

that these preliminary animal results support our further investigation of

the

potential clinical applications of IL-17E.

Clinical

Development

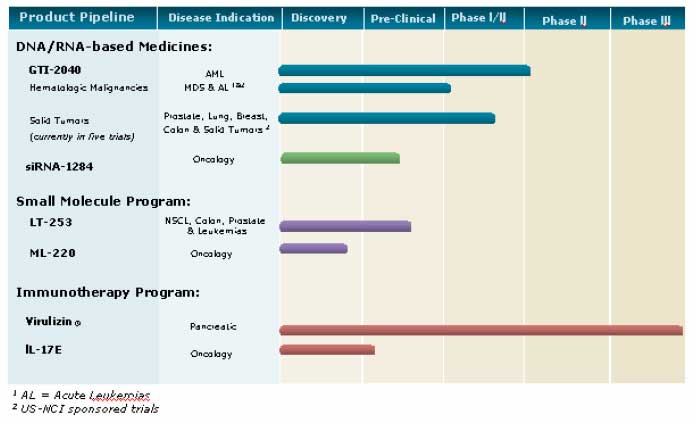

The

chart below illustrates our current view of the clinical development stage

of

each of our products. This chart reflects the current regulatory

approval process for biopharmaceuticals in Canada and the United States (with

the exception of Virulizin® for malignant melanoma which is approved for use in

the private market in Mexico). See “Regulatory Requirements” for a

description of the regulatory approval process in Canada and the United States.

These qualitative estimates of the progress of our products are intended

solely

for illustrative purposes and the information contained herein is qualified

in

its entirety by the information appearing elsewhere or incorporated by reference

in this annual information form.

-

6

-

REGULATORY

REQUIREMENTS

Overview

Regulation

by government authorities in Canada, the United States, Mexico and the European

Union is a significant factor in our current research and drug development

activities. To clinically test, manufacture and market drug products

for therapeutic use, we must satisfy the rigorous mandatory procedures and

standards established by the regulatory agencies in the countries in which

we

currently operate or intend to operate.

The

laws of most of these countries require the licensing of manufacturing

facilities, carefully controlled research and the extensive testing of

products. Biotechnology companies must establish the safety and

efficacy of their new products in clinical trials, establish cGMP and control

over marketing activities before being allowed to market their

products. The safety and efficacy of a new drug must be shown through

clinical trials of the drug carried out in accordance with the mandatory

procedures and standards established by regulatory agencies.

The

process of completing clinical trials and obtaining regulatory approval for

a

new drug takes a number of years and requires the expenditure of substantial

resources. Once a new drug or product license application is

submitted, we cannot assure you that a regulatory agency will review and

approve

the application in a timely manner. Even after initial approval has

been obtained, further studies, including post-marketing studies, may be

required to provide additional data on efficacy and safety necessary to confirm

the approved indication or to gain approval for the use of the new drug as

a

treatment for clinical indications other than those for which the new drug

was

initially tested. Also, regulatory agencies require post-marketing

surveillance programs to monitor a new drug’s side effects. Results

of post-marketing programs may limit or expand the further marketing of new

drugs. A serious safety or effectiveness problem involving an

approved new drug may result in a regulatory agency requiring withdrawal

of the

new drug from the market and possible civil action. We cannot assure

you that we will not encounter such difficulties or excessive costs in our

efforts to secure necessary approvals, which could delay or prevent us from

manufacturing or marketing our products.

-

7

-

In

addition to the regulatory product approval framework, biotechnology companies,

including Lorus, are subject to regulation under local provincial, state

and

federal law, including requirements regarding occupational safety, laboratory

practices, environmental protection and hazardous substance control, and

may be

subject to other present and future local, provincial, state, federal and

foreign regulation, including possible future regulation of the biotechnology

industry.

Canada

In

Canada, the manufacture and sale of new drugs are controlled by Health Canada

(“HC”). New drugs must pass through a number of testing stages,

including pre-clinical testing and clinical trials. Pre-clinical

testing involves testing the new drug’s chemistry, pharmacology and toxicology

in vitro and in vivo. Successful results (that is,

potentially valuable pharmacological activity combined with an acceptable

low

level of toxicity) enable the developer of the new drug to file a clinical

trial

application (“CTA”) to begin clinical trials involving humans.

To

study a drug in Canadian patients, a CTA submission must be filed with

HC. The CTA submission must contain specified information, including

the results of the pre-clinical tests completed at the time of the submission

and any available information regarding use of the drug in humans. In

addition, since the method of manufacture may affect the efficacy and safety

of

a new drug, information on manufacturing methods and standards and the stability

of the drug substance and dosage form must be presented. Production

methods and quality control procedures must be in place to ensure an acceptably

pure product, essentially free of contamination, and to ensure uniformity

with

respect to all quality aspects.

Provided

HC does not reject a CTA submission, clinical trials can

begin. Clinical trials for product candidates to treat cancer are

generally carried out in three phases. Phase I involves studies to

evaluate toxicity and ideal dose levels in humans. The new drug is

administered to human patients who have met the clinical trial entry criteria

to

determine pharmacokinetics, human tolerance and prevalence of adverse side

effects. Phases II and III involve therapeutic studies. In

Phase II, efficacy, dosage, side effects and safety are established in a

small

number of patients who have the disease or disorder that the new drug is

intended to treat. In Phase III, there are controlled clinical trials

in which the new drug is administered to a large number of patients who are

likely to receive benefit from the new drug. In Phase III, the

effectiveness of the new drug is compared to that of standard accepted methods

of treatment in order to provide sufficient data for the statistical proof

of

safety and efficacy for the new drug.

If

clinical studies establish that a new drug has value, the manufacturer submits

a

new drug submission (“NDS”) application to HC for marketing

approval. The NDS contains all information known about the new drug,

including the results of pre-clinical testing and clinical

trials. Information about a substance contained in an NDS includes

its proper name, its chemical name, and details on its method of manufacturing

and purification, and its biological, pharmacological and toxicological

properties. The NDS also provides information about the dosage form

of the new drug, including a quantitative listing of all ingredients used

in its

formulation, its method of manufacture, manufacturing facility information,

packaging and labelling, the results of stability tests, and its diagnostic

or

therapeutic claims and side effects, as well as details of the clinical trials

to support the safety and efficacy of the new drug. Furthermore, for

biological products, an on-site evaluation is required prior to the issuance

of

a notice of compliance (“NOC”). All aspects of the NDS are critically

reviewed by HC. If an NDS is found satisfactory, a NOC is issued permitting

the

new drug to be sold. In Canada an Establishment license must be

obtained prior to marketing the product.

HC

has a policy of priority evaluation of new drug submissions for all drugs

intended for serious or life-threatening diseases for which no drug product

has

received regulatory approval in Canada and for which there is reasonable

scientific evidence to indicate that the proposed new drug is safe and may

provide effective treatment.

-

8

-

The

monitoring of a new drug does not cease once it is on the market. For

example, a manufacturer of a new drug must report any new information received

concerning serious side effects, as well as the failure of the new drug to

produce desired effects. As well, if HC determines it to be in the

interest of public health, a notice of compliance for a new drug may be

suspended and the new drug may be removed from the market.

An

exception to the foregoing requirements relating to the manufacture and sale

of

a new drug is the limited authorization that may be available in respect

of the

sale of new drugs for emergency treatment. Under the special access

program, HC may authorize the sale of a quantity of a new drug for human

use to

a specific practitioner for the emergency treatment of a patient under the

practitioner’s care. Prior to authorization, the practitioner must

supply HC with information concerning the medical emergency for which the

new

drug is required, such data as is in the possession of the practitioner with

respect to the use, safety and efficacy of the new drug, the names of the

institutions at which the new drug is to be used and such other information

as

may be requested by HC. In addition, the practitioner must agree to

report to both the drug manufacturer and HC the results of the new drug’s use in

the medical emergency, including information concerning adverse reactions,

and

must account to HC for all quantities of the new drug made

available.

The

Canadian regulatory approval requirements for new drugs outlined above are

similar to those of other major pharmaceutical markets. While the

testing carried out in Canada is often acceptable for the purposes of regulatory

submissions in other countries, individual regulatory authorities may request

supplementary testing during their assessment of any submission. We cannot

assure you that the clinical testing conducted under HC authorization or

the

approval of regulatory authorities of other countries will be accepted by

regulatory authorities outside Canada or such other countries.

United

States

In

the United States, the FDA controls the manufacture and sale of new

drugs. New drugs require FDA approval of a marketing application

(e.g. an NDA or FDA application) prior to commercial

sale. To obtain marketing approval, data from adequate and

well-controlled clinical investigations, demonstrating to the FDA’s satisfaction

a new drug’s safety and effectiveness for its intended use, are

required. Such data are generated in studies conducted pursuant to an

IND submission, similar to that required for a CTA in Canada. As in

Canada, clinical studies are characterized as Phase I, Phase II and Phase

III

trials or a combination thereof. In a marketing application, the

manufacturer must also demonstrate the identity, potency, quality and purity

of

the active ingredients of the new drug involved, and the stability of those

ingredients. Further, the manufacturing facilities, equipment,

processes and quality controls for the new drug must comply with the FDA’s cGMP

regulations for drugs or biological products both in a pre-licensing inspection

before product licensing and in subsequent periodic inspections after

licensing. In the case of a biological product, an establishment

license must be obtained prior to marketing and batch releasing.

A

five-year period of market exclusivity for a drug comprising a new chemical

entity (“NCE”) is available to an applicant that succeeds in obtaining FDA

approval of a NCE, provided the active ingredient of the NCE has never before

been approved in an NDA. During this exclusivity period, the FDA may not

approve

any abbreviated application filed by another sponsor for a generic version

of

the NCE. Further, a three-year period of market exclusivity for a new use

or

indication for a previously approved drug is available to an applicant that

submits new clinical studies that are essential to support the new use or

indication. During the latter period of exclusivity, the FDA may not approve

an

abbreviated application filed by another sponsor for a generic version of

the

product for that use or indication.

The

FDA has “fast track” regulations intended to accelerate the approval process for

the development, evaluation and marketing of new drugs used to diagnose or

treat

life-threatening and severely debilitating illnesses for which no satisfactory

alternative therapies exist. “Fast track” designation affords early

interaction with the FDA in terms of protocol design and permits, although

it

does not require, the FDA to

-

9

-

issue

marketing approval after completion of Phase II clinical trials (although

the

FDA will require subsequent clinical trials or even post-approval efficacy

studies).

BUSINESS

OF THE COMPANY

Overview

Chemotherapeutic

drugs have been the predominant medical treatment option for cancer,

particularly metastatic cancer, for the past 30 years. More recently, a range

of

novel cancer drugs have been developed that are efficacious while improving

patient quality of life. Unlike chemotherapies, which are typically

based on chemical synthesis, these new drugs may be of biological origin,

based

on naturally occurring molecules, proteins or genetic material. While

chemotherapy drugs are relatively non-specific and as a result toxic to normal

cells, these biological agents specifically target individual molecules or

genes

that are involved in disease and are therefore preferentially toxic to tumor

cells. The increased specificity of these drugs may result in fewer

and milder side effects, meaning that, in theory, larger and therefore, more

effective doses can be administered. The current paradigm in cancer management

is a multi-modal approach that combines multiple treatment options tailored

to

the specific indication and individual patient. As a result, drug regimens

that

combine novel small molecule chemotherapies based on emerging understanding

of

cancer development with biological agents are of considerable

interest.

We

believe that the future of cancer treatment and management lies in drugs

that

are effective, safe and have minimal side effects leading to improved patient

quality of life. Many of the drugs currently approved for the treatment and

management of cancer are toxic resulting in severe side effects that limit

dosing and efficacy. We believe that a product development plan based

on effective and safe drugs would have broad applications in cancer treatment.

Lorus’ strategy is to continue the development of our product pipeline using

several therapeutic approaches. Each therapeutic approach is dependent on

different technologies, which we believe mitigates the development risks

associated with a single technology platform. In developing and evaluating

our

products, we evaluate the merits of each product throughout the clinical

trial

process and consider commercialization opportunities.

Antisense-DNA/RNA-based

Therapeutics

Introduction

Metabolism,

cell growth and cell division are tightly controlled by complex protein

signalling pathways in response to specific conditions, thereby maintaining

normal function. Many human diseases, including cancer, can be traced to

faulty

protein production and/or regulation. As a result, traditional therapeutics

are

designed to interact with the disease-causing proteins and modify their

function. A significant number of current anticancer drugs act by damaging

either DNA or proteins within cells (e.g., chemotherapy) or by inhibiting

the

function of proteins or small molecules (e.g. estrogen blockers, such

as Tamoxifen). Antisense therapeutics offer a novel approach to treatment

in

that they are designed to prevent the production of proteins causing

disease.

The

premise of this therapeutic approach is to target an earlier stage of the

biochemical process than is usually possible with conventional drugs. The

blueprint for protein production is encoded in the DNA of each cell. To

translate this code into protein the cell first produces mRNAs (messenger

ribonucleic acids) specific to each protein and these act as intermediaries

between the information encoded in DNA and production of the corresponding

protein. Most traditional therapies interact with the final synthesized or

processed protein. Often this interaction lacks specificity that

would allow for interaction with only the intended target, resulting in

undesired side effects. In contrast, this newer approach alters

gene-expression at the mRNA level, prior to protein synthesis, with specificity

such that expression of only the intended target is affected. We

believe that

-

10

-

drugs

based on this approach may have broad applicability, greater efficacy and

fewer

side effects than conventional drugs.

We

have developed a number of antisense drugs, of which our lead products are

GTI-2040 and GTI-2501. These products target the two components of

ribonucleotide reductase (“RNR”). RNR is a highly regulated, cell

cycle-controlled protein required for DNA synthesis and repair. RNR

is made up of two components, R1 and R2, encoded by different genes. RNR

is

essential for the formation of deoxyribonucleotides, which are the building

blocks of DNA. Since RNR activity is highly elevated in tumor cell

populations and is associated with tumor cell proliferation, we have developed

antisense molecules specific for the mRNA of the R1 (GTI-2501) or the R2

(GTI-2040) components of RNR. Furthermore, the R2 component also appears

to be a

signal molecule in cancer cells and its elevation is believed to modify a

biochemical pathway that can increase the malignant properties of tumor cells.

Consequently, reducing the expression of the RNR components in a tumor cell

with

antisense drugs is expected to have antitumor effects.

GTI-2040

Our

lead antisense therapy is GTI-2040, an antisense drug that targets the R2

component of RNR and has exhibited antitumor properties against over a dozen

different human cancers in standard mouse models, including chemotherapy

resistant tumors. We have completed a Phase I/II clinical trial of

GTI-2040 for advanced or metastatic renal cell carcinoma. We are also

conducting or have completed a multiple Phase I/II clinical trial program

in

cooperation with the NCI, for the study of GTI-2040 for the treatment of

AML,

breast cancer, lung cancer, colon cancer, prostate cancer , a series of solid

tumors and myelodysplastic syndrome and acute leukemia. We also

recently initiated Phase II clinical trial with GTI-2040 and high dose Ara-C

in

refractory and relapsed AML.

Pre-clinical

Testing

GTI-2040

has demonstrated excellent anti-tumour activity in a number of murine models

of

human cancer including xenograft tumour growth, metastasis and survival models.

The results of these studies were published in the June 1, 2003 issue of

Cancer Research. Additional studies have demonstrated combination drug

efficacy in xenograft tumour growth studies for human cancer cells, including

drug resistant tumour cell lines. More recent studies, the results of which

were

presented at the 2007 annual meeting of the AACR, focus on dose schedule

optimization for GTI-2040 in combination with docetaxel. These studies

demonstrate that the timing of these two drugs can be optimized: observations

that have implications for the ongoing NCI sponsored clinical trials. These

studies continued in 2007. Lorus has also published results from studies

aimed

at development of an assay for R2 determination from clinical samples

(Journal of Clinical Laboratory Analysis, 2005). Formal pre-clinical

development of GTI-2040, including manufacturing and toxicology studies,

was

initiated in mid-1998. Pre-clinical studies, including GLP toxicology

studies in standard animal models, have demonstrated that GTI-2040 is well

tolerated at concentrations that exceed commensurate therapeutic doses in

humans.

Clinical

Development

Lorus

Sponsored Trials

Acute

Myeloid Leukemia:

In

August 2007, we announced an expansion of GTI-2040 development program in

AML

indication with initiation of a more advanced Phase II clinical trial with

GTI-2040 and high dose Ara-C in refractory (HiDAC) and relapsed AML. This

Phase

II study includes both an efficacy study and a novel additional study to

measure

intracellular target activities and pharmacological synergies between the

two

agents. In the first stage of the 60 patient trial, the pharmacologic and

target

related activity of GTI-2040 and HiDAC will be

-

11

-

evaluated

in two groups, to determine the contribution of each agent alone and in

combination. The second stage of the trial will provide efficacy evaluation

in a

larger patient population. Lorus expects the clinical trial to be completed

by

the end of 2008. The decision to advance clinical development of GTI-2040

is

based on the encouraging results from our recently completed proof of concept

NCI-sponsored study of GTI-2040 in combination with HiDAC in patients with

refractory and relapsed AML.

Advanced

Renal Cell Cancer:

In

April 2005, we announced completion of a Phase I/II clinical trial of GTI-2040

in combination with capecitabine, in patients with advanced, end-stage renal

cell cancer in the United States. This trial was a single-arm pilot study

examining the safety and efficacy of GTI-2040 used in combination with the

anticancer agent capecitabine. The majority of patients had failed two or

more

prior therapies before entering the study, exhibited extensive metastases,

and

were representative of a population with very poor prognostic outcome in

renal

cell cancer. All 33 patients entering this study had advanced disease

with multiple metastatic sites, with or without prior removal of the primary

kidney tumor. However, more than half (52%) of the patients on the recommended

dose exhibited disease stabilization or better, including one confirmed partial

response. GTI-2040 was well tolerated when combined with a cytotoxic agent

with

expected adverse events. The results of this study were accepted for publication

in the journal Cancer Chemotherapy and Pharmacology in 2007 (June 2007

e-pub date). Lorus is actively searching for partnerships

to assist with the further development of GTI-2040 for the treatment of renal

cell cancer.

NCI

Sponsored Trials

Current

clinical development for GTI-2040 is in conjunction with the US NCI, which

pays

for the cost of all clinical trials. See “-- Agreements -

Collaboration Agreements - National Cancer Institute”. To date we

have announced and/or initiated seven clinical trials with the NCI for GTI-2040

in patients with AML, metastic breast cancer, non-small all lung cancer,

solid

tumors, unresectable colon cancer, hormone refractory prostate cancer, and

MDS

and acute leukemia. These indications were selected based on the most

promising results from our preclinical studies. Upon receipt of the clinical

data from the ongoing NCI clinical trials, Lorus will

analyze and make decisions regarding the strategic direction of our antisense

portfolio. Lorus continues to search for partnerships for the future

development of GTI-2040.

In

September 2005, Lorus announced a steering committee assessment of progress

in

the ongoing U.S. NCI-sponsored clinical studies of GTI-2040. The committee

concluded that all six studies continue to progress without unacceptable

toxicity. Studies reviewed in this process included GTI-2040 in combination

with

chemotherapies in non-small cell lung cancer (NSCLC), hormone refractory

prostate cancer (HRPC), breast cancer, acute myeloid leukemia (AML), colorectal

cancer and a variety of solid tumors. Combination chemotherapies under study

include docetaxel, capecitabine, oxaliplatin, cytarabine, and

gemcitabine.

Acute

Myeloid Leukemia:

In

July 2003, we announced the FDA’s approval of the NCI-sponsored IND application

for a clinical trial of GTI-2040 in combination with cytarabine, in patients

with refractory or relapsed AML. Cytarabine is the current established drug

for

treating AML patients. The study is part of a Phase II clinical

program to be conducted under the sponsorship of the Cancer Treatment Evaluation

Program of the NCI pursuant to a clinical trial agreement between Lorus and

the

NCI.

In

December 2005, we announced interim data from the NCI-sponsored trial of

GTI-2040 in acute myeloid leukemia. The data presented showed

complete responses in 44 per cent of patients 60 years of age or

younger. Patients in this trial had either failed to respond to prior

therapy or had rapidly relapsed and as such had a low expectation of response

to

subsequent treatment (10-20%). Complete responses in the clinical

trial directly correlated with down regulation of R2, the intracellular target

of GTI-2040, demonstrating drug specificity and providing strong evidence

for an

antisense mechanism of action. Toxicities for the

-

12

-

combination

were comparable to those expected for cytarabine alone and were non

dose-limiting. Updated results were presented at the 2006 annual

meeting of ASCO and support the continued dose escalation study in younger

cohorts of patients to establish a recommended phase II dose. The AML study

group developed a novel method for analysis of GTI-2040 in biological samples

(2006 issue of Pharmaceutical Research). Furthermore this group has

reported the results of metabolic and pharmacokinetic analyses at the annual

meeting of the American Association of Pharmaceutical Scientists and the

2006

meeting of the International Society of Xenobiotics. Results have also been

published in volume 8, issue 4 of the American Association of Pharmaceutical

Scientists Journal. These studies demonstrate the uptake and accumulation

of GTI-2040 in target tissues, important observations in support of an antisense

mechanism of action for this drug candidate.

In

August 2007, we announced the completion of this study. This clinical trial

demonstrated safety and appropriate dosing of the combination regimen and

showed

promising clinical responses in patients under 60 years of

age. Moreover, the clinical responses correlated with downregulation

of R2, the cellular target of GTI-2040, and were further supported by

demonstration of intracellular GTI-2040 in circulating and bone marrow leukemic

cells. Complete results from the clinical trial are expected to be presented

by

the investigators in a scientific publication.

Metastatic

Breast Cancer:

In

August 2003, we announced that the FDA had approved the NCI’s IND to begin a

Phase I/II clinical trial to investigate GTI-2040 as a treatment for metastatic

breast cancer in combination with capecitabine (Xeloda, manufactured by Roche

Laboratories Inc.). In support of continued studies aimed at demonstrating

R2

target down-regulation in patient samples this group, in collaboration with

Lorus, published preliminary results of RT-PCR studies in the May issue of

Oncology Reports. The results demonstrate that the assay

developed by Lorus can feasibly assess R2 level is blood and tumour tissues

from

patients before and after treatment. This study is

ongoing.

Non-Small

Cell Lung Cancer:

In

September 2003, we received approval from Health Canada for initiation of

a

clinical trial of GTI-2040 in combination with docetaxel for the treatment

of

advanced non-small cell lung cancer (“NSCLC”), as part of a Phase I/II clinical

program of GTI-2040 in collaboration with the NCI. Interim results from this

study were announced in May 2005. Our interim results showed that the toxicity

profile was determined to be acceptable for the specific combination therapy

and

the observed level of disease stabilizations was encouraging given the advanced

stage of the disease in this subset of patients. The study group published

a

paper in the December issue of the Journal of Chromatography,

outlining the development of a method for determination of GTI-2040

in

human plasma samples. This highly sensitive method will be used for

pharmacokinetic studies in patient samples from the trial. This study

is ongoing.

Solid

Tumors:

In

February 2004, we announced the initiation of a Phase I/II clinical trial

examining the use of GTI-2040 in combination with gemcitabine in patients

with

solid tumors. In June 2005, results from the trial were

published. The trial was intended to identify the recommended dose of

GTI-2040 and its toxicity profile. At the recommended dose GTI-2040

demonstrated a manageable toxicity profile and was generally well tolerated

when

given as a single agent. This study is ongoing.

Unresectable

Colon Cancer:

In

May 2004, we announced the initiation of a Phase I/II clinical trial examining

GTI-2040 in combination with oxaliplatin and capecitabine in the treatment

of

advanced unresectable colon cancer. This study is part of a clinical

trials program sponsored by the NCI. This study is

ongoing.

-

13

-

Hormone

Refractory Prostate Cancer:

In

November 2004, we announced the initiation of a Phase I/II clinical trial

examining GTI-2040 in combination with docetaxel and prednisone in hormone

refractory prostate cancer. In November 2005, we announced interim

data from this trial. The data showed that along with an acceptable

tolerability profile, nine of 22 PSA evaluable patients demonstrated a PSA

response (reductions of greater than 50%). PSA is overproduced in

prostate cancer cells and is commonly used to assess disease progression

and

response. This data was also presented at the 2006 annual meeting of

ASCO.

High

Grade Myelodysplastic Syndrome and acute leukemia:

Lorus

announced in June 2006 a plan for a new clinical investigation of GTI-2040

as a

single-agent in patients with high grade myelodysplastic syndrome and acute

leukemia. This trial was initiated in mid 2007. This clinical study is designed

to evaluate the safety and activity of GTI-2040 as a single agent for acute

leukemia and MDS using a novel treatment schedule. The effect on leukemic

blasts

and blood count recovery will be assessed as part of a detailed investigation

of

the pharmacodynamic and pharmacokinetic effects, dose-response

relationships and tolerability of GTI-2040 during multiple courses of

treatment.

Orphan

Drug Status

On

March 12, 2003, the FDA awarded Orphan Drug Status to GTI-2040 for the treatment

of renal cell carcinoma.In May 2005, Lorus received Orphan Drug designation

from

the FDA for GTI-2040 in the treatment of AML.

siRNA

In

2003, Lorus began development of an anticancer therapeutic based on

siRNA-mediated inhibition of R2 expression. Early screening experiments have

identified lead compounds and preliminary in vitro and in vivo

characterization of these compounds has yielded promising

results. The

results of these studies were published in the April 2007 issue of

Anti-Cancer Drugs and were presented at the 2007 annual meeting of the

AACR. siRNA-1284, the lead compound identified from the screening study,

specifically targets R2 expression. In in vitro studies,

down-regulation of R2 expression by siRNA-1284 results in

decreased tumor cell growth (proliferation) with a concomitant

block in cell cycle progression. Furthermore, siRNA-1284 demonstrates anti-tumor

activity against human kidney, skin and colon cancer in mouse experimental

models of tumor growth. We feel that the results of these studies warrant

further development of siRNA-1284 as well as expansion of siRNA research

to

other cancer targets.

GTI-2501

Our

other antisense therapy currently in clinical development is GTI-2501. GTI-2501

targets the R1 subunit of RNR and has been shown to have antitumor activity

and

a good safety profile in pre-clinical testing. A Phase I trial also

demonstrated the safety of GTI-2501.

Pre-clinical

Testing

GTI-2501

has demonstrated antitumor activity in a number of standard mouse models

of

cancer progression including xenografts tumour growth, metastasis and survival

models. GTI-2501 was effective against a broad range of cancers including

human

breast, kidney and prostate cancers (Results published in the February 2006

Issue of the International Journal of Oncology). In

addition, pre-clinical studies have demonstrated that GTI-2501 is well tolerated

in standard animal models at concentrations that exceed commensurate therapeutic

doses in humans.

-

14

-

Clinical

Development Program

GLP-toxicology

studies for GTI-2501 were completed in November 2000 and approval of an IND

was

received from the FDA in February 2001. A Phase I dose-escalating study at

the

University of Chicago Medical Center was designed to establish the recommended

clinical Phase II dose as well as look at the safety profile of

GTI-2501. A total of 34 patients with solid tumors or lymphoma were

enrolled and have been evaluated following clinical completion. The study

demonstrated a reasonable safety profile for GTI-2501 up to the predicted

therapeutically relevant dose. In December 2003, we announced that a Phase

I/II

clinical trial for the treatment of hormone refractory prostate cancer (HRPC)

had been initiated at the Toronto Sunnybrook Regional Cancer Centre, in which

GTI-2501 is administered in combination with docetaxel. The combination of

GTI-2501 and docetaxel in this clinical trial is being investigated in patients

with asymptomatic or symptomatic HRPC where disease progression is

uncontrolled. This represents the first clinical trial of GTI-2501 in

Canada following the successful conclusion of the Phase I clinical trial

in 2004

in the United States. We announced expansion of this ongoing HRPC

trial to two additional sites in Canada in July 2004. The results of the

dose

escalation portion of the trial were presented at the 2006 annual meeteing

of

ASCO. This portion of the trial involved 13 patients in three dose cohorts.

The

results demonstrated that GTI-2501 given in combination with docetaxel was

safe

at the highest dose of GTI-2501 planned. These results warranted initiation

of

the Phase II portion of the trial which is currently ongoing.

GTI-2601

GTI-2601

is an antisense compound that targets thioredoxin, a gene whose increased

expression has been implicated in cancer progression and poor prognosis.

GTI-2601 is an effective anti-cancer agent in pre-clinical studies in animal

models of human colon cancer. The results of these studies were published

in the

February 2006 issue of Anti-cancer Drugs.

On

April 5, 2005 we announced that we had signed a collaboration agreement with

one

of Japan’s leading pharmaceutical companies, Sumitomo Pharmaceuticals Co. Ltd.

(“Sumitomo”) and Koken Co. Ltd (“Koken”) with respect to GTI-2601, our lead

antisense compound targeting thioredoxin, a gene that is over-expressed in

many

tumor tissues and has been correlated with poor prognosis and chemotherapy

resistance. Sumitomo and Koken have developed an advanced delivery

system based on collagen complexed with macromolecules. The

collaboration agreement provides that Sumitomo and Koken will further develop

their delivery technology to complex with GTI-2601, so that increased efficacy

is provided with decreased doses of the antisense drug. This

agreement provides that Lorus, Sumitomo and Koken will jointly own the compounds

that result from this collaboration (Lorus will share the results of the

collaboration with Sumitomo and Koken, 1:1).

Other

Antisense Targets

Lorus’

antisense

technology platform

extends further to other anti-cancer drug targets including thioredoxin,

thioredoxin reductase, neuropilin/VEGF165R and insulin-like

growth factor II (IGF-II). All targets have been implicated in cancer as

a

growth stimulator, a growth factor, an inhibitor of apoptosis and/or an

angiogenic factor. These projects are in the research phase of development

which

includes screening, lead candidate identification and efficacy

studies.

Small

Molecule Therapies

Introduction

Most

anticancer chemotherapeutic treatments are DNA damaging, cytotoxic agents,

designed to act on rapidly dividing cells. Treatment with these drugs

typically includes unpleasant or even serious side effects due to

-

15

-

the

inability of these drugs to differentiate between normal and cancer cells

and/or

due to a lack of high specificity for the targeted protein. In

addition, these drugs often lead to the development of tumor-acquired drug

resistance. As a result of these limitations, a need exists for more effective

anticancer drugs. One approach is to develop small molecules with a

greater specificity as anticancer drugs. Chemical compounds weighing

less than 1000 daltons (a unit of molecular weight) are designated as small

or

low molecular weight molecules. These molecules can be designed to target

specific proteins or receptors that are known to be involved with

disease.

LT-253

In

August 2005 Lorus announced the selection of two leading small molecule

compounds from a series of novel small molecules discovered by Lorus scientists

that exhibit potent anticancer activity in in vitro screens. The

results of characterization studies of these compounds were presented at

the

2006 annual meeting of the AACR and early formulation studies were published

in

the September 2006 issue of Cancer Chemotherapy and Pharmacology .Our

studies identify the main mechanism of action of these compounds, which involves

the induction of the tumor suppressor Krüppel-like factor 4. The down regulation

of Krüppel-like factor 4 is believed to be critical in the development and

progression of certain types of cancer and presents the possibility of

exploiting a novel anticancer mechanism of action. From these two

compounds, LT-253 was selected as the lead compound for development as a

drug

candidate for the treatment of colon carcinoma and non-small cell lung cancer.

This decision was based on its potent in vitro anti-proliferative

activity, its efficacy in in vivo xenograft models of human colon and

lung cancer, and on its safety profile. Manufacturing of a GMP product,

formulation development as well as formal toxicology studies in different

animal

species with the aim of filing an IND application for the initiation of a

Phase

I clinical trial are in progress.

Other

Small Molecule Targets

Lorus

is also pursuing other candidates at earlier stages of development. These

include:

|

|

•

|

LT-253

second generation derivatives for oral

administration:

|

Further

structural modifications of LT-253 produced derivatives optimized for oral

absorption. Animal efficacy studies are in progress.

|

|

•

|

ML-220

platform

|

Lorus

is developing novel derivatives that target cancer relevant genes, which

are

critical in a major signaling pathway involved in tumorigenesis and represent

important new cancer targets. Lead optimization of ML-220 yielded several

novel

derivatives that showed potent target inhibitory activity in vitro and

in cancer cells, and growth inhibitory activity against prostate and renal

carcinoma cell lines.

Immunotherapy

Introduction

Immunotherapy

is a form of treatment that stimulates the body’s immune system to fight

diseases including cancer. Immunotherapy may help the immune system

to fight cancer by improving recognition of differences between healthy cells

and cancer cells. Alternatively it may stimulate the production of specific

cancer fighting cells.

-

16

-

Virulizin®

Virulizin®,

Lorus’ immunotherapeutic drug, has been shown in pre-clinical studies to be an

effective immunotherapy that stimulates monocytes and macrophages to infiltrate

tumor tissue and attack tumor cells. The ability to stimulate NK cells and

macrophages results in Virulizin® anti-tumour efficacy demonstrated in a number

of animal models of human tumour growth. Monocytes and macrophages

are types of white blood cells that are key players in the immune response

to

foreign pathogens and tumor cells. When macrophages and monocytes are

activated, they produce proteins called cytokines that have the ability to

kill

tumor cells directly. Our studies indicate that Virulizin® stimulates

the release of tumor necrosis factor (TNF-alpha), one type of cytokine, in

immune cells to induce apoptosis (programmed cell death) of tumor cells.

In

addition, Virulizin® has been shown to increase the expression of IL-12 in

macrophages. The resulting increased levels of IL12 in mouse serum

lead to NK cell activation. Since 2003 the results of these studies have

been

published in five peer-reviewed scientific journals and presented at a number

of

international conferences.

Our

studies indicate that Virulizin® produces fewer negative side effects than

commonly used chemotherapy agents likely because the drug works by stimulating

the immune system to attack the cancer, rather than directly killing cancerous

cells.

Clinical

Development Program

In

2002 Lorus initiated a Phase III double-blind, multicenter, randomized study

in

patients with locally advanced or metastatic pancreatic cancer who had not

previously received systemic chemotherapy. This clinical trial was conducted

at

over 100 sites in North America and Europe with enrolment of 436 patients

with

advanced pancreatic cancer. Patients enrolled in the study were

randomly selected to receive treatment with either: (i) Virulizin® plus

gemcitabine or (ii) placebo plus gemcitabine. Optional second line therapy

for

those patients who failed to respond or became resistant to gemcitabine included

Virulizin® or placebo, alone or in combination with 5-fluorouracil

(“5-FU”). All study subjects were monitored throughout the remainder

of their lifespan. The end points of the study were survival and

clinical benefits. In July 2005 Lorus announced completion of “last patient

visit” for the phase III trial. Lorus announced the results of the

phase III trial in October 2005 and those results are discussed in detail

below.

Clinical

Trial Results

In

October 2005, we released the results of the Phase III clinical trial evaluating

Virulizin® for the treatment of pancreatic cancer. The primary end

points of the study were not met. For the efficacy evaluable

population, the study showed that the addition of Virulizin® to gemcitabine

resulted in a median overall survival of 6.8 months and a one-year survival

rate

of 27.2%, compared to 6.0 months and 16.8% for placebo plus

gemcitabine. In the intent to treat population the median overall

survivals were 6.3 months for Virulizin plus gemcitabine (one year survival

rate

of 25.9%) compared to 6.0 months for placebo plus gemcitabine (one year survival

rate of 17.6%). While comparison of the median overall survival times

did not reach statistical significance, exploratory analysis did show promising

trends in specific patient populations. The results of the exploratory sub-group

analyses were presented at the 2006 annual meeting of the American Society

of

Clinical Oncology (“ASCO”). From these analyses the following sub-groups were

identified as having demonstrated benefit that approaches statistical

significance: patients with low ECOG scores (better overall performance),

patients with metastatic disease and patients that continued Virulizin® therapy

during second line therapy. In addition, those patients that continued

Virulizin® during salvage therapy demonstrated a survival benefit that was

statistically significant.

Lorus

is currently seeking partners to continue the clinical development of Virulizin®

in these patient specific populations.

-

17

-

Orphan

Drug

Lorus

received Orphan Drug designation from the United States Food and Drug

Administration (“FDA”) in February 2001 for Virulizin® in the treatment of

pancreatic cancer. Orphan drug status is awarded to drugs used in the

treatment of a disease that afflicts less than 200,000 patients annually

in the

United States to encourage research and testing. This status means

that the FDA will help to facilitate the drug’s development process by providing

financial incentives and granting seven years of market exclusivity in the

United States (independent of patent protection) upon approval of the drug

in

the United States. In June 2005, Lorus announced that Virulizin® was granted

Orphan Drug status in the European Union for pancreatic cancer.

IL-17E

Lorus

has recently discovered a new lead drug candidate, IL-17E, which belongs

to a

larger family of cytokines. The results of these studies were presented at

the

2006 annual meeting of the American Association for Cancer Research (“AACR”).

IL-17E has demonstrated significant antitumor activity against a variety

of

human tumors, including melanoma, pancreatic, colon, lung and ovarian tumors

grown in mice. In addition, combinations of IL-17E with chemotherapeutic

agents

showed enhanced anti-tumor efficacy against human colon, lung, melanoma and

ovarian tumor models in mice. The anti-tumor activity was dose-dependent

and was

observed using three different routes of administration. Studies on the

mechanism of action showed that treatment with IL-17E resulted in increased

serum levels of IL-5 and increased percentages of eosinophils in peripheral

blood. Spleen cells isolated from IL-17E-treated mice showed increases in

eosinophils and B-cells, as well as an increase in the percentage of activated

B

cells. Furthermore, treatment with IL-17E resulted in phosphorylation of

kinases

and activation of transcription factors involved in immune stimulation. Taken

together, the data support further investigation of the potential clinical

application of IL-17E, placing IL-17E in a growing class of anticancer

immunotherapeutic drugs.

Other

Technologies

We

are currently assessing several new technologies for their potential as new

drug

candidates. They include technologies in areas of tumor suppressor

gene therapy and other small molecule technology platform that we believe

to

have the potential to work through a unique mechanism of action to decrease

the

expression of cancer relevant genes.

Gene

Therapy

Researchers

at Lorus have developed a gene therapy product using the R1 gene of

ribonucleotide reductase (which has been shown to act as a tumour suppressor

gene) encoded in a modified adenoviral vector (rAd5-R1) for the potential

treatment of patients with colon cancer. This project is in the pre-clinical

phase of development and has resulted in publication of an article in the

October 2003 issue of Clinical Cancer Research.

Agreements

Manufacturing

Agreements

Bio

Vectra dcl

In

July 2004, we entered into negotiations with Diagnostics Chemicals Limited

(doing business as BioVectra dcl) in Prince Edward Island for the commercial

manufacture of Virulizin®, for which a contract was

-

18

-

executed

in October 2004. BioVectra has a cGMP facility capable of large-scale commercial

production. In June 2005 Lorus announced that BioVectra had successfully

produced Virulizin® in both optimized clinical and commercial batch

scales. The contract remains in force, although Bio Vectra is not

currently performing any manufacturing of Virulizin®.

Licence

Agreements

Ion

Pharmaceuticals and Cyclacel

In

December 1997, Lorus, through NuChem, acquired certain patent rights and

a

sublicense from Ion to develop and commercialize the anticancer applications

of

CLT and new chemical entities related to CLT (the “NuChem

Analogs”). To July 2006, NuChem had made cash payments totalling US

$500,000 to Ion. The balance is payable upon the achievement of

certain milestones based on the commencement and completion of clinical trials

related to the NuChem Analogs.

The

NuChem Analog patents are ancillary to the Company’s primary development

activities and do not relate to the Company’s core research and development

focus, namely GTI-2040, nor did they relate specifically to the development

of

the Virulizin product. In addition to the amounts previously paid in

cash or shares, the Company is required to make future cash payments based

on

achieving certain future milestones on the first of any Sublicense Product

or

Lead Compound (as defined in the agreements), including: US$250 thousand

on

completion of a Phase I trial, US$500 thousand on completion of a Phase II

trial, US$750 thousand upon completion of the first Phase III trial and US$1.5

million on marketing approval for the production the United States, Canada,

England or France. The company does not currently expect to achieve

any of the above milestones in fiscal years ended May 31, 2007 or 2008 and

cannot reasonably predict when such milestones will be achieved, if at

all.

All

research and development activities to be undertaken by NuChem are to be

funded

by us through subscriptions for non-participating preference shares of

NuChem. As at May 31, 2007, we had provided a total of $5,749,000 of

funding to NuChem.

In

September 2003, Lorus, NuChem and Cyclacel Limited signed an exclusive worldwide

license agreement for the development and commercialization of the NuChem

Analogs. Under the terms of the agreement, Lorus received upfront

fees of US $400,000 and will receive milestone payments which, assuming all

milestones are achieved, will total approximately US $11.6 million for our

pre-clinical compound NC 381, and similar milestone payments for each of

any

other compounds developed from the compound library. In addition to

these payments, we will receive royalties based on product

sales. Cyclacel is responsible for all future drug development

costs.

In

reference to the Cyclacel agreement, the Company is entitled to receive certain

future milestone payments based on the commencement of future trials in relation

to those products developed by Cyclacel under the agreement including for

the

first product/follow-on products, as defined in the agreement and in certain

cases, back-up product as defined in the agreement: $US600,000 upon

commencement of a Phase II trial, US$3,000,000 on commencement of a Phase

III

trial, and between US$1,750,000 and $4,000,000 upon receipt of

marketing approval in each of various geographic areas. Thereafter

the company is entitled to a royalty of between 2.0% and 4.0% depending upon

the

level of sales. The agreement also contains certain milestone and

royalty obligations based on whether Cyclacel chooses to sublicense any of

the

products covered by that agreement. The company does not

currently expect Cyclacel to achieve any of the above milestones in fiscal

years

ended May 31, 2007 or 2008 and cannot reasonably predict when such milestones

will be achieved, if at all.

-

19

-

University

of Manitoba

The

University of Manitoba (the “University”), Dr. Jim Wright, Dr. Aiping Young and

Cancer Care entered into an exclusive license agreement (the “License

Agreement”) with GeneSense dated June 20, 1997 pursuant to which GeneSense was

granted an exclusive worldwide license to certain patent rights with the

right

to sub-license. In consideration for the exclusive license to

GeneSense of the patent rights, the University and Cancer Care are entitled

to

an aggregate of 1.67% of the net sales received by GeneSense from the sale

of

products or processes derived from the patent rights and 1.67% of all monies

received by GeneSense from sub-licenses of the patent rights. GeneSense is

solely responsible for the preparation, filing, prosecution and maintenance

of

all patent applications and patents included in the patent rights and all

related expenses. Pursuant to the terms of the License Agreement, any

and all improvements to any of the patent rights derived in whole or in part

by

GeneSense after the date of the License Agreement are not included within

the

scope of the License Agreement and do not trigger any payment of

royalties.

The

University of Manitoba agreement relates specifically to antisense patents

in

existence or pending at the time of the agreement, subsequent patent amendments

or advancements to these patents remain as the property of Lorus, without

license rights accruing back to the University of Manitoba. The

Company is currently pursing its antisense development program, primarily