MANAGEMENT

INFORMATION CIRCULAR

PROXY

INFORMATION

Solicitation

Of Proxies

The

information contained in this management information circular (the “Circular”)

is furnished in connection with the solicitation of proxies to be used at

the

annual and special meeting of shareholders (the “Meeting”) of Lorus Therapeutics

Inc. (the “Corporation”, “Lorus”, “we” or “our”) to be held on Thursday,

November 18, 2004 at 4:00 p.m. (Toronto time) at The Toronto Stock Exchange

Conference Centre, 130 King Street West, Toronto, Ontario and at all

adjournments thereof, for the purposes set forth in the accompanying notice

of

Meeting. It is expected that the solicitation

will be made primarily by mail but proxies may also be solicited personally

by

directors, officers, employees or agents of the Corporation. The

solicitation of proxies by this Circular is being made by or on behalf of

the

management of the Corporation. The total cost of the solicitation

will be borne by Lorus. The information contained herein is given as at October

7, 2004 except where otherwise noted.

Appointment

of Proxies

The

persons named in the enclosed form of proxy are representatives of the

management of the Corporation and are directors or officers of the Corporation.

A shareholder who wishes to appoint some other person to represent

the

shareholder at the Meeting may do soby inserting such person’s

name in the blank space provided in the enclosed form of proxy. Such

other person need not be a shareholder of the Corporation.

To

be

valid, proxies must be deposited with Computershare Trust Company of Canada,

100

University Avenue, 8th Floor,

Toronto,

Canada M5J 2Y1, so as to arrive not later than 5:00 p.m. (Toronto time) on

Tuesday, November 16, 2004 or, if the Meeting is adjourned, 48 hours

(excluding Saturdays, Sundays and holidays) before any adjournment of the

Meeting.

Non-Registered

Holders

These

securityholder materials are being sent to both registered and non-registered

owners of the securities. If you are a non-registered owner and the issuer

or

its agent has sent these materials directly to you, your name and address

and

information about your holdings of securities have been obtained in accordance

with applicable securities regulatory requirements from the intermediary

holding

on your behalf.

By

choosing to send these materials to you directly, the issuer (and not the

intermediary holding on your behalf) has assumed responsibility for (i)

delivering these materials to you, and (ii) executing your proper voting

instructions. Please return your voting instructions as specified in the

request

for voting instructions.

Only

registered holders of our common shares, or the persons they appoint as their

proxies, are permitted to attend and vote at the Meeting. However, in

many cases, common shares beneficially owned by a non-registered holder are

registered either:

|

|

(a)

|

in

the name of an intermediary that the non-registered holder deals

with in

respect of the shares, such as, among others, banks, trust companies,

securities dealers or brokers and trustees or administrators of

self-administered RRSPs, RRIFs, RESPs and similar plans;

or

|

|

|

(b)

|

in

the name of a depository (such as The Canadian Depository for Securities

Limited, or “CDS”) of which the intermediary is a

participant.

|

In

accordance with Canadian securities law, we have distributed copies of the

notice of meeting, this Circular, the form of proxy, and the 2004 annual

report

which includes management’s discussion and analysis (collectively, the

“meeting materials”) to CDS and intermediaries

for onward distribution to those non-registered holders to whom we have not

sent

the meeting materials directly.

Page

1 of

24

In

such

cases, intermediaries are required to forward meeting materials to

non-registered holders unless a non-registered holder has waived the right

to

receive them. Very often, intermediaries will use a service company (such

as ADP

Investor Communications, or “ADP IC”) to forward the meeting

materials to non-registered holders.

Non-registered

holders who have not waived the right to receive meeting materials will receive

either a voting instruction form or, less frequently, a form of

proxy. The purpose of these forms is to permit non-registered holders

to direct the voting of the shares they beneficially

own. Non-registered holders should follow the procedures set out

below, depending on which type of form they receive.

|

A.

|

Voting

Instruction Form. In most cases, a non-registered holder will

receive, as part of the meeting materials, a voting instruction

form. If the non-registered holder does not wish to attend and

vote at the meeting in person (or have another person attend and

vote on

the non-registered holder’s behalf), the voting instruction form must be

completed, signed and returned in accordance with the directions

on the

form. If a non-registered holder wishes to attend and vote at

the Meeting in person (or have another person attend and vote on

the

non-registered holder’s behalf), the non-registered holder must complete,

sign and return the voting instruction form in accordance with

the

directions provided and a form of proxy giving the right to attend

and

vote will be forwarded to the non-registered

holder.

|

|

or

|

|

|

B.

|

Form

of Proxy. Less frequently, a non-registered holder will

receive, as part of the meeting materials, a form of proxy that

has

already been signed by the intermediary (typically by a facsimile,

stamped

signature) which is restricted as to the number of shares beneficially

owned by the non-registered holder but which is otherwise

uncompleted. If the non-registered holder does not wish to

attend and vote at the Meeting in person (or have another person

attend

and vote on the non-registered holder’s behalf), the non-registered holder

must complete the form of proxy and deposit it with Computershare

Trust

Company of Canada, 100 University Avenue, 8th

Floor

Toronto, Canada, M5J 2Y1 as described above. If a

non-registered holder wishes to attend and vote at the Meeting

in person

(or have another person attend and vote on the non-registered holder’s

behalf), the non-registered holder must strike out the names of

the

persons named in the proxy and insert the non-registered holder’s (or such

other person’s) name in the blank space

provided.

|

Non-registered

holders should follow the instructions on the forms they receive and contact

their intermediaries promptly if they need

assistance.

Revocation

A

registered shareholder who has given a proxy may revoke the proxy

by:

|

|

(a)

|

completing

and signing a proxy bearing a later date and depositing it with

Computershare Trust Company of Canada as described above;

or

|

|

|

(b)

|

depositing

an instrument in writing executed by the shareholder or by the

shareholder’s attorney authorized in writing: (i) at our registered office

at any time up to and including the last business day preceding

the day of

the Meeting, or any adjournment of the Meeting, at which the proxy

is to

be used, or (ii) with the chairman of the Meeting prior to the

commencement of the Meeting on the day of the Meeting or any adjournment

of the Meeting; or

|

|

|

(c)

|

in

any other manner permitted by law.

|

A

non-registered holder may revoke a voting instruction form or a waiver of

the

right to receive Meeting materials and to vote given to an intermediary or

to

the Corporation, as the case may be, at any time by written notice to the

intermediary or the Corporation, except that neither an intermediary nor

the

Corporation is required to act on a revocation of a voting instruction form

or

of a waiver of the right to receive materials

Page

2 of

24

and

to

vote that is not received by such intermediary or the Corporation, at least

seven days prior to the Meeting.

VOTING

OF PROXIES

The

management representatives designated in the enclosed form of proxy will

vote or

withhold from voting the shares in respect of which they are appointed by

proxy

on any ballot that may be called for in accordance with the instructions

of the

shareholder as indicated on the proxy and, if the shareholder specifies a

choice

with respect to any matter to be acted upon, the shares will be voted

accordingly.

In

the absence of such direction, such shares will be voted by the management

representatives:

|

|

•

|

FOR

the election of directors;

|

|

|

•

|

FOR

the appointment of

auditors;

|

|

|

•

|

FOR

the resolution ratifying the amendment to the Corporation’s 1993 Stock

Option Plan (as defined below) to extend the expiry time of options

granted under our 1993 Stock Option Plan from five years to 10

years, as

set forth in Appendix “B” attached to this Circular and described under

the heading “Special Business - Amendment to Our Stock Option Plan”;

and,

|

|

|

•

|

FOR

the approval of the resolution ratifying the amendment to the

Corporation’s By-Law No. 1, as set forth in Appendix “C” attached to this

Circular and as described under the heading “Special Business - Amendment

to By-Law No. 1”.

|

The

enclosed form of proxy confers discretionary authority upon the management

representatives designated in the form of proxy with respect to amendments

to or

variations of matters identified in the notice of meeting and with respect

to

other matters which may properly come before the Meeting. At the date

of this Circular, the management of the Corporation knows of no such amendments,

variations or other matters.

VOTING

SHARES

On

October 7, 2004 we had outstanding 171,804,989 common shares. Each

holder of common shares of record at the close of business on October 7,

2004,

the record date established for notice of the meeting, will be entitled to

one

vote for each common share held on all matters proposed to come before the

Meeting, except to the extent that the holder has transferred any common

shares

after the record date and the transferee of such shares establishes ownership

of

them and makes a written demand, not later than the close of business on

November 8, 2004, to be included in the list of shareholders entitled to

vote at

the Meeting, in which case the transferee will be entitled to vote such

shares.

PRINCIPAL

HOLDERS OF VOTING SECURITIES

To

the

knowledge of our directors and officers, as of the date hereof, no person

or

company beneficially owns, directly or indirectly, or exercises control or

direction over, more than 10% of our outstanding common shares.

PARTICULARS

OF MATTERS TO BE ACTED UPON

Appointment

And Remuneration Of Auditors

Unless

the shareholder has specified in the enclosed form of proxy that the common

shares represented by the proxy are to be voted against the appointment of

auditors, on any ballot that may be called for in the appointment of

auditors, the management representatives designated in the enclosed form

of

proxy intend to vote the common shares in respect of which they are appointed

proxy for the appointment

Page

3 of

24

of

KPMG LLP, Chartered Accountants, as auditors of the Corporation to hold office

until the next annual meeting of shareholders, and authorizing the directors

to

fix the remuneration of the auditors.

KPMG

LLP was first appointed as our auditor in October 1994. For fiscal

2004, fees for audit and audit related services provided by the auditors

to the

Corporation and its subsidiaries were $114,449, as compared to $79,000 in

fiscal

2003. Non-audit fees paid to the auditors relating to tax planning

and compliance, internal control, risk management and other advisory services

were $33,865 in 2004 compared to $45,707 in 2003.

Election

Of Directors

Our

board of directors currently consists of seven directors. All directors elected

at the Meeting will hold office until our next annual meeting of shareholders

or

until their successors are elected or appointed.

Unless

the shareholder has specified in the enclosed form of proxy that the common

shares represented by the proxy are to be voted against the election of

directors, on any ballot that may be called for in the election of

directors, the management representatives designated in the enclosed form

of

proxy intend to vote the common shares in respect of which they are appointed

proxy for the election as directors of the proposed nominees whose names

are set

forth below. All such nominees except for Dr. Gregory Curt are now

directors and have been directors since the dates indicated

below. Management does not contemplate that any of the proposed

nominees will be unable to serve as a director but, if that should occur

for any

reason prior to the Meeting, the management representatives designated in

the

enclosed form of proxy reserve the right to vote for another nominee at their

discretion.

The

following table sets out the name of each of the persons proposed to be

nominated for election as a director, all major positions and offices in

the

Corporation held by each nominee, the principal occupation or employment

of each

nominee, the year in which each nominee was first elected or appointed a

director of the Corporation and the approximate number of our common shares

that

each nominee has advised us are beneficially owned by, or subject to the

control

or direction of, such nominee. The Corporation has an Audit

Committee, a Corporate Governance and Nominating Committee, a Human Resources

and Compensation Committee (the “Compensation

Committee”) and an Environmental

Committee. The members of these committees are indicated in the table

below.

|

Name

Of Director

|

Year

First

Elected/

Appointed

A

Director

|

Ownership

Or

Control

Over

Common

Shares(1)

|

|

GREGORY

CURT, M.D., Bethesda, Maryland

Medical

Director, Field Medical Group, AstraZeneca

|

-

|

-

|

|

J.

KEVIN BUCHI(2),

West

Chester, Pennsylvania

Senior

Vice President and Chief Financial Officer, Cephalon Inc.

|

2003

|

50,000

|

|

DONALD

W. PATERSON(2)

(4) , Toronto, Ontario

President,

Cavandale Corporation

(corporate

consulting)

|

1991

|

125,260

|

|

ELLY

REISMAN, Richmond Hill, Ontario

President,

Great Gulf Group of Companies

|

1999

|

1,485,508

|

|

ALAN

STEIGROD(3),

Newport

Beach, CA

Managing

Director, Newport Health Care Ventures

|

2001

|

-

|

|

GRAHAM

STRACHAN(2) (3)(4)

(5), Toronto, Ontario

President,

GLS Business Development Inc.

|

2001

|

10,000

|

|

JIM

A. WRIGHT, Oakville, Ontario

President

and Chief Executive Officer of the Corporation

|

1999

|

6,112,800(6)

|

Page

4 of

24

|

(1)

|

In

addition, as at May 31, 2004, the current directors hold, in aggregate,

options to purchase 1,242,500 common shares. These options were

granted to the directors as consideration for services rendered

as

directors of the Corporation. See “Executive Compensation -

Compensation of Directors”.

|

|

(2)

|

Member

of the Audit Committee.

|

|

(3)

|

Member

of the Compensation Committee.

|

|

(4)

|

Member

of the Corporate Governance and Nominating

Committee.

|

|

(5)

|

Member

of the Environmental Committee.

|

|

(6)

|

Of

the 6,112,800 common

shares, 4,428,541 are owned

directly by Dr. Wright and 1,684,259 are owned by a trust for the

benefit

of Dr. Wright’s spouse.

|

During

the past five years each of the directors of the Corporation listed above

has

held his present principal occupation as set out above except: (i) Mr. Strachan

who, prior to December 1999, was President and Chief Executive Officer of

Allelix Biopharmaceuticals Inc., (ii) Dr. Curt, who was Clinical Director

of the

National Cancer Institute in Bethseda, Maryland from 1989 until 2002; and,

(iii)

Dr. Wright, who co-founded GeneSense Technologies Inc. (“GeneSense”), now our

wholly owned subsidiary, in 1996, and served as its President, Chief Scientific

Officer and a director before becoming our President and Chief Scientific

Officer in October 1999 on our acquisition of GeneSense. The

information as to principal occupation, business or employment and shares

beneficially owned or controlled is not within the knowledge of management

of

the Corporation and has been furnished by the respective nominees.

SPECIAL

BUSINESS

Amendment

to Our 1993 Stock Option Plan

Our

success is based in large part on key personnel, management and the board

of

directors. The ability to staff these positions with the desired individuals

is

a product of sustained efforts to recruit, motivate and retain desired personnel

in a very competitive marketplace. Our granting of stock options is an important

mechanism that we use to achieve the goals of recruitment, motivation and

retention.

Our

original stock option plan was established in 1993 (the “1993 Stock

Option Plan”); however, due to significant developments in the laws

relating to share option plans and our future objectives, we created a new

stock

option plan (the “2003 Stock Option Plan”), ratified by our

shareholders at last year’s annual and special meeting, pursuant to which all

future grants of stock options would be made. Together, the number of

common shares subject to options under the 1993 Stock Option Plan and the

2003

Stock Option Plan and to be reserved for issuance under the 2003 Stock Option

Plan is 20,582,081 which represents 14,800,000 shares reserved for issuance

under the 1993 Stock Option Plan, plus the reserve of an additional 5,782,081

shares under the 2003 Stock Option Plan. This represents approximately 12%

of

our outstanding common shares.

Options

issued under the 1993 Stock Option Plan are exerciseable for a period of

up to

five years, whereas options issued under the 2003 Stock Option Plan are

exerciseable for a period of up to 10 years. By resolution approved

on October 7, 2004, the board of directors authorized and approved an amendment

to the 1993 Stock Option Plan whereby the expiry date of options granted

under

the 1993 Stock Option Plan was extended from five years to 10 years following

the date of grant.

We

believe that the extension of the exercise period gives employees who have

been

granted options pursuant to the 1993 Stock Option Plan the same rights as

those

employees whose options have been granted pursuant to the 2003 Stock Option

Plan. This will assist us to retain our longer-serving employees, many of

whom

have been granted options under the 1993 Stock Option Plan. As of the

date of this Circular, 5,204,536 options remain outstanding under the 1993

Stock

Option Plan. Of those options, 3,689,053, or approximately 71%, are

held by directors and officers of the Corporation, and 1,515,483 or

approximately 29% are held by employees who are not directors or officers

of the

Corporation. In addition, prior to the authorization and approval of

the amendment to the 1993 Stock Option Plan by the board on October 7, 2004,

of

the options held by employees 265,845 options were to expire on October 28,

2004. None of these options were held by directors or officers of the

Corporation. The price ranges for these options are (i) 33 cents per

share to $2.50 per share for directors and officers, and (ii) 40 cents per

share

to $2.50 per share for employees.

Page

5 of

24

At

the

Meeting, disinterested shareholders will be asked to ratify the amendment

to the

1993 Stock Option Plan that extended the expiry date of options granted under

the 1993 Stock Option Plan from five years to 10 years following the date

of

grant. The purpose of this proposed resolution is to recognize the important

contributions of long-serving Lorus employees who were issued five year stock

options under the 1993 Stock Option Plan. The text of the proposed

resolution is appended to this Circular as Appendix “B”. In order to

be effective, the resolution must be passed by a majority of the votes cast

by

disinterested shareholders at the Meeting. To the best of the

Corporation’s knowledge, the number of common shares excluded from voting on

this proposed resolution which are held by directors, officers and employees,

which insiders also hold options which are subject to the proposed amendment,

is

approximately 7,374,301. If shareholders do not ratify the amendment

to the 1993 Stock Option Plan, then the expiry date of options granted under

the

1993 Stock Option Plan will remain as five years following the date of the

grant

and the 265,845 options originally set to expire on October 28, 2004 will

expire

and become unexerciseable.

Unless

the shareholder has specified in the enclosed form of proxy that the common

shares represented by the proxy are to be voted against the amendment to

the

1993 Stock Option Plan, on any ballot that may be called for in the amendment

to

the 1993 Stock Option Plan, the management representatives designated in

the

enclosed form of proxy intend to vote the common shares in respect of which

they

are appointed proxy for the approval of the resolution ratifying the amendment

to the Corporation’s 1993 Stock Option Plan to extend the expiry date of options

granted under the 1993 Stock Option Plan from five years to 10 years, as

set

forth in Appendix “B” to this Circular. The board of directors of the

Corporation recommends that shareholders vote for the

resolution.

Amendment

to By-Law No. 1

By

resolution approved on October 7, 2004, the board of directors authorized

and

approved certain amendments to the Corporation’s By-Law No. 1, the particulars

of which are set out in Schedule 1 to Appendix “C” to this

Circular. The purpose of the amendments is to allow a meeting of

shareholders to be held by telephonic or electronic means and to allow a

shareholder to vote through such means, as permitted by the Business

Corporations Act (Ontario), to allow for electronic delivery of materials

to shareholders and directors, and to amend the title of the Corporation’s

By-Law to reflect the name “Lorus Therapeutics Inc.”. These

amendments to the By-Law No. 1 became effective upon being approved by the

board

of directors, however, the board is required to submit the By-Law amendments

to

shareholders at the Meeting for confirmation, rejection or

amendment.

The

shareholders will be asked to consider, and if deemed advisable, to approve,

by

a simple majority of votes cast at the Meeting, an ordinary resolution

confirming the By-Law amendment. The text of this resolution is set

out in Appendix “C” to this Circular. If the By-Law amendments are

not approved by shareholders at the Meeting, the By-Law amendments will cease

to

be effective.

Unless

the shareholder has specified in the enclosed form of proxy that the common

shares represented by the proxy are to be voted against the amendment to

By-Law

No. 1, on any ballot that may be called for in the amendment of By-Law No.

1,

the management representatives designated in the enclosed form of proxy intend

to vote for the approval of the resolution ratifying the amendments to the

Corporation’s By-Law No. 1, as set forth in Appendix “C” to this Circular. The

board of directors of the Corporation recommends that shareholders vote for

the

resolution.

CORPORATE

GOVERNANCE

Our

board of directors is committed to ensuring that we have an effective corporate

governance system, which adds value and assists us in achieving our

objectives. At Lorus, corporate governance means the process and

structure used to supervise the Corporation’s business and affairs with the

objective of enhancing shareholder value. The process and structure define

the

division of authority and responsibilities and establish mechanisms for

achieving accountability by the board and management.

The

Toronto Stock Exchange (“TSX”) has adopted 14 guidelines for

effective corporate governance (the “Guidelines”). The

Guidelines address matters such as the constitution and independence of

corporate boards, the functions to be performed by boards and their committees

and the effectiveness and evaluation of board members. Companies whose

securities are listed on the TSX are required to annually disclose

how

Page

6 of

24

their

governance practices conform or depart from the Guidelines, but conforming

with

the Guidelines is not itself a requirement of listing.

We

acknowledge the benefits received by us and our shareholders from the disclosure

of governance practices and are committed to an ongoing process of disclosure

and further implementation of the guidelines, where appropriate. The

disclosure is attached to this Circular as Appendix “A”.

There

have been substantial developments in legislation and regulation related

to

corporate governance in both Canada and the United States. The corporate

governance committee is in the process of reviewing and modifying, where

applicable, our policies to ensure compliance with legislative requirements

and

acceptable corporate practice.

EXECUTIVE

COMPENSATION

Compensation

of Named Executive Officers

The

following tables and related narrative below present information about

compensation for the fiscal years ended May 31, 2004, May 31, 2003 and May

31,

2002 for our ‘‘Named Executive Officers’’ (determined in accordance with

applicable rules).

Summary

Compensation Table

|

Annual

Compensation

|

Long-Term

Compensation

Awards

|

|||||

|

Name

and Principal Position

|

Fiscal

Year

|

Salary

($)

|

Bonus

($)

|

Other

Annual

Compensation

($)

|

Securities

Under

Options/

SARs

Granted

(#)

|

All

Other

Compensation

($)

|

|

Dr. Jim

A. Wright

President

and Chief

Executive

Officer

|

2004

2003

2002

|

285,000

265,000

225,000

|

102,600

110,000

61,480

|

Nil

Nil

Nil

|

570,000

417,000

300,000

|

Nil

Nil

Nil

|

|

Dr.

Aiping Young (1)

Chief

Operating

Officer

|

2004

2003

2002

|

197,945

185,815

168,000

|

45,390

49,829

24,480

|

Nil

Nil

Nil

|

225,000

150,000

200,000

|

Nil

Nil

Nil

|

|

Ms.

Ping Wei (2)

Former

Director of Finance

and

Comptroller; Former

Acting

Chief Financial Officer

|

2004

2003

2002

|

96,222

66,263

68,269

|

9,414

13,087

8,075

|

Nil

Nil

Nil

|

52,561

42,500

5,652

|

Nil

Nil

Nil

|

|

Mr.

Shane Ellis

Vice-President,

Legal Affairs

and

Corporate Secretary

|

2004

2003

2002

|

148,288

139,252

130,250

|

34,003

31,838

18,023

|

Nil

Nil

Nil

|

150,000

125,000

100,000

|

Nil

Nil

Nil

|

|

Ms.

Suzanne Cadden (3)

Former

Vice President,

Clinical

and Regulatory Affairs

|

2004

2003

2002

|

174,503

166,628

126,373

|

32,318

47,275

19,503

|

Nil

Nil

Nil

|

75,000

135,000

63,300

|

74,214

Nil

Nil

|

(1) Dr.

Aiping Young was promoted to the position of Chief Operating Officer on November

20, 2003. As a result, Dr. Young’s salary for 2004 represents

approximately six months compensation as Chief Technology Officer and six

months

compensation as Chief Operating Officer.

Page

7 of

24

(2) Ms.

Wei was our Former Director of Finance and Comptroller and acted in the capacity

of an interim Acting Chief Financial Officer from January 2003 until September

2004. As a result, Ms. Wei’s salary for 2004 represents approximately

five months compensation as Acting Chief Financial Officer and seven months

compensation as Director of Finance and Comptroller.

(3)

Ms. Cadden resigned from her position on April 30, 2004. The amount

of "All Other Compensation" relates to a lump sum amount paid pursuant to

our

separation agreement with Ms. Cadden.

Stock

Option Incentive Compensation

The

following tables set forth the options granted to and exercised by each of

the

Named Executives during the year ended May 31, 2004:

Option/SAR

Grants During the Most Recently Completed Financial

Year

|

NEO

Name and

Principal

Position

|

Securities

Under

Options/SARs

Granted

(#)

|

%

of Total

Options/SARs

Granted

to

Employees

in

Financial

Year

(%)

|

Exercise

or

Base

Price

($/Security)

|

Market

Value

of

Securities

Underlying

Options/SARs

on

the

Date

of Grant

($/Security)

|

Expiration

Date

|

|

Dr.

Jim A. Wright

President

and Chief

Executive

Officer

|

300,000

(1)

270,000(2)

|

11.41

10.27

|

1.23

1.17

|

1.23

1.17

|

16-Jul-2008

9-Sep-2008

|

|

Dr.

Aiping Young

Chief

Operating Officer

|

75,000

(1)

150,000(2)

|

2.85

5.70

|

1.23

1.17

|

1.23

1.17

|

16-Jul-2008

9-Sep-2008

|

|

Ms.

Ping Wei

Former

Director of

Finance

and Comptroller;

Former

Acting Chief

Financial

Officer

|

52,561

|

2.00

|

1.23

|

1.23

|

16-Jul-2008

|

|

Mr.

Shane Ellis

Vice-President,

Legal

Affairs

and Corporate

Secretary

|

75,000

(1)

75,000(2)

|

2.85

2.85

|

1.23

1.17

|

1.23

1.17

|

16-Jul-2008

9-Sep-2008

|

|

Ms.

Suzanne Cadden

Former

Vice President,

Clinical

and Regulatory

Affairs

|

75,000

|

2.85

|

1.23

|

1.23

|

16-Jul-2008(3)

|

|

(1)

|

These

options were granted on July 17, 2003 in respect of corporate and

personal

performance during the year ended May 31, 2004. The options vest

on the

basis of 50% on the first anniversary and 25% on the second and

third

anniversary of the date of granting. The exercise price of all

the $1.23 options was the closing price of our common shares on

the TSX on

July 15, 2003.

|

|

(2)

|

These

options are incentive options granted to certain Named Executive

Officers

to purchase common shares of the Corporation. The options vest

immediately upon the attainment of specific undertakings; failing

to

achieve the undertakings will result in forfeiture on the specified

deadline. These options granted were presented net of

forfeiture.

|

|

(3)

|

These

options expired three months after Ms. Cadden’s departure from the

Corporation.

|

Page

8 of

24

Aggregated

Option/SAR Exercises During the Most Recently

Completed

Financial

Year and Financial Year-End Option/SAR Values

|

Name

|

Securities

Acquired

on

Exercise

(#)

|

Aggregate

Value

Realized

($)

|

Unexercised

Options/SARs

at

May 31,

2004

(#)

Exercisable/

Unexercisable

|

Value

of Unexercised

in-the-Money

Options/SARs

at

May 31,

2004 ($)

Exercisable/

Unexercisable

|

|

Dr.

Jim A. Wright

President

and Chief Executive Officer

|

Nil

|

Nil

|

618,500/658,500

|

78,210/15,210

|

|

Dr.

Aiping Young

Chief

Operating Officer

|

Nil

|

Nil

|

378,723/309,574

|

38,250/0

|

|

Ms.

Ping Wei

Former

Director of Finance and Comptroller

Former

Acting Chief Financial Officer

|

Nil

|

Nil

|

25,489/75,224

|

Nil

|

|

Mr.

Shane Ellis

Vice-President,

Legal Affairs and Corporate Secretary

|

Nil

|

Nil

|

530,006/206,250

|

72,653/0

|

|

Ms.

Suzanne Cadden

Former

Vice President, Clinical and Regulatory Affairs

|

Nil

|

Nil

|

187,475/150,000(1)

|

Nil

|

|

(1)

|

These

options expired three months after Ms. Cadden’s departure from the

Corporation.

|

EQUITY

COMPENSATION PLANS

Performance

Based Compensation Plans

Executive

officers of the Corporation, including the Named Executive Officers

(collectively the “Executive Officers”), are

eligible to participate in a performance related compensation plan

(the “Compensation Plan”). The

Compensation Plan provides for potential annual cash bonus payments and annual

granting of options to purchase common shares under our 2003 Stock Option

Plan.

The potential annual cash bonus and annual granting of options to each Executive

Officer are conditional upon the achievement by the Corporation and each

Executive Officer of predetermined objectives reviewed by the Compensation

Committee and approved by our board of

directors. See “Compensation Committee” and “Report on Executive

Compensation”.

Our

employees other than Executive Officers participate in a separate performance

bonus plan which provides for the annual granting of options to purchase

common

shares under the 2003 Stock Option Plan. We also grant options to

purchase common shares to certain employees upon commencement of their

employment with us. During the year ended May 31, 2004, we

granted options to employees other than Executive Officers to purchase 829,573

common shares, being 32% of the total incentive stock options granted under

the

2003 Stock Option Plan during the year to employees and Executive

Officers.

Page

9 of

24

Directors’

and Officers’ Alternate Compensation Plan

We

have

a directors’ and officers’ alternate compensation plan (the “Alternate

Compensation Plan”). Under

the Alternate Compensation Plan, we have the option of paying annual fees

(the

“Annual Fees”) to directors who are not full

time employees of the Corporation (“Participating

Directors”) by the allotment and issuance from

treasury to each of the Participating Directors of such number of common

shares

as is equivalent to the cash value of the Annual Fees. Under the

Alternate Compensation Plan, the Compensation Committee may at any time during

the period between annual meetings of the shareholders of the Corporation

recommend the allotment and issuance of common shares from treasury in

satisfaction of Annual Fees otherwise payable in cash to Participating

Directors. The board of directors may then formally allot and issue the common

shares at an issue price equal to the closing price of our common shares

on the

TSX on the day of, or the day immediately preceding, such recommendation

by the

Compensation Committee or such other amount as determined by the board of

directors and permitted by the stock exchanges or other market(s) upon which

the

common shares are from time to time listed for trading and any other applicable

regulatory authority (collectively, the “Regulatory

Authorities”).

In

addition, the Alternate Compensation Plan permits us, at our option, to satisfy

the meeting attendance fees (the “Meeting

Fees”) earned by the Participating Directors

as a

result of attendance at board meetings held between annual shareholder meetings

by the allotment and issuance of common shares. The issue price is equal

to the

closing price of the common shares on the TSX on the day of, or the day

immediately preceding such recommendation by the Compensation Committee or

such

other amount as determined by the board of directors and permitted by the

Regulatory Authorities.

The

Alternate Compensation Plan also permits us, at our option, to provide for

the

payment of all or part of the performance bonuses (the “Performance

Bonuses”) for certain of our employees (the

“Participating Employees”),

which bonuses

would otherwise be payable entirely in cash, through the issuance of common

shares. Under this aspect of the Alternate Compensation Plan, the Compensation

Committee may at any time recommend the allotment and issuance of common

shares

from treasury to one or more Participating Employees in satisfaction of

Performance Bonuses established in accordance with criteria set by the board

of

directors (in consultation with the Compensation Committee). The issue price

for

the common shares will be at a price equal to the closing price of our common

shares on the TSX on the day of, or the day immediately preceding such

recommendation by the Compensation Committee or such other amount as determined

by the board of directors and permitted by the Regulatory Authorities. The

board

of directors will not be obliged to allot and issue common shares to

Participating Employees. However, if the board of directors elects to meet

its

obligations to satisfy Performance Bonuses through the allotment and issuance

of

common shares, it will do so by passing a resolution allotting and issuing

the

appropriate number of common shares only if and when the criteria for payment

of

the related Performance Bonuses are met.

The

Alternate Compensation Plan is administered by the board of directors (in

consultation with the Compensation Committee) and, subject to regulatory

requirements, may be amended by the board of directors without shareholder

approval, provided that the maximum number of common shares which may be

issued

under the Alternate Compensation Plan is not in excess of 2,500,000 common

shares. Common shares issued under the Alternate Compensation Plan

will be subject to trading or resale restrictions under any applicable laws.

The

board of directors may terminate the Alternate Compensation Plan any time

before

or after any reservation, allotment or issuance of common shares

thereunder.

Deferred

Profit Sharing Plan

We

have

a Deferred Profit Sharing Plan (“DPSP”) matching program which

is available to all employees. The DPSP matching program provides 100% matching

of employee contributions into each employee’s Group RRSP account up to a

maximum of three percent (3%) of the employee’s gross earnings. We

began making contributions to the employees’ Group Retirement Savings Plan in

fiscal 1998. Beginning February 2001, our contributions have been

paid into an employer-sponsored DPSP.

Directors’

and Officers’ Deferred Share Unit Plan

We

created a deferred share unit plan for directors and officers (the

“Deferred Share Unit

Plan”). Under

the Deferred Share Unit Plan,

participating directors may elect to receive either a portion or all of their

Annual Fees from us in deferred share units. Under the Deferred Share

Unit Plan, the Compensation Committee

Page

10 of

24

may

at

any time during the period between the annual meetings of our shareholders,

recommend the Corporation credit to each Participating Director who has elected

under the terms of the Deferred Share Unit Plan, the number of units equal

to

the gross amount of the Annual Fees to be deferred divided by the fair market

value of the shares. The fair market value of the shares is

determined as the closing price of our common shares on the TSX on the day

immediately preceding such recommendation by the Compensation Committee or

such

other amount as determined by the board of directors and permitted by the

Regulatory Authorities.

In

addition, the participating directors may elect under the Deferred Share

Unit

Plan to receive deferred share units in satisfaction for Meeting Fees earned

by

the Participating Directors as a result of attendance at meetings of the

board

of directors held between the annual meetings of our shareholders by the

credit

to each Participating Director of the number of units equal to the gross

amount

of the Meeting Fees to be deferred divided by the fair market value of the

shares, being the closing price of the common shares on the TSX on the day

immediately preceding the recommendation by the Compensation Committee or

such

other amount as determined by the board of directors and permitted by the

Regulatory Authorities.

The

Deferred Share Unit Plan is administered by the board of directors (in

consultation with the Compensation Committee) and, subject to regulatory

requirements, may be amended by the board of directors without shareholder

approval. When a Participating Director ceases to hold the position

of director and is no longer otherwise employed by us, the Participating

Director receives either (a) a lump sum cash payment equal to the number

of

deferred share units held multiplied by the then fair market value of our

common

shares on the date of termination, or (b) the number of common shares that

can

be acquired in the open market with the amount described in (a), either case

being subject to withholding for income tax. The board of directors

may terminate the Deferred Share Unit Plan any time before or after any

allotment or accrediting of deferred share units thereunder.

TERMINATION

OF EMPLOYMENT, CHANGE IN RESPONSIBILITIES AND EMPLOYMENT

CONTRACTS

We

have

employment agreements with each of the Named Executive

Officers. These agreements provide for a notice period in the event

of termination without cause or a resignation due to change in role as a

result

of a change in control equal to 12 months. Other than the President

and Chief Executive Officer who reports directly to the board of directors,

each

Named Executive Officer reports to the Chief Executive Officer. The bonus

and

options allocation of the President and Chief Executive Officer is determined

by

the board of directors, whereas the bonus and options allocation of each

Named

Executive Officer is as recommended to the board of directors by the Chief

Executive Officer. The bonus is awarded based 75% on achievement of

corporate objectives and 25% on achievement of the Named Executive Officer’s

objectives. Vacation allocation on a calendar year basis for each

Named Executive Officer is four weeks of paid vacation, pro rated to reflect

a

period of employment less than a full calendar year. Each employment

agreement provides that the Corporation may at any time assign the Named

Executive Officer to perform other functions that are consistent with the

Named

Executive Officer’s skills, experience and position within the

Corporation. Salary and bonus amounts for each of the Named Executive

Officers for the fiscal year 2004 were as set out in the above Summary

Compensation Table.

REPORT

ON EXECUTIVE COMPENSATION

Composition

of the Human Resources and Compensation Committee

The

board of directors, upon the advice of the Compensation Committee, determines

executive compensation. During the period from June 1,

2003 to January 16, 2004, the Compensation Committee was

comprised of three directors who were not employees or officers of the

Corporation, Mr. Strachan, Mr. Capizzi, and Mr. Steigrod. Since

January 16, 2004, the Compensation Committee has been comprised of two directors

who were not employees or officers of the Corporation, Mr. Strachan and Mr.

Steigrod. Mr. Steigrod is Chair of the Compensation

Committee. The Compensation Committee met five times during the above

period.

Page

11 of

24

Compensation Objectives

and Philosophy

The

Compensation Committee’s mandate is to review, and advise the board of directors

on, the recruitment, appointment, performance, compensation, benefits and

termination of Executive Officers. The Compensation Committee also administers

and reviews procedures and policies with respect to our 2003 Stock Option

Plan,

employee benefit programs, pay equity and employment equity. The philosophy

of

the Compensation Committee towards Executive Officer compensation is to reward

performance and to provide a total compensation package that will attract

and

retain qualified, motivated and achievement oriented Executive

Officers.

The

Compensation Committee attempts to create compensation arrangements that

will

align the interests of our Executive Officers and our shareholders. The key

components of Executive Officer compensation are base salary, potential annual

cash bonuses and annual participation in the 2003 Stock Option

Plan.

Base

Salary - Initial Stock Options

Base

salary for each Executive Officer is a function of the individual’s experience,

past performance and anticipated future contribution. The Compensation Committee

uses private and public compensation surveys to assist with the determination

of

an appropriate compensation package for each Executive Officer.

Executive

Officers are granted stock options on the commencement of employment with

us in

accordance with the responsibility delegated to each Executive Officer for

achieving corporate objectives and enhancing shareholder value.

Potential

Annual Cash Bonuses and Annual Participation in the 2003 Stock Option

Plan

Generally,

potential annual cash bonuses and annual awards of options under the 2003

Stock

Option Plan for each Executive Officer are conditional in part upon the

achievement by the Corporation of predetermined scientific, clinical,

regulatory, intellectual property, business and corporate development and

financial objectives, and in part upon the achievement by each Executive

Officer

of individual performance objectives. Executive Officer individual

performance objectives for each fiscal year are consistent with corporate

objectives and each Executive Officer’s role in achieving them. All

corporate and Executive Officer objectives are predetermined by the board

of

directors after review by the Compensation Committee. Seventy-five

percent of each Executive Officer’s potential annual cash bonus is conditional

upon the achievement of corporate objectives with the remaining twenty-five

percent being conditional upon the achievement of individual Executive Officer

objectives. The Compensation Committee reserves the right to recommend to

the

board of directors the awarding of bonuses, payable in cash, stock or stock

options, to reward extraordinary individual performance.

For

each Executive Officer, during the year ended May 31, 2004, the potential

annual cash bonuses are 20% of base salary when all corporate and individual

Executive Officer objectives were achieved, increasing to 30% of base salary

when the corporate and individual Executive Officer objectives were

significantly overachieved.

Cash

bonuses are determined as soon as practicable after the end of the fiscal

year

and are included in the Summary Compensation Table in the year in respect

of

which they are earned.

There

is a potential for an annual allocation from our 2003 Stock Option Plan for

each

Executive Officer when all Corporate and Executive Officer objectives are

achieved. The allocation of options is approved by the Compensation

Committee of the Corporation and options are priced using the closing market

price of the Corporation’s common shares on the TSX on the last trading day

prior to the date of grant. Options to purchase common shares expire

five years from the date of grant and vest over three years. The granting

of

options to purchase common shares is included in the Summary Compensation

Table

in the year that they are earned.

President

and Chief Executive Officer Compensation

The

performance of the President and Chief Executive Officer for the 2004 financial

year was measured in the following areas:

Page

12 of

24

|

|

•

|

Virulizin

clinical study - expansion of the Phase III clinical trial of Virulizin

to

at least 70 sites and to screen 400 - 500 patients and enroll 200

- 250

patients to be on target for full enrolment by Q4

2004;

|

|

|

•

|

Antisense

clinical studies - a) complete the analysis of the Phase II trial

of

GTI-2040 in renal cell carcinoma; and if resources are available

design

and implement a further clinical study of the drug; b) in cooperation

with

the U.S. National Cancer Institute advance the clinical program

for

GTI-2040 by initiating at least five new clinical trials; and,

c) complete

a clinical research report on the Phase I clinical trial of GTI-2501

and

initial a Phase II clinical trial in prostate

cancer;

|

|

|

•

|

Manufacturing

- Develop a scale-up manufacturing process for Virulizin to meet

appropriate milestones to be on target for an NDA

submission;

|

|

|

•

|

Technology

- Diversify the Lorus product portfolio further by either acquiring

a new

technology or by developing a new in-house drug

program;

|

|

|

•

|

Investor

Relations - Broaden sell-side coverage to five investment houses

with at

least one in the U.S.A. that have Lorus on their cover list and

at least

three that have published reports on Lorus;

and,

|

|

|

•

|

Finance

- Have at least two years of operating

cash.

|

Submitted

by the Human Resources and Compensation Committee of the Board of

Directors:

Alan

Steigrod (Chair)

Graham

Strachan

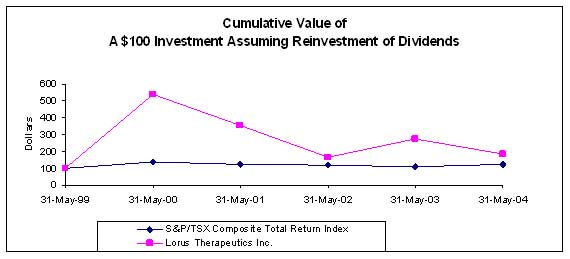

PERFORMANCE

GRAPH

The

following graph illustrates our cumulative total shareholder return (assuming

a

$100 investment) for our common shares on the TSX as compared with The

S&P/TSX Composite Total Return Index Value during the period May 31,

1999 to May 31, 2004. From December 23, 1998 to February 23, 2004,

the Common Shares traded on the OTC-BB under the symbol

“LORFF”. Since February 23, 2004 the Common Shares have traded on the

American Stock Exchange under the symbol “LRP”.

COMPENSATION

OF DIRECTORS

During

the fiscal year ended May 31, 2004, each director who was not an officer of

the Corporation or a representative of a shareholder was entitled to receive

50,000 stock options (the Chair received 100,000)

Page

13 of

24

and,

at

his election, shares, deferred share units and/or cash compensation for

attendance at board committee meetings. Compensation consisted of an annual

fee

of $15,000 (the Chair received $35,000) and $1,500 per board meeting attended

($4,500 to the Chairman of a board meeting). Members of the Audit

Committee received an annual fee of $8,000 (the Chair received

$10,000). Members of the Compensation and Human Resources committee

received an annual fee of $5,000, and members of the Corporate Governance

and

Environmental Health and Safety committees received annual fees of $4,000

(the

Chair of each of the three committees received $5,000)

In

November 2003, stock options to purchase 350,000 common shares at a price

of

$1.03 per share expiring November 1, 2013 were granted, in aggregate, to

our

directors in this regard. In addition, the Corporation reimbursed the

directors for expenses incurred in attending Meetings of the board of directors

and Committees of the board.

Directors

are entitled to participate in our Alternate Compensation Plan and our Deferred

Share Unit Plan. See "Equity Compensation Plans - Directors and

Officers’ Alternate Compensation Plan” and “Equity Compensation Plans -

Directors and Officers’ Deferred Share Unit Plan”.

SECURITIES

AUTHORIZED FOR ISSUANCE

UNDER EQUITY COMPENSATION PLANS

The

following table sets forth certain details as at the end of the last fiscal

year

ended May 31, 2004 with respect to compensation plans pursuant to which equity

securities of the Corporation are authorized for issuance.

|

Plan

Category

|

#

of Shares to be

issued

upon

exercise

of

outstanding

options

|

Weighted-average

exercise

price of

outstanding

options

|

#

of Shares

remaining

available

for

future issuance

under

the Equity

Compensation

Plans

|

|||

|

Plans

approved by Shareholders(1)

|

6,372,813

|

$1.05

|

6,697,521

|

|||

|

Plans

not approved by Shareholders

|

-

|

-

|

-

|

|||

|

Total

|

6,372,813

|

$1.05

|

6,697,521

|

|

(1)

|

This

includes options granted and reserved for issuance pursuant to

our 1993

Stock Option Plan, 2003 Stock Option Plan, and our Alternate Compensation

Plan.

|

INDEBTEDNESS

The

Corporation did not provide

financial assistance to any employees, officers or directors for the purchase

of

common shares in fiscal 2004. As of May 31, 2004 and at all times throughout

the

fiscal year, there was no indebtedness owing to the Corporation by any

employees, officers or directors of the Corporation.

USE

OF PROCEEDS

In

our prospectus dated June 3, 2003,

we indicated that the proceeds to be received from that financing would be

used

as follows: (i) $12 million for the product development of our

immunotherapy platform; (ii) $11 million for the product development of our

antisense platform; and, (iii) $2 million for pre-clinical and discovery

programs. We anticipated that the balance of the funding would be

used for working capital and general corporate purposes. During

fiscal 2004, we incurred $19.9 million in research and development expenses

in

respect of our immunotherapy platform, $6.7 million in respect of our antisense

platform, and $200,000 in respect of our pre-clinical and discovery

programs. The additional spending in respect of our immunotherapy

platform was funded through cash and short-term investments held by us

prior

Page

14 of

24

to

the

2003 offering, and is the direct result of the expansion of our Virulizin® Phase

III clinical trial. The spending anticipated in the 2003 prospectus

on our antisense platform and pre-clinical and discovery programs was to

be

incurred over a number of years, not solely in 2004.

DIRECTOR’S

AND OFFICER’S LIABILITY

We

purchase and maintain liability insurance for the benefit of directors and

officers to cover any liability incurred by such person in such

capacities. The policy provides for coverage in the amount of

$10,000,000 with a deductible amount of $150,000 (with some

exceptions). For the period June 1, 2003 to May 31,

2004, the premium cost of this insurance was $144,855.

INTEREST

OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Other

than as set forth above under the heading “Executive Compensation”, during the

financial year of the Corporation ended May 31, 2004, no director, senior

officer or associate of a director or senior officer nor, to the knowledge

of

our directors or senior officers, after having made reasonable inquiry, any

person or company who beneficially owns, directly or indirectly, common shares

carrying more than 10% of the voting rights attached to all common shares

outstanding at the date hereof, or any associate or affiliate thereof, had

any

material interest, direct or indirect, in any material transaction of the

Corporation, nor do any such persons have a material interest, direct or

indirect, in any proposed transaction of the Corporation.

OTHER

BUSINESS

Management

of the Corporation knows of no matter to come before the Meeting other than

the

matters referred to in the notice of Meeting.

ADDITIONAL

INFORMATION

Information

contained herein is given as of October 7, 2004, except as otherwise noted.

If

any matters which are not now known should properly come before the Meeting,

the

accompanying form of proxy will be voted on such matters in accordance with

the

best judgment of the person voting it.

Additional

information relating to Lorus, including our most current annual information

form (together with documents incorporated therein by reference), our 2004

annual report containing our comparative consolidated financial statements

for

the financial year ended May 31, 2004, together with the report of the auditors

thereon, management’s discussion and analysis of our financial condition and

results of operations for fiscal 2004, our interim financial statements for

periods subsequent to the end of our last financial year, can be found on

the

Canadian Security Administrators’ System for Electronic Document Analysis and

Retrieval (SEDAR) at www.sedar.com. Copies of those documents, as well as

and

additional copies of this Circular, are available upon written request to

the

Corporate Secretary, upon payment of a reasonable charge where applicable.

Financial information of the Corporation is provided in our comparative

consolidated financial statements for the year ended May 31, 2004 and

management’s discussion and analysis of our financial condition and results of

operations for fiscal 2004.

DIRECTORS’

APPROVAL

The

contents and sending of this Circular have been approved by the directors

of the

Corporation.

|

(signed)

SHANE A. ELLIS

|

|

| October 7, 2004 |

Vice

President of Legal Affairs and

|

|

Corporate

Secretary

|

Page

15 of

24

APPENDIX

“A”

Statement

Of Corporate Governance Practices

The

TSX

Guidelines emphasize the importance of board-member independence and the

responsibility of the Board for adopting a strategic planning process,

identifying and monitoring risks and overseeing risk management, succession

planning for senior management, overseeing corporate communications and adopting

internal control and management information systems. We subscribe to

the principles enunciated in the guidelines.

Our

Board has established a Corporate Governance and Nominating Committee to

help us

set in place corporate governance guidelines, to the extent they are practical

for the Corporation. The Corporate Governance and Nominating

Committee has reviewed the guidelines and the Corporation’s own corporate

governance practices, with input and guidance from the Board. The

following table sets forth the 14 TSX Guidelines, together with a summary

of our

position with respect to each guideline:

|

TSX

Guidelines

|

Comments

|

|

|

(1)

|

The

board should explicitly assume responsibility for stewardship of

the

Corporation, and as part of the overall stewardship responsibility,

should

assume responsibility for the following matters:

|

The

Board of Directors has assumed responsibility for the stewardship

of the

Corporation by overseeing the management and operations of the

business

and supervising management, which is responsible for the day-to-day

conduct of the business.

The

Board Policy

Manual and the terms of reference of the Board of Directors, committees

and individual directors set out the purpose, procedure and organization,

and responsibilities and duties of the Board and its

committees.

|

|

(a)

|

adoption

of a strategic planning process;

|

The

Board has assumed

responsibility for ensuring there are long-term goals and strategies

in

place for the Corporation. The Corporation’s goals and

strategies are prepared and reviewed together by management and

the Board

on an annual basis and are a primary component of the Board’s annual

agenda.

|

|

The

Board as a whole

participates in discussions on corporate strategy and, where appropriate,

approves the strategies and implementation plans recommended by

management.

|

||

|

Implementation

of the strategic

plan is the responsibility of management. The Board provides

guidance but does not become involved in day-to-day

matters.

|

||

|

Management

reports to the Board

on the Corporation’s progress in achieving the strategic objectives set

out in the strategic plan.

|

Page

16 of

24

|

TSX

Guidelines

|

Comments

|

|

|

(b)

|

the

identification of the principal risks of the Corporation’s business and

ensuring the implementation of appropriate systems to manage these

risks;

|

The

Board, through its committees and as a whole, believes that it

understands

the specific risks of the Corporation’s business. The Corporate Governance

and Nominating Committee has established a review process to assign

responsibility for principal risks among the Board as a whole and

the

committees of the Board.

Management

reports to the Board or committees of the Board on a regular basis

on the

status of key risk areas.

The

Board reviews and approves the Corporation’s annual capital and operating

budgets. The Audit Committee reviews performance against

budgets on a quarterly basis.

|

|

(c)

|

succession

planning, including appointing, training and monitoring senior

management;

|

The

Human Resources and Compensation Committee periodically reviews

the

Corporation’s organizational plan and structure and annually reviews the

senior executive succession plan, recommending the same to the

Board for

approval.

The

Corporation’s Human Resources and Compensation Committee, composed of

unrelated directors, monitors the performance of senior management

and

reports to the whole Board.

|

|

(d)

|

a

communications policy for the corporation; and

|

A

formal disclosure and communications policy has been developed

which

includes the assignment of responsibility for disclosure to a corporate

communications team. It is intended that this team may consult

with

professional advisors and/or Board members as appropriate in the

circumstances.

The

Corporation has established a policy addressing employee and insider

trading. Among other things, the policy requires that the

Corporation set trading blackouts for employees and directors in

advance

of news releases and/or in other circumstances as

appropriate.

|

|

(e)

|

the

integrity of the corporation’s internal control and management information

systems.

|

The

Board has appointed an Audit Committee composed of independent

directors

that reviews compliance of financial reporting with accounting

principles

and appropriate internal controls. The Audit Committee meets

quarterly with management and periodically with the external auditors

to

review financial statements, internal controls and other

matters. The Audit Committee reports to the Board prior to the

approval of the quarterly and annual financial

statements.

|

Page

17 of

24

|

TSX

Guidelines

|

Comments

|

|

|

(2)

|

A

majority of directors should be “unrelated” (independent of management and

free from any business or other relationship which could, or could

reasonably be perceived to, materially interfere with the director’s

ability to act with a view to the best interests of the Corporation

other

than interests and relationships arising from

shareholding).

|

The

Corporation’s Board is constituted of a majority of unrelated

directors. The only related Board member is Dr. Jim Wright, the

Corporation’s President and Chief Executive Officer. The other

Board members are unrelated. The Corporation does not have any

significant shareholders (i.e. holders of 10% or greater of the

outstanding common shares of the Corporation).

|

|

(3)

|

The

board has responsibility for applying the definition of “unrelated

director” to each individual director and for disclosing annually the

analysis of the application of the principles supporting this definition

and whether the board has a majority of unrelated

directors.

|

Dr.

Jim Wright is a related Board member, as he is the President and

Chief

Executive Officer of the Corporation. If elected at the

Meeting, the Board has determined that Dr. Wright will be the only

director who is a related director.

The

remainder of the present directors and nominees for election to

the Board

at the Meeting are unrelated. Additional disclosure on Board

members, with respect to their business experience and backgrounds,

can be

found in our annual information form and in our annual

report.

|

|

(4)

|

The

board should appoint a committee of directors composed exclusively

of

outside, i.e., non-management directors, a majority of whom are

unrelated

directors, with the responsibility for proposing new nominees to

the board

and for assessing directors on an ongoing basis.

|

The

Corporation has established a Corporate Governance and Nominating

Committee, which as part of its mandate, has the responsibility

of

recommending qualified candidates for the Board and annually reviewing

the

effectiveness of the Board and individual members of the

Board.

All

members of the Corporate Governance and Nominating Committee are

unrelated

directors.

|

|

(5)

|

The

board should implement a process to be carried out by an appropriate

committee, for assessing the effectiveness of the board as a whole,

the

committees of the board and the contribution of individual

directors.

|

The

Corporate Governance and Nominating Committee has been mandated

to ensure

that the contribution of Board members, committees of the Board

and the

Board as a whole is reviewed on an annual basis. A process is

being established which will involve questionnaires to be completed

by

individual board members. The Corporate Governance and

Nominating Committee will review the findings of the questionnaires

and

will report the results regarding the Board members and Board committees

to the Board. Additionally, the Corporate Governance and

Nominating Committee monitors the quality of the relationship between

management and the Board in order to recommend ways to improve

that

relationship.

|

Page

18 of

24

|

TSX

Guidelines

|

Comments

|

|

|

(6)

|

The

company, as an integral element of the process for appointing new

directors, should provide an orientation and education program

for new

directors.

|

The

Corporation is developing a director’s orientation manual containing

salient information about the Corporation including the operation

of the

Board and the committees of the Board. Additionally, the

Corporation provides new directors the opportunity to meet senior

management both prior and subsequent to joining the Board.

Most

Board meetings are held at the Corporation’s premises to give additional

insight into the business.

The

President and Chief Executive Officer, in conjunction with the

Chairman of

the Board, also periodically selects special educational or informational

topics for presentation and discussion at Board meetings, which

deal with

the business and regulatory environment in which the Corporation

operates,

and the biopharmaceutical industry generally.

|

|

(7)

|

The

board should examine its size, and, with a view to determining

the impact

upon effectiveness, undertake where appropriate, a program to reduce

the

number of directors to a number which facilitates more effective

decision-making.

|

A

Board must have enough directors to carry out its duties efficiently,

while presenting a diversity of views and independence. The

Board has considered whether the current size of the Board permits

such

diversity and allows sufficient resources to carry out the duties

of the

Board. The number of directors fixed for the coming year is

seven. From time to time the Board assesses the number of

directors for Board effectiveness.

|

|

(8)

|

The

board should review the adequacy and form of compensation of directors

and

ensure the compensation realistically reflects the risks and

responsibilities involved in being an effective director.

|

It

is in the mandate of the Human Resources and Compensation Committee

to

review the appropriateness and adequacy of directors’ compensation on an

annual basis.

|

|

(9)

|

Committees

of the board should generally be composed of outside directors,

a majority

of whom are unrelated directors, although some board committees,

such as

the executive committee, may include one or more inside

directors.

|

All

Board committees are composed solely of non-management

directors.

|

Page

19 of

24

|

TSX

Guidelines

|

Comments

|

|

|

(10)

|

The

board should expressly assume responsibility for, or assign to

a committee

of directors the general responsibility for, developing the company’s

approach to governance issues. The committee would, amongst

other things, be responsible for the company’s response to these

governance guidelines.

|

The