|

|

(a)

|

in

the name of an intermediary that the non-registered holder deals

with in

respect of the shares, such as, among others, banks, trust companies,

securities dealers or brokers and trustees or administrators of

self-administered RRSPs, RRIFs, RESPs and similar plans;

or

|

|

|

(b)

|

in

the name of a depository (such as The Canadian Depository for Securities

Limited, or “CDS”) of which the intermediary is a

participant.

|

|

A.

|

Voting

Instruction Form. In most cases, a non-registered holder will

receive, as part of the meeting materials, a voting instruction

form. If the non-registered holder does not wish to attend and

vote at the meeting in person (or have another person attend and

vote on

the non-registered holder’s behalf), the voting instruction form must be

completed, signed and returned in accordance with the directions

on the

form. If a non-registered holder wishes to attend and vote at

the Meeting in person (or have another person attend and vote on

the

non-registered holder’s behalf), the non-registered holder must complete,

sign and return the voting instruction form in accordance with the

directions provided and a form of proxy giving the right to attend

and

vote will be forwarded to the non-registered

holder.

|

|

|

or

|

|

B.

|

Form

of Proxy. Less frequently, a non-registered holder will

receive, as part of the meeting materials, a form of proxy that has

already been signed by the intermediary (typically by a facsimile

or

stamped signature) which is restricted as to the number of shares

beneficially owned by the non-registered holder but which is otherwise

uncompleted. If the non-registered holder does not wish to

attend and vote at the Meeting in person (or have another person

attend

and vote on the non-registered holder’s behalf), the non-registered holder

must complete the form of proxy and deposit it with Computershare

Trust

Company of Canada, 100 University Avenue, 8th

Floor

Toronto, Canada, M5J 2Y1 as described above. If a

non-registered holder wishes to attend and vote at the Meeting in

person

(or have another person attend and vote on the non-registered holder’s

behalf), the non-registered holder must strike out the names of the

persons named in the proxy and insert the non-registered holder’s (or such

other person’s) name in the blank space

provided.

|

|

|

(a)

|

completing

and signing a proxy bearing a later date and depositing it with

Computershare Trust Company of Canada as described above;

or

|

|

|

(b)

|

depositing

an instrument in writing executed by the shareholder or by the

shareholder’s attorney authorized in writing: (i) at our registered office

at any time up to and including the last business day preceding the

day of

the Meeting, or any adjournment of the Meeting, at which the proxy

is to

be used, or (ii) with the chairman of the Meeting prior to the

commencement of the Meeting on the day of the Meeting or any adjournment

of the Meeting; or

|

|

|

(c)

|

in

any other manner permitted by law.

|

|

|

•

|

FOR

the election of directors;

|

|

|

•

|

FOR

the appointment of

auditors;

|

|

|

•

|

FOR

the ordinary resolution amending the 1993 Stock Option Plan and the

2003

Stock Option Plan to change the maximum number of Common Shares of

the

Corporation that may be reserved for issuance under the Plans from

a fixed

number to an amount equal to 15% of the issued and outstanding common

shares of the Corporation from time to time, as set forth in Appendix

“B”

to this Circular and described under the heading “Special Business -

Amendment to our 1993 Stock Option Plan and 2003 Stock Option Plan”;

and

|

|

|

•

|

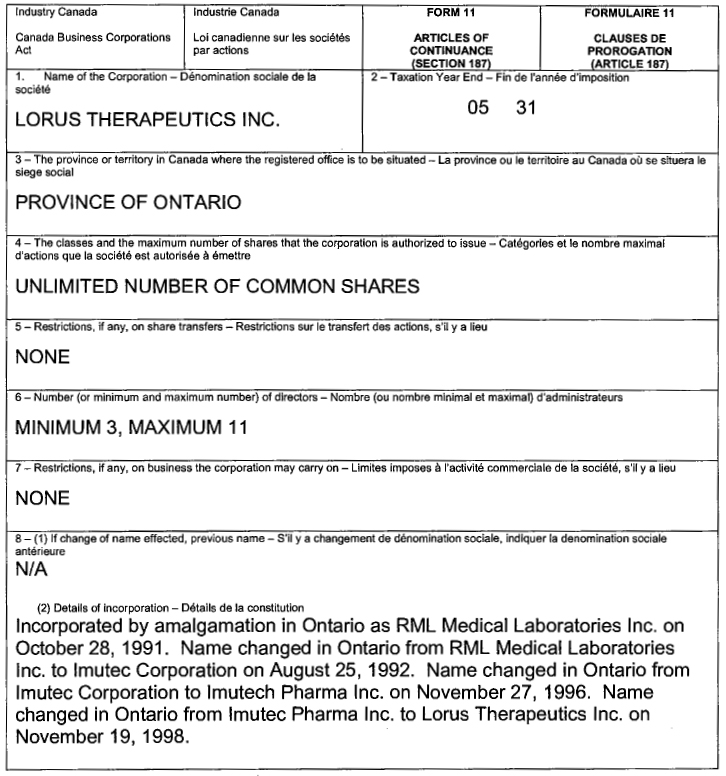

FOR

the special resolution authorizing the continuance of the Corporation

out

of Ontario into the federal jurisdiction so that it is governed by

the

Canada Business Corporations

Act, as set forth in Appendix “C” to this Circular

and described under the heading “Special Business - Continuance of the

Corporation”.

|

|

Name

Of Director

|

Year

First

Elected/

Appointed

A

Director

|

Ownership

Or

Control

Over

Common

Shares(1)

|

|

J.

KEVIN BUCHI (2),

West

Chester, Pennsylvania

Senior

Vice President and Chief Financial Officer, Cephalon Inc.

(biopharmaceutical

specializing in drugs to treat and manage

neurological

diseases, sleep disorders, cancer and pain)

|

2003

|

50,000

|

|

DONALD

W. PATERSON(2)

(4) , Toronto, Ontario

President,

Cavandale Corporation

(corporate

consulting)

|

1991

|

125,260

|

|

ELLY

REISMAN, Richmond Hill, Ontario

President,

Great Gulf Group of Companies

(real

estate development)

|

1999

|

1,485,508

|

|

ALAN

STEIGROD(3),

Newport

Beach, CA

Managing

Director, Newport Health Care Ventures

(corporate

consulting)

|

2001

|

-

|

|

GRAHAM

STRACHAN(2) (3)(4)

(5), Toronto, Ontario

President,

GLS Business Development Inc.

(corporate

consulting)

|

2001

|

10,000

|

|

JIM

A. WRIGHT, Oakville, Ontario

President

and Chief Executive Officer of the Corporation

|

1999

|

6,112,800(6)

|

|

(1)

|

In

addition, as at May 31, 2005, the current directors hold, in aggregate,

options to purchase 3,039,500 common shares. These options were

granted to the directors as consideration for services rendered as

directors of the Corporation. See “Executive Compensation -

Compensation of Directors”.

|

|

(2)

|

Member

of the Audit Committee.

|

|

(3)

|

Member

of the Compensation Committee.

|

|

(4)

|

Member

of the Corporate Governance and Nominating

Committee.

|

|

(5)

|

Member

of the Environmental Committee.

|

|

(6)

|

Of

the 6,112,800 common

shares, 4,428,541 are owned

directly by Dr. Wright and 1,684,259 are owned by a trust for the

benefit

of Dr. Wright’s spouse.

|

|

Rights

of Dissenting Shareholders

185.

(1) Subject to

subsection (3) and to sections 186 and 248, if a corporation

resolves

to,

(a) amend

its articles under section 168 to add, remove or change restrictions

on

the issue, transfer or ownership of shares

|

of

a class or series of the shares of the corporation;

(b) amend

its articles under section 168 to add, remove or change any restriction

upon the business or businesses that the corporation may carry

on or upon

the powers that the corporation may

exercise;

|

|

(c) amalgamate

with

another corporation under sections 175 and 176;

(d) be

continued under the laws of another jurisdiction under section 181;

or

(e)

sell, lease or exchange all or substantially all its property under

subsection 184 (3),

a

holder of shares of any class or series entitled to vote on the resolution

may dissent.

(2) If

a

corporation resolves to amend its articles in a manner referred to

in

subsection 170 (1), a holder of shares of any class or series entitled

to

vote on the amendment under section 168 or 170 may dissent, except

in

respect of an amendment referred to in,

(a) clause

170 (1) (a), (b) or (e) where the articles provide that the holders

of

shares of such class or series are not entitled to dissent;

or

(b)

subsection 170 (5) or (6).

(3) A

shareholder of a corporation incorporated before the 29th day of

July,

1983 is not entitled to dissent under this section in respect of

an

amendment of the articles of the corporation to the extent that the

amendment,

(a) amends

the express terms of any provision of the articles of the corporation

to

conform to the terms of the provision as deemed to be amended by

section

277; or

(b) deletes

from the articles of the corporation all of the objects of the corporation

set out in its articles, provided that the deletion is made by the

29th

day of July, 1986.

(4) In

addition to any other right the shareholder may have, but subject

to

subsection (30), a shareholder who complies with this section is

entitled,

when the action approved by the resolution from which the shareholder

dissents becomes effective, to be paid by the corporation the fair

value

of the shares held by the shareholder in respect of which the shareholder

dissents, determined as of the close

|

of

business on the day before the resolution was adopted.

(5) A

dissenting shareholder may only claim under this section with respect to

all the shares of a class held by the dissenting shareholder on behalf

of

any one beneficial owner and registered in the name of the dissenting

shareholder.

(6) A

dissenting shareholder shall send to the corporation, at or before

any

meeting of shareholders at which a resolution referred to in subsection

(1) or (2) is to be voted on, a written objection to the resolution,

unless the corporation did not give notice to the shareholder of

the

purpose of the meeting or of the shareholder's right to

dissent.

(7) The

execution or exercise of a proxy does not constitute a written objection

for purposes of subsection (6).

(8) The

corporation shall, within ten days after the shareholders adopt the

resolution, send to each shareholder who has filed the objection

referred

to in subsection (6) notice that the resolution has been adopted,

but such

notice is not required to be sent to any shareholder who voted for

the

resolution or who has withdrawn the objection.

(9) A

notice sent under subsection (8) shall set out the rights of the

dissenting shareholder and the procedures to be followed to exercise

those

rights.

(10) A

dissenting shareholder entitled to receive notice under subsection

(8)

shall, within twenty days after receiving such notice, or, if the

shareholder does not receive such notice, within twenty days after

learning that the resolution has been adopted, send to the corporation

a

written notice containing,

(a) the

shareholder's name and address;

(b) the

number and class of shares in respect of which the shareholder dissents;

and

(c) a

demand for payment of the fair value of such shares.

(11) Not

later than the thirtieth day after the sending of a notice under

subsection (10),

a dissenting shareholder shall send the certificates representing

the

shares in respect of which the

|

|

shareholder

dissents to the corporation or its transfer agent.

(12) A

dissenting shareholder who fails to comply with subsections (6),

(10) and

(11) has no right to make a claim under this section.

(13) A

corporation or its transfer agent shall endorse on any share certificate

received under subsection (11) a notice that the holder is a dissenting

shareholder under this section and shall return forthwith the share

certificates to the dissenting shareholder.

(14) On

sending a notice under subsection (10), a dissenting shareholder

ceases to

have any rights as a shareholder other than the right to be paid

the fair

value of the shares as determined under this section except

where,

(a) the

dissenting shareholder withdraws notice before the corporation makes

an

offer under subsection (15);

(b) the

corporation fails to make an offer in accordance with subsection

(15) and

the dissenting shareholder withdraws notice; or

(c) the

directors

revoke a resolution to amend the articles under subsection 168 (3),

terminate an amalgamation agreement under subsection 176 (5) or an

application for continuance under subsection 181 (5), or abandon

a sale,

lease or exchange under subsection 184 (8),

in

which case the dissenting shareholder's rights are reinstated as

of the

date the dissenting shareholder sent the notice referred to in subsection

(10), and the dissenting shareholder is entitled, upon presentation

and

surrender to the corporation or its transfer agent of any certificate

representing the shares that has been endorsed in accordance with

subsection (13), to be issued a new certificate representing the

same

number of shares as the certificate so presented, without payment

of any

fee.

(15) A

corporation shall, not later than seven days after the later of the

day on

which the action approved by the resolution is effective or the day

the

corporation received the notice referred to in subsection (10), send

to

each

|

dissenting

shareholder who has sent such notice,

(a) a

written

offer to pay for the dissenting shareholder's shares in an amount

considered by the directors of the corporation to be the fair value

thereof, accompanied by a statement showing how the fair value was

determined; or

(b) if

subsection

(30) applies, a notification that it is unable lawfully to pay dissenting

shareholders for their shares.

(16) Every

offer made under subsection (15) for shares of the same class or

series

shall be on the same terms.

(17) Subject

to subsection (30), a corporation shall pay for the shares of a dissenting

shareholder within ten days after an offer made under subsection

(15) has

been accepted, but any such offer lapses if the corporation does

not

receive an acceptance thereof within thirty days after the offer

has been

made.

(18) Where

a

corporation fails to make an offer under subsection (15) or if a

dissenting shareholder fails to accept an offer, the corporation

may,

within fifty days after the action approved by the resolution is

effective

or within such further period as the court may allow, apply to the

court

to fix a fair value for the shares of any dissenting

shareholder.

(19) If

a

corporation fails to apply to the court under subsection (18), a

dissenting shareholder may apply to the court for the same purpose

within

a further period of twenty days or within such further period as

the court

may allow.

(20) A

dissenting shareholder is not required to give security for costs

in an

application made under subsection (18) or (19).

(21) If

a

corporation fails to comply with subsection (15), then the costs

of a

shareholder application under subsection (19) are to be borne by

the

corporation unless the court otherwise orders.

(22) Before

making application to the court under subsection (18) or not later

than

seven days after receiving notice of an application to the court

under

subsection (19), as the case may

|

|

be,

a corporation shall give notice to each dissenting shareholder who,

at the

date upon which the notice is given,

(a) has

sent to

the corporation the notice referred to in subsection (10);

and

(b) has

not

accepted an offer made by the corporation under subsection (15),

if such

an offer was made,

of

the date, place and consequences of the application and of the dissenting

shareholder's right to appear and be heard in person or by counsel,

and a

similar notice shall be given to each dissenting shareholder who,

after

the date of such first mentioned notice and before termination of

the

proceedings commenced by the application, satisfies the conditions

set out

in clauses (a) and (b) within three days after the dissenting shareholder

satisfies such conditions.

(23) All

dissenting shareholders who satisfy the conditions set out in clauses

(22)

(a) and (b) shall be deemed to be joined as parties to an application

under subsection (18) or (19) on the later of the date upon which

the

application is brought and the date upon which they satisfy the

conditions, and shall be bound by the decision rendered by the court

in

the proceedings commenced by the application.

(24) Upon

an

application to the court under subsection (18) or (19), the court

may

determine whether any other person is a dissenting shareholder who

should

be joined as a party, and the court shall fix a fair value for the

shares

of all dissenting shareholders.

(25) The

court may in its discretion appoint one or more appraisers to assist

the

court to fix a fair value for the shares of the dissenting

shareholders.

(26) The

final order of the court in the proceedings commenced by an application

under subsection (18) or (19) shall be rendered against the corporation

and in favour of each dissenting shareholder who, whether before

or after

the date of the order, complies with the conditions set out in clauses

(22) (a) and (b).

(27) The

court may in its discretion allow a reasonable rate of interest on

the

amount payable to each dissenting shareholder from the date the action

approved by the resolution is effective until the date of

payment.

|

(28) Where

subsection (30) applies, the corporation shall, within ten days after

the

pronouncement of an order under subsection (26), notify each dissenting

shareholder that it is unable lawfully to pay dissenting shareholders

for

their shares.

(29) Where

subsection (30) applies, a dissenting shareholder, by written notice

sent

to the corporation within thirty days after receiving a notice under

subsection (28), may,

(a) withdraw

a

notice of dissent, in which case the corporation is deemed to consent

to

the withdrawal and the shareholder's full rights are reinstated;

or

(b) retain

a

status as a claimant against the corporation, to be paid as soon

as the

corporation is lawfully able to do so or, in a liquidation, to be

ranked

subordinate to the rights of creditors of the corporation but in

priority

to its shareholders.

(30) A

corporation shall not make a payment to a dissenting shareholder

under

this section if there are reasonable grounds for believing

that,

(a) the

corporation is or, after the payment, would be unable to pay its

liabilities as they become due; or

(b) the

realizable value of the corporation's assets would thereby be less

than

the aggregate of its liabilities.

(31) Upon

application by a corporation that proposes to take any of the actions

referred to in subsection (1) or (2), the court may, if satisfied

that the

proposed action is not in all the circumstances one that should give

rise

to the rights arising under subsection (4), by order declare that

those

rights will not arise upon the taking of the proposed action, and

the

order may be subject to compliance upon such terms and conditions

as the

court thinks fit and, if the corporation is an offering corporation,

notice of any such application and a copy of any order made by the

court

upon such application shall be served upon the Commission.

(32) The

Commission may appoint counsel to assist the court upon the hearing

of an

application under subsection (31), if the corporation is an offering

corporation.

|

|

Annual

Compensation

|

Long-Term

Compensation

Awards

|

|||||

|

Name

and Principal Position

|

Fiscal

Year

|

Salary

($)

|

Bonus

($)

|

Other

Annual

Compensation

($)

|

Securities

Under

Options/

SARs

Granted

(#)

(4)

|

All

Other

Compensation

($)

|

|

Dr. Jim

A. Wright

President

and Chief

Executive

Officer

|

2005

2004

2003

|

313,586

285,000

265,000

|

95,760

102,600

110,000

|

Nil

Nil

Nil

|

228,000

570,000

417,000

|

Nil

Nil

Nil

|

|

Dr.

Aiping Young (1)

Chief

Operating Officer

|

2005

2004

2003

|

222,697

197,945

185,815

|

46,125

45,390

49,829

|

Nil

Nil

Nil

|

250,000

225,000

150,000

|

Nil

Nil

Nil

|

|

Mr.

Paul Van Damme (2)

Chief

Financial Officer

|

2005

2004

2003

|

152,654

Nil

Nil

|

35,030

Nil

Nil

|

Nil

Nil

Nil

|

202,500

Nil

Nil

|

37,000

Nil

Nil

|

|

Mr.

Bruce Rowlands (3)

Senior

Vice President,

Planning

and Public Affairs

|

2005

2004

2003

|

164,000

67,492

Nil

|

36,698

20,398

Nil

|

Nil

Nil

Nil

|

75,000

122,500

200,000

|

Nil

Nil

Nil

|

|

Mr.

Shane Ellis

Vice-President,

Legal Affairs

and

Corporate Secretary

|

2005

2004

2003

|

159,031

148,288

139,252

|

31,800

34,003

31,838

|

Nil

Nil

Nil

|

187,500

150,000

125,000

|

Nil

Nil

Nil

|

|

(1)

|

Dr.

Aiping Young was promoted to the position of Chief Operating Officer

on

November 20, 2003. As a result, Dr. Young’s salary for 2004

represents approximately six months compensation as Chief Technology

Officer and six months compensation as Chief Operating

Officer.

|

|

(2)

|

Mr.

Van Damme started with Lorus on September 7, 2004; hence, there are

no

amounts relating to Mr. Van Damme’s compensation for 2003 or

2004.

|

|

(3)

|

Mr.

Rowlands joined the Corporation as an employee on January 1,

2004. He had previously served as a

consultant.

|

|

Name

and

Principal

Position

|

Securities

Under

Options/SARs

Granted

(#)

(4)

|

%

of Total

Options/SARs

Granted

to

Employees

in

Financial

Year

(%)

|

Exercise

or

Base

Price

($/Security)

|

Market

Value

of

Securities

Underlying

Options/SARs

on

the

Date

of Grant

($/Security)

|

Expiration

Date

|

|

Dr.

Jim A. Wright

President

and Chief

Executive

Officer

|

228,000

(2)

|

7.27%

|

0.78

|

0.78

|

21-Jul-2014

|

|

Dr.

Aiping Young

Chief

Operating Officer

|

75,000

(1)

175,000(2)

|

2.39%

5.58%

|

0.78

0.78

|

0.78

0.78

|

21-Jul-2014

21-Jul-2014

|

|

Mr.

Paul Van Damme

Chief

Financial Officer

|

127,500

(2)

75,000

(3)

|

4.06%

2.39%

|

0.74

0.74

|

0.74

0.74

|

6-Oct-2014

6-Oct-2014

|

|

Mr.

Bruce Rowlands

Senior

Vice-President,

Planning

and Public Affairs

|

75,000

(1)

|

2.39%

|

0.78

|

0.78

|

21-Jul-2014

|

|

Mr.

Shane Ellis

Vice-President,

Legal

Affairs

and Corporate

Secretary

|

75,000

(1)

62,500

(2)

50,000

(2)

|

2.39%

1.99%

1.59%

|

0.78

0.78

0.72

|

0.78

0.78

0.72

|

21-Jul-2014

21-July-2014

17-Nov-2014

|

|

(1)

|

These

options were granted on July 22, 2004 in respect of corporate and

personal

performance during the year ended May 31, 2005. The options vest

on the

basis of 50% on the first anniversary and 25% on the second and third

anniversaries of the date of granting. The exercise price of

all the $0.78 options was the closing price of our common shares

on the

TSX on July 21, 2004.

|

|

(2)

|

These

options are incentive options granted to certain Named Executive

Officers

to purchase common shares of the Corporation. The options vest

immediately upon the attainment of specific undertakings; failing

to

achieve the undertakings will result in forfeiture on the specified

deadline.

|

|

(3)

|

These

options were granted in recognition of Mr. Van Damme’s commencement of

employment with the Corporation and vested

immediately.

|

|

(4)

|

Options

granted are net of forfeitures.

|

|

Name

|

Securities

Acquired

on

Exercise

(#)

|

Aggregate

Value

Realized

($)

|

Unexercised

Options/SARs

at

May

31, 2005

(#)

Exercisable/

Unexercisable

|

Value

of

Unexercised

in-the-Money

Options/SARs

at

May

31, 2005 ($)

Exercisable/

Unexercisable

|

|

Dr.

Jim A. Wright

President

and Chief Executive Officer

|

Nil

|

Nil

|

1,295,750/179,250

|

35,408/3,803

|

|

Dr.

Aiping Young

Chief

Operating Officer

|

Nil

|

Nil

|

807,047/131,250

|

28,500/0

|

|

Mr.

Paul Van Damme

Chief

Financial Officer

|

Nil

|

Nil

|

202,500/0

|

0/0

|

|

Mr.

Bruce Rowlands

Senior

Vice-President, Planning and

Public

Affairs

|

Nil

|

Nil

|

247,500/75,000

|

21,250/0

|

|

Mr.

Shane Ellis

Vice-President,

Legal Affairs and

Corporate

Secretary

|

Nil

|

Nil

|

792,506/131,250

|

48,934/0

|

|

|

•

|

Virulizin

clinical study - Successfully progress the Virulizin Phase III clinical

trial to be on target to achieve last patient last visit by July,

2005,

including conduct of clinical audits and database tracking for closure

of

the clinical study, so that data can be expeditiously analyzed for

NDA

submission;

|

|

|

•

|

Antisense

clinical studies - Complete the Phase II clinical trial for GTI-2040

in

renal cell carcinoma, finalize the clinical research report for this

Phase

II clinical trial, and prepare a detailed protocol for a Phase II/III

registration clinical trial with GTI-2040 in combination with a

cytokine;

|

|

|

•

|

Manufacturing

- Successfully transition the Virulizin manufacturing process to

Lorus’

commercial manufacturing partner, by demonstrating the ability to

successfully prepare a 96 litre batch of Virulizin using the optimized

consolidated process to obtain material that meets FDA approval

criteria;

|

|

|

•

|

Partnership

- Obtain a commitment for a partnership agreement with one of Lorus’

technologies: Virulizin, GTI-2040, GTI-2501, small molecule,

tumor suppressor; and,

|

|

|

•

|

Finance

- Have at least 18 months of operating

cash.

|

|

Plan

Category

|

#

of Shares to be

issued

upon

exercise

of

outstanding

options

|

Weighted-average

exercise

price of

outstanding

options

|

#

of Shares

remaining

available

for

future issuance

under

the Equity

Compensation

Plans

|

|||

|

Plans

approved by Shareholders(1)

|

8,034,750

|

$0.96

|

4,758,924

|

|||

|

Plans

not approved by Shareholders

|

-

|

-

|

-

|

|||

|

Total

|

8,034,750

|

$0.96

|

4,758,924

|

|

(1)

|

This

includes options granted and reserved for issuance pursuant to our

1993

Stock Option Plan, 2003 Stock Option Plan, and our Alternate Compensation

Plan.

|

|

(signed)

SHANE A. ELLIS

|

|

|

July

29, 2005

|

Vice

President of Legal Affairs and

|

|

Corporate

Secretary

|

|

TSX

Guidelines

|

Comments

|

|

|

(1)

|

The

board should explicitly assume responsibility for stewardship of

the

Corporation, and as part of the overall stewardship responsibility,

should

assume responsibility for the following matters:

|

The

Board of Directors has assumed responsibility for the stewardship

of the

Corporation by overseeing the management and operations of the

business

and supervising management, which is responsible for the day-to-day

conduct of the business.

The

Board Policy Manual and the terms of reference of the Board of

Directors,

committees and individual directors set out the purpose, procedure

and

organization, and responsibilities and duties of the Board and

its

committees.

|

|

(a)

|

adoption

of a strategic planning process;

|

The

Board has assumed

responsibility for ensuring there are long-term goals and strategies

in

place for the Corporation. The Corporation’s goals and

strategies are prepared and reviewed together by management and

the Board

on an annual basis and are a primary component of the Board’s annual

agenda.

|

|

The

Board as a whole participates in discussions on corporate strategy

and,

where appropriate, approves the strategies and implementation plans

recommended by management.

|

||

|

Implementation

of the strategic plan is the responsibility of management. The

Board provides guidance but does not become involved in day-to-day

matters.

|

||

|

Management

reports to the Board on the Corporation’s progress in achieving the

strategic objectives set out in the strategic

plan.

|

||

|

TSX

Guidelines

|

Comments

|

|

|

(b)

|

the

identification of the principal risks of the Corporation’s business and

ensuring the implementation of appropriate systems to manage these

risks;

|

The

Board, through its committees and as a whole, believes that it understands

the specific risks of the Corporation’s business. The Corporate Governance

and Nominating Committee has established a review process to assign

responsibility for principal risks among the Board as a whole and

the

committees of the Board.

Management

reports to the Board or committees of the Board on a regular basis

on the

status of key risk areas.

The

Board reviews and approves the Corporation’s annual capital and operating

budgets. The Audit Committee reviews performance against

budgets on a quarterly basis.

|

|

(c)

|

succession

planning, including appointing, training and monitoring senior

management;

|

The

Human Resources and Compensation Committee periodically reviews the

Corporation’s organizational plan and structure and annually reviews the

senior executive succession plan, recommending the same to the Board

for

approval.

The

Corporation’s Human Resources and Compensation Committee, composed of

unrelated directors, monitors the performance of senior management

and

reports to the whole Board.

|

|

(d)

|

a

communications policy for the corporation; and

|

A

formal disclosure and communications policy has been developed which

includes the assignment of responsibility for disclosure to a corporate

communications team. It is intended that this team may consult with

professional advisors and/or Board members as appropriate in the

circumstances.

The

Corporation has established a policy addressing employee and insider

trading. Among other things, the policy requires that the

Corporation set trading blackouts for employees and directors in

advance

of news releases and/or in other circumstances as

appropriate.

|

|

(e)

|

the

integrity of the corporation’s internal control and management information

systems.

|

The

Board has appointed an Audit Committee composed of independent directors

that reviews compliance of financial reporting with accounting principles

and appropriate internal controls. The Audit Committee meets

quarterly with management and the external auditors to review financial

statements, internal controls and other matters. The Audit

Committee reports to the Board prior to the approval of the quarterly

and

annual financial statements.

|

|

TSX

Guidelines

|

Comments

|

|

|

(2)

|

A

majority of directors should be “unrelated” (independent of management and

free from any business or other relationship which could, or could

reasonably be perceived to, materially interfere with the director’s

ability to act with a view to the best interests of the Corporation

other

than interests and relationships arising from

shareholding).

|

The

Corporation’s Board is constituted of a majority of unrelated

directors. The only related Board member is Dr. Jim Wright, the

Corporation’s President and Chief Executive Officer. The other

Board members are unrelated. The Corporation does not have any

significant shareholders (i.e. holders of 10% or greater of the

outstanding common shares of the Corporation).

|

|

(3)

|

The

board has responsibility for applying the definition of “unrelated

director” to each individual director and for disclosing annually the

analysis of the application of the principles supporting this definition

and whether the board has a majority of unrelated

directors.

|

Dr.

Jim Wright is a related Board member, as he is the President and

Chief

Executive Officer of the Corporation. The Board has determined

that Dr. Wright will be the only director who is a related

director.

The

remainder of the present directors and nominees for election to the

Board

at the Meeting are unrelated. Additional disclosure on Board

members, with respect to their business experience and backgrounds,

can be

found in our annual information form and in our annual

report.

|

|

(4)

|

The

board should appoint a committee of directors composed exclusively

of

outside, i.e., non-management directors, a majority of whom are unrelated

directors, with the responsibility for proposing new nominees to

the board

and for assessing directors on an ongoing basis.

|

The

Corporation has established a Corporate Governance and Nominating

Committee, which as part of its mandate, has the responsibility of

recommending qualified candidates for the Board and annually reviewing

the

effectiveness of the Board and individual members of the

Board.

All

members of the Corporate Governance and Nominating Committee are

unrelated

directors.

|

|

(5)

|

The

board should implement a process to be carried out by an appropriate

committee, for assessing the effectiveness of the board as a whole,

the

committees of the board and the contribution of individual

directors.

|

The

Corporate Governance and Nominating Committee has been mandated to

ensure

that the contribution of Board members, committees of the Board and

the

Board as a whole is reviewed on an annual basis. A process is

being established which will involve questionnaires to be completed

by

individual board members. The Corporate Governance and

Nominating Committee will review the findings of the questionnaires

and

will report the results regarding the Board members and Board committees

to the Board. Additionally, the Corporate Governance and

Nominating Committee monitors the quality of the relationship between

management and the Board in order to recommend ways to improve that

relationship.

|

|

TSX

Guidelines

|

Comments

|

|

|

(6)

|

The

company, as an integral element of the process for appointing new

directors, should provide an orientation and education program for

new

directors.

|

The

Corporation is developing a director’s orientation manual containing

salient information about the Corporation including the operation

of the

Board and the committees of the Board. Additionally, the

Corporation provides new directors the opportunity to meet senior

management both prior and subsequent to joining the Board.

Most

Board meetings are held at the Corporation’s premises to give additional

insight into the business.

The

President and Chief Executive Officer, in conjunction with the Chairman

of

the Board, also periodically selects special educational or informational

topics for presentation and discussion at Board meetings, which deal

with

the business and regulatory environment in which the Corporation

operates,

and the biopharmaceutical industry generally.

|

|

(7)

|

The

board should examine its size, and, with a view to determining the

impact

upon effectiveness, undertake where appropriate, a program to reduce

the

number of directors to a number which facilitates more effective

decision-making.

|

A

Board must have enough directors to carry out its duties efficiently,

while presenting a diversity of views and independence. The

Board has considered whether the current size of the Board permits

such

diversity and allows sufficient resources to carry out the duties

of the

Board. The number of directors fixed for the coming year is

six. From time to time the Board assesses the number of

directors for Board effectiveness.

|

|

(8)

|

The

board should review the adequacy and form of compensation of directors

and

ensure the compensation realistically reflects the risks and

responsibilities involved in being an effective director.

|

It

is in the mandate of the Human Resources and Compensation Committee

to

review the appropriateness and adequacy of directors’ compensation on an

annual basis.

|

|

(9)

|

Committees

of the board should generally be composed of outside directors, a

majority

of whom are unrelated directors, although some board committees,

such as

the executive committee, may include one or more inside

directors.

|

All

Board committees are composed solely of non-management

directors.

|

|

TSX

Guidelines

|

Comments

|

|

|

(10)

|

The

board should expressly assume responsibility for, or assign to a

committee

of directors the general responsibility for, developing the company’s

approach to governance issues. The committee would, amongst

other things, be responsible for the company’s response to these

governance guidelines.

|

The

Corporate Governance and Nominating Committee is made up of two outside

directors, Graham Strachan and Donald Paterson. The committee met

fifteen

times in fiscal 2005. The committee is responsible for and makes

recommendations to the Board concerning the governance of the

Corporation. Included in the Corporate Governance and

Nominating Committee mandate is the responsibility to:

1. develop

the Corporation’s approach to corporate governance issues;

2. monitor

the application of the Corporation’s governance principles and report to

the Board on a regular basis; and

3. review

the mandates of the various Board Committees and recommend

changes.

The

committee has developed a code of ethics for the principal and senior

officers of the Corporation. Such code is aimed at creating written

standards that are reasonably designed to deter wrongdoing and to

promote:

• honest

and ethical conduct, including the ethical handling of actual or

apparent

conflicts of interest between personal and professional

relationships;

|

|

• full,

fair, accurate, timely and understandable disclosure in public

communications and in reports and documents that are filed with or

submitted to the all security regulatory authorities;

• compliance

with applicable laws, rules and regulations;

• the

prompt internal reporting of code violations to such person or persons

identified in the code; and

• accountability

for adherence to the code.

|

||

|

The

code also contains a prohibition on taking any action to fraudulently

influence, coerce, manipulate or mislead the auditors of the Corporation

and prohibit retaliation against “Whistle Blowers” (employees who provide

information or assist in a government or supervisory investigation

of the

Corporation).

|

||

|

TSX

Guidelines

|

Comments

|

|

|

(11)

|

The

board of directors, together with the CEO, should develop position

descriptions for the board and for the CEO, involving the definition

of

the limits to management’s responsibilities. The board should approve or

develop the corporate objectives, which the CEO is responsible for

meeting.

|

Position

descriptions are being developed for all senior management including

the

President and Chief Executive Officer. Mandates have been established

for

all committees of the Board. It is intended that the limits to

management’s authority, and the circumstances where Board approval is

required will be clearly defined.

The

Corporation sets and approves corporate objectives as part of its

annual

budgeting process. These objectives, together with the

Corporation’s strategic plan, comprise the principal mandate of the

President and Chief Executive Officer. The President and Chief

Executive Officer’s objectives also include the general mandate to

maximize shareholder value.

The

corporate objectives are reviewed quarterly by the Board and the

President

and Chief Executive Officer’s performance is review based on performance

against these objectives.

|

|

(12)

|

The

board should have in place appropriate structures and procedures

to ensure

that the board can function independently of management. An appropriate

structure would be to (i) appoint a Chair of the board who is not

a member

of management with responsibility to ensure that the board discharges

its

responsibilities or (ii) adopt alternate means such as assigning

this

responsibility to a committee of the board or to a director, sometimes

referred to as the “lead director”.

Appropriate

procedures may involve the board meeting on a regular basis without

management present or may involve expressly assigning responsibility

for

administering the board’s relationship to management to a committee of the

board.

|

The

Chair of the Board is not a member of management and together with

the

Corporate Governance and Nominating Committee has the responsibility

to

ensure the Board discharges its responsibilities. The Chair of

the Board maintains open communication with all directors. The

Board meets independent of management

quarterly.

|

|

TSX

Guidelines

|

Comments

|

|

|

(13)

|

The

Audit Committee should be composed only of outside directors. The

roles

and responsibilities of the Audit Committee should be specifically

defined

so as to provide appropriate guidance to Audit Committee members

as to

their duties. The Audit Committee should have direct communication

channels with the internal and the external auditors to discuss and

review

specific issues as appropriate.

|

The

Audit Committee, which is composed entirely of outside directors,

is

responsible for reviewing audit functions and financial statements,

and

reviewing and recommending for approval for release to the Board

all

public disclosure information such as financial statements, quarterly

reports, financial news releases, annual information forms, management’s

discussion and analysis and prospectuses. The Audit committee includes

a

director, J. Kevin Buchi, with financial expertise.

|

|

The

Audit Committee duties should include oversight responsibility for

management reporting on internal control. While it is management’s

responsibility to design and implement an effective system of internal

control, it is the responsibility of the Audit Committee to ensure

that

management has done so.

|

The

Audit Committee ensures that the auditor reports to the Audit

Committee on (i) all critical accounting policies, (ii) alternative

treatments of financial information that have been discussed with

management and (iii) other material written communications with

management.

The

Audit Committee also ensures that management has effective internal

control systems, and an appropriate relationship with the external

auditors and meets regularly with the external auditors, without

management present.

|

|

|

(14)

|

The

board of directors should implement a system to enable an individual

director to engage an outside advisor, at the expense of the company

in

appropriate circumstances. The engagement of the outside

advisor should be subject to the approval of an appropriate committee

of

the board.

|

Individual

directors may engage outside advisers at the Corporation’s expense, where

appropriate, with the prior approval of the Corporate Governance

and

Nominating Committee.

|

|

|

(i)

|

the

number of shares issuable to insiders, at any time, under the Plan

and all

other security-based compensation arrangements, cannot exceed 10%

of

issued and outstanding shares; and

|

|

|

(ii)

|

the

number of shares issued to insiders, within any one year period,

under the

Plan and all other security-based compensation arrangements, cannot

exceed

10% of issued and outstanding shares;

and

|

|

|

(i)

|

the

number of shares issuable to insiders, at any time, under the Plan

and all

other security-based compensation arrangements, cannot exceed 10%

of

issued and outstanding shares; and

|

|

|

(ii)

|

the

number of shares issued to insiders, within any one year period,

under the

Plan and all other security-based compensation arrangements, cannot

exceed

10% of issued and outstanding

shares.

|