|

(a)

|

in

the name of an intermediary that the non-registered holder deals

with in

respect of the shares, such as, among others, banks, trust companies,

securities dealers or brokers and trustees or administrators of

self-administered RRSPs, RRIFs, RESPs and similar plans;

or

|

|

(b)

|

in

the name of a depository (such as The Canadian Depository for Securities

Limited, or “CDS”)

of which the intermediary is a participant.

|

|

A.

|

Voting

Instruction Form. In most cases, a non-registered holder will receive,

as

part of the meeting materials, a voting instruction form. If the

non-registered holder does not wish to attend and vote at the Meeting

in

person (or have another person attend and vote on the non-registered

holder’s behalf), the voting instruction form must be completed, signed

and returned in accordance with the directions on the form. If a

non-registered holder wishes to attend and vote at the Meeting in

person

(or have another person attend and vote on the non-registered holder’s

behalf), the non-registered holder must complete, sign and return

the

voting instruction form in accordance with the directions provided

and a

form of proxy giving the right to attend and vote will be forwarded

to the

non-registered holder.

|

| or |

| B. |

Form

of Proxy. Less frequently, a non-registered holder will receive,

as part

of the meeting materials, a form of proxy that has already been signed

by

the intermediary (typically by a facsimile or stamped signature),

which is

restricted as to the number of Common Shares beneficially owned by

the

non-registered holder but which is otherwise uncompleted. If the

non-registered holder does not wish to attend and vote at the Meeting

in

person (or have another person attend and vote on the non-registered

holder’s behalf), the non-registered holder must complete the form of

proxy and deposit it with Computershare Trust Company of Canada,

100

University Avenue, 8th Floor Toronto, Canada, M5J 2Y1 as

described above. If a non-registered holder wishes to attend and

vote at

the Meeting in person (or have another person attend and vote on

the

non-registered holder’s behalf), the non-registered holder must strike out

the names of the persons named in the proxy and insert the non-registered

holder’s (or such other person’s) name in the blank space

provided.

|

|

(a)

|

completing

and signing a proxy bearing a later date and depositing it with

Computershare Trust Company of Canada as described above;

or

|

|

(b)

|

depositing

an instrument in writing executed by the shareholder or by the

shareholder’s attorney authorized in writing: (i) at our registered office

at any time up to and including the last business day preceding the

day of

the Meeting, or any adjournment of the Meeting, at which the proxy

is to

be used, or (ii) with the chair of the Meeting prior to the commencement

of the Meeting on the day of the Meeting or any adjournment of the

Meeting; or

|

|

(c)

|

in

any other manner permitted by law.

|

|

•

|

FOR

the election of directors

|

|

•

|

FOR

the appointment of

auditors

|

|

Name

Of Director,

Province/State

and

Country

of Residence

|

Position

with the Corporation and when Individual became a

Director

|

Present

Principal Occupation or Employment

|

No.

of Common Shares Beneficially Owned, Controlled or

Directed

|

|

J.

KEVIN BUCHI(1)(2)

Pennsylvania,

United States

|

Director

December

2003

|

Senior

Vice President and Chief Financial Officer, Cephalon Inc.

(biopharmaceutical

specializing

in drugs to treat and manage neurological diseases, sleep disorders,

cancer and pain)

|

50,000

|

|

DONALD

W. PATERSON(1)(3)

Ontario,

Canada

|

Director

July

1991

|

President,

Cavandale Corporation

(corporate

consulting)

|

125,260

|

|

GEORG

LUDWIG

Eschen,

Liechtenstein

|

n/a

|

Managing

Director, ConPharm Anstalt

(January

2005 to present)

(consulting

and managing company for life science funds)

Managing

Director, High Tech Private Equity (general partner of High

Tech)

(September

2000 to December 2004)

|

28,800,000(4)

|

|

MICHAEL

MOORE

Surrey,

United Kingdom

|

n/a

|

Chief

Executive Officer, Piramed Limited

(2003

to present)

(biopharmaceutical

specializing in new classes of small molecule anti-tumour

agents)

Chief

Scientific Officer and Research Director, Xenova Group plc

(1988-2003)

(biopharmaceutical

company focused on the development of novel drugs to treat cancer

and

addiction with a secondary focus in immunotherapy)

|

Nil

|

|

Name

Of Director,

Province/State

and

Country

of Residence

|

Position

with the Corporation and when Individual became a

Director

|

Present

Principal Occupation or Employment

|

No.

of Common Shares Beneficially Owned, Controlled or

Directed

|

|

ALAN

STEIGROD(2)

Florida,

United States

|

Director

May

2001

|

Managing

Director, Newport Health Care Ventures

(corporate

consulting)

|

Nil

|

|

GRAHAM

STRACHAN(1)(2)(3)(5)

Ontario,

Canada

|

Director

and Chair of the board of directors

May

2001

|

President,

GLS Business Development Inc.

(2003

- present)

(corporate

consulting)

President

and Chief Executive Officer, Allelix Biopharmaceuticals Inc.

(1996-2002)

(biopharmaceutical

specializing in development of products for the treatment of osteoporosis,

HIV and Cytomegalovirus)

|

10,000

|

|

JIM

A. WRIGHT

Ontario,

Canada

|

Director,

President and Chief Executive Officer

October

1999

|

President

and Chief Executive Officer of the Corporation

|

4,429,541

|

|

Annual

Compensation

|

Long-Term

Compensation

Awards

|

|||||

|

Name

and Principal Position

|

Fiscal

Year

|

Salary

($)

|

Bonus

($)

|

Other

Annual

Compensation

($)

|

Securities

Under

Options/

SARs

Granted

(#)(1)

|

All

Other

Compensation

($)

|

|

Dr. Jim

A. Wright

President

and Chief Executive Officer

|

2006

2005

2004

|

345,442

313,586

285,000

|

53,000

95,760

102,600

|

Nil

Nil

Nil

|

947,500

228,000

570,000

|

Nil

Nil

Nil

|

|

Dr.

Aiping Young

Chief

Operating Officer

|

2006

2005

2004

|

259,692

222,697

197,945

|

32,000

46,125

45,390

|

Nil

Nil

Nil

|

1,194,144

250,000

225,000

|

Nil

Nil

Nil

|

|

Ms.

Elizabeth Williams(2)

Director

of Finance, Acting Chief Financial Officer

|

2006

2005

2004

|

88,631

84,163

Nil

|

7,000

7,990

Nil

|

Nil

Nil

Nil

|

228,035

52,388

Nil

|

Nil

Nil

Nil

|

|

Mr.

Paul Van Damme(3)

Former

Chief Financial Officer

|

2006

2005

2004

|

110,813

152,654

Nil

|

11,000

35,030

Nil

|

Nil

Nil

Nil

|

Nil

202,500

Nil

|

74,633

37,000

Nil

|

|

Name

and

Principal

Position

|

Securities

Under

Options/SARs

Granted

(#)(1)

|

%

of Total

Options/SARs

Granted

to

Employees

in

Financial

Year

(%)

|

Exercise

or

Base

Price

($/Security)

|

Market

Value of

Securities

Underlying

Options/SARs

on the

Date

of Grant

($/Security)

|

Expiration

Date

|

|

Dr.

Jim A. Wright

President

and Chief Executive Officer

|

300,000(2)

807,500(3)

|

2.08

12.01

|

0.78

0.30

|

0.78

0.30

|

July

19, 2015

Oct.

10, 2010 to

July

19, 2015

|

|

Dr.

Aiping Young

Chief

Operating Officer

|

208,333(2)

75,000(4)

50,000

50,000

200,000(2)

610,811(3)

|

3.10

1.12

0.74

0.74

2.98

9.09

|

0.78

0.78

0.26

0.30

0.30

0.30

|

0.78

0.78

0.26

0.30

0.30

0.30

|

July

19, 2015

July

19, 2015

Nov.

30, 2015

Jan.

5, 2016

Jan.

5, 2016

Oct.

10, 2010 to

July

19, 2015

|

|

Ms.

Elizabeth Williams

Director

of Finance, Acting Chief Financial Officer

|

54,487(4)

50,000

50,000

20,000

53,548(3)

|

0.81

0.74

0.74

0.30

0.80

|

0.78

0.26

0.30

0.30

0.30

|

0.78

0.26

0.30

0.30

0.30

|

July

19, 2015

Nov.

30, 2015

Jan.

5, 2016

Jan.

5, 2016

July

20, 2014 to

July

19, 2015

|

|

Mr.

Paul Van Damme

Former

Chief Financial Officer

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

|

Name

|

Securities

Acquired

on

Exercise

(#)

|

Aggregate

Value

Realized

($)

|

Unexercised

Options/SARs

at

May

31, 2006

(#)

Exercisable/

Unexercisable

|

Value

of Unexercised

in-the-Money

Options/SARs

at

May

31, 2006 ($)

Exercisable/

Unexercisable

|

|

Dr.

Jim A. Wright

President

and Chief Executive Officer

|

Nil

|

Nil

|

2,310,000/112,500

|

38,500/1,875

|

|

Dr.

Aiping Young

Chief

Operating Officer

|

Nil

|

Nil

|

1,644,941/487,500

|

29,228/19,812

|

|

Ms.

Elizabeth Williams

Acting

Chief Financial Officer

|

Nil

|

Nil

|

39,921/241,022

|

655/10,817

|

|

Mr.

Paul Van Damme

Former

Chief Financial Officer

|

Nil

|

Nil

|

Nil

|

Nil

|

|

Plan

Category

|

#

of Common Shares to be issued upon exercise of outstanding

options

|

Weighted-average

exercise price of outstanding options

|

#

of Common Shares remaining available for future issuance under the

equity

compensation plans

|

|||

|

Plans

approved by Shareholders(1)

|

10,300,000

|

$0.70

|

7,832,390

|

|||

|

Plans

not approved by Shareholders

|

-

|

-

|

-

|

|||

|

Total

|

10,300,000

|

$0.70

|

7,832,390

|

|||

|

(1)

|

This

includes options granted and reserved for issuance pursuant to our

amended

1993 Stock Option Plan, amended 2003 Stock Option Plan and our Alternate

Compensation Plan.

|

|

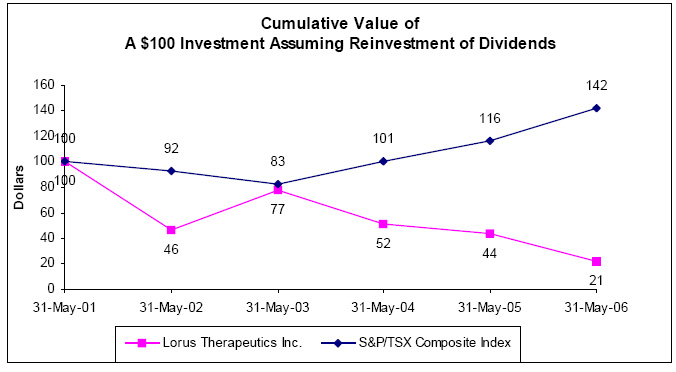

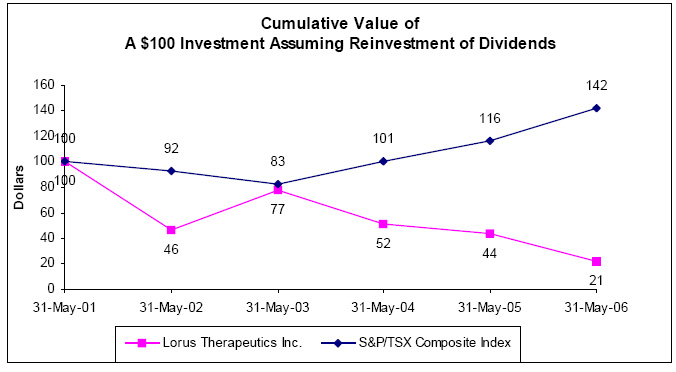

Year

End

|

2001

|

2002

|

2003

|

2004

|

2005

|

2006

|

|

LOR

|

$100

|

$46

|

$77

|

$52

|

$44

|

$21

|

|

S&P/TSX

Composite Index

|

$100

|

$92

|

$83

|

$101

|

$116

|

$142

|

|

Year

End

|

31-May-01

|

31-May-02

|

31-May-03

|

31-May-04

|

31-May-05

|

31-May-06

|

|

LOR

|

100

= $1.63

|

$0.75

|

$1.26

|

$0.84

|

$0.71

|

$0.35

|

|

S&P/TSX

Composite Index

|

100

= 8,293

|

7,656

|

6,860

|

8,347

|

9,619

|

11,744

|

|

Director

or Nominee Director

|

Independent

|

|

Jim

A. Wright

|

No

|

|

Graham

Strachan

|

Yes

|

|

J.

Kevin Buchi

|

Yes

|

|

Donald

W. Paterson

|

Yes

|

|

Alan

Steigrod

|

Yes

|

|

Michael

Moore

|

Yes

|

|

Georg

Ludwig

|

No

|

|

Board

Member

|

Reporting

Issuer

|

|

James

A. Wright

|

-

|

|

Graham

Strachan

|

Amorfix

Biotechnologies Inc.

Ibex

Technologies Inc.

|

|

J.

Kevin Buchi

|

Encysive

Pharmaceuticals

Celator

Pharmaceuticals

|

|

Donald

Paterson

|

ANGOSS

Software Corporation

NewGrowth

Inc.

Homeserve

Technologies Inc.

Utility

Corporation

|

|

Alan

Steigrod

|

Sepracor

Inc.

Poniard

Pharmaceuticals Inc.

|

|

Michael

Moore

|

-

|

|

Georg

Ludwig

|

-

|

|

Board

Member

|

Meetings

Attended

|

|

James

A. Wright

|

8

of 8

|

|

Graham

Strachan

|

8

of 8

|

|

J.

Kevin Buchi

|

8

of 8

|

|

Donald

W. Paterson

|

8

of 8

|

|

Alan

Steigrod

|

7

of 8

|

|

Elly

Reisman(1)

|

4

of 4

|

|

1.

|

The

Board will be comprised of a majority of independent directors and

will

have no more than the maximum set out in the Corporation’s articles and

by-laws, which maximum number the Board will reassess from time to

time

having consideration for the particular needs of the

Corporation.

|

|

2.

|

Appointments

to the Board will be reviewed on an annual basis. The Corporate Governance

and Nominating Committee, in consultation with the CEO, is responsible

for

identifying and recommending new nominees with appropriate skills

to the

Board.

|

|

3.

|

The

chair of the Board (the “Chair”)

will be an independent director and will be appointed by a vote of

the

Board on an annual basis.

|

|

4.

|

The

Board will report to the shareholders of the

Corporation.

|

|

1.

|

The

Board will meet as required, but at least once

quarterly.

|

|

2.

|

The

independent directors will meet as required, without the non-independent

directors and members of management, but at least once

quarterly.

|

|

3.

|

In

connection with each meeting of the Board and each meeting of a committee

of the Board of which a director is a member, each director

will:

|

|

(a)

|

review

thoroughly the materials provided to the directors in connection

with the

meeting and be adequately prepared for the meeting; and

|

|

(b)

|

attend

each meeting in person, by phone or by video-conference depending

on the

format of the meeting, to the extent

practicable.

|

|

4.

|

The

Board will:

|

|

(a)

|

adopt

a strategic planning process and approve a strategic plan each year;

and

|

|

(b)

|

approve

and monitor the operational plans and budgets of the Corporation

submitted

by management at the beginning of each fiscal

year.

|

|

(c)

|

ensure

that it has adequate opportunity and information available to it

to gain

knowledge of the business and the industry sufficient to make fully

informed decisions and to adopt meaningful and realistic long-term

and

short-term strategic objectives for the Corporation. This may include

the

opportunity for the Board to meet from time to time with industry,

medical

and scientific experts in related fields of

interest;

|

|

(d)

|

ensure

that effective policies and processes are in place relating to the

proper

conduct of the business, the effective management of risk and the

values

to be adopted by the Corporation;

and

|

|

(e)

|

ensure

that appropriate and effective environmental and occupational health

and

safety policies are in place, are operational and are supported by

adequate resources.

|

|

5.

|

The

Board will:

|

|

(a)

|

ensure

the integrity of the Corporation’s financial reporting and internal

control and disclosure policies and

processes;

|

|

(b)

|

review

the Corporation’s quarterly and year-end audited financial statements;

|

|

(c)

|

review

annual audit plans and findings and monitor the implementation of

audit

recommendations; and

|

|

(d)

|

ensure

that the Board has available to it any independent external advice

that

may be required from time to time.

|

|

6.

|

The

Board will:

|

|

(a)

|

ensure

that the business of the Corporation is conducted in compliance with

applicable laws and regulations and according to the highest ethical

standards;

|

|

(b)

|

identify

and document the financial risks and other risks that the Corporation

faces in the course of its business and ensure that such risks are

appropriately managed; and

|

|

(c)

|

adopt

a disclosure policy.

|

|

7.

|

The

Board will ensure that effective communication and disclosure policies

are

in place between the Board and the Corporation’s shareholders, other

stakeholders and the public. The Board will determine, from time

to time,

the appropriate criteria against which to evaluate performance against

shareholder expectations and will set corporate strategic goals and

objectives within this context. The Board will regularly review its

criteria for the evaluation of shareholder expectations to ensure

that

they remain relevant to changing

circumstances.

|

|

8.

|

The

Board will:

|

|

(a)

|

to

the extent feasible, satisfy itself as to the integrity of the CEO

and

other executive officers and that all such officers are creating

a culture

of integrity throughout the

Corporation;

|

|

(b)

|

ensure

that the CEO is appropriately managing the business of the

Corporation;

|

|

(c)

|

ensure

appropriate succession planning is in place (including appointing,

training and monitoring senior management), in particular with respect

to

the CEO position;

|

|

(d)

|

establish

corporate objectives for the CEO annually and evaluate the performance

of

the CEO against these corporate

objectives;

|

|

(e)

|

consider

and approve major business initiatives and corporate transactions

proposed

by management; and

|

|

(f)

|

ensure

the Corporation has internal control and management information systems

in

place.

|

|

9.

|

The

Board will:

|

|

(a)

|

ensure

that an appropriate governance structure is in place, including a

proper

delineation of roles and clear authority and accountability among

the

Board, Board committees, the CEO, the Chief Financial Officer (or

its

functional equivalent) and the Chief Operating

Officer;

|

|

(b)

|

develop

a process for the orientation and education of new members of the

Board;

|

|

(c)

|

support

continuing education opportunities for all members of the

Board;

|

|

(d)

|

in

conjunction with the Corporate Governance and Nominating Committee,

assess

the participation, contributions and effectiveness of the Chair,

and

individual Board members on an annual

basis;

|

|

(e)

|

monitor

the effectiveness of the Board and its committees and the actions

of the

Board as viewed by the individual directors and senior

management;

|

|

(f)

|

ensure

that Board meetings operate effectively, agendas are focused on the

governance role of the Board, and that the Board is able to function

independently of management when

required;

|

|

(g)

|

ensure

that effective governance policies are in place regarding the conduct

of

individual directors and employees, including but not limited to,

policies

relating to insider trading and confidentiality and conflict of

interest;

|

|

(h)

|

establish

the committees of the Board it deems necessary or as required by

applicable law to assist it in the fulfillment of its mandate;

and

|

|

(i)

|

disclose

on an annual basis the mandate, composition of the Board and its

committees.

|