UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

__________________

SCHEDULE 14A

__________________

INFORMATION REQUIRED IN PROXY

STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant | ☒ |

| Filed by a Party other than the Registrant | ☐ |

|

Check the appropriate box: |

| ☐ | Preliminary Proxy Statement | |||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ☒ | Definitive Proxy Statement | |||

| ☐ | Definitive Additional Materials | |||

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

Aptose Biosciences Inc.

(Name of Registrant as Specified in Its Charter)

_____________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ |

No fee required

| |||

| ☐ |

Fee paid previously with preliminary materials

| |||

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1)

|

Notice and Proxy Statement

For the

Annual and Special Meeting of Shareholders

to be held on May 23, 2023

April 18, 2023

Letter from Our Chairman, President, and CEO

Dear Fellow Shareholders,

During 2022, Aptose advanced its goal of developing new precision therapeutics for the treatment of patients with hematologic malignancies resistant or refractory to current standard of care therapies. While the biotech market has been, and continues to be, extraordinarily challenging, Aptose maintained a steady march forward and we were able to execute on many key initiatives:

| · | We controlled expenses and extended our cash runway to the end of Q1 2024, |

| · | We continued building a talented and commercially experienced team, |

| · | We added pharmaceutical expertise and diversity to our Board of Directors, |

| · | We updated succession planning and risk mitigation strategies for all executives, |

| · | We upgraded cybersecurity and financial analytic tools, |

| · | We created and began testing the new G3 formulation for luxeptinib, and |

| · | We made significant strides in the clinical development of tuspetinib for the treatment of acute myeloid leukemia, AML. |

The key event for 2022 was completion of a successful Phase 1/2 dose escalation and dose exploration trial of tuspetinib, formerly HM43239, a myeloid kinase inhibitor and our most advanced and primary asset being developed as a once daily oral treatment for AML. Tuspetinib potently and simultaneously suppresses the SYK kinase, the mutant and wildtype forms of FLT3 kinase, the JAK1 and JAK2 kinases, the mutant forms of KIT kinase, and RSK1 and RSK2 kinases. This kinase targeting pattern allows tuspetinib to deliver clinical responses across AML populations with a diverse array of adverse mutations while maintaining a favorable safety profile.

During the Phase 1/2 dose escalation and dose exploration clinical trial, tuspetinib delivered complete and partial remissions (CRs and PRs) and dramatically reduced bone marrow leukemic blasts across four dose levels as a single agent with no dose-limiting toxicities in heavily pre-treated relapsed or refractory (R/R) AML patients harboring a wide range of highly adverse mutations. Tuspetinib delivered meaningful clinical benefit to all responders, either through bridging them to a stem cell transplant, or by providing a durable response over time. Before enrollment in the Aptose clinical trial, these patients had been treated with the best available approved therapies, and in many cases had failed various investigational drugs and prior hematopoietic stem cell transplants. These are exceedingly sick patients, and to reverse disease progression with a once daily oral tablet is a remarkable accomplishment.

At the American Society of Hematology (ASH) meeting in December 2022, lead investigator Naval Daver, MD, Associate Professor in the Department of Leukemia, MD Anderson Cancer Center, presented data from the Phase 1/2 dose escalation and exploration trial. The findings revealed that tuspetinib can effectively treat certain genotypically-defined AML populations with high unmet need, and the data established that tuspetinib has strikingly broad activity across patients with diverse genotypic backgrounds. In addition, tuspetinib distinguished itself as a highly safe and well tolerated drug for AML with no observed drug related adverse events, deaths, QTc prolongation, or differentiation syndrome – and no myelosuppression to date. Collectively, these findings place tuspetinib in a class of its own.

The completed Phase 1/2 dose escalation and exploration monotherapy trial was essential to identify AML populations that may be pursued for registrational studies and approvals. Indeed, our understanding of the safety, efficacy, roles in AML treatment, and market potential for tuspetinib have evolved significantly. We now believe tuspetinib has paths for accelerated approvals as a monotherapy to treat specific subpopulations of R/R AML with high unmet needs, and that its superior safety profile and potency position tuspetinib as a potential drug of choice for doublet and triplet combination in earlier lines of therapy, as well as maintenance therapy. Combination therapy offers the greatest promise for deep and durable remissions in AML patients, and we believe tuspetinib is positioned to be a major player in that role.

The next step in the progression of tuspetinib is to collect sufficient data as a monotherapy and in drug combination to guide the design of registrational studies in the appropriate patient populations and to justify those trials to the key regulatory bodies. This led us to kick off the APTIVATE dose expansion trial earlier this year with tuspetinib. Throughout 2023, APTIVATE is expected to deliver up to 100 patients on study, to demonstrate single agent activity to support accelerated approval trials in patients with specific adverse mutations, and to demonstrate potent activity in combination therapies. Enrollment for APTIVATE has been brisk – we now we are enrolling and treating AML patients for tuspetinib as monotherapy and in combination treatment with venetoclax, and we look forward to delivering data from the APTIVATE trial as they become available throughout 2023.

Also during 2022, we began testing the G3 formulation of luxeptinib, our first-in-class, non-covalent and potent FLT3/BTK inhibitor, which many of you know as CG-806 or Lux. We already had reported that luxeptinib administered orally as our original first generation formulation delivered a complete remission in an AML patient and in a DLBCL lymphoma patient, demonstrating luxeptinib is a clinically active agent in different types of hematologic malignancies. In single dose administrations in patients, we determined the new G3 formulation achieved up to 18-fold greater absorption than the original G1 formulation. Because the highest dose of the original formulation was set at 900 mg, we initiated continuous dosing of G3 with an 18-fold lower dose of 50 mg. We continue to collect PK and safety data with G3 in AML patients, and a preliminary review suggests 50 mg of G3 delivers roughly equivalent plasma exposures as 900 mg of the original formulation. That was the target we hoped to achieve with 50 mg of G3, and we are now planning to administer a higher dose of G3 to determine if it can deliver even greater plasma exposure levels. I remind you that in preclinical studies of AML, luxeptinib triggered profound apoptosis and demonstrated in vivo tumor eradication. So while luxeptinib is behind tuspetinib in development, it still is an important part of our pipeline. We will keep you posted on our findings.

In addition to clinical activities, we continued to expand the capabilities of our Board of Directors. Our two most recent recruitments to the Board of Directors include Ms. Carol Ashe, a pharmaceutical legal and business development expert, and Bernd Seizinger, M.D., Ph.D., a highly accomplished senior executive with global expertise in oncology drug development, business development, management and Board experience. Our Board respectfully challenges management and each other, ensures risks are aired and mitigated, scrutinizes financial, clinical, HR and governance matters, and requires third party guidance on compensation related matters. While I serve as the CEO of the corporation and the Chairperson of the Board, all other directors and committees are independent and engage in Executive Sessions and In-Camera Sessions without the presence of management. All directors act in the best interest of the Corporation and ensure the Corporation abides by the requirements of relevant regulatory bodies.

We also are fortunate to be supported by a stellar Scientific Advisory Board, headed by distinguished hematologist Brian Druker, M.D, well-known for his role in developing Gleevec® for patients with chronic myeloid leukemia. Our scientific advisors work closely with our resident KOL and Chief Medical Officer, Rafael Bejar, M.D., Ph.D., also an internationally recognized physician scientist with extensive research and clinical experience in the area of hematologic malignancies.

From a comprehensive perspective, Aptose made significant progress in 2022 and we look forward to a 2023 that promises to be an exciting year. We are especially grateful for the patients, families and investigators who are participating in advancing our essential work and support our efforts to create superior therapeutics. I thank our entire Aptose organization and thank you, our shareholders, for your support and for being part of our journey. We are eager to report our progress to you throughout the coming year.

Sincerely,

William G. Rice, Ph.D.

Chairman, President and Chief Executive Officer

Letter from Our Lead Independent Director

Dear Fellow Shareholders:

I have had the privilege of working closely with an active and diverse group of executives and directors at Aptose over the past several years. As Lead Independent Director, my most important responsibility is to act on the behalf of all shareholders, and with my fellow directors, we take our oversight responsibilities very seriously. The Aptose Board of Directors is committed to representing your interests and believes that sound governance is key to creating long-term value for all shareholders.

On behalf of the Board, I’m pleased to provide an update on some of our priorities:

Strategic oversight

The Board not only evaluates company strategy but also shares perspectives, provides advice, and oversees and assesses management’s implementation of company objectives. Each quarter we discuss and debate topics critical to the Corporation’s long-term success and we are available to provide guidance as necessary.

Company performance

The Board remains focused on company performance and meeting clinical development goals. Aptose is committed to developing unique targeted therapies for hematological malignancies and we were pleased with the progress we made in 2022, particularly in the clinical development of our lead asset, tuspetinib, in acute myeloid leukemia, AML. The management team was able to complete a successful dose escalation and exploration trial of tuspetinib in very ill AML patients, while extending its cash runway into 2024 during challenging market conditions.

Risk oversight

We have a coordinated, comprehensive approach to overseeing the Corporation’s enterprise risk management. The Board regularly reviews strategic threats, opportunities, and key risks, including financial, product, cybersecurity, privacy, regulatory, and reputational risk. Both your Board and your management team are fully engaged in risk management and have made it a fundamental aspect of company strategy.

Talent and succession planning

Our role in talent and succession planning applies to both company leadership and the Board. We remain committed to regular Board refreshment, striving for balance between introducing new perspectives and maintaining continuity. In 2022, we added Bernd R. Seizinger, M.D., Ph.D., to the Board of Directors. An accomplished biotechnology and pharmaceutical executive leader in Europe and the U.S., Bernd brings 25 years of industry experience and oncology drug discovery expertise to Aptose. Another of our most recent directors, Carol Ashe brings notable biotech and pharmaceutical experience with a background that includes venture capital, corporate development and legal experience in mergers, acquisitions, and equity investments. Leadership on our Board committees continues to evolve; our corporate governance, Board committees and respective charters are all available to view on Aptose’s website. Our board is now composed of 7 directors, 6 of whom are independent, with broad expertise, skills, and viewpoints to help the Corporation advance and execute its strategy.

Let me close by thanking you for your continued support. We are always open to hearing from you with your questions and thoughts. On behalf of all of us on the Board of Directors, thank you for your investment in the success of Aptose.

Sincerely,

Denis R. Burger, Ph.D.

Lead Independent Director

Aptose Biosciences Inc.

Suite 120, 12770 High Bluff Drive, San Diego, California, 92130

Notice of 2023 Annual and Special Meeting of Shareholders

NOTICE IS HEREBY GIVEN that the annual and special meeting (the “Meeting”) of shareholders of Aptose Biosciences Inc. (the “Corporation”) will be held on May 23, 2023 at 9:00 a.m. (Pacific time). The Meeting will be conducted in a hybrid format. Therefore shareholders are invited to attend in person at Highlands Corporate Center - Conference Room, 12730 High Bluff Drive, Cantina Ste, San Diego, 92130 or by live webcast accessible directly online at web.lumiagm.com/472428776, where they will be able to listen, vote, and submit questions during the Meeting.

What the Meeting is About

The following items of business will be covered at the Meeting:

| 1. | receiving the financial statements of the Corporation for the fiscal year ended December 31, 2022, including the auditor’s report thereon; |

| 2. | Proposal No. 1 – electing seven directors to serve until the 2024 Annual Meeting of Shareholders; |

| 3. | Proposal No. 2 – appointing KPMG LLP as the independent registered public accounting firm of the Corporation for the fiscal year ending December 31, 2023; |

| 4. | Proposal No. 3 – passing an ordinary resolution, the full text of which is set forth in the accompanying proxy statement (the “Proxy Statement”), approving an amendment to the Corporation’s 2021 stock incentive plan to increase the number of common shares (the “Shares”) reserved for issuance thereunder by 1,027,758 Shares; |

| 5. | Proposal No. 4 – passing a special resolution, the full text of which is set forth in the Proxy Statement, approving the adoption of an amendment to the Corporation’s articles to effect a reverse stock split of the Corporation’s outstanding Shares at a ratio in the range of 1-for-10 to 1-for-20 (the “Reverse Stock Split”), such amendment to become effective at an exact ratio and a date to be determined by the board of directors of the Corporation (the “Board”) if the Board considers it to be in the best interests of the Corporation to implement such Reverse Stock Split, all as more particularly described in the Proxy Statement; |

| 6. | Proposal No. 5 – passing a resolution, the full text of which is set forth in the Proxy Statement, approving one or more adjournments of the Meeting, if necessary or appropriate, if a quorum is present, to permit further solicitation of proxies if there are not sufficient votes at the time of the Meeting to approve Proposals No. 3 and 4; |

| 7. | Proposal No. 6 – passing an advisory (non-binding) resolution on the compensation of the Corporation’s named executive officers, as more particularly described in the Proxy Statement; and |

| 8. | transacting such other business as may be properly brought before the Meeting. |

The shareholders may also consider other business that properly comes before the Meeting or any adjournment of the Meeting. The Proxy Statement provides additional information relating to the matters to be dealt with at the Meeting and forms part of this notice.

You have the right to vote.

You are entitled to receive notice of and vote at the Meeting, or any adjournment, if you are a holder of Shares at the close of business on April 3, 2023.

You have the right to vote your shares on items 2 through 7 listed above and any other items that may properly come before the Meeting or any adjournment.

The Notice of Meeting, Proxy Statement and the form of proxy will be mailed to you on or around April 26, 2023. Detailed instructions regarding shareholders’ voting process are also available on our website at https://www.aptose.com/investors/news-events/ir-calendar.

Your vote is important.

If you are not able to attend the Meeting, please exercise your right to vote by signing and returning the enclosed form of proxy to Computershare Investor Services Inc., 100 University Avenue, 8th Floor, Toronto, Canada M5J 2Y1, so as to arrive not later than 5:00 p.m. (Toronto time) on May 18, 2023 or, if the Meeting is adjourned, 48 hours (excluding Saturdays, Sundays and holidays) before any adjournment of the Meeting.

BY ORDER OF THE BOARD OF DIRECTORS

William G. Rice, Ph.D.

Chairman, President and Chief Executive Officer

April 18, 2023

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 23, 2023.

Our Notice of 2023 Annual and Special Meeting of Shareholders, Proxy Statement and Annual Report to Shareholders are available on the Corporation’s website at https://www.aptose.com/investors/news-events/ir-calendar.

Copies are also available upon written request to the Senior Vice President, Chief Financial Officer and Corporate Secretary (i) at our principal executive and registered office located at 251 Consumers Road, Suite 1105, Toronto, Ontario, Canada, M2J 4R3; or (ii) at our executive headquarters located at Suite 120, 12770 High Bluff Drive, San Diego, California, 92130.

TABLE OF CONTENTS

| GENERAL INFORMATION ABOUT THE PROXY STATEMENT | 1 |

| QUESTIONS ABOUT THE ANNUAL AND SPECIAL MEETING AND VOTING YOUR SHARES | 1 |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 12 |

| VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES | 13 |

| SHARE OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, MANAGEMENT AND DIRECTORS | 13 |

| RECEIPT OF FINANCIAL STATEMENTS | 15 |

| PROPOSAL NO. 1—ELECTION OF DIRECTORS | 15 |

| Board Recommendation | 20 |

| CORPORATE GOVERNANCE | 20 |

| Board Mandate | 21 |

| Composition and Independence of the Board | 21 |

| Board Leadership | 22 |

| Board Oversight of Risk | 22 |

| Nomination of Directors | 23 |

| Diversity | 23 |

| Director Term Limits and Other Mechanisms of Board Renewal | 25 |

| Position Descriptions | 25 |

| Orientation and Continuing Education | 25 |

| Assessments | 26 |

| Meeting Attendance | 26 |

| Executive Sessions | 27 |

| Ethical Business Conduct | 27 |

| Conflicts of Interest | 28 |

| Shareholder Communications with the Board | 28 |

| Board Committees | 28 |

| PROPOSAL NO. 2—APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 32 |

| Board Recommendation | 32 |

| Audit, Audit-Related, Tax and Other Fees | 32 |

| Pre-Approval Policies and Procedures | 32 |

| Audit Committee Report | 33 |

| PROPOSAL NO. 3—Approval of Amendment to The Corporation’s 2021 Stock Incentive Plan | 34 |

| 2021 Stock Incentive Plan Highlights, as proposed to be amended, and Certain Important Provisions | 35 |

| Summary of the 2021 Stock Incentive Plan | 36 |

| New Plan Benefits | 36 |

| U.S. Federal Income Tax Consequences | 39 |

| Canadian Federal Income Tax Consequences | 41 |

| Approval | 44 |

| Board Recommendation | 45 |

| PROPOSAL NO. 4—APPROVAL OF REVERSE STOCK SPLIT | 46 |

| Effects of the Reverse Stock Split | 47 |

| Accounting Consequences | 49 |

| Interests of Directors and Executive Officers | 49 |

| Certain U.S. Federal Income Tax Consequences of the Reverse Stock Split | 49 |

| Certain Canadian Federal Income Tax Consequences of the Reverse Stock Split | 51 |

| Certain Risks Associated with the Reverse Stock Split | 52 |

| Approval | 53 |

| Board Recommendation | 54 |

| PROPOSAL NO. 5—APPROVAL TO ADJOURN THE MEETING, IF NECESSARY, TO SOLICIT ADDITIONAL PROXIES | 55 |

| Approval | 55 |

| Board Recommendation | 55 |

| PROPOSAL NO. 6—Advisory (non-binding) vote on the compensation of our named executive officers | 56 |

| Board Recommendation | 57 |

| EXECUTIVE COMPENSATION | 58 |

| Information About Our Executive Officers | 58 |

| Compensation Philosophy | 59 |

| Independent Advice | 59 |

| Comparator Group | 60 |

| Summary Compensation Table | 64 |

| Outstanding Equity Awards at Fiscal Year-End | 66 |

| Retirement Benefits | 67 |

| Termination and Change of Control Benefits | 67 |

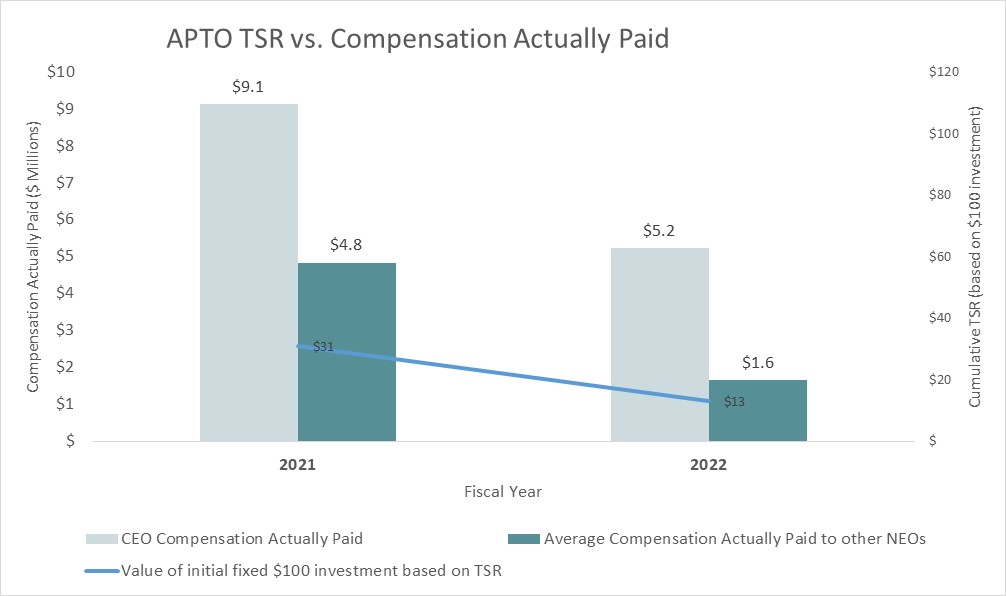

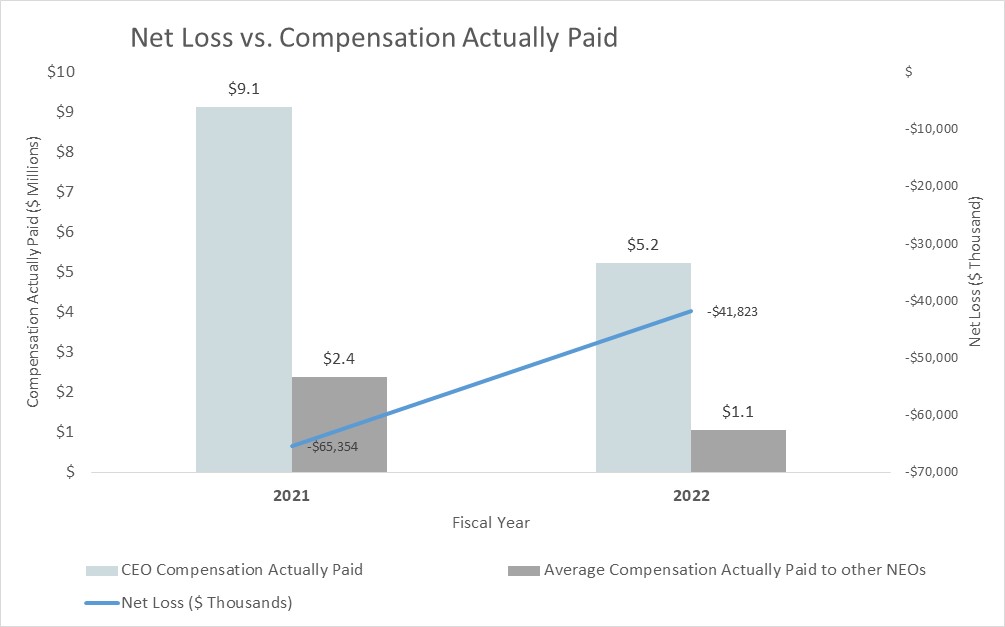

| Pay versus Performance | 68 |

| Pay versus Performance Table | 68 |

| DIRECTOR COMPENSATION | 70 |

| Overview | 70 |

| Cash Compensation | 70 |

| Option Awards | 71 |

| EQUITY COMPENSATION PLAN INFORMATION | 73 |

| General | 73 |

| 2021 Stock Incentive Plan | 73 |

| Share Option Plan | 73 |

| Employee Share Purchase Plan | 74 |

| ESPP Highlights | 74 |

| ESPP Benefits | 75 |

| Summary of Material Provisions of the ESPP | 75 |

| Equity Compensation Plan Information | 77 |

| Annual Burn Rate | 77 |

| INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON | 78 |

| INTEREST OF RELATED PERSONS IN TRANSACTIONS | 78 |

| DELINQUENT section 16(A) REPORTS | 78 |

| Householding of Annual Proxy Materials | 79 |

| INDEBTEDNESS | 79 |

| DIRECTORS AND OFFICERS’ LIABILITY | 79 |

| MANAGEMENT CONTRACTS | 79 |

| ADDITIONAL INFORMATION | 79 |

| DIRECTORS’ APPROVAL | 80 |

GENERAL INFORMATION ABOUT THE PROXY STATEMENT

The information contained in this proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies by Aptose Biosciences Inc. (the “Corporation”, “Aptose”, “we” or “our”) to be used at the annual and special meeting (the “Meeting”) of holders (the “Shareholders”) of common shares (the “Shares”) of the Corporation to be held on May 23, 2023 at 9:00 a.m. (Pacific time) and at all adjournments thereof, for the purposes set forth in the accompanying notice of meeting (the “Notice of Meeting”). The Meeting will be held at Highlands Corporate Center - Conference Room, 12730 High Bluff Drive, Cantina Ste, San Diego, 92130 as well as online at web.lumiagm.com/472428776, where Shareholders will be able to listen, vote and submit questions during the Meeting.

The information contained in this Proxy Statement is given as at April 3, 2023 except where otherwise noted. All references to “dollar” or the use of the symbol “$” are to United States dollars and use of the symbol “CA$” refers to Canadian dollars, unless otherwise indicated.

QUESTIONS ABOUT THE ANNUAL

AND SPECIAL MEETING

AND VOTING YOUR SHARES

What are the date, time and place of the Meeting?

The Meeting will be held on May 23, 2023 at 9:00 a.m. (Pacific time). The Meeting will be held in person at Highlands Corporate Center - Conference Room, 12730 High Bluff Drive, Cantina Ste, San Diego, 92130 as well as online at web.lumiagm.com/472428776. The online Meeting will be accessible 15 minutes before the start time.

How can I access the Meeting virtually?

To participate in the Meeting virtually, visit web.lumiagm.com/472428776. Registered Shareholders and duly appointed and registered proxyholders will be able to listen, vote and ask questions via the virtual meeting platform. It is to be noted, however, that questions cannot be submitted prior to the Meeting. Non-registered Shareholders who have not appointed themselves as proxyholders will only be able to attend the online Meeting as “Guests” and will not be able to vote or ask questions at the Meeting. To access the Meeting virtually, registered Shareholders and duly appointed proxyholders will need an Internet connection and an Internet-connected device (such as a desktop, laptop, tablet or cell phone) running the most updated version of applicable software and plugins. The virtual meeting platform is fully supported across browsers (Microsoft Edge, Chrome, Firefox and Safari). Participants in the online Meeting must be connected to Internet at all times during the Meeting in order to vote when balloting commences. A summary of the information Shareholders will need to attend the Meeting virtually is provided below:

1. Registered Shareholders and duly appointed proxyholders can participate in the Meeting virtually by clicking “I have a login” and entering a Username and Password before the start of the Meeting.

| a. | Registered Shareholders – The 15-digit control number located on the form of proxy or in the email notification you received is the Username and the Password is “aptose2023”. |

| b. | Duly appointed proxyholders – Following the registration of the proxyholder with Computershare Investor Services Inc. (“Computershare”), Computershare will provide the proxyholder with a Username after the voting deadline has passed. The Password to the online Meeting is “aptose2023”. |

2. Voting at the Meeting will only be available for registered Shareholders and duly appointed and registered proxyholders. Non-registered Shareholders who have not appointed themselves may attend the Meeting virtually by clicking “I am a guest” and completing the online form. This will allow them to listen to the online Meeting; however, they will not be able to vote or submit questions.

3. Registered Shareholders who use a 15-digit control number to login to the online Meeting and who accept the terms and conditions will be revoking any and all previously submitted proxies. However, in such a case, registered Shareholders will be provided the opportunity to vote by ballot on the matters put forth at the Meeting. If registered Shareholders do not wish to revoke all previously submitted proxies, they should not accept the terms and conditions, in which case they can only enter the online Meeting as a guest.

If you attend the Meeting virtually, it is important that you remain connected to the internet at all times during the online Meeting in order to vote when balloting commences. It is your responsibility to ensure connectivity for the duration of the Meeting. You will be able to access the online Meeting 15 minutes before the start time and should allow ample time for online check-in, which will begin at 8:45 a.m. (Pacific time) on May 23, 2023.

Why is the Meeting held in hybrid format?

By conducting our Meeting in person as well as online, the Board aims to provide Shareholders with the option to choose to attend the Meeting in person if their circumstances allow it but also with an effective way to participate in the Meeting if they cannot attend in person.

The format of the Meeting has been designed to ensure that Shareholders who attend the Meeting online will be afforded the same rights and opportunities to participate as the Shareholders who attend in person.

Can I submit questions prior or at the Meeting?

Registered Shareholders and duly appointed and registered proxyholders can ask questions during the online Meeting via the virtual meeting platform. Registered Shareholders attending the Meeting in person will also have the opportunity to ask questions. It is to be noted, however, that questions cannot be submitted prior to the Meeting. Questions pertinent to the Meeting matters will be answered at a designated time during the Meeting, subject to time constraints. The chair of the Meeting reserves the right to edit or reject questions it deems irrelevant to meeting matters, profane or inappropriate.

The chair of the Meeting has broad authority to conduct the Meeting in an orderly manner. To ensure the Meeting is conducted in a manner that is fair to all Shareholders, the chair of the Meeting may exercise its discretion in recognizing Shareholders who wish to participate, in determining the order in which questions are answered, and the amount of time devoted to each question. However, consistent with prior annual shareholders’ meetings, questions submitted in accordance with the rules of conduct generally will be addressed in the order received during the allotted time for questions.

Who can vote at the Meeting?

Only Shareholders as of the close of business on the record date, being April 3, 2023, are entitled to receive notice of and vote on matters to be presented at the Meeting, or any adjournment or postponement thereof, in the manner and subject to the procedures described in this Proxy Statement and the accompanying form of proxy.

| 2 |

At the close of business on the record date, 93,005,278 Shares were issued and outstanding.

Each Shareholder is entitled to one vote per Share held on all matters to come before the Meeting. Shares of Aptose are the only securities of Aptose which will have voting rights at the Meeting.

What is the quorum for the Meeting?

The presence at the opening of the Meeting of two persons who are entitled to vote either as Shareholders or as proxyholders and holding or representing not less than 33⅓% of the outstanding Shares entitled to vote at the Meeting as of the record date will constitute a quorum for the transaction of business at the Meeting. In general, Shares represented by a properly signed and returned form of proxy, or properly voted by Internet or telephone, or voted by your broker will be counted as Shares present and entitled to vote at the Meeting for purposes of determining a quorum. Shares represented by proxies marked “Abstain” and “broker non-votes” are also counted in determining whether a quorum is present.

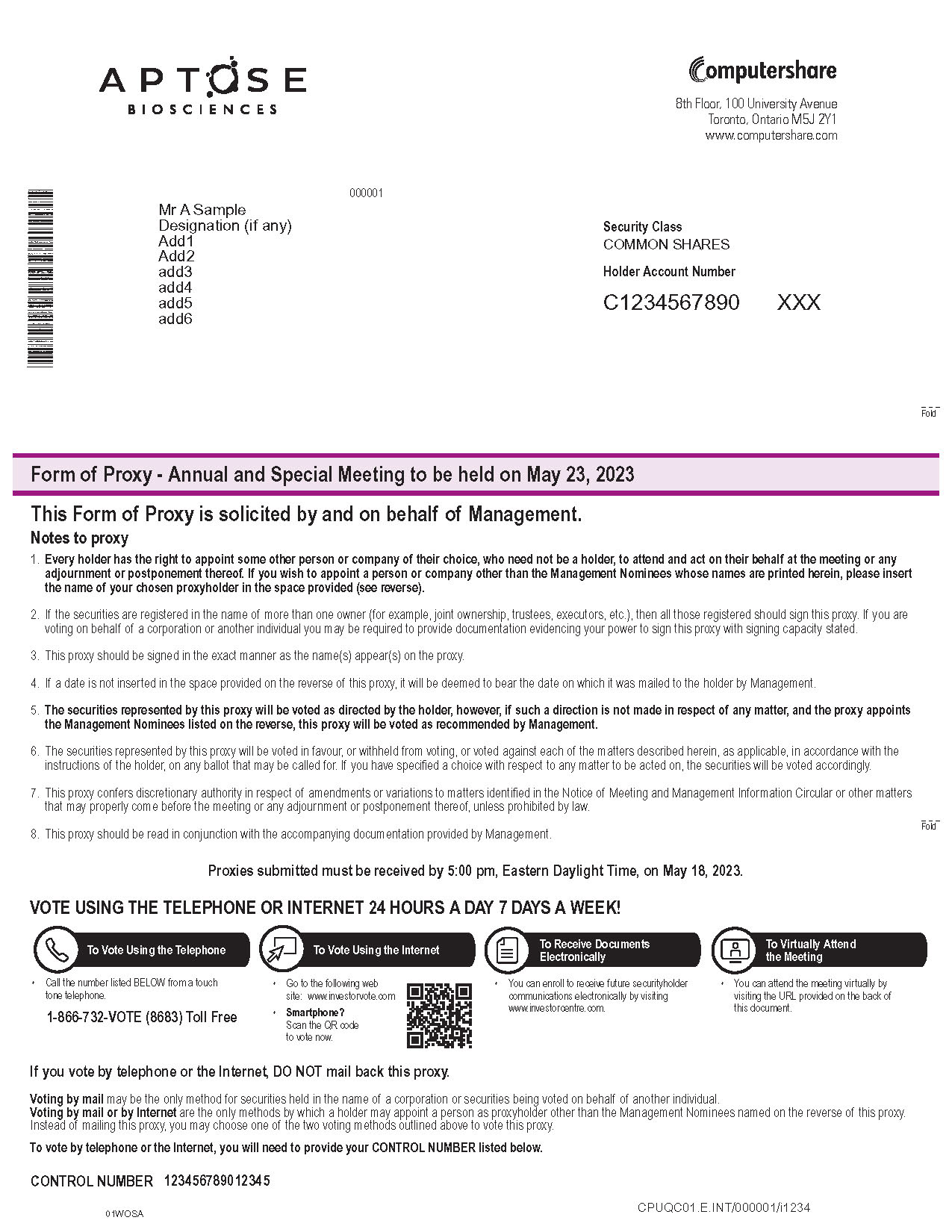

What does it mean to vote by proxy?

Voting by proxy means that you are giving the person or people named on your form of proxy (the “proxyholder”) the authority to vote your Shares for you at the Meeting or any adjournment. A form of proxy is included with this Proxy Statement.

The management representatives named on the form of proxy will vote your Shares for you, unless you appoint someone else to be your proxyholder. You have the right to appoint a person to represent you at the Meeting other than the persons named on the form of proxy. If you appoint someone else, he or she must be present at the Meeting to vote your Shares. If you want to appoint someone else, you can insert that person’s name in the blank space provided in the form of proxy. That other person does not need to be a Shareholder of the Corporation.

If you are voting your Shares by proxy, our transfer agent, Computershare, must receive your completed form of proxy by 5:00 p.m. (Toronto time) on May 18, 2023 or, if the Meeting is adjourned, 48 hours (excluding Saturdays, Sundays and holidays) before any adjournment of the Meeting.

What’s the difference between registered and non-registered (beneficial) Shareholders?

The voting process is different depending on whether you are a registered or non-registered (beneficial) Shareholder:

Registered Shareholders

You are a registered Shareholder if your name appears on your Share certificate or in the registers of the Corporation maintained by Computershare. Your form of proxy tells you whether you are a registered Shareholder. We mail copies of the Notice of Meeting, this Proxy Statement and the form of proxy (collectively, the “proxy materials”) directly to registered Shareholders. We have previously mailed our annual report to all registered Shareholders.

| 3 |

Non-Registered (or Beneficial) Shareholders

You are a non-registered (or beneficial) Shareholder if your bank, trust company, securities broker or other financial institution holds your Shares for you (as your nominee). For most of you, your voting instruction form or proxy tells you whether you are a non-registered (or beneficial) Shareholder.

In accordance with Canadian securities law and SEC rules, we have distributed copies of the proxy materials and the annual report to CDS Clearing and Depository Services Inc. and intermediaries (such as securities brokers or financial institutions) for onward distribution to those non-registered or beneficial Shareholders to whom we have not sent the proxy materials and the annual report directly.

The intermediaries are required to forward proxy materials and the annual report to non-registered or beneficial Shareholders unless a non-registered or beneficial Shareholder has waived the right to receive them. Very often, intermediaries will use a service company such as Broadridge Investor Communication Solutions to forward the proxy materials to non-registered or beneficial Shareholders.

How do I vote?

Most non-registered or beneficial Shareholders who have not waived the right to receive proxy materials will receive a voting instruction form (“VIF”). Registered Shareholders will, and some non-registered (beneficial) Shareholders may receive a form of proxy. Shareholders should follow the additional procedures set out below, depending on what type of form they receive. Detailed instructions regarding Shareholders’ voting process are also available on the Investors page of our website at https://www.aptose.com/investors/news-events/ir-calendar.

| 1. | Voting Instruction Form. If the non-registered Shareholder does not wish to attend and vote at the Meeting (or have another person attend and vote on the non-registered Shareholder’s behalf), the voting instruction form must be completed, signed and returned in accordance with the directions on the form, so that the intermediary may vote on the non-registered Shareholder’s behalf. |

If a non-registered Shareholder wishes to attend and vote at the Meeting (or have another person attend and vote on the non-registered Shareholder’s behalf), the non-registered Shareholder must complete, sign and return the VIF in accordance with the directions provided. If the non-registered Shareholder wishes to attend and vote at the Meeting, they must appoint themselves as proxyholder. Otherwise, the non-registered Shareholder will only be able to attend the Meeting as a “Guest”, and will not be able to vote or ask questions at the Meeting. Non-registered Shareholders should visit our website at https://www.aptose.com/investors/news-events/ir-calendar to obtain additional instructions on how to vote online during the Meeting.

Non-registered Shareholders who wish to appoint themselves as a proxy holder in order to attend the Meeting virtually or who wish to appoint a proxyholder other than a management representative to represent them at the online Meeting must submit their VIF prior to registering themselves or their proxyholder, as applicable. Registering themselves or the proxyholder, as applicable, is an additional step once a non-registered Shareholder has submitted their VIF. Failure to register themselves or another person other than a management representative as duly appointed proxyholder will result in the non-registered Shareholder or the proxyholder not receiving a Username to participate in the Meeting. To register a proxyholder (be it themselves or another person other than a management representative), non-registered Shareholders must visit https://www.computershare.com/aptose by 5:00 p.m. (Toronto time) on May 18, 2023 or, if the Meeting is adjourned, 48 hours (excluding Saturdays, Sundays and holidays) before any adjournment of the Meeting, and provide Computershare with their information or their proxyholder’s contact information, as applicable, so that Computershare may provide them or the proxyholder, as applicable, with a Username via email. Without a Username, non-registered Shareholders who appointed themselves as proxyholders and proxyholders will only be able to attend the Meeting as “Guests” and will not be able to vote or ask questions at the Meeting.

| 4 |

Or

| 2. | Form of Proxy. A registered Shareholder will receive a form of proxy to be completed, signed and returned in accordance with the directions on the form, if the registered Shareholder does not wish to attend and vote at the Meeting virtually (or have another person attend and vote on the registered Shareholder’s behalf). |

Registered Shareholders who wish to appoint a proxyholder other than a management representative to represent them at the online Meeting must submit their form of proxy prior to registering their proxyholder. Registering the proxyholder is an additional step once a registered Shareholder has submitted their proxy. Failure to register a duly appointed proxyholder will result in the proxyholder not receiving a Username to participate in the Meeting. To register a proxyholder, registered Shareholders must visit https://www.computershare.com/aptose by 5:00 p.m. (Toronto time) on May 18, 2023 or, if the Meeting is adjourned, 48 hours (excluding Saturdays, Sundays and holidays) before any adjournment of the Meeting, and provide Computershare with their proxyholder’s contact information, so that Computershare may provide the proxyholder with a Username via email. Without a Username, proxyholders will only be able to attend the Meeting as “Guests” and will not be able to vote or ask questions at the Meeting.

Registered Shareholders may also attend and vote at the Meeting. Registered Shareholders wishing to attend the Meeting virtually should visit our website at https://www.aptose.com/investors/news-events/ir-calendar to obtain additional instructions on how to vote online during the Meeting. The 15-digit control number provided on the registered Shareholder’s form of proxy will be required.

Less frequently, a non-registered Shareholder will receive, as part of the proxy materials, a form of proxy that has already been signed by the intermediary (typically by a facsimile or stamped signature), which is restricted as to the number of Shares beneficially owned by the non-registered Shareholder, but which is otherwise uncompleted. If the non-registered Shareholder does not wish to attend and vote at the Meeting (or have another person attend and vote on the non-registered Shareholder’s behalf), the non-registered Shareholder must complete the form of proxy and deposit it with Computershare, 100 University Avenue, 8th Floor, Toronto, Canada, M5J 2Y1 as described above.

If a non-registered Shareholder wishes to attend and vote at the Meeting (or have another person attend and vote on the non-registered Shareholder’s behalf), the non-registered Shareholder must strike out the names of the persons named in the proxy and if they intend to participate in the Meeting virtually, insert the non-registered Shareholder’s (or such other person’s) name in the blank space provided. The non-registered Shareholder must then register themselves or the other person, as applicable, as proxyholder. Registering themselves or the other person, as applicable, is an additional step once a non-registered Shareholder has submitted their completed form of proxy. Failure to register themselves or the other person, as applicable, as duly appointed proxyholder will result in the non-registered Shareholder or the proxyholder, as applicable, not receiving a Username to participate in the online Meeting. To register a proxyholder (be it themselves or another person), non-registered Shareholders must visit https://www.computershare.com/aptose by 5:00 p.m. (Toronto time) on May 18, 2023 or, if the Meeting is adjourned, 48 hours (excluding Saturdays, Sundays and holidays) before any adjournment of the Meeting, and provide Computershare with their information or their proxyholder’s contact information, as applicable, so that Computershare may provide them or the proxyholder, as applicable, with a Username via email. Without a Username, non-registered Shareholders who appointed themselves as proxyholders and proxyholders will only be able to attend the Meeting as “Guests” and will not be able to vote or ask questions at the Meeting.

| 5 |

| 3. | United States non-registered (beneficial) Shareholders. If a non-registered Shareholder in the United States wishes to attend and vote at the online Meeting, they must first obtain a valid legal proxy from their broker, bank or other agent and then register in advance to attend the Meeting. The U.S. non-registered Shareholder should follow the instructions from their broker or bank included with these proxy materials, or contact their broker or bank to request a legal form of proxy. After first obtaining a valid legal proxy from their broker, bank or other agent, the U.S. non-registered Shareholder must then register to attend the online Meeting by submitting a copy of their legal proxy to Computershare. Requests for registration should be directed to: |

Computershare

100 University Avenue

8th Floor

Toronto, Ontario

M5J 2Y1

OR

Email at: uslegalproxy@computershare.com

Requests for registration must be labelled as “Legal Proxy” and be received no later than by 5:00 p.m. (Toronto time) on May 18, 2023. U.S. non-registered Shareholders will receive a confirmation of their registration by email receipt of their registration materials by Computershare. U.S. non-registered Shareholders will then be able to attend the Meeting and vote and ask questions at web.lumiagm.com/472428776. U.S. non-registered Shareholders are required to register their appointment at www.computershare.com/appointee. If U.S. non-registered Shareholders do not follow the procedures set out above, they will only be able to attend the Meeting virtually as “Guests” and will not be able to vote or ask questions at the online Meeting.

Shareholders should follow the instructions on the forms they receive, and non-registered Shareholders should contact their intermediaries promptly if they need assistance.

How do I request a copy of proxy materials?

To request a printed copy of the proxy materials, please contact your broker, if you are a non-registered Shareholder, or if you are a registered Shareholder, contact our Senior Vice President, Chief Financial Officer and Corporate Secretary at Aptose Biosciences Inc., Suite 120, 12770 High Bluff Drive, San Diego, California, telephone: 858-926-2730.

The proxy materials are being sent or made available to both registered and non-registered owners of Shares. The Corporation is sending proxy materials indirectly to non-objecting beneficial owners (as defined in National Instrument 54-101 - Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”)). The Corporation intends to pay for intermediaries to forward to objecting beneficial owners (as defined in NI 54-101) the proxy materials.

| 6 |

What am I voting on at the Meeting?

The following items of business will be covered at the Meeting:

| 1. | receiving the financial statements of the Corporation for the fiscal year ended December 31, 2022, including the auditor’s report thereon; |

| 2. | Proposal No. 1 – electing seven directors to serve until the 2024 Annual Meeting of Shareholders; |

| 3. | Proposal No. 2 – appointing KPMG LLP as the independent registered public accounting firm of the Corporation for the fiscal year ending December 31, 2023; |

| 4. | Proposal No. 3 – passing an ordinary resolution approving an amendment to the Corporation’s 2021 stock incentive plan to increase the number of Shares reserved for issuance thereunder by 1,027,758 Shares; |

| 5. | Proposal No. 4 - passing a special resolution approving the adoption of an amendment to the Corporation’s articles to effect a reverse stock split of the Corporation’s outstanding Shares at a ratio in the range of 1-for-10 to 1-for-20 (the “Reverse Stock Split”), such amendment to become effective at an exact ratio and a date to be determined by the board of directors of the Corporation (the “Board”) when the Board considers it to be in the best interests of the Corporation to implement such Reverse Stock Split, all as more particularly described in the Proxy Statement; |

| 6. | Proposal No. 5 - Passing a resolution, the full text of which is set forth in the Proxy Statement, approving one or more adjournments of the Meeting, if necessary or appropriate, if a quorum is present, to permit further solicitation of proxies if there are not sufficient votes at the time of the Meeting to approve Proposals No. 3 and 4; |

| 7. | Proposal No. 6 – passing an advisory (non-binding) resolution on the compensation of the Corporation’s named executive officers; and |

| 8. | transacting such other business as may be properly brought before the Meeting. |

As of the date of this Proxy Statement, the Board is not aware of any such other business.

How does the Board recommend that I vote?

Our Board recommends that each Shareholder vote “FOR” each of Proposals No. 1 through No. 6.

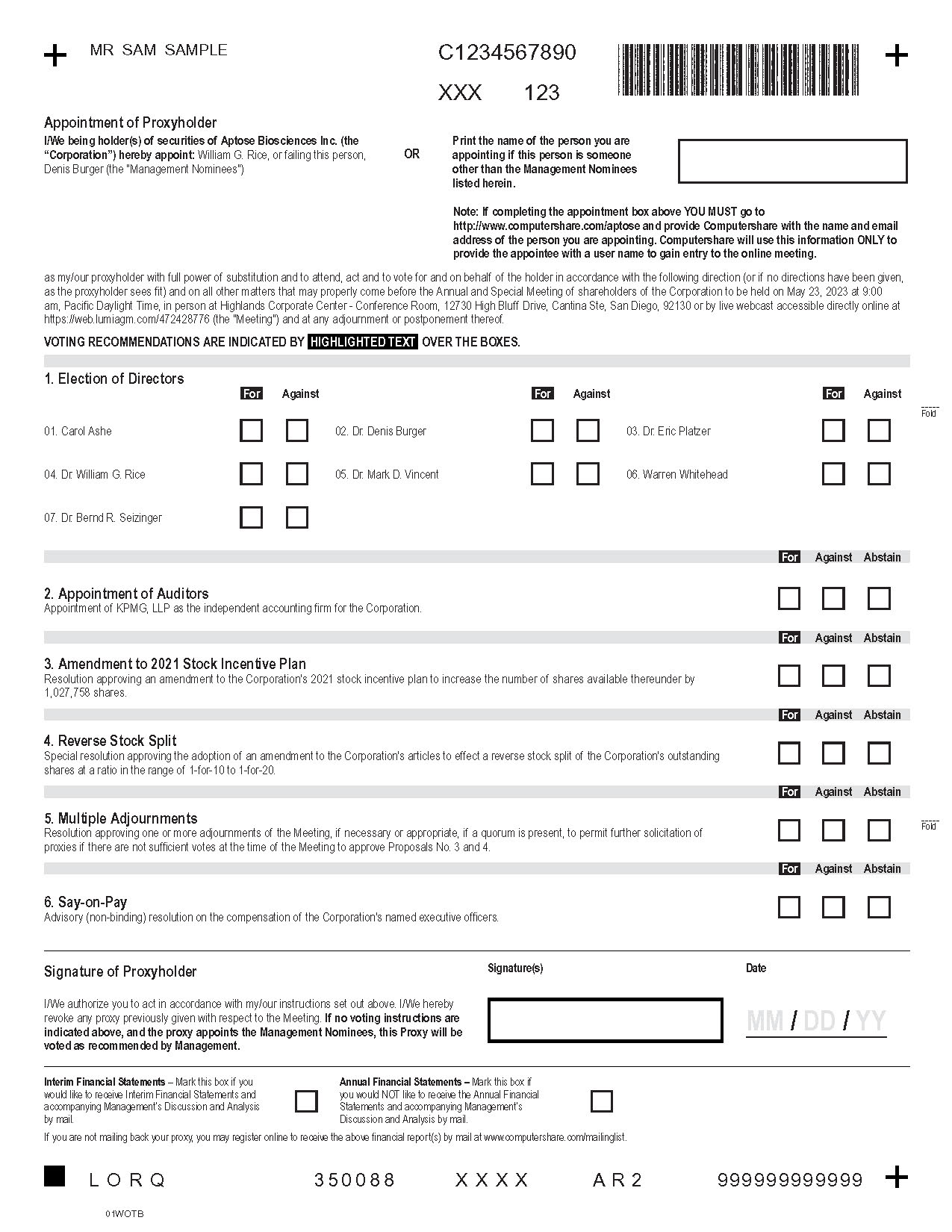

What votes may I cast with regard to each proposal?

You can choose to vote “For”, “Against” or “Abstain”, for Proposals No. 1s through No. 6. The Shares represented by the form of proxy will be voted in accordance with the instructions of the Shareholder on any ballot that may be called for and, if the Shareholder specifies a choice with respect to any matter to be acted upon, the Shares will be voted accordingly.

If you return your form of proxy and do not tell us how you want to vote your Shares, your Shares will be voted in accordance with Board recommendations for each proposal by the management representatives named in the form of proxy.

The enclosed form of proxy confers discretionary authority upon the management representatives designated in the form of proxy with respect to amendments to or variations of matters identified in the Notice of Meeting and with respect to other matters that may properly come before the Meeting. At the date of this Proxy Statement, management of the Corporation knows of no such amendments, variations or other matters.

| 7 |

What vote is required in order to approve each proposal?

| • | Proposal No. 1: Pursuant to recent changes to the Canada Business Corporations Act (“CBCA”), there is a statutory voting requirement for uncontested directors elections whereby Shareholders are allowed to vote “for” or “against” (as opposed to “for” and “withhold”) nominees for the Board. If a nominee does not receive a majority of the votes cast for their election, the nominee will not be elected and the Board position will remain open or, if in the case of incumbent directors, such director may continue in office until the earlier of (i) the 90th day after the election, or (ii) the day on which his or her successor is appointed or elected. Abstentions and broker non-votes will not be included in the total votes cast and will not affect the results. |

| • | Proposal No. 2: The appointment of KPMG LLP as our independent registered public accounting firm requires a majority of the votes cast at the Meeting, and votes cast only include those votes cast “For” or “Against” the proposal. |

| • | Proposal No. 3: The approval of the amendment to the Corporation’s 2021 stock incentive plan requires a majority of the votes cast at the Meeting, and votes cast only include those votes cast “For” or “Against” the proposal. Abstentions and broker non-votes will not be included in the total votes cast and will not affect the results. |

| • | Proposal No. 4: The approval of the Reverse Stock Split requires the approval of a majority of not less than two-thirds (2/3) of the votes cast by Shareholders present in person or by proxy at the Meeting, and votes cast only include those votes cast “For” or “Against” the proposal. Abstentions and broker non-votes will not be included in the total votes cast and will not affect the results. |

| • | Proposal No. 5: The approval of one or more adjournments of the Meeting requires a majority of the votes cast at the Meeting, and votes cast only include those votes cast “For” or “Against” the proposal. Abstentions and broker non-votes will not be included in the total votes cast and will not affect the results. |

| • | Proposal No. 6: The approval of the advisory (non-binding) resolution on the compensation of the Corporation’s named executive officers requires a majority of the votes cast at the Meeting, and votes cast only include those votes cast “For” or “Against” the proposal. Abstentions and broker non-votes will not be included in the total votes cast and will not affect the results. |

What impact does an “Abstain” vote have?

If you select “Abstain,” your vote will have no effect on the votes cast for the purposes of approving each proposal.

What is the effect if I do not cast my vote?

If, as a registered Shareholder, you do not cast your vote at the Meeting or by proxy, no votes will be cast on your behalf on any of the proposals.

If you are a U.S. beneficial Shareholder with an intermediary, you must instruct your U.S. intermediary how to vote your shares. If, as a U.S. non-registered or beneficial Shareholder, you do not instruct your intermediary on how to vote on any of the proposals at the Meeting, we believe that the intermediary has discretionary authority to vote your shares on Proposals No. 2 and No. 4, but the intermediary does not have discretionary authority to vote your shares on Proposal No. 1, Proposals No. , No. 5 and No. 6 or any unusual item, so a “broker non-vote” will be recorded with respect to such item. Broker non-votes will be treated as not entitled to vote on any such matter and will not be counted as having been voted in respect of any such matter. Shares represented by such broker “non-votes” will, however, be counted in determining whether there is a quorum for the Meeting.

| 8 |

How do I change my vote?

A registered Shareholder who has given a proxy may revoke that proxy and change a vote by:

| (a) | completing and signing a proxy bearing a later date and depositing it with Computershare as described above; |

| (b) | depositing an instrument in writing executed by the Shareholder or by the Shareholder’s attorney authorized in writing at our registered office located at 251 Consumers Road, Suite 1105, Toronto, Ontario, Canada, M2J 4R3 at any time before 5:00 p.m. (Toronto time) on May 19, 2023, or on the last business day before any adjournment of the Meeting at which the proxy is to be used; |

| (c) | using your 15-digit control number and voting online at the Meeting; or |

| (d) | in any other manner permitted by law. |

A non-registered or beneficial Shareholder may revoke a voting instruction form or a waiver of the right to receive proxy materials and to vote given to an intermediary or to the Corporation, as the case may be, at any time by written notice to the intermediary or the Corporation, except that neither an intermediary nor the Corporation is required to act on a revocation of a voting instruction form or on a waiver of the right to receive materials and to vote that is not received by such intermediary or the Corporation, at least seven days prior to the Meeting.

What does it mean if I receive more than one set of proxy materials?

This means that you own Shares that are registered under different accounts. For example, you may own some Shares directly as a registered Shareholder and other Shares as a non-registered beneficial Shareholder through an intermediary, or you may own Shares through more than one such organization. In these situations, you will receive multiple sets of proxy materials. It is necessary for you to complete and return all forms of proxy and VIFs in order to vote all of the Shares you own. Please make sure you return each form of proxy or VIF in the accompanying return envelope. You may also vote by Internet, telephone, facsimile or email, as applicable, by following the instructions on your proxy materials.

Who is soliciting the proxies, how will proxies be solicited and who will pay the cost of the proxy solicitation?

Aptose is soliciting proxies to be used at the Meeting. The solicitation of proxies will be primarily by mail, but Aptose’s directors, officers and regular employees may also solicit proxies personally or by telephone. Aptose will bear all costs of the solicitation, including the printing, handling and mailing of the Meeting materials. Aptose has arranged for intermediaries to forward the Meeting materials to non-registered or beneficial Shareholders of record, and Aptose may reimburse the intermediaries for their reasonable fees and disbursements in that regard.

In addition, we have engaged Morrow Sodali LLC to help us solicit proxies from Shareholders for a fee of $12,500 plus reimbursement for out-of-pocket expenses.

| 9 |

How can I make a Shareholder proposal for the 2024 Annual General Meeting of Shareholders?

For a proposal to be valid, it must comply with the requirements if the CBCA, as well as those of the Securities Exchange Act of 1934 (United States) (the “Exchange Act”).

In order for a Shareholder proposal to be eligible for inclusion in the Proxy Statement under the Exchange Act, the Shareholder must submit the proposal in accordance with Rule 14a-8, by no later than December 28, 2023, and the Shareholder must follow the procedures of Rule 14a-8 including having continuously held at least US$2,000 in market value of the Shares entitled to be voted on the proposal at the Meeting, for at least three years; at least US$15,000 in market value of the Shares entitled to vote on the proposal for at least two years; at least US$25,000 in market value of the Shares entitled to vote on the proposal for at least one year by the date the Shareholder submits the proposal. The Shareholder must continue to hold those Shares through the date of the Meeting. A shareholder proposal submitted pursuant to the rules of the SEC under the Exchange Act must be received at our principal executive office at 251 Consumers Road, Suite 1105, Toronto, ON M2J 4R3 by December 28, 2023 and must comply with the requirements of Rule 14a-8 of the Exchange Act.

Shareholders who do not wish to use the mechanism provided by the Exchange Act may submit proposals to be considered at the 2024 annual general meeting of Shareholders under the provisions of the CBCA. In order for a Shareholder proposal to be eligible under the CBCA, it must be in writing, accompanied by the requisite declarations and signed by the submitter and qualified Shareholders who at the time of signing are the registered or beneficial owners of Shares that, in the aggregate: (a) constitute at least 1% of our issued Shares that have the right to vote at general meetings; or (b) have a fair market value in excess of CA$2,000. For the submitter or a qualified Shareholder to be eligible to sign the proposal, that Shareholder must have been the registered or beneficial owner of our Shares that carry the right to vote at general meetings for an uninterrupted period of at least six months before the date the proposal is submitted. To be considered for inclusion in the proxy materials for the 2024 annual general meeting of Shareholders, any such Shareholder proposal under the CBCA must be received by Aptose by no later than February 23, 2024.

A Shareholder wishing to nominate an individual to be a director, other than pursuant to a requisition of a meeting made pursuant to the CBCA or a Shareholder proposal made pursuant to the CBCA or Exchange Act provisions described above, is required to comply with Section 3.1 of By-Law 2015-01 – Advance Notice By-Law of Aptose Biosciences Inc. (the “Advance Notice Bylaw”).

Shareholders who wish to suggest a candidate for our Board in compliance with Section 3.1 of the Advance Notice Bylaw may submit a written recommendation to our Secretary at 251 Consumers Road, Suite 1105, Toronto, ON M2J 4R3 along with the Shareholder’s name, setting forth, among other things:

• the name, age, and province or state, and country of residence of the proposed nominee;

• the principal occupation, business or employment of the proposed nominee, both at present and within the five years preceding the recommendation;

• the number of securities of each class of voting securities of the Corporation or its subsidiaries which are beneficially owned, or controlled or directed, directly or indirectly, by the proposed nominee as of the record date for the meeting of Shareholders (if such date shall then have been made publicly available and shall have occurred) and as of the date of such notice;

• a description of any agreement, arrangement or understanding (financial, compensation or indemnity related or otherwise) between the nominating Shareholder and the proposed nominee, or any affiliates or associates of, or any person acting jointly or in concert with the nominating Shareholder or the proposed nominee, in connection with the proposed nominee’s election as director; and

| 10 |

• whether the proposed nominee is party to any existing or proposed relationship, agreement, arrangement or understanding with any competitor of the Corporation or its affiliates or any other third party which may give rise to a real or perceived conflict of interest between the interests of the Corporation and the interests of the proposed nominee.

The corporate governance and nominating committee of the Board (the “Corporate Governance and Nominating Committee” may also request that the Shareholder provide certain additional information.

For the Board to consider a candidate for nomination at the 2024 Annual Meeting, Shareholders should submit the required information to the Secretary by the date not less than 30 days before the 2024 Annual Meeting; provided, however, that if the 2024 annual general meeting of Shareholders is to be held on a date that is fewer than 50 days after the date (the “Notice Date”) on which the first public announcement of the meeting was made, notice by the nominating Shareholder may be given not later than the close of business on the tenth day following the Notice Date. The foregoing is merely a summary of provisions contained in Section 3.1 of the Advance Notice Bylaw, and is not comprehensive and is qualified by the full text of such provisions. The full text of such provisions is set out in Section 3.1 of the Advance Notice Bylaw, a copy of which is filed under the Corporation’s profile at www.sedar.com or www.sec.gov.

These advance notice provisions are in addition to, and separate from, the requirements that a stockholder must meet in order to have a proposal included in the proxy statement under the rules of the SEC and the CBCA. For such Shareholder’s director nominee to be eligible for inclusion in the proxy statement, please refer to the deadlines pursuant to the Exchange Act and the CBCA set out above.

To comply with the universal proxy rules set forth in Rule 14a-19 of the Exchange Act, shareholders who intend to solicit proxies in support of director nominees other than the Corporation’s nominees must provide notice to the Corporate Secretary that sets forth the information required by Rule 14a-19(b) under the Exchange Act, which shall be postmarked or transmitted electronically to the Corporation at the Corporation’s principal executive offices no later than March 24, 2024.

What if amendments are made to the proposals or if other matters are brought before the Meeting?

With respect to any amendments or variations in any of the proposals shown in the Proxy Statement, or any other matters which may properly come before the Meeting, the Shares will be voted by the appointed proxyholder as he or she in their sole discretion sees fit.

As of the date of this Proxy Statement, the Board is not aware of any such amendments, variations or other matters to come before the Meeting. However, if any such changes that are not currently known to the Board should properly come before the Meeting, the Shares represented by your proxyholders will be voted in accordance with the best judgment of the proxyholders.

Who will tabulate the votes?

We currently expect that Computershare will tabulate the votes, and the secretary of the Meeting will be our inspector of elections for the Meeting.

| 11 |

When will voting results be disclosed?

Preliminary voting results will be announced at the Meeting. Final voting results will be filed with the Canadian provincial securities regulatory authorities on SEDAR at www.sedar.com promptly following the Meeting, and will also be published in a Current Report on Form 8-K filed with the SEC on EDGAR at www.sec.gov within four business days of the Meeting.

Whom do I contact if I have questions regarding the Meeting?

If you have any questions or require assistance in voting your Shares, please call Mr. Fletcher Payne, Senior Vice President, Chief Financial Officer and Corporate Secretary, at 858-926-2730.

Who may adjourn the Meeting?

The Meeting may be adjourned to any other time and any other place by the Shareholders who attend the Meeting or who are represented at the Meeting and entitled to vote even when such Shareholders do not constitute a quorum.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Proxy Statement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act, and are subject to the safe harbor created by those sections. This Proxy Statement also contains “forward-looking information” within the meaning of applicable Canadian securities laws. We refer to such forward-looking statements and forward-looking information collectively as “forward-looking statements”. We have identified some of these forward-looking statements with words like “believe,” “may,” “could,” “would,” “might,” “possible,” “potential,” “will,” “should,” “expect,” “intend,” “plan,” “predict,” “anticipate,” “estimate,” “contemplate” and “continue”, the negative of these words, other words and terms of similar meaning and the use of future dates. Forward-looking statements involve risks and uncertainties. These uncertainties include factors that affect all businesses as well as matters specific to us.

Forward-looking statements by their nature address matters that are, to different degrees, uncertain. Uncertainties and risks may cause our actual results to be materially different than those expressed in or implied by our forward-looking statements. For us, particular uncertainties and risks include those described in our filings with the Securities and Exchange Commission (the “SEC”), including our most recent Annual Report on Form 10-K for the year ended December 31, 2022. A copy of this document can be found by accessing the SEC’s EDGAR filing database at www.sec.gov and on SEDAR at www.sedar.com; however we will promptly provide a copy of this document to any Shareholder of the Corporation free of charge upon request. All forward-looking statements in this Proxy Statement speak only as of the date of this Proxy Statement and are based on our current beliefs and expectations. We undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as otherwise required by law.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

As of the record date April 3, 2023, 93,005,278 Shares are issued and outstanding. Each holder of Shares of record at the close of business on April 3, 2023 will be entitled to one vote for each Share held on all matters proposed to come before the Meeting, except to the extent that the Shareholder has transferred any Shares after the record date and the transferee of such Shares establishes ownership of them and makes a written demand, not later than 10 days prior to the Meeting, to be included in the list of Shareholders entitled to vote at the Meeting, in which case the transferee will be entitled to vote such Shares.

| 12 |

SHARE OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS,

MANAGEMENT AND DIRECTORS

The table below sets forth information known to us regarding the beneficial ownership of our Shares as of April 3, 2023 for:

| • | each person the Corporation believes beneficially holds more than 5% of our outstanding Shares based solely on our review of SEC filings; |

| • | each of our directors and nominees for directors; |

| • | each of the named executive officers named in the Summary Compensation Table (we collectively refer to these persons as our “Named Executive Officers”); and |

| • | all of our directors and executive officers as a group. |

The number of Shares beneficially owned by a person includes shares subject to options held by that person that are currently exercisable or that become exercisable within 60 days of April 3, 2023. Percentage calculations assume, for each person and group, that all Shares that may be acquired by such person or group pursuant to options currently exercisable or that become exercisable within 60 days of April 3, 2023 are outstanding for the purpose of computing the percentage of Shares owned by such person or group. However, such unissued Shares described above are not deemed to be outstanding for calculating the percentage of Shares owned by any other person.

| 13 |

Except as otherwise indicated, the persons in the table below have sole voting and investment power with respect to all Shares shown as beneficially owned by them, subject to community property laws where applicable and subject to the information contained in the notes to the table.

|

Name of Beneficial Owner |

Amount and |

Percent of |

||||||

| Named Executive Officers and Directors | ||||||||

| Carol G. Ashe | 242,500 | * | ||||||

| Dr. Rafael Bejar | 1,138,669 | 1.22% | ||||||

| Dr. Denis Burger | 444,005 | * | ||||||

| Philippe Ledru | 400,500 | * | ||||||

| Fletcher Payne | 110,000 | * | ||||||

| Dr. Erich Platzer | 887,500 | * | ||||||

| Dr. William G. Rice | 4,830,511 | 5.19% | ||||||

| Dr. Bernd R. Seizinger | - | * | ||||||

| Mark D. Vincent | 422,500 | * | ||||||

| Warren Whitehead | 387,500 | * | ||||||

| All Executive Officers and Directors as a Group (10 persons) | 8,863,685 | 9.53% | ||||||

| Beneficial Owners of More Than 5% | ||||||||

| Nantahala Capital Management, LLC(2) | 6,052,867 | 6.51% | ||||||

| DRW Holdings, LLC(3) | 8,892,437 | 9.56% | ||||||

| Aaron G.L. Fletcher(4) | 6,246,788 | 6.72% | ||||||

|

|

||||||||

| *Does not exceed one percent of Shares outstanding | ||||||||

|

(1) Includes for the persons listed below the following Shares subject to options held by such persons that are currently exercisable or become exercisable within 60 days of April 3, 2023: Ms. Carol G. Ashe: 242,500; Dr. Rafael Bejar: 1,028,669; Dr. Denis Burger: 422,334; Mr. Philippe Ledru: 300,000; Dr. Erich Platzer: 382,500; Mr. Fletcher Payne: nil; Dr. William G. Rice: 4,317,299; Dr. Bernd R. Seizinger: nil; Dr. Mark Vincent: 416,000; and Mr. Warren Whitehead: 372,500.

| ||||||||

(2) Based on information contained in a schedule 13G filed with the SEC on February 14, 2023 by Nantahala Capital Management, LLC, Wilmot B. Harkey and Daniel Mack, 130 Main St. 2nd Floor, New Canaan, CT, 06840, United States of America. The filing indicates that, as of December 31, 2022, Nantahala Capital Management, LLC may be deemed to be the beneficial of 6,052,867 shares held by funds and separately managed accounts under its control, and as the managing members of Nantahala Capital Management, LLC, each of Wilmot B. Harkey and Daniel Mack may be deemed to be a beneficial owner of those shares.

| ||||||||

| (3) Based on information contained in a schedule 13G filed with the SEC on August 3, 2021 by DRW Investments, LLC, DRW Commodities, LLC, DRW Securities, LLC, DRW Holdings, LLC, Donald R. Wilson, Jr., 540 West Madison Street, Suite 2500, Chicago, Illinois 60661, United States of America. The filing indicates that, as of August 3, 2021, each of DRW Holdings, LLC and Donald R. Wilson, Jr. could be deemed to beneficially own the 8,888,275 shares beneficially owned by DRW Investments, LLC and the 4,162 shares beneficially owned by DRW Commodities, LLC. | ||||||||

| 14 |

| (4) Based on information contained in a schedule 13G filed on January 17, 2023 by Bios Special Opportunity Fund II, LP, Bios Special Opportunity Fund, LP, Bios Equity Partners SOF I, LP, Precise Bios Special Opportunities LLC, Joseph O’Donnell Kleinheinz Family Foundation for the Arts and Education, Robert Vernon Vanman, Vanman Charitable Foundation, Bios Advisors GP, LLC and Aaron G.L. Fletcher, 1751 River Run, Suite 400, Fort Worth, Texas, 76107, United States of America. The filing indicates that, as of January 17, 2023, Aaron G.L. Fletcher holds 1,136,188 Shares and has sole voting and dispositive power over an additional 5,110,600 Shares in his capacity as Manager of Bios Advisors GP, LLC, the general partner of Bios Capital Management, LP, the general partner of each Bios Equity Partners SOF I, LP, which is the general partner of each of Bios Special Opportunity Fund II, LP and Bios Special Opportunity Fund, LP. Bios Capital Management LP also act as the investment adviser to each of Precise Bios Special Opportunities LLC, Joseph O’Donnell, Kleinheinz Family Foundation for the Arts and Education, Robert Vernon Vanman, and Vanman Charitable Foundation. Aaron Fletcher is the manager of Bios Advisors GP, LLC, the general partner of Bios Capital Management, LP, the general partner of Bios Equity SOF I, LP, the general partner of each of Bios Special Opportunity Fund II, LP and Bios Special Opportunity Fund, LP. | ||||||||

| 15 |

RECEIPT OF FINANCIAL STATEMENTS

At the Meeting, Shareholders will receive and consider the financial statements of the Corporation for the fiscal year ended December 31, 2022 and the auditor’s report thereon, but no vote by the Shareholders with respect thereto is required or proposed to be taken.

PROPOSAL NO. 1—ELECTION OF DIRECTORS

Pursuant to the articles of the Corporation, the number of directors of the Corporation is set at a minimum of three and a maximum of eleven, and the Board is authorized to determine the actual number of directors to be elected from time to time. The Corporation currently has seven directors, all of whom are being proposed for nomination at the Meeting. Unless they resign, all directors elected at the Meeting will hold office until our next annual meeting of Shareholders or until their successors are elected or appointed.

Pursuant to recent changes to the CBCA, there is a statutory voting requirement for uncontested directors elections whereby shareholders are allowed to vote “for” or “against” (as opposed to “for” and “withhold”) nominees for the Board. The required vote to elect a nominee to the Board is the majority of the votes cast for their election. If a nominee does not receive a majority of the votes cast for their election, the nominee will not be elected and the Board position will remain open or, if in the case of incumbent directors, such director may continue in office until the earlier of (i) the 90th day after the election, or (ii) the day on which his or her successor is appointed or elected.

| 16 |

The following incumbent directors of the Corporation are nominated for election at the Meeting.

| Director | Experience and Qualifications

|

|

Carol G. Ashe(2)(3)

Pennsylvania, United States

Director Since August 2018

|

Ms. Ashe, age 65, has been the Chief Business Officer at the New York Genome Center, an independent, non-profit academic research institution focused on genomic science, and its application to novel biomedical discoveries to advance the understanding of the genetic basis of neurodegenerative disease, neuropsychiatric disease, and cancer, since 2014. Previously, she served as Vice President of Corporate Development for Endo’s branded, generic and platform drug delivery pharmaceutical business units from 2011 to 2013; a Partner at SR One, the corporate venture capital fund of GlaxoSmithKline (“GSK”), from 2008 to 2010; and head of GSK’s US Corporate Legal Group supporting US-based mergers, acquisitions and equity investments from 2007 to 2008. Prior to that, Ms. Ashe led GSK’s global Business Development Transactions Legal Team supporting both the pharmaceutical and consumer healthcare business units from 1995 to 2007. In 2020, Ms. Ashe joined the Board of Elicio Therapeutics, a privately held clinical-stage biotechnology company developing a pipeline of novel immunotherapies, as an independent director. Ms. Ashe received her BS degree in Biology from Pennsylvania State University, her law degree from Villanova University School of Law and is a registered patent attorney.

Ms. Ashe makes valuable contributions to the Board based on over 25 years of experience in the pharmaceutical and biotechnology industry in business development and as legal counsel for business development transactions and patent matters.

|

|

Dr. Denis Burger(1)(2)(3)(4)

Oregon, United States

Director Since 2007

|

Dr. Burger, age 79, currently is the managing member of Paradigm Ventures LLC, a healthcare consulting and funding firm based in Portland, Oregon, from 1986. Previously, he co-founded Trinity Biotech, PLC, a diagnostic biotechnology company based in Dublin, Ireland, where he was Chairman from 1992 to 1995 and served on its board of directors until 2020 and chaired its Audit Committee from 1996 to 2016. Dr. Burger served as the Chairman, Chief Executive Officer and a Director of AVI Biopharma Inc., an Oregon-based biotechnology company, from 1996 to 2007. He was a co-founder and Chairman of Epitope Inc. from 1981 to 1990. Dr. Burger was Vice Chairman and Chief Scientific Officer of CytoDyn Inc. from 2014 to 2018. Dr. Burger has served as President of Yamhill Valley Vineyards since 1983. In addition, Dr. Burger previously held a professorship in the Department of Microbiology and Immunology and Surgery (Surgical Oncology) at the Oregon Health Sciences University in Portland. Dr. Burger received his M.Sc. and Ph.D. in Microbiology and Immunology from the University of Arizona.

Dr. Burger served on the board of directors of Epitope Inc (1986-1990)*, Trinity Biotech, PLC. (1992 to 2020)*, CytoDyn Inc. (2014 to 2018)* and AVI BioPharma Inc (1996-2007)*. Dr. Burger serves on the Board of Aptose since 2007 and was Chair of the Audit Committee of Aptose from 2008 to 2015.

Dr. Burger makes valuable contributions to the Board based on his Ph.D. in microbiology and immunology, and his more than 25 years of experience in the biotechnology industry as a senior executive and as a corporate director. |

| 17 |

| Director | Experience and Qualifications

|

|

Dr. Erich Platzer(2)

Basel, Switzerland

Director Since 2014

|

Dr. Platzer, age 72, served as a board certified physician in internal medicine, hematology and medical oncology between 1979 and 1991. In 2001, Dr. Platzer co-founded HBM Healthcare Investments (formerly HBM BioVentures), a global leader in healthcare investing and served as their investment advisor until 2015. Previously, he served as the business director of oncology, as well as the global strategic marketing and therapeutic area head of oncology at Roche, Basel. He also served in various other leadership roles at Roche and was responsible for various strategic corporate partnerships. He has over 12 years of experience in academic medicine and research and was a key member of the team at MSKCC that purified human G-CSF in 1983 (recombinant form: Neupogen®). He earned his M.D. from the Medical School of the University of Erlangen, where he also received his “Dr. med. habil.” (M.D., Ph.D.).

Dr. Platzer has served as a pharmaceutical industry expert on the board of directors of multiple biotech companies in both the U.S. and Europe. Currently he serves as chairman of Vivoryon Therapeutics NV, as well as a director of Panavance Therapeutics Inc. and of MedTech Innovation Partners, MTIP, a Swiss VC firm focusing on MedTech and eHealth. He has also served as the president of Swiss business angel group StartAngelsNetwork and remains a board member there.

Dr. Platzer makes valuable contributions to the Board based on over twenty-five years’ experience in the biotechnology industry as a physician in hematology and medical oncology, as a corporate executive, and as a corporate director. |

| 18 |

Director

|

Experience and Qualifications |

|

Dr. Bernd R. Seizinger(1)

New Jersey, United States

Director Since 2022

|

Dr. Seizinger, age 66, is an accomplished senior executive leader with more than 25 years of industry experience in both U.S. and European biotechnology and pharmaceutical companies and multiple financial advisory positions.

His current positions include: Chairman of the board of directors, Oxford BioTherapeutics (U.K. private company, since 2016); Co-founder, executive chairman of the board and acting CEO, CryptoMedix (U.S. private company, since 2015). Furthermore, he is currently a member of the board of directors of the following publicly traded biotech companies: Aprea Therapeutics Inc. (U.S.; NASDAQ; since 2014)*; Oncolytics Biotech Inc. (Canada/U.S.; NASDAQ and TSX; since 2015)*; BioInvent International AB (Sweden; NASDAQ Stockholm; since 2018); Nykode Therapeutics ASA (Norway; Oslo Stock Exchange; since 2014). In addition, he is currently serving on the advisory board of biotech venture capital fund Pureos (Switzerland; since 2019) and is senior advisor to biotech venture fund Hadean (Sweden & Norway; since 2018).