FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the Month of August, 2007

Commission File Number 1-32001

Lorus Therapeutics Inc.

(Translation of registrant's name into English)

2 Meridian Road, Toronto, Ontario M9W 4Z7

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

| Form 20-F | ý | Form 40-F | o |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

| Yes | o | No | ý |

If

"Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

82- .

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| LORUS THERAPEUTICS INC. | |||

Date: August 29, 2007 |

|||

By: |

/s/ ELIZABETH WILLIAMS Elizabeth Williams Director of Finance |

||

NOTICE AND MANAGEMENT PROXY CIRCULAR

FOR THE

ANNUAL AND SPECIAL MEETING OF

SHAREHOLDERS

SEPTEMBER 19, 2007

August 15, 2007

Lorus Therapeutics Inc.

Notice of 2007 Annual and Special Meeting of Shareholders

NOTICE IS HEREBY GIVEN that the annual and special meeting of shareholders (the "Meeting") of Lorus Therapeutics Inc. (the "Corporation") will be held at The Trading Floor, The Design Exchange, 234 Bay Street, Toronto Dominion Centre, Toronto, Ontario on Wednesday, September 19, 2007 at 10:00 a.m. (Toronto time).

What the Meeting is about

We will be covering five items of business at the Meeting:

The Meeting may also consider other business that properly comes before the Meeting or any adjournment of the Meeting. The Circular accompanying this notice of Meeting provides additional information relating to the matters to be dealt with at the Meeting and forms part of this notice.

You have the right to vote

You are entitled to receive notice of and vote at our annual and special shareholder meeting, or any adjournment, if you were a holder of common shares of the Corporation on August 15, 2007.

You have the right to vote your shares on items 2 to 5 listed above and any other items that may properly come before the Meeting or any adjournment.

Your vote is important

If you are not able to be present at the Meeting, please exercise your right to vote by signing and returning the enclosed form of proxy to Computershare Investor Services Inc., 100 University Avenue, 8th Floor, Toronto, Canada M5J 2Y1, so as to arrive not later than 10:00 a.m. on Monday, September 17, 2007 or, if the Meeting is adjourned, 48 hours (excluding Saturdays, Sundays and holidays) before any adjournment of the Meeting.

BY ORDER OF THE BOARD OF DIRECTORS

"Aiping Young"

Aiping Young

President and Chief Executive Officer

Toronto,

Canada

August 15, 2007

MANAGEMENT INFORMATION CIRCULAR

PLAN OF ARRANGEMENT AND CORPORATE REORGANIZATION

On July 10, 2007 (the "Arrangement Date"), the Corporation completed a plan of arrangement and corporate reorganization with, among others, 4325231 Canada Inc. (formerly Lorus Therapeutics Inc.) ("Old Lorus"), 6707157 Canada Inc. and Pinnacle International Lands, Inc. As a result of the plan of arrangement and reorganization, among other things, each common share of Old Lorus was exchanged for one common share of the Corporation and the assets (excluding certain future tax assets and related valuation allowance) and liabilities of Old Lorus (including all of the shares of its subsidiaries) were transferred, directly or indirectly, to the Corporation and/or its subsidiaries. The Company continued the business of Old Lorus after the Arrangement Date with the same officers and employees and continued to be governed by the same board of directors of Old Lorus prior to the Arrangement Date. References in this Circular to the Corporation, "we", "our", "us" and similar expressions, unless otherwise stated, are references to Old Lorus prior to the Arrangement Date and the Corporation after the Arrangement Date.

Solicitation Of Proxies

The information contained in this management information circular (the "Circular") is furnished in connection with the solicitation of proxies to be used at the annual and special meeting of shareholders (the "Meeting") of Lorus Therapeutics Inc. (the "Corporation", "Lorus", "we" or "our") to be held on Wednesday, September 19, 2007 at 10:00 a.m. (Toronto time) at The Trading Floor, The Design Exchange, 234 Bay Street, Toronto Dominion Centre, Toronto, Ontario and at all adjournments thereof, for the purposes set forth in the accompanying notice of Meeting. It is expected that the solicitation will be made primarily by mail but proxies may also be solicited personally by directors, officers, employees or agents of the Corporation. The solicitation of proxies by this Circular is being made by or on behalf of the management of the Corporation. The total cost of the solicitation will be borne by Lorus. The information contained in this Circular is given as at August 15, 2007 except where otherwise noted.

Appointment of Proxies

This is the easiest way to vote. Voting by proxy means that you are giving the person or people named on your proxy form (the "proxyholder") the authority to vote your shares for you at the Meeting or any adjournment. A proxy form is included with the Circular.

The persons named on the proxy form will vote your shares for you, unless you appoint someone else to be your proxyholder. If you appoint someone else, he or she must be present at the Meeting to vote your shares. If you want to appoint someone else, you can insert that person's name in the blank space provided in the form of proxy. That other person does not need to be a shareholder of the Corporation.

If you are voting your shares by proxy, our transfer agent, Computershare Investor Services Inc. ("Computershare"), must receive your completed proxy form by 10:00 a.m. (Toronto time) on Monday, September 17, 2007 or, if the Meeting is adjourned, 48 hours (excluding Saturdays, Sundays and holidays) before any adjournment of the Meeting.

Registered Shareholders

You are a registered shareholder if your name appears on your share certificate. Your proxy form tells you whether you are a registered shareholder.

1

Non-Registered (or Beneficial) Shareholders

You are a non-registered (or beneficial) shareholder if your bank, trust company, securities broker or other financial institution holds your shares for you (your nominee). For most of you, your voting instruction form or proxy tells you whether you are a non-registered (or beneficial) shareholder.

In accordance with Canadian securities law, we have distributed copies of the notice of Meeting, this Circular, the form of proxy, to those who requested it, our 2007 annual report, which includes the audited financial statements of Lorus Therapeutics Inc. for the year ended May 31, 2007 and the auditors' report thereon, management's discussion and analysis and, as supplemental financial information, the audited consolidated financial statements of Old Lorus for the year ended May 31, 2007 and the auditors report thereon, (collectively, the "meeting materials") to CDS and intermediaries (such as securities brokers or financial institutions) for onward distribution to those non-registered or beneficial holders to whom we have not sent the meeting materials directly.

In such cases, intermediaries are required to forward meeting materials to non-registered or beneficial holders unless a non-registered or beneficial holder has waived the right to receive them. Very often, intermediaries will use a service company such as Broadridge Investor Communication Solutions to forward the meeting materials to non-registered or beneficial holders.

Non-registered or beneficial holders who have not waived the right to receive meeting materials will receive either a voting instruction form or, less frequently, a form of proxy. The purpose of these forms is to permit non-registered or beneficial holders to direct the voting of the common shares they beneficially own. Non-registered or beneficial holders should follow the procedures set out below, depending on what type of form they receive.

or

Non-registered holders should follow the instructions on the forms they receive and contact their intermediaries promptly if they need assistance.

Changing Your Vote

A registered shareholder who has given a proxy may revoke that proxy by:

2

A non-registered or beneficial holder may revoke a voting instruction form or a waiver of the right to receive meeting materials and to vote given to an intermediary or to the Corporation, as the case may be, at any time by written notice to the intermediary or the Corporation, except that neither an intermediary nor the Corporation is required to act on a revocation of a voting instruction form or of a waiver of the right to receive materials and to vote that is not received by such intermediary or the Corporation, at least seven (7) days prior to the Meeting.

You can choose to vote "For", "Against" or "Withhold", depending on the items listed on the proxy form.

When you sign the proxy form, you authorize the management representatives named in the proxy form to vote your shares for you at the Meeting according to your instructions.

If you return your proxy form and do not tell us how you want to vote your shares, your common shares will be voted by the management representatives named in the proxy form:

The enclosed form of proxy confers discretionary authority upon the management representatives designated in the form of proxy with respect to amendments to or variations of matters identified in the notice of Meeting and with respect to other matters that may properly come before the Meeting. At the date of this Circular, the management of the Corporation knows of no such amendments, variations or other matters.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

On August 15, 2007, we had outstanding 212,627,876 common shares. Each holder of common shares of record at the close of business on August 15, 2007, the record date established for notice of the Meeting, will be entitled to one vote for each common share held on all matters proposed to come before the Meeting, except to the extent that the holder has transferred any common shares after the record date and the transferee of such shares establishes ownership of them and makes a written demand, not later than10 days prior to the meeting, to be included in the list of shareholders entitled to vote at the Meeting, in which case the transferee will be entitled to vote such shares.

To the knowledge of Lorus' directors and executive officers, no single person or entity beneficially owns, directly or indirectly, or exercises control or direction over more than 10% of the votes attached to all the outstanding common shares, other than High Tech Beteiligungen GmbH & Co. KG ("High Tech") that, according to public filings dated July 10, 2007, held 29,090,000 common shares or approximately 14% of the common shares outstanding.

3

PARTICULARS OF MATTERS TO BE ACTED UPON

Appointment and Remuneration of Auditors

Unless you have specified in the enclosed form of proxy that the votes attaching to the common shares represented by the proxy are to be withheld with respect to the appointment of auditors, on any ballot that may be called for in the appointment of auditors, the management representatives designated in the enclosed form of proxy intend to vote the common shares in respect of which they are appointed proxy FOR the appointment of KPMG LLP, Chartered Accountants, as auditors of the Corporation to hold office until the next annual meeting of shareholders, and authorizing the directors to fix the remuneration of the auditors.

KPMG LLP was first appointed as the auditor of Old Lorus in October 1994 and of the Corporation effective the date of its incorporation.

Election of Directors

Unless they resign, all directors elected at the Meeting will hold office until our next annual meeting of shareholders or until their successors are elected or appointed.

Unless you have specified in the enclosed form of proxy that the votes attaching to the common shares represented by the proxy are to be withheld with respect to the election of directors, on any ballot that may be called for in the election of directors, the management representatives designated in the enclosed form of proxy intend to vote the common shares in respect of which they are appointed proxy FOR the election as directors of the proposed nominees whose names are set forth below.

Management does not contemplate that any of the proposed nominees will be unable to serve as a director but, if that should occur for any reason prior to the Meeting, the management representatives designated in the enclosed form of proxy may vote for another nominee at their discretion.

Pursuant to the articles of the Corporation, the number of directors of the Corporation is set at a minimum of three and a maximum of eleven and the directors are authorized to determine the actual number of directors to be elected from time to time.

The Corporation currently has nine directors, and is proposing nine directors for nomination. Messrs. Graham Strachan, Don Paterson and Michael Moore have advised the Corporation that they will not be standing for re-election as directors.

The following table sets out for all persons proposed to be nominated by management for election as director, the name and place of residence, all major positions and offices with the Corporation now held by them, the period during which they have served as directors of the Corporation, their present principal occupation and principal occupation for the preceding five years, and the number of common shares beneficially owned, directly or indirectly, by each of them, or over which they exercise control or direction as at August 15, 2007.

The Corporation has an Audit Committee, a Corporate Governance and Nominating Committee, a Compensation Committee and an Environment, Health and Safety Committee. The members of these committees are indicated in the table below.

Since the last annual and special meeting of shareholders of the Corporation:

4

| Name Of Director, Province/State and Country of Residence |

Position with the Corporation and when Individual became a Director |

Present Principal Occupation or Employment |

No. of common shares Beneficially Owned, Controlled or Directed |

|||

|---|---|---|---|---|---|---|

| HERBERT ABRAMSON Ontario, Canada |

Director July 2007 | Chairman, CEO and Portfolio Manager, Trapeze Capital Corp. (investment dealer/portfolio manager) Chairman and Portfolio Manager, Trapezes Asset Management Inc. (investment counselor) |

20,840,400 | |||

J. KEVIN BUCHI(1)(3) Pennsylvania, United States |

Director December 2003 |

Executive Vice President and Chief Financial Officer, Cephalon Inc. (biopharmaceutical specializing in drugs to treat and manage neurological diseases, sleep disorders, cancer and pain) |

50,000 |

|||

DR. DENIS BURGER Oregon, United States |

N/A |

Retired, Currently lead independent director of Trinity Biotech plc. (developer, manufacturer of clinical diagnostic products) Chairman and CEO of AVI BioPharma, Inc. (1992-2007) (biopharmaceutical using gene-targeted therapeutics to interfere with ribosomal translation) |

Nil |

|||

SUSAN KOPPY California, United States |

N/A |

Senior Vice President Corporate & Business Development, Idenix Pharmaceuticals, Inc (2006 to present) (fully integrated anti-viral therapeutic company) VP Strategy and Business Development, Applied Biosystems, Inc. (2004-2005) (life sciences tools company) Business Development Director, Novartis Pharmaceuticals (2001-2004) (biopharmaceutical company focused on the development of a wide range of drug therapies) |

Nil |

|||

GEORG LUDWIG(2)(5) Eschen, Liechtenstein |

Director September 2006 |

Managing Director, ConPharm Anstalt (2005 to present) (consulting and managing company for life science funds) Managing Director, High Tech Private Equity (general partner of High Tech) (2000 to 2004) |

29,090,000 |

|||

5

ALAN STEIGROD(2) Florida, United States |

Director May 2001 |

Managing Director, Newport Health Care Ventures (corporate consulting) |

10,000 |

|||

DR. MARK D. VINCENT Ontario, Canada |

N/A |

Chief Executive Officer, Sarissa Inc. (biotechnology company focused on development of targeted products for the therapeutic manipulation of gene expression) |

Nil |

|||

DR. JIM A. WRIGHT Ontario, Canada |

Director, October 1999 |

Chief Executive Officer of NuQuest Bio Inc. (2006 to present) (start-up biotechnology company with the intention of developing novel therapies for treatment of life threatening diseases) President and Chief Executive Officer, Old Lorus (1999 to 2006) |

4,429,541 |

|||

DR. AIPING YOUNG(4) Ontario, Canada |

President and Chief Executive Officer October 1999 |

President and Chief Executive Officer of the Corporation (2006 to present) Chief Operating Officer, Old Lorus (2003 to 2006) |

37,803 |

The information as to principal occupation, business or employment and common shares beneficially owned or controlled is not within the knowledge of management of the Corporation and has been furnished by the respective nominees.

Amendments to 2003 Share Option Plan and 1993 Share Option Plan

See also "Equity Compensation Plans — Stock Option Plans"

Lorus proposes to amend its 2003 Share Option Plan (the "2003 Plan") and its 1993 Share Option Plan (the "1993 Plan") (collectively the "Stock Option Plans") to:

6

Amending Procedures

The amending procedures of the Stock Option Plans provided for the board of directors of Lorus (the "Board") to be able to amend, suspend or terminate the Stock Option Plans and to the extent any such amendment, suspension or termination adversely affected any stock options previously granted under the Stock Option Plans to a participant, the consent of that participant was required. It was implicit under the Stock Option Plans that the Board could make these amendments without shareholder approval. However, the Toronto Stock Exchange ("TSX") now requires the Stock Option Plans to explicitly provide that shareholder approval is not required to implement any amendments, save and except for amendments related to:

In other words, other than these four prescribed items, any other amendment can be made by the Board without shareholder approval. Such amendments may, for example, include, without limitation, amendments related to:

If the proposed amendments are approved by shareholders, the Stock Option Plans will comply with the TSX requirements.

Expiry During Black-Out Periods

As part of Lorus' good corporate governance practices, Lorus self-imposes trading restrictions from time to time, (such periods being each a "Black-Out Period"), preventing officers, directors and employees from exercising vested stock options. The Stock Option Plans will be amended such that, should the expiry date of a vested option fall on, or within ten Trading Days immediately following a Black-Out period or other trading restriction imposed by Lorus, the expiry date of such a vested stock option will be the last day of the 10-day period.

Addition of Reloading Feature

Currently, the 2003 Plan provides that the maximum number of Shares that may be reserved for issuance upon the exercise of options granted under the 2003 Plan shall not exceed 15% of the number of Shares of the Corporation then issued and outstanding. The Corporation wishes to amend the 2003 Plan to provide that any exercises of options under the 2003 Plan would make new grants available under the 2003 Plan resulting in the "reloading" of the 2003 Plan.

7

Clean-up Changes

In addition, certain other "clean-up" changes have been made to the Stock Option Plans so that they conform to changes in Canadian securities legislation.

Except for the three changes described above and the "clean-up" amendments, the Stock Option Plans will be substantially the same as they were before the adoption of the amendments.

Required Approvals

Pursuant to the requirements of the TSX respecting stock option plans, the amendment of the Stock Option Plans must be approved by a majority of votes cast by the holders of common shares at the Meeting. Accordingly, at the Meeting, shareholders will be asked to consider and, if deemed advisable, adopt the resolution set out at Appendix "C" hereto.

Unless you have specified in the enclosed form of proxy that the votes attaching to the common shares represented by the proxy are to be voted against the adoption of stock option amendments, on any ballot that may be called for in adoption of stock option amendments, the management representatives designated in the enclosed form of proxy intend to vote the common shares in respect of which they are appointed proxy for adoption of stock option amendments as provided in Appendix "C" attached hereto.

Repeal and Ratification of By-law

The by-laws of the Corporation adopted in connection with the Arrangement ("By-law No. 1") were based on those of Old Lorus and have not been updated since By-law No. 1 was adopted by Old Lorus.

The Corporation has determined that there have been changes to the corporate legislation governing the Corporation since the time of original incorporation. On July 19, 2007 the board of directors of the Corporation adopted the new form of by-laws of the Corporation ("By-law No. 2") to reflect:

Unless the shareholder has specified in the enclosed form of proxy that the votes attaching to the common shares represented by the proxy are to be voted against the repeal of By-law No. 1 and ratification and confirmation of the Corporation's by-law, on any ballot that may be called for in connection with the repeal of By-law No. 1 and ratification and confirmation of By-law No. 2, the management representatives designated in the enclosed form of proxy intend to vote the common shares in respect of which they are appointed proxy for ratification and confirmation of the Corporation's By-law No. 2 as provided in Appendix "D" attached hereto.

During the fiscal year of Old Lorus ended May 31, 2007, each director who was not an officer of the Corporation was entitled to receive 50,000 stock options (the Chair received 100,000) and, at his election, common shares, deferred share units and/or cash compensation for attendance at the board of directors of the Corporation (the "Board") committee meetings. Compensation consisted of an annual fee of $15,000 (the Chair received $35,000) and $1,500 per Board meeting attended ($4,500 to the Chair of a Board meeting). Members of the Audit Committee received an annual fee of $8,000 (the Chair received $10,000). Each member of the Compensation Committee, Corporate Governance and Nominating Committee and the Environment, Health and Safety Committee received an annual fee of $5,000 per committee.

In September 2006, stock options to purchase 400,000 common shares at a price of $0.30 per share expiring September 20, 2016 were granted, in aggregate, to our directors. These options vested 50% upon issuance and the remaining 50% will vest after one year. In addition, Old Lorus reimbursed the directors for expenses incurred in attending meetings of the Board and committees of the Board.

8

Directors are entitled to participate in our Deferred Share Unit Plan. See "Equity Compensation Plans — Directors' and Officers' Deferred Share Unit Plan".

CORPORATE GOVERNANCE PRACTICES

Effective June 30, 2005, National Instrument 58-101 — Disclosure of Corporate Governance Practices ("NI 58-101") and National Policy 58-201 — Corporate Governance Guidelines ("NP 58-201") were adopted in each of the provinces and territories of Canada. NI 58-101 requires issuers to disclose the corporate governance practices that they have adopted. NP 58-201 provides guidance on governance practices. The Corporation is also subject to Multilateral Instrument 52-110 — Audit Committees ("MI 52-110"), which has been adopted in various Canadian provinces and territories and which prescribes certain requirements in relation to audit committees. The required disclosure under NI 58-101 is attached hereto as Appendix "A". In addition, the disclosure required on the Audit Committee of the Corporation pursuant to MI 52-110 is attached hereto as Appendix "B".

Compensation of Named Executive Officers

The following tables and related narrative below present information about compensation for the fiscal years ended May 31, 2007, May 31, 2006 and May 31, 2005 for our "Named Executive Officers".

Summary Compensation Table

| |

|

Annual Compensation |

Long-Term Compensation Awards |

|

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Principal Position |

Fiscal Year |

Salary ($) |

Bonus ($) |

Other Annual Compensation ($) |

Securities Under Options/SARs Granted (#)(1) |

All Other Compensation ($) |

||||||

| Dr. Aiping Young President and Chief Executive Officer, former Chief Operating |

2007 2006 2005 |

286,269 259,692 222,697 |

41,250 32,000 46,125 |

Nil Nil Nil |

2,312,496 1,194,144 250,000 |

Nil Nil Nil |

||||||

Ms. Elizabeth Williams Director of Finance, Acting Chief Financial Officer |

2007 2006 2005 |

87,152 88,631 84,163 |

7,565 7,000 7,990 |

Nil Nil Nil |

139,739 228,035 52,388 |

Nil Nil Nil |

||||||

Dr. Jim A. Wright Former President and Chief Executive Officer |

2007 2006 2005 |

108,814 345,442 313,586 |

131,070 53,000 95,760 |

Nil Nil Nil Nil |

(265,000) 947,500 228,000 |

584,630 Nil Nil |

||||||

Mr. Paul Van Damme(3) Former Chief Financial Officer |

2007 2006 2005 |

Nil 152,654 Nil |

Nil 35,030 Nil |

Nil Nil Nil |

Nil Nil 202,500 |

Nil 74,633 37,000 |

||||||

9

Stock Option Incentive Compensation

The following tables set forth the options granted to and exercised by each of the Named Executive Officers during the year ended May 31, 2007:

Option/SAR Grants During the Most Recently Completed Financial Year

| Name and Principal Position |

Securities Under Options/SARs Granted (#)(1) |

% of Total Options/SARs Granted to Employees in Financial Year (%) |

Exercise or Base Price ($/Security) |

Market Value of Securities Underlying Options/SARs on the Date of Grant ($/Security) |

Expiration Date |

|||||

|---|---|---|---|---|---|---|---|---|---|---|

| Dr. Aiping Young President and Chief Executive Officer, Former Chief Operating Officer |

75,000 1,000,000 500,000 1,000,000 |

(1) (2) (3) (4) |

1.40 18.80 9.40 18.80 |

0.33 0.27 0.27 0.27 |

0.33 0.27 0.27 0.27 |

July 28, 2016 October 5, 2016 October 5, 2016 October 5, 2106 |

||||

Ms. Elizabeth Williams Director of Finance, Acting Chief Financial Officer |

159,848 |

(1) |

3.00 |

0.33 |

0.33 |

July 28, 2016 |

||||

Dr. Jim A. Wright Former President and Chief Executive Officer |

50,000 |

(5) |

0.90 |

0.30 |

0.30 |

Sept. 20, 2016 |

Aggregated Option/SAR Exercises During the Most Recently Completed

Financial Year and Financial Year-End Option/SAR Values

| Name |

Securities Acquired on Exercise (#) |

Aggregate Value Realized ($)Nil |

Unexercised Options/SARs at May 31, 2007 (#) Exercisable/ Unexercisable |

Value of Unexercised in-the-Money Options/SARs at May 31, 207 ($) Exercisable/ Unexercisable |

||||

|---|---|---|---|---|---|---|---|---|

| Dr. Aiping Young President and Chief Executive Officer Former Chief Operating Officer |

Nil | Nil | 2,890,255/1,617,187 | 0/0 | ||||

Ms. Elizabeth Williams Director of Finance, Acting Chief Financial Officer |

Nil |

Nil |

299,802/120,360 |

0/0 |

||||

Dr. Jim A. Wright Former President and Chief Executive Officer |

Nil |

Nil |

2,447,500/25,000 |

0/0 |

10

EMPLOYMENT CONTRACTS WITH NAMED EXECUTIVE OFFICERS

Under the employment agreement with Dr. Aiping Young dated September 21, 2006, Dr. Young is President and Chief Executive Officer of the Corporation at an annual salary of $300,000. This agreement provides for a notice period equal to 18 months plus one additional month for each year of employment under the agreement in the event of termination without cause or a resignation. If within 18 months of a change of control of Lorus, Dr. Young's employment is terminated without cause or if she terminates the agreement with good reason as defined in the agreement, then she is entitled to receive the equivalent of two years' of her basic salary plus one month salary for each year under the agreement, plus an annual bonus prorated over the severance period (based on the bonus paid in respect of the last completed fiscal year).

Dr. Young will also be entitled to benefits coverage for the severance period or a cash payment in lieu thereof. The employment agreement provides that the Corporation may at any time assign Dr. Young to perform other functions that are consistent with her skills, experience and position within the Corporation. Dr. Young reports directly to the Board. The bonus and options allocation of the President and Chief Executive Officer is determined by the Board and is awarded based 100% on achievement of corporate objectives. Ms. Young is entitled to five weeks annual vacation prorated to reflect a period of employment less than a full calendar year.

Under the employment agreement with Ms. Elizabeth Williams dated May 31, 2004, Ms. Williams' position is Director of Finance of the Corporation for an annual salary of $124,000. This agreement provides for a notice period equal to the greater of one month and the applicable notice entitlement under employment legislation in the event of termination. Ms. Williams reports to the Chief Executive Officer. The bonus and options allocation of the Director of Finance is as recommended to the Board by the Chief Executive Officer. Ms Williams is entitled to four weeks of paid vacation, pro rated to reflect a period of employment less than a full calendar year.

Salary and bonus amounts for each of the Named Executive Officers for the fiscal year 2007 were as set out in the above Summary Compensation Table.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table sets forth certain details as at the end of the fiscal year of Old Lorus, ended May 31, 2007 and at August 15, 2007 with respect to compensation plans pursuant to which equity securities of the Corporation are authorized for issuance.

| |

Number of common shares to be issued upon exercise of outstanding options (a) |

|

Number of common shares remaining available for future issuance under the equity compensation plans (Excluding Securities reflected in Column (a)) (c) |

|

|

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

Total Stock Options outstanding and available for Grant (a) + (c) |

||||||||||||||

| |

|

% of common shares outstanding |

Weighted- average exercise price of outstanding options (b) |

|

% of common shares outstanding |

|||||||||||

| Plan Category |

Number |

Number |

Number |

% of Common shares outstanding |

||||||||||||

| Equity compensation plans approved by Shareholders | 12,987,431 | 6.1 | $ | 0.59 | 18,800,951 | 8.9 | 31,788,382 | 15 | % | |||||||

Equity compensation plans approved by Shareholders (August 15, 2007) |

12,494,389 |

5.9 |

$ |

0.59 |

19,399,792 |

(1) |

9.1 |

31,894,181 |

15 |

% |

||||||

11

Stock Option Plans

Our original stock option plan was established in the 1993 Plan; however, due to significant developments in the laws relating to share option plans and our then future objectives, in November 2003 we created the 2003 Plan, ratified by our shareholders, pursuant to which all future grants of stock options would be made.

On January 1, 2005, the TSX amended its rules (the "TSX Rules") to provide that, among other things, the maximum number of shares issuable under a stock option plan of a TSX issuer may be a rolling number based on a fixed percentage of the number of outstanding shares of such issuer from time to time. Previously, the TSX Rules required a stock option plan to have a fixed number of shares issuable thereunder. The amended TSX Rules require that a stock option plan with a rolling maximum be approved by the shareholders of an issuer every three years.

At our annual meeting held on September 13, 2005, shareholders of the Corporation approved an amendment to the Stock Option Plans to provide that the number of shares available for issue is a rolling rate of 15% of the issued common shares of the Corporation. Shareholders also approved amendments to remove all prior limits on grants of options and issuance of common shares to any one individual and for individual insiders under the 1993 Stock Option Plan and 5% limits for individual insiders under the 2003 Stock Option Plan, and to replace such limits with the 10% limit for insiders as a group as provided under the amended TSX Rules.

The 1993 Plan and 2003 Plan were continued as stock option plans of the Corporation in connection with the Arrangement.

1993 Plan

Under the 1993 Plan, options were granted to directors, officers, consultants and employees of the Corporation or its subsidiaries. The total number of options issued under the 1993 Plan is 3,635,534. This represents 1.7% of the Corporation's issued and outstanding capital as at August 15, 2007. As of November 2003, option grants were no longer made under the 1993 Plan. Therefore, no further options are issuable under the 1993 Plan. The total number of common shares issuable under actual grants pursuant to the1993 Plan is 3,635,534, being 1.7% of the Corporation's issued and outstanding capital as at August 15, 2007.

The number of common shares issuable to insiders, at any time, under the 1993 Plan and any other compensation arrangement of the Corporation cannot exceed 10% of the issued and outstanding common shares of the Corporation. The number of shares issued to insiders, within any one year period, under the 2003 Plan and any other compensation arrangement of the Corporation cannot exceed 10% of the issued and outstanding common shares of the Corporation. The maximum percentage of common shares reserved for issuance to any one person is 5% of the issued and outstanding common shares of the Corporation. The exercise price of options granted under the 1993 Plan was established by the Board on the basis of the closing market price of common shares of the Corporation on the TSX on the last trading day preceding the date of grant. If such a price was not available, the exercise price was to be determined on the basis of the average of the bid and ask for the common shares on the TSX on the date preceding the date of grant. The vesting period of options was determined by the Board at the time of granting the option. The term of options granted under the 1993 Plan and outstanding as of October 7, 2004 is 10 years from the date of grant.

If an option holder ceases to be an officer, director, continuing consultant or employee of the Corporation or a subsidiary, each unexpired, vested option may be exercised within 3 months of the date of cessation. In the event of the death of an optionee, each unexpired, vested option may be exercised within 9 months of the option holder's date of death.

Options granted under the 1993 Plan are not transferable. Currently, the 1993 Plan may be amended by the Board subject to regulatory approval in certain circumstances.

2003 Plan

Under the 2003 Plan, options may be granted to employees, officers, directors or consultants of the Corporation as well as employees of an affiliate of the Corporation or consultants of a related entity of the

12

Corporation. The total number of options issued under the 2003 Plan is 8,858,855. This represents 4.2% of the Corporation's issued and outstanding capital as at August 15, 2007. The total number of shares issuable under the 2003 Plan is 31,894,181. This represents 15% of the Corporation's issued and outstanding capital as at August 15, 2007. As at the date of this circular, the Corporation has only applied to the TSX to list 5,592,097 of the common shares available for future issuance under the Corporation's equity compensation plans. The total number of common shares issuable under actual grants pursuant to the 2003 Plan is 8,858,855 being 4.2% of the Corporation's currently issued and outstanding capital as at August 15, 2007.

The maximum number of common shares reserved for issuance to insiders, at any time, under the 2003 Plan and any other compensation arrangement of the Corporation is 10% of the issued and outstanding common shares of the Corporation. The maximum number of common shares that may be issued to insiders, at any time, under the 2003 Plan and any other compensation arrangement of the Corporation within a 12 month period is 10% of the issued and outstanding common shares of the Corporation. The maximum number of common shares reserved for issuance to any one person is 5% of the issued and outstanding common shares of the Corporation. The exercise price of options granted under the 2003 Plan is established by the Board and will be equal to the closing market price of the common shares on the TSX on the last trading day preceding the date of grant. If there is no trading on that date, the exercise price will be the average of the bid and ask on the TSX on the last trading date preceding the date of grant. If not otherwise determined by the Board, an option granted under the 2003 Plan will vest as to 50% on the first anniversary of the date of grant of the option and an additional 25% on the second and third anniversaries after the date of grant. The Board fixes the term of each option when granted, but such term may not be greater than 10 years from the date of grant.

If an option holder is terminated without cause, resigns or retires, each option that has vested will cease to be exercisable 3 months after the option holder's termination date. Any portion of an option that has not vested on or prior to the termination date will expire immediately. If an option holder is terminated for cause, each option that has vested will cease to be exercisable immediately upon the Corporation's notice of termination. Any portion of an option that has not vested on or prior to the termination date will expire immediately.

Options granted under the 2003 Plan are not assignable. Currently, the 2003 Plan may be amended by the Board subject to regulatory and shareholder approval in certain circumstances.

During the period June 1, 2006 to May 31, 2007, options to purchase 5,318,000 common shares were granted under the 2003 Plan at exercise prices between $0.27 and $0.33 per common share. During the year ended May 31, 2007, we granted options to employees, other than executive officers of the Corporation, to purchase 2,183,067 common shares, being 41% of the total incentive stock options granted during the year to employees and executive officers.

See "Particulars of Matters to be Acted Upon — Amendments to 2003 Share Option Plan and 1993 Share Option Plan".

Performance Based Compensation Plans

Executive officers of the Corporation are eligible to participate in a performance related compensation plan (the "Compensation Plan"). The Compensation Plan provides for potential annual cash bonus payments and annual granting of options to purchase common shares under our 2003 Plan. The potential annual cash bonus and annual granting of options to each executive officer are conditional upon the achievement by the Corporation and each executive officer of predetermined objectives reviewed by the Compensation Committee and approved by the Board. See "Compensation Committee" and "Report on Executive Compensation".

Employee Share Purchase Plan

In November 2004, the Board adopted the Employee Share Purchase Plan ("ESPP"), effective January 1, 2005. For the year ended May 31, 2007 a total of 69,000 common shares had been purchased by employees under the ESPP at prices per share between $0.23 and $0.35 per common share and a weighted average purchase price of $0.26. During fiscal 2007, no executive officers purchased shares under the ESPP. The purpose of the ESPP is to assist the Corporation to retain the services of its employees, to secure and retain the services of new employees and to provide incentives for such persons to exert maximum efforts for the success of the

13

Corporation. The ESPP provides a means by which employees of the Corporation and its affiliates may purchase common shares at a 15% discount through accumulated payroll deductions. Eligible participants in the ESPP include all employees, including executive officers, who work at least 20 hours per week and are customarily employed by the Corporation or an affiliate of the Corporation for at least six months per calendar year. Generally, each offering is of three months' duration with purchases occurring every month. Participants may authorize payroll deductions of up to 15% of their base compensation for the purchase of common shares under the ESPP.

The Employee Share Purchase Plan was adopted by the Corporation in connection with the Arrangement.

Deferred Profit Sharing Plan

We have a Deferred Profit Sharing Plan ("DPSP") matching program which is available to all employees. The DPSP matching program provides 100% matching of employee contributions into each employee's Group RRSP account up to a maximum of 3% of the employee's gross earnings. We began making contributions to the employees' Group Retirement Savings Plan in fiscal 1998. Beginning February 2001, our contributions have been paid into an employer-sponsored DPSP.

Directors' and Officers' Deferred Share Unit Plan

We have a deferred share unit plan for directors and officers (the "Deferred Share Unit Plan"). Under the Deferred Share Unit Plan, participating directors may elect to receive either a portion or all of their annual fees for acting as a director ("Annual Fees") from us in deferred share units. Under the Deferred Share Unit Plan, the Compensation Committee may at any time during the period between the annual meetings of our shareholders, in its discretion recommend the Corporation credit to each participating director who has elected under the terms of the Deferred Share Unit Plan, the number of units equal to the gross amount of the Annual Fees to be deferred divided by the fair market value of the common shares. The fair market value of the common shares is determined as the closing price of the common shares on the TSX on the day immediately preceding such recommendation by the Compensation Committee or such other amount as determined by the Board and permitted by the stock exchanges or other market(s) upon which the common shares are from time to time listed for trading and by any other applicable regulatory authority (collectively, the "Regulatory Authorities").

In addition, the participating directors may elect under the Deferred Share Unit Plan to receive deferred share units in satisfaction for meeting fees earned by the Participating Directors as a result of attendance at meetings of the Board held between the annual meetings of our shareholders by the credit to each Participating Director of the number of units equal to the gross amount of the meeting fees to be deferred divided by the fair market value of the common shares, being the closing price of the common shares on the TSX on the day immediately preceding the recommendation by the Compensation Committee or such other amount as determined by the Board and permitted by the Regulatory Authorities.

The Deferred Share Unit Plan is administered by the Board (in consultation with the Compensation Committee) and, subject to regulatory requirements, may be amended by the Board without shareholder approval. When a participating director ceases to hold the position of director and is no longer otherwise employed by us, the participating director receives either (a) a lump sum cash payment equal to the number of deferred share units held multiplied by the then fair market value of the common shares on the date of termination, or (b) the number of common shares that can be acquired in the open market with the amount described in (a), either case being subject to withholding for income tax. The Board may terminate the Deferred Share Unit Plan any time before or after any allotment or accrediting of deferred share units thereunder.

The Deferred Share Unit Plan was adopted by the Corporation in connection with the Arrangement.

14

REPORT ON EXECUTIVE COMPENSATION

Composition of the Compensation Committee

The Board, upon the advice of the Compensation Committee, determines executive compensation. During the period from June 1 to September 21, 2006 the Compensation Committee was comprised of three independent directors, Mr. Steigrod, Mr. Strachan and Mr. Buchi. From September 21, 2006 to present, the Compensation committee is comprised of Mr. Steigrod, Mr. Ludwig and Dr. Moore. Dr. Moore is interim chair of the Compensation Committee. The Compensation Committee met once during the above period.

Compensation Objectives and Philosophy

The Compensation Committee's mandate is to review, and advise the Board on, the recruitment, appointment, performance, compensation, benefits and termination of executive officers. The Compensation Committee also administers and reviews procedures and policies with respect to our 2003 Stock Option Plan, employee benefit programs, pay equity and employment equity. The philosophy of the Compensation Committee regarding executive officer compensation is to reward performance and to provide a total compensation package that will attract and retain qualified, motivated and achievement oriented executive officers.

The Compensation Committee attempts to create compensation arrangements that will align the interests of our executive officers and our shareholders. The key components of executive officer compensation are base salary, potential annual cash bonuses and annual participation in the 2003 Stock Option Plan.

Base Salary — Initial Stock Options

Base salary for each executive officer is a function of the individual's experience, past performance and anticipated future contribution. The Compensation Committee uses private and public compensation surveys to assist with the determination of an appropriate compensation package for each executive officer.

Executive officers are granted stock options on the commencement of employment with Lorus in accordance with the responsibility delegated to each executive officer for achieving corporate objectives and enhancing shareholder value.

Potential Annual Cash Bonuses and Annual Participation in the 2003 Stock Option Plan

Generally, potential annual cash bonuses and annual awards of options under the 2003 Stock Option Plan for each executive officer are conditional in part upon the achievement by the Corporation of predetermined scientific, clinical, regulatory, intellectual property, business and corporate development and financial objectives, and in part upon the achievement by each executive officer of individual performance objectives. Executive officer individual performance objectives for each fiscal year are consistent with corporate objectives and each executive officer's role in achieving them. All corporate and executive officer objectives are predetermined by the Board after review by the Compensation Committee. With the exception of the President and Chief Executive Officer, seventy-five percent of each executive officer's potential annual cash bonus is conditional upon the achievement of corporate objectives, with the remaining twenty-five percent being conditional upon the achievement of individual executive officer objectives. All of the President and Chief Executive Officer's potential annual bonus is conditional upon achievement of corporate objectives. The Compensation Committee recommends to the Board the awarding of bonuses, payable in cash, stock or stock options, to reward extraordinary individual performance.

For each executive officer, during the year ended May 31, 2007, the potential annual cash bonuses range from 15% to 40% of base salary when all corporate and individual executive officer objectives were achieved.

Cash bonuses are determined as soon as practicable after the end of the fiscal year and, for the Named Executive Officers, are included in the Summary Compensation Table in the year in respect of which they are earned.

There is a potential for an annual allocation of options under our 2003 Stock Option Plan for each executive officer when corporate and executive officer objectives are achieved. The Compensation Committee

15

approves the allocation of options and options are priced using the closing market price of the common shares on the TSX on the last trading day prior to the date of grant. Options to purchase common shares expire ten years from the date of grant and vest over three years. The granting of options to purchase common shares for Named Executive Officers is included in the Summary Compensation Table in the year that they are earned.

President and Chief Executive Officer Compensation

The performance of the President and Chief Executive Officer for the 2007 financial year was measured in the following areas:

Each of the above is weighted 60%, 20%, 10%, and 10% in relation to assessment of satisfaction of overall corporate objective and determination of any general corporate bonuses. For the year ended May 31, 2007 the President and CEO substantially met each of these objectives.

Submitted by the Compensation Committee of the Board:

Michael

Moore (Interim Chair)

Georg Ludwig

Alan Steigrod

16

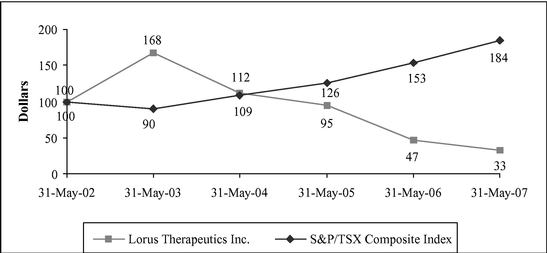

The following graph illustrates our cumulative total shareholder return (assuming a $100 investment) for the common shares on the TSX as compared with the S&P/TSX Composite Index during the period May 31, 2002 to May 31, 2007. From December 23, 1998 to February 23, 2004, the common shares traded on the OTC-BB under the symbol "LORFF". Since February 23, 2004, the common shares have also traded on the American Stock Exchange under the symbol "LRP".

| Year End |

2002 |

2003 |

2004 |

2005 |

2006 |

2007 |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| LOR | $ | 100 | $ | 168 | $ | 112 | $ | 95 | $ | 47 | $ | 33 | ||||||

| S&P/TSX Composite Index | $ | 100 | $ | 90 | $ | 109 | $ | 126 | $ | 153 | $ | 184 | ||||||

| Year End |

31-May-02 |

31-May-03 |

31-May-04 |

31-May-05 |

31-May-06 |

31-May-07 |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| LOR | 100=$0.75 | $ | 1.26 | $ | 0.84 | $ | 0.71 | $ | 0.35 | $ | 0.25 | ||||||

| S&P/TSX Composite Index | 100=7,656 | 6,860 | 8,347 | 9,619 | 11,744 | 14,082 | |||||||||||

The Corporation did not provide financial assistance to any employees, officers or directors for the purchase of securities in fiscal 2007. As of, and at all times throughout the fiscal year ended May 31, 2007, there was no indebtedness owing to the Corporation by any employees, officers or directors of the Corporation.

DIRECTORS AND OFFICERS' LIABILITY

We purchase and maintain liability insurance for the benefit of directors and officers to cover any liability incurred by such person in such capacities. The policy provides for coverage in the amount of $10,000,000 with a deductible amount of $150,000 (with certain exceptions). For the period June 1, 2006 to May 31, 2007, the premium cost of this insurance was $153,900.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

None of the directors or executive officers of the Corporation, no proposed nominee for election as a director of the Corporation, none of the persons who have been directors or executive officers of the Corporation at any time since June 1, 2006 and no associate or affiliate of any of the foregoing has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter scheduled to be acted upon at the Meeting other than the election of directors.

17

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Other than as set forth above under the headings "Executive Compensation" and "Voting Securities and Principal Holders of Voting Securities", during the financial year of the Corporation ended May 31, 2007, no director, proposed director, officer, or associate of a director, proposed director or officer nor, to the knowledge of our directors or officers, after having made reasonable inquiry, any person or company who beneficially owns, directly or indirectly, common shares carrying more than 10% of the voting rights attached to all common shares outstanding at the date hereof, or any associate or affiliate thereof, had any material interest, direct or indirect, in any material transaction of the Corporation, nor do any such persons have a material interest, direct or indirect, in any proposed transaction of the Corporation.

For the next annual meeting of shareholders of Lorus, shareholders must submit any proposal that they wish to raise at that meeting on or before May 10, 2008.

Additional information relating to Lorus, including our most current annual information form (together with documents incorporated therein by reference), our 2007 annual report containing the financial statements of Lorus Therapeutics Inc. for the financial year ended May 31, 2007, the report of the auditors thereon, and, as Supplement Financial Information, the annual consolidated financial statements of Old Lorus for the year ended May 31, 2007 and the report of the auditor thereon, management's discussion and analysis of our financial condition and results of operations for fiscal 2007 and our interim financial statements for periods subsequent to the end of our last financial year, can be found on the Canadian Security Administrators' System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com. For any documents relating to Old Lorus filed on SEDAR prior to the Arrangement Date, please refer to 4325231 Canada Inc. Copies of those documents, as well as additional copies of this Circular, are available upon written request to the Director of Finance of the Corporation, upon payment of a reasonable charge where applicable. Financial information of the Corporation is provided in our consolidated financial statements for the year ended May 31, 2007 and management's discussion and analysis of our financial condition and results of operations for fiscal 2007.

The contents and sending of this Circular have been approved by the directors of the Corporation.

(signed)

AIPING YOUNG

President and CEO

18

APPENDIX A

Corporate Governance Practices

Effective June 30, 2005, National Instrument 58-101 — Disclosure of Corporate Governance Practices ("NI 58-101") and National Policy 58-201 — Corporate Governance Guidelines were adopted in each of the provinces and territories of Canada. NI 58-101 requires issuers to disclose the corporate governance practices that they have adopted. NP 58-201 provides guidance on governance practices. The Corporation is also subject to Multilateral Instrument 52-110 — Audit Committees ("MI 52-110"), which has been adopted in various Canadian provinces and territories and which prescribes certain requirements in relation to audit committees.

Plan of Arrangement and Corporate Reorganization

On July 10, 2007 (the "Arrangement Date"), the Corporation completed a plan of arrangement and corporate reorganization with, among others, 4325231 Canada Inc. ("Old Lorus"), 6707157 Canada Inc. and Pinnacle International Lands, Inc. (the "Arrangement"). As a result of the plan of arrangement and reorganization, among other things, each common share of Old Lorus was exchanged for one common share of the Corporation and all of the assets and liabilities of Old Lorus were transferred to the Corporation and/or its subsidiaries. References in this Circular to the Corporation, "we", "our", "us" and similar expressions, unless otherwise stated, are references to Old Lorus prior to the Arrangement Date and the Corporation after the Arrangement Date.

General

The Corporation adopted the mandates, code of ethics, position descriptions and all other corporate governance practices of Old Lorus in connection with the Arrangement.

The Corporation is committed to sound and comprehensive corporate governance policies and practices and is of the view that its corporate governance policies and practices, outlined below, are comprehensive and consistent with NP 58-201 and MI 52-110.

Board of Directors

The board of directors of the Corporation (the "Board") encourages sound and comprehensive corporate governance policies and practices designed to promote the ongoing development of the Corporation.

Composition of the Board

The Corporation's Board is currently composed of nine directors, a majority of whom are independent directors. All of the proposed new nominees for director are independent. An "independent" board member, as further defined in MI 52-110, means that such member has no "material relationship" with the issuer. A "material relationship" is a relationship that could, in the view of the Board, be reasonably expected to interfere with the exercise of a member's judgment.

| Director or Nominee Director |

Independent |

|

|---|---|---|

| Herbert Abramson(5) | Yes | |

| J. Kevin Buchi | Yes | |

| Denis Burger(2) | Yes | |

| Susan Koppy(2) | Yes | |

| Georg Ludwig | No | |

| Michael Moore(1) | Yes | |

| Donald W. Paterson(1) | Yes | |

| Alan Steigrod | Yes | |

| Graham Strachan(1) | Yes | |

| Mark Vincent(2) | Yes | |

| Jim A. Wright | No | |

| Aiping Young | No |

19

Aiping Young, the President and Chief Executive Officer of the Corporation, is not an independent director by virtue of her role on the Corporation's management team. Dr. Jim A. Wright, the President and Chief Executive Officer of the Corporation, is not an independent director by virtue of his previous role on the Corporation's management team. Georg Ludwig is not an independent director by virtue of his affiliation with a significant investor of the Corporation.

The following table outlines other reporting issuers that Board members are directors of:

| Director or Nominee Director |

Reporting Issuer |

|

|---|---|---|

| Herbert Abramson | St Andrew Goldfields Ltd. | |

| J. Kevin Buchi | Encysive Pharmaceuticals | |

| Denis Burger(2) | Trinity Biotech plc | |

| Susan Koppy(2) | — | |

| Georg Ludwig | — | |

| Michael Moore(1) | — | |

| Donald W. Paterson(1) | ANGOSS Software Corporation NewGrowth Inc. Homeserve Technologies Inc. Utility Corporation |

|

| Alan Steigrod | Sepracor Inc. | |

| Graham Strachan(1) | Amorfix BiotechnologiesInc. Ibex Technologies Inc. |

|

| Mark Vincent(2) | — | |

| Jim A. Wright | — | |

| Aiping Young | — |

The independent directors hold meetings as a matter of routine after each Board meeting, without the presence of non-independent directors and members of management. There were four meetings of the independent directors in the financial year ended May 31, 2007. With the exception of the Compensation Committee and the Environmental Health and Safety Committee, Board committees are comprised entirely of independent directors and such committees meet regularly without management. Mr. Ludwig was a member of the Compensation Committee. The Board determined that his extensive experience in the biotech industry would benefit the Committee and that the nature of his relationship with the Corporation did not interfere with his ability to participate in an objective manner in the decisions taken by the Committee. The Board determined that Dr. Young's knowledge of day to day operation of the business would benefit the Committee.

Graham Strachan, the chair of the Board (the "Chair") is an independent director.

The Chair provides leadership to the Board in discharging its mandate and also assists the Board in discharging its stewardship function, which includes (i) working to ensure a strong, effective, well-balanced and representative membership of the Board and its committees, (ii) ensuring that committees are working effectively, (iii) ensuring the integrity of management, (iv) evaluating, together with the Compensation Committee and Nominating and Corporate Governance Committee, the President and Chief Executive Officer ("CEO") and corporate performance, and (v) ensuring the Board receives timely and accurate information before, during and after Board meetings.

20

The following table illustrates the attendance record of each director for all board meetings held for the fiscal year ended May 31, 2007.

| Director |

Meetings Attended |

|

|---|---|---|

| J. Kevin Buchi | 8 of 8 | |

| Georg Ludwig(2) | 6 of 7 | |

| Michael Moore(1)(2) | 7 of 7 | |

| Donald W. Paterson(1) | 8 of 8 | |

| Alan Steigrod | 7 of 8 | |

| Graham Strachan(1) | 8 of 8 | |

| Jim A. Wright | 7 of 8 | |

| Aiping Young(3) | 7 of 7 |

Board Mandate

The Board has adopted a mandate in which it explicitly assumes responsibility for stewardship of the Corporation. The Board is mandated to represent the shareholders to ensure appropriate succession planning is in place, select the appropriate CEO, assess and approve the strategic direction of the Corporation, ensure that appropriate processes for risk assessment, management and internal control are in place, monitor management performance against agreed benchmarks, and assure the integrity of financial reports. A copy of the Board Mandate is attached hereto as Schedule 1.

Position Descriptions

The Board has developed written position descriptions, which are reviewed annually, for the Chair and the chairs of each of the audit committee, the compensation committee, the corporate governance and nominating committee and the environment, health and safety committee. The CEO also has a written position description that has been approved by the Board and is reviewed annually.

Orientation and Continuing Education

It is the mandate of the Corporate Governance and Nominating Committee to ensure that a process is established for the orientation and education of new directors that addresses the nature and operation of the Corporation's business and their responsibilities and duties as directors (including the contribution individual directors are expected to make and the commitment of time and resources that the Corporation expects from its directors).

With respect to the continuing education of directors, the Corporate Governance and Nominating Committee ensures that directors receive adequate information and continuing education opportunities on an ongoing basis to enable directors to maintain their skills and abilities as directors and to ensure their knowledge and understanding of the Corporation's business remains current.

Ethical Business Conduct

The Corporation has adopted a Code of Business Conduct and Ethics (the "Code") that applies to the directors, officers and employees of the Corporation and each of its subsidiaries. Additionally, consultants and agents for Lorus are expected to abide by the Code. The Code is disclosed on the Corporation's website at: www.lorusthera.com or at www.sedar.com.

The Corporate Governance and Nominating Committee regularly monitors compliance with the Code and ensures that management of the Corporation encourages and promotes a culture of ethical business conduct.

21

The Corporation has developed a Disclosure and Insider Trading Policy that covers "whistle blowing" and provides an anonymous means for employees and officers to report violations of the Code or any other corporate policies.

The Board has not granted any waiver of the Code in favour of a director or officer.

Conflicts of Interest

The Corporate Governance and Nominating Committee monitors the disclosure of conflicts of interest by directors and ensures that no director will vote or participate in a discussion on a matter in respect of which such director has a material interest.

Nomination of Directors

It is the mandate of the Corporate Governance and Nominating Committee to identify and recommend qualified candidates for the Board. In assessing whether identified candidates are suitable for the Board, the Corporate Governance and Nominating Committee considers: (i) the competencies and skills considered necessary for the Board as a whole; (ii) the competencies and skills that the existing directors possess and the competencies and skills nominees will bring to the Board; and (iii) whether nominees can devote sufficient time and resources to his or her duties as a member of the Board. In addition, the Corporate Governance and Nominating Committee assesses the participation, contribution and effectiveness of the individual members of the Board on an annual basis. All members of the Corporate Governance and Nominating Committee are independent in accordance with the mandate of the Corporate Governance and Nominating Committee.

Further to this process, three nominees have been proposed for election to the Board, Susan Koppy, Mark Vincent, and Denis Burger.

Compensation

The Compensation Committee is responsible for reviewing and recommending to the Board the compensation of: (i) the directors, (ii) the Chair of the Board, (iii) the chairs of the Corporation's committees, and (iv) the senior officers. In addition, the Compensation Committee reviews and makes recommendations to the Board regarding the corporate goals and objectives, performance and compensation of the CEO on an annual basis and is responsible for reviewing the recommendations of the CEO regarding compensation of the senior officers.

In addition, the Compensation Committee reviews and recommends changes to the compensation of the members of the Board based on a comparison of peer companies and issues relevant to the Corporation. The Compensation Committee also reviews and makes recommendations regarding annual bonus policies for employees, the incentive-compensation plans and equity-based plans for the Corporation and reviews executive compensation disclosure before the Corporation publicly discloses this information.

Further information pertaining the compensation of directors and officers can be found in this Circular under the heading "Statement of Executive Compensation".

Assessments

It is the Board's mandate, in conjunction with the Corporate Governance and Nominating Committee, to assess the participation, contributions and effectiveness of the Chair and the individual members of the Board on an annual basis. The Board also monitors the effectiveness of the Board and its committees and the actions of the Board as viewed by the individual directors and senior management.

22

SCHEDULE 1

LORUS THERAPEUTICS INC.

BOARD MANDATE

Purpose

The board of directors (the "Board") of Lorus Therapeutics Inc. (the "Corporation") is responsible for the proper stewardship of the Corporation. The Board is mandated to represent the shareholders to select the appropriate Chief Executive Officer ("CEO"), assess and approve the strategic direction of the Corporation, ensure that appropriate processes for risk assessment, management and internal control are in place, monitor management performance against agreed bench marks, and assure the integrity of financial reports.

Membership and Reporting

Terms of Reference

Meetings

Meeting Preparation and Attendance

Corporate Planning and Performance

23

opportunity for the Board to meet from time to time with industry, medical and scientific experts in related fields of interest;

Risk Management and Ethics

Shareholder Communication

Supervision of Management

24

Management of Board Affairs

25

APPENDIX "B"

AUDIT COMMITTEE INFORMATION

Plan of Arrangement and Corporate Reorganization

On July 10, 2007 (the "Arrangement Date"), the Corporation completed a plan of arrangement and corporate reorganization with, among others, 4325231 Canada Inc. ("Old Lorus"), 6707157 Canada Inc. and Pinnacle International Lands, Inc. (the "Arrangement"). As a result of the plan of arrangement and reorganization, among other things, each common share of Old Lorus was exchanged for one common share of the Corporation and all of the assets and liabilities of Old Lorus were transferred to the Corporation and/or its subsidiaries. References in this Circular to the Corporation, "we", "our", "us" and similar expressions, unless otherwise stated, are references to Old Lorus prior to the Arrangement Date and the Corporation after the Arrangement Date.

The Audit Committee Charter of Old Lorus was adopted by the Corporation is connection with the Arrangement.

The charter of our audit committee is attached as Schedule 1. The current members of the audit committee are J. Kevin Buchi, Donald W. Paterson and Graham Strachan. Pursuant to Canadian securities laws, our board of directors has determined that Messrs. Buchi, Paterson and Strachan are financially literate, as all have experience in reviewing and analysing the financial reports and ascertaining the financial position of a corporation. Mr. Buchi is a certified public accountant and holds the position of Chief Financial Officer in a public pharmaceutical company. Pursuant to United States securities laws, Mr. Buchi is also a "financial expert". Mr. Paterson, in his position as President of Cavandale Corporation, is educated and experienced in reading and analyzing financial statements. Mr. Strachan has experience reading and analyzing financial statements both as President of his own life science consulting firm and in a prior position as President, Chief Executive Officer and a director of a biopharmaceutical company. Additionally, we believe that all three members of the audit committee qualify as "independent" as that term is defined in the relevant Canadian and United States securities laws relating to the composition of the audit committee.

Pre-Approval Policies and Procedures

The audit committee of our board of directors has, pursuant to the audit committee charter, adopted specific responsibilities and duties regarding the provision of services by our external auditors, currently KPMG LLP. Our charter requires audit committee pre-approval of all permitted audit and audit-related services. Any non-audit services must be submitted to the audit committee for review and approval. Under the charter, all permitted services to be provided by KPMG LLP must be pre-approved by the audit committee.

Subject to the charter, the audit committee may establish fee thresholds for a group of pre-approved services. The audit committee then recommends to the board of directors approval of the fees and other significant compensation to be paid to the independent auditors. No audit-related services were provided under a de minimus exemption for our fiscal year ended May 31, 2007.

Auditors' Fees

The total fees billed for professional services by KPMG LLP (our independent auditors) for the years ended May 31, 2007 and 2006 are as follows:

| |

2007 |

2006 |

||||

|---|---|---|---|---|---|---|

| Audit Fees | $ | 330,000 | $ | 198,500 | ||

| Tax Fees | $ | 8,500 | $ | 13,100 | ||

| Total | $ | 338,500 | $ | 211,600 | ||

Audit fees consist of the fees paid with respect to the audit of our consolidated annual financial statements, quarterly reviews, accounting assistance and fees for services associated with the filing of the management proxy circular in May 2007 amounting to $150,000. Tax fees relate to assistance provided with respect of proposed transactions and review of tax returns.

26

SCHEDULE 1

CHARTER OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

OF LORUS THERAPEUTICS INC. (THE "COMPANY")

1. PURPOSE

The Audit Committee is a committee of the board of directors of the Company (the "Board"). The primary function of the Audit Committee is to assist the Board in fulfilling its oversight responsibilities. The Audit Committee's primary duties and responsibilities are to:

The Audit Committee has the authority to conduct any investigation appropriate to fulfilling its responsibilities, and it has direct access to the independent auditors as well as anyone in the Company. The Audit Committee has the ability to retain, at the Company's expense, special legal, accounting, or other consultants or experts it deems necessary in the performance of its duties.

2. COMPOSITION AND MEETINGS

Audit Committee members shall meet the requirements of Canadian and United States securities laws, including the requirements of the stock exchanges on which the Company's securities are listed.

The Audit Committee shall be comprised of three or more directors as determined by the Board, each of whom shall be independent as defined by Multilateral Instrument 52-110 — Audit Committees of the Canadian Securities Administrators ("MI 52-110"), United States securities laws, and applicable stock exchange rules. All members of the Audit Committee shall have a basic understanding of finance and accounting and be able to read and understand fundamental financial statements, and at least one member of the Committee shall have accounting or related financial management expertise.

Audit Committee members shall be appointed by the Board. If an Audit Committee Chair is not designated or present, the members of the Audit Committee may designate a Chair by majority vote of the Audit Committee membership.

The Audit Committee shall meet at least four times annually, or more frequently as circumstances require. The Audit Committee Chair shall prepare and/or approve an agenda in advance of each meeting.

The Audit Committee may ask members of management or others to attend meetings and provide pertinent information as necessary. The Audit Committee should meet privately in executive session at least annually with management, the independent auditors, and as a committee to discuss any matters that the Audit Committee or each of these groups believe should be discussed. In addition, the Audit Committee should communicate with management quarterly to review the Company's financial statements.

3. RESPONSIBILITIES AND DUTIES

27

28

The Audit Committee shall put in place procedures for:

29

APPENDIX "C"

RESOLUTION APPROVING AMENDMENTS TO THE CORPORATION'S 1993 STOCK OPTION PLAN AND 2003 STOCK OPTION PLAN

BE IT RESOLVED THAT:

30

SCHEDULE 1

AMENDMENTS TO 2003 STOCK OPTION PLAN AND 1993 STOCK OPTION PLAN

LORUS THERAPEUTICS INC.

1993

STOCK OPTION PLAN

1. DEFINITIONS

"Black Out Period" means any period during which a policy of the Company prevents an insider from trading in the Shares.