UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form CB

TENDER OFFER/RIGHTS OFFERING NOTIFICATION FORM

Please place an X in the box(es) to designate the appropriate rule provision(s) relied upon to file this Form:

Securities Act Rule 801 (Rights Offering) o

Securities Act Rule 802 (Exchange Offer) ý

Exchange Act Rule 13e-4(h)(8) (Issuer Tender Offer) o

Exchange Act Rule 14d-1(c) (Third Party Tender Offer) o

Exchange Act Rule 14e-2(d) (Subject Company Response) o

Filed or submitted in paper if permitted by Regulation S-T Rule 101(b)(8):

| ý (6650309 Canada Inc.) | ||

| o (Lorus Therapeutics Inc.) |

Lorus Therapeutics Inc.

(Name of Subject Company)

N/A

(Translation of Subject Company's Name into English (if applicable))

Canada

(Jurisdiction of Subject Company's Incorporation or Organization)

Lorus Therapeutics Inc.

6650309 Canada Inc.

(Name of Person(s) Furnishing Form)

Common Shares

(Title of Class of Subject Securities)

544191109

(CUSIP Number of Class of Securities (if applicable))

DL Services Inc.

1420 Fifth Avenue

Suite 3400

Seattle, Washington 98101

Telephone: (206) 903-5448

(Name, Address (including zip code) and Telephone Number (including area code)

of Person(s) Authorized to Receive Notices and Communications

on Behalf of Subject Company)

June 1, 2007

(Date Tender Offer/Rights Offering Commenced)

PART I

INFORMATION SENT TO SECURITY HOLDERS

Item 1. Home Jurisdiction Documents

Item 2. Informational Legends

See pages 1 and 2 of the Circular.

LORUS THERAPEUTICS INC.

NOTICE OF SPECIAL MEETING OF HOLDERS OF

COMMON SHARES, OPTIONS, WARRANTS

AND CONVERTIBLE DEBENTURES

TO BE HELD ON JUNE 25, 2007

- AND -

MANAGEMENT PROXY CIRCULAR

MAY 25, 2007

May 25, 2007

Dear Lorus Securityholder:

You are invited to attend a special meeting (the "Meeting") of holders of common shares (the "Shareholders") and of the holders of options to purchase common shares, warrants to purchase common shares and debentures convertible into common shares (collectively, the "Convertible Securities") (the Shareholders and the holders of Convertible Securities being collectively referred to herein as the "Securityholders") of Lorus Therapeutics Inc. ("Lorus") to be held on June 25, 2007, at 10:00 a.m. (Toronto time), at Le Royal Meridien King Edward, 37 King Street East, Toronto, Ontario, in the Kensington Room.

The purpose of the Meeting is to seek the approval of the Securityholders for an arrangement of Lorus (the "Arrangement"), pursuant to which Lorus will transfer its business to a new corporate entity ("New Lorus"), which entity will possess the same net assets, name, board of directors and management as Lorus, but will also have approximately an additional $8.5 million in cash, subject to a $600,000 holdback and a maximum post closing adjustment of $270,000, not including the costs of the transaction. The existing Lorus entity, of which current Shareholders who are not resident in the United States will continue to own a part following the Arrangement, will pursue opportunities as a real estate development company ("RealCo") under a new name, with a new board of directors and new management.

Lorus is undertaking the Arrangement because Lorus believes the Arrangement provides the following advantages to Lorus and its Securityholders:

The Arrangement will only take effect if it is approved by (i) at least two-thirds of the votes cast by Securityholders voting together as a single class, in person or by proxy, at the Meeting, (ii) a simple majority of the votes cast by Shareholders who are "minority" Shareholders, in person or by proxy, at the Meeting, and (iii) a final order of the Ontario Superior Court of Justice.

Deloitte & Touche LLP has provided the board of directors of Lorus (the "Board") with a fairness opinion to the effect that the Arrangement is fair, from a financial point of view, to the Securityholders. Those members of the Board entitled to approve the Arrangement unanimously recommend that Securityholders vote FOR the Arrangement.

As part of the Arrangement, Securityholders will be asked to consider and, if thought advisable, approve (i) various amendments to the articles of RealCo, and (ii) certain transactions between RealCo and related parties of RealCo including, among other things, the purchase of certain limited partnership interests in two residential and mixed-use condominium projects in Toronto, Ontario, the entering into by RealCo of one or more agreements to provide certain services to affiliates of RealCo and the engagement by RealCo of certain agents and contractors as required for the business of RealCo.

The accompanying management proxy circular contains a detailed description of the Arrangement, as well as detailed information regarding Lorus, New Lorus and RealCo. Lorus recognizes the environmental impact of producing the management proxy circular and in an effort to minimize this impact, Lorus intends to donate $2,500 to an environmental organization focused on reforestation and nature conservation issues. In this way Lorus believes that it can help replenish those resources used to meet our corporate requirements.

This is an important matter affecting the future of Lorus, and it is important that your common shares and Convertible Securities be represented at the Meeting. Regardless of whether you plan to attend the Meeting, please complete the appropriate enclosed proxy forms and return them in the manner set out in the accompanying management proxy circular to ensure that your intentions are represented at the Meeting.

On behalf of Lorus, I would like to thank you for your past and ongoing support.

Yours very truly,

LORUS THERAPEUTICS INC. |

|

|

|

(Signed) Graham Strachan Chair of the Board of Directors |

2

LORUS THERAPEUTICS INC.

NOTICE OF SPECIAL MEETING OF HOLDERS OF

COMMON SHARES, OPTIONS, WARRANTS AND CONVERTIBLE DEBENTURES OF

LORUS THERAPEUTICS INC.

to be held on June 25,

2007

NOTICE IS HEREBY GIVEN that a special meeting (the "Meeting") of the holders of common shares ("Shareholders") of Lorus Therapeutics Inc. ("Lorus") and of the holders of options to purchase common shares, warrants to purchase common shares and debentures convertible into common shares (collectively with the Shareholders, the "Securityholders") will be held on June 25, 2007, at 10:00 a.m. (Toronto time), at the Le Royal Meridien King Edward, 37 King Street East, Toronto, Ontario, in the Kensington Room for the following purposes:

The details of the matters proposed to be put before the Meeting are set forth in the Circular, including the appendices attached thereto.

Only Securityholders of record at the close of business on May 24, 2007 will be entitled to vote at the Meeting.

DATED at the City of Toronto, in the Province of Ontario, this 25th day of May, 2007.

BY ORDER OF THE BOARD OF DIRECTORS OF LORUS THERAPEUTICS INC.

(Signed) Graham Strachan

Chair of the Board of Directors

A Securityholder may attend the Meeting in person or may be represented by proxy. Registered Securityholders who are unable to attend the Meeting in person are requested to complete, date, sign and return the applicable accompanying proxy forms for use at the Meeting. To be valid, proxies must be deposited with Computershare Investor Services Inc., 100 University Avenue, 8th Floor, Toronto, Canada M5J 2Y1, so as to arrive not later than 5:00 p.m. (Toronto time) on June 21, 2007 or, if the Meeting is adjourned, 48 hours (excluding Saturdays, Sundays and holidays) before the time set for the adjourned Meeting. Securities held by Securityholders will be voted in accordance with the instructions indicated in the applicable proxy forms.

i

| |

Page |

|

|---|---|---|

| INTRODUCTION | 1 | |

| INFORMATION FOR UNITED STATES SECURITYHOLDERS | 1 | |

| EXCHANGE RATE INFORMATION | 3 | |

| GLOSSARY OF TERMS | 4 | |

| SUMMARY | 11 | |

| FORWARD-LOOKING STATEMENTS | 21 | |

| SOLICITATION OF PROXIES AND VOTING AT THE MEETING | 22 | |

| VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF | 25 | |

| INTERESTS OF CERTAIN PERSONS IN MATTERS TO BE ACTED ON | 25 | |

| THE ARRANGEMENT | 26 | |

| FAIRNESS OPINION | 41 | |

| RECOMMENDATION OF THE BOARD OF DIRECTORS | 42 | |

| CANADIAN SECURITIES MATTERS | 43 | |

| TIMING | 45 | |

| CERTAIN CANADIAN FEDERAL INCOME TAX CONSEQUENCES FOR SHAREHOLDERS | 46 | |

| CERTAIN CANADIAN FEDERAL INCOME TAX CONSEQUENCES FOR HOLDERS OF OPTIONS | 48 | |

| ELIGIBILITY FOR INVESTMENT | 49 | |

| CERTAIN UNITED STATES FEDERAL INCOME TAX CONSEQUENCES FOR SHAREHOLDERS | 49 | |

| AMENDMENT OF LORUS' ARTICLES AND CONTINUANCE OF LORUS INTO BRITISH COLUMBIA | 52 | |

| DISTRIBUTION OF CERTIFICATES AND CASH PAYMENTS | 52 | |

| STOCK EXCHANGE LISTINGS | 53 | |

| RESALE OF SECURITIES | 54 | |

| INDEBTEDNESS OF DIRECTORS AND OFFICERS | 56 | |

| INFORMATION RESPECTING LORUS | 56 | |

| INFORMATION RESPECTING NEW LORUS | 56 | |

| INFORMATION RESPECTING REALCO | 57 | |

| RISK FACTORS | 57 | |

| ARRANGEMENT DISSENT RIGHTS | 58 | |

| OTHER BUSINESS | 60 | |

| AUDITORS | 60 | |

| LEGAL MATTERS | 60 | |

| APPROVAL OF DIRECTORS | 60 | |

| ADDITIONAL INFORMATION | 60 |

ii

| APPENDIX "A" | — | ARRANGEMENT RESOLUTION | ||

| APPENDIX "B" | FORM OF ARTICLES OF AMENDMENT OF REALCO | |||

| APPENDIX "C" | — | PLAN OF ARRANGEMENT | ||

| APPENDIX "D" | — | INTERIM ORDER AND NOTICE OF APPLICATION FOR THE FINAL ORDER | ||

| APPENDIX "E" | — | FAIRNESS OPINION | ||

| APPENDIX "F" | — | INFORMATION RESPECTING LORUS | ||

| APPENDIX "G" | — | INFORMATION RESPECTING NEW LORUS | ||

| APPENDIX "H" | — | INFORMATION RESPECTING REALCO AND FINANCIAL STATEMENTS OF THE PINNACLE PARTNERSHIPS | ||

| APPENDIX "I" | — | UNAUDITED PRO FORMA BALANCE SHEET OF REALCO | ||

| APPENDIX "J" | — | BALANCE SHEET OF NEW LORUS | ||

| APPENDIX "K" | COMPARISON OF CBCA TO BCBCA | |||

| APPENDIX "L" | — | SECTION 190 OF THE CBCA |

iii

MANAGEMENT PROXY CIRCULAR

Special Meeting of Securityholders

to be held on June 25, 2007

This Circular is furnished in connection with the solicitation of proxies by and on behalf of the management of Lorus Therapeutics Inc. ("Lorus") for use at the Meeting. No Person has been authorized to give any information or make any representation in connection with the Arrangement or other matters to be considered at the Meeting other than those contained in this Circular and, if given or made, any such information or representation must not be relied upon as having been authorized. This Circular does not constitute an offer to sell securities, a solicitation of an offer to purchase securities, or the solicitation of a proxy by any Person in any jurisdiction in which such an offer or solicitation is not authorized or in which the Person making such offer or solicitation is not qualified to do so or to any Person to whom it is unlawful to make such an offer or solicitation. Neither delivery of this Circular nor any distribution of the securities referred to in this Circular will, under any circumstance, create an implication that there has been no change in the information set forth herein since the date of this Circular.

The Meeting has been called for the purposes of considering and, if deemed advisable, passing the Arrangement Resolution and to transact such other business as may properly come before the Meeting.

All summaries of, and references to, the Arrangement in this Circular are qualified in their entirety by reference to the complete text of the Arrangement Agreement available on SEDAR at www.sedar.com, the Arrangement Resolution attached as Appendix A to this Circular, and the Plan of Arrangement attached as Appendix C to this Circular. You are urged to carefully read this Circular, the full text of the Arrangement Resolution, the Arrangement Agreement (including the schedules thereto), and the Plan of Arrangement.

All capitalized terms used in this Circular but not otherwise defined herein have the meanings set forth under "Glossary of Terms". In this Circular, unless otherwise specified, all dollar amounts and financial information are expressed in Canadian dollars. Information contained in this Circular is given as of May 24, 2007 unless otherwise specifically stated.

INFORMATION FOR UNITED STATES SECURITYHOLDERS

The solicitation and transactions contemplated in this Circular are made in the United States for securities of a Canadian issuer in accordance with Canadian corporate and securities laws and, accordingly, this Circular has been prepared in accordance with disclosure requirements applicable in Canada. Securityholders in the United States should be aware that such requirements are different from those of the United States applicable to registration statements under the 1933 Act and proxy statements under the 1934 Act. The solicitation of proxies is not subject to the requirements of Section 14(a) of the 1934 Act. The pro forma and historical financial statements and other financial information of RealCo and the Pinnacle Partnerships included in this Circular have been prepared in accordance with Canadian generally accepted accounting principles, which differ from United States generally accepted accounting principles in certain material respects, and are subject to Canadian auditing and auditor independence standards, and thus are not comparable in all respects to pro forma and historical financial statements and other financial information of United States companies. Likewise, information concerning the operations of Lorus and New Lorus contained herein, including the information incorporated by reference herein, has been prepared in accordance with Canadian standards and is not comparable in all respects to similar information for United States companies.

Securityholders should be aware that the Arrangement and the ownership of Securities of New Lorus may have tax consequences in both Canada and the United States. See "Certain Canadian Federal Income Tax Consequences for Shareholders", "Certain Canadian Federal Income Tax Consequences for Holders of Options" and "Certain United States Federal Income Tax Consequences for Shareholders".

1

The New Lorus Common Shares, New Lorus Options, New Lorus Warrants and RealCo Voting Shares to be issued under the Arrangement have not been and will not be registered under the 1933 Act and will be issued in reliance on the exemption from registration set forth in Section 3(a)(10) thereof. The AMEX has conditionally approved the listing of the New Lorus Common Shares and the New Lorus Common Shares issuable upon the exercise of the New Lorus Options and the New Lorus Warrants. The New Lorus Options, New Lorus Warrants and RealCo Voting Shares will not be listed for trading on any United States stock exchange.

The 1933 Act imposes restrictions on the resale of securities received pursuant to the Arrangement by Persons who were "affiliates" of Lorus, New Lorus, RealCo, Pinnacle or Investor immediately prior to the Arrangement or are "affiliates" of New Lorus, RealCo, Pinnacle or Investor after completion of the Arrangement. The New Lorus Options will be non-transferable. See "Resale of Securities".

The New Lorus Options and the New Lorus Warrants may only be exercised pursuant to an exemption or exclusion from the registration requirements of the 1933 Act. Therefore, such securities may be exercised only by a holder who represents that at the time of exercise the holder is not then located in the United States, is not a U.S. Person as defined in Rule 902 of Regulation S under the 1933 Act ("Regulation S"), and is not exercising the New Lorus Options or New Lorus Warrants for the account or benefit of a U.S. Person or a Person in the United States, unless the holder provides a legal opinion or other evidence reasonably satisfactory to New Lorus to the effect that the exercise of the New Lorus Options or New Lorus Warrants does not require registration under the 1933 Act or applicable state securities laws. In addition, any New Lorus Common Shares issuable upon the exercise of the New Lorus Options or New Lorus Warrants in the United States or for the account or benefit of a U.S. Person or a Person in the United States will be "restricted securities" within the meaning of Rule 144 under the 1933 Act, certificates representing such New Lorus Common Shares will bear a legend to that effect, and such New Lorus Common Shares may be resold only pursuant to an exemption or exclusion from the registration requirements of the 1933 Act and applicable state securities laws. Subject to certain limitations, the New Lorus Warrants may be resold outside the United States without registration under the 1933 Act pursuant to Regulation S. See "Resale of Securities".

The enforcement by Securityholders in the United States of civil liabilities under United States securities laws may be affected adversely by the fact that Lorus, New Lorus, RealCo, Pinnacle and Investor are organized under the laws of a jurisdiction other than the United States, that all or a majority of their executive officers and directors are residents of countries other than the United States, that the experts named in this Circular are residents of countries other than the United States, and that substantially all of the assets of Lorus, New Lorus, RealCo, Pinnacle and Investor and such Persons are located outside the United States.

THE NEW LORUS COMMON SHARES, THE NEW LORUS OPTIONS, THE NEW LORUS WARRANTS, THE NEW LORUS COMMON SHARES ISSUABLE UPON EXERCISE OF THE NEW LORUS OPTIONS AND THE NEW LORUS WARRANTS AND THE REALCO VOTING SHARES TO BE ISSUED IN CONNECTION WITH THE ARRANGEMENT HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES REGULATORY AUTHORITY OF ANY STATE OF THE UNITED STATES, NOR HAS THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES REGULATORY AUTHORITY OF ANY STATE OF THE UNITED STATES PASSED ON THE ADEQUACY OR ACCURACY OF THIS CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

2

In this Circular, unless otherwise specified, all dollar amounts and financial information are expressed in Canadian dollars. The Bank of Canada noon spot exchange rate on May 24, 2007 was U.S.$1.0841 = $1.00. The average exchange rate for the years ended 2006, 2005 and 2004 and for the nine-month periods ended February 28, 2007 and 2006 and the exchange rate at the end of such periods for the conversion of U.S. dollars into Canadian dollars based on the Bank of Canada closing rate of exchange for United States dollars were as follows:

| |

Year Ended May 31, |

Nine Months Ended February 28, |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2006 |

2005 |

2004 |

2007 |

2006 |

||||||||||

| End of Period | $ | 1.1015 | $ | 1.2552 | $ | 1.3634 | $ | 1.1698 | $ | 1.1366 | |||||

| Period Average | $ | 1.1701 | $ | 1.2551 | $ | 1.3423 | $ | 1.1381 | $ | 1.1857 | |||||

3

For the assistance of Securityholders, the following is a glossary of terms used throughout this Circular.

"1933 Act" means the United States Securities Act of 1933, as amended;

"1934 Act" means the United States Securities Exchange Act of 1934, as amended;

"Acquisition Proposal" has the meaning set forth in the section hereof entitled "The Arrangement — Arrangement Agreement — Non Solicitation and Right to Match";

"affiliate" or "associate" when used to indicate a relationship with a Person, has the meaning ascribed to it in the Securities Act (Ontario);

"AMEX" means the American Stock Exchange;

"AMEX Rules" means collectively, all rules, requirements and policies of the AMEX applicable to Lorus, including such as are contained in the Rules of the AMEX and the AMEX Company Guide;

"Antisense Patent Assets" means those assets set out in the Antisense Patent Assets Transfer Agreement;

"Antisense Patent Assets Transfer Agreement" means the asset purchase agreement to be entered into between GeneSense and New Lorus pursuant to which GeneSense will transfer its Antisense Patent Assets to New Lorus, as contemplated in the Plan of Arrangement;

"Applicable Laws" means, in relation to any Person, Property, transaction or event, all applicable provisions in effect at the relevant time (or mandatory applicable provisions) of federal, provincial, territorial, state, local or foreign laws, statutes, rules, regulations, directives and orders of all Governmental Authorities, and all judgments, orders, decrees, decisions, rulings or awards of all Governmental Authorities to which the Person in question is a party or by which it is bound or having application to the Person, Property, transaction or event, including the Securities Laws;

"Appropriate Number" means that number of RealCo Voting Shares which, if combined with the aggregate number of RealCo Voting Shares purchased pursuant to Section 3.01(24) of the Plan of Arrangement, would result in Investor holding a total number of RealCo Voting Shares representing approximately 41% of the issued and outstanding RealCo Voting Shares at the conclusion of the Arrangement;

"Arrangement" means the arrangement of Lorus under Section 192 of the CBCA on the terms and subject to the conditions set out in the Arrangement Agreement, subject to any amendments or variations thereto made in accordance with the terms hereof and/or of the Plan of Arrangement or made at the direction of the Court in the Final Order;

"Arrangement Agreement" means the arrangement agreement dated as of May 1, 2007 between Lorus, NuChem, GeneSense, New Lorus, Pinnacle and Investor pursuant to which such parties have proposed to implement the Arrangement, including any amendments thereto;

"Arrangement Dissent Rights" means the right of dissent provided for in the Interim Order and in the Plan of Arrangement and available to Registered Shareholders in connection with the Arrangement;

"Arrangement Resolution" means the special resolution of Securityholders approving the Plan of Arrangement to be considered at the Meeting and attached as Appendix A to this Circular;

"Articles of Arrangement" means the articles of arrangement of Lorus giving effect to the Arrangement which, pursuant to the CBCA, will be filed with the Director after the Final Order has been issued;

4

"Asset Transfer Agreements" means, collectively, the Tangible Business Assets Transfer Agreement, the Antisense Patent Assets Transfer Agreement, the Virulizin and Small Molecule Patent Assets Transfer Agreement and the Prepaid Expenses and Receivables Transfer Agreement;

"Assets" means, collectively, the Tangible Business Assets, the Antisense Patent Assets, the Virulizin and Small Molecule Patent Assets, the Prepaid Expenses and Receivables and all other assets of Lorus;

"BCBCA" means the Business Corporations Act (British Columbia);

"BCBCA Articles" means the notice of articles filed with the Registrar of Companies (British Columbia) to effect the Continuation;

"Board of Directors" or "Board" means the board of directors of Lorus;

"business day" means a day other than a Saturday, Sunday or other day when banks in Toronto, Ontario or Vancouver, British Columbia are not generally open for business;

"Canadian Securities Legislation" has the meaning attributed to such term in NI 14-101 and includes published policies promulgated thereunder from time to time by any of the Canadian Securities Regulatory Authorities and the TSX Company Manual;

"Canadian Securities Regulatory Authorities" has the meaning ascribed to such term in NI 14-101;

"CBCA" means the Canada Business Corporations Act;

"CDS" means CDS Clearing and Depository Services Inc.;

"Certificate of Arrangement" means the certificate of arrangement giving effect to the Arrangement, issued pursuant to subsection 192(7) of the CBCA;

"Circular" means this management proxy circular dated May 25, 2007, together with all appendices attached hereto and including the summary hereof, distributed by Lorus in connection with the Meeting;

"Closing" means the closing of the Arrangement and the other transactions contemplated by the Arrangement Agreement;

"Closing Date" means the date of the Closing;

"Common Shares" means the common shares in the share capital of Lorus;

"Continuation" means the continuance of RealCo from the Canadian federal jurisdiction to the Province of British Columbia;

"Continuous Disclosure Reports" means reports, financial statements, schedules, forms, statements and other documents required to be filed or submitted by Lorus under the Securities Laws, for the three years preceding the date of the Arrangement Agreement (or such shorter period as Lorus may have been required by the Securities Laws to file or submit such material), including the exhibits thereto and documents incorporated by reference therein;

"Convertible Debentures" means the prime plus 1% secured convertible debentures of Lorus due on October 6, 2009 in the aggregate principal amount of $15,000,000, issued to TEMIC in equal principal amounts of $5,000,000 each on each of October 6, 2004, January 14, 2005 and April 15, 2005;

"Convertible Securities" means, collectively, the Options, Warrants and Convertible Debentures;

"Convertible Securityholders" means the holders of Convertible Securities and "Convertible Securityholder" means any one of them;

5

"Court" means the Ontario Superior Court of Justice;

"Debenture Assumption Agreement" means the assignment, novation and amendment agreement dated May 1, 2007 between Lorus and New Lorus pursuant to which, among other things, New Lorus will assume Lorus' obligation to pay TEMIC the aggregate principal amount of $15,000,000 plus accrued interest owing under the Convertible Debentures;

"Director" means the Director appointed under section 260 of the CBCA;

"Dissent Procedures" means the dissent procedures, as described under the heading "Arrangement Dissent Rights";

"Dissent Rights" has the meaning set forth in the section hereof entitled "Arrangement Dissent Rights";

"Dissenting Shareholder" has the meaning set forth in the section hereof entitled "Arrangement Dissent Rights";

"Dissenting Shares" means the Common Shares in respect of which a Dissenting Shareholder dissents;

"Effective Date" means the effective date set out in the Articles of Arrangement that are filed with the Director;

"Effective Time" means 12:01 a.m. (Toronto time) on the Effective Date;

"Escrow Agreement" means the escrow agreement to be entered into on the Effective Date between Investor, New Lorus and the escrow agent appointed thereunder, as contemplated by the Pinnacle Share Purchase Agreement;

"Fairness Opinion" means the opinion of Deloitte & Touche LLP dated April 30, 2007 to the effect that the Arrangement is fair, from a financial point of view, to the Securityholders, a copy of which is attached as Appendix E to this Circular;

"Final Order" means the final order of the Court issued in connection with the approval of the Arrangement, providing, among other matters, for the Arrangement to be sanctioned and to take effect, as such order may be affirmed, amended or modified by any court of competent jurisdiction;

"GeneSense" means GeneSense Technologies Inc., a corporation existing under the laws of Canada;

"GeneSense Share Purchase Agreement" means the share purchase agreement to be entered into between Lorus and New Lorus pursuant to which Lorus will transfer all of the GeneSense Shares to New Lorus;

"GeneSense Shares" means common shares in the capital of GeneSense;

"Governmental Authority" means any federal, provincial, territorial, state, local or foreign government or any department, agency, board, tribunal (judicial, quasi-judicial, administrative, quasi-administrative or arbitral) or authority thereof or other political subdivision thereof and any Person exercising executive, legislative, judicial, regulatory or administrative functions of, or pertaining thereto or the operation thereof, including the Canadian Securities Regulatory Authorities, SEC, TSX and AMEX;

"High Tech" means High Tech Beteilingungen GmbH & Co. KG;

"Holder" has the meaning set forth in the section hereof entitled "Certain Canadian Federal Income Tax Consequences for Shareholders";

"Indemnification Agreement" means the indemnification agreement to be entered into on the Effective Date between Lorus, New Lorus, GeneSense and NuChem;

"Intellectual Property Rights" means all patents, patent applications, trademarks, trademark applications, service marks, trade names, copyrights, licenses and other similar rights necessary or material for use in connection with

6

Lorus' and its subsidiaries' respective businesses as currently conducted and anticipated to be conducted, as described in the Continuous Disclosure Reports;

"Interim Order" means the interim order of the Court dated May 16, 2007 under Section 192 of the CBCA, containing declarations and directions with respect to the Arrangement and the holding of the Meeting, a copy of which order is attached as Appendix D to this Circular, including any amendments or modifications thereto;

"Investor" means 6707157 Canada Inc., a corporation incorporated under the CBCA on January 23, 2007;

"Letter of Intent" means the non-binding letter of intent entered into on April 4, 2006, as amended, between Lorus and Pinnacle in respect of the Arrangement;

"Letter of Transmittal" means the letter of transmittal enclosed with this Circular pursuant to which a Shareholder is required to surrender certificates representing Common Shares in order to receive, upon completion of the Arrangement, New Lorus Common Shares and RealCo Voting Shares (if a Non-U.S. Person) or New Lorus Common Shares and a cash payment in lieu of RealCo Voting Shares (if a U.S. Person) issued pursuant to the Arrangement;

"Lorus" means Lorus Therapeutics Inc. prior to the reorganization of its share capital pursuant to the Arrangement, a company existing under the laws of Canada;

"Lorus Note" means the non-interest bearing promissory note to be issued by Lorus to New Lorus as consideration for New Lorus assuming Lorus' obligation to pay TEMIC, pursuant to the Debenture Assumption Agreement, the amount owing under the Convertible Debentures;

"Lorus Stock Option Plans" means Lorus' 1993 Stock Option Plan and 2003 Stock Option Plan;

"Material Adverse Change" or "Material Adverse Effect" means, when used in connection with Lorus, any change, effect, event, occurrence or change in a state of facts that is, or would reasonably be expected to be, material and adverse to the business, operations, assets, capitalization, liabilities or condition (financial or otherwise) of Lorus or any of its subsidiaries other than (i) any change in the trading price or trading volume of the Common Shares, (ii) any change affecting economic or financial conditions generally (global, national or regional, as applicable) that does not have a disproportionate effect on such party, (iii) any failure by Lorus to meet analysts' or internal earnings estimates, milestones or business plans, (iv) any action contemplated by the Convertible Debentures or taken by Lorus, at Investor's request, (v) any action required by Applicable Laws, or (vi) the results of any of Lorus' clinical trials for any product candidates;

"Meeting" means the special meeting of the Securityholders to be held on June 25, 2007, and any adjournment(s) thereof, to consider and, if deemed advisable, approve the Arrangement Resolution;

"Minority Shareholders" means all Shareholders other than High Tech, any related party of High Tech within the meaning of Rule 61-501 and Regulation Q-27 subject to the exceptions set out therein, and any Person acting jointly or in concert with High Tech;

"New Lorus" means 6650309 Canada Inc., a corporation incorporated under the CBCA on November 1, 2006 and a wholly-owned subsidiary of Lorus which, following completion of the Arrangement, will carry on the business and operations of Lorus as they existed immediately prior to the completion of the Arrangement;

"New Lorus Common Shares" means common shares in the share capital of New Lorus;

"New Lorus Note 1" means the demand non-interest bearing promissory note to be issued by New Lorus to GeneSense as consideration for the transfer by GeneSense to New Lorus of the Antisense Patent Assets, as contemplated by the Plan of Arrangement;

7

"New Lorus Note 2" means the demand non-interest bearing promissory note to be issued by New Lorus to Lorus as partial consideration for the transfer by Lorus to New Lorus of its GeneSense Shares pursuant to the GeneSense Share Purchase Agreement, as contemplated by the Plan of Arrangement;

"New Lorus Note 3" means the demand non-interest bearing promissory note to be issued by New Lorus to Lorus as consideration for the transfer by Lorus to New Lorus of its NuChem Shares pursuant to the NuChem Share Purchase Agreement, as contemplated by the Plan of Arrangement;

"New Lorus Options" means stock options to acquire New Lorus Common Shares to be issued to directors, officers, employees and consultants of New Lorus pursuant to the New Lorus Stock Option Plan;

"New Lorus Replacement Note" means the replacement non-interest bearing demand promissory note to be issued by New Lorus to Lorus to repay the remaining amount owing by New Lorus to Lorus under the New Lorus Note 2 and New Lorus Note 3 following the setoff of such notes by New Lorus against the Lorus Note, as contemplated by the Plan of Arrangement;

"New Lorus Stock Option Plan" means the stock option plans of New Lorus as contemplated by the Plan of Arrangement;

"New Lorus Warrants" means warrants to acquire New Lorus Common Shares to be issued by New Lorus in replacement of the Warrants;

"Non-U.S. Persons" means Shareholders that are not Resident in the United States and "Non-U.S. Person" means any one of them;

"Notice of Meeting" means the notice of the Meeting that accompanies this Circular;

"NI 14-101" means National Instrument 14-101 — Definitions, of the Canadian Securities Administrators, as such instrument may be amended or supplemented from time to time, or any similar instrument, rule or regulation hereafter adopted by any of the Canadian Securities Regulatory Authorities having substantially the same effect as such instrument;

"NuChem" means NuChem Pharmaceuticals Inc., a corporation existing under the laws of the Province of Ontario;

"NuChem Share Purchase Agreement" means the share purchase agreement to be entered into between Lorus and New Lorus pursuant to which Lorus will transfer all of the NuChem Shares held by it to New Lorus;

"NuChem Shares" means common shares in the capital of NuChem;

"Optionholder" has the meaning set forth in the section hereof entitled "Certain Canadian Federal Income Tax Consequences for Holders of Options";

"Options" means the issued and outstanding stock options to acquire Common Shares issued to directors, senior officers, employees and consultants of Lorus, governed by the terms of the Lorus Stock Option Plans and permitting the holders thereof to purchase an aggregate of a rolling rate of 15% of the issued Common Shares, as such number may be amended from time to time;

"Person" means any individual, partnership, association, body corporate, trust, joint venture, unincorporated organization, union, trustee, heir, executor, administrator, legal representative, government, regulatory authority or other entity;

"Pinnacle" means Pinnacle International Lands, Inc., a corporation existing under the laws of the Province of British Columbia;

"Pinnacle Partnerships" means, collectively, Pinnacle Centre Three Limited Partnership and Pinnacle Centre Four Limited Partnership;

8

"Pinnacle Share Purchase Agreement" means the share purchase agreement to be entered into between Investor and New Lorus pursuant to which Investor will purchase from New Lorus the Appropriate Number of RealCo Voting Shares and all of the RealCo Non-Voting Shares, as contemplated by the Plan of Arrangement;

"Plan" or "Plan of Arrangement" means the plan of arrangement attached as Appendix C to this Circular, as amended or varied from time to time in accordance with the terms thereof;

"Prepaid Expenses and Receivables" means those assets set out in the Prepaid Expenses and Receivables Transfer Agreement;

"Prepaid Expenses and Receivables Transfer Agreement" means the asset purchase agreement to be entered into between Lorus and GeneSense pursuant to which Lorus will transfer the Prepaid Expenses and Receivables to GeneSense;

"Property" means property, real or personal, tangible or intangible, other than Intellectual Property Rights;

"Purchaser Indemnified Parties" means Investor, its directors, officers, employees, successors and assigns;

"RealCo" means Lorus following the completion of the transactions contemplated by the Arrangement and prior to the Continuation;

"RealCo (BC)" means RealCo following the Continuation;

"RealCo Non-Voting Shares" means non-voting common shares of RealCo issued and outstanding following the reorganization of Lorus' share capital pursuant to the Arrangement;

"RealCo Voting Shares" means voting common shares of RealCo issued and outstanding following the reorganization of Lorus' share capital pursuant to the Arrangement;

"Record Date" means the close of business on May 24, 2007;

"Registered Shareholder" means a registered holder of Common Shares as recorded in the Shareholders' register maintained by the Transfer Agent and Registrar;

"Regulation Q-27" means Regulation Q-27 — Respecting Protection of Minority Securityholders in the Course of Certain Transactions, as it may be amended from time to time;

"Resident in the United States" shall be determined as provided in Rule 12g-4(a)(2) under the 1934 Act;

"Rule 61-501" means Rule 61-501 — Insider Bids, Issuer Bids, Going Private Transactions and Related Party Transactions of the Ontario Securities Commission, as it may be amended from time to time;

"Sarbanes Oxley Act" means the United States Sarbanes-Oxley Act of 2002, and any successor thereto, and any rules and regulations promulgated thereunder, all as the same will be in effect from time to time;

"SEC" means the United States Securities and Exchange Commission, or any other federal agency at the time administering the 1933 Act or the 1934 Act;

"Securities" means, collectively, the Common Shares, Options, Warrants and Convertible Debentures;

"Securities Laws" means the Canadian Securities Legislation and the United States Securities Laws;

"Securityholders" means the holders of Securities and "Securityholder" means any one of them;

"SEDAR" means The Canadian Securities Administrators' System for Electronic Document Analysis and Retrieval;

"Shareholders" means the holders of Common Shares and "Shareholder" means any one of them;

9

"Subsidiary Share Purchase Agreements" means, collectively, the GeneSense Share Purchase Agreement and the NuChem Share Purchase Agreement;

"Superior Proposal" has the meaning set forth in the section hereof entitled "The Arrangement — The Arrangement Agreement — Non-Solicitation and Right to Match";

"Tangible Business Assets" means Lorus' depreciable property set out in the Tangible Business Assets Transfer Agreement;

"Tangible Business Assets Transfer Agreement" means the asset purchase agreement to be entered into by Lorus and GeneSense pursuant to which Lorus will transfer the Tangible Business Assets to GeneSense, as contemplated in the Plan of Arrangement;

"Tax Act" means the Income Tax Act (Canada), R.S.C. 1985, C.1, 5th Supplement, as amended, including the tax regulations enacted thereunder;

"Technifund Entities" means collectively, Technifund Inc. and Herbert Abramson;

"TEMIC" means The Erin Mills Investment Corporation;

"Trading Day" means a day when the TSX is open for trading;

"Transfer Agent and Registrar" means Computershare Investor Services Inc. at its offices at 100 University Avenue, 11th Floor, Toronto, Ontario M5J 2Y1;

"TSX" means the Toronto Stock Exchange;

"United States" means the United States of America, its territories and possessions, any state of the United States, and the District of Columbia;

"United States Securities Laws" means the 1933 Act, the 1934 Act, the Sarbanes Oxley Act, all applicable state or "blue sky" laws and all rules and regulations promulgated thereunder or otherwise adopted from time to time by the applicable authority having jurisdiction in respect thereof, and the AMEX Rules, as applicable;

"U.S. Holder" has the meaning set forth in the section hereof entitled "Certain Canadian Federal Income Tax Consequences for Shareholders — Holders who are Residents of the United States";

"U.S. Persons" means Shareholders that are Resident in the United States;

"U.S. Shareholders" has the meaning set forth in the section hereof entitled "Certain United States Federal Consequences for Shareholders — U.S. Shareholders";

"Virulizin and Small Molecule Patent Assets" means those assets set out in the Virulizin and Small Molecule Patent Assets Transfer Agreement;

"Virulizin and Small Molecule Patent Assets Transfer Agreement" means the asset purchase agreement to be entered into between Lorus and GeneSense pursuant to which Lorus will transfer the Virulizin and Small Molecule Patent Assets to GeneSense, as contemplated in the Plan of Arrangement;

"Warrant Repurchase Agreement" means the warrant repurchase agreement dated May 1, 2007 between New Lorus and TEMIC pursuant to which New Lorus will repurchase the New Lorus Warrants; and

"Warrants" means the issued and outstanding 3,000,000 common share purchase warrants of Lorus issued to TEMIC, each of which entitles TEMIC to acquire, subject to adjustment, one Common Share at a price per share of $1.00.

Words importing the singular number only include the plural and vice versa and words importing any gender include all genders and the word "including" means "including without limiting the generality of the foregoing".

10

The following is a summary of certain information contained elsewhere in this Circular, including the appendices hereto and the documents incorporated by reference herein. This Summary is qualified in its entirety by the more detailed information and financial data and statements contained, referred to or incorporated elsewhere in this Circular, the appendices hereto and the documents incorporated by reference herein. You are urged to read carefully this entire document, the various documents that are referred to herein and the appendices attached hereto. Terms with initial capital letters used in this Summary but not otherwise defined are defined in the "Glossary of Terms".

Unless otherwise specified, all dollar amounts and financial information are expressed in Canadian dollars.

The Meeting

The Meeting will be held at Le Royal Meridien King Edward, 37 King Street East, Toronto, Ontario, in the Kensington Room, on June 25, 2007, at 10:00 a.m. (Toronto time) for the purpose of considering and, if deemed advisable, passing, with or without variation, the Arrangement Resolution. See "The Arrangement".

Background to the Arrangement

Since its inception, Lorus has financed its operations and technology acquisitions primarily from equity and debt financings, the exercise of warrants and stock options, and interest income on funds held for future investments.

To date, none of Lorus' product candidates has been approved by regulatory agencies for sale and Lorus has accumulated losses in the development of its products in excess of $100 million. The amount to be received by New Lorus pursuant to the Arrangement will be approximately $8.5 million, subject to a $600,000 holdback and a maximum post closing adjustment of $270,000, not including the costs of the transaction. In addition, Non-U.S. Persons will hold, at the Effective Time, in the aggregate, approximately a 0.5% economic equity interest in a new real estate development venture to be carried on by RealCo and U.S. Persons will, subject to certain limitations, receive a cash payment in lieu of such economic equity interest.

Beginning in January, 2006, Pinnacle and Lorus began preliminary discussions with a view to pursuing an arrangement that would restructure Lorus and provide non-dilutive financing for Lorus' biotechnology business. Following negotiations, on April 4, 2006, Lorus and Pinnacle entered into the Letter of Intent in respect of the Arrangement.

In October 2006, the Board of Directors engaged Deloitte & Touche LLP to consider whether the Arrangement is fair, from a financial point of view, to the Securityholders. In connection with this mandate, Deloitte & Touche LLP has prepared the Fairness Opinion that states that, as of the date of the opinion, the Arrangement is fair, from a financial point of view, to the Securityholders. The Fairness Opinion is subject to the restrictions, limitations and assumptions contained therein and should be read in its entirety. See Appendix E (Fairness Opinion) attached hereto.

Benefits of the Arrangement

There are a number of benefits that Lorus anticipates will result from the Arrangement, including the following:

11

See "— Shareholder Entitlements".

Intention of Certain Securityholders

High Tech, the Technifund Entities and TEMIC have entered into agreements pursuant to which they will vote their Securities in favour of the Arrangement Resolution. In addition, the directors and officers of Lorus who are Securityholders have expressed their intention to vote their Securities in favour of the Arrangement Resolution. High Tech, the Technifund Entities, TEMIC and the directors and officers of Lorus held in aggregate, as of the Record Date, Securities representing approximately 37% of the votes attached to all of the Securities. The votes attaching to the Common Shares of High Tech will not be included in the votes cast by Shareholders who are "minority" Shareholders. See "— Procedure for the Arrangement to Become Effective".

The Arrangement

The Arrangement will be implemented in a series of transactions pursuant to, or in connection with, the Plan of Arrangement attached as Appendix C to this Circular. See "The Arrangement — Arrangement Agreement".

Asset Transfer Agreements

As part of the Arrangement, Lorus will transfer the Tangible Business Assets to GeneSense pursuant to the terms and conditions of the Tangible Business Assets Transfer Agreement in consideration for the issuance by GeneSense of one GeneSense Share to Lorus.

In addition, GeneSense will transfer the Antisense Patent Assets to New Lorus pursuant to the terms and conditions of the Antisense Patent Assets Transfer Agreement in consideration for the issuance by New Lorus of the New Lorus Note 1.

Pursuant to the Virulizin and Small Molecule Patent Assets Transfer Agreement, Lorus will transfer the Virulizin and Small Molecule Patent Assets to GeneSense in consideration for the issuance by GeneSense of one GeneSense Share to Lorus and pursuant to the Prepaid Expenses and Receivables Transfer Agreement, Lorus will transfer the Prepaid Expenses and Receivables to GeneSense in consideration for the issuance by GeneSense of one GeneSense Share to Lorus.

New Lorus will, as of the Effective Time, continue to employ each of the employees employed by Lorus as of the Closing Date on terms and conditions of employment that are the same as those applicable to such employees as of the Closing Date.

Indemnification Agreement

Pursuant to the Indemnification Agreement, New Lorus will fully indemnify and save harmless Lorus and its directors, officers and employees from and against all damages, losses, expenses (including fines and penalties), other third party costs and legal expenses, to which any of them may be subject arising out of any matter occurring: (i) prior to, at or after the Effective Time and directly or indirectly relating to the Assets (including losses for income, sales, excise and other taxes arising in connection with the transfer of any Assets) or the conduct of the business of Lorus prior to the Effective Time; (ii) prior to, at or after the Effective Time as

12

a result of any and all interests, rights, liabilities and other matters relating to the Assets; and (iii) prior to or at the Effective Time and directly or indirectly relating to, with certain exceptions, any of the activities of Lorus or the Arrangement.

Subsidiary Share Purchase Agreements

Pursuant to the GeneSense Share Purchase Agreement, Lorus will transfer all of the GeneSense Shares to New Lorus at a price equal to their fair market value in exchange for the assumption by New Lorus of Lorus' remaining liabilities (other than the Lorus Note) and the issuance by New Lorus to Lorus of the New Lorus Note 2.

Pursuant to the NuChem Share Purchase Agreement, Lorus will transfer all of the NuChem Shares held by it to New Lorus at a price equal to their fair market value in consideration for the issuance by New Lorus to Lorus of the New Lorus Note 3.

Purchase of RealCo Voting Shares from Certain Shareholders

As part of the Arrangement and at the request of the Investor, Investor will purchase all of the RealCo Voting Shares that will be received by High Tech and each of the Technifund Entities pursuant to the Arrangement, at the same price per RealCo Voting Share as paid at the Effective Time by Investor to New Lorus for each RealCo Voting Share pursuant to the Pinnacle Share Purchase Agreement, upon and subject to the terms and conditions of share purchase agreements between Investor and each of High Tech and the Technifund Entities.

Shareholder Entitlements

New Lorus Common Shares

As part of the Arrangement, each Shareholder will receive one New Lorus Common Share for each Common Share held.

RealCo Voting Shares

As part of the Arrangement, in addition to receiving New Lorus Common Shares as indicated above, each Shareholder (other than U.S. Persons, High Tech and the Technifund Entities) will receive approximately 0.08 RealCo Voting Shares for each Common Share held, disregarding fractions. Any entitlement that would otherwise include a fractional interest in RealCo Voting Shares will be rounded down to the next lowest whole number of RealCo Voting Shares. No cash payment or other compensation will be made with respect to any such fractional interest.

The actual number of RealCo Voting Shares that will be distributed to Shareholders (other than U.S. Persons, High Tech and the Technifund Entities) depends on a number of variables that will be determined as of the Effective Date, including, among other things, the actual number of Common Shares held by U.S. Persons and the actual number of RealCo Voting Shares that Investor will purchase from New Lorus pursuant to the Pinnacle Share Purchase Agreement. The entitlement to RealCo Voting Shares described above is an estimate based on current information available to Lorus, however, such entitlement is subject to change and will not be determined until the Effective Date.

Cash Payments

As part of the Arrangement, in addition to receiving New Lorus Common Shares as indicated above, each U.S. Person, High Tech and the Technifund Entities will receive a cash payment equal to $0.0040775156 for each RealCo Voting Share that they would otherwise have received, rounded to the nearest $0.01. Based on current

13

information available to Lorus with respect to the number of Common Shares held by U.S. Persons, High Tech and the Technifund Entities, the estimated cash payments are expected to be approximately as follows:

| |

Estimated # of RealCo Voting Shares |

Rate per RealCo Voting Share |

Estimated Cash Payment |

||||||

|---|---|---|---|---|---|---|---|---|---|

| U.S. Persons | 1,098,000 | $ | 0.0040775156 | $ | 4,500 | ||||

| High Tech | 2,304,000 | $ | 0.0040775156 | $ | 9,400 | ||||

| Technifund Entities | 1,653,000 | $ | 0.0040775156 | $ | 6,700 | ||||

| TOTAL | $ | 20,600 | |||||||

The cash payments described above are estimates based on current information available to Lorus, however, such payments are subject to change based on the actual number of Common Shares held by U.S. Persons, High Tech and the Technifund Entities as of the Effective Date.

Treatment of Options, Convertible Debentures and Warrants

The Plan of Arrangement provides that the Options and Warrants will be exchanged for New Lorus Options and New Lorus Warrants and will thereafter be cancelled and will cease to represent any right or claim whatsoever in RealCo. The New Lorus Options will entitle the holder thereof to receive, upon the exercise of the New Lorus Options, a number of New Lorus Common Shares equivalent to the number of Common Shares such holder would have been entitled to receive pursuant to the Options.

Pursuant to the Debenture Assumption Agreement, New Lorus will assume Lorus' obligation to pay TEMIC the $15,000,000 aggregate principal amount plus accrued interest owing under the Convertible Debentures in consideration for Lorus issuing the Lorus Note. The right of TEMIC under the Convertible Debentures to convert such debentures into Common Shares will be exchanged for the right to convert such debentures into an equal number of New Lorus Common Shares. TEMIC has requested that New Lorus repurchase the New Lorus Warrants from TEMIC effective the Effective Date for cash consideration of $252,000 pursuant to the terms and conditions of the Warrant Repurchase Agreement.

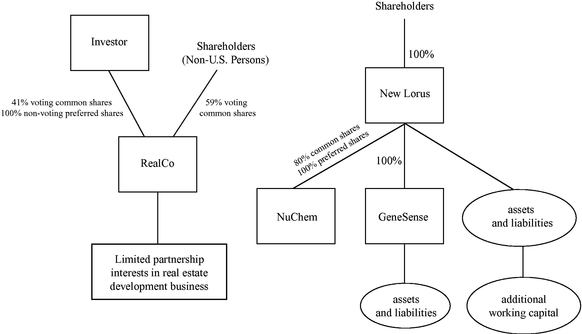

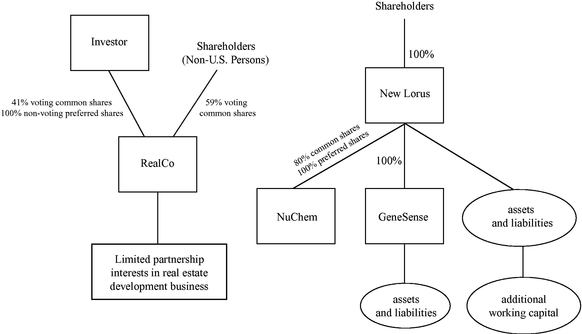

Effect of the Arrangement

Upon completion of the Arrangement, the Shareholders will be the holders of all of the issued and outstanding New Lorus Common Shares and New Lorus will be the holder of the Antisense Patent Assets, and will carry on the business previously carried on by Lorus with an additional working capital of approximately $8.5 million, subject to a $600,000 holdback and a maximum post closing adjustment of $270,000, not including the costs of the transaction. GeneSense will be a wholly-owned subsidiary of New Lorus and New Lorus will hold all of the NuChem Shares previously held by Lorus. GeneSense will be the holder of the Tangible Business Assets, the Virulizin and Small Molecule Patent Assets and the Prepaid Expenses and Receivables, which assets, together with the Antisense Patent Assets and NuChem Shares, constitute all of the assets of Lorus prior to the Arrangement.

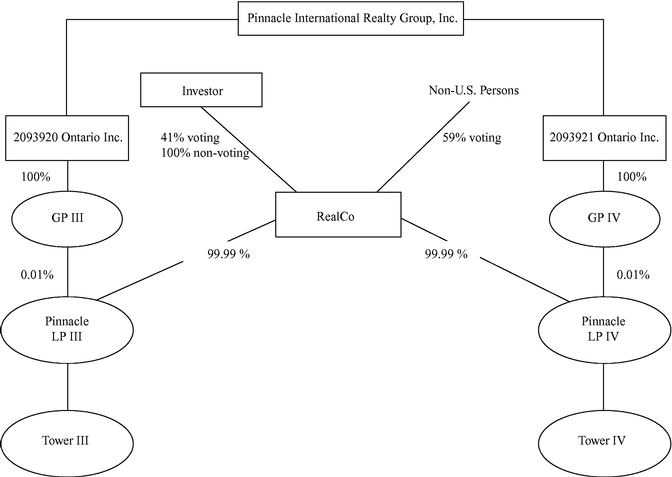

In addition, Non-U.S. Persons will hold, at the Effective Time, in the aggregate, approximately 59% of the RealCo Voting Shares then outstanding, representing approximately a 0.5% economic equity interest in RealCo. Following Closing, RealCo will hold limited partnership interests in two residential and mixed-use condominium projects in Toronto, Ontario and may raise additional capital on a dilutive basis to focus on pursuing opportunities as a real estate development company. High Tech, the Technifund Entities and U.S. Persons will, subject to certain limitations, receive a cash payment in an amount equal to the value of the RealCo Voting Shares otherwise distributable to them. Neither the RealCo Voting Shares nor the RealCo Non-Voting Shares will be listed on any stock exchange.

14

Provided that the transactions described in this Circular are approved, immediately upon completion of the transactions contemplated by the Arrangement, Investor will own approximately 41% of the RealCo Voting Shares and 100% of the RealCo Non-Voting Shares, representing, in the aggregate at the Effective Time, approximately 99.5% of the economic equity interest in RealCo.

Lorus will also assign all of its contractual obligations to New Lorus and New Lorus will assume such obligations, including employment obligations.

In connection with the Arrangement, New Lorus will cause the New Lorus Common Shares to be listed on the TSX subject to the fulfillment of the conditions set by the TSX. Lorus has made an application to the AMEX to have the New Lorus Common Shares listed on the AMEX, but cannot assure Shareholders that the New Lorus Common Shares will be listed and posted for trading on the AMEX. The New Lorus Common shares will be registered under section 12(b) of the 1934 Act. Upon the completion of the Arrangement, the Common Shares will be delisted from both the TSX and the AMEX and Lorus will cease reporting under the 1934 Act.

As a result of the Arrangement, Investor, an affiliate of Pinnacle, will obtain an economic interest in a company having certain non-transferable corporate attributes, including, among other things, a wide shareholder base and status as a "reporting issuer" under applicable Canadian Securities Legislation, all of which Investor believes may be of benefit to RealCo's business following completion of the Arrangement.

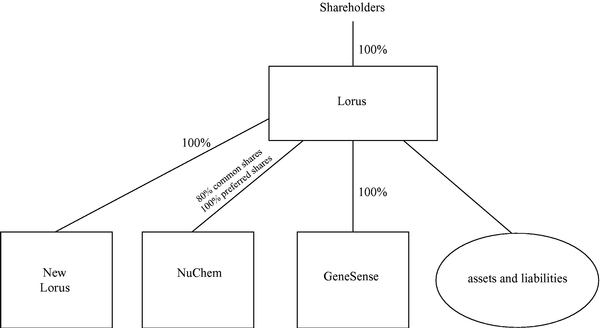

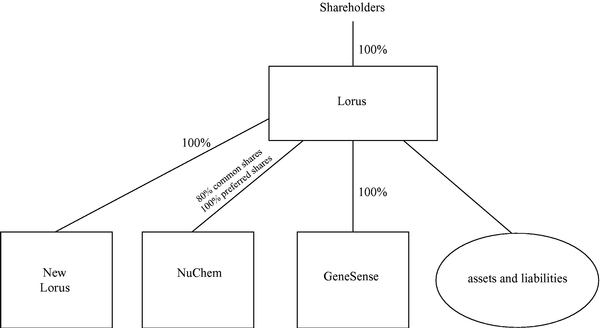

Corporate Structure

Presented below are simplified corporate structures of Lorus both before and immediately after completion of the Arrangement:

15

STRUCTURE IMMEDIATELY AFTER THE ARRANGEMENT

Procedure for the Arrangement to Become Effective

Securityholder Approval

The Interim Order provides that the Arrangement Resolution must be approved by (i) at least two-thirds of the votes cast by the Securityholders present in person or represented by proxy at the Meeting voting as a single class, each Shareholder entitled to vote thereon being entitled to one vote for each Common Share held and each Convertible Securityholder entitled to vote thereon being entitled to one vote for each Common Share such holder would have been entitled to receive upon the valid exercise or conversion of his, her or its Convertible Securities, as applicable and (ii) at least a simple majority of the votes cast by Minority Shareholders. See "Canadian Securities Matters".

Notwithstanding the foregoing, the Arrangement Agreement authorizes Lorus, GeneSense, NuChem, New Lorus and Pinnacle, subject to the terms and conditions of the Arrangement Agreement, without further notice to or approval of the Securityholders, to amend or terminate the Plan of Arrangement, to decide not to proceed with the Arrangement and to revoke the Plan of Arrangement at any time prior to the Effective Time.

Court Approval

The CBCA provides that the Arrangement requires Court approval. On May 16, 2007, Lorus obtained the Interim Order providing for the calling and holding of the Meeting and other procedural matters. See the Interim Order included as Appendix D (Interim Order and Notice of Application for the Final Order) attached hereto.

Subject to the terms of the Arrangement Agreement and the adoption of the Arrangement Resolution at the Meeting in the manner required by the Interim Order, Lorus will make application to the Court for the Final Order at the Ontario Superior Court of Justice, Toronto, Ontario, on June 27, 2007 at 10:00 a.m. (Toronto time) or as soon thereafter as counsel may be heard. See "The Arrangement — Procedure for the Arrangement Becoming Effective".

16

Conditions Precedent

All conditions precedent to the Arrangement, as set forth in the Arrangement Agreement, including receipt of the requisite regulatory approvals prior to the Effective Date, must be satisfied or waived by the appropriate party. See "The Arrangement — Arrangement Agreement".

Fairness Opinion

The Board of Directors engaged Deloitte & Touche LLP to consider whether the Arrangement is fair, from a financial point of view, to the Securityholders. In connection with this mandate, Deloitte & Touche LLP has prepared the Fairness Opinion that states that, as of the date of the opinion, the Arrangement is fair, from a financial point of view, to the Securityholders. The Fairness Opinion is subject to the restrictions, limitations and assumptions contained therein and should be read in its entirety. A copy of the Fairness Opinion is attached hereto as Appendix E (Fairness Opinion).

Recommendation of the Board of Directors

The Board of Directors has determined that the terms of the Arrangement are in the best interests of Lorus and the Securityholders, as a whole, and are fair, from a financial point of view, to the Securityholders. As such, those members of the Board of Directors entitled to vote on the approval of the Arrangement have unanimously approved the Arrangement and authorized the submission of the Arrangement to the Securityholders for approval.

Those members of the Board of Directors entitled to approve the Arrangement unanimously recommend that Securityholders vote FOR the Arrangement Resolution.

Timing

If the Meeting is held as scheduled and is not adjourned and the other necessary conditions of the Arrangement are satisfied or waived, Lorus will apply to the Court for the Final Order. If the Final Order is obtained on or about June 27, 2007, in form and substance satisfactory to Lorus, NuChem, GeneSense, New Lorus, Pinnacle and Investor and all other conditions specified are satisfied or waived, Lorus expects the Effective Date of the Arrangement to be on or about June 29, 2007.

Stock Exchange Listings

The Common Shares are currently listed and posted for trading on the TSX under the symbol "LOR" and on the AMEX under the symbol "LRP". On April 30, 2007, being the last Trading Day prior to the date of the announcement of the Arrangement, the closing price of the Common Shares on the TSX and the AMEX was $0.26 and U.S. $0.25, respectively, per Common Share.

Lorus has made an application for a substitutional listing of the New Lorus Common Shares (and the New Lorus Common Shares issuable upon the exercise or conversion of the New Lorus Options and New Lorus Warrants) on the TSX and on the AMEX in substitution for the Common Shares.

As of the date of this Circular, Lorus has not received approval from the AMEX in respect of the substitutional listing of the New Lorus Common Shares. Lorus cannot assure Shareholders that the AMEX will approve a substitutional listing or whether the New Lorus Common Shares will continue to be listed on the AMEX.

The TSX has conditionally approved the listing of the New Lorus Common Shares on the TSX under the symbol "LOR", which approval is subject to the satisfaction of certain conditions on or before June 28, 2007, including (i) the Securityholders of Lorus approving the Arrangement at the Meeting, (ii) the Minority Shareholders approving the Arrangement Resolution at the Meeting, (iii) the Closing of the Arrangement,

17

(iv) the filing of all documents required by the TSX and the payment of the fees required pursuant to the policies of the TSX, and (v) New Lorus meeting the TSX's continued listing requirements.

New Lorus expects that it will be able to satisfy all of the conditions of the TSX relating to the listing of the New Lorus Common Shares upon completion of the Arrangement.

Upon any substitutional listing of the New Lorus Common Shares, the Common Shares will cease to be listed on the TSX and the AMEX. Neither the RealCo Voting Shares nor the RealCo Non-Voting Shares will be listed on the TSX, the AMEX or any other stock exchange.

Certain Canadian Federal Income Tax Consequences

SHAREHOLDERS SHOULD CAREFULLY READ THE INFORMATION UNDER THE HEADING "CERTAIN CANADIAN FEDERAL INCOME TAX CONSEQUENCES FOR SHAREHOLDERS".

Canadian Resident Shareholders

Subject to the qualifications under the heading "Certain Canadian Federal Income Tax Consequences for Shareholders", generally, (i) the exchange of Common Shares for New Lorus Common Shares, and (ii) the distribution of the RealCo Voting Shares as a return of stated capital of New Lorus Common Shares, will not be taxable events under the Tax Act for a Holder.

U.S. Resident Shareholders

Subject to the qualifications under the heading "Certain Canadian Federal Income Tax Consequences for Shareholders", generally, (i) the exchange of Common Shares for New Lorus Common Shares, and (ii) the cash distribution as a reduction of stated capital of New Lorus will not be a taxable event under the Tax Act for a U.S. Holder.

If the Common Shares constitute "taxable Canadian property" (as defined by the Tax Act) to a U.S. Holder, at the Effective Time, the U.S. Holder will be required to file a Canadian tax return reporting the disposition of such shares even though the exchange of such shares is not subject to Canadian tax or section 116 certificate compliance requirements under the Tax Act.

Holders of Options

Holders of Options who exercise their Options to acquire Common Shares prior to the Effective Time may be subject to income tax consequences arising on such exercise. Holders of Options who are considering the exercise of their Options should consult their own tax advisors to determine the tax consequences to them of such exercise.

Subject to the qualifications under the heading "Certain Canadian Federal Income Tax Consequences for Holders of Options", an Optionholder who exchanges an Option for a New Lorus Option will not be considered to have disposed of the Option and the New Lorus Option will be deemed to be the same as, and a continuation of, the Option.

Eligibility for Investments

Subject to the qualifications under "Eligibility for Investment", the New Lorus Common Shares will be "qualified investments" under the Tax Act at the Effective Time for trusts governed by registered retirement savings plans (RRSPs), registered retirement income funds (RRIFs), deferred profit sharing plans (DPSPs) or registered education savings plans (RESPs), as defined in the Tax Act.

18

Certain U.S. Federal Income Tax Consequences

SHAREHOLDERS SHOULD CAREFULLY READ THE INFORMATION UNDER THE HEADING "CERTAIN UNITED STATES FEDERAL INCOME TAX CONSEQUENCES FOR SHAREHOLDERS".

The Arrangement sets forth a series of complex steps that should result in taxation for U.S. Shareholders. The Arrangement should be taxable to the U.S. Shareholders, and should be characterized as a disposition of Common Shares.

If the Arrangement is treated as a disposition of Common Shares, a gain or loss, if any, realized by a U.S. Shareholder on the exchange of his, her or its Common Shares generally would be subject to United States federal income taxation as capital gain (or capital loss) in an amount equal to the difference between the U.S. Shareholder's adjusted tax basis in the Common Shares and the amount realized on the disposition. Net capital gains (i.e., capital gains in excess of capital losses) recognized by a non-corporate U.S. Shareholder upon a sale or other disposition of Common Shares that have been held for more than one year is generally subject to a maximum United States federal income tax rate of 15%, under present law. Deductions for capital losses are subject to limitations.

If Lorus was a "controlled foreign corporation", or a "passive foreign investment company" for a U.S. Shareholder, the United States federal tax consequences summarized herein could be materially and adversely different.

New Lorus

New Lorus was incorporated under the CBCA as 6650309 Canada Inc. on November 1, 2006. New Lorus has not carried on any active business since its incorporation. As of the date hereof, the sole shareholder of New Lorus is Lorus.

Following the completion of the Arrangement, New Lorus will use (i) the Anti-Sense Patent Assets it holds directly, (ii) the Tangible Business Assets, Prepaid Expenses and Receivables and Virulizin and Small Molecule Patent Assets it holds indirectly through GeneSense, and (iii) the additional working capital of approximately $8.5 million, subject to a $600,000 holdback and a maximum post closing adjustment of $270,000, not including the costs of the transaction, to carry out the business as carried on by Lorus prior to the completion of the Arrangement.

New Lorus' head office will be located at 2 Meridian Road, Toronto, Ontario, Canada M9W 4Z7. See Appendix G (Information Respecting New Lorus) attached hereto.

Immediately prior to the completion of the Arrangement, the board of directors of New Lorus will consist of those same individuals who are currently the directors of Lorus, namely Kevin Buchi, Donald Paterson, Georg Ludwig, Michael Moore, Alan Steigrod, Graham Strachan, Jim Wright and Aiping Young. In addition, the management team of New Lorus is and will continue to be comprised of those same individuals who are currently the management team of Lorus, namely Aiping Young (President and Chief Executive Officer), Elizabeth Williams (Director of Finance, Acting Chief Financial Officer), Dr. Yoon Lee (Director of Research) and Peter Murray (Director of Clinical Development).

Pinnacle

Pinnacle was incorporated on July 26, 2001 under the BCBCA. Pinnacle and its affiliates have been involved in the development, design, construction and management of real estate for over thirty years. Pinnacle's track record includes exclusive urban residences from Toronto high-rise penthouses to waterview landmarks in Vancouver. Pinnacle's head office is located at Suite 300, 911 Homer Street, Vancouver, British Columbia V6B 2W6. Mr. Michael De Cotiis is the Chair and Chief Executive Officer of Pinnacle.

19

Investor

Investor was incorporated on January 23, 2007 under the CBCA as 6707157 Canada Inc. Investor has not carried on any active business since its incorporation. As of the date hereof, Investor is an affiliate of Pinnacle and Mr. Michael De Cotiis is the President and sole shareholder of Investor. As of the date hereof, Investor's registered office is located at 66 Wellington Street West, Suite 4700, Toronto, Ontario M5K 1E6.

RealCo

Following the Effective Date, RealCo will hold limited partnership interests in two residential and mixed-use condominium projects in Toronto, Ontario and may raise additional capital on a dilutive basis in order to focus on pursuing opportunities as a real estate development company. Following the completion of the Arrangement, RealCo's head office will be located at Suite 300, 911 Homer Street, Vancouver, British Columbia V6B 2W6. There is currently no intention to list the RealCo Voting Shares or the RealCo Non-Voting Shares on any stock exchange or other public securities market. Detailed information regarding RealCo can be found at Appendix H (Information Respecting RealCo and Financial Statements of the Pinnacle Partnerships) attached hereto.

As soon as practicable following completion of the Arrangement, it is expected that RealCo will be continued from the Canadian federal jurisdiction to the Province of British Columbia. Following such continuance, RealCo will be governed by the BCBCA. Please see Appendix K (Comparison of CBCA to BCBCA) attached hereto for a summary comparison of certain provisions of the CBCA and the BCBCA.

Selected Unaudited Pro Forma Financial Information Relating to RealCo and the Pinnacle Partnerships

Pro forma information relating to Lorus after giving effect to the Arrangement (i.e., RealCo) and the Pinnacle Partnerships can be found at Appendix I (Unaudited Pro Forma Balance Sheet of RealCo) and Appendix H (Information Respecting RealCo and Financial Statements of the Pinnacle Partnerships) attached hereto. Furthermore, the audited balance sheet of New Lorus as at November 1, 2006 can be found at Appendix J (Balance Sheet of New Lorus) attached hereto.

Risk Factors

In connection with the Arrangement, Securityholders should be aware that there are various risks, including those described in this Circular under the heading "Risk Factors" and those described in Appendix F (Information Respecting Lorus), Appendix G (Information Respecting New Lorus) and Appendix H (Information Respecting RealCo and Financial Statements of the Pinnacle Partnerships) attached hereto. Securityholders should carefully consider these risk factors, together with other information included in this Circular, before deciding whether or not to approve the Arrangement Resolution.

Dissent Rights

The Interim Order and the Plan of Arrangement provide Registered Shareholders with dissent and appraisal rights (the "Arrangement Dissent Rights") in connection with the transactions that will be authorized in the event that the Arrangement Resolution is approved by Securityholders. The Arrangement Dissent Rights are similar to the dissent and appraisal rights provided by section 190 of the CBCA. Shareholders who are considering exercising their Arrangement Dissent Rights should carefully review the description of such rights set forth in this Circular. See "Arrangement Dissent Rights".

20

This Circular and the documents incorporated by reference herein may contain forward-looking statements within the meaning of Canadian and U.S. securities laws. Such statements include, but are not limited to, statements relating to future financial position, business strategy, budgets, project costs and plans and objectives of management for future operations. You can identify many of these statements by looking for words such as "anticipate", "contemplate", "continue", "believe", "plan", "estimate", "expect", "intend", "will", "should", "may", and other similar expressions.

These forward-looking statements include statements with respect to:

We cannot assure you that any of the plans, objectives, intentions or expectations upon which these forward-looking statements are based will occur.

Such statements reflect our current views with respect to future events and are subject to risks and uncertainties and are necessarily based upon a number of estimates and assumptions that, while considered reasonable by us, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors could cause our actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including, among others:

Should one or more of these risks or uncertainties materialize, or should the assumptions set out in the section entitled "Risk Factors" underlying those forward-looking statements prove incorrect, actual results may vary materially from those described herein. These forward-looking statements are made as of the date of this Circular or, in the case of documents incorporated by reference herein, as of the date of such documents, and we do not intend, and do not assume any obligation, to update these forward-looking statements, except as required by law. We cannot assure you that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Securityholders are cautioned that forward-looking statements are not guarantees of future performance and accordingly are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty therein.

21

SOLICITATION OF PROXIES AND VOTING AT THE MEETING

Solicitation of Proxies

The enclosed proxy forms are being solicited by the management of Lorus. The solicitation is being made primarily by mail, but proxies may also be solicited by telephone, by telecopier, by the Internet, by advertisement or by other personal contact by directors, officers or other employees of Lorus. The entire cost of the solicitation will be borne by Lorus.

The Meeting is being called pursuant to the Interim Order to seek the requisite approval of the Securityholders to the Arrangement. See "The Arrangement".

This Circular is being mailed to Securityholders of Lorus. Each Securityholder has been assigned a different colour of proxy form for completion and return.

In order for your vote to be counted, Securityholders are reminded to complete and return the appropriate colour of proxy. If you are a non-registered holder of Lorus securities, please see "— Non-Registered Holders".

Appointment of Proxies

The individuals named in the enclosed form of proxy are representatives of the management of Lorus and are directors or officers of Lorus. A Securityholder who wishes to appoint some other individual to represent the Securityholder at the Meeting may do so by inserting such individual's name in the blank space provided in the enclosed form of proxy. Such other individual need not be a Securityholder of Lorus.

To be valid, proxies must be deposited with Computershare Investor Services Inc., 100 University Avenue, 8th Floor, Toronto, Canada M5J 2Y1, so as to arrive not later than 5:00 p.m. (Toronto time) on June 21, 2007 or, if the Meeting is adjourned, 48 hours (excluding Saturdays, Sundays and holidays) before the time set for the adjourned Meeting.

Non-Registered Holders

These Meeting materials are being sent to both registered and non-registered holders of Securities. If you are a non-registered holder and we or our agent have sent these materials directly to you, your name and address and information about your holdings of Securities have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding on your behalf.

By choosing to send these materials to you directly, we (and not the intermediary holding on your behalf) have assumed responsibility for (i) delivering these materials to you, and (ii) executing your proper voting instructions. Please return your voting instructions as specified in the request for voting instructions.

Only registered holders of the Securities, or the individuals they appoint as their proxies, are permitted to attend and vote at the Meeting. However, in many cases, Securities beneficially owned by a non-registered holder are registered either:

22